0000874499

false

0000874499

2023-10-31

2023-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 31, 2023

GULFPORT ENERGY CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-19514 |

|

86-3684669 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

713 Market Drive

Oklahoma City, Oklahoma |

|

73114 |

(Address of principal

executive offices) |

|

(Zip code) |

(405) 252-4600

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Name

of each exchange on which registered |

|

Trading

Symbol |

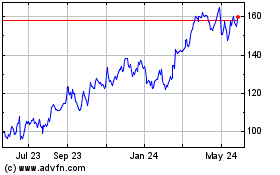

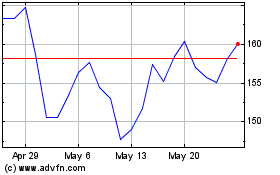

| Common stock, par value $0.0001 per share |

|

The New York Stock Exchange |

|

GPOR |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 31, 2023, Gulfport Energy Corporation (“Gulfport”)

issued a press release reporting its financial and operating results for the three months ended September 30, 2023, and provided an update

on its 2023 development plan and financial guidance. A copy of the press release and supplemental financial information are attached as

Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

Item 7.01. Regulation FD Disclosure.

Also on October 31, 2023, Gulfport posted an updated investor presentation

and its 2023 Corporate Sustainability Report on its website. The presentation may be found on Gulfport’s website at http://www.gulfportenergy.com

by selecting “Investors,” “Company Information” and then “Presentations” and the sustainability report

may be found on Gulfport’s website by selecting “Sustainability.”

Additionally, on October 31, 2023, Gulfport issued a press release announcing the results of its MiQ methane emissions certification for

its natural gas production across its Appalachia operations, and that it published its 2023 Corporate Sustainability Report. A copy of

the press release is attached as Exhibit 99.3 to this Current Report on Form 8-K.

The information in the press releases, updated

investor presentation and sustainability report is being furnished, not filed, pursuant to Item 2.02 and Item 7.01. Accordingly, the

information in the press releases, updated investor presentation and sustainability report will not be incorporated by

reference into any registration statement filed by Gulfport under the Securities Act of 1933, as amended, unless specifically

identified therein as being incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

GULFPORT ENERGY CORPORATION |

| |

|

| Date: October 31, 2023 |

By: |

/s/ Michael Hodges |

| |

|

Michael Hodges |

| |

|

Chief Financial Officer |

Exhibit 99.1

| |

|

| Gulfport Energy Reports Third Quarter 2023 Financial and Operating Results |

OKLAHOMA CITY (October 31, 2023) Gulfport

Energy Corporation (NYSE: GPOR) (“Gulfport” or the “Company”) today reported financial and operating results for

the three months ended September 30, 2023 and provided an update on its 2023 development plan and financial guidance.

Third Quarter 2023 and Recent Highlights

| ● | Delivered total net production of 1,056.9 MMcfe per day, above analyst consensus expectations |

| ● | Reported $608.4 million of net income and $160.0 million of adjusted EBITDA(1), above analyst consensus expectations |

| ● | Generated $156.3 million of net cash provided by operating activities and $48.9 million of adjusted free cash flow(1),

excluding discretionary acreage acquisitions and above analyst consensus expectations |

| ● | Incurred capital expenditures, excluding discretionary acreage acquisitions, of $89.8 million, below analyst consensus expectations |

| ● | Utilized adjusted free cash flow(1) for discretionary acreage acquisitions totaling

$19.4 million |

| ● | Per unit operating costs(2) totaled $1.12 per Mcfe, below analyst consensus expectations |

| ● | Expanded common stock repurchase authorization by 63 percent to $650 million |

| ● | Repurchased 3.9 million shares of common stock for approximately $334.6 million(3) since the inception of the repurchase

program |

| ● | Reaffirmed borrowing base of $1.1 billion with elected commitments to remain at $900 million |

| ● | Completed Marcellus two-well pad in Belmont County, Ohio and recently began flowback operations in October 2023 |

| ● | Issued 2023 Corporate Sustainability Report and remain committed to delivering cleaner, lower carbon energy in a safe, environmentally

responsible manner |

Updated Full Year 2023 Outlook

| ● | Raising full year 2023 net production guidance to 1,045 MMcfe - 1,055 MMcfe per day |

| ● | Reducing guidance for total base capital expenditures to $435 million – $455 million, consisting of drilling and completion

expenditures of $385 million - $395 million and maintenance leasehold and land investment of $50 million - $60 million, excluding discretionary

acreage acquisitions |

John Reinhart, President and CEO, commented, “Gulfport

continued to make steady progress in the third quarter, demonstrated by our strong production profile, robust margins, improvement in

operational efficiencies and cycle times and the continued return of capital to shareholders through our common share repurchase program.

Our operations teams continue to perform at a high level of efficiency and as a result, we forecast the Company has realized over $35

million in capital savings on our full year 2023 drilling and completion budget. We have elected to reinvest these savings into our high-quality

assets, increasing our operated working interests and adding incremental activity in both the Utica and SCOOP. We plan to accelerate drilling

on seven additional wells, two of which will complete drilling during the fourth quarter, as well as initiate completion operations on

a three-well Utica pad. This activity is predominantly focused in our liquids rich areas, benefiting our 2024 program and positioning

us well as we enter next year. Including this additional activity, we are lowering our 2023 capital budget while also increasing our 2023

production guidance, delivering total net production approximately 3% above our initial 2023 guidance provided in February.”

Reinhart continued, “We continue to prioritize

the return of capital to our shareholders through common stock repurchases, as further evidenced by the recent increase in the size of

the program in place by 63% to $650 million. We plan to continue allocating substantially all of our adjusted free cash flow to common

share repurchases after accounting for discretionary acreage acquisitions. Through September 30, we have invested roughly $25 million

in discretionary acreage acquisition opportunities during 2023 and remain on target to allocate $40 million of our robust 2023 adjusted

free cash flow to be invested in extending our high-quality inventory by approximately 1.5 years and provide optionality for near term

development.”

A company presentation to accompany the Gulfport

earnings conference call can be accessed by clicking here.

| 1. | A non-GAAP financial measure. Reconciliations of these non-GAAP measures and other disclosures are provided

with the supplemental financial tables available on our website at www.gulfportenergy.com. |

| 2. | Includes lease operating expense, transportation, gathering, processing and compression expense and taxes

other than income. |

| 3. | As of October 26, 2023. |

Operational Update

The table below summarizes Gulfport’s operated

drilling and completion activity for the third quarter of 2023:

| | |

Quarter Ended September 30, 2023 | |

| | |

Gross | | |

Net | | |

Lateral Length | |

| Spud | |

| | | |

| | | |

| | |

| Utica/Marcellus | |

| 5 | | |

| 5.0 | | |

| 17,300 | |

| SCOOP | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | |

| Drilled | |

| | | |

| | | |

| | |

| Utica/Marcellus | |

| 2 | | |

| 2.0 | | |

| 11,900 | |

| SCOOP | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | |

| Completed | |

| | | |

| | | |

| | |

| Utica/Marcellus | |

| 6 | | |

| 5.3 | | |

| 16,100 | |

| SCOOP | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | |

| Turned-to-Sales | |

| | | |

| | | |

| | |

| Utica/Marcellus | |

| 5 | | |

| 4.9 | | |

| 11,300 | |

| SCOOP | |

| — | | |

| — | | |

| — | |

Gulfport’s net daily production for the

third quarter of 2023 averaged 1,056.9 MMcfe per day, primarily consisting of 812.0 MMcfe per day in the Utica and 244.9 MMcfe per day

in the SCOOP. For the third quarter of 2023, Gulfport’s net daily production mix was comprised of approximately 92% natural gas,

6% natural gas liquids (“NGL”) and 2% oil and condensate.

