0001881551

false

0001881551

2023-07-14

2023-07-14

0001881551

NUBI:UnitsEachConsistingOfOneShareOfCommonStockAndOnehalfOfOneRedeemableWarrantMember

2023-07-14

2023-07-14

0001881551

NUBI:CommonStockParValue0.0001PerShareMember

2023-07-14

2023-07-14

0001881551

NUBI:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member

2023-07-14

2023-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

July 14, 2023

Date of Report (Date of earliest event reported)

Nubia Brand International Corp.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41323 |

|

87-1993879 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

13355 Noel Rd, Suite 1100

Dallas, TX |

|

75240 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (972) 918-5120

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act |

| ☒ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Units, each consisting of one share of Common Stock and one-half of one Redeemable Warrant |

|

NUBIU |

|

The Nasdaq Capital Market LLC |

| Common Stock, par value $0.0001 per share |

|

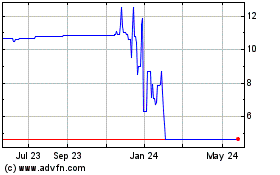

NUBI |

|

The Nasdaq Capital Market LLC |

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

NUBIW |

|

The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

As previously disclosed, on

February 16, 2023, Nubia Brand International Corp. (“Nubia”) entered into a Merger Agreement (the “Merger Agreement”)

by and among Honeycomb Battery Company, an Ohio corporation (“Honeycomb”), Nubia, and Nubia Merger Sub, Inc., an Ohio corporation

(“Merger Sub”) and wholly-owned subsidiary of Nubia, pursuant to which Merger Sub will merge with and into Honeycomb (the

“Merger”) with Honeycomb as the surviving corporation of the Merger and becoming a wholly-owned subsidiary of Nubia.

Attached as Exhibit 99.1 is

the investor presentation (the “Investor Presentation”) of Honeycomb that may be used by Honeycomb and Nubia in connection

with the proposed Merger. The Investor Presentation is furnished as Exhibit 99.1 and incorporated by reference into this Item 7.01.

The foregoing (including Exhibit 99.1)

is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange

Act of 1934, as amended (the “;Exchange Act”), or otherwise be subject to the liabilities of that section, nor will they be

deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(c) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated July 14, 2023 |

|

| |

|

| NUBIA BRAND INTERNATIONAL CORP. |

|

| |

|

| By: |

/s/ Jaymes Winters |

|

| Name: |

Jaymes Winters |

|

| Title: |

Chief Executive Officer |

|

2

Exhibit 99.1

H ONEYCOMB B ATTERY C OMPANY N UBIA B RAND I NTERNATIONAL C ORP . Advancing energy storage in a smart, sustainable way INVESTO R PRESENTATION J U L Y 2023

H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . AB OU T T HI S P R ESE N T A T IO N This presentation is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination (the “proposed business combination”) between Honeycomb Battery Company (“HBC”) and Nubia Brand International Corporation (“Nubia”) and related transactions and for no other purpose . No representations or warranties, express or implied, are given in, or in respect of, this presentation . To the fullest extent permitted by law, in no circumstances will HBC, NUBIA or any of their respective subsidiaries, interest holders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target”, “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and operational metrics, projections of market opportunity, market share and product sales, expectations and timing related to commercial product launches, including the start of production and launch of the HBC Air and any future products, the performance, technology and other features of HBC products, future market opportunities, including with respect to energy storage systems and automotive partnerships, future manufacturing capabilities (including production volumes) and facilities, future sales channels and strategies, future market launches and expansion, future capital expenditures, the amount of cash that will be required to fund HBC’s planned operations, the potential benefits of the proposed transactions and PIPE investment (collectively, the “proposed transactions”) and the potential success of HBC’s go - to - market strategy, and expectations related to the terms and timing of the proposed transactions . These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of HBC’s and NUBIA’s management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of HBC and NUBIA . These forward - looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions ; the inability of the parties to successfully or timely consummate the proposed transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transactions or that the approval of the shareholders of NUBIA or HBC is not obtained ; the outcome of any legal proceedings that may be instituted against HBC or NUBIA following announcement of the proposed transactions ; failure to realize the anticipated benefits of the proposed transactions ; risks relating to the uncertainty of the projected financial information with respect to HBC, including conversion of reservations into binding orders ; risks related to the timing of expected business milestones and commercial launch, including HBC’s ability to mass produce HBC’s products and complete the tooling of its manufacturing facility ; risks related to the expansion of HBC’s manufacturing facility and the increase of HBC’s production capacity ; Risks related to future market adoption of HBC’s offerings ; HBC’s ability to anticipate demand for HBC’s products, and planned variants ; the effects of competition and the pace and depth of electric vehicle adoption generally on HBC’s future business ; changes in regulatory requirements, governmental incentives and fuel and energy prices ; HBC’s ability to rapidly innovate ; HBC’s ability to enter into or maintain partnerships with original equipment manufacturers, vendors and technology providers ; HBC’s ability to effectively manage its growth and recruit and retain key employees, including its chief executive officer and executive team ; HBC’s ability to establish its brand and capture additional market share, and the risks associated with negative press or reputational harm ; HBC’s ability to manage expenses ; HBC’s ability to effectively utilize benefits from the Inflation Reduction Act ; the amount of redemption requests made by NUBIA’s public stockholders ; the ability of NUBIA or the combined company to obtain additional financing for its planned operations, including its ability to issue equity or equity - linked securities ; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries ; and the impact of the global COVID - 19 pandemic on HBC, NUBIA, the combined company’s projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that neither HBC nor NUBIA presently know or that HBC and NUBIA currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect HBC’s and NUBIA’s expectations, plans or forecasts of future events and views as of the date of this presentation, except that certain forward - looking statements indicated in this presentation reflect HBC’s and NUBIA’s expectations, plans or forecasts of future events and views as of February 13 , 2023 and have not been updated since . HBC and NUBIA anticipate that events and developments subsequent to the date of the applicable forward - looking statement will cause HBC’s and NUBIA’s assessments to change . However, while HBC and NUBIA may elect to update these forward - looking statements at some point in the future, HBC and NUBIA specifically disclaim any obligation to do so . These forward - looking statements should not be relied upon as representing HBC’s and NUBIA’s assessments as of any date subsequent to the date of this presentation (or, if earlier, the date of the forward - looking statement). Accordingly, undue reliance should not be placed upon the forward - looking statements. Use of Projections This presentation contains projected financial information with respect to the combined company, namely revenue, cost of goods sold, gross profit, EBITDA and capital expenditures for 2023 – 2030 . Such projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . For instance, HBC’s projected financial information as of February 13 , 2023 incorporated certain financial and operational assumptions based on information available at the time the forecasts were made, have not been updated since such date, and should not be regarded as an indication that HBC or any other recipient of this information considered, or now considers, it to be predictive of actual future results . See “Forward - Looking Statements” above . Actual results may differ materially from the results contemplated by the projected financial information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved . Neither the independent auditors of NUBIA nor the independent registered public accounting firm of HBC has audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation . Industry and Market Data Industry and market data used in this presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Neither HBC nor NUBIA has independently verified the data obtained from these sources, and they cannot assure you of the data’s accuracy or completeness . This data is subject to change . In addition, this presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of HBC or the proposed transactions . Viewers of this presentation should each make their own evaluation of HBC and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . Information in this presentation about battery storage competitors is derived from figures published by manufacturers and other publicly available information . Neither HBC nor NUBIA has independently verified the data obtained from these sources, and they cannot assure you of the data’s accuracy or completeness . Additional Information About the Proposed Transactions and Where to Find It This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . This communication relates to a proposed business combination between NUBIA and HBC . In connection with the proposed business combination, NUBIA will file additional documents regarding the proposed business combination with the SEC . Before making any voting decision, investors and security holders of NUBIA are urged to read all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed transaction . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Participants in the Solicitation NUBIA, HBC and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from NUBIA’s shareholders in connection with the proposed transactions . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of NUBIA’s shareholders in connection with the proposed transactions will be set forth in NUBIA’s proxy statement/prospectus . Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is included in the proxy statement/prospectus . Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully before making any voting or investment decisions . You may obtain free copies of these documents from the sources indicated above . No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction .

