As filed with the Securities and Exchange Commission on August 23, 2023

Registration No. 333-271563

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Digital Media Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 7389 | 98-1399727 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

4800 140th Avenue N., Suite 101

Clearwater, FL

(877) 236-8632

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Anthony Saldana

Executive Vice President & General Counsel

Digital Media Solutions, Inc.

4800 140th Avenue N., Suite 101

Clearwater, FL

(877) 236-8632

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With Copies to:

Jeremy L. Moore

Baker & McKenzie LLP

800 Capital Street

Houston, TX 77002

(713) 427-5000

From time to time after this Registration Statement becomes effective

(Approximate Date of Commencement of Proposed Sale to the Public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling security holders may sell or distribute the securities described herein until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 23, 2023

PRELIMINARY PROSPECTUS

Digital Media Solutions, Inc.

49,206,264 Shares of Class A Common Stock

This prospectus relates to the offer and sale from time to time by the selling shareholders identified in this prospectus (the “Selling Shareholders”), or their permitted transferees, of up to 49,206,264 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”) of Digital Media Solutions, Inc., a Delaware corporation (“DMS”), consisting of (i) 19,863,897 shares of Class A Common Stock issuable upon the conversion of 80,000 shares of Series A Convertible Redeemable Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”) issued in a private placement in March 2023 (the “Private Placement”); (ii) 14,897,923 shares of Class A Common Stock issuable upon the conversion of 60,000 shares of Series B Convertible Redeemable Preferred Stock, par value $0.0001 per share (the “Series B Preferred Stock” and, together with the Series A Preferred Stock, the “Preferred Stock”) issued in the Private Placement; and (iii) 14,444,444 shares of Class A Common Stock issuable upon the conversion of warrants to acquire shares of Class A Common Stock, at an exercise price of $0.6453 per share (the “March Warrants”) issued in the Private Placement.

This prospectus provides you with a general description of such securities and the general manner in which the Selling Shareholders may offer or sell the securities. More specific terms of any securities that DMS and the Selling Shareholders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

DMS will not receive any proceeds from the sale of shares of the Preferred Stock or Class A Common Stock by the Selling Shareholders pursuant to this prospectus. However, DMS will pay the expenses, other than underwriting discounts and commissions, associated with the sale of securities by the Selling Shareholders pursuant to this prospectus.

The registration of the securities covered by this prospectus does not mean that the Selling Shareholders will offer or sell any of such securities. The Selling Shareholders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. See the section of this prospectus entitled “Plan of Distribution” for additional information.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in DMS securities.

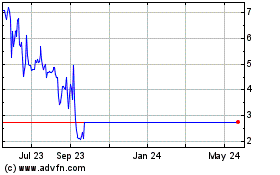

The Class A Common Stock is traded on the New York Stock Exchange under the symbol “DMS.” On April 28, 2023, the closing price of the Class A Common Stock was $0.69 per share.

DMS is an “emerging growth company” and a “smaller reporting company,” as such terms are defined under the federal securities laws and, as such, is subject to certain reduced public company reporting requirements.

Investing in DMS securities involves risks. See the risk factors set forth in the section of this prospectus entitled “Risk Factors” beginning on page 5 and in any applicable prospectus supplement and incorporated by reference herein. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 23, 2023.

Table of Contents

About This Prospectus

Unless the context indicates otherwise, references to “DMS,” the “Company,” “we,” “us” and “our” in this prospectus refer to Digital Media Solutions, Inc., a Delaware corporation, and its consolidated subsidiaries following the Business Combination (as defined in “Selected Definitions”).

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, the Selling Shareholders may, from time to time, offer and sell, the securities described in this prospectus in one or more offerings. The Selling Shareholders may use the shelf registration statement to sell up to an aggregate of 49,206,264 shares of Class A Common Stock, consisting of (i) 19,863,897 shares of Class A Common Stock issuable upon the conversion of 80,000 shares of Series A Preferred Stock issued in the Private Placement; (ii) 14,897,923 shares of Class A Common Stock issuable upon the conversion of 60,000 shares of Series B Preferred Stock issued in the Private Placement; and (iii) 14,444,444 shares of Class A Common Stock issuable upon the conversion of the March Warrants to acquire shares of Class A Common Stock at an exercise price of $0.6453 per share issued in the Private Placement, from time to time through any means described in “Plan of Distribution.” More specific terms of any securities that the Selling Shareholders may offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the Class A Common Stock being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Shareholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Shareholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

Where You Can Find More Information

We have filed with the SEC a registration statement under the Securities Act with respect to the securities offered by this prospectus. This prospectus, which forms a part of such registration statement, does not contain all of the information included in the registration statement. For further information pertaining to us and our securities, you should refer to the registration statement and to its exhibits. The registration statement has been filed electronically and may be obtained in any manner listed below. Whenever we make reference in this prospectus to any of our contracts, agreements or other documents, the references are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement or a report we file under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), you should refer to the copy of the contract or document that has been filed. Each statement in this prospectus relating to a contract or document filed as an exhibit to a registration statement or report is qualified in all respects by the filed exhibit.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the internet at the SEC’s website at www.sec.gov and on our website at www.digitalmediasolutions.com. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this prospectus. You may inspect a copy of the registration statement through the SEC’s website, as provided herein.

Incorporation of Documents by Reference

This registration statement incorporates by reference important business and financial information about our Company that is not included in or delivered with this document. The information incorporated by reference is considered to be part of this prospectus, and the SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important information to you by referring you to those documents instead of having to repeat the information in this prospectus. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate by reference:

•our Annual Reports on Form 10-K/A for the year ended December 31, 2022, filed with the SEC on April 5, 2023 and May 1, 2023, respectively (each individually, an “Annual Report”); •our Quarterly Report on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023, filed on May 10, 2023 and August 17, 2023, respectively; •our Current Reports on Form 8-K filed with the SEC on March 10, 2023, April 5, 2023, April 17, 2023, May 4, 2023, May 9, 2023, May 15, 2023, May 25, 2023, June 12, 2023, June 20, 2023, June 26, 2023, and June 30, 2023; and •the description of our securities contained in Exhibit 4.4 to our Annual Report on Form 10-K/A for the year ended December 31, 2020, filed with the SEC on May 18, 2021. We also incorporate by reference any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished to, rather than filed with, the SEC), including prior to the termination of the offering of the common stock made by this prospectus. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Digital Media Solutions, Inc.

