As filed with the Securities and Exchange Commission

on July 5, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES

ACT OF 1933

G Medical

Innovations Holdings LTD.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

Not applicable |

|

(State or other jurisdiction of

incorporation

or organization) |

|

(I.R.S. Employer

Identification No.) |

G Medical Innovations Holdings Ltd.

5 Oppenheimer St.

Rehovot 7670105, Israel

Tel: +972.8.9584777

(Address of Principal Executive Offices)

G Medical Innovations Holdings Ltd. Global Equity

Plan

(Full title of the plan)

G Medical Innovations USA Inc.

12708 Rita Vista Cir. Ste. A-103

Austin, TX 78727

Tel: 800.595.2898

(Name, Address and Telephone Number of Agent for

Service)

COPIES TO:

Oded Har-Even, Esq.

Eric Victorson, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

Tel: (212) 660-3000

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

|

Smaller reporting company ☐ |

| |

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

On

July 8, 2022, G Medical Innovations Holdings Ltd., or the Registrant, filed a Registration Statement on Form S-8 (File No. 333-266063),

or the Original Registration Statement, with the Securities and Exchange Commission, or the Commission, to

register an aggregate of 5,742,912 ordinary shares, par value $0.09 per share (which, after giving effect to a 35-for-one consolidation

of ordinary shares pursuant to which holders of the Registrant’s ordinary shares received one ordinary share for every 35 ordinary

shares held which took effect on November 16, 2022, equates to 164,083 ordinary shares),

that may be issued pursuant to the G Medical Innovations Holdings Ltd. Global Equity Plan, G Medical Innovations Holdings Ltd. –

Israel Sub-Plan and G Medical Innovations Holdings Ltd. – U.S. Sub-Plan, as amended from time to time, or, collectively, the Plans.

The Registrant is filing this

Registration Statement to register an additional 4,018,281 ordinary shares, par value $0.0001 per share, that may be issued under the

Plans. The Registrant’s board of directors approved increasing the reservation of the aforementioned additional shares under the

Plans on June 28, 2023.

Pursuant to General Instruction

E to Form S-8, the contents of the Original Registration Statement are incorporated herein by reference, except for Item 3 and Item 8

of Part II of the Original Registration Statement, which are being updated by this registration statement.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information required

in Part I of this registration statement have been or will be sent or given to participating employees as specified in Rule 428(b)(1)

under the Securities Act of 1933, as amended, or the Securities Act, in accordance with the rules and regulations of the United States

Securities and Exchange Commission, or the Commission. Such documents are not being filed with the Commission either as part of this registration

statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated

by reference into this registration statement pursuant to Item 3 of Part II of this registration statement, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which have been filed

by G Medical Innovations Holdings Ltd., or the Registrant, with the Commission under the Securities Exchange Act of 1934, as amended,

or the Exchange Act, are incorporated by reference in and made a part of this registration statement, as of their respective dates:

| (a) | The Registrant’s

annual report for the fiscal year ended December 31, 2022 on Form 20-F, filed with the Commission

on May 16, 2023; |

| |

(b) |

The Registrant’s Reports of Foreign Private Issuer on Form 6-K filed with the Commission on: May 16, 2023; May 19, 2023; and June 1, 2023; and |

| |

|

|

| |

(c) |

The description of the Registrant’s ordinary shares contained in the Registrant’s registration

statement on Form 8-A (File No. 001-39674), filed by the registrant with the Commission under Section 12(b) of the Exchange Act on

June 24, 2021, including any amendments or reports filed for the purpose of updating such description. |

In addition to the foregoing, all documents subsequently

filed by us with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective

amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall

be deemed to be incorporated by reference in this registration statement and to be part hereof from the date of filing of such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this registration statement

to the extent that a statement herein, or in any subsequently filed document which also is or is deemed to be incorporated by reference,

modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this registration statement.