What if… El ec tri c Veh i c le ba tt e r y ma t e ri a l s cou l d b e de ri ved f r o m r ene w ab l e sources… Ni cke l an d Coba lt cou l d b e r ep l aced wit h r ead ily ava il ab l e abundant ma t e r ial s …

“Green” Graphite • S y n t he t i c G r aph i t e • de r i ve d f r o m B i o m ass • Les s cos t l y t han pe tr o l eu m coke , l ess i m pac t o n env i r on m en t • M i t i gate s C li mat e Chang e G r aph i t e m ake s u p 25 % - 28 % o f E V ba tt e r y • O n l y tw o na t u r a l G r aph i t e M i ne s i n t h e U.S. • Mad e i n Amer i c a

Next - Gen Cathode • Hi g h - capac i t y su lf u r • ca t hod e m a t e r i a l s • N o nee d f o r Ni cke l, C oba l t o r M anganes e • M os t p r ocess - f r i end ly so li d - s t a t e e l ec tr o l y t es E x cep t i ona l s pec ifi c energy • Lo w e r cos t t han conven t i ona l so l u t i ons • Mad e i n Amer i c a

H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . Sum mary Transaction Terms Pro Forma Valuation Share Price Pro Forma Shares Outstanding (MM) (8) Notes: (1) Existing Honeycomb shareholders (G3) at time of transaction close is entitled to the earn - out shares (2) Price targets achieved if the VWAP share price exceeds the applicable price target for any 10 trading days within a 30 - day trading period occurring between the closing an d o n o r p ri o r t o t h e app li cab l e exp ir a ti o n da t e (3) Earn - out eligibility begins thirty (30) days following the Closing Date (4) Earn - out eligibility begins one hundred eighty (180) days following the Closing Date (5) T r u s t a cc oun t ba l an c e a s o f 6 / 30 / 23 (6) E xac t F i nanc i n g s tr uc t u r e T BD (7) Excludes ~$70MM in anticipated committed equity financing which may be available within 30 days of the Closing Date (8) Pro forma ownership structure at $10.00 / share based on ~$41M cash in trust, assuming no redemptions. Excludes NUBI public and private warrants (9) A ssu m e s ~$10 M i n tr ansac ti o n cos t s , n o r ede m p ti on s OVERVIEW EARN - OUT CASH S O URCES CAPITAL STRUCTURE ▪ Global Graphene Group (“G3”) is carving out its battery division, renamed Honeycomb Battery Co. ▪ Honeycomb is expected to combine with Nubia Brand International Corp. (“NUBI”) to advance and accelerate the commercialization of Honeycomb’s battery technology ▪ Transaction expected to close Q3 2023 ▪ Issuing 70.0MM shares to existing Honeycomb shareholders (G3) ▪ Pro forma enterprise value of approximately $740MM ▪ ~$32MM of cash to balance sheet (assuming no redemptions) to fund R&D and investments in growth and expansion (7)(9) ▪ Honeycomb shareholders (G3) rolling 100% of its equity ▪ No minimum cash condition P r o Fo rm a Ow n e r s h i p ( 7 )( 8) ▪ NUBI has ~$42MM (5) cash in trust ▪ Expected at least $ 70 MM within 30 days post - close via a combination of non - redemption agreements, PIPE, convertible notes, Committed Equity Facility and/or Forward Share Purchase Agreements (FSPA) ( 6 ) VALUATION ▪ Strong incentive structure facilitated by earn - out provisions, with 22.5MM shares to be released at specified earn - out thresholds: (1)(2) – Tranche 1: 5.0MM issued at a price target of $12.50 by second anniversary of the Closing Date (3) – Tranche 2: 7.5MM issued at a price target of $15.00 forty - two (42) months following the Closing Date (4) – Tranche 3: 10MM issued at a price target of $25.00 by the fourth anniversary of the Closing Date (4) TRA N SACT IO N S U MMARY $ M M $10.00 77.1 P r o Fo r m a M a r ke t C a p i t a li z a t i o n $771 Less: Pro Forma Net Cash (9) ($32) H on eyc o m b P r o Fo r m a E n t e r p r i s e Va l u e $73 9 Estimated Sources Honeycomb Shareholder Equity Rollover NUBI Cash in Trust $ M M $700 $42 To t a l S ou r ce s $74 2 Estimated Uses Honeycomb Shareholder Equity Rollover Estimated Fees & Expenses Cash to Honeycomb Balance Sheet $ M M $700 $10 $32 To t a l U se s $74 2 5 NUBI Sponsor 4.0% NUBI Shareholders 5.1% Represen t a t ive Shares 0.2% Honeycomb Shareholders (G3) 90.7%

H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 6 1 KnowMade Report, 12/2021; 2 KnowMade report, 04/2022 ; 3 LexisNexis Report 03/2022 Recognized as a global leader in both high - capacity anode & high - energy solid - state batteries. ▪ Advanced anode materials that deliver specific capacity from 300 to 3,500+ mAh/g ▪ Uniquely positioned to supply graphite from sustainable sources, silicon oxide (SiO x ), silicon (Si), & protected lithium metal anode Transformative solid - state battery platform technology. ▪ Solid - state cells that can be manufactured at scale using current lithium - ion cell production facilities ▪ Delivers significantly extended EV range, improved battery safety and lower cost per kWh ▪ Rapid time - to - market next - gen cathodes with potential to replace expensive nickel and cobalt with sulfur (S) and other more abundant elements One of the world’s best IP portfolios among all the battery start - ups. ▪ 525 + pa t en t s ( 355 + U S an d 170 + f o r e i gn) ▪ Acknowledged as one of the two US - based leaders in solid - state electrolytes 1 ▪ Ranked as No. 1 company in the USA and No. 1 battery startup in the world in Si anode technology 2 ▪ R e c ogn i ze d a s a G l oba l T o p 10 0 I nno v a t o r 3 Over $75M in capital deployed to date. Dr. Bor Z. Jang Co - F ounde r an d C E O, G l oba l G r aphen e G r ou p & H one yc o m b B atte r y C o . Dr. Aruna Zhamu Co - F ounde r an d T e c hni c a l A d v i s o r , G loba l G r aphen e G r ou p & H one yc o m b B a tt e r y Co . H ONEYCOMB B ATTERY C OMPANY FOUNDERS O V E RVI E W O F HON E YC O M B BA TTE R Y C O MP A NY

90+ Combined Years of Experience Significant experience in the private & public markets and regulatory bodies Extensive background in operational and management roles within manufacturing Broad Business networks Robust M&A and investing experience 1 5 4 3 2 O V E RVI E W O F NU BI A BRA N D IN TE R N A T IONA L C O R P . ▪ Nubia Brand International Corp (NUBI) is a Special Purpose Acquisition Company (SPAC) formed for the purpose of effecting a merger, stock purchase or similar business combination ▪ Trading commenced on March 11, 2022, on Nasdaq ▪ Holds approximately $42 Million cash in trust ▪ Underwriter: EF Hutton, division of Benchmark Investments, LLC O FFIC E R S NU BI A O V E RVI E W B O AR D M E M B E RS Michael Patterson Director ▪ Chief Administrative Officer an d Chie f Lega l Off i c e r f o r B l ue C r o s s an d Bl u e S h i e l d o f Alabama. ▪ S e r v e d o n t h e boa r d o f Lakeshor e F ounda t ion. ▪ B S Acc oun t i ng , U n iv e r si t y o f Alabama - Birmingham. ▪ J D B i rm ingha m Sc hoo l o f Law . David Campbell Director ▪ F o rm e r P r e si den t an d CE O f o r H o r iz o n Ai r o f t h e Al a sk a Air Gr ou p ( NYSE : ALK ) . ▪ 20 + y ear s o f experienc e a s an execu t i v e i n t h e avia t i o n s ec t or . ▪ B oa r d m e m be r e x pe r i en c e a t A m e r ic a n Ai r li ne s an d F ede r a l C r ed i t U n i on . ▪ B . S . B u si ne s s A d m i n is tr a t i o n & M anage m en t , Loui s ian a T e ch U n iv e r si t y , an d M B A U n iv e r si t y o f T exa s - A r li ng t on . Karin - Joyce Tjon Director ▪ S e r v e d a s C h i e f F i nan ci a l Off i c e r an d E x e c u t i v e Vi c e P r e si den t f o r E p i q Sys t e m s (NASDAQ:EPIQ). ▪ Ex e c u t iv e l e v e l e x pe r i en c e i n Acc oun t i ng , SE C f ili ng s , t a x planning , inves t o r r ela t ions . ▪ BS S Or gan iz a t i ona l B eha vi o r & M anage m en t S u mm a c u m l aud e fr o m O h i o U n iv e r si t y . ▪ M B A Colu m bi a Uni v e rs i ty. Yvonne Brown Director ▪ P r e vi ou sl y s e r v e d a s D tr . o f Di g i t a l B u si ne s s & D tr . o f Tr an si t i on s a t C ogn iz an t T e c hno l og y S o l u t i on s ( NASDA Q : “ C T SH ”) , V P o f Transition/ Transformation MGMT S e r vic e s wi t h X e r o x. ▪ 20 + y ear s o f S enio r m anagement experienc e i n t h e I T s ec t or . ▪ B A C o m pu t e r Sci en c e , E a st C a r o li n a U n iv e r si t y . ▪ M S Enginee r in g M anage m en t , S ou t he r n M e t hod is t U n iv e r si t y. Jaymes Winters C ha i rm a n & CE O ▪ 7+ years as Chief Executive Officer at Mach FM Corp. ▪ Former founder and CEO of United Energy Inc. ▪ Over 15 years experience as a CEO in the oil and gas, telecommunications and retail space with extensive experience in Mergers and Acquisitions Vlad Prantsevich C F O & Di r e c t o r ▪ 6+ years as Executive Vice President of Operations at Mach FM Corp. ▪ 8+ Years of executive management level experience in charge of Corporate Finance at 64 Audio. H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 7