| | |

Three Months

Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| Production | |

| | |

| |

| Natural gas (Mcf/day) | |

| 971,352 | | |

| 815,660 | |

| Oil and condensate (Bbl/day) | |

| 3,195 | | |

| 4,366 | |

| NGL (Bbl/day) | |

| 11,061 | | |

| 12,172 | |

| Total (Mcfe/day) | |

| 1,056,887 | | |

| 914,888 | |

| Average Prices | |

| | | |

| | |

| Natural Gas: | |

| | | |

| | |

| Average price without the impact of derivatives ($/Mcf) | |

$ | 1.99 | | |

$ | 7.80 | |

| Impact from settled derivatives ($/Mcf) | |

$ | 0.54 | | |

$ | (4.72 | ) |

| Average price, including settled derivatives ($/Mcf) | |

$ | 2.53 | | |

$ | 3.08 | |

| Oil and condensate: | |

| | | |

| | |

| Average price without the impact of derivatives ($/Bbl) | |

$ | 77.90 | | |

$ | 89.75 | |

| Impact from settled derivatives ($/Bbl) | |

$ | (7.25 | ) | |

$ | (22.49 | ) |

| Average price, including settled derivatives ($/Bbl) | |

$ | 70.65 | | |

$ | 67.26 | |

| NGL: | |

| | | |

| | |

| Average price without the impact of derivatives ($/Bbl) | |

$ | 26.49 | | |

$ | 39.61 | |

| Impact from settled derivatives ($/Bbl) | |

$ | 2.62 | | |

$ | (2.53 | ) |

| Average price, including settled derivatives ($/Bbl) | |

$ | 29.11 | | |

$ | 37.08 | |

| Total: | |

| | | |

| | |

| Average price without the impact of derivatives ($/Mcfe) | |

$ | 2.34 | | |

$ | 7.91 | |

| Impact from settled derivatives ($/Mcfe) | |

$ | 0.50 | | |

$ | (4.35 | ) |

| Average price, including settled derivatives ($/Mcfe) | |

$ | 2.84 | | |

$ | 3.56 | |

| Selected operating metrics | |

| | | |

| | |

| Lease operating expenses ($/Mcfe) | |

$ | 0.16 | | |

$ | 0.18 | |

| Taxes other than income ($/Mcfe) | |

$ | 0.07 | | |

$ | 0.20 | |

| Transportation, gathering, processing and compression expense ($/Mcfe) | |

$ | 0.89 | | |

$ | 1.06 | |

| Recurring cash general and administrative expenses ($/Mcfe) (non-GAAP) | |

$ | 0.12 | | |

$ | 0.12 | |

| Interest expenses ($/Mcfe) | |

$ | 0.15 | | |

$ | 0.18 | |

Capital Investment

Capital investment was $89.8 million (on an incurred

basis) for the third quarter of 2023, of which $81.4 million related to drilling and completion (“D&C”) activity and $8.4

million related to maintenance leasehold and land investment. In addition, Gulfport invested approximately $19.4 million in discretionary

acreage acquisitions.

For the nine-month period ended September 30,

2023, capital investment was $360.6 million (on an incurred basis), of which $319.2 million related to D&C activity and

$41.4 million related to maintenance leasehold and land investment. In addition, Gulfport invested approximately $24.9 million

in discretionary acreage acquisitions.

Common Stock Repurchase Program

Gulfport repurchased approximately 76.2 thousand

shares of common stock during the third quarter of 2023 at an average price of $113.97. As of October 26, 2023, the Company had repurchased

approximately 3.9 million shares of common stock at a weighted-average share price of $86.14 since the program initiated in March 2022,

totaling approximately $334.6 million in aggregate. The Company currently has approximately $315.4 million of remaining capacity under

the share repurchase program.

Financial Position and Liquidity

As of September 30, 2023, Gulfport had approximately

$8.3 million of cash and cash equivalents, $95.0 million of borrowings under its revolving credit facility, $66.9 million of

letters of credit outstanding and $550 million of outstanding 2026 senior notes.

Gulfport’s liquidity at September 30, 2023,

totaled approximately $746.4 million, comprised of the $8.3 million of cash and cash equivalents and approximately $738.1 million of available

borrowing capacity under its credit facility.

Credit Facility Borrowing Base Redetermination

On October 27, 2023, Gulfport completed its semi-annual

borrowing base redetermination during which the borrowing base was reaffirmed at $1.1 billion with the elected commitments remaining at

$900 million.

Full Year 2023 Guidance

The Company is providing updated full year 2023

guidance (changes in italics) as set forth in the table below:

| | |

Year Ending | |

| | |

December 31, 2023 | |

| | |

Low | | |

High | |

| Production | |

| | |

| |

| Average daily gas equivalent (MMcfe/day) | |

| 1,045 | | |

| 1,055 | |

| % Gas | |

| ~90% | |

| | |

| | | |

| | |

| Realizations (before hedges) | |

| | | |

| | |

| Natural gas (differential to NYMEX settled price) ($/Mcf) | |

$ | (0.20 | ) | |

$ | (0.35 | ) |

| NGL (% of WTI) | |

| 35 | % | |

| 40 | % |

| Oil (differential to NYMEX WTI) ($/Bbl) | |

$ | (3.50 | ) | |

$ | (4.50 | ) |

| | |

| | | |

| | |

| Expenses | |

| | | |

| | |

| Lease operating expense ($/Mcfe) | |

$ | 0.16 | | |

$ | 0.18 | |

| Taxes other than income ($/Mcfe) | |

$ | 0.10 | | |

$ | 0.12 | |

| Transportation, gathering, processing and compression ($/Mcfe) | |

$ | 0.90 | | |

$ | 0.94 | |

| Recurring cash general and administrative(1,2) ($/Mcfe) | |

$ | 0.11 | | |

$ | 0.13 | |

| | |

| | | |

| | |

| | |

| Total | |

| Capital expenditures (incurred) | |

| (in millions) | |

| D&C | |

$ | 385 | | |

$ | 395 | |

| Maintenance leasehold and land | |

$ | 50 | | |

$ | 60 | |

| Total base capital expenditures | |

$ | 435 | | |

$ | 455 | |

| | |

| | | |

| | |

| Discretionary acreage acquisitions | |

| ~$40 | |

| (1) | Recurring cash G&A includes capitalization. It excludes

non-cash stock compensation and expenses related to the continued administration of our prior Chapter 11 filing. |

| (2) | This is a non-GAAP measure. Reconciliations of these non-GAAP

measures and other disclosures are provided with the supplemental financial tables available on our website at www.gulfportenergy.com. |

Derivatives

Gulfport enters into commodity derivative contracts

on a portion of its expected future production volumes to mitigate the Company’s exposure to commodity price fluctuations. For details,

please refer to the “Derivatives” section provided with the supplemental financial tables available on our website at ir.gulfportenergy.com.

Third Quarter 2023 Conference Call

Gulfport will host a teleconference and webcast

to discuss its third quarter of 2023 results beginning at 9:00 a.m. ET (8:00 a.m. CT) on Wednesday, November 1, 2023.

The conference call can be heard live through

a link on the Gulfport website, www.gulfportenergy.com. In addition, you may participate in the conference call by dialing 866-373-3408

domestically or 412-902-1039 internationally. A replay of the conference call will be available on the Gulfport website and a telephone

audio replay will be available from November 2, 2023 to November 16, 2023, by calling 877-660-6853 domestically or 201-612-7415

internationally and then entering the replay passcode 13742014.

Financial Statements and Guidance Documents

Third quarter of 2023 earnings results and supplemental

information regarding quarterly data such as production volumes, pricing, financial statements and non-GAAP reconciliations are available

on our website at ir.gulfportenergy.com.

Non-GAAP Disclosures

This news release includes non-GAAP financial

measures. Such non-GAAP measures should be not considered as an alternative to GAAP measures. Reconciliations of these non-GAAP measures

and other disclosures are provided with the supplemental financial tables available on our website at ir.gulfportenergy.com.

About Gulfport

Gulfport is an independent natural gas-weighted

exploration and production company focused on the exploration, acquisition and production of natural gas, crude oil and NGL in the United

States with primary focus in the Appalachia and Anadarko basins. Our principal properties are located in eastern Ohio targeting the Utica

and Marcellus formations and in central Oklahoma targeting the SCOOP Woodford and SCOOP Springer formations.

Forward Looking Statements

This press release includes “forward-looking

statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are statements

other than statements of historical fact. They include statements regarding Gulfport’s current expectations, management’s outlook

guidance or forecasts of future events, projected cash flow and liquidity, inflation, share repurchases and other return of capital plans,

its ability to enhance cash flow and financial flexibility, future production and commodity mix, plans and objectives for future operations,

the ability of our employees, portfolio strength and operational leadership to create long-term value and the assumptions on which such

statements are based. Gulfport believes the expectations and forecasts reflected in the forward-looking statements are reasonable, Gulfport

can give no assurance they will prove to have been correct. They can be affected by inaccurate or changed assumptions or by known or unknown

risks and uncertainties. Important risks, assumptions and other important factors that could cause future results to differ materially

from those expressed in the forward-looking statements are described under “Risk Factors” in Item 1A of Gulfport’s annual

report on Form 10-K for the year ended December 31, 2022 and any updates to those factors set forth in Gulfport’s subsequent quarterly

reports on Form 10-Q or current reports on Form 8-K (available at https://www.gulfportenergy.com/investors/sec-filings). Gulfport undertakes

no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated

events.

