0001106838

false

0001106838

2023-08-31

2023-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 31, 2023

Sonnet

BioTherapeutics Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35570 |

|

20-2932652 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

100

Overlook Center, Suite 102

Princeton,

NJ |

|

08540 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (609) 375-2227

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.0001 per share |

|

SONN |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

On

August 31, 2023, Sonnet BioTherapeutics Holdings, Inc. (the “Company” or “Sonnet”) held an annual meeting of

stockholders (the “Annual Meeting”). The matters voted on at the Annual Meeting were the following proposals: (1) to elect

six directors to the Company’s Board of Directors (the “Board”) to hold office for the following year until their successors

are elected, (2) to adopt and approve an amendment to the Company’s Certificate of Incorporation, as amended (the “Charter”),

to effect a reverse stock split of the Company’s issued and outstanding shares of common stock (the “Common Stock”)

at a specific ratio, ranging from one-for-two (1:2) to one-for-thirty five (1:35), at any time prior to the one-year anniversary date

of the Annual Meeting, with the exact ratio to be determined by the Board without further approval or authorization of the Company’s

stockholders, and (3) to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for

the year ending September 30, 2023.

At

the Annual Meeting, the foregoing stockholder proposals were approved, based upon an aggregate of 38,511,014 shares of Common Stock outstanding

as of July 27, 2023, which was the record date for the Annual Meeting. The final voting results were as follows:

| 1. |

The votes cast with respect

to the proposal to elect six directors to the Board to hold office for the following year until their successors are elected were

as follows: |

| | |

For | | |

Withheld | | |

Broker Non-Votes | |

| Pankaj Mohan, Ph.D. | |

| 12,186,984 | | |

| 1,051,699 | | |

| 8,355,426 | |

| Nailesh Bhatt | |

| 12,010,142 | | |

| 1,228,541 | | |

| 8,355,426 | |

| Albert Dyrness | |

| 12,025,447 | | |

| 1,213,236 | | |

| 8,355,426 | |

| Donald Griffith | |

| 12,134,812 | | |

| 1,103,871 | | |

| 8,355,426 | |

| Raghu Rao | |

| 11,959,482 | | |

| 1,269,201 | | |

| 8,355,426 | |

| Lori McNeill | |

| 12,274,197 | | |

| 964,486 | | |

| 8,355,426 | |

| 2. |

The proposal to adopt and

approve an amendment to the Charter to effect a reverse stock split of the Company’s issued and outstanding shares of Common

Stock, at a specific ratio, ranging from one-for-two (1:2) to one-for-thirty five (1:35), at any time prior to the one-year anniversary

date of the Annual Meeting, with the exact ratio to be determined by the Board was approved by a majority of the votes cast at the

Annual Meeting, based upon the following votes: |

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 15,763,763 |

|

5,775,163 |

|

55,183 |

| 3. |

The proposal to ratify

the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending September 30,

2023 was approved by a majority of the votes cast at the Annual Meeting, based upon the following votes: |

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 20,050,763 |

|

519,412 |

|

1,023,933 |

| Item 7.01 |

Regulation FD Disclosure. |

On

August 31, 2023, the Company issued a press release announcing a reverse stock split, a copy of which is furnished as Exhibit 99.1 to

this Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Sonnet

BioTherapeutics Holdings, Inc. |

| |

|

|

| August

31, 2023 |

By: |

/s/

Pankaj Mohan, Ph.D. |

| |

Name: |

Pankaj

Mohan, Ph.D. |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Sonnet

BioTherapeutics Announces 1-for-22 Reverse Stock Split

PRINCETON,

NJ / ACCESSWIRE / August 31, 2023 / Sonnet BioTherapeutics Holdings, Inc. (NASDAQ:SONN) (“Sonnet” or the “Company”),

a biopharmaceutical company developing innovative targeted biologic drugs, announced today that it will effect a 1-for-22 reverse stock

split of its outstanding common stock. This will be effective for trading purposes as of the commencement of trading on Friday, September

1, 2023.