4800 140th Avenue N., Suite 101

Clearwater, FL

(877) 236-8632

Those copies will not include exhibits, unless the exhibits have specifically been incorporated by reference in this document or you specifically request them.

Cautionary Statement Regarding Forward-Looking Statements

This prospectus contains certain statements that are, or may be deemed to be, forward-looking statements within the meaning of that term in Section 27A of the Securities Act, and Section 21E of the Exchange Act, and are made in reliance upon the protections provided by such acts for forward-looking statements. These forward statements are often identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “assume,” “likely,” “predicts,” “potential,” “continue,” and similar expressions. These forward-looking statements are often identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “assume,” “likely,” “predicts,” “potential,” “continue,” and similar expressions. These forward-looking statements include, without limitation, DMS’s expectations with respect to its future performance and its ability to implement its strategy, and are based on the beliefs and expectations of our management team from the information available at the time such statements are made. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside DMS’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to:

•DMS’s ability to attain the expected financial benefits from the ClickDealer transaction;

•any impacts to the ClickDealer business from our acquisition thereof;

•the COVID-19 pandemic or other public health crises;

•management of our international expansion as a result of the ClickDealer acquisition;

•changes in client demand for our services and our ability to adapt to such changes;

•the entry of new competitors in the market;

•the ability to maintain and attract consumers and advertisers in the face of changing economic or competitive conditions;

•the ability to maintain, grow and protect the data DMS obtains from consumers and advertisers, and to ensure compliance with data privacy regulations in newly entered markets;

•the performance of DMS’s technology infrastructure;

•the ability to protect DMS’s intellectual property rights;

•the ability to successfully source, complete and integrate acquisitions;

•the ability to improve and maintain adequate internal controls over financial and management systems, and remediate material weaknesses therein, including any integration of the ClickDealer business;

•changes in applicable laws or regulations and the ability to maintain compliance;

•our substantial levels of indebtedness;

•volatility in the trading price on the NYSE of our common stock and warrants;

•fluctuations in value of our private placement warrants; and

•other risks and uncertainties indicated from time to time in DMS’s filings with the SEC, including those described herein under the heading “Risk Factors”.

There may be additional risks that we consider immaterial or which are unknown, and it is not possible to predict or identify all such risks. DMS cautions that the foregoing list of factors is not exclusive. In addition, DMS cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. DMS does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Prospectus Summary

This summary highlights certain significant aspects of our business and is a summary of information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this entire prospectus, including the information presented under “Cautionary Statement Regarding Forward Looking Statements” and the information incorporated by reference including the risk factors and our consolidated financial statements and the related notes thereto before making an investment decision. The definition of some of the terms used in this prospectus are set forth under “Selected Definitions.”

Our Business

Digital Media Solutions, Inc. (“DMS Inc.” or the “Company” or “DMS” or “us”, “our” or “we”) is a leading provider of technology enabled digital performance advertising solutions connecting consumers and advertisers. Our performance-based ROI-driven business model derisks ad spend for advertisers which in turn positions DMS to grow as digital ad spend accelerates because advertisers are shifting more of their ad spend from traditional channels like TV and radio to digital channels, including social media, search, display, e-mail, push and connected TV. As used in this prospectus, the “Company” refers to DMS Inc. and its consolidated subsidiaries, (including its wholly-owned subsidiary, CEP V DMS US Blocker Company, a Delaware corporation (“Blocker”)).

The Company is headquartered in Clearwater, Florida. The Company primarily operates and derives most of its revenues in the United States.

The Company has three material revenue streams: (1) customer acquisition, (2) managed services and (3) software services (“SaaS”).

•Customer acquisition - The process of identifying and cultivating potential customers (also known as customers or near customers otherwise known as leads) for our customer’s business products or services through impressions, clicks and direct messaging (email, push and text/SMS or short message service) based on predefined qualifying characteristics specified by the customer. Revenue is earned based on the cost per action (“CPA”) defined within the executed insertion order (“IO”) and/or agreed to with the customer.

•Managed Services - The management of a customer’s marketing spend and performance, through the utilization of proprietary software delivery platform. Revenue in certain cases, is earned based on a percentage (%) of the customer’s total media spend, which is recognized as a net revenue, while other revenue is recognized on a gross basis.

•Software Services (“SaaS”) - The application of propriety performance marketing software, which tracks lead counts, sources and channels, pricing and overall spend for each client. The software allows online real-time management of marketing activities and spend to attract potential applicants, sourced through various digital online methods. Revenue is earned by licensing the software to customers under a Software Services (“SaaS”) based contract.

Private Placement of Convertible Preferred Stock and Warrants

On March 29, 2023, the Company entered into a Securities Purchase Agreement with certain investors, pursuant to which the Company sold (i) 80,000 shares of Series A Preferred Stock accompanied with warrants to purchase 8,253,968 Class A Common Stock (“Series A Warrant”) and (ii) 60,000 shares of Series B Preferred Stock accompanied with warrants to purchase 6,190,476 shares of Class A Common Stock (“Series B Warrants”). One share of Series A Preferred Stock with the accompanying warrants (“Series A Unit”) and one share of Series B Preferred Stock with the accompanying warrants (“Series B Unit”) were sold at $100 per unit.

On June 15, 2023 the Company remeasured the Preferred Stock following the accretion method, which resulted in the Preferred Stock being measured at its maximum redemption value of $16.3 million and accretion of $11.3 million, included in Cumulative Deficit on the consolidated balance sheets as of June 30, 2023. The fair value of the preferred stock at issuance was recognized using the discount method, which accounts for the 11% discount of the stated value and a pro-rata allocation of the proceeds between the preferred shares and the warrants, less a pro-rata amount of the transaction costs.