Differentiated and Transformative Battery Technologies Leading innovations in energy density and safety, while removing reliance on critical nickel and cobalt materials Recognized Global Leader in Battery Intellectual Property Extensive IP portfolio that includes industry - leading solid - state electrolytes and silicon - based anode materials Mass i v e Ma r ke t O ppo r tun i ty E xpe rt s p r ed i c t a TA M o f app r ox i m a t e l y $300 B b y 203 0 ( CA G R 22 %) 1 R a p i d Gr o w t h a n d S ca l e P o te n t i a l Multiple products are ready to scale; leverages existing Li - ion production equipment, processes, and supply chain, reducing time - to - market S t r on g Bu s i n es s M od e l Significant manufacturing cost reductions, sustainable solutions and reduced reliance on increasingly scarce components R es u l t s - d ri ve n L ea d e r s h i p T ea m HBC brings technology leaders in the EV and battery space; Nubia brings business network and public company experience H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 8 IN VESTME N T HIGH L IGH T S 1 McKinsey & Company, 2023

Strong combination of battery technology innovators, entrepreneurial and execution mindsets ▪ A nnua ll y na m e d t o B e s t La wy e r s i n A m e r ic a ( an d m u l t i p l e wi nne r o f P a t en t La w Law y e r o f t h e Y ea r f or C o l o r ado ) , AV - r a t e d ▪ P a rt ne r a t M a r sh F isc h m an n & B r e y f og l e ▪ Di r e c t o r o f I n t e ll e c t ua l P r ope rt y f o r Dis p l a y t e c h , I n c . ( no w M i cr o n T e c hnolog y) m anu f a ct u r in g an d di str ibu t i o n experienc e ▪ P r e vi ou sl y C FO , PM Company ▪ P r e vi ou sl y F i nan ce Di r e c t o r , C a sc ade s , Inc. ▪ P r e vi ou sl y F i nan ce Di r e c t o r , P r e s t o li t e El e c tr ic , I n c . ▪ P ionee r i n g r aphen e t ec hno l og y ; r an k e d a m on g t o p gr aphen e inven t or s , a pioneer i n g r aphen e enab l e d batte r i e s , supercapacitors and fuel cells ▪ Fo rme r Dea n , C o ll eg e o f E nginee r in g & Co m pu t e r S c ien c e , W r igh t S t a t e U n iv e r si t y an d f o r m e r F ul b r i gh t S c hola r an d V i s i t in g P r o f e ss o r wi t h th e U n iv e r si t y o f Cambridge ▪ A t o t a l o f 680 + U S pa t en t s & pendi n g appli c a t ions ; plus 200 + f orei g n pa t en t s ▪ Th e 201 9 C l as s o f Na t ion a l A cade m y o f Inven t o rs Fellows ▪ P h D an d M S i n M a t e r ial s S c ien c e an d E nginee r in g f r o m MIT Co. ▪ H a s m o r e t ha n 30 0 U S pa t en t s ▪ A tot a l o f 500 + U S p a t e nt s & p e ndin g a ppli ca tion s ; plus 200 + f orei g n pa t en t s (I nven t ed m o s t u t ili z e d g r aphen e produc t i o n proces s e s s uc h as li qu i d pha s e e x f o li a t i o n an d elec tr ochemi c a l ex f olia t ion) ▪ L e d a t ea m th a t buil t wo r ld’s fi rs t mas s p r odu c tio n f ac ility fo r g ra ph e n e ma t er i a l s ▪ L e d a t ea m th a t buil t a S i - r i c h a nod e ma t er i al p r odu c tio n f ac ilit y ▪ P o s t - doc t ora l r esear c he r i n M e c hani c a l Enginee r in g & A pp li e d M e c han ic s a t N o rt h D a k o t a S t a t e U n iv e r si t y ▪ Post - doctoral r e s ea rc he r a t MI T ▪ P r i n ci pa l E ng i nee r a t TSMC ▪ S en i o r E ng i nee r B u si ne s s Pl ann i n g a t CPDC ▪ P h D i n C he m ic a l E ng i nee r i n g fr o m N a t i ona l T a iw a n University experienc e i n c arbon, graphi t e , graphene, an d ba tt er y m a t erial s ▪ Post - doctoral r e s ea rc he r , Uni v . o f California - Berkeley ▪ R e s ea r c h a ss o ci a t e , D o E O a k Ri dg e N a t i ona l La b (O RN L ) ▪ P h D i n C he m is tr y fr o m T si nghu a U n iv e r si ty Dr. Oliver Chang Bob Crouch Stuart Blair Dr. Songhai Chai Vlad Prantsevich Jaymes Winters Dr. Aruna Zhamu Dr. Bor Z. Jang V P o f M a r k e t i n g & T e c hn ic a l S e r vic e V P o f Lega l A ff a i r s V P o f F i nan ce CTO CFO CEO T e c hn ic a l A d vis o r Ex e c u t iv e C ha i rm a n & CSO ▪ >1 5 y ea r s o f ba tt e r y ▪ >3 3 y ea r s e x pe r ien c e ▪ >3 5 Yea r s o f g r een f iel d ▪ >1 5 y ea r s o f ▪ CFO and Board Member, ▪ CEO and Board Member, ▪ Co - F ounde r an d T e c hn ic a l ▪ Co - F ounde r an d C E O , G loba l m a t e r ia l de v elop m en t i n pa t en t s an d o t he r st a r t - up , M&A , PE , technology Nubia Brand International Nubia Brand International A d vis o r , G l oba l Gr aphen e G r aphen e G r ou p & experience f o rm s o f IP international development Corp. Corp. Gr ou p & Hone yc o m b Ba tt e r y H one yc o m b B atte r y C o . ▪ Over 15 years experience as a CEO in the oil and gas, telecommunications and retail space with extensive experience in Mergers and Acquisitions ▪ Chief Executive Officer at Mach FM Corp. since its inception in 2015 ▪ Former founder and CEO of United Energy Inc, which for seven consecutive years was one of the largest African American businesses on the west coast with revenues of nearly $100 million and 1,000 employees. Directed and negotiated four M&A transactions utilizing private equity firms ▪ 6+ years as Executive Vice President of Operations at Mach FM Corp, leading key corporate strategy, finance and operations planning responsibilities as well as M&A initiatives ▪ 8+ Years of executive management level experience in charge of Corporate Finance at 64 Audio, leading the business through a period of rapid growth, implementing key processes, driving software - based improvements of operations, and development of manufacturing and sales channel partners P O ST - C L O S I N G MA N A G EME N T TEAM H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 9

HON EYC O M B PR O D U CT S Product(s) : Sustainable graphite using biomass as feedstock Value Proposition : 20 - 30% reduction in CAPEX Customer : Conventional/Solid - state battery manufacturers Expected start of production : Q4 2024 Product(s) : Sulfur - based V al u e P ropo siti o n : rep l a c e e x pen siv e n ick e l an d c oba l t wi t h sulfur (S) and other more abundant elements Customer : Conventional/Solid - state battery manufacturers Expected start of production : 2025/2026 Product(s) : (1) Silicon rich, (2) Graphene - enhanced silicon oxide (3 ) Graph i te - ba s e d (4 ) L i th i u m - meta l Value Proposition : High energy capacity, at a lower cost C u st om e r : C on v ent i ona l / S o li d - s tat e batte r y m anufa c tu r e r s E x p ecte d sta r t o f produ cti on : Q 4 202 4 Product(s) : (1) quasi - solid, (2) solid polymer (3) polymer composite Value Proposition : Flame - resistant, compatible with existing li - ion manufacturing equipment Customer : Conventional/Solid - state battery manufacturers Expected start of production : 2025/2026 Hi gh - C apac i t y Anode 2024 - 2026 Sustainable S yn t he ti c Gr aph it e 2024 N ex t - G e n Cathode 2025/2026 F l a m e - r es i s t an t Electrolytes 2025/2026 P a ten t P r otecte d D e si gne d f o r S ca l e Fa s te r T i m e - to - m arke t U. S . B a s e d Manu f actur i n g E V G rad e Hi g h per f or m ance , i n a co s t - e ff ect i v e an d s a f e m anner R educe d C arbo n Footpr i n t R educe d CA P E X Hi g h Marg i n s Product(s) : (Gen 1 ) Lithium - ion, (Gen 2 ) Lithium Metal (Gen 3 ) Lithium - sulfur Value Proposition : Higher energy density, faster charging, reduced cost Customer : Auto OEMs, Energy Storage Systems, Consumer Electronics Expected start of production : 2025 / 2026 Next - Gen B atter y C e ll s 2025/2026 Positioned to be a major provider of technologically advanced battery materials and cells Con v en t iona l H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 10