Item 8. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Rehovot,

Israel on July 5, 2023.

| |

G MEDICAL INNOVATIONS HOLDINGS LTD. |

| |

|

|

| |

By: |

/s/ Dr. Yacov Geva |

| |

|

Dr. Yacov Geva |

| |

|

Chief Executive Officer |

POWER OF ATTORNEY

We, the undersigned

officers and directors of G Medical Innovations Holdings Ltd., hereby severally constitute and appoint Dr. Yacov Geva and

David Seligman and each of them, as our true and lawful attorney to sign for us and in our names in the capacities indicated below any

and all amendments or supplements, including any post-effective amendments, to this registration statement on Form S-8 and to file the

same, with exhibits thereto and other documents in connection therewith, with the SEC, granting unto said attorney full power and authority

to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and

purposes as he might or could do in person, hereby ratifying and confirming our signatures to said amendments to this registration statement

signed by our said attorney and all else that said attorney may lawfully do and cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act, this registration statement on Form S-8 has been signed below by the following persons in the

capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Dr. Yacov Geva |

|

President and Chief Executive Officer |

|

July 5, 2023 |

| Dr. Yacov Geva |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ David Seligman |

|

Chief Financial Officer |

|

July 5, 2023 |

| David Seligman |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Dr. Kenneth R. Melani |

|

Director, Chairman of the Board of Directors |

|

July 5, 2023 |

| Dr. Kenneth R. Melani |

|

|

|

|

| |

|

|

|

|

| /s/ Dr. Yeshoshua (Shuki) Gleitman |

|

Director |

|

July 5, 2023 |

| Dr. Yeshoshua (Shuki) Gleitman |

|

|

|

|

| |

|

|

|

|

| /s/ Prof. Zeev Rotstein |

|

Director |

|

July 5, 2023 |

| Prof. Zeev Rotstein |

|

|

|

|

| |

|

|

|

|

| /s/ Urs Wettstein |

|

Director |

|

July 5, 2023 |

| Urs Wettstein |

|

|

|

|

| |

|

|

|

|

| /s/ Chanan Epstein |

|

Director |

|

July 5, 2023 |

| Chanan Epstein |

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant to the Securities Act, as amended, the

undersigned duly authorized representative in the United States of G Medical Innovations Holdings Ltd., has signed this registration statement

on July 5, 2023.

| |

G Medical Innovations USA Inc. |

| |

|

| |

/s/ Dr. Yacov Geva |

| |

By: |

Dr. Yacov Geva |

| |

Its: |

Director |

Exhibit 5.1

Our

ref:

|

AMCK/SMCK/1062033/0004 |

|

5 July 2023 |

G Medical Innovations Holdings Ltd.

PO Box 10008, Willow House

Cricket Square, Grand Cayman

KY1-1104

Cayman Islands

|

|

| Dear Sirs |

|

| |

|

| G Medical Innovations Holdings Ltd. (the “Company”) |

|

We have acted as Cayman Islands legal counsel to the Company in connection

with the Company’s registration statement, as amended, on Form S-8 (the “Registration Statement”), provided to

us as filed with the United States Securities and Exchange Commission (the “Commission”) under the United States

Securities Act 1933, as amended (the “Securities Act”) on or around 5 July 2023 in relation to the registration of 4,018,281

ordinary shares of par value US$0.0001 each in the capital of the Company (the “Ordinary Shares”) upon the granting of

certain awards under the G Medical Innovations Holdings Ltd. 2016 Global Equity Incentive Plan (the “Global Plan”), G

Medical Innovations Holdings Ltd. – Israel Sub-Plan (the “Israel Sub Plan”) and G Medical Innovations Holdings

Ltd. – U.S. Sub-Plan (the “U.S. Sub Plan” and, together with the 2016 Plan and Israel Sub Plan, the “Plan”).

For the purposes of this Opinion, the term “Ordinary

Shares” includes those ordinary shares issuable above.

This Opinion is given only on the laws of the

Cayman Islands in force at the date hereof and is based solely on matters of fact known to us at the date hereof. We have not investigated

the laws or regulations of any jurisdiction other than the Cayman Islands. We express no opinion as to matters of fact or, unless expressly

stated otherwise, the commercial terms of, or veracity of any representations or warranties given in or in connection with any of the

documents set out in Section 2.