The foregoing description of the Private Placement and the securities issued in such financing are qualified in its entirety by reference to the applicable agreements and the amendments thereto, furnished as exhibits to our Annual Report on Form 10-K/A filed with the SEC April 5, 2023, and the Certificate of Designation of the Series A Preferred Stock (the “Series A Certificate of Designation”) and the Certificate of Designation of the Series D Preferred Stock (the “Series B Certificate of Designation”).

Proceeds were $13.1 million, net of transaction costs, which the Company received on March 30, 2023, and used to consummate the ClickDealer acquisition and for other corporate purposes.

Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until December 31, 2023. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Recent Updates

On August 18, 2023, we announced that our board of directors approved a reverse stock split of the Company’s Class A Common Stock and Class B Common Stock at a ratio of 1-for-15 (the “Reverse Stock Split”). Earlier, on April 28, 2023, a majority of the Selling Shareholders approved a reverse stock split subject to the board of directors determining the final ratio. The Reverse Stock Split is expected to be effective after market close on August 28, 2023 (the “Reverse Stock Split Effective Time”). The Company’s Class A Common Stock will begin trading on a split-adjusted basis on the New York Stock Exchange (NYSE) at the market open on August 29, 2023.

At the Reverse Stock Split Effective Time, every 15 issued and outstanding shares of the Company’s Class A Common Stock and Class B Common Stock will be converted automatically into one share of the Company’s Class A Common Stock and Class B Common Stock, respectively, without any change in the par value per share. Once effective, the Reverse Stock Split will reduce the number of shares of Class A Common Stock issued and outstanding from approximately 40.9 million to approximately 2.7 million and Class B Common Stock issued and outstanding from approximately 25.1 million to approximately 1.7 million.

No fractional shares will be issued in connection with the Reverse Stock Split. Selling Shareholders who otherwise would be entitled to receive a fractional share will instead be entitled to receive one whole share of common stock in lieu of such fractional share.

The Reverse Stock Split will affect all Selling Shareholders uniformly and will not alter any Selling Shareholders’ percentage interest in the Company’s equity, except to the extent that the Reverse Stock Split would result in a Selling Shareholders owning a fractional share and such shareholder receives a whole share in lieu thereof. Proportional adjustments will be made to the terms of the Company’s Series A Preferred Stock and Series B Preferred Stock, its stock options, performance stock units, restricted stock units and warrants.

Holders of the Company’s Class A Common Stock and Class B Common Stock held in book-entry form or through a bank, broker or other nominee will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to a broker’s particular processes, and do not need to take any action in connection with the Reverse Stock Split. Selling Shareholders of record will be receiving information from Continental Stock Transfer & Trust Company, the Company’s transfer agent, regarding their stock ownership post-split. Selling Shareholders who hold shares in brokerage accounts should direct any questions concerning the Reverse Stock Split to their brokers; all other Selling Shareholders may direct questions to the transfer agent, Continental Stock Transfer & Trust Company, who can be reached at 212-509-4000.

The Reverse Stock Split will not modify any rights or preferences of the Company’s Class A Common Stock or Class B Common Stock. The Reverse Stock Split is intended to increase the market price per share of the Company’s Class A Common Stock to ensure the Company regains full compliance with the NYSE share price listing rule and maintains its listing on the NYSE. As previously announced, the Company can regain compliance with the NYSE’s continued listing standards if, as of the last trading day of any calendar month during the six-month cure period that ends September 29, 2023, the Company’s Class A Common Stock has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the prior 30 trading-day period. The Company anticipates that the effects of the Reverse Stock Split will be sufficient for the Company to regain compliance with the NYSE’s continued listing standards.

The trading symbol for the Company’s Class A common stock will remain “DMS.” The new CUSIP number for the Company’s Class A Common Stock following the Reverse Stock Split will be 25401G 403.

All references in this prospectus to share counts, including amounts owned by the Selling Shareholders, does not take into account the effect of the Reverse Stock Split, which is expected to become effective at the Reverse Stock Split Effective Time.

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in “Risk Factors” included in this prospectus, that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business.

Corporate Information

We were incorporated on November 29, 2017 as a Cayman Island exempted company under the name “Leo Holdings Corp.” and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. On July 15, 2020, in connection with the consummation of the Business Combination, we domesticated as a corporation incorporated in the state of Delaware and changed our name to “Digital Media Solutions, Inc.” Our principal executive offices are located at 4800 140th Avenue N., Suite 101, Clearwater, Florida 33762, and our telephone number is (877) 236-8632.

Our website is www.DigitalMediaSolutions.com. Interested readers can access, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Act, through the SEC website at www.sec.gov and searching with our ticker symbol “DMS.” Such reports are generally available the day they are filed. Upon request, we will furnish interested readers a paper copy of such reports free of charge by contacting Investor Relations at investors@dmsgroup.com.

The Offering

We are registering the resale by the Selling Shareholders or their permitted transferees of up to 49,206,264 shares of Class A Common Stock, consisting of (i) 19,863,897 shares of Class A Common Stock issuable upon the conversion of 80,000 shares of Series A Preferred Stock issued in the Private Placement; (ii) 14,897,923 shares of Class A Common Stock issuable upon the conversion of 60,000 shares of Series B Preferred Stock issued in the Private Placement; and (iii) 14,444,444 shares of Class A Common Stock issuable upon the exercise of the March Warrants issued in the Private Placement. Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under the heading “Risk Factors.”

| | | | | |

Issuer | Digital Media Solutions, Inc. |

| |

Shares of Class A Common Stock potentially offered by the Selling Shareholders | 49,206,264 shares of Class A Common Stock, par value $0.0001 per share, consisting of (i) 19,863,897 shares of Class A Common Stock issuable upon the conversion of 80,000 shares of Series A Preferred Stock issued in the Private Placement; (ii) 14,897,923 shares of Class A Common Stock issuable upon the conversion of 60,000 shares of Series B Preferred Stock issued in the Private Placement; and (iii) 14,444,444 shares of Class A Common Stock issuable upon the exercise of the March Warrants issued in the Private Placement. |

| |

Shares of Class A Common Stock Outstanding prior to this Offering | 40,037,079 shares of Common Stock. |

| |

Use of Proceeds | We will not receive any proceeds from the sale of the Series A Preferred Stock, Series B Preferred Stock or Class A Common Stock to be offered by the Selling Shareholders. |

| |

NYSE Ticker Symbols | Our Class A Common Stock is listed on the NYSE under the symbol “DMS”. |

| |

Risk Factors | Any investment in our securities is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” in this prospectus and as disclosed in our other SEC filings. |

