false000094664700009466472023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 25, 2023 |

Premier Financial Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ohio |

0-26850 |

34-1803915 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

601 Clinton Street |

|

Defiance, Ohio |

|

43512 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 419 785-8700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 Per Share |

|

PFC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 25, 2023, Premier Financial Corp. (“Premier”) issued a press release regarding its earnings for the quarter ended June 30, 2023. A copy of the press release is attached as Exhibit 99.1.

The information set forth in this Current Report on Form 8-K (including the information in Exhibits 99.1 attached hereto) is being furnished to the Securities and Exchange Commission and is not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under the Exchange Act. Such information will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Premier Financial Corp. |

|

|

|

|

Date: |

July 25, 2023 |

By: |

/s/ Gary M. Small |

|

|

|

Gary M. Small, President and CEO |

Exhibit 99.1

Contact:

Paul Nungester

EVP and CFO 419.785.8700

PNungester@yourpremierbank.com

FOR IMMEDIATE RELEASE

PREMIER FINANCIAL CORP. ANNOUNCES SECOND QUARTER 2023 RESULTS

Completes sale of insurance agency for $36 million gain

Strengthens capital, liquidity and interest rate asset sensitivity

Second Quarter 2023 Highlights

•Completed sale of insurance agency at a significant gain that strengthens capital without diluting future earnings

•Executed hedges to improve asset-sensitivity and provide protection against additional rate increases

•CET1 ratio increased 80 basis points to 10.81% and tangible equity ratio increased 52 basis points to 7.55% from the prior quarter

•Loan growth of $132.7 million (up 8.1% annualized), including $75.2 million for commercial loans excluding PPP (up 7.0% annualized)

•Declared dividend of $0.31 per share, up 3.3% from prior year comparable period

DEFIANCE, OHIO (July 25, 2023) – Premier Financial Corp. (Nasdaq: PFC) (“Premier” or the “Company”) announced today 2023 second quarter results, including net income of $48.4 million or $1.35 per diluted common share, compared to $22.4 million, or $0.63 per diluted common share, for the second quarter of 2022. Second quarter 2023 results include the impact of the disposition of the Company’s insurance agency, First Insurance Group (“FIG”), for a net gain on sale after transaction costs of $32.6 million pre-tax or $0.67 per diluted share after-tax. Excluding the impact of this transaction, second quarter 2023 earnings would be $0.68 per diluted share.

“Premier’s second quarter performance reflected the expected increase in quarterly core earnings to $0.68 per share,” said Gary Small, President and CEO of Premier. “The improvement was driven by multiple factors. Strong loan growth resulting from selective new business loan origination, coupled with a strong funding pace of prior year construction commitments. C&I commitments totaled 49% of second quarter commercial loan origination activity. Total deposits grew $220 million, or 3.3%, for the quarter. Customer deposit balance movement stabilized, down just $38 million, or 0.6%.”

1

“Core non-interest income revenue grew 9.4% versus second quarter 2022, and core expenses fell 4.6% versus first quarter 2023 reflecting the progress made associated with the cost reduction initiative announced last quarter. Margin continued to decline but at a more moderate pace. Hedging activity was initiated in June that will both add to near term net interest income and protect the organization against the unfavorable impacts of future Fed Fund rate increases. Our consumer customers continue to exhibit active spending habits and credit portfolio indicators remain very favorable. The commercial loan portfolio continues to perform well with no unfavorable trends or early indicators of stress,” added Small.

“The sale of the insurance agency delivered positive outcomes for all stakeholders,” Small continued. “The combination of FIG and Risk Strategies brings new opportunities for the FIG team; our joint bank/agency clients will benefit from a broader product offering and expanded agency capabilities; and the Premier shareholders benefit from a tremendous capital boost with the transaction increasing tangible book value by $1.37 per share. As we look forward, the organization is focused on moderate balance sheet growth, continued non-interest revenue improvement (adjusting for FIG), and strong expense management. Deposit mix will continue to be a challenge although our beta management techniques continue to evolve.”

Insurance agency sale

As previously announced, on June 30, 2023 the Company completed the sale of FIG to Risk Strategies Corporation. The disposition generated a gain on sale of $36.3 million before transaction costs of $3.7 million. The transaction strengthened capital by increasing equity $24.2 million (24 basis points and $0.68 per share) and tangible equity by $48.8 million (54 basis points and $1.37 per share), which included the recovery of goodwill and intangibles of $24.7 million at June 30, 2023. Utilization of sale proceeds will improve net interest income that effectively offsets pre-tax earnings previously generated from the insurance agency assuming paydown of borrowings and will become accretive to earnings upon deployment into higher yielding loans.

Addressing interest rate sensitivity

During June 2023, the Company completed a series of balance sheet hedges to improve asset-sensitivity and provide protection against additional rate increases. In total, the Company executed $500 million notional of pay-fixed/receive-variable interest rate swaps with half 2-year and half 3-year in duration. The average pay rate for these swaps is approximately 4.12%. Based on rates as of June 30, 2023, these swaps are expected to generate approximately $4.7 million of annualized pre-tax net interest income. The full quarter benefit of these swaps will begin to be realized in the third quarter, and the positive impact will increase as SOFR increases. Each 25 basis point increase in SOFR is expected to generate an additional $625 thousand of annualized pre-tax net interest income, including the impact of the new swaps and the prior $250 million notional receive-fixed/pay-variable swap.

2

Quarterly results

Capital, deposits and liquidity

Capital improved significantly during the second quarter of 2023. Total equity increased $22.5 million, or 2.5%, including the positive impact of the insurance agency sale offset by a $15.0 million detriment in accumulated other comprehensive income (“AOCI”), primarily due to a negative valuation adjustment on the available-for-sale (“AFS”) securities portfolio. Tangible equity increased $48.4 million, or 8.4%, and the tangible equity ratio increased 52 basis points to 7.55%, or 9.58% excluding AOCI. Regulatory ratios also improved during the second quarter of 2023, including CET1 of 10.81%, Tier 1 of 11.28% and Total Capital of 13.05%, each up 80 basis points. All of these ratios also exceed well-capitalized guidelines pro forma for AOCI, including CET1 of 8.53%, Tier 1 of 9.00% and Total Capital of 10.77%.

Total deposits increased 3.3%, or $220.4 million, during the second quarter of 2023, due to a $258.4 million increase in brokered deposits offset partly by a net decrease of $38.0 million in customer deposits. Total average interest-bearing deposit costs increased 38 basis points to 2.07% for the second quarter of 2023. This increase was primarily due to brokered deposits and the migration of customers from non-interest bearing deposits into interest-bearing deposits, including higher cost time deposits, as customers sought to obtain yield. Average interest-bearing deposit costs excluding brokered deposits and acquisition marks were 2.08% during the month of June, representing a cumulative beta of 37% compared to the change in the monthly average effective Federal Funds rate that increased 500 basis points to 5.08% since December 2021, as reported by the Federal Reserve Economic Data.