In giving this Opinion we have reviewed originals,

copies, drafts, and certified copies of the documents set out in Section 2. This Opinion is given on the basis that the assumptions set

out in Section 3 (which we have not independently investigated or verified) are true, complete and accurate in all respects. In addition,

this Opinion is subject to the qualifications set out in Section 4.

Carey Olsen Singapore LLP (Registration No. T15LL1127K)

is a limited liability partnership registered in Singapore under the Limited Liability Partnerships Act (Chapter 163A)

When the Ordinary Shares have been issued by

the Company pursuant to the provisions of the Plan and any relevant agreement thereunder and duly recorded in the Company’s register

of members and the subscription price of such Ordinary Shares (being not less than the par value of the Ordinary Shares) has been fully

paid, the Ordinary Shares will be validly issued, fully paid and non-assessable (which term means when used herein that no further sums

are required to be paid by the holders thereof in connection with the issue of such shares).

The documents listed in this Section 2 are the

only documents and/or records we have examined and relied upon and the only searches and enquiries we have carried out for the purposes

of this Opinion.

| (a) | The certificate of incorporation dated 21

August 2014 and the certificate of incorporation on change of name of the Company dated 28

December 2016, the amended and restated memorandum and articles of association (the “Memorandum

and Articles”) as conditionally adopted on 16 February 2023, and the Register of

Directors, in each case, of the Company. |

| (b) | The Registration Statement. |

| (d) | The signed written resolutions of the board

of directors of the Company dated 26 December 2016 approving the Plan. |

| (e) | The signed minutes of a meeting of the board

of directors of the Company dated 28 June 2023, and a signed confirmation certificate to

us from the Company provided on 28 June 2023. |

We have assumed: (a) the Plan

and any other relevant agreement thereunder (including an option agreement, and award agreement) (the “Plan Documents”)

has been or will be authorised and duly executed and unconditionally delivered by or on behalf of all relevant parties in accordance

with all relevant laws (other than, with respect to the Company, the laws of the Cayman Islands); (b) any Plan Document is, or will be,

legal, valid, binding and enforceable against all relevant parties in accordance with its terms under the laws of the Cayman Islands

(the “Relevant Law”) and all other relevant laws; (c) the choice of the Relevant Law as the governing law of any Plan

Document has been made in good faith and would be regarded as a valid and binding selection which will be upheld by the courts of any

relevant jurisdiction (other than the Cayman Islands) as a matter of the Relevant Law and all other relevant laws (other than the laws

of the Cayman Islands); (d) the authenticity, accuracy and completeness of all documents supplied to us, whether as originals or copies

and of all factual representations expressed in or implied by the documents we have examined; (e) that where we have been provided with

a document in executed form or with only the signature page of an executed document, that such executed document does not differ from

the latest draft version of the document provided to us and, where a document has been reviewed by us in draft or specimen form, it will

be or has been executed in the form of that draft or specimen; (f) all signatures, initials and seals are genuine; (g) the Memorandum

and Articles remain in full force and effect and are unamended; (h) the full power (including both capacity and authority), legal right

and good standing of each of the parties (other than the Company as a matter of Cayman law) to execute, date, unconditionally deliver

and perform their obligations under any Plan Document; (i) save for the Memorandum and Articles, there are no resolutions, agreements,

documents or arrangements which materially affect, amend or vary the transactions contemplated by the Registration Statement; (j) that

the issuance and sale of and payment for the Ordinary Shares, or exercise of awards, warrants or options in respect of the Ordinary Shares,

will be in accordance with the Plan Documents and the Registration Statement; (l) that no party is aware of any improper purpose for

the issue of the Ordinary Shares; (m) no law or regulation of any jurisdiction other than the Cayman Islands qualifies or affects this

Opinion; (n) the Registration Statement will be duly filed with and declared effective by the Commission; and (o) that the Registration

Statement (or any prospectus contained therein), when published/effective, will be in substantially the same form as that examined by

us for purposes of this Opinion.

This Opinion is subject to

the following qualifications:

| (a) | The register of members of a Cayman Islands

company provides prima facie evidence of the legal ownership of registered shares in a company.