H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 11 MARKET O PP O R T UNI T Y

Global Li - ion Battery demand, which includes mobility, stationary storage and consumer electronics is expected to see a 27% CAGR from 2022 to 2030, reaching 4,700 GWh 1 . Key demand drivers: ▪ Improved technology ▪ Growing consumer demand for clean energy vehicles ▪ Regulatory shift towards sustainability ▪ OEM movement to achieve new emission - reduction targets 1 McKinsey & Company, 2023 ~ 700 GWh ~ 4,700 GWh 2022 2030 Total Addressable Market of battery active materials , cell, and pack is expected to see a 22% CAGR from 2022 to 2030, reaching $305B 1 . Pr e s en ti n g a l a r ge , f a s t g r o wi n g m a r ke t oppo rt un it y f o r H one y co mb $64 B $305 B 2022 2030 M AR K E T O PP O R T UNI T Y Global demand for batteries, driven by vehicle electrification, is expected to soar H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 12

M AR K E T O PP O R T UNI T Y Favo r ab l e M a r ke t an d Leg i s l a t i v e Tr ends Inflation Reduction Act (IRA) Accelerates Clean Energy Transition ▪ Designed to move future materials reliance to domestically sourced supply ▪ An additional $500m in critical mineral investments ▪ $60B Production tax credit (PTC) ▪ Up to $250 in clean energy loans from DOE ▪ Up to $10B in Advanced Energy Project tax credit Major “Made In America” implications ▪ IRA requires 80% of EV battery materials to be sourced in North America by 2026 ▪ North American based battery materials mining and manufacturing business benefit significantly ▪ Little to no domestically produced graphite, anode, cathode, and electrolyte currently exists ▪ Mining and mid - stream processing capacity needs rapid investment and growth Auto OEMs are leaning into electric vehicle space 1 20 EVs available in the U.S. by 2025 100% all - electric model lineup by 2035 1.87 million battery electric vehicles sales annually by 2030 2 million EVs produced annually by 2026 50% of its global sales volume will be EV by 2030 ~12 new EVs to market by 2025. 50% of its global sales volume EV by 2030 Massive opportunity in filling U.S. supply chain gaps Projected 2030 Supply and Demand of Anode and Cathode Materials in North America (Metric tons) 2 424,120 43,000 1,636,700 2,518,000 A n o d e Cathode Demand (MT) Supply (MT) 1 OEM PR releases 2 ChangeDiscussion, Bipartisan Infrastructure Law Battery Materials Processing and Battery Manufacturing & Recycling Funding Opportunity Announcement and PR releases from different sources. H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 13

M AR K E T O PP O R T UNI T Y Low Energy Density Range anxiety is still a roadblock to EV purchase decisions Expensive Current battery cell cost of $138/kWh 1 too high for widespread EV adoption and not - competitive against ICE vehicles Increasingly Scarce Raw Materials 2 Reliance on cobalt and nickel in the battery cathode Today’s Conventional Li - ion Batteries Long Charge Time EV customers’ limit of patience <15 minutes Flammable Liquid Electrolytes Potential fire and explosion hazards still impacting EV and Stationary Energy Storage customers Pr o b l em s w i t h C u rr en t B a tt e r y S o l u t i on s A superior solution is needed to fulfill the wide - spread demand for electric vehicles and stationary storage 1 Average cost according to E Source 2 S&P Global Today’s Solid - state Batteries (lithium metal startups) Incompatible Equipment Typically, incompatible with current Li - ion cell production equipment – a major barrier to widespread adoption Separator production challenges Oxide - based ceramic separators are brittle, expensive, and difficult to fabricate Other technical issues Several technical issues (e.g., high interfacial impedance, high stack - holding pressure, and low active material proportion) remain to be resolved H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 14

SOLID - STATE PERFORMANCE (fastest time to market) S AF E FASTER RECHARGE (under development) LOWER COST PER KWH (15 - 35% cost advantage) ENERGY DENSITY 20% to 80% increase in EV driving range to eliminate range anxiety Converting Li - ion battery facilities into solid - state lithium battery production lines; Solid - state batteries available in 2 - 3 years (HBC) vs. 4 - 7 years (competitors) Quasi - solid and solid - state electrolytes provide effective solutions to battery fire and explosion issues Developing anode materials designs, innovative cell configurations, and both passive and active thermal management at both cell - and pack - levels for improved charging speeds Lower material and pack system costs resulting from energy density increases, safety improvements, simplified pack design (reduced cooling provisions and/or connecting wires), eliminated or reduced electrochemical formation, and ability to use current lithium - ion cell production equipment M AR K E T O PP O R T UNI T Y H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 15 The Solution – Honeycomb’s Solid - State Battery Honeycomb offers greater energy density, faster time to market, safety, lower manufacturing costs and faster charging

Improvement T o da y’ s Li - I o n 92% 350L (480 Wh/L) 350L (250 Wh/L) P a c k V olum e 94% 165 kWh 85 kWh P a c k E n e r g y ( g i ve n sam e pac k vo l ume) 94% 620 Miles 320 Miles Range 50% <15 minutes (0%~80%) >30 minutes (5%~80%) Charge ( 0% ~ 80% ) 62.5% 650 kW 400 kW Power Much safer FireShield TM (Fire - resistant electrolyte) Organic Electrolyte Safety Note: Estimated HBC Gen2 and Gen3 battery performance M AR K E T O PP O R T UNI T Y P e r f o rm anc e I mp r o v emen t s v s C on v en t i ona l L i - I o n H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 16

PRODUCTS

PRODUCTS H oneyco m b ’ s B a tt e r y M a t e r i a l s & S o l u t i on s Distribution agreement with 3rd party 1. quasi - solid electrolytes (solvent - in - salt & solvent - in - polymer) 2. solid polymer electrolytes (in situ polymerization & solid elastomeric electrolytes) 3. polymer composite electrolytes (elastic, flame - retardant, & high - temperature polymers) Sulfur - based, next - gen cathodes with the potential to replace expensive nickel and cobalt with sulfur (S) and other more abundant elements Four anode active materials for improved energy density: 1. Si - rich anode materials 2. Graphene - enhanced silicon oxide (SiOx) 3. Graphite - based anode powder (mainly from sustainable sources) 4. Protected lithium metal anode Graphite materials for anode production derived mainly from North American biomass sources Description -- 2025/2026 2025/2026 Q4 2024 Q4 2024 S t a r t of P r oduc ti on (SOP) ▪ Microgrid and Off - Grid Products ▪ Commercial / Industrial / Residential Solar Storage ▪ Utility Grade Storage Conventional/Solid - state battery manufacturers Conventional/Solid - state battery manufacturers Conventional/Solid - state battery manufacturers Conventional/Solid - state battery manufacturers Potential C us t o m e r s Graphite A nod e Cathode Electrolyte B atter y E nerg y S t orag e S o l ut i on s H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 18

Thin lithium metal anode, a graphene - enabled sulfur or conversion - type cathode, and a polymer - inorganic composite electrolyte Thin lithium metal anode or an initially lithium metal - free anode (“anode - less”) and a polymer - inorganic composite electrolyte Si - rich anode and a quasi - solid or polymer - inorganic composite electrolyte Featuring 2025/2026 2025 2H 2024 S t a r t o f P r oduc ti o n ( S O P) >400 - 500 Wh/kg >400 Wh/kg >350 Wh/kg Spec ifi c Ene r gy -- >1000 Wh/L* >900 Wh/L* Ene r g y D en s it y 1000+** 1000+** 1000+ C yc l e T i m e < $80/kWh** < $90/kWh** < $90/kWh** Cost G e n 1 lit h i u m - i o n ce lls G e n 2 lit h i u m m e t a l ce lls G e n 3 lit h i u m - s u lf u r ce lls PRODUCTS * HBC estimates ** HBC goal H oneyco m b ’ s S o li d - St a t e B a tt e r y C e ll s P o tent i a l App li cat i on s H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 19 Consumer El ec tr on i c s E ne r g y St o r ag e Systems Passenger Tr an s po rt a ti o n Commercial Tr an s po rt a ti o n