Risk Factors

Investing in our securities involves a high degree of risk. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed herein under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks under Item 1A of Part I incorporated by reference in this prospectus to our most recent Annual Report on Form 10-K/A and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus before acquiring any such securities. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. See the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Documents by Reference.” Additionally, the risks and uncertainties incorporated by reference in this prospectus, or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Determination of Offering Price

The Selling Shareholders will determine at what price they may sell the securities offered by this prospectus, and such sales may be made at fixed prices, prevailing market prices at the time of the sale, varying prices determined at the time of sale, or negotiated prices. For more information, see “Plan of Distribution.”

Use of Proceeds

We are filing the registration statement of which this prospectus is a part pursuant to our contractual obligations to the Selling Shareholders. The shares of Class A Common Stock being offered by the Selling Shareholders are those shares of Class A Common Stock issuable upon the conversion of the Series A Preferred Stock, those shares of Class A Common Stock issuable upon the conversion of the Series B Preferred Stock and those shares of Class A Common Stock issuable upon the exercise of the March Warrants. For additional information on the private placements and regarding the issuance of the securities in such private placement, see “Prospectus Summary–Private Placement of Convertible Preferred Stock and Warrants.” All of the securities offered by the Selling Shareholders pursuant to this prospectus will be sold by the Selling Shareholders for their respective accounts. We will not receive any of the proceeds from these sales.

All underwriting discounts, selling commissions and stock transfer taxes (“Selling Expenses”) relating to securities registered on behalf of the Selling Shareholders shall be borne by the Selling Shareholders of the registered securities included in such registration. We will bear the costs, fees and expenses incurred in effecting the registration of the securities covered by this prospectus, including all registration and any filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accounting firm.

Description of Securities

The following summary of certain provisions of the Company securities does not purport to be complete and is subject to the Certificate of Incorporation and the Bylaws, which are included as exhibits to the registration statement of which this prospectus is a part. The summary below is also qualified by reference to the provisions of the DGCL, as applicable.

Authorized Capitalization

The total amount of the Company’s authorized capital stock consists of (a) 600,000,000 shares of common stock, par value $0.0001 per share, consisting of (i) 500,000,000 shares of Class A Common Stock, (ii) 60,000,000 shares of Class B Common Stock, and (iii) 40,000,000 shares of Class C Common Stock, and (b) 100,000,000 shares of preferred stock, par value $0.0001 per share. At April 26, 2023, there were 40,037,079 shares of Class A Common Stock outstanding and 25,699,464 shares of Class B Stock outstanding.

DMS Common Stock

Voting rights. Each holder of DMS Common Stock will be entitled to one (1) vote for each share of DMS Common Stock held of record by such holder. The holders of shares of DMS Common Stock will not have cumulative voting rights. Except as otherwise required in the Certificate of Incorporation or by applicable law, the holders of Class A Common Stock, Class B Common Stock and Class C Common Stock will vote together as a single class on all matters on which stockholders are generally entitled to vote (or, if any holders of Preferred Stock are entitled to vote together with the holders of DMS Common Stock, as a single class with such holders of Preferred Stock). In addition to any other vote required in the Certificate of Incorporation or by applicable law, the holders of Class A Common Stock, Class B Common Stock and Class C Common Stock will each be entitled to vote separately as a class only with respect to amendments to the Certificate of Incorporation that increase or decrease the par value of the shares of such class or alter or change the powers, preferences or special rights of the shares of such class so as to affect them adversely. Notwithstanding the foregoing, except as otherwise required by law, holders of DMS Common Stock, as such, will not be entitled to vote on any amendment to the Certificate of Incorporation (including any Preferred Stock Designation (as defined in the Certificate of Incorporation) relating to any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to the Certificate of Incorporation (including any Preferred Stock Designation relating to any series of Preferred Stock) or pursuant to the DGCL.

Dividend rights. Subject to any other provisions of the Certificate of Incorporation, as it may be amended from time to time, holders of shares of Class A Common Stock will be entitled to receive ratably, in proportion to the number of shares of Class A Common Stock held by them, such dividends and other distributions in cash, stock or property of the Company when, as and if declared thereon by the Board from time to time out of assets or funds of the Company legally available therefor.

Except as provided in the Certificate of Incorporation, dividends and other distributions will not be declared or paid on the Class B Common Stock.

Subject to any other provisions of the Certificate of Incorporation, as it may be amended from time to time, holders of shares of Class C Common Stock will be entitled to receive ratably, in proportion to the number of shares held by them, the dividends and other distributions in cash, stock or property of the Company payable or to be made on outstanding shares of Class A Common Stock that would have been payable on the shares of Class C Common Stock if each such share of Class C Common Stock had been converted into a fraction of a share of Class A Common Stock equal to the Conversion Ratio (as defined in the Certificate of Incorporation) immediately prior to the record date for such dividend or distribution. The holders of shares of Class C Common Stock will be entitled to receive, on a pari passu basis with the holders of the Class A Common Stock, such dividend or other distribution on the Class A Common Stock when, as and if declared by the Board from time to time out of assets or funds of the Company legally available therefor.

Redemption. The holder of each DMS Unit other than Blocker Corp will, pursuant to the terms and subject to the conditions of Amended Partnership Agreement, have the right (the “Redemption Right”) to redeem each such DMS Unit for the applicable Cash Amount (as defined in the Amended Partnership Agreement), subject to the Company’s right, in its sole and absolute discretion, to elect to acquire some or all of such DMS Units that such DMS Member has tendered for redemption for a number of shares of Class A Common Stock, an amount of cash or a combination of both (the “Exchange Option”), in the case of each of the Redemption Right and the Exchange Option, on and subject to the terms and conditions set forth in the Certificate of Incorporation and in the Amended Partnership Agreement.