Investors should note that Gulfport announces

financial information in SEC filings, press releases and public conference calls. Gulfport may use the Investors section of its

website (www.gulfportenergy.com) to communicate with investors. It is possible that the financial and other information posted there

could be deemed to be material information. The information on Gulfport’s website is not part of this filing.

Investor Contact:

Jessica Antle – Vice President, Investor

Relations

jantle@gulfportenergy.com

405-252-4550

5

Exhibit 99.2

Three months and nine months ended September

30, 2023

Supplemental Information of Gulfport Energy

Production Volumes by Asset Area: Three months ended September 30,

2023

Production Volumes

| | |

Three Months

Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| Natural gas (Mcf/day) | |

| | |

| |

| Utica | |

| 795,191 | | |

| 597,027 | |

| SCOOP | |

| 176,161 | | |

| 218,633 | |

| Total | |

| 971,352 | | |

| 815,660 | |

| Oil and condensate (Bbl/day) | |

| | | |

| | |

| Utica | |

| 528 | | |

| 646 | |

| SCOOP | |

| 2,667 | | |

| 3,721 | |

| Total | |

| 3,195 | | |

| 4,366 | |

| NGL (Bbl/day) | |

| | | |

| | |

| Utica | |

| 2,271 | | |

| 2,458 | |

| SCOOP | |

| 8,790 | | |

| 9,714 | |

| Total | |

| 11,061 | | |

| 12,172 | |

| Combined (Mcfe/day) | |

| | | |

| | |

| Utica | |

| 811,985 | | |

| 615,649 | |

| SCOOP | |

| 244,902 | | |

| 299,239 | |

| Total | |

| 1,056,887 | | |

| 914,888 | |

| Totals may not sum or recalculate due to rounding. | |

| | | |

| | |

Production Volumes by Asset Area: Nine months ended September 30,

2023

Production Volumes

| | |

Nine Months

Ended

September 30,

2023 | | |

Nine Months

Ended

September 30,

2022 | |

| Natural gas (Mcf/day) | |

| | |

| |

| Utica | |

| 755,372 | | |

| 664,967 | |

| SCOOP | |

| 198,616 | | |

| 200,847 | |

| Total | |

| 953,989 | | |

| 865,814 | |

| Oil and condensate (Bbl/day) | |

| | | |

| | |

| Utica | |

| 558 | | |

| 689 | |

| SCOOP | |

| 3,256 | | |

| 3,539 | |

| Total | |

| 3,813 | | |

| 4,228 | |

| NGL (Bbl/day) | |

| | | |

| | |

| Utica | |

| 2,466 | | |

| 2,252 | |

| SCOOP | |

| 9,921 | | |

| 9,275 | |

| Total | |

| 12,387 | | |

| 11,526 | |

| Combined (Mcfe/day) | |

| | | |

| | |

| Utica | |

| 773,512 | | |

| 682,611 | |

| SCOOP | |

| 277,676 | | |

| 277,730 | |

| Total | |

| 1,051,188 | | |

| 960,341 | |

| Totals may not sum or recalculate due to rounding. | |

| | | |

| | |

Production and Pricing: Three months ended September 30, 2023

The following table summarizes production and related pricing for

the three months ended September 30, 2023, as compared to such data for the three months ended September 30, 2022:

| | |

Three Months Ended

September 30,

2023 | | |

Three Months Ended

September 30,

2022 | |

| Natural gas sales | |

| | |

| |

| Natural gas production volumes (MMcf) | |

| 89,364 | | |

| 75,041 | |

| Natural gas production volumes (MMcf) per day | |

| 971 | | |

| 816 | |

| Total sales | |

$ | 177,401 | | |

$ | 585,596 | |

| Average price without the impact of derivatives ($/Mcf) | |

$ | 1.99 | | |

$ | 7.80 | |

| Impact from settled derivatives ($/Mcf) | |

$ | 0.54 | | |

$ | (4.72 | ) |

| Average price, including settled derivatives ($/Mcf) | |

$ | 2.53 | | |

$ | 3.08 | |

| | |

| | | |

| | |

| Oil and condensate sales | |

| | | |

| | |

| Oil and condensate production volumes (MBbl) | |

| 294 | | |

| 402 | |

| Oil and condensate production volumes (MBbl) per day | |

| 3 | | |

| 4 | |

| Total sales | |

$ | 22,896 | | |

$ | 36,050 | |

| Average price without the impact of derivatives ($/Bbl) | |

$ | 77.90 | | |

$ | 89.75 | |

| Impact from settled derivatives ($/Bbl) | |

$ | (7.25 | ) | |

$ | (22.49 | ) |

| Average price, including settled derivatives ($/Bbl) | |

$ | 70.65 | | |

$ | 67.26 | |

| | |

| | | |

| | |

| NGL sales | |

| | | |

| | |

| NGL production volumes (MBbl) | |

| 1,018 | | |

| 1,120 | |

| NGL production volumes (MBbl) per day | |

| 11 | | |

| 12 | |

| Total sales | |

$ | 26,953 | | |

$ | 44,351 | |

| Average price without the impact of derivatives ($/Bbl) | |

$ | 26.49 | | |

$ | 39.61 | |

| Impact from settled derivatives ($/Bbl) | |

$ | 2.62 | | |

$ | (2.53 | ) |

| Average price, including settled derivatives ($/Bbl) | |

$ | 29.11 | | |

$ | 37.08 | |

| | |

| | | |

| | |

| Natural gas, oil and condensate and NGL sales | |

| | | |

| | |

| Natural gas equivalents (MMcfe) | |

| 97,234 | | |

| 84,170 | |

| Natural gas equivalents (MMcfe) per day | |

| 1,057 | | |

| 915 | |

| Total sales | |

$ | 227,250 | | |

$ | 665,997 | |

| Average price without the impact of derivatives ($/Mcfe) | |

$ | 2.34 | | |

$ | 7.91 | |

| Impact from settled derivatives ($/Mcfe) | |

$ | 0.50 | | |

$ | (4.35 | ) |

| Average price, including settled derivatives ($/Mcfe) | |

$ | 2.84 | | |

$ | 3.56 | |

| | |

| | | |

| | |

| Production Costs: | |

| | | |

| | |

| Average lease operating expenses ($/Mcfe) | |

$ | 0.16 | | |

$ | 0.18 | |

| Average taxes other than income ($/Mcfe) | |

$ | 0.07 | | |

$ | 0.20 | |

| Average transportation, gathering, processing and compression ($/Mcfe) | |

$ | 0.89 | | |

$ | 1.06 | |

| Total lease operating expenses, midstream costs and production taxes ($/Mcfe) | |

$ | 1.12 | | |

$ | 1.44 | |

Production and Pricing: Nine months ended September 30, 2023

The following table summarizes production and related pricing for

the nine months ended September 30, 2023, as compared to such data for the nine months ended September 30, 2022:

| | |

Nine Months

Ended

September 30,

2023 | | |

Nine Months

Ended

September 30,

2022 | |

| Natural gas sales | |

| | |

| |

| Natural gas production volumes (MMcf) | |

| 260,439 | | |

| 236,367 | |

| Natural gas production volumes (MMcf) per day | |

| 954 | | |

| 866 | |

| Total sales | |

$ | 619,181 | | |

$ | 1,529,898 | |

| Average price without the impact of derivatives ($/Mcf) | |

$ | 2.38 | | |

$ | 6.47 | |

| Impact from settled derivatives ($/Mcf) | |

$ | 0.37 | | |

$ | (3.19 | ) |

| Average price, including settled derivatives ($/Mcf) | |

$ | 2.75 | | |

$ | 3.28 | |

| | |

| | | |

| | |

| Oil and condensate sales | |

| | | |

| | |

| Oil and condensate production volumes (MBbl) | |

| 1,041 | | |

| 1,154 | |

| Oil and condensate production volumes (MBbl) per day | |

| 4 | | |

| 4 | |

| Total sales | |

$ | 76,212 | | |

$ | 111,298 | |

| Average price without the impact of derivatives ($/Bbl) | |

$ | 73.21 | | |

$ | 96.42 | |

| Impact from settled derivatives ($/Bbl) | |

$ | (2.29 | ) | |

$ | (27.26 | ) |

| Average price, including settled derivatives ($/Bbl) | |

$ | 70.92 | | |

$ | 69.16 | |

| | |

| | | |

| | |

| NGL sales | |

| | | |

| | |

| NGL production volumes (MBbl) | |

| 3,382 | | |

| 3,147 | |

| NGL production volumes (MBbl) per day | |

| 12 | | |

| 12 | |

| Total sales | |

$ | 92,935 | | |

$ | 143,741 | |

| Average price without the impact of derivatives ($/Bbl) | |

$ | 27.48 | | |

$ | 45.68 | |

| Impact from settled derivatives ($/Bbl) | |

$ | 1.88 | | |

$ | (4.38 | ) |

| Average price, including settled derivatives ($/Bbl) | |

$ | 29.36 | | |

$ | 41.30 | |

| | |

| | | |

| | |

| Natural gas, oil and condensate and NGL sales | |

| | | |

| | |

| Natural gas equivalents (MMcfe) | |

| 286,974 | | |

| 262,173 | |

| Natural gas equivalents (MMcfe) per day | |

| 1,051 | | |

| 960 | |

| Total sales | |

$ | 788,328 | | |

$ | 1,784,937 | |

| Average price without the impact of derivatives ($/Mcfe) | |

$ | 2.75 | | |

$ | 6.81 | |

| Impact from settled derivatives ($/Mcfe) | |

$ | 0.35 | | |

$ | (3.05 | ) |

| Average price, including settled derivatives ($/Mcfe) | |

$ | 3.10 | | |

$ | 3.76 | |

| | |

| | | |

| | |

| Production Costs: | |

| | | |

| | |

| Average lease operating expenses ($/Mcfe) | |

$ | 0.18 | | |

$ | 0.18 | |

| Average taxes other than income ($/Mcfe) | |

$ | 0.09 | | |

$ | 0.17 | |

| Average transportation, gathering, processing and compression ($/Mcfe) | |

$ | 0.91 | | |

$ | 1.00 | |

| Total lease operating expenses, midstream costs and production taxes ($/Mcfe) | |

$ | 1.18 | | |

$ | 1.35 | |

Consolidated Statements of Income: Three months ended September

30, 2023

(In thousands, except per share data)

(Unaudited)

| | |

Three Months

Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| REVENUES: | |

| | |

| |

| Natural gas sales | |

$ | 177,401 | | |

$ | 585,596 | |

| Oil and condensate sales | |

| 22,896 | | |

| 36,050 | |

| Natural gas liquid sales | |

| 26,953 | | |

| 44,351 | |

| Net gain (loss) on natural gas, oil and NGL derivatives | |

| 39,417 | | |

| (474,895 | ) |

| Total revenues | |

| 266,667 | | |

| 191,102 | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Lease operating expenses | |

| 15,627 | | |

| 15,363 | |

| Taxes other than income | |

| 7,216 | | |

| 16,529 | |

| Transportation, gathering, processing and compression | |

| 86,602 | | |

| 89,234 | |

| Depreciation, depletion and amortization | |

| 79,505 | | |

| 64,419 | |

| General and administrative expenses | |

| 9,894 | | |

| 8,752 | |

| Accretion expense | |

| 639 | | |

| 673 | |

| Total operating expenses | |

| 199,483 | | |

| 194,970 | |

| INCOME (LOSS) FROM OPERATIONS | |

| 67,184 | | |

| (3,868 | ) |

| OTHER EXPENSE (INCOME): | |

| | | |

| | |

| Interest expense | |

| 14,919 | | |

| 15,461 | |

| Other, net | |

| (1,438 | ) | |

| (857 | ) |

| Total other expense | |

| 13,481 | | |

| 14,604 | |

| INCOME (LOSS) BEFORE INCOME TAXES | |

| 53,703 | | |

| (18,472 | ) |

| INCOME TAX BENEFIT: | |

| | | |

| | |

| Current | |

| — | | |

| — | |

| Deferred | |

| (554,741 | ) | |

| — | |

| Total income tax benefit | |

| (554,741 | ) | |

| — | |

| NET INCOME (LOSS) | |

$ | 608,444 | | |

$ | (18,472 | ) |

| Dividends on preferred stock | |

| (1,133 | ) | |

| (1,309 | ) |

| Participating securities - preferred stock | |

| (89,756 | ) | |

| — | |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON STOCKHOLDERS | |

$ | 517,555 | | |

$ | (19,781 | ) |

| | |

| | | |

| | |

| NET INCOME (LOSS) PER COMMON SHARE: | |

| | | |

| | |

| Basic | |

$ | 27.72 | | |

$ | (1.01 | ) |

| Diluted | |

$ | 27.37 | | |

$ | (1.01 | ) |

| Weighted average common shares outstanding—Basic | |

| 18,670 | | |

| 19,635 | |

| Weighted average common shares outstanding—Diluted | |

| 18,954 | | |

| 19,635 | |

Consolidated Statements of Income: Nine months ended September 30,

2023

(In thousands, except per share data)

(Unaudited)

| | |

Nine Months

Ended

September 30,

2023 | | |

Nine Months

Ended

September 30,

2022 | |

| REVENUES: | |

| | |

| |

| Natural gas sales | |

$ | 619,181 | | |

$ | 1,529,898 | |

| Oil and condensate sales | |

| 76,212 | | |

| 111,298 | |

| Natural gas liquid sales | |

| 92,935 | | |

| 143,741 | |

| Net gain (loss) on natural gas, oil and NGL derivatives | |

| 514,266 | | |

| (1,436,317 | ) |

| Total revenues | |

| 1,302,594 | | |

| 348,620 | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Lease operating expenses | |

| 51,644 | | |

| 47,246 | |

| Taxes other than income | |

| 25,849 | | |

| 45,679 | |

| Transportation, gathering, processing and compression | |

| 259,883 | | |

| 261,778 | |

| Depreciation, depletion and amortization | |

| 238,747 | | |

| 189,305 | |

| General and administrative expenses | |

| 27,238 | | |

| 24,128 | |

| Restructuring costs | |

| 4,762 | | |

| — | |

| Accretion expense | |

| 2,117 | | |

| 2,057 | |

| Total operating expenses | |

| 610,240 | | |

| 570,193 | |

| INCOME (LOSS) FROM OPERATIONS | |

| 692,354 | | |

| (221,573 | ) |

| OTHER EXPENSE (INCOME): | |

| | | |

| | |

| Interest expense | |

| 42,402 | | |

| 43,679 | |

| Other, net | |

| (20,492 | ) | |

| (11,385 | ) |

| Total other expense | |

| 21,910 | | |

| 32,294 | |

| INCOME (LOSS) BEFORE INCOME TAXES | |

| 670,444 | | |

| (253,867 | ) |

| INCOME TAX BENEFIT: | |

| | | |

| | |

| Current | |

| — | | |

| — | |

| Deferred | |

| (554,741 | ) | |

| — | |

| Total income tax benefit | |

| (554,741 | ) | |

| — | |

| NET INCOME (LOSS) | |

$ | 1,225,185 | | |

$ | (253,867 | ) |

| Dividends on preferred stock | |

| (3,718 | ) | |

| (4,136 | ) |

| Participating securities - preferred stock | |

| (180,394 | ) | |

| — | |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON STOCKHOLDERS | |

$ | 1,041,073 | | |

$ | (258,003 | ) |

| | |

| | | |

| | |

| NET INCOME (LOSS) PER COMMON SHARE: | |

| | | |

| | |

| Basic | |

$ | 55.72 | | |

$ | (12.58 | ) |

| Diluted | |

$ | 55.08 | | |

$ | (12.58 | ) |

| Weighted average common shares outstanding—Basic | |

| 18,686 | | |

| 20,514 | |

| Weighted average common shares outstanding—Diluted | |

| 18,937 | | |

| 20,514 | |

Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 8,325 | | |

$ | 7,259 | |

| Accounts receivable—oil, natural gas, and natural gas liquids sales | |

| 106,731 | | |

| 278,404 | |

| Accounts receivable—joint interest and other | |

| 12,364 | | |

| 21,478 | |

| Prepaid expenses and other current assets | |

| 8,173 | | |

| 7,621 | |

| Short-term derivative instruments | |

| 136,706 | | |

| 87,508 | |

| Total current assets | |

| 272,299 | | |

| 402,270 | |

| Property and equipment: | |

| | | |

| | |

| Oil and natural gas properties, full-cost method | |

| | | |

| | |

| Proved oil and natural gas properties | |

| 2,802,653 | | |

| 2,418,666 | |

| Unproved properties | |

| 196,947 | | |

| 178,472 | |

| Other property and equipment | |

| 8,120 | | |

| 6,363 | |

| Total property and equipment | |

| 3,007,720 | | |

| 2,603,501 | |

| Less: accumulated depletion, depreciation and amortization | |

| (784,635 | ) | |

| (545,771 | ) |

| Total property and equipment, net | |

| 2,223,085 | | |

| 2,057,730 | |

| Other assets: | |

| | | |

| | |

| Long-term derivative instruments | |

| 32,687 | | |

| 26,525 | |

| Deferred tax asset | |

| 554,741 | | |

| — | |

| Operating lease assets | |

| 17,466 | | |

| 26,713 | |

| Other assets | |

| 36,668 | | |

| 21,241 | |

| Total other assets | |

| 641,562 | | |

| 74,479 | |

| Total assets | |

$ | 3,136,946 | | |

$ | 2,534,479 | |

Consolidated Balance Sheets

(In thousands, except share data)