PRODUCTS Cross - section of a pair of electrode, showing thickness C a t hod e G ra ph ite Anode Liquid Electrolyte Current Day Lithium - ion Cell C u rr en t D a y L i t h i um - i o n Ce lls Gen1 L i t h i u m - i o n Ce lls Gen2 L i t h i u m me t a l ce l l s Gen3 L i t h i um - s u lf u r ce ll s S ili c o n Anode S ili c on - r i c h Li - ion Cell C a t hod e Quasi - Solid or Solid Electrolyte C a t hod e Solid Electrolyte Thin Li Anode Li - Metal Cell Solid Electrolyte Thin Li Anode Lithium - sulfur Cell Sulfur Cathode Spec ifi c Ene r gy 200 – 260 Wh/kg >350 Wh/kg >400 Wh/kg >400 Wh/kg >400 - 500 Wh/kg Ene r g y D en s it y 600 Wh/L >900 Wh/L >1,000 Wh/L >1,000 Wh/L -- C yc l e T i m e 1 , 000+ 1 , 000+ 1 , 000+ 1 , 000+ 1 , 000+ C os t > $110/kWh < $90/kWh N/ A < $90/kWh < $80/kWh Sa f e t y Flammable liquid electrolytes fire/flame - resistant fire/flame - resistant fire/flame - resistant fire/flame - resistant Manufacturability Sc ala b l e S ca l a ble Difficult/unproven S ca l a ble S ca l a ble C a t hod e Solid Electrolyte Thin Li Anode C o m p e tit i on s’ Li - Metal Cell Inorganic S o li d - S t a t e B a tt e r i e s S o li d - St a t e B a tt e r y C e l l C ompa r i s o n H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 20

TECHNOLOGY

Anode/Cathode Materials 41% Lithium Metal Anodes/Li - S cells 28% Beyond Lithium 7% No n - flammable Electrolytes 6% Fast Charging 5% Advanced Current Collectors 4% Others (stack designs, etc.) 9% Nex t - ge n all - soli d s t a t e o r li t hiu m me t a l ba tt er i e s (40 0 - 55 0 W h / kg) A d v an c e d c urren t c olle c t or s, ex t endin g cycl e li f e , opera t ing t empera t ure s & vol t age s F i re - res i s t an t elec t roly t e s f o r li t hiu m ba tt erie s (L i - ion , L i me t al , Li - S , e tc . ) G raphen e - o r polyme r - enhance d S i - base d ma t erial s ( > 350 - 40 0 W h / kg ) ▪ graphene - enabled batteries ▪ elastic polymer - protected batteries ▪ quasi - solid electrolytes ▪ elastomeric solid - state electrolytes ▪ advanced polymer/inorganic hybrid electrolytes ▪ numerous other disruptive battery technologies K e y In v en ti on s ▪ Si - rich anode having highest performance/cost ratio ▪ highest - capacity sulfur cathode materials (Co - , Ni - , and Mn - free) ▪ most process - friendly solid - state electrolytes ▪ protected lithium metal anode ▪ fast chargeability ▪ aluminum - ion cells ▪ sodium - ion cells K e y E nab li n g Ba tt e r y T echno l og i e s H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 22 TECHNOLOGY Proprietary technologies across all core battery components, protected by 525+ patents E x t en s i v e I P P o rt f o li o an d T e chno l og y A d v an t ag e

TECHNOLOGY 0 100 200 300 400 500 600 100 200 300 372 500 600 700 800 900 1000 1200 1400 1600 1800 2000 2200 2400 2600 2800 3000 3500 3580 Anode specific capacity (mAh/g) Cell specific energy (Wh/kg) Estimated Cell Specific Energy vs. Anode Specific Capacity 1 Current EV batteries G r aphite Graphite + Si or SiOx S i Ox Graphene / elastomer - protected Si P r ote c te d Li metal A nod e Pr oduc t s H B C Pr ov i de s a Fu l l S pec tr u m o f A nod e M a t e r i a l s & E l ec tr ode s De li ve r i n g p r oduc t s ac r o s s en t i r e spec i f i c capac it y s pec tr um Uniquely capable of supplying: graphite - , SiOx - , Si - , and Li metal based anode active materials (having a specific capacity from 300 to 3500 mAh/g), graphene - enabled sulfur cathode materials (800 - 1200 mAh/g), providing an estimated cell energy density from 300 to 500 Wh/kg (vs. 260 Wh/kg of current EV batteries) N ex t - ge n s u l fu r ca t hode/L i me t a l anode ▪ Graphene - enabled sulfur cathode Li - S cells are capable of delivering a specific energy of 400 - 500 Wh/kg, doubling the EV driving range given the same battery weight ▪ HBC has the enabling graphene - protected S and solid polymer electrolyte technologies 1 Assuming a cathode material specific capacity of 200 mAh/g H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 23

TECHNOLOGY • HBC‘s patented technologies enable highly scalable low - cost Si - rich products. ▪ In contrast, competitors produce Si anode materials via Chemical Vapor Deposition (CVD) method, which is expensive and difficult to scale up, and uses toxic or explosive gaseous raw materials • Compatible with solid - state and liquid - state electrolytes • Higher energy density and lower cost per kWh • HBC’s current Si anode material production capacity of 15 MT per year will be scaled up to >3,000 MTA by 2026 Ion - conducting elastic polymer - encapsulated Si or SiOx particles Graphene sheet - encapsulated Si particles 5 m H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 24 HBC produces the high Si content or SiO anode materials that meet the requirements of increased energy density at a lower cost for next - gen EV batteries H BC’ s S i - r i c h Anod e Mater i a l – E x t end i n g t h e E V Dr i v i n g R ang e

TECHNOLOGY Tesla suggested on “Battery Day” (09/22/2020) that the best Si anode should have the following features: Low - cost Si particles (simple design, instead of highly engineered structures such as CVD Si; hence, lower anode material cost) Elastic, ion - conducting polymer coating that protects these Si particles Highly elastic binder & some electrode design used in the anode to maintain structural integrity of the electrode. CVD SiNW anode cost > $100/kWh Elastic polymer - protected Si anode enables a significantly higher battery energy density (extended EV driving range) at a lower cost ($/kWh)! HBC can help a Tier - 1 EV battery supplier maintain or become a battery technology leader in the global EV industry. HBC has the earliest and most significant IP in this technology H BC’ s S i A nod e M a t e r i a l s Pr ec i se l y M ee t t h e R equ i r e m en t s f o r t h e N ex t - gene r a t i o n E V B a tt e r i e s a s O u t li ne d b y T es l a H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 25

H O NE Y C O M B B ATT ER Y C O . + N UB I A B R A N D I N T ERN ATI O N A L C O R P . 26 TECHNOLOGY G C A - Si Low - cost h i gh - v o l u me production equipment G r aphen e Low - cost s ili co n o r coated Si Other add i t i v es Chemical Vapor Deposition (CVD) Silicon source ( Silane can be expensive & explosive ) Si nano wire (Slow Growth) Or Nano Si coating inside porous carbon (Expensive process) I m ag e sou r ce : Tesla Battery Day (09/2020) CVD anode alone > $100/kWh ▪ Significantly lower cost per kWh ▪ Advanced particle structural design to overcome Si swelling challenges C omp e t i to r s’ S il a n e - b ase d Processes Highly scalable production of high - performance Si - rich products in a cost - effective and safe manner Expensive and difficult to scale up; using toxic or explosive gaseous raw materials (silane) HBC’s Graphene - Enhanced Si Anode Material: Low Cost, High Performance Cost - effective production capability of high Si content anode materials (graphene/elastomer encapsulated Si particles, first - cycle efficiency up to 94% and specific capacity of 3,000 mAh/g) that meet the requirements of increased energy density and lower cost for next - gen EV batteries.