Retirement of Class B Common Stock. In the event that (i) any DMS Unit is consolidated or otherwise cancelled or retired or (ii) any outstanding share of Class B Common Stock held by a holder of a corresponding DMS Unit otherwise will cease to be held by such holder, in each case, whether as a result of exchange, reclassification, redemption or otherwise (including in connection with the Redemption Right and the Exchange Option as described above), then the corresponding share(s) of Class B Common Stock (which, for the avoidance of doubt, will be equal to such DMS Unit divided by the Conversion Ratio prior to and until the Effective Time (as defined below) (in the case of (i)) or such share of Class B Common Stock (in the case of (ii)) will automatically and without further action on the part of the Company or any holder of Class B Common Stock be transferred to the Company for no consideration and thereupon will be retired and restored to the status of authorized but unissued shares of Class B Common Stock.

Rights upon Liquidation. In the event of any liquidation, dissolution or winding up (either voluntary or involuntary) of the Company after payments to creditors of the Company that may at the time be outstanding, and subject to the rights of any holders of Preferred Stock that may then be outstanding, holders of shares of Class A Common Stock and Class C Common Stock will be entitled to receive ratably, in proportion to the number of shares held by them, all remaining assets and funds of the Company available for distribution; provided, however, that, for purposes of any such distribution, each share of Class C Common Stock will be entitled to receive the same distribution as would have been payable if such share of Class C Common Stock had been converted into a fraction of a share of Class A Common Stock equal to the Conversion Ratio immediately prior to the record date for such distribution. The holders of shares of Class B Common Stock, as such, will not be entitled to receive any assets of the Company in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company.

Automatic Conversion of Class B Common Stock. Immediately and automatically upon the earlier of (the “Effective Time”) (i) July 4, 2024 and (ii) the date on which there are no amounts owed to any lender pursuant to the Credit Facility, each share of Class B Common Stock will automatically and without any action on the part of the holder thereof, be reclassified as and changed, pursuant to a reverse stock split, into a fraction of a share of Class B Common Stock equal to the Conversion Ratio.

Conversion of Class C Common Stock. Each holder of Class C Common Stock will have the right, at such holder’s option, at any time, to convert all or any portion of such holder’s shares of Class C Common Stock, and the Company will have the right, at the Company’s option, from and after the Effective Time, to convert all or any portion of the issued and outstanding shares of Class C Common Stock, in each case into shares of fully paid and non-assessable Class A Common Stock at the ratio of one (1) share of Class A Common Stock for the number of shares of Class C Common Stock equal to the Issuance Multiple (as defined in the Business Combination Agreement) so converted.

Transfers. The holders of shares of Class B Common Stock will not transfer such shares other than as part of a concurrent transfer of (i) if prior to the Effective Time, a number of DMS Units equal to the number of shares of Class B Common Stock being so Transferred multiplied by the Conversion Ratio or (ii) if after the Effective Time, an equal number of DMS Units, in each case made to the same transferee in accordance with the restrictions on transfer contained in the Amended Partnership Agreement.

Other rights. No holder of shares of DMS Common Stock will be entitled to preemptive or subscription rights. There are no redemption or sinking fund provisions applicable to the DMS Common Stock. The rights, preferences and privileges of holders of the DMS Common Stock will be subject to those of the holders of any shares of the Preferred Stock the Company may issue in the future.

Dividends

DMS has never paid any dividends. The payment of future dividends on the shares of Class A Common Stock or Class C Common Stock will depend on the financial condition of the Company after the completion of the Business Combination subject to the discretion of the Board. It is presently expected that the Company will retain all earnings for use in the business operations of the Company and, accordingly, it is not expected that the Board will declare any dividends in the foreseeable future. The ability of the Company to declare dividends may be limited by the terms of any other financing and other agreements entered into by the Company or its subsidiaries from time to time.

The Company is a holding company with no material assets other than the equity interests in Blocker Corp held by it. Blocker Corp will be a wholly owned subsidiary of the Company and a holding company with no material assets other than its ownership of DMS Units. The Amended Partnership Agreement requires DMS to make “tax distributions” pro rata to holders of DMS Units (including Blocker Corp) in amounts sufficient for the Company and Blocker Corp to cover applicable taxes and other obligations under the Tax Receivable Agreement as well as any cash dividends declared by the Company.

The Company anticipates that the distributions Blocker Corp will receive from DMS may, in certain periods, exceed the Company’s and Blocker Corp’s actual tax liabilities and obligations to make payments under the Tax Receivable Agreement. The Board, in its sole discretion, will make any determination from time to time with respect to the use of any such excess cash so accumulated, which may include, among other uses, acquiring additional newly issued DMS Units from DMS at a per unit price determined by reference to the market value of the shares of Class A Common Stock at such time (which DMS Units are expected to be contributed to Blocker Corp); paying dividends, which may include special dividends, on Class A Common Stock and Class C Common Stock; funding repurchases of Class A Common Stock or Class C Common Stock; or any combination of the foregoing. The Company will have no obligation to distribute such cash (or other available cash other than any declared dividend) to its stockholders. To the extent that the Company does not distribute such excess cash as dividends on Class A Common Stock or otherwise undertake ameliorative actions between DMS Units and shares of Class A Common Stock and instead, for example, holds such cash balances, holders of DMS Units other than Blocker Corp may benefit from any value attributable to such cash balances as a result of their ownership of shares of Class A Common Stock following an exchange of their DMS Units, notwithstanding that such holders may previously have participated as holders of DMS Units in distributions by DMS that resulted in such excess cash balances at the Company. We also expect, if necessary, to undertake ameliorative actions, which may include pro rata or non-pro rata reclassifications, combinations, subdivisions or adjustments of outstanding DMS Units, to maintain one-for-one parity between DMS Units and shares of Class A Common Stock of DMS. See “Risk Factors.”

