Mitcham Industries, Inc. - Value

October 25 2011 - 8:00PM

Zacks

The energy service companies are sitting pretty.

Mitcham

Industries, Inc. (MIND) is expected to grow its fiscal 2012

earnings by 312% as customer demand remains strong. This Zacks #1

Rank (strong buy) is also a value stock, with a forward P/E of just

9.2.

Mitcham supplies rental or new seismic equipment to

the oil and gas industry, seismic contractors, government agencies

and universities. It also manufactures specialized seismic marine

equipment through its Seamap brand.

A global company headquartered in Texas, it has

sales and service offices in Canada, Australia, Singapore, Russia,

Peru, Colombia, and the United Kingdom.

On Oct 6, the company announced a new warehouse,

logistics and repair facility in Budapest, Hungary which it

believes will tap into the capital spending on oil and gas

exploration in Eastern Europe.

Revenue Soared 40% in Fiscal Q2

On Sep 7, Mitcham reported its fiscal second

quarter results and saw sales climb 40% to $21.3 million from $15.2

million a year ago.

It also surprised on the Zacks Consensus Estimate

by 10%. Earnings per share were 11 cents compared with the

consensus of 10 cents.

It was the best second quarter ever for core

leasing revenue, which jumped 89% to $12.3 million. This was due to

stronger customer demand and increased utilization in Latin America

where increased equipment was deployed in the first half of the

year.

The company also saw increased activity from

European customers for jobs in both Europe and North Africa and

steady activity in the United States.

The Seamap segment also saw strong demand and is

seeing considerable after-market business, including in parts

sales, training, service and repair work.

In the first half of the year, Mitcham purchased an

additional $35 million in new equipment to meet growing demand. It

expects total capital expenditures in fiscal 2012 to reach $65 to

$70 million.

The company did a follow-on offering in June which

gave it $31 million which was used to fund the expansion. It is

focusing the new equipment on South America, Europe and the marine

segment leasing business.

Massive Earnings Growth in Fiscal 2012

Since the second quarter earnings report on Sep 7,

the analysts have revised their full year estimates higher for both

fiscal 2012 and fiscal 2013.

The fiscal 2012 Zacks Consensus jumped to $1.40

from $1.20 in the last 60 days. That is earnings growth of 312% as

the company only make 34 cents last year.

But the growth is expected to continue into fiscal

2013. The 2013 Zacks Consensus Estimate rose to $2.01 from $1.83

which is another 43% EPS growth.

Growth and Value

Like a lot of stocks, Mitcham saw a sharp sell off

in its shares over the summer which has made it even more

attractive.

In addition to a P/E of only 9.2, which is well

under its peers which average 16.4x, Mitcham has a price-to-book

ratio of 1.1. A P/B ratio under 3.0 usually indicates value.

With no signs of a slowdown in the oil and gas

industries, Mitcham is an attractive combination of both growth and

value.

Tracey Ryniec is the Value Stock Strategist for

Zacks.com. She is also the Editor of the Turnaround Trader and

Insider Trader services. You can follow her at

twitter.com/traceyryniec.

MITCHAM INDS (MIND): Free Stock Analysis Report

Zacks Investment Research

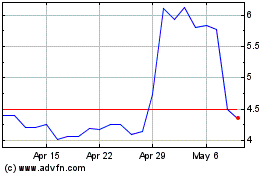

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From May 2024 to Jun 2024

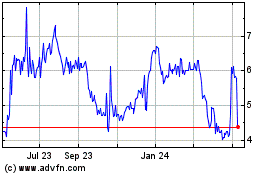

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Jun 2023 to Jun 2024