TECHNOLOGY A B C CVD Si e l ec tr opho r e t i c manufacturing CVD silicon nanowire cells CVD Si manufacturing Graphene/Si powder & cells P ri mar y B us i nes s S cop e ? ? ? ***** Scalability *** *** *** ***** C os t C ompet i t i venes s *** ***** *** ***** S pec ifi c C apac i t y @ P r oduc t Leve l **** *** ? ***** 1s t C yc l e E ffi c i ency **** **** **** **** C yc l e L if e Yes Yes Yes No F l a mm ab l e L i qu i d E l ec tr o l y t e 38 (18 issued) 60 (39 issued) 104 (52 issued) 355 (214 issued) E st i mate d N o . o f U S P aten t A pp li cat i on s ( # i ssued ) o n ba tt e r y , a s o f 02 / 26 / 2023 , U SPT O Dominant IPs, Proven Scalability, Low Cost, and Highest - performing Si - rich Anode Materials Best Si Anode Solution H B C vs . O t he r S ili co n A nod e M a t e r i a l s St a r t - ups H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 27

TECHNOLOGY Traditional Electrolyte Fireshield Electrolyte A Truly Disruptive Solid - State Platform Technology that Can Help Solidify th e Batter y S a f et y o f th e E n t i r e E V I ndustry ▪ Invented elastomeric solid electrolytes ▪ Has most significant IP in in - situ curing or in - situ solidification of polymer electrolytes ▪ Developed thermally stable and flame - retardant polymer or polymer/inorganic hybrid electrolytes H BC’ s ke y e l ec tr o lyt e t echno l og i e s ▪ Compatible with current Li - ion infrastructure and processes ▪ Versatile and easy - to - process solid - state electrolytes for safe lithium - ion and lithium - metal batteries Fea t u r e s o f H BC’ s e l ec tr o lyt es H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 28

TECHNOLOGY H BC’ s H yb r i d o r C o m pos i t e S o lid - St a t e E l ec tr o l y te Low stack - holding pressure, low impedance, high energy density, easy to process using current Li - ion cell facilities Common inorganic solid - state batteries Require high stack - holding pressure and high inactive electrolyte proportion to improve contacts Key Issue: Gaps between particles or between electrode and solid electrolyte inorganic/polymer hybrid solid - state batteries Fill every free space with HBC’s proprietary Polymer electrolyte Anode active material Binde r I no r gan i c solid Cathode active material C ondu c t i ve additives • Reduced external pressure requirement • Reduced weight proportion of electrolyte (more active materials and higher energy density) Anode active material Binde r I no r gan i c solid Cathode active material C ondu c t i ve additives H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 29

Graphene/Polymer - Enabled Protective Layer Li - Metal Li - Metal Anode May be initially Li metal - free (anode - less) Elastomer or elastomer composite solid electrolyte Elastomeric solid electrolyte/separator: a critical technology enabling all types of high - energy Li metal batteries Cathode ▪ Graphene/polymer - based Li metal protection layers (key enab li n g t echno l og i es ) ; ▪ Overcoming technical barriers (e.g., Li dendrites, large interfacial i mpedan c e , e t c . ) t ha t ha v e t hu s f a r i mpede d c ommer c i a li za t i o n o f so li d - s t a t e li t h i u m me t a l ba tt er i es; ▪ I n no v a t i v e dro p - i n s o l u t i on s l ead i n g t o redu c e d c o s t s ( vs . o t he r so li d - s t a t e li t h i u m me t a l ba tt er i es) ▪ H B C’ s anod e - p r o t ec t i n g l aye r s an d e l as t o m e r i c so li d electrolytes accelerate commercialization of ultra - thin lithium (Li - light) anode or anodeless batteries, both featuring reduced cell weight and volume and thus higher energy densities. TECHNOLOGY H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 30 Solving the Lithium Metal Anode Problems in Solid - State Li - Metal Batteries Enabling safety and highest energy density (Gen - 2 and Gen - 3 battery cells)

C OMM E RC I A L IZ A TI O N & MANUFACTURING

MANUFACTURI NG Made in America Movement – Inflation Reduction Act By 2026, 80% of battery materials must meet these content requirements 1. Critical minerals in the EV battery be extracted or processed in the U.S., countries with which the U.S. has a free trade agreement or have been recycled in North America 2. 100% of battery components must be manufactured and assembled in North America by 2028 for a vehicle to be eligible for the clean vehicle tax credit. By 2026, 80% of battery materials and components made by will comply with the IRA 1. Anode materials for Lithium - ion cells will be domestically produced from renewable (biomass) and recycled feedstocks (plastics) without extraction or mining 2. Sulfur cathode materials lessen the need for imported Manganese, Cobalt and Nickel. 3. HBC local sourcing and manufacturing ability makes it an ideal candidate for government grants and loans H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 32

MANUFACTURI NG “ Gr een ” Gr aph ite Enabling a truly sustainable approach to synthetic graphite production Economics ▪ 20 - 30% lower CAPEX and faster time - to - market vs competing natural / synthetic graphite production peers ▪ Payback: 2.5 – 3 years ▪ Strong gross profit margins Demand ▪ Expected to 4x by 2035, driven primary by electrification of transportation according to Benchmark Material Intelligence ▪ Qualifies for IRA vehicle credit Overview E V ba tt e r y - grad e graph i t e ▪ Can be cost - effectively produced from domestic renewable and sustainable biomass as feedstock ▪ Approximately 28% of the battery cell weight P l a n f o r P r oduct i o n Phase 1 Processing plant for a production capacity of 20,000 metric tons projected by 2025 First 20,000 tons of capacity ▪ Capex $100M ▪ Revenue: $90M - $100M Expansion Plan Capacity expansion to annual capacity of 150,000 metric tons by 2030 Production Process: Biomass - to - anode material (B - to - A) Hard Carbon or Graphite Sustainable Biomass Anode Materials Advantages Sustainability ▪ Wide availability/accessibility of bio - based feedstocks ▪ Does not use petroleum or coal products ▪ Removes wasteful refining processes ▪ No environmentally impactful extraction or mining proprietary process proprietary process H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 33

MANUFACTURI NG A nod e Pr oduc ts Delivering a full spectrum of high capacity, next generation anodes Economics ▪ Favorable unit economics using lower cost internally produced graphite ▪ Lower unit cost in future years using proprietary lower temperature process Demand ▪ Expected to 5x by 2030, driven primary by electrification of transportation according to McKinsey & Company ▪ Qualifies for IRA vehicle credit Overview E V ba tt e r y - grad e anode ▪ Silicon rich, Graphene - enabled silicon oxide, Graphite - based anode active materials for improved energy density are ready for production ▪ Next generation protected lithium metal anode commercialized in 2025 C urren t P roduct i o n D a yt on , O H A fully operational manufacturing plant with an annual production capacity of 15 metric tons P r oduct i o n R oadma p ▪ Graphite - based anode materials: primarily from sustainable sources (biomass); heat treatment (in - house or contract manufacturing) & chemical treatment (in - house) ▪ SiO x - rich anode materials: SiO x initially sourced from Asia until our own facilities are ready (2 - 3 years); in - house treatments of SiO x powder, followed by production of secondary particles ▪ Si - rich anode materials: in - house manufacturing (preferred), licensing (for certain Li - ion cells), and JV; will expand from 15 MT/year to 600 - 1200 MT/year ▪ Protected lithium metal anode: IP licensing ▪ Graphene - protected aluminum current collector: contract manufacturing or JV 2023 2024 2025 2026 2027 2028 2029 2030 Advantages Sustainability ▪ Internally produced, sustainable synthetic graphite ▪ Benefits Climate Change initiatives ▪ Ecological and economical 9,000 6,000 4,200 1,500 150 150 150 15 G CA - S i P r oduc t io n C apaci t y ( M T) 180,000 180,000 120,000 21,000 1,500 300 150 - G raph i t e P roduct i o n Capac i t y ( M T ) 33,000 33,000 15,000 6,000 900 150 150 5 G CA - S i O x P r oduc t io n C apaci t y ( M T) H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 34

COMMERCIALIZ ATION P r oduc t 202 3 202 4 202 5 202 6 202 7 202 8 202 9 2030 Graphite - based Anode Materials SiOx and GCA - SiOx Materials GCA - Si Anode Materials Graphite - based Anode Materials SiOx and GCA - SiOx Materials GCA - Si Anode Materials R e s ea r c h & D e v elopmen t Commercializatio n HBC Manufacturing Plant: 150 MT/a Capacity (2024) ramping to 33,000 MT/a (2030) HBC Pilot Plant: 60 MT/a Capacity (2023) ramp to 150 Mt/a (2024) HBC Manufacturing Plant: 150 MT/a Capacity (2024) ramping to 9,000 MT/a (2030) Refine Product / Sample Testing HBC Manufacturing Plant: 300 MT/a Capacity (2024) ramping to 180,000 MT/a (2030) Biomass supply agreements signed; contract heat - treatment facilities identified; equipment purchased In - house heating facilities built; chem. treatment facilities built Refine Product / Sample Testing Refine Product / Sample Testing H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 35 C o mm e r c i a liz a t i o n R oad m a p o f A nod e M a t e r i a l s