Uninsured deposits at June 30, 2023 were 31.5% of total deposits, or 17.3% adjusting for collateralized deposits, other insured deposits and internal company accounts. The Company successfully established eligibility for the Federal Reserve Borrower-In-Custody Collateral Program, which increased borrowing capacity by more than $300 million during the second quarter. Total quantifiable liquidity sources totaled $2.8 billion, or 230.5% of adjusted uninsured deposits, and were comprised of the following at June 30, 2023:

•$121.7 million of cash and cash equivalents with a 5.15% Federal Reserve rate;

•$298.5 million of unpledged securities with an average yield of 3.02%;

•$1.5 billion of FHLB borrowing capacity with an overnight borrowing rate of 5.17%;

•$288.7 million of brokered deposits based on a Company policy limit of 10% of deposits, with market pricing dependent on brokers and duration;

•$70.0 million of unused lines of credit with an average borrowing rate of 6.08%; and

•$491.1 million of borrowing capacity at the Federal Reserve with an average rate of 5.31%.

Additional liquidity sources include deposit growth, cash earnings in excess of dividends, loan repayments/participations/sales, and securities cash flows, which are estimated to be $64.7 million over the next 12 months.

3

Net interest income and margin

Net interest income of $54.1 million on a tax equivalent (“TE”) basis in the second quarter of 2023 was down 4.1% from $56.4 million in the first quarter of 2023 and 8.9% from $59.3 million in the second quarter of 2022. The TE net interest margin of 2.72% in the second quarter of 2023 decreased 18 basis points from 2.90% in the first quarter of 2023 and 64 basis points from 3.36% in the second quarter of 2022. Results for all periods include the impact of PPP as well as acquisition marks and related accretion. Second quarter 2023 includes $168 thousand of accretion in interest income, $212 thousand of accretion in interest expense, and $5 thousand of interest income on average balances of $673 thousand for PPP.

Excluding the impact of acquisition marks accretion and PPP loans, core net interest income was $53.7 million, down 4.2% from $56.0 million in the first quarter of 2023 and 8.2% from $58.5 million in the second quarter of 2022. Additionally, the core net interest margin was 2.70% for the second quarter of 2023, down 18 basis points from 2.88% for the first quarter of 2023 and 62 basis points from 3.32% for the second quarter of 2022. These results are positively impacted by the combination of loan growth and higher loan yields, which were 4.86% for the second quarter of 2023 compared to 4.66% in the first quarter of 2023 and 3.99% in the second quarter of 2022. Excluding the impact of PPP, balance sheet hedges and acquisition marks accretion, loan yields were 5.01% in June 2023 for an increase of 129 basis points since December 2021, which represents a cumulative beta of 25% compared to the change in the monthly average effective Federal Funds rate for the same period.

The cost of funds in the second quarter of 2023 was 1.92%, up 41 basis points from the first quarter of 2023 and up 168 basis points from the second quarter of 2022. The year-over-year increase is largely due to utilization of higher cost FHLB borrowings in support of loan growth in excess of deposit growth during 2022. The linked quarter increase is due to higher rates on FHLB borrowings and higher average deposit costs discussed above. Excluding the impact of balance sheet hedges and acquisition marks accretion, cost of funds were 2.05% in June 2023 for an increase of 184 basis points since December 2021, which represents a cumulative beta of 37% compared to the change in the monthly average effective Federal Funds rate for the same period.

“The second quarter 2023 individual monthly margin results were much more stable than those experienced in fourth quarter 2022 and first quarter 2023, which were in constant decline,” said Small. “This reflects less ‘early mover’ activity affecting our deposit book combined with less active Fed Fund rate movement during the quarter. While we expect to continue to see deposit mix movement in the book, the second quarter represents a trend in the right direction.”

Non-interest income

Excluding the $36.3 million gain on the sale of the insurance agency, total non-interest income in the second quarter of 2023 of $17.1 million was up 36.8% from $12.5 million in the first quarter of 2023 and 18.7% from $14.4 million in the second quarter of 2022, primarily due to fluctuations in mortgage banking and gains/losses on securities. Mortgage banking income increased $3.2 million on a linked quarter basis and $1.0 million year-over-year as a result of increased gains primarily from increases

4

in hedge valuations. While mortgage pipeline hedges effectively net out over the life of the loans, individual periods can be volatile as market rates and prices change.

Security gains were $64 thousand in the second quarter of 2023, primarily due to increased valuations on equity securities. This compares to a loss of $1.4 million in the first quarter of 2023 and to $1.2 million of losses each from decreased valuations on equity securities. The company also sold $5 million of AFS securities for a $7 thousand loss with average yields less than FHLB borrowing rates during the second quarter of 2023. Service fees in the second quarter of 2023 were $7.2 million, an 11.9% increase from $6.4 million in the first quarter of 2023 and a 7.7% increase from $6.7 million in the second quarter of 2022,primarily due to fluctuations in loan fees including commercial customer swap activity. Insurance commissions were $4.1 million in the second quarter of 2023 down from $4.7 million in the first quarter of 2023 and $4.3 million in the second quarter of 2022 with the linked quarter decrease primarily due to $0.9 million of contingent commissions that only occur in the first quarter. Wealth management income of $1.5 million in the second quarter of 2023 was consistent with $1.5 million in the first quarter of 2023 and up from $1.4 million in the second quarter of 2022. BOLI income of $1.0 million in the second quarter of 2023 decreased from $1.4 million in the first quarter of 2023 and was flat from $1.0 million in the second quarter of 2022, with $0.4 million of claim gains in the first quarter of 2023 compared to none in the second quarter periods.

“Consumer deposit related fees and wealth management income for the current quarter exceed second quarter 2022 results by 7.7% and 8.7%, respectively,” said Small “As previously mentioned, our consumer client activity remains robust and the current equity and fixed income markets bode well for the asset management function over the remainder of the year.”

Non-interest expenses

Excluding transaction costs for the insurance agency sale, non-interest expenses in the second quarter of 2023 were $40.8 million, a 4.6% decrease from $42.8 million in the first quarter of 2023 but a 4.5% increase from $39.1 million in the second quarter of 2022. Compensation and benefits were $24.2 million in the second quarter of 2023, compared to $25.7 million in the first quarter of 2023 and $22.3 million in the second quarter of 2022. The linked quarter decrease was primarily due to cost saving initiatives that began during the second quarter of 2023. The year-over-year increase was primarily due to costs related to higher staffing levels for our 2022 growth initiatives and higher base compensation, including 2022 mid-year adjustments and 2023 annual adjustments. Other expenses decreased $0.5 million on a linked quarter basis due to cost saving initiatives, and all other non-interest expenses increased a net $83 thousand on a linked quarter basis. FDIC premiums increased $1.0 million on a year-over-year basis due to higher rates and our 2022 growth initiatives and all other non-interest expenses decreased a net $1.1 million on a year-over-year basis due to cost saving initiatives. The efficiency ratio (excluding transaction costs and the FIG gain on sale) for the second quarter of 2023 of 57.5% improved from 60.9% in the first quarter of 2023 due to cost saving initiatives but worsened from 52.2% in the second quarter of 2022 due to lower revenues.