The

reverse stock split is intended to increase the per share trading price of Sonnet’s common stock to satisfy the $1.00 minimum bid

price requirement for continued listing on The Nasdaq Capital Market (Rule 5550(a)(2)). Sonnet’s common stock will continue to

trade on The Nasdaq Capital Market under the symbol “SONN” and under a new CUSIP number, 83548R303. As a result of the reverse

stock split, every twenty-two pre-split shares of common stock outstanding will become one share of common stock. The par value

of the Company’s common stock will remain unchanged at $0.0001 per share after the reverse stock split. The reverse stock split

will not change the authorized number of shares of the Company’s common stock. The reverse stock split will affect all stockholders

uniformly and will not alter any stockholder’s percentage interest in the Company’s equity, except to the extent that the

reverse stock split results in some stockholders owning a fractional share. No fractional shares will be issued in connection with the

reverse split. Stockholders who would otherwise be entitled to receive a fractional share will instead receive a cash payment based on

the average closing price of the Company’s common stock on the five (5) consecutive days leading up to the effective date of the

reverse split. The reverse split will also apply to common stock issuable upon the exercise of Sonnet’s outstanding warrants and

stock options, with a proportionate adjustment to the exercise prices thereof, and under the Company’s equity incentive plans.

The

reverse stock split will reduce the number of shares of common stock issued and outstanding from approximately 38.5 million to approximately

1.8 million.

On

August 31, 2023, the stockholders of the Company approved the reverse stock split by a majority of the votes cast and gave the

Company’s board of directors discretionary authority to select a ratio for the split ranging from 1-for-2 to 1-for-35. The board

of directors approved the reverse stock split at a ratio of 1-for-22 on August 31, 2023.

Securities

Transfer Corporation is acting as the exchange agent and transfer agent for the reverse stock split. Stockholders holding their shares

in book-entry form or in brokerage accounts need not take any action in connection with the reverse stock split. Beneficial holders are

encouraged to contact their bank, broker or custodian with any procedural questions.

About

Sonnet BioTherapeutics Holdings, Inc.

Sonnet

BioTherapeutics is an oncology-focused biotechnology company with a proprietary platform for innovating biologic drugs of single

or bispecific action. Known as FHAB (Fully Human Albumin Binding), the technology utilizes a fully human single chain antibody

fragment (scFv) that binds to and “hitch-hikes” on human serum albumin (HSA) for transport to target tissues. Sonnet’s

FHAB was designed to specifically target tumor and lymphatic tissue, with an improved therapeutic window for optimizing the

safety and efficacy of immune modulating biologic drugs. FHAB is the foundation of a modular, plug-and-play construct for

potentiating a range of large molecule therapeutic classes, including cytokines, peptides, antibodies, and vaccines.

Forward-Looking

Statements

This

press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the

Company’s reverse stock split, product development, clinical and regulatory timelines, market opportunity, competitive position,

possible or assumed future results of operations, business strategies, potential growth opportunities and other statements that are predictive

in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry

and markets in which we operate and management’s current beliefs and assumptions.

These

statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,”

“intend,” “plan,” “believe,” “estimate,” “potential, “predict,” “project,”

“should,” “would” and similar expressions and the negatives of those terms. These statements relate to future

events or our financial performance and involve known and unknown risks, uncertainties, and other factors which may cause actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the

forward-looking statements. Such factors include those set forth in the Company’s filings with the Securities and Exchange Commission.

Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of

this press release. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new

information, future events or otherwise.

Sonnet

BioTherapeutics Investor Contact

Jack

Yauch

Solebury

Strategic Communications

862-754-1024

jyauch@soleburystrat.com

SOURCE:

Sonnet BioTherapeutics, Inc.

v3.23.2

Cover

|

Aug. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 31, 2023

|

| Entity File Number |

001-35570

|

| Entity Registrant Name |

Sonnet

BioTherapeutics Holdings, Inc.

|

| Entity Central Index Key |

0001106838

|

| Entity Tax Identification Number |

20-2932652

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100

Overlook Center

|

| Entity Address, Address Line Two |

Suite 102

|

| Entity Address, City or Town |

Princeton

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08540

|

| City Area Code |

(609)

|

| Local Phone Number |

375-2227

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$0.0001 per share

|

| Trading Symbol |

SONN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

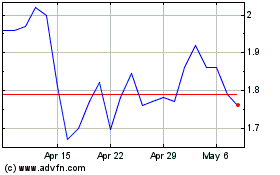

Sonnet BioTherapeutics (NASDAQ:SONN)

Historical Stock Chart

From Apr 2024 to May 2024

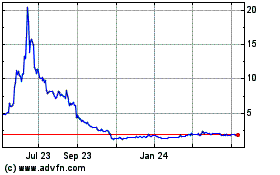

Sonnet BioTherapeutics (NASDAQ:SONN)

Historical Stock Chart

From May 2023 to May 2024