MANUFACTURI NG S o li d - St a t e B a tt e r y C e ll s Next generation battery technology to power the world Economics ▪ Approx. 29% CAPEX reductions. Requires no capital expense for equipment upgrades to conventional battery manufacturing facilities ▪ Faster time - to - market with strategic use of toll manufacturing and JVs Demand ▪ Expected to 7x by 2030, driven primary by electrification of transportation according to McKinsey & Company ▪ Qualifies for IRA vehicle credit Overview S o lid - stat e battery ▪ Proprietary technology which reduces need for lithium and electrolytes ▪ Many uses (aviation) beyond EV’s C urren t P roduct i o n D a yt on , O H Pilot scale battery manufacturing lab P r oduct i o n R oadma p Advantages Sustainability ▪ Discards need for controversial rare earth metals ▪ Benefits climate change initiatives ▪ Ecological and economical 1. Solid - state cells (Gen 1, 2 & 3): Initial HBC plans are to begin with the toll manufacturing/Joint venture (TM/JV) model for commercializing these solid - state battery technologies ▪ We provide drop - in solutions: Our electrolyte formulations are compatible with existing lithium - ion cell production equipment and process, making it technically viable and economically attractive for our partners to convert their lithium - ion production lines to production facilities of safe solid - state batteries ▪ This disruptive platform technology can transform liquid electrolyte - based cells into solid electrolyte - based cells (using current infrastructure and supply - chains) for the entire lithium battery industry ▪ The TM/JV partners are expected to acquire Si - rich anode materials (Gen - 1), protected lithium metal anode (Gen - 2 & Gen - 3), graphene - protected sulfur cathode materials (Gen - 3), and electrolytes (Gen 1, 2 & 3) from HBC as part of the TM/JV agreement 2. At a later stage, HBC may consider building our own facilities for producing certain specialty cells (e.g., bipolar or high - voltage cells) responsive to market demands 2030 2029 2028 2027 2026 2025 2024 2023 1 1 1 1 1 0.5 - - P i lo t ( 1 G Wh ) 2 2 2 2 2 0.5 - - Jo i n t Ventur e Gi ga f actor y - 1 ( 2 G Wh) 50 25 13 9 2.3 1.2 0.1 - 3r d part y manu f actur i n g ( 5 0 G Wh) 20 5 - - - - - - Jo i n t Ventur e Gi ga f actor y - 2 ( 2 0 G Wh) ~700K vehicles annually (assumes 100kWh pack) H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 36

COMMERCIALIZ ATION 2027 2028 2029 2030 2026 2023 2024 2025 Product 3 rd Party Manufacturing Plant (50 GWh by 2030) HBC Pilot Plant: (0.5 GWh by end of 2025) JV Gigafactory - 1 (2 GWh by 2026) Execute JV agreement JV Gigafactory - 2 (20 GWh by 2030) SOP A - Sample B - Sample C - Sample SOP A - Sample B - Sample C - Sample SOP A - Sample B - Sample C - Sample Execute 3 rd party manufacturing agreement Construction of HBC’s own pilot production facility Execute JV agreement Gen 1: Si - Rich All - Solid - State Battery Gen 2: All - Solid - State Li - Metal Battery Gen 3: Li - Sulfur Battery Gen 1 – Gen 3 Batteries (Interchangeable Production lines)* R e s ea r c h & D e v elopmen t Commercializatio n *The production lines for the three generations of batteries are substantially identical (interchangeable) and, hence, can be readily switched over when one type of battery is in higher demand than another type. This is made possible by HBC’s versatile solid - state platform. H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 37 C o mm e r c i a liz a t i o n R oad m a p o f A dvance d S o li d - St a t e B a tt e r i e s

MANUFACTURI NG Traditional liquid electrolyte - based Li - ion battery production requires conditioning steps such as pre - formation, aging, degassing, formation, and final storage. Capex needed for these steps is the largest contributor to processing cost during battery production. 1 1 Oak Ridge National Lab 2 BatPac ANL, US DOE Conditioning Steps Pre - formation Aging Degassing Formation Final storage up to ~29% savings 2 Traditional Li - ion Receiving and shipping Materials preparation Electrode coating Calendering Materials handling Electrode slitting Vacuum drying Control laboratory Cell assembly in dry room Module and pack assembly Rejected cell and scrap Solid - state battery manufacturing can eliminate these steps and save up to ~29% of CAPEX in a typical GWh - scale Li - ion production plant 2 H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 38 CAPEX Savings Enabled by Honeycomb’s Solid State Battery Manufacturing

F IN A N C I A L OUTLOOK

F IN A N C I A L OU T L OO K H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 40 2030 2029 2028 2027 2026 2025 2024 2023 ( $ i n m illi on s ) ( 1 ) $2.7 $2.5 $2.2 $2.1 $2.4 $2.2 $1.7 $0.9 GCA - Si Anode Material $1,931.3 $1,327.1 $1,061.7 $193.2 $13.7 $2.1 $1.0 $0.0 360 mAh/g Anode Material $2,670.1 $1,223.2 $652.4 $197.9 $44.3 $13.6 $1.7 $0.2 Gr/Si Anode Material $5,022 $2,142 $972.0 $349.6 $35.1 $16.2 $1.0 $0.0 Solid - State Battery $24.0 $22.0 $20.0 $18.0 $16.0 $12.0 $10.0 Other Revenue Sources $9,650.1 $4,716.8 $2,708.2 $760.8 $111.6 $46.1 $15.3 $1.1 Total Revenue (2) $2,864.5 $1,239.2 $738.9 $194.3 $32.1 $14.8 $0.7 - $9.5 Gross Profit (3) 30% 26% 27% 26% 29% 32% 4% - $353.8 $179.3 $103.1 $69.4 $18.7 $13.5 $10.2 $8.8 Operating Expenses (4) 4% 4% 4% 9% 17% 29% 67% - $2,510.8 $1,059.9 $635.8 $124.9 $13.5 $1.4 - $9.6 - $18.3 EBITDA (5) 26% 22% 23% 16% 12% 3% - - $323.5 $1,249.0 $1,936.6 $973.4 $160.5 $68.4 $17.7 $18.8 Capital Expenditures (6) S u mma r y Pr o j ec t e d F i nanc i a l s Notes: 1) All amounts are estimates as of the date such projections were prepared. 2) Other revenue sources include licensing revenues and other battery solutions. 3) Cost of goods forecasts and assumptions are based on Honeycomb’s detailed product Bill of Materials (BOM), direct labor, production overhead costs and other production related costs associated with manufacturing active materials and solid - state battery cells. Projections include the planned use of toll manufacturing and joint ventures. 4) Operating expense projections include general and administrative expenses such as finance and legal, sales and marketing, investor relations, research & development expenses required to operate highly technical, competitive, and innovative, energy storage businesses and other operating expenses associated with operating as a public company. 5) Honeycomb defines EBITDA as net income (loss) before income tax provision and depreciation expense. EBITDA is not a financial measure prepared in accordance with GAAP and should not be considered a substitute for the net income (loss) prepared in accordance with GAAP 6) Capital expenditures include equipment, building improvements, instillation and other building support costs associated with setting up manufacturing of battery cells and active materials.