(Unaudited)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

| |

| Liabilities, Mezzanine Equity and Stockholders’ Equity | |

| | |

| |

| Current liabilities: | |

| | |

| |

| Accounts payable and accrued liabilities | |

$ | 310,584 | | |

$ | 437,384 | |

| Short-term derivative instruments | |

| 50,947 | | |

| 343,522 | |

| Current portion of operating lease liabilities | |

| 12,932 | | |

| 12,414 | |

| Total current liabilities | |

| 374,463 | | |

| 793,320 | |

| Non-current liabilities: | |

| | | |

| | |

| Long-term derivative instruments | |

| 54,020 | | |

| 118,404 | |

| Asset retirement obligation | |

| 34,270 | | |

| 33,171 | |

| Non-current operating lease liabilities | |

| 4,534 | | |

| 14,299 | |

| Long-term debt | |

| 644,324 | | |

| 694,155 | |

| Total non-current liabilities | |

| 737,148 | | |

| 860,029 | |

| Total liabilities | |

$ | 1,111,611 | | |

$ | 1,653,349 | |

| Commitments and contingencies (Note 9) | |

| | | |

| | |

| Mezzanine Equity: | |

| | | |

| | |

| Preferred stock - $0.0001 par value, 110.0 thousand shares authorized, 45.3 thousand issued and outstanding at September 30, 2023, and 52.3 thousand issued and outstanding at December 31, 2022 | |

| 45,329 | | |

| 52,295 | |

| Stockholders’ Equity: | |

| | | |

| | |

| Common stock - $0.0001 par value, 42.0 million shares authorized, 18.7 million issued and outstanding at September 30, 2023, and 19.1 million issued and outstanding at December 31, 2022 | |

| 2 | | |

| 2 | |

| Additional paid-in capital | |

| 379,102 | | |

| 449,243 | |

| Common stock held in reserve, 62.0 thousand shares at September 30, 2023, and 62.0 thousand shares at December 31, 2022 | |

| (1,996 | ) | |

| (1,996 | ) |

| Retained Earnings | |

| 1,603,339 | | |

| 381,872 | |

| Treasury stock, at cost - 3.7 thousand shares at September 30, 2023, and 3.9 thousand shares at December 31, 2022 | |

| (441 | ) | |

| (286 | ) |

| Total stockholders’ equity | |

$ | 1,980,006 | | |

$ | 828,835 | |

| Total liabilities, mezzanine equity and stockholders’ equity | |

$ | 3,136,946 | | |

$ | 2,534,479 | |

Consolidated Statement of Cash Flows: Three months ended September

30, 2023

(In thousands)

(Unaudited)

| | |

Three Months Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net income (loss) | |

$ | 608,444 | | |

$ | (18,472 | ) |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depletion, depreciation and amortization | |

| 79,505 | | |

| 64,419 | |

| Net (gain) loss on derivative instruments | |

| (39,417 | ) | |

| 474,895 | |

| Net cash receipts (payments) on settled derivative instruments | |

| 49,061 | | |

| (365,950 | ) |

| Deferred income tax benefit | |

| (554,741 | ) | |

| — | |

| Other, net | |

| 4,043 | | |

| 3,232 | |

| Changes in operating assets and liabilities, net | |

| 9,379 | | |

| 9,758 | |

| Net cash provided by operating activities | |

| 156,274 | | |

| 167,882 | |

| Cash flows from investing activities: | |

| | | |

| | |

| Additions to oil and natural gas properties | |

| (137,726 | ) | |

| (150,207 | ) |

| Proceeds from sale of oil and natural gas properties | |

| (1 | ) | |

| 2,630 | |

| Other, net | |

| (661 | ) | |

| (478 | ) |

| Net cash used in investing activities | |

| (138,388 | ) | |

| (148,055 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Principal payments on Credit Facility | |

| (230,000 | ) | |

| (676,000 | ) |

| Borrowings on Credit Facility | |

| 226,000 | | |

| 731,000 | |

| Debt issuance costs and loan commitment fees | |

| (45 | ) | |

| (42 | ) |

| Dividends on preferred stock | |

| (1,131 | ) | |

| (1,308 | ) |

| Repurchase of common stock under Repurchase Program | |

| (8,241 | ) | |

| (70,579 | ) |

| Other, net | |

| (1,413 | ) | |

| (1,192 | ) |

| Net cash used in financing activities | |

| (14,830 | ) | |

| (18,121 | ) |

| Net increase in cash and cash equivalents | |

| 3,056 | | |

| 1,706 | |

| Cash and cash equivalents at beginning of period | |

| 5,269 | | |

| 6,581 | |

| Cash and cash equivalents at end of period | |

$ | 8,325 | | |

$ | 8,287 | |

Consolidated Statement of Cash Flows: Nine months ended September

30, 2023

(In thousands)

(Unaudited)

| | |

Nine Months

Ended

September 30,

2023 | | |

Nine Months

Ended

September 30,

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net income (loss) | |

$ | 1,225,185 | | |

$ | (253,867 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Depletion, depreciation and amortization | |

| 238,747 | | |

| 189,305 | |

| Net (gain) loss on derivative instruments | |

| (514,266 | ) | |

| 1,436,317 | |

| Net cash receipts (payments) on settled derivative instruments | |

| 101,947 | | |

| (799,416 | ) |

| Deferred income tax benefit | |

| (554,741 | ) | |

| — | |

| Other, net | |

| 13,270 | | |

| 8,303 | |

| Changes in operating assets and liabilities, net | |

| 57,538 | | |

| (29,560 | ) |

| Net cash provided by operating activities | |

| 567,680 | | |

| 551,082 | |

| Cash flows from investing activities: | |

| | | |

| | |

| Additions to oil and natural gas properties | |

| (421,132 | ) | |

| (331,994 | ) |

| Proceeds from sale of oil and natural gas properties | |

| 2,647 | | |

| 3,210 | |

| Other, net | |

| (1,496 | ) | |

| (536 | ) |

| Net cash used in investing activities | |

| (419,981 | ) | |

| (329,320 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Principal payments on Credit Facility | |

| (748,000 | ) | |

| (1,512,000 | ) |

| Borrowings on Credit Facility | |

| 698,000 | | |

| 1,527,000 | |

| Debt issuance costs and loan commitment fees | |

| (6,965 | ) | |

| (211 | ) |

| Dividends on preferred stock | |

| (3,718 | ) | |

| (4,136 | ) |

| Repurchase of common stock under Repurchase Program | |

| (82,757 | ) | |

| (225,791 | ) |

| Other, net | |

| (3,193 | ) | |

| (1,597 | ) |

| Net cash used in financing activities | |

| (146,633 | ) | |

| (216,735 | ) |

| Net increase in cash and cash equivalents | |

| 1,066 | | |

| 5,027 | |

| Cash and cash equivalents at beginning of period | |

| 7,259 | | |

| 3,260 | |

| Cash and cash equivalents at end of period | |

$ | 8,325 | | |

$ | 8,287 | |

Full Year 2023E Guidance

The Company’s full year 2023 guidance (changes

in italics) is set forth in the table below. Gulfport’s 2023 guidance assumes commodity strip prices as of October 17, 2023, adjusted

for applicable commodity and location differentials, and no property acquisitions or divestitures.