5

“Executing on our cost saving initiatives helped drive an almost 5% decrease in expenses excluding transaction costs and a 3.4% improvement to our core efficiency ratio from the prior quarter,” said Paul Nungester, CFO of Premier. “We currently estimate full year core expenses to be $158 million, down $5 million from our prior estimate of $163 million, including $6 million due to the sale of our insurance agency offset by $1 million of other costs including higher FDIC premiums.”

Credit quality

Non-performing assets totaled $37.6 million, or 0.44% of assets, at June 30, 2023, an increase from $34.8 million at March 31, 2023, and from $35.2 million at June 30, 2022. Loan delinquencies increased to $19.0 million, or 0.27% of loans, at June 30, 2023, from $11.1 million at March 31, 2023, and from $11.2 million at June 30, 2022. Classified loans totaled $60.5 million, or 0.85% of loans, as of June 30, 2023, an increase from $44.9 million at March 31, 2023, and from $48.8 million at June 30, 2022.

The 2023 second quarter results include net recoveries of $0.2 million and a total provision expense of $0.5 million, compared with net loan charge-offs of $5.3 million and a total provision expense of $6.6 million for the same period in 2022. The prior year charge-offs were primarily due to the student loan servicer credit that had been previously fully reserved. The allowance for credit losses as a percentage of total loans was 1.13% at June 30, 2023, compared with 1.13% at March 31, 2023, and 1.14% at June 30, 2022. The allowance for credit losses as a percentage of total loans excluding PPP and including unaccreted acquisition marks was 1.16% at June 30, 2023, compared with 1.16% at March 31, 2023, and 1.21% at June 30, 2022. The continued economic improvement following the 2020 pandemic-related downturn has resulted in a year-over-year decrease in the allowance percentages.

Year to date results

For the six-month period ended June 30, 2023, net income totaled $66.5 million, or $1.86 per diluted common share, compared to $48.7 million, or $1.36 per diluted common share for the six months ended June 30, 2022. 2023 results include the impact of the insurance agency sale for a net gain on sale after transaction costs of $32.6 million pre-tax or $0.67 per diluted share after-tax. Excluding the impact of this item, first half 2023 earnings were $1.19 per diluted share.

Net interest income of $110.4 million on a TE basis for the first half of 2023 was down 6.0% from $117.4 million in the first half of 2022. The TE net interest margin of 2.81% in the first half of 2023 decreased 59 basis points from 3.40% in the first half of 2022. Results for all periods include the impact of PPP as well as acquisition marks and related accretion. First half 2023 includes $333 thousand of accretion in interest income, $433 thousand of accretion in interest expense, and $11 thousand of interest income on average balances of $818 thousand for PPP. Excluding the impact of acquisition marks accretion and PPP loans, core net interest income was $109.7 million, down 2.3% from $112.2 million in the first half of 2022. Additionally, the core net interest margin was 2.79% for the first half of 2023, down 47 basis points from 3.26% for the first half of 2022. These results are positively impacted by the combination of loan growth and higher loan yields, which were 4.76% for the first half of 2023 compared to 4.05% in the first half of 2022. The cost of funds in the first half of

6

2023 was 1.72%, up 151 basis points from the first half of 2022. The year-over-year increase is largely due to utilization of higher cost FHLB borrowings in support of loan growth in excess of deposit growth during 2022.

Excluding the $36.3 million gain on the sale of the insurance agency, total non-interest income in the first half of 2023 of $29.5 million was down 5.5% from $31.2 million in the first half of 2022. Mortgage banking income decreased $3.5 million year-over-year as a result of a $2.3 million decrease in gains primarily from lower production and margin as well as a $24 thousand MSR valuation gain in the second quarter of 2023 compared to a $1.5 million gain in the first half of 2022.

Security losses were $1.3 million in the first half of 2023, primarily due to decreased valuations on equity securities. This compares to a loss of $1.8 million from decreased valuations on equity securities in the first half of 2022. The company also sold $21 million of AFS securities for a $27 thousand gain with average yields less than FHLB borrowing rates during the first half of 2023. Service fees in the first half of 2023 were $13.6 million, a 7.4% increase from $12.7 million in the first half of 2022, primarily due to fluctuations in loan fees including commercial customer swap activity and consumer activity for interchange and ATM/NSF charges. Insurance commissions were $8.9 million in the first half of 2023 down slightly from $9.0 million in the first half of 2022 due to $0.9 million of contingent commissions in 2023 compared to $1.1 million in 2022. Wealth management income of $3.0 million in the first half of 2023 was up slightly from $2.9 million in the first half of 2022. BOLI income of $2.4 million in the first half of 2023 increased from $2.0 million in the first half of 2022 with $0.4 million of claim gains in the first half of 2023 compared to none in the first half of 2022.

Excluding transaction costs for the insurance agency sale, non-interest expenses in the first half of 2023 were $83.6 million, a 4.0% increase from $80.4 million in the first half of 2022. Compensation and benefits were $49.8 million in the first half of 2023, compared to $47.9 million in the first half of 2022. The year-over-year increase was primarily due to costs related to higher staffing levels for our 2022 growth initiatives and higher base compensation, including 2022 mid-year adjustments and 2023 annual adjustments, offset partly by cost saving initiatives that began during the second quarter of 2023. FDIC premiums increased $1.7 million on a year-over-year basis primarily due to higher rates and our 2022 growth initiatives. All other non-interest expenses decreased a net $0.4 million on a year-over-year basis. The efficiency ratio (excluding transaction costs and the FIG gain on sale) for the first half of 2023 of 59.2% worsened from 53.4% in the first half of 2022 due to lower revenues partly offset by cost saving initiatives that began during the second quarter of 2023.

The 2023 first half results include net loan charge-offs of $2.2 million and a total provision expense of $4.2 million, compared with net loan charge-offs of $5.2 million and a total provision expense of $7.5 million for the same period in 2022. The provision expense for both years is primarily due to relative loan growth.

7

Total assets at $8.62 billion

Total assets at June 30, 2023, were $8.62 billion, compared to $8.56 billion at March 31, 2023, and $8.01 billion at June 30, 2022. Loans receivable were $6.71 billion at June 30, 2023, compared to $6.58 billion at March 31, 2023, and $5.90 billion at June 30, 2022. At June 30, 2023, loans receivable increased $132.7 million on a linked quarter basis, or 8.1% annualized. Commercial loans excluding PPP increased by $75.2 million from March 31, 2023, or 7.0% annualized. Securities at June 30, 2023, were $0.97 billion, compared to $1.00 billion at March 31, 2023, and $1.15 billion at June 30, 2022. All securities are either AFS or trading and are reflected at fair value on the balance sheet. Also, at June 30, 2023, goodwill and other intangible assets totaled $309.9 million compared to $335.8 million at March 31, 2023, and $339.3 million at June 30, 2022, with the decreases attributable to intangibles amortization and the FIG sale.