F IN A N C I A L OU T L OO K R e v enu e b y P r oduc t ($mm ) 112 46 15 1 2030 2029 2028 2027 2026 2025 2024 2023 761 2 , 708 4 , 717 9 , 650 GCA - Si Anode Material Solid - State Battery 360 mAh/g Anode Material Other Revenue Sources Gr/Si Anode Material G ros s P ro fi t ( $ mm) E B IT D A ( $ mm ) Note: EBITDA is a non - GAAP financial measure and should not be considered in isolation or as alternatives to measures derived in accordance with GAAP. Pr o fi t & Lo s s Pr o j ec t i on s (18) 2023 (10) 2024 1 13 125 636 1,060 2,5 1 1 (9) 2023 H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 41 1 15 32 194 1,239 739 2,865 2024 2025 2026 2027 2028 2029 2030 2025 2026 2027 2028 2029 2030

F IN A N C I A L OU T L OO K E x pec t e d U s e o f Pr o ceed s G rowt h Capital R e s ea r c h & D e v elopmen t G&A ▪ Growth correlated capital to execute on buildout of anode material production facilities ▪ Efficient sales & marketing spend on go - to market strategy • Gr • Ef ▪ Continuous innovation and product improvement of solid - state battery technologies ▪ Governance, legal, compliance, systems, and investor relations H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 42

S U MM AR Y R I S K F AC T O R S In evaluating an investment in the proposed transaction, you should carefully read the proxy statement filed by Nubia in connection with the transaction and especially consider the factors discussed in the section entitled “Risk Factors.” These risks include, but are not limited to the following: ▪ If Honeycomb’s batteries fail to perform as expected, Honeycomb’s ability to develop, market and sell its batteries would be adversely affected. ▪ Original equipment manufacturers (“OEMs”) may elect to pursue other battery cell technologies, which likely would impair Honeycomb’s revenue generating ability. ▪ Honeycomb has only conducted preliminary safety testing on its high - capacity anode and high - energy solid - state battery technology, and its technology will require additional and extensive safety testing prior to being installed in electric vehicles. ▪ Honeycomb relies on complex equipment for its operations, and production involves a significant degree of risk and uncertainty in terms of operational performance and costs. ▪ Substantial increases in the prices for Honeycomb’s raw materials and components, some of which are obtained from a limited number of sources where demand may exceed supply, could materially and adversely affect its business. ▪ If Honeycomb is unable to attract and retain key employees and qualified personnel, its ability to compete could be harmed. ▪ Honeycomb’s insurance coverage may not be adequate to protect it from all business risks. ▪ The battery cell market continues to evolve and is highly competitive, and Honeycomb may not be successful in competing in this market or establishing and maintaining confidence in its long - term business prospects among current and future partners and customers. ▪ Honeycomb’s future growth and success are dependent upon consumers’ willingness to adopt electric vehicles. ▪ Honeycomb may not succeed in attracting customers during the development stage or for high volume commercial production, and its future growth and success depend on its ability to attract customers. ▪ Honeycomb may not be able to accurately estimate the future supply and demand for its high - capacity anode and high - energy solid - state battery technology, which could result in a variety of inefficiencies in its business and hinder its ability to generate revenue. If Honeycomb fails to accurately predict its manufacturing requirements, it could incur additional costs or experience delays. ▪ Honeycomb’s business model has yet to be tested and any failure to commercialize its strategic plans would have an adverse effect on its operating results and business, harm its reputation and could result in substantial liabilities that exceed its resources. ▪ Honeycomb is an early - stage company with a history of financial losses and expects to incur significant expenses and continuing losses for the foreseeable future. ▪ Honeycomb’s history of recurring losses and anticipated expenditures raise substantial doubts about its ability to continue as a going concern. Honeycomb’s ability to continue as a going concern requires that it obtain sufficient funding to finance its operations. ▪ Honeycomb may require additional capital to support business growth, and this capital might not be available on commercially reasonable terms or at all. There is substantial doubt as to Honeycomb’s ability to continue as a going concern. ▪ Most of Honeycomb’s management does not have experience in operating a public company. ▪ Honeycomb may not succeed in establishing, maintaining and strengthening its brand, which would materially and adversely affect customer acceptance of its technologies and its business, revenues and prospects. ▪ Honeycomb relies heavily on owned intellectual property, which includes patent rights, trade secrets, copyright, trademarks, and know - how. If Honeycomb is unable to protect and maintain access to these intellectual property rights, its business and competitive position would be harmed. ▪ Honeycomb’s patent applications may not result in issued patents, which would result in the disclosures in those applications being available to the public. Also, Honeycomb’s patent rights may be contested, circumvented, invalidated or limited in scope, any of which could have a material adverse effect on our ability to prevent others from interfering with commercialization of our products. ▪ Honeycomb’s expectations and targets regarding the times when it will achieve various technical, pre - production and production - level performance objectives depend in large part upon assumptions, estimates, measurements, testing, analyses and data developed and performed by Honeycomb, which if incorrect or flawed, could have a material adverse effect on its actual operating results and performance. ▪ Incorrect estimates or assumptions by management in connection with the preparation of Honeycomb’s financial statements could adversely affect our reported assets, liabilities, income, revenue or expenses. ▪ Honeycomb will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations. ▪ The unavailability, reduction or elimination of government and economic incentives could have a material adverse effect on Honeycomb’s business, prospects, financial condition and operating results. ▪ Honeycomb is subject to regulations regarding the storage and handling of various products. Honeycomb may become subject to product liability claims, which could harm its financial condition and liquidity if it is not able to successfully defend or insure against such claims. ▪ From time to time, Honeycomb may be involved in litigation, regulatory actions or government investigations and inquiries, which could have an adverse impact on its profitability and consolidated financial position. ▪ Honeycomb is subject to substantial regulation, and unfavorable changes to, or failure by Honeycomb to comply with, these regulations could substantially harm its business and operating results. ▪ Honeycomb’s technology and its website, systems, and data it maintains may be subject to intentional disruption, security breaches and other security incidents, or alleged violations of laws, regulations, or other obligations relating to data handling that could result in liability and adversely impact its reputation and future sales. Honeycomb may be required to expend significant resources to continue to modify or enhance its protective measures to detect, investigate and remediate vulnerabilities to security breaches and incidents. Any actual or alleged failure to comply with applicable cybersecurity or data privacy legislation or regulation could have a material adverse effect on Honeycomb’s business, reputation, results of operations or financial condition. ▪ The Sponsor, certain members of the Nubia Board and certain Nubia officers have interests in the business combination that are different from or are in addition to other stockholders in recommending that stockholders vote in favor of approval of the business combination proposal and approval of the other proposals described in this proxy statement. ▪ Nasdaq may not continue to list our securities, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. ▪ The Sponsor is liable to ensure that proceeds of the trust are not reduced by vendor claims in the event a business combination is not consummated . It has also agreed to pay for any liquidation expenses if a business combination is not consummated . Such liability may have influenced the Sponsor’s decision to approve the Transactions . ▪ If Nubia is unable to complete the Transactions or another initial business combination by June 15 , 2023 (or September 15 , 2023 if Nubia has extended the deadline for completing the business combination by an additional three months by contributing $ 1 , 235 , 000 for the extension to Nubia’s trust account in accordance with the current certificate of incorporation), Nubia will cease all operations except for the purpose of winding up, redeeming 100 % of the outstanding public shares and, subject to the approval of its remaining stockholders and the Nubia Board, dissolving and liquidating . In such event, third parties may bring claims against Nubia and, as a result, the proceeds held in the trust account could be reduced and the per - share liquidation price received by stockholders could be less than $ 10 . 00 per share . ▪ Nubia’s stockholders will experience dilution as a consequence of, among other transactions, the issuance of Nubia’s Class A common stock as consideration in the business combination . Having a minority share position may reduce the influence that Nubia’s current stockholders have on the management of Nubia . ▪ G 3 and the Sponsor will have substantial control over the Combined Company after the business combination, which may limit other shareholders’ ability to influence corporate matters and delay or prevent a third party from acquiring control over the Combined Company . ▪ The Sponsor will beneficially own a significant equity interest in Nubia and may take actions that conflict with your interests . ▪ Nubia and Honeycomb have incurred and expect to incur significant costs associated with the business combination. Whether or not the business combination is completed, the incurrence of these costs will reduce the amount of cash available to be used for other corporate purposes by Nubia if the business combination is not completed. ▪ Even if Nubia consummates the business combination, there is no guarantee that the public warrants will ever be in the money, and they may expire worthless and the terms of Nubia’s warrants may be amended. ▪ Nubia and Honeycomb will be subject to business uncertainties and contractual restrictions while the business combination is pending. ▪ If Nubia’s due diligence investigation of the Honeycomb business was inadequate, then stockholders of Nubia following the business combination could lose some or all of their investment. ▪ A market for the Combined Company’s securities may not continue, which would adversely affect the liquidity and price of the Combined Company’s securities. ▪ Legal proceedings in connection with the business combination, the outcomes of which are uncertain, could delay or prevent the completion of the business combination. H ONEYCOMB B ATTERY C O . + N UBIA B RAND I NTERNATIONAL C ORP . 43

THAN K YOU H ONEYCOMB B ATTERY C OMPANY N UBIA B RAND I NTERNATIONAL C ORP .

v3.23.2

Cover

|

Jul. 14, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 14, 2023

|

| Entity File Number |

001-41323

|

| Entity Registrant Name |

Nubia Brand International Corp.

|

| Entity Central Index Key |

0001881551

|

| Entity Tax Identification Number |

87-1993879

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

13355 Noel Rd

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75240

|

| City Area Code |

972

|

| Local Phone Number |

918-5120

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|