| | |

Year Ending | |

| | |

December 31, 2023 | |

| | |

Low | | |

High | |

| Production | |

| | |

| |

| Average daily gas equivalent (MMcfe/day) | |

| 1,045 | | |

| 1,055 | |

| % Gas | |

| ~90% | |

| | |

| | | |

| | |

| Realizations (before hedges) | |

| | | |

| | |

| Natural gas (differential to NYMEX settled price) ($/Mcf) | |

$ | (0.20 | ) | |

$ | (0.35 | ) |

| NGL (% of WTI) | |

| 35 | % | |

| 40 | % |

| Oil (differential to NYMEX WTI) ($/Bbl) | |

$ | (3.50 | ) | |

$ | (4.50 | ) |

| | |

| | | |

| | |

| Expenses | |

| | | |

| | |

| Lease operating expense ($/Mcfe) | |

$ | 0.16 | | |

$ | 0.18 | |

| Taxes other than income ($/Mcfe) | |

$ | 0.10 | | |

$ | 0.12 | |

| Transportation, gathering, processing and compression ($/Mcfe) | |

$ | 0.90 | | |

$ | 0.94 | |

| Recurring cash general and administrative(1,2) ($/Mcfe) | |

$ | 0.11 | | |

$ | 0.13 | |

| | |

Total | |

| Capital expenditures (incurred) | |

(in millions) | |

| D&C | |

$ | 385 | | |

$ | 395 | |

| Maintenance leasehold and land | |

$ | 50 | | |

$ | 60 | |

| Total base capital expenditures | |

$ | 435 | | |

$ | 455 | |

| | |

| | | |

| | |

| Discretionary acreage acquisitions | |

| ~$40 | |

| (1) | Recurring cash G&A includes capitalization. It excludes

non-cash stock compensation and expenses related to the continued administration of our prior Chapter 11 filing. |

| (2) | This is a non-GAAP measure. Reconciliations of these non-GAAP

measures and other disclosures are provided with the supplemental financial tables available on our website at www.gulfportenergy.com. |

Derivatives

The below details Gulfport’s hedging positions

as of October 31, 2023:

| | |

| 4Q2023 | | |

| Full Year

2024 | | |

| Full Year

2025 | |

| Natural Gas Contract Summary (NYMEX): | |

| | | |

| | | |

| | |

| Fixed Price Swaps | |

| | | |

| | | |

| | |

| Volume (BBtupd) | |

| 280 | | |

| 325 | | |

| 150 | |

| Weighted Average Price ($/MMBtu) | |

$ | 4.36 | | |

$ | 4.05 | | |

$ | 4.08 | |

| | |

| | | |

| | | |

| | |

| Fixed Price Collars | |

| | | |

| | | |

| | |

| Volume (BBtupd) | |

| 285 | | |

| 225 | | |

| 100 | |

| Weighted Average Floor Price ($/MMBtu) | |

$ | 2.93 | | |

$ | 3.36 | | |

$ | 3.62 | |

| Weighted Average Ceiling Price ($/MMBtu) | |

$ | 4.78 | | |

$ | 5.14 | | |

$ | 4.54 | |

| | |

| | | |

| | | |

| | |

| Fixed Price Calls Sold | |

| | | |

| | | |

| | |

| Volume (BBtupd) | |

| 408 | | |

| 202 | | |

| 193 | |

| Weighted Average Price ($/MMBtu) | |

$ | 3.21 | | |

$ | 3.33 | | |

$ | 5.80 | |

| | |

| | | |

| | | |

| | |

| Rex Zone 3 Basis | |

| | | |

| | | |

| | |

| Volume (BBtupd) | |

| 140 | | |

| 150 | | |

| — | |

| Differential ($/MMBtu) | |

$ | (0.22 | ) | |

$ | (0.15 | ) | |

$ | — | |

| | |

| | | |

| | | |

| | |

| Tetco M2 Basis | |

| | | |

| | | |

| | |

| Volume (BBtupd) | |

| 210 | | |

| 140 | | |

| — | |

| Differential ($/MMBtu) | |

$ | (0.91 | ) | |

$ | (0.94 | ) | |

$ | — | |

| | |

| | | |

| | | |

| | |

| NGPL TX OK Basis | |

| | | |

| | | |

| | |

| Volume (BBtupd) | |

| 80 | | |

| 70 | | |

| — | |

| Differential ($/MMBtu) | |

$ | (0.35 | ) | |

$ | (0.31 | ) | |

$ | — | |

| | |

| | | |

| | | |

| | |

| Oil Contract Summary (WTI): | |

| | | |

| | | |

| | |

| Fixed Price Swaps | |

| | | |

| | | |

| | |

| Volume (Bblpd) | |

| 3,000 | | |

| 500 | | |

| — | |

| Weighted Average Price ($/Bbl) | |

$ | 74.47 | | |

$ | 77.50 | | |

$ | — | |

| | |

| | | |

| | | |

| | |

| Fixed Price Collars | |

| | | |

| | | |

| | |

| Volume (Bblpd) | |

| — | | |

| 1,000 | | |

| — | |

| Weighted Average Floor Price ($/Bbl) | |

$ | — | | |

$ | 62.00 | | |

$ | — | |

| Weighted Average Ceiling Price ($/Bbl) | |

$ | — | | |

$ | 80.00 | | |

$ | — | |

| | |

| | | |

| | | |

| | |

| NGL Contract Summary: | |

| | | |

| | | |

| | |

| C3 Propane Fixed Price Swaps | |

| | | |

| | | |

| | |

| Volume (Bblpd) | |

| 3,000 | | |

| 2,500 | | |

| 1,000 | |

| Weighted Average Price ($/Bbl) | |

$ | 38.07 | | |

$ | 30.25 | | |

$ | 30.03 | |

Non-GAAP Reconciliations

Gulfport’s management uses certain

non-GAAP financial measures for planning, forecasting and evaluating business and financial performance, and believes that they are

useful tool to assess Gulfport’s operating results. Although these are not measures of performance calculated in accordance

with generally accepted accounting principles (GAAP), management believes that these financial measures are useful to an investor in

evaluating Gulfport because (i) analysts utilize these metrics when evaluating company performance and have requested this

information as of a recent practicable date, (ii) these metrics are widely used to evaluate a company’s operating performance,

and (iii) we want to provide updated information to investors. Investors should not view these metrics as a substitute for measures

of performance that are calculated in accordance with GAAP. In addition, because all companies do not calculate these measures

identically, these measures may not be comparable to similarly titled measures of other companies.

These non-GAAP financial measures include adjusted

net income, adjusted EBITDA, adjusted free cash flow, and recurring general and administrative expense. A reconciliation of each financial

measure to its most directly comparable GAAP financial measure is included in the tables below. These non-GAAP measure should be considered

in addition to, but not instead of, the financial statements prepared in accordance with GAAP.

Definitions

Adjusted net income is a non-GAAP financial measure

equal to net income (loss) less deferred income tax benefit, non-cash derivative (gain) loss, non-recurring general and administrative

expenses comprised of expenses related to the continued administration of our prior Chapter 11 filing, stock-based compensation expenses,

restructuring costs and other items which include items related to our Chapter 11 filing and other non-material expenses.

Adjusted EBITDA is a non-GAAP financial measure

equal to net income (loss), the most directly comparable GAAP financial measure, plus interest expense, deferred income tax benefit, depreciation,

depletion and amortization, and impairment of oil and gas properties, property and equipment, accretion, non-cash derivative (gain) loss,

non-recurring general and administrative expenses comprised of expenses related to the continued administration of our prior Chapter 11

filing, stock-based compensation, restructuring costs and other items which include items related to our Chapter 11 filing and other non-material

expenses.

Adjusted free cash flow is a non-GAAP measure

defined as adjusted EBITDA plus certain non-cash items that are included in net cash provided by (used in) operating activities but excluded

from adjusted EBITDA less interest expense, capitalized expenses incurred and capital expenditures incurred, excluding discretionary acreage

acquisitions. Gulfport includes an adjusted free cash flow estimate for 2023. We are unable, however, to provide a quantitative reconciliation

of the forward-looking non-GAAP measure to its most directly comparable forward-looking GAAP measure because management cannot reliably

quantify certain of the necessary components of such forward-looking GAAP measure. Accordingly, Gulfport is relying on the exception provided

by Item 10(e)(1)(i)(B) of Regulation S-K to exclude such reconciliation. Items excluded in net cash provided by (used in) operating activities

to arrive at adjusted free cash flow include interest expense, income taxes, capitalized expenses as well as one-time items or items whose

timing or amount cannot be reasonably estimated.