The Preferred Stock

The Board has the authority to issue shares of preferred stock from time to time on terms it may determine, to divide shares of preferred stock into one or more series and to fix the designations, preferences, privileges, and restrictions of preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preference, sinking fund terms, and the number of shares constituting any series or the designation of any series to the fullest extent permitted by the DGCL. The issuance of DMS Preferred Stock could have the effect of decreasing the trading price of DMS Common Stock, restricting dividends on the capital stock of the DMS, diluting the voting power of the DMS Common Stock, impairing the liquidation rights of the capital stock of DMS, or delaying or preventing a change in control of DMS.

The Series A and Series B Preferred Stock

The Company has filed the Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Redeemable Preferred Stock (the “Series A Certificate of Designation”) and the Certificate of Designation of Preferences, Rights and Limitations of Series B Convertible Redeemable Preferred Stock (the “Series B Certificate of Designation” and, together with the Series A Certificate of Designation, the “Certificates of Designation”) with the Secretary of State of the State of Delaware. The material terms of the Preferred Stock set forth in the Certificates of Designation are as follows:

Designation and Amount. The Series A Certificate of Designation designates 80,000 shares of Series A Preferred Stock and 60,000 shares of Series B Preferred Stock, with each share having a par value of $0.0001 per share and a stated value equal to $111.11 (as adjusted pursuant to the Certificates of Designation, the “Stated Value”).

Ranking and Liquidation Preference. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a “Liquidation”), prior and in preference to the Common Stock (and, in the case of the Series A Preferred Stock, the Series B Preferred Stock), holders of Preferred Stock shall be entitled to receive out of the assets available for distribution to stockholders an amount equal in cash to 115% of the aggregate Stated Value of all shares of Preferred Stock held by such holder, plus any accrued but unpaid Dividends (as defined below) thereon any other fees then due and owing thereon under the Certificates of Designation, and no more, and if the assets of the Company shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the holders shall be ratably distributed among the holders in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

Dividend. Each holder of Preferred Stock is entitled to receive dividends of 4.0% per annum (“Dividends”), which Dividends are cumulative and continue to accrue and compound annually whether or not declared and whether or not in any fiscal year there shall be net profits or surplus available for the payment of dividends in such fiscal year. Dividends are payable on each conversion or redemption date for the applicable Preferred Stock.

Voting Rights. Except as otherwise required by the DGCL or the Certificate of Incorporation (including the Certificates of Designation), each share of Preferred Stock is entitled to vote on each matter submitted to a vote of the stockholders generally and shall vote together with the Common Stock and any other class or series of capital stock entitled to vote thereon as a single class and on an as converted to Common Stock basis. Notwithstanding the foregoing, at no time shall the voting power of a

share of Preferred Stock voting on an as converted basis exceed the voting power of such share based upon the conversion price of $0.6453 per share.

Holders of the Preferred Stock have the right to consent to various actions by the Company, including, but not limited to entering into or incurring any liens; amending the charter documents of the Company or its subsidiaries; repurchasing or otherwise acquiring any capital stock; paying cash dividends or distributions on any equity securities, other than the payments with respect to the Preferred Stock; engaging in any materially different line of business, or modifying its corporate structure or purpose; allowing the Company or its subsidiaries to fail to maintain good standing in their relevant jurisdictions; failing to take all actions necessary to maintain all intellectual property; allowing the Company or its subsidiaries to fail to maintain insurance; entering into any transaction with any affiliate of the Corporation which would be publicly disclosed (unless made on an arm’s length basis and approved by a majority of disinterested directors of the Company); entering into a transaction to sell, lease, license, assign, transfer, spin-off, split-off, close, convey or otherwise dispose of any assets or rights of the Company or its subsidiaries unless in the ordinary course of business; and allowing the cash balance of the Company to fall below $10 million at any time while the Series A Preferred Stock is outstanding.

Conversion. The Preferred Stock is convertible at the option of the holder at any time into shares of Common Stock at a fixed conversion price of $0.56 (the “Conversion Price”), which Conversion Price is subject to adjustment but not below a price of $0.484 (the “Floor Price”). In addition, at any time at the option of the holder, the Preferred Stock may be converted at the option of the holder into shares of Common Stock at a conversion price at the lower of (i) 90% of the arithmetic average of the three lowest volume-weight average prices (“VWAPs”) during the 20 trading days before a conversion notice is delivered and (ii) 90% of the VWAP of the trading day before a notice of conversion is delivered (the “Alternate Conversion Price”).

Redemption. The Company is required to redeem one-tenth of the number of shares of each series of Preferred Stock on a pro rata basis among all of the holders of each series commencing on the earlier of (i) the three-month anniversary of the closing of the preferred offering and on each successive monthly anniversary date thereafter and (ii) the date a registration statement relating to the underlying shares of Common Stock is declared effective and on each successive monthly anniversary date thereafter. The form of such redemptions is at the option of the Company and may be (i) in cash at 104% of the stated value of the Preferred Stock, plus accrued and unpaid dividends and any other amounts due (the “Mandatory Redemption Price”), (ii) in shares of Common Stock or (iii) a combination thereof.

Each series of Preferred Stock provides for the ability of a holder to require the Company to redeem all of the holder’s shares of Preferred Stock at any time after June 15, 2023 (the “Accelerated Redemption Date”). In addition, the Company may elect to redeem all of the shares of the Series A Preferred Stock, but not Series B Preferred Stock, after the Accelerated Redemption Date. At the option of the holder being redeemed, an accelerated redemption will be (i) in cash at the Mandatory Redemption Price, (ii) in shares of Common Stock or (iii) a combination thereof.

Upon a change of control, the holders of the Preferred Stock may require the Company to redeem any outstanding Preferred Stock in cash at 115% of the greater of (i) the redemption price or (ii) the then prevailing conversion value, plus in each case accrued but unpaid interest and any other amounts owed.

Upon the occurrence of certain events, including, but not limited to (i) the failure of the Company to maintain a minimum cash and cash equivalent balance of $10.0 million; (ii) a default under existing indebtedness of the Company or any subsidiary of at least $50.0 thousand that results in the acceleration of such indebtedness; (iii) the failure to file required reports under the Securities Exchange Act of 1934, as amended; and (iv) the failure to deliver common stock following the conversion of Preferred Stock into common stock, the holders of Preferred Stock may require the Company to redeem any outstanding Preferred Stock in cash at a price equal to 115% of the redemption price.

