Skechers Transforms in Japan - Analyst Blog

March 06 2012 - 11:03AM

Zacks

Following its sluggish fourth-quarter 2011 results,

Skechers USA Inc (SKX) is trying hard to

reposition itself for 2012. Yesterday, the company announced its

intention to double its business in Japan over the next three to

five years by transitioning its business model from a third-party

distributor to a wholly owned subsidiary.

Japan has been one of the company’s biggest distribution

markets. Thus, the company plans to roll-out new Skechers retail

stores across the country, including its collection of performance

and lifestyle footwear for men, women and children for boosting

revenues.

International business remains a significant growth driver for

the company’s sales. International wholesale business’ revenue

jumped 12% to $487.3 million during fiscal 2011 and International

retail sales surged 22% during fiscal 2011.

Further, management remains committed to focus on new lines of

products, including ‘Skechers GOrun,’ opening of additional

Skechers stores and increasing distribution channels with the

development of international distribution agreements to improve its

sales and profitability.

Skechers reported a loss of 54 cents per share in the fourth

quarter of 2011 compared with earnings of 7 cents in the prior-year

period. On a reported basis, including one time items, Skechers

delivered a loss of $1.18. The Zacks Consensus Estimate stood at a

loss of 23 cents for the quarter.

Moreover, Skechers, which competes with Deckers Outdoor

Corporation (DECK) and Nike Inc. (NKE),

stated that total net sales for the quarter dropped 37.7% to $283.2

million from the prior-year quarter, reflecting lower sales of

high-priced toning shoes and sluggish performances across other

footwear lines, principally in domestic wholesale business. The

reported revenue was well short of the Zacks Consensus Estimate of

$322 million.

The company appointed Hirokazu Iwasaki as the new representative

director and country manager of Skechers Japan.

Currently, we maintain a long-term Neutral recommendation on the

stock. However, Skechers retains a Zacks #5 Rank that translates

into a short-term Strong Sell rating

DECKERS OUTDOOR (DECK): Free Stock Analysis Report

NIKE INC-B (NKE): Free Stock Analysis Report

SKECHERS USA-A (SKX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

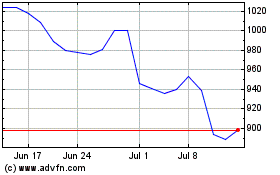

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From May 2024 to Jun 2024

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From Jun 2023 to Jun 2024