Total non-brokered deposits at June 30, 2023, were $6.58 billion, compared with $6.62 billion at March 31, 2023, and $6.52 billion at June 30, 2022. At June 30, 2023, customer deposits increased $64.9 million on a year-over-year basis, or 1.0%. Brokered deposits were $413.2 million at June 30, 2023, compared to $154.9 million at March 31, 2023 and none at June 30, 2022.

Total stockholders’ equity was $937.0 million at June 30, 2023, compared to $914.5 million at March 31, 2023, and $901.1 million at June 30, 2022. The quarterly increase in stockholders’ equity was primarily due to net earnings after dividends including the impact of the insurance agency sale partly offset by a decrease in AOCI, which was primarily related to $12.1 million for a negative valuation adjustment on the AFS securities portfolio. The year-over-year increase was primarily due to net earnings after dividends including the impact the insurance agency sale offset partly by a decrease in AOCI, which was primarily related to $35.1 million of negative valuation adjustments on the AFS securities portfolio. At June 30, 2023, 1,199,634 common shares remained available for repurchase under the Company’s existing repurchase program.

Dividend to be paid August 11

The Board of Directors declared a quarterly cash dividend of $0.31 per common share payable August 11, 2023, to shareholders of record at the close of business on August 4, 2023. The dividend represents an annual dividend of 6.5 percent based on the Premier common stock closing price on July 24, 2023. Premier has approximately 35,730,000 common shares outstanding.

Conference call

Premier will host a conference call at 11:00 a.m. ET on Wednesday, July 26, 2023, to discuss the earnings results and business trends. The conference call may be accessed by calling 1-833-470-1428 and using access code 374150. Internet access to the call is also available (in listen-only mode) at the following URL: https://events.q4inc.com/attendee/827280709.The webcast replay of the conference call will be available at www.PremierFinCorp.com for one year.

About Premier Financial Corp.

Premier Financial Corp. (Nasdaq: PFC), headquartered in Defiance, Ohio, is the holding company for Premier Bank. Premier Bank, headquartered in Youngstown, Ohio, operates 75 branches and 9 loan offices in Ohio, Michigan, Indiana and Pennsylvania and also serves clients through a team of wealth

8

professionals dedicated to each community banking branch. For more information, visit the company’s website at PremierFinCorp.com.

Financial Statements and Highlights Follow-

Safe Harbor Statement

This document may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements may include, but are not limited to, statements regarding projections, forecasts, goals and plans of Premier Financial Corp. and its management, future movements of interests, loan or deposit production levels, future credit quality ratios, future strength in the market area, and growth projections. These statements do not describe historical or current facts and may be identified by words such as “intend,” “intent,” “believe,” “expect,” “estimate,” “target,” “plan,” “anticipate,” or similar words or phrases, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “may,” “can,” or similar verbs. There can be no assurances that the forward-looking statements included in this presentation will prove to be accurate. In light of the significant uncertainties in the forward-looking statements, the inclusion of such information should not be regarded as a representation by Premier or any other persons, that our objectives and plans will be achieved. Forward-looking statements involve numerous risks and uncertainties, any one or more of which could affect Premier’s business and financial results in future periods and could cause actual results to differ materially from plans and projections. These risks and uncertainties include, but not limited to: financial markets, our customers, and our business and results of operation; changes in interest rates; disruptions in the mortgage market; risks and uncertainties inherent in general and local banking, insurance and mortgage conditions; political uncertainty; uncertainty in U.S. fiscal or monetary policy; uncertainty concerning or disruptions relating to tensions surrounding the current socioeconomic landscape; competitive factors specific to markets in which Premier and its subsidiaries operate; increasing competition for financial products from other financial institutions and nonbank financial technology companies; future interest rate levels; legislative or regulatory rulemaking or actions; capital market conditions; security breaches or unauthorized disclosure of confidential customer or Company information; interruptions in the effective operation of information and transaction processing systems of Premier or Premier’s vendors and service providers; failures or delays in integrating or adopting new technology; the impact of the cessation of LIBOR interest rates and implementation of a replacement rate; and other risks and uncertainties detailed from time to time in our Securities and Exchange Commission (SEC) filings, including our Annual Report on Form 10-K for the year ended December 31, 2022 and any further amendments thereto. All forward-looking statements made in this presentation are based on information presently available to the management of Premier and speak only as of the date on which they are made. We assume no obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law. As required by U.S. GAAP, Premier will evaluate the impact of subsequent events through the issuance date of its June 30, 2023, consolidated financial statements as part of its Quarterly Report on Form 10-Q to be filed with the SEC. Accordingly, subsequent events could occur that may cause Premier to update its critical accounting estimates and to revise its financial information from that which is contained in this news release.

Non-GAAP Reporting Measures

We believe that net income, as defined by U.S. GAAP, is the most appropriate earnings measurement. However, we consider core net interest income, core net income and core pre-tax pre-provision income to be a useful supplemental measure of our operating performance. We define core net interest income as net interest income on a tax-equivalent basis excluding income from PPP loans and purchase accounting marks accretion. We define core net income as net income excluding the after-tax impact of the insurance agency gain on sale and related transaction costs. We define core pre-tax pre-provision income as pre-tax pre-provision income excluding the pre-tax impact of the insurance agency gain on sale and related transaction costs. We believe that these metrics are useful supplemental measures of operating performance because investors and equity analysts may use these measures to compare the operating performance of the Company between periods or as compared to other financial institutions or other companies on a consistent basis without having to account for income from PPP loans, purchase accounting marks accretion or the insurance agency sale. Our supplemental reporting measures and similarly entitled financial measures are widely used by investors, equity and debt analysts and ratings agencies in the valuation, comparison, rating and investment recommendations of companies. Our management uses these financial measures to facilitate internal and external comparisons to historical operating results and in making operating decisions. Additionally, they are utilized by the Board of Directors to evaluate management. The supplemental reporting measures do not represent net income or cash flow provided from operating activities as determined in accordance with U.S. GAAP and should not be considered as alternative measures of profitability or liquidity. Finally, the supplemental reporting measures, as defined by us, may not be comparable to similarly entitled items reported by other financial institutions or other companies. Please see the exhibits for reconciliations of our supplemental reporting measures.k financial technology companies; future interest rate levels; legislative or regulatory rulemaking or actions; capital market conditions; security breaches or unauthorized disclosure of confidential customer or Company information; interruptions in the effective operation of information and transaction processing systems of Premier or Premier’s vendors and service providers; failures or delays in integrating or adopting new technology; the impact of the cessation of LIBOR interest rates and implementation of a replacement rate; and other risks and uncertainties detailed from time to time in our Securities and Exchange Commission (SEC) filings, including our Annual Report on Form 10-K for the year ended December 31, 2022 and any further amendments thereto. All forward-looking statements made in this presentation are based on information presently available to the management of Premier and speak only as of the date on which they are made. We assume no obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law. As required by U.S. GAAP, Premier will evaluate the impact of subsequent events through the issuance date of its June 30, 2023, consolidated financial statements as part of its Quarterly Report on Form 10-Q to be filed with the SEC. Accordingly, subsequent events could occur that may cause Premier to update its critical accounting estimates and to revise its financial information from that which is contained in this news release.