Recurring general and administrative expense is

a non-GAAP financial measure equal to general and administrative expense (GAAP) plus capitalized general and administrative expense, less

non-recurring general and administrative expenses comprised of expenses related to the continued administration of our prior Chapter 11

filing. Gulfport includes a recurring general and administrative expense estimate for 2023. We are unable, however, to provide a quantitative

reconciliation of the forward-looking non-GAAP measure to its most directly comparable forward-looking GAAP measure because management

cannot reliably quantify certain of the necessary components of such forward-looking GAAP measure. Accordingly, Gulfport is relying on

the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude such reconciliation. Items excluded in general and administrative

expense to arrive at recurring general and administrative expense include capitalized expenses as well as one-time items or items whose

timing or amount cannot be reasonably estimated. The non-GAAP measure recurring general and administrative expenses allows investors to

compare Gulfport’s total general and administrative expenses, including capitalization, to peer companies that account for their

oil and gas operations using the successful efforts method.

Adjusted Net Income: Three months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Three Months

Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| | |

| | |

| |

| Net Income (Loss) (GAAP) | |

$ | 608,444 | | |

$ | (18,472 | ) |

| | |

| | | |

| | |

| Adjustments: | |

| | | |

| | |

| Deferred income tax benefit | |

| (554,741 | ) | |

| — | |

| Non-cash derivative loss | |

| 9,644 | | |

| 108,945 | |

| Non-recurring general and administrative expense | |

| 700 | | |

| 914 | |

| Stock-based compensation expense | |

| 2,360 | | |

| 1,583 | |

| Other, net | |

| (1,438 | ) | |

| (857 | ) |

| Adjusted Net Income (Non-GAAP) | |

$ | 64,969 | | |

$ | 92,113 | |

Adjusted Net Income: Nine months ended September

30, 2023

(In thousands)

(Unaudited)

| | |

Nine Months

Ended

September 30,

2023 | | |

Nine Months

Ended

September 30,

2022 | |

| | |

| | |

| |

| Net Income (Loss) (GAAP) | |

$ | 1,225,185 | | |

$ | (253,867 | ) |

| | |

| | | |

| | |

| Adjustments: | |

| | | |

| | |

| Deferred income tax benefit | |

| (554,741 | ) | |

| — | |

| Non-cash derivative (gain) loss | |

| (412,319 | ) | |

| 636,901 | |

| Non-recurring general and administrative expense | |

| 2,435 | | |

| 1,673 | |

| Stock-based compensation expense | |

| 6,138 | | |

| 4,157 | |

| Restructuring costs | |

| 4,762 | | |

| — | |

| Other, net(1)(2) | |

| (20,492 | ) | |

| (11,385 | ) |

| Adjusted Net Income (Non-GAAP) | |

$ | 250,968 | | |

$ | 377,479 | |

| (1) |

For the nine months ended September 30, 2023, “Other, net” included a $17.8 million receipt of funds related to our interim claim distribution from our Chapter 11 Plan of Reorganization and a $1 million administrative payment to Rover as part of the executed settlement. The distribution and settlement is more fully described in Note 9 of our consolidated financial statements included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2023. Additionally, “Other, net” included a $5.0 million recoupment of previously placed collateral for certain firm transportation commitments during our Chapter 11 filing. |

| (2) |

For the nine months ended September 30, 2022, “Other, net” included $11.5 million receipt of funds related to our initial claim distribution from our Chapter 11 Plan of Reorganization. The distribution is more fully described in Note 9 of our consolidated financial statements included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2023. Additionally, “Other, net” included a $5.1 million payment to settle certain gas imbalance positions and a $5.2 million receipt of funds from a litigation settlement. |

Adjusted EBITDA: Three months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Three Months

Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| | |

| | |

| |

| Net Income (Loss) (GAAP) | |

$ | 608,444 | | |

$ | (18,472 | ) |

| | |

| | | |

| | |

| Adjustments: | |

| | | |

| | |

| Interest expense | |

| 14,919 | | |

| 15,461 | |

| Deferred income tax benefit | |

| (554,741 | ) | |

| — | |

| DD&A and accretion | |

| 80,144 | | |

| 65,092 | |

| Non-cash derivative loss | |

| 9,644 | | |

| 108,945 | |

| Non-recurring general and administrative expenses | |

| 700 | | |

| 914 | |

| Stock-based compensation expense | |

| 2,360 | | |

| 1,583 | |

| Other, net | |

| (1,438 | ) | |

| (857 | ) |

| Adjusted EBITDA (Non-GAAP) | |

$ | 160,032 | | |

$ | 172,666 | |

Adjusted EBITDA: Nine months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Nine Months

Ended

September 30,

2023 | | |

Nine Months

Ended

September 30,

2022 | |

| | |

| | |

| |

| Net Income (Loss) (GAAP) | |

$ | 1,225,185 | | |

$ | (253,867 | ) |

| | |

| | | |

| | |

| Adjustments: | |

| | | |

| | |

| Interest expense | |

| 42,402 | | |

| 43,679 | |

| Deferred income tax benefit | |

| (554,741 | ) | |

| — | |

| DD&A and accretion | |

| 240,864 | | |

| 191,362 | |

| Non-cash derivative (gain) loss | |

| (412,319 | ) | |

| 636,901 | |

| Non-recurring general and administrative expenses | |

| 2,435 | | |

| 1,673 | |

| Stock-based compensation expense | |

| 6,138 | | |

| 4,157 | |

| Restructuring costs | |

| 4,762 | | |

| — | |

| Other, net(1)(2) | |

| (20,492 | ) | |

| (11,385 | ) |

| Adjusted EBITDA (Non-GAAP) | |

$ | 534,234 | | |

$ | 612,520 | |

| (1) |

For the nine months ended September 30, 2023, “Other, net” included a $17.8 million receipt of funds related to our interim claim distribution from our Chapter 11 Plan of Reorganization and a $1 million administrative payment to Rover as part of the executed settlement. The distribution and settlement is more fully described in Note 9 of our consolidated financial statements included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2023. Additionally, “Other, net” included a $5.0 million recoupment of previously placed collateral for certain firm transportation commitments during our Chapter 11 filing. |

| (2) |

For the nine months ended September 30, 2022, “Other, net” included $11.5 million receipt of funds related to our initial claim distribution from our Chapter 11 Plan of Reorganization. The distribution is more fully described in Note 9 of our consolidated financial statements included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2023. Additionally, “Other, net” included a $5.1 million payment to settle certain gas imbalance positions and a $5.2 million receipt of funds from a litigation settlement. |

Adjusted Free Cash Flow: Three months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Three Months

Ended

September 30,

2023 | | |

Three Months

Ended

September 30,

2022 | |

| | |

| | |

| |

| Net cash provided by operating activity (GAAP) | |

$ | 156,274 | | |

$ | 167,882 | |

| Adjustments: | |

| | | |

| | |

| Interest expense | |

| 14,919 | | |

| 15,461 | |

| Non-recurring general and administrative expenses | |

| 700 | | |

| 914 | |

| Other, net | |

| (2,482 | ) | |

| (1,833 | ) |

| Changes in operating assets and liabilities, net: | |

| | | |

| | |

| Accounts receivable - oil, natural gas, and natural gas liquids sales | |

| 14,627 | | |

| 631 | |

| Accounts receivable - joint interest and other | |

| (5,519 | ) | |

| 10,836 | |

| Accounts payable and accrued liabilities | |

| (17,175 | ) | |

| (21,603 | ) |

| Prepaid expenses | |

| (1,329 | ) | |

| 324 | |

| Other assets | |

| 17 | | |

| 54 | |

| Total changes in operating assets and liabilities, net | |

$ | (9,379 | ) | |

$ | (9,758 | ) |

| Adjusted EBITDA (Non-GAAP) | |

$ | 160,032 | | |

$ | 172,666 | |

| Interest expense | |

| (14,919 | ) | |

| (15,461 | ) |

| Capitalized expenses incurred(1) | |

| (5,611 | ) | |

| (4,109 | ) |

| Capital expenditures incurred(2,3) | |

| (90,584 | ) | |

| (142,017 | ) |

| Adjusted free cash flow (Non-GAAP)(3) | |

$ | 48,918 | | |

$ | 11,079 | |

| (1) |

Includes cash capitalized general and administrative expense and incurred capitalized interest expenses. |

| (2) |

Incurred capital expenditures and cash capital expenditures may vary from period to period due to the cash payment cycle. |

| (3) |

Includes $0.7 million of non-O&G capital and excludes targeted discretionary acreage acquisitions of $19.4 million that the Company has previously guided to an anticipated total of ~$40 million of discretionary acreage acquisitions in 2023. |

Adjusted Free Cash Flow: Nine months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Nine Months Ended