Under any scenario in which a holder of Preferred Stock has elected to have its Preferred Stock redeemed for cash, and such cash payment required to be made by the Company has not been made, then the Holder may provide to the Company written notice within five business days that the holder desires to retain its shares of Preferred Stock that have not been redeemed and sell the shares to a third party.

Registration Rights. The Company has agreed to provide customary resale registration rights to the holders of Preferred Stock with respect to the Class A Common Stock received by such holders upon conversion or redemption of their shares of Preferred Stock and exercise of their March Warrants.

Other Matters

The Series A Preferred Stock does not have any sinking fund provisions.

Pursuant to the SPA, for 24 months following closing of the offering, the purchasers of the Preferred Stock will have a right to participate on a pro rata basis in the aggregate up to 35% of any subsequent debt or equity financing conducted by the Company. Without the prior consent of the holders of Preferred Stock, the Company is prohibited from issuing common stock until 90 days after effective date of resale registration statement, subject to customary exceptions, and the Company is prohibited from entering into certain variable rate equity transactions while the Preferred Stock remain outstanding.

Upon completion of a subsequent offering of debt or equity by the Company, the holders of Preferred Stock have the right (but not the obligation) to apply 35% of the gross proceeds of such subsequent placement to redeem the preferred stock.

There is no established trading market for the Series A Preferred Stock, and the Company does not expect a market to develop. The Company does not intend to apply for a listing for the Series A Preferred Stock on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Series A Preferred Stock will be limited.

This section describes the material terms of the Certificates of Designation. The foregoing description of the Certificates of Designation does not purport to be complete and is qualified in its entirety by reference to the complete text of the Certificates of Designation.

Election of Directors and Vacancies

Subject to the rights of the holders of any series of DMS Preferred Stock to elect additional directors under specified circumstances and the terms and conditions of the Director Nomination Agreement, the number of directors which will constitute the Board will be not less than five (5) nor more than eleven (11), and the exact number of directors will be fixed from time to time, within the limits specified herein, by the Board.

Under the Bylaws, at all meetings of stockholders called for the election of directors, a plurality of the votes cast will be sufficient to elect such directors to the Board.

Except as the DGCL or the Director Nomination Agreement may otherwise require, in the interim between annual meetings of stockholders or special meetings of stockholders called for the election of directors and/or the removal of one or more directors and the filling of any vacancy in that connection, newly created directorships and any vacancies on the Board, including unfilled vacancies resulting from the removal of directors, may be filled only by the affirmative vote of a majority of the remaining directors then in office, although less than a quorum, or by the sole remaining director. All directors will hold office until the expiration of their respective terms of office and until their successors will have been elected and qualified. A director elected or appointed to fill a vacancy resulting from the death, resignation or removal of a director or a newly created directorship will serve for a term expiring at the next annual meeting of stockholders and until his or her successor will have been elected and qualified.

Any director may be removed from office with or without cause by the affirmative vote of the holders of a majority of the outstanding voting stock (as defined below) of the Company. Subject to the terms and conditions of the Director Nomination Agreement, in case the Board or any one or more directors should be so removed, new directors may be elected at the same time for the unexpired portion of the full term of the director or directors so removed.

The directors in their discretion may submit any contract or act for approval or ratification at any annual meeting of the stockholders or at any meeting of the stockholders called for the purpose of considering any such act or contract, and, to the fullest extent permitted by law, any contract or act that will be approved or be ratified by the affirmative vote of the holders of a majority of the total voting power of all of the then-outstanding shares of stock of the Company, which is represented in person or by proxy at such meeting and entitled to vote thereon (provided that a lawful quorum of stockholders be there represented in person or by proxy), will be as valid and binding upon the Company and upon all the stockholders as though it had been approved or ratified by every stockholder of the Company, whether or not the contract or act would otherwise be open to legal attack because of directors’ interests, or for any other reason.

In addition to the powers and authorities herein before or by statute expressly conferred upon them, the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation, subject, nevertheless, to the provisions of the DGCL, the Certificate of Incorporation and to any Bylaws adopted from time to time by the stockholders; provided, however, that no Bylaw so adopted will invalidate any prior act of the directors which would have been valid if such Bylaw had not been adopted.

Notwithstanding the foregoing provisions, any director elected pursuant to the right, if any, of the holders of DMS Preferred Stock to elect additional directors under specified circumstances will serve for such term or terms and pursuant to such other provisions as specified in the relevant Preferred Stock Designation.

Quorum

The holders of a majority of the voting power of the capital stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy, will constitute a quorum at all meetings of the stockholders for the transaction of business except as otherwise required by law or provided by the Certificate of Incorporation. If, however, such quorum will not be present or represented at any meeting of the stockholders, the holders of a majority of the voting power present in person or represented by proxy, will have power to adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum will be present or represented. At such adjourned meeting at which a quorum will be present or represented, any business may be transacted which might have been transacted at the meeting as originally noticed. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting will be given to each stockholder entitled to vote at such adjourned meeting as of the record date fixed for notice of such adjourned meeting.

Anti-takeover Effects of the Certificate of Incorporation and the Bylaws

The Certificate of Incorporation and the Bylaws contain provisions that may delay, defer or discourage another party from acquiring control of us. We expect that these provisions, which are summarized below, will discourage coercive takeover practices or inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with the Board, which we believe may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give the Board the power to discourage acquisitions that some stockholders may favor.

Authorized but Unissued Capital Stock

Delaware law does not require stockholder approval for any issuance of authorized shares. However, the listing standards of NYSE, which apply if and so long as the Class A common stock remains listed on NYSE, require stockholder approval of certain issuances equal to or exceeding 20% of the then outstanding voting power or then outstanding number of shares of Class A common stock. Additional shares that may be issued in the future may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions.

One of the effects of the existence of unissued and unreserved common stock may be to enable the Board to issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise and thereby protect the continuity of management and possibly deprive stockholders of opportunities to sell their shares of Class A Common Stock at prices higher than prevailing market prices.