Non-GAAP Reporting Measures

9

We believe that net income, as defined by U.S. GAAP, is the most appropriate earnings measurement. However, we consider core net interest income, core net income and core pre-tax pre-provision income to be a useful supplemental measure of our operating performance. We define core net interest income as net interest income on a tax-equivalent basis excluding income from PPP loans and purchase accounting marks accretion. We define core net income as net income excluding the after-tax impact of the insurance agency gain on sale and related transaction costs. We define core pre-tax pre-provision income as pre-tax pre-provision income excluding the pre-tax impact of the insurance agency gain on sale and related transaction costs. We believe that these metrics are useful supplemental measures of operating performance because investors and equity analysts may use these measures to compare the operating performance of the Company between periods or as compared to other financial institutions or other companies on a consistent basis without having to account for income from PPP loans, purchase accounting marks accretion or the insurance agency sale. Our supplemental reporting measures and similarly entitled financial measures are widely used by investors, equity and debt analysts and ratings agencies in the valuation, comparison, rating and investment recommendations of companies. Our management uses these financial measures to facilitate internal and external comparisons to historical operating results and in making operating decisions. Additionally, they are utilized by the Board of Directors to evaluate management. The supplemental reporting measures do not represent net income or cash flow provided from operating activities as determined in accordance with U.S. GAAP and should not be considered as alternative measures of profitability or liquidity. Finally, the supplemental reporting measures, as defined by us, may not be comparable to similarly entitled items reported by other financial institutions or other companies. Please see the exhibits for reconciliations of our supplemental reporting measures.

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets (Unaudited) |

|

|

|

|

|

|

|

|

|

Premier Financial Corp. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

(in thousands) |

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

Cash and amounts due from depositories |

$ |

71,096 |

|

$ |

68,628 |

|

$ |

88,257 |

|

$ |

67,124 |

|

$ |

62,080 |

|

Interest-bearing deposits |

|

50,631 |

|

|

88,399 |

|

|

39,903 |

|

|

37,868 |

|

|

72,314 |

|

|

|

121,727 |

|

|

157,027 |

|

|

128,160 |

|

|

104,992 |

|

|

134,394 |

|

|

|

|

|

|

|

|

|

|

|

|

Available-for-sale, carried at fair value |

|

961,123 |

|

|

998,128 |

|

|

1,040,081 |

|

|

1,063,713 |

|

|

1,140,466 |

|

Equity securities, carried at fair value |

|

6,458 |

|

|

6,387 |

|

|

7,832 |

|

|

15,336 |

|

|

13,293 |

|

Securities investments |

|

967,581 |

|

|

1,004,515 |

|

|

1,047,913 |

|

|

1,079,049 |

|

|

1,153,759 |

|

|

|

|

|

|

|

|

|

|

|

|

Loans (1) |

|

6,708,568 |

|

|

6,575,829 |

|

|

6,460,620 |

|

|

6,207,708 |

|

|

5,890,823 |

|

Allowance for credit losses - loans |

|

(75,921 |

) |

|

(74,273 |

) |

|

(72,816 |

) |

|

(70,626 |

) |

|

(67,074 |

) |

Loans, net |

|

6,632,647 |

|

|

6,501,556 |

|

|

6,387,804 |

|

|

6,137,082 |

|

|

5,823,749 |

|

Loans held for sale |

|

128,079 |

|

|

119,604 |

|

|

115,251 |

|

|

129,142 |

|

|

145,092 |

|

Mortgage servicing rights |

|

20,160 |

|

|

20,654 |

|

|

21,171 |

|

|

20,832 |

|

|

20,693 |

|

Accrued interest receivable |

|

30,056 |

|

|

29,388 |

|

|

28,709 |

|

|

26,021 |

|

|

22,533 |

|

Federal Home Loan Bank stock |

|

39,887 |

|

|

37,056 |

|

|

29,185 |

|

|

28,262 |

|

|

23,991 |

|

Bank Owned Life Insurance |

|

171,856 |

|

|

170,841 |

|

|

170,713 |

|

|

169,728 |

|

|

168,746 |

|

Office properties and equipment |

|

55,736 |

|

|

55,982 |

|

|

55,541 |

|

|

53,747 |

|

|

54,060 |

|

Real estate and other assets held for sale |

|

561 |

|

|

393 |

|

|

619 |

|

|

416 |

|

|

462 |

|

Goodwill |

|

295,602 |

|

|

317,988 |

|

|

317,988 |

|

|

317,948 |

|

|

317,948 |

|

Core deposit and other intangibles |

|

14,298 |

|

|

17,804 |

|

|

19,074 |

|

|

19,972 |

|

|

21,311 |

|

Other assets |

|

138,021 |

|

|

129,508 |

|

|

133,214 |

|

|

148,949 |

|

|

123,886 |

|

Total Assets |

$ |

8,616,211 |

|

$ |

8,562,316 |

|

$ |

8,455,342 |

|

$ |

8,236,140 |

|

$ |

8,010,624 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing deposits |

$ |

1,573,837 |

|

$ |

1,649,726 |

|

$ |

1,869,509 |

|

$ |

1,826,511 |

|

$ |

1,786,516 |

|

Interest-bearing deposits |

|

5,007,358 |

|

|

4,969,436 |

|

|

4,893,502 |

|

|

4,836,113 |

|

|

4,729,828 |

|

Brokered deposits |

|

413,237 |

|

|

154,869 |

|

|

143,708 |

|

|

69,881 |

|

|

- |

|

Total deposits |

|

6,994,432 |

|

|

6,774,031 |

|

|

6,906,719 |

|

|

6,732,505 |

|

|

6,516,344 |

|

Advances from FHLB |

|

455,000 |

|

|

658,000 |

|

|

428,000 |

|

|

411,000 |

|

|

380,000 |

|

Subordinated debentures |

|

85,166 |

|

|

85,123 |

|

|

85,103 |

|

|

85,071 |

|

|

85,039 |

|

Advance payments by borrowers |

|

26,045 |

|

|

26,300 |

|

|

34,188 |

|

|

33,511 |

|

|

40,344 |

|

Reserve for credit losses - unfunded commitments |

|

5,708 |

|

|

6,577 |

|

|

6,816 |

|

|

7,061 |

|

|

6,755 |

|

Other liabilities |

|

112,889 |

|

|

97,835 |

|

|

106,795 |

|

|

102,032 |

|

|

80,995 |

|

Total Liabilities |

|

7,679,240 |

|

|

7,647,866 |

|

|

7,567,621 |

|

|

7,371,180 |

|

|

7,109,477 |

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

Preferred stock |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Common stock, net |

|

306 |

|

|

306 |

|

|

306 |

|

|

306 |

|

|

306 |

|

Additional paid-in-capital |

|

689,579 |

|

|

689,807 |

|

|

691,453 |

|

|

691,578 |

|

|

690,905 |

|

Accumulated other comprehensive income (loss) |

|

(168,721 |

) |

|

(153,709 |

) |

|

(173,460 |

) |

|

(181,231 |

) |

|

(126,754 |

) |

Retained earnings |

|

547,336 |

|

|

510,021 |

|

|

502,909 |

|

|

488,305 |

|

|

470,779 |

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasury stock, at cost |

|

(131,529 |

) |

|

(131,975 |

) |

|

(133,487 |

) |

|

(133,998 |

) |

|

(134,089 |

) |

Total Stockholders’ Equity |

|

936,971 |

|

|

914,450 |

|

|

887,721 |

|

|

864,960 |

|

|

901,147 |

|

Total Liabilities and Stockholders’ Equity |

$ |

8,616,211 |

|

$ |

8,562,316 |

|

$ |

8,455,342 |

|

$ |

8,236,140 |

|

$ |

8,010,624 |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes PPP loans of: |

