B&G Foods, Inc. - Growth & Income

November 01 2011 - 8:00PM

Zacks

Estimates have been rising for

B&G Foods, Inc. (BGS)

after the company delivered solid third quarter results. It is a

Zacks #1 Rank (Strong Buy) stock.

Net sales were up 6% on strong volume and EPS

jumped 32% as the company leveraged its interest expense. Analysts

expect strong earnings growth to continue over the next couple of

years too.

Based on consensus estimates, analysts project 20%

EPS growth this year and 7% growth next year. In addition, the

company pays a dividend that yields a juicy 4.4%.

Company Description

B&G Foods, Inc. manufactures various

shelf-stable foods, including hot cereals, fruit spreads, spices,

seasonings, salad dressings, Mexican food, pickles and other

specialty foods products. Its brands include Cream of Wheat, Cream

of Rice, Emeril's, Las Palmas, Ortega and Red Devil.

On October 28, the company announced that it has

entered into an agreement to acquire the Mrs. Dash, Molly McButter,

Sugar Twin, Baker's Joy, Static Guard and Kleen Guard brands from

Unilever for approximately $325 million.

B&G Foods is headquartered in Parsippany, New

Jersey and has a market cap of $995 million.

Third Quarter Results

B&G delivered solid third quarter results on

October 25. Net sales rose 6% year-over-year to $133 million due in

large part to higher unit volume.

Higher commodity costs squeezed margins at B&G,

but only slightly. The gross margin declined 10 basis points to

31.2% of net sales. Income before taxes surged 27% as the company

leveraged its interest expense.

Earnings per share came in at 25 cents, meeting the

Zacks Consensus Estimate. It was a stellar 32% increase over the

same quarter in 2010.

Estimates Rising

Despite EPS coming in-line with estimates, analysts

revised their estimates for both 2011 and 2012 higher, sending the

stock to a Zacks #1 Rank (Buy).

The Zacks Consensus Estimate for 2011 is now $1.08,

representing 20% growth over 2010 EPS. The 2012 consensus estimate

is 7% higher at $1.16.

Attractive Dividend

In addition to solid earnings growth, B&G pays

a dividend that yields a juicy 4.4%. The company recently announced

the it was raising its quarterly dividend by 10%.

Valuation

The valuation picture looks reasonable for BGS.

Shares trade at 18.0x 12-month forward earnings, a premium to the

industry average of 15.5x. But this premium appears justified given

the company's solid growth projections and fat dividend yield.

Its prices to sales ratio of 1.9 is in-line with

its peers.

The Bottom Line

With rising earnings estimates, solid growth

projections, a 4.4% dividend yield and reasonable valuation,

B&G Foods offers investors strong total return potential.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Co-Editor of the

Reitmeister Value Investor.

B&G FOODS CL-A (BGS): Free Stock Analysis Report

Zacks Investment Research

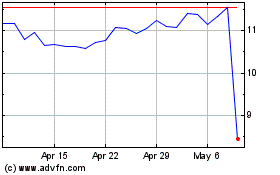

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2024 to May 2024

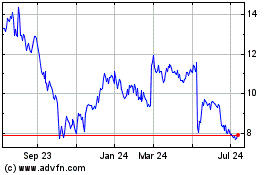

B and G Foods (NYSE:BGS)

Historical Stock Chart

From May 2023 to May 2024