Special Meeting, Action by Written Consent and Advance Notice Requirements for Stockholder Proposals

Unless otherwise required by law, and subject to the rights of the holders of any series of DMS Preferred Stock, special meetings of the stockholders of the Company, for any purpose or purposes, may be called only (i) by a majority of the Board or the Chief Executive Officer of the Company or (ii) at any time when Prism, Clairvest and any of their respective affiliates (as defined in the Certificate of Incorporation) (including any Affiliated Companies (as defined in the Certificate of Incorporation) of Clairvest) (collectively, the “DMS Group”) collectively own, in the aggregate, at least fifty percent (50%) of the outstanding voting stock of the Company, by the holders of a majority of the outstanding voting stock of the Company Subject to the rights of the holders of any series of Preferred Stock, at any time when the DMS Group collectively owns, in the aggregate, at least fifty percent (50%) of the outstanding voting stock of the Company, any action required or permitted to be taken by the stockholders of the Company may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the actions so taken, shall be signed by the holders of shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Company in accordance with Section 228 of the DGCL and the Bylaws; provided that, from and after the first date that the DMS Group ceases to collectively own, in the aggregate, at least fifty percent (50%) of the outstanding voting stock of the Company, any action required or permitted to be taken by the stockholders of the Company shall be effected at a duly called annual or special meeting of such holders and may not be effected by written consent of the stockholders. Unless otherwise required by law, written notice of a special meeting of stockholders, stating the time, place and purpose or purposes thereof, shall be given to each stockholder entitled to vote at such meeting, not less than ten (10) or more than sixty (60) days before the date fixed for the meeting. Business transacted at any special meeting of stockholders will be limited to the purposes stated in the notice.

The Bylaws also provide that unless otherwise restricted by the Certificate of Incorporation or the Bylaws, any action required or permitted to be taken at any meeting of the Board or of any committee thereof may be taken without a meeting, if all members of the Board or of such committee, as the case may be, consent thereto in writing or by electronic transmission, and the writing or writings or electronic transmission or transmissions are filed with the minutes of proceedings of the Board or committee.

In addition, the Bylaws require advance notice procedures for stockholder proposals to be brought before an annual meeting of the stockholders, including the nomination of directors. Stockholders at an annual meeting may only consider the proposals specified in the notice of meeting or brought before the meeting by or at the direction of the Board, or by a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has delivered a timely written notice in proper form to our secretary, of the stockholder’s intention to bring such business before the meeting.

These provisions could have the effect of delaying until the next stockholder meeting any stockholder actions, even if they are favored by the holders of a majority of our outstanding voting securities.

Amendment to Certificate of Incorporation and Bylaws

The DGCL provides generally that the affirmative vote of a majority of the outstanding stock entitled to vote on amendments to a corporation’s certificate of incorporation or bylaws is required to approve such amendment, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater percentage.

The Certificate of Incorporation provides that the following provisions therein may be amended, altered, repealed or rescinded only by the affirmative vote of the holders of at least 66-2/3% in voting power all the then outstanding shares of the Company’s stock entitled to vote thereon, voting together as a single class:

•the provisions regarding the size of the Board and the election of directors pursuant to the Director Nomination Agreement;

•the provisions regarding calling special meetings of stockholders;

•the provisions regarding the limited liability of directors of the Company;

•the provisions regarding the election not to be governed by Section 203 of the DGCL;

•the provision regarding the votes necessary to amend the Bylaws; and

•the amendment provision requiring that the above provisions be amended only with a 66-2/3% supermajority vote.

Further, the provision regarding the waiver of the corporate opportunity doctrine may only be amended by the affirmative vote of at least eighty percent (80%) of the outstanding voting stock of the Company.

As long as there are any shares of Class B Common Stock issued and outstanding, the existence of the Class A Common Stock and the Class B Common Stock, and the rights, preferences and privileges conferred upon the holders of Class A Common Stock and Class B Common Stock in the Certificate of Incorporation, including those related to the Redemption Right and the Exchange Option, may not be amended, altered, repealed or rescinded, in whole or in part, or any provision inconstant therewith or herewith may be adopted, only by the unanimous affirmative vote of all of the holders of the Class B Common Stock.

The Bylaws may be amended (A) by the affirmative vote of a majority of the entire Board (subject to any bylaw requiring the affirmative vote of a larger percentage of the members of the Board) or (B) without the approval of the Board, by the affirmative vote of the holders of a majority of the outstanding voting stock of the Company.

Delaware Anti-Takeover Statute

Section 203 of the DGCL provides that if a person acquires 15% or more of the voting stock of a Delaware corporation, such person becomes an “interested stockholder” and may not engage in certain “business combinations” with the corporation for a period of three years from the time such person acquired 15% or more of the corporation’s voting stock, unless:

•the board of directors approves the acquisition of stock or the merger transaction before the time that the person becomes an interested stockholder;

•the interested stockholder owns at least 85% of the outstanding voting stock of the corporation at the time the merger transaction commences (excluding voting stock owned by directors who are also officers and certain employee stock plans); or

•the merger transaction is approved by the board of directors and at a meeting of stockholders, not by written consent, by the affirmative vote of 2/3 of the outstanding voting stock which is not owned by the interested stockholder. A

Delaware corporation may elect in its certificate of incorporation or bylaws not to be governed by this particular Delaware law.

In the Certificate of Incorporation, the Company opted out of Section 203 of the DGCL and therefore is not subject to Section 203. However, the Certificate of Incorporation contains similar provisions providing that the Company may not engage in certain “business combinations” with any “interested stockholder” for a three-year period following the time that the stockholder became an interested stockholder, unless:

•prior to such time, the Board approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of our voting stock outstanding at the time the transaction commenced, excluding certain shares; or

•at or subsequent to that time, the business combination is approved by our board of directors and by the affirmative vote of holders of at least 66-2/3% of the outstanding voting stock that is not owned by the interested stockholder.

Generally, a “business combination” includes a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an “interested stockholder” is a person who, together with that person’s affiliates and associates, owns, or within the previous three years owned, 15% or more of our voting stock.