$ |

577 |

|

$ |

791 |

|

$ |

1,143 |

|

$ |

1,181 |

|

$ |

4,561 |

|

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income (Unaudited) |

|

|

|

|

|

|

|

|

Premier Financial Corp. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

(in thousands, except per share amounts) |

6/30/23 |

|

3/31/23 |

|

12/31/22 |

|

9/30/22 |

|

6/30/22 |

|

|

6/30/23 |

|

6/30/22 |

|

Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

81,616 |

|

$ |

76,057 |

|

$ |

72,194 |

|

$ |

65,559 |

|

$ |

56,567 |

|

|

$ |

157,674 |

|

$ |

111,808 |

|

Investment securities |

|

6,997 |

|

|

7,261 |

|

|

7,605 |

|

|

6,814 |

|

|

6,197 |

|

|

|

14,257 |

|

|

11,676 |

|

Interest-bearing deposits |

|

641 |

|

|

444 |

|

|

444 |

|

|

221 |

|

|

120 |

|

|

|

1,085 |

|

|

166 |

|

FHLB stock dividends |

|

905 |

|

|

394 |

|

|

482 |

|

|

510 |

|

|

174 |

|

|

|

1,299 |

|

|

233 |

|

Total interest income |

|

90,159 |

|

|

84,156 |

|

|

80,725 |

|

|

73,104 |

|

|

63,058 |

|

|

|

174,315 |

|

|

123,883 |

|

Interest Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

26,825 |

|

|

21,458 |

|

|

13,161 |

|

|

6,855 |

|

|

2,671 |

|

|

|

48,283 |

|

|

4,893 |

|

FHLB advances |

|

8,217 |

|

|

5,336 |

|

|

3,941 |

|

|

2,069 |

|

|

527 |

|

|

|

13,554 |

|

|

540 |

|

Subordinated debentures |

|

1,125 |

|

|

1,075 |

|

|

1,000 |

|

|

868 |

|

|

763 |

|

|

|

2,199 |

|

|

1,459 |

|

Notes Payable |

|

- |

|

|

- |

|

|

4 |

|

|

- |

|

|

1 |

|

|

|

- |

|

|

1 |

|

Total interest expense |

|

36,167 |

|

|

27,869 |

|

|

18,106 |

|

|

9,792 |

|

|

3,962 |

|

|

|

64,036 |

|

|

6,893 |

|

Net interest income |

|

53,992 |

|

|

56,287 |

|

|

62,619 |

|

|

63,312 |

|

|

59,096 |

|

|

|

110,279 |

|

|

116,990 |

|

Provision (benefit) for credit losses - loans |

|

1,410 |

|

|

3,944 |

|

|

3,020 |

|

|

3,706 |

|

|

5,151 |

|

|

|

5,354 |

|

|

5,777 |

|

Provision (benefit) for credit losses - unfunded

commitments |

|

(870 |

) |

|

(238 |

) |

|

(246 |

) |

|

306 |

|

|

1,415 |

|

|

|

(1,108 |

) |

|

1,724 |

|

Total provision (benefit) for credit losses |

|

540 |

|

|

3,706 |

|

|

2,774 |

|

|

4,012 |

|

|

6,566 |

|

|

|

4,246 |

|

|

7,501 |

|

Net interest income after provision |

|

53,452 |

|

|

52,581 |

|

|

59,845 |

|

|

59,300 |

|

|

52,530 |

|

|

|

106,033 |

|

|

109,489 |

|

Non-interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service fees and other charges |