September 30,

2023 | | |

Nine Months Ended

September 30,

2022 | |

| | |

| | |

| |

| Net cash provided by operating activity (GAAP) | |

$ | 567,680 | | |

$ | 551,082 | |

| Adjustments: | |

| | | |

| | |

| Interest expense | |

| 42,402 | | |

| 43,679 | |

| Non-recurring general and administrative expenses | |

| 2,435 | | |

| 1,673 | |

| Restructuring costs | |

| 4,762 | | |

| — | |

| Other, net(1)(2) | |

| (25,507 | ) | |

| (13,474 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable - oil, natural gas, and natural gas liquids sales | |

| (171,673 | ) | |

| 84,674 | |

| Accounts receivable - joint interest and other | |

| (9,114 | ) | |

| 14,947 | |

| Accounts payable and accrued liabilities | |

| 123,657 | | |

| (65,648 | ) |

| Prepaid expenses | |

| (356 | ) | |

| (3,061 | ) |

| Other assets | |

| (52 | ) | |

| (1,352 | ) |

| Total changes in operating assets and liabilities | |

$ | (57,538 | ) | |

$ | 29,560 | |

| Adjusted EBITDA (Non-GAAP) | |

$ | 534,234 | | |

$ | 612,520 | |

| Interest expense | |

| (42,402 | ) | |

| (43,679 | ) |

| Capitalized expenses incurred(3) | |

| (16,117 | ) | |

| (12,486 | ) |

| Capital expenditures incurred(4,5) | |

| (362,298 | ) | |

| (348,147 | ) |

| Adjusted free cash flow (Non-GAAP)(5) | |

$ | 113,417 | | |

$ | 208,208 | |

| (1) |

For the nine months ended September 30, 2023, “Other, net” included a $17.8 million receipt of funds related to our interim claim distribution from our Chapter 11 Plan of Reorganization and a $1 million administrative payment to Rover as part of the executed settlement. The distribution and settlement is more fully described in Note 9 of our consolidated financial statements included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2023. Additionally, “Other, net” included a $5.0 million recoupment of previously placed collateral for certain firm transportation commitments during our Chapter 11 filing. |

| (2) |

For the nine months ended September 30, 2022, “Other, net” included $11.5 million receipt of funds related to our initial claim distribution from our Chapter 11 Plan of Reorganization. The distribution is more fully described in Note 9 of our consolidated financial statements included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2023. Additionally, “Other, net” included a $5.1 million payment to settle certain gas imbalance positions and a $5.2 million receipt of funds from a litigation settlement. |

| (3) |

Includes cash capitalized general and administrative expense and incurred capitalized interest expenses. |

| (4) |

Incurred capital expenditures and cash capital expenditures may vary from period to period due to the cash payment cycle. |

| (5) |

Includes $1.7 million of non-O&G capital and excludes targeted discretionary acreage acquisitions of $24.9 million that the Company has previously guided to an anticipated total of ~$40 million of discretionary acreage acquisitions in 2023. |

Recurring General and Administrative Expenses:

Three months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Three Months Ended September 30,

2023 | | |

Three Months Ended September 30,

2022 | |

| | |

Cash | | |

Non-Cash | | |

Total | | |

Cash | | |

Non-Cash | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| General and administrative expense (GAAP) | |

$ | 7,534 | | |

$ | 2,360 | | |

$ | 9,894 | | |

$ | 7,169 | | |

$ | 1,583 | | |

$ | 8,752 | |

| Capitalized general and administrative expense | |

| 4,496 | | |

| 1,162 | | |

| 5,658 | | |

| 4,109 | | |

| 815 | | |

| 4,924 | |

| Non-recurring general and administrative expense | |

| (700 | ) | |

| — | | |

| (700 | ) | |

| (914 | ) | |

| — | | |

| (914 | ) |

| Recurring general and administrative before capitalization (Non-GAAP) | |

$ | 11,330 | | |

$ | 3,522 | | |

$ | 14,852 | | |

$ | 10,364 | | |

$ | 2,398 | | |

$ | 12,762 | |

Recurring General and Administrative Expenses:

Nine months ended September 30, 2023

(In thousands)

(Unaudited)

| | |

Nine Months Ended September 30,

2023 | | |

Nine Months Ended September 30,

2022 | |

| | |

Cash | | |

Non-Cash | | |

Total | | |

Cash | | |

Non-Cash | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| General and administrative expense (GAAP) | |

$ | 21,100 | | |

$ | 6,138 | | |

$ | 27,238 | | |

$ | 19,971 | | |

$ | 4,157 | | |

$ | 24,128 | |

| Capitalized general and administrative expense | |

| 13,163 | | |

| 3,023 | | |

| 16,186 | | |

| 12,486 | | |

| 2,142 | | |

| 14,628 | |

| Non-recurring general and administrative expense | |

| (2,435 | ) | |

| — | | |

| (2,435 | ) | |

| (1,673 | ) | |

| — | | |

| (1,673 | ) |

| Recurring general and administrative before capitalization (Non-GAAP) | |

$ | 31,828 | | |

$ | 9,161 | | |

$ | 40,989 | | |

$ | 30,784 | | |

$ | 6,299 | | |

$ | 37,083 | |

Page 23

Exhibit 99.3

| |

|

| Gulfport Energy Achieves Grade “A” MiQ Certification for Appalachia Operations and Publishes 2023 Corporate Sustainability Report |

OKLAHOMA CITY (October 31, 2023) Gulfport

Energy Corporation (NYSE: GPOR) (“Gulfport” or the “Company”) today announced that it has achieved a grade “A”

under the MiQ methane emissions standard for its natural gas production across the entirety of its Appalachia operations. In addition,

the Company published its 2023 Corporate Sustainability Report, providing updates on topics significant to stakeholders and an update

on Gulfport’s commitment to emission intensity reductions throughout our operations.

John Reinhart, President and CEO, commented, “As

a leading natural gas producer in Appalachia, Gulfport is committed to emission intensity reductions throughout our operations, and the

A grade certification announced today underscores our ongoing commitment to responsibly produce and deliver independently certified gas

to domestic markets. In addition, we are pleased to share with you Gulfport’s 2023 Sustainability Report, a direct reflection of

our continuous improvement culture, and our commitment to responsible and transparent environmental, social and governance practices.

While we are proud of our progress, we recognize that there is more work to be done to shape our sustainable future. We remain committed

to increasing value for our shareholders while being a good steward of the assets we operate, which we believe benefits all our stakeholders.”

Corporate Sustainability Report Highlights

| ● | Received an “A” grade MiQ certification for all Appalachia assets in 2023 |

| ● | Reduced methane emissions intensity by 25% in 2022 compared to 2021 |

| ● | Reused or recycled 71% of water generated from production and flowback operations during 2022 |

| ● | Reduced combined total recordable incident rate by 43% in 2022 compared to 2021 |

| ● | Increased diversity in the workplace with 45% of new hires identifying as gender or ethnically diverse |

| ● | Appointed two gender diverse directors in 2023, resulting in 60% diversity of Independent Directors |

| ● | Partnered with organizations that support Gulfport’s key focus areas in Oklahoma and Ohio through volunteering and monetary

contributions |

The full Corporate Sustainability Report can be accessed by clicking

here or visiting www.gulfportenergy.com/sustainability.

MiQ Certification

Gulfport’s Appalachia assets were independently

analyzed by MiQ, an independent non-profit organization dedicated to facilitating a rapid reduction in methane emissions from the oil

and gas sector. The certification process included an independent assessment of the Company’s emissions performance from the wellhead

to delivery, focused on monitoring and best practices, with validation by a third-party auditor. The MiQ standard incorporates A to F

grades and is an annual certification that validates the Company’s commitment to managing, reducing, and accurately reporting methane

emissions. Gulfport achieved the highest available “A” grade in all three major areas for its Appalachia operations: calculated

methane intensity, robust monitoring technology deployment (at facility- and source-levels) and company practices.

About Gulfport

Gulfport is an independent natural gas-weighted

exploration and production company focused on the exploration, acquisition and production of natural gas, crude oil and NGL in the United

States with primary focus in the Appalachia and Anadarko basins. Our principal properties are located in eastern Ohio targeting the Utica

and Marcellus formations and in central Oklahoma targeting the SCOOP Woodford and SCOOP Springer formations.

About MiQ

MiQ is an independent not-for-profit established

to facilitate a rapid reduction in methane emissions from the oil and gas sector. MiQ is the fastest growing and globally recognized methane