Current Report Filing (8-k)

May 15 2020 - 9:01AM

Edgar (US Regulatory)

0000907471false00009074712020-05-152020-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2020

META FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

0-22140

|

42-1406262

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

5501 South Broadband Lane, Sioux Falls, South Dakota 57108

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (605) 782-1767

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

CASH

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

MetaBank, National Association (the “Bank”), a wholly owned subsidiary of Meta Financial Group, Inc. (the “Company”) has entered into a letter of intent with Emerald Financial Services, LLC (“EFS”), a wholly owned indirect subsidiary of H&R Block, Inc. (“H&R Block”), to enter into a multi-year program management agreement (a “PMA”) pursuant to which Meta would offer certain financial products to H&R Block clients, and to negotiate the transition of certain financial products under an existing program manager agreement between H&R Block and a third party. The letter of intent is non-binding and no binding agreement will occur unless and until all required parties have negotiated, approved, executed, and delivered the appropriate definitive agreements. There is no guarantee as to whether or when we will enter into a PMA with EFS or any agreement transitioning existing financial products to Meta from H&R Block’s existing counterparty, or what the final terms or structure of any such arrangements will be. The terms of any PMA or transition agreements, or of any potential relationship with EFS, H&R Block or any other counterparty, is subject to a number of contingencies, including the negotiation and execution of definitive agreements, regulatory approval, and the satisfaction of customary closing conditions, as applicable under such agreements.

In the event the Bank enters into a PMA with EFS pursuant to the letter of intent, the Company expects the relationship to result in approximately $15 million to $20 million of net operating income (related revenue, less related expense, provision and income tax) for the 2021 fiscal year.

The information in this Item 7.01 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as “may,” “will,” “should,” “would,” “expects,” “intends,” “intent,” or other similar expressions. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. All forward-looking statements speak only as of the date they are made and reflect the Company's good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, the factors reflected under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company’s fiscal year ended September 30, 2019 and Quarterly Report on Form 10-Q for the Company’s fiscal quarter ended March 31, 2020, and in other filings made with the SEC.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

META FINANCIAL GROUP, INC.

|

|

|

|

|

|

Date: May 15, 2020

|

By:

|

/s/ Glen W. Herrick

|

|

|

|

Glen W. Herrick

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Jun 2024 to Jul 2024

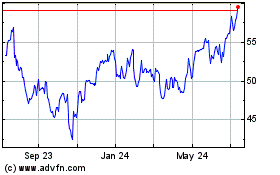

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Jul 2023 to Jul 2024