|

7,190 |

|

|

6,428 |

|

|

6,632 |

|

|

6,545 |

|

|

6,676 |

|

|

|

13,618 |

|

|

12,676 |

|

Mortgage banking income |

|

2,940 |

|

|

(274 |

) |

|

(299 |

) |

|

3,970 |

|

|

1,948 |

|

|

|

2,666 |

|

|

6,200 |

|

Gain (loss) on sale of non-mortgage loans |

|

71 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

71 |

|

|

- |

|

Gain on sale of insurance agency |

|

36,296 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

36,296 |

|

|

- |

|

Gain (loss) on sale of available for sale securities |

|

(7 |

) |

|

34 |

|

|

1 |

|

|

- |

|

|

- |

|

|

|

27 |

|

|

- |

|

Gain (loss) on equity securities |

|

71 |

|

|

(1,445 |

) |

|

1,209 |

|

|

43 |

|

|

(1,161 |

) |

|

|

(1,374 |

) |

|

(1,804 |

) |

Insurance commissions |

|

4,131 |

|

|

4,725 |

|

|

3,576 |

|

|

3,488 |

|

|

4,334 |

|

|

|

8,856 |

|

|

8,973 |

|

Wealth management income |

|

1,537 |

|

|

1,485 |

|

|

1,582 |

|

|

1,355 |

|

|

1,414 |

|

|

|

3,022 |

|

|

2,891 |

|

Income from Bank Owned Life Insurance |

|

1,015 |

|

|

1,417 |

|

|

984 |

|

|

983 |

|

|

983 |

|

|

|

2,432 |

|

|

1,979 |

|

Other non-interest income |

|

102 |

|

|

92 |

|

|

543 |

|

|

320 |

|

|

171 |

|

|

|

194 |

|

|

313 |

|

Total Non-interest Income |

|

53,346 |

|

|

12,462 |

|

|

14,228 |

|

|

16,704 |

|

|

14,365 |

|

|

|

65,808 |

|

|

31,228 |

|

Non-interest Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

24,175 |

|

|

25,658 |

|

|

24,999 |

|

|

24,522 |

|

|

22,334 |

|

|

|

49,833 |

|

|

47,875 |

|

Occupancy |

|

3,320 |

|

|

3,574 |

|

|

3,383 |

|

|

3,463 |

|

|

3,494 |

|

|

|

6,894 |

|

|

7,194 |

|

FDIC insurance premium |

|

1,786 |

|

|

1,288 |

|

|

1,276 |

|

|

976 |

|

|

802 |

|

|

|

3,074 |

|

|

1,395 |

|

Financial institutions tax |

|

961 |

|

|

852 |

|

|

795 |

|

|

1,050 |

|

|

1,074 |

|

|

|

1,813 |

|

|

2,265 |

|

Data processing |

|

3,640 |

|

|

3,863 |

|

|

3,882 |

|

|

3,121 |

|

|

3,442 |

|

|

|

7,503 |

|

|

6,777 |

|

Amortization of intangibles |

|

1,223 |

|

|

1,270 |

|

|

1,293 |

|

|

1,338 |

|

|

1,380 |

|

|

|

2,493 |

|

|

2,818 |

|

Transaction costs |

|

3,652 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

3,652 |

|

|

- |

|

Other non-interest expense |

|

5,738 |

|

|

6,286 |

|

|

7,400 |

|

|

6,629 |

|

|

6,563 |

|

|

|

12,024 |

|

|

12,060 |

|

Total Non-interest Expense |

|

44,495 |

|

|

42,791 |

|

|

43,028 |

|

|

41,099 |

|

|

39,089 |

|

|

|

87,286 |

|

|

80,384 |

|

Income before income taxes |

|

62,303 |

|

|

22,252 |

|

|

31,045 |

|

|

34,905 |

|

|

27,806 |

|

|

|

84,555 |

|

|

60,333 |

|

Income tax expense |

|

13,912 |

|

|

4,103 |

|

|

5,770 |

|

|

6,710 |

|

|

5,446 |

|

|

|

18,015 |

|

|

11,616 |

|

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

$ |

48,391 |

|

$ |

18,149 |

|

$ |

25,275 |

|

$ |

28,195 |

|

$ |

22,360 |

|

|

$ |

66,540 |

|

$ |

48,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.35 |

|

$ |

0.51 |

|

$ |

0.71 |

|

$ |

0.79 |

|

$ |

0.63 |

|

|

$ |

1.86 |

|

$ |

1.36 |

|

Diluted |

$ |

1.35 |

|

$ |

0.51 |

|

$ |

0.71 |

|

$ |

0.79 |

|

$ |

0.63 |

|

|

$ |

1.86 |

|

$ |

1.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

35,722 |

|

|

35,606 |

|

|

35,589 |

|

|

35,582 |

|

|

35,560 |

|

|

|

35,686 |

|

|

35,768 |

|

Diluted |

|

35,800 |

|

|

35,719 |

|

|

35,790 |

|

|

35,704 |

|

|

35,682 |

|

|

|

35,750 |

|

|

35,880 |

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premier Financial Corp. |

|

|

|

|

|

|

|

|

|

|

|

|

Selected Quarterly Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

(dollars in thousands,

except per share data) |

6/30/23 |

|

3/31/23 |

|

12/31/22 |

|

9/30/22 |

|

6/30/22 |

|

|

6/30/23 |

|

6/30/22 |

|

Summary of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-equivalent interest income (1) |

