Play This Top-Ranked Industry With This Sector ETF (SOIL) - Top Yielding ETFs

December 02 2011 - 5:34AM

Zacks

With such an uncertain market, broad allocations across the

equity world seem destined to disappoint investors, at least in the

near term. One way to play the environment could be to seek out

top-ranked sectors and only invest in securities in those spaces.

This strategy may allow investors to only focus in on those sectors

that are poised to rise in the near future while hopefully avoiding

the worst of the downturns that have been prevalent as of late. One

intriguing industry that could fall into this category is the

fertilizer space where growth is abundant and demand could be

nearly recession-proof.

This is because fertilizer is a key component of global food

production and with the ever rising world population, a robust

supply of staple products is becoming increasingly important. This

is especially true given that close to two billion more people are

expected to be living by 2050, putting extra strains on food supply

chains across the world. As a result of this, global fertilizer

consumption has been growing at a steady 3% over the past 15 years

and could continue to surge, especially if current

predictions—which call for a 30% increase in grain and oilseed

consumption by the end of the decade—come to fruition (see Inside

The SuperDividend ETF).

Thanks to these trends, many companies in the fertilizer space

have been able to hold their ground when compared to their peers in

the broad agriculture sector, making them solid investments in this

uncertain time. Furthermore, many companies have seen positive

earnings revisions as of late, helping to push the overall rank of

the sector pretty high when compared to its counterparts. In fact,

the fertilizer sector is currently ranked in the top 20 among all

Industries according to our research, suggesting that the space

could be due for outperformance in the near future. While buying up

any of these stocks could be a decent investment, for those looking

to get broad access to the space an ETF tracking the sector exists

as well, the Global X Fertilizers/Potash ETF (SOIL).

This relatively new fund from the New York-based ETF issuer

tracks the Solactive Global Fertilizers/Potash Index which is a

benchmark of about 30 securities that measures the performance of

the largest and most liquid listed companies from around the globe

that are active in some aspect of the fertilizer industry.

Although the fund is relatively new and has assets of just

under $30 million, SOIL has volume of about 70,000 shares a day

which is enough to produce relatively tight bid/ask spreads for

most investors (see Top Three Precious Metal Mining ETFs).

The fund holds all eight of the securities that are in the Zacks

Industry of Fertilizers including top rated Yara International

(YARIY) as well as highly-rated Agrium (AGU) CF industries Holdings

(CF), and CVR Partners (UAN). The fund also includes weightings to

Intrepid Potash (IPI), Mosaic Company (MOS), Potash Corp of

Saskatchewan (POT) and Sociedad Quimica Minera de Chile (SQM)

although these four are currently rated as 3s . Beyond these firms,

the product also tracks a number of securities that are not ranked

by Zacks—due to their geographic location—but are in the fertilizer

industry nonetheless. So while U.S. stocks take the top spot at

just over 22% of assets, firms from Israel and Canada also make up

more than 10.9% each while firms from a host of emerging markets,

including China, Brazil, Russia, and Chile, also receive decent

sized allocations as well.

This results in a portfolio that is very well diversified from a

geographic perspective, giving allocations across five continents.

Furthermore, no one security makes up more than 6% of total assets

so company-specific risk is pretty much non-existent in the fund.

In terms of performance, SOIL has had a rough time over the past

few months but given the positive earnings revisions in many of the

companies in the space, as well as possibility of a broad market

turnaround, this could change in short-order, especially if firms

live up to their earnings expectations (see Top Three High Yield

Real Estate ETFs).

However, it is important to remember that the fund isn’t a

direct proxy for the fertilizer industry as ranked by Zacks, for a

few reasons. First, the product obviously has a greater number of

securities more than what our rank currently is tracking. As a

result, the rank of the industry could be worse if these other

securities are included (although it could also rise as well).

Secondly, it is important to remember that SOIL tracks companies

that are engaged in some aspect of the fertilizer industry and do

not necessarily have to be entirely devoted to the space. This

could also make the fund deviate from how the Zacks industry

performs as a whole or make the fund outperform (or lag) companies

that have more of their revenues tied to the fertilizer space.

Nevertheless, the product could make for a nice diversified play on

a sector that could be poised to outperform in the near term or at

the very least, surge over the long-term thanks to favorable

demographic trends and rising demands for higher quality food in

the developing world.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

AGRIUM INC (AGU): Free Stock Analysis Report

CF INDUS HLDGS (CF): Free Stock Analysis Report

INTREPID POTASH (IPI): Free Stock Analysis Report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

POTASH SASK (POT): Free Stock Analysis Report

SOC QUIMICA MIN (SQM): Free Stock Analysis Report

CVR PARTNERS LP (UAN): Free Stock Analysis Report

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

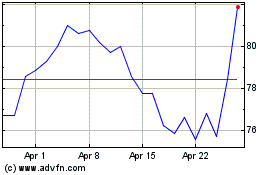

CVR Partners (NYSE:UAN)

Historical Stock Chart

From Apr 2024 to May 2024

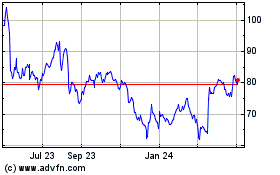

CVR Partners (NYSE:UAN)

Historical Stock Chart

From May 2023 to May 2024