$ |

90,226 |

|

$ |

84,260 |

|

$ |

80,889 |

|

$ |

73,301 |

|

$ |

63,283 |

|

|

$ |

174,485 |

|

$ |

124,336 |

|

Interest expense |

|

36,167 |

|

|

27,869 |

|

|

18,106 |

|

|

9,792 |

|

|

3,962 |

|

|

|

64,036 |

|

|

6,893 |

|

Tax-equivalent net interest income (1) |

|

54,059 |

|

|

56,391 |

|

|

62,783 |

|

|

63,509 |

|

|

59,321 |

|

|

|

110,449 |

|

|

117,443 |

|

Provision expense for credit losses |

|

540 |

|

|

3,706 |

|

|

2,774 |

|

|

4,012 |

|

|

6,566 |

|

|

|

4,246 |

|

|

7,501 |

|

Non-interest income (ex securities

gains/losses) |

|

53,282 |

|

|

13,873 |

|

|

13,018 |

|

|

16,661 |

|

|

15,526 |

|

|

|

67,155 |

|

|

33,032 |

|

Core non-interest income (ex securities

gains/losses) (2) |

|

16,986 |

|

|

13,873 |

|

|

13,018 |

|

|

16,661 |

|

|

15,526 |

|

|

|

30,859 |

|

|

33,032 |

|

Non-interest expense |

|

44,495 |

|

|

42,791 |

|

|

43,028 |

|

|

41,099 |

|

|

39,089 |

|

|

|

87,286 |

|

|

80,384 |

|

Core non-interest expense (2) |

|

40,843 |

|

|

42,791 |

|

|

43,028 |

|

|

41,099 |

|

|

39,089 |

|

|

|

|

|

|

Income tax expense |

|

13,912 |

|

|

4,103 |

|

|

5,770 |

|

|

6,710 |

|

|

5,446 |

|

|

|

18,015 |

|

|

11,616 |

|

Net income |

|

48,391 |

|

|

18,149 |

|

|

25,275 |

|

|

28,195 |

|

|

22,360 |

|

|

|

66,540 |

|

|

48,717 |

|

Core net income (2) |

|

24,230 |

|

|

18,149 |

|

|

25,275 |

|

|

28,195 |

|

|

22,360 |

|

|

|

42,379 |

|

|

48,717 |

|

Tax equivalent adjustment (1) |

|

67 |

|

|

104 |

|

|

164 |

|

|

197 |

|

|

225 |

|

|

|

170 |

|

|

453 |

|

At Period End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

8,616,211 |

|

$ |

8,562,316 |

|

$ |

8,455,342 |

|

$ |

8,236,140 |

|

$ |

8,010,624 |

|

|

|

|

|

|

Goodwill and intangibles |

|

309,900 |

|

|

335,792 |

|

|

337,062 |

|

|

337,920 |

|

|

339,259 |

|

|

|

|

|

|

Tangible assets (3) |

|

8,306,311 |

|

|

8,226,524 |

|

|

8,118,280 |

|

|

7,898,220 |

|

|

7,671,365 |

|

|

|

|

|

|

Earning assets |

|

7,818,825 |

|

|

7,751,130 |

|

|

7,620,056 |

|

|

7,411,403 |

|

|

7,218,905 |

|

|

|

|

|

|

Loans |

|

6,708,568 |

|

|

6,575,829 |

|

|

6,460,620 |

|

|

6,207,708 |

|

|

5,890,823 |

|

|

|

|

|

|

Allowance for loan losses |

|

75,921 |

|

|

74,273 |

|

|

72,816 |

|

|

70,626 |

|

|

67,074 |

|

|

|

|

|

|

Deposits |

|

6,994,432 |

|

|

6,774,031 |

|

|

6,906,719 |

|

|

6,732,505 |

|

|

6,516,344 |

|

|

|

|

|

|

Stockholders’ equity |

|

936,971 |

|

|

914,450 |

|

|

887,721 |

|

|

864,960 |

|

|

901,147 |

|

|

|

|

|

|

Stockholders’ equity / assets |

|

10.87 |

% |

|

10.68 |

% |

|

10.50 |

% |

|

10.50 |

% |

|

11.25 |

% |

|

|

|

|

|

Tangible equity (3) |

|

627,071 |

|

|

578,658 |

|

|

550,659 |

|

|

527,040 |

|

|

561,888 |

|

|

|

|

|

|

Tangible equity / tangible assets |

|

7.55 |

% |

|

7.03 |

% |

|

6.78 |

% |

|

6.67 |

% |

|

7.32 |

% |

|

|

|

|

|

Average Balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

8,597,786 |

|

$ |

8,433,100 |

|

$ |

8,304,462 |

|

$ |

8,161,389 |

|

$ |

7,742,550 |

|

|

$ |

8,515,898 |

|

$ |

7,626,888 |

|

Earning assets |

|

7,951,520 |

|

|

7,783,850 |

|

|

7,653,648 |

|

|

7,477,795 |

|

|

7,051,661 |

|

|

|

7,871,629 |

|

|

6,904,082 |

|

Loans |

|

6,714,240 |

|

|

6,535,080 |

|

|

6,359,564 |

|

|

6,120,324 |

|

|

5,667,853 |

|

|

|

6,625,155 |

|

|

5,526,127 |

|

Deposits and interest-bearing liabilities |

|

7,538,674 |

|

|

7,385,946 |

|

|

7,278,531 |

|

|

7,116,910 |

|

|

6,706,250 |

|

|

|

7,462,732 |

|

|

6,561,669 |

|

Deposits |

|

6,799,605 |

|

|

6,833,521 |

|

|

6,773,382 |

|

|

6,654,328 |

|

|

6,385,857 |

|

|

|

6,816,469 |

|

|

6,350,235 |

|

Stockholders’ equity |

|

921,441 |

|

|

901,587 |

|

|

875,287 |

|

|

912,224 |

|

|

921,847 |

|

|

|

911,569 |

|

|

961,873 |

|

Goodwill and intangibles |

|

334,862 |

|

|

336,418 |

|

|

337,207 |

|

|

338,583 |

|

|

339,932 |

|

|

|

335,636 |

|

|

340,639 |

|

15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible equity (3) |

|

586,579 |

|

|

565,169 |

|

|

538,080 |

|

|

573,641 |

|

|

581,915 |

|

|

|

575,933 |

|

|

621,234 |

|

Per Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share ("EPS") - Basic |

$ |

1.35 |

|

$ |

0.51 |

|

$ |

0.71 |

|

$ |

0.79 |

|

$ |

0.63 |

|

|

$ |

1.86 |

|

$ |

1.36 |

|

EPS - Diluted |

|

1.35 |

|

|

0.51 |

|

|

0.71 |

|

|

0.79 |

|

|

0.63 |

|

|

|

1.86 |

|

|

1.36 |

|

EPS - Core diluted (2) |

|

0.68 |

|

|

0.51 |

|

|

0.71 |

|

|

0.79 |

|

|

0.63 |

|

|

|

1.19 |

|

|

1.36 |

|

Dividends Paid |

|

0.31 |

|

|

0.31 |

|

|

0.30 |

|

|

0.30 |

|

|

0.30 |

|

|

|

0.62 |

|

|

0.60 |

|

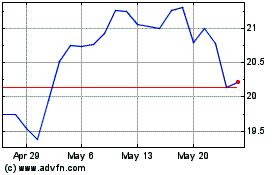

Market Value: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

$ |

21.01 |

|

$ |

27.80 |

|

$ |

30.51 |

|

$ |

29.36 |

|

$ |

30.13 |

|

|

$ |

27.99 |

|

$ |

32.52 |

|

Low |

|

13.60 |

|

|

20.39 |

|

|

26.11 |

|

|

24.67 |

|

|

25.31 |

|

|

|

13.60 |

|

|

25.31 |

|

Close |

|

16.02 |

|

|

20.73 |

|

|

26.97 |

|

|

25.70 |

|

|

25.35 |

|

|

|

16.02 |

|

|

30.91 |

|

Common Book Value |

|

26.23 |

|

|

25.61 |

|

|

24.94 |

|

|

24.32 |

|

|

25.35 |

|

|

|

|

|

|

Tangible Common Book Value (3) |

|

17.55 |

|

|

16.21 |

|

|

15.47 |

|

|

14.82 |

|

|

15.80 |

|

|

|

|

|

|

Shares outstanding, end of period (000s) |

|

35,727 |

|

|

35,701 |

|

|

35,591 |

|

|

35,563 |

|

|

35,555 |

|

|

|

|

|

|

Performance Ratios (annualized) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-equivalent net interest margin (1) |

|

2.72 |

% |

|

2.90 |

% |

|

3.28 |

% |

|

3.40 |

% |

|

3.36 |

% |

|

|

2.81 |

% |

|

3.40 |

% |

Return on average assets |

|

2.26 |

% |

|

0.86 |

% |

|

1.21 |

% |

|

1.37 |

% |

|

1.16 |

% |

|

|

1.58 |

% |

|

1.29 |

% |

Core return on average assets (2) |

|

1.13 |

% |

|

0.86 |

% |

|

1.22 |

% |

|

1.39 |

% |

|

1.16 |

% |

|

|

1.00 |

% |

|

1.29 |

% |

Return on average equity |

|

21.06 |

% |

|

8.07 |

% |

|

11.46 |

% |

|

12.26 |

% |

|

9.73 |

% |

|

|

14.72 |

% |

|

10.21 |

% |

Core return on average equity (2) |

|

10.55 |

% |

|

8.07 |

% |

|

11.58 |

% |

|

12.40 |

% |

|

9.73 |

% |

|

|

9.38 |

% |

|

10.21 |

% |

Return on average tangible equity |

|

33.09 |

% |

|

12.88 |

% |

|

18.64 |

% |

|

19.50 |

% |

|

15.41 |

% |

|

|

23.30 |

% |

|

15.81 |

% |

Core return on average tangible equity (2) |

|

16.57 |

% |

|

10.51 |

% |

|

14.64 |

% |

|

16.33 |

% |

|

12.95 |

% |

|

|

14.84 |

% |

|

15.81 |

% |

Efficiency ratio (4) |

|

41.45 |

% |

|

60.90 |

% |

|

56.76 |

% |

|

51.26 |

% |

|

52.23 |

% |

|

|

49.15 |

% |

|

53.42 |

% |

Core efficiency ratio (2) |

|

57.49 |

% |

|

60.90 |

% |

|

56.76 |

% |

|

51.26 |

% |

|

52.23 |

% |

|

|

59.19 |

% |

|

53.42 |

% |

Effective tax rate |

|

22.33 |

% |

|

18.44 |

% |

|

18.59 |

% |

|

19.22 |

% |

|

19.59 |

% |

|

|

21.31 |

% |

|

19.25 |

% |

Common dividend payout ratio |

|

22.96 |

% |

|

60.78 |

% |

|

42.25 |

% |

|

37.97 |

% |

|

47.62 |

% |

|

|

33.33 |

% |

|

44.12 |

% |

(1) Interest income on tax-exempt securities and loans has been adjusted to a tax-equivalent basis using the statutory federal income tax rate of 21%. |

|

(2) Core items exclude the impact of insurance agency disposition related items. See non-GAAP reconciliations. |

|