No purported creation or transfer of legal title to Ordinary Shares is effective until the

register of members is updated accordingly. However, an entry in the register of members

may be subject to rectification (for example, in the case of fraud or manifest error). |

| (b) | Any issue of Ordinary Shares that takes place

after the commencement of the winding up of the Company is void unless consented to by the

liquidator (in the case of a voluntary winding up of the Company) or the courts of the Cayman

Islands (in the case of a court-supervised winding up of the Company). |

| (c) | To maintain the Company in good standing under

the laws of the Cayman Islands, annual filing fees must be paid and returns made to the Registrar

within the time frame prescribed by law. |

This Opinion (and any obligations arising out

of or in connection with it) is given on the basis that it shall be governed by and construed in accordance with the current law and

practice in the Cayman Islands. By relying on the opinions set out in this Opinion the addressee(s) hereby irrevocably agree(s) that

the courts of the Cayman Islands are to have exclusive jurisdiction to settle any disputes which may arise in connection with this Opinion.

We are furnishing this Opinion as exhibit 5.1

to the Registration Statement. We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to the

use of our name therein. In giving this consent, we do not hereby admit that we are experts within the meaning of Section 11 of

the Securities Act or that we are within the category of persons whose consent is required under Section 7 of the Securities Act

or the rules and regulations of the Commission promulgated thereunder.

Yours faithfully

/s/ Carey Olsen Singapore LLP

Carey Olsen Singapore LLP

Exhibit 23.1

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S

CONSENT

We hereby consent to the incorporation by reference in the Registration

Statement on Form S-8 of our report dated May 16, 2023, with respect to the financial statements of G Medical Innovations Holdings Ltd.

appearing in the Company’s Annual Report on Form 20-F for the year ended December 31, 2022.

| Tel Aviv, Israel |

|

/s/ Ziv Haft |

| July 5, 2023 |

|

Certified Public Accountants (Isr.) |

| |

|

BDO Member Firm |

Exhibit 99.1

G MEDICAL INNOVATIONS HOLDINGS LTD.

2016 Global Amended and Restated Equity Incentive

Plan

The purpose of the 2016 Global Equity Incentive Plan is to provide

eligible employees, directors, consultants and sub-contractors of the Company and its Affiliates the ability to share in the Company’s

future success. Through this Global Equity Incentive Plan, the Company has established a framework for offering eligible employees, directors,

consultants and sub-contractors an opportunity to benefit from the success of the Company and its Affiliates, with appropriate modification

through Sub-Plans for relevant jurisdictions.

The following capitalized terms, as used in the 2016 Global Equity

Incentive Plan, shall have the respective meanings set forth in this Section:

| 2.1 |

“Affiliate” means (i) any entity that directly or indirectly controls, is controlled by or is under common control with the Company and/or (ii) to the extent provided by the Board, any person or entity in which the Company has a significant interest as determined by the Board in its discretion. The term “control” (including, with correlative meaning, the terms “controlled by” and “under common control with”), as applied to any person or entity, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such person or entity, whether through the ownership of voting or other securities, by contract or otherwise. |

| 2.2 |

“Award” means the grant by the Company of Options, Restricted Share, Restricted Share Units, Share Appreciation Rights and any other share-based grant, pursuant to the Global Equity Incentive Plan. |

| 2.3 |

“Board” means the board of directors of the Company, or a committee to which the board of directors shall have delegated power to act on its behalf with respect to the Plan. If a committee is appointed it shall consist of such number of members (but not less than two (2)) as may be determined by the Board. |

| 2.4 |

“Company” means G Medical Innovations Holdings Ltd., an exempted company with limited liability incorporated in the Cayman Islands under the Companies Law (as revised) of the Cayman Islands |

| 2.5 |

“Disability” means the inability of a Participant to engage in any substantially gainful activity by reason of any medically determinable physical or mental impairment that is expected to result in death or has lasted or can be expected to last for a continuous period of twelve (12) months or more or, if different, the meaning ascribed to the term under the laws of the country in which a Participant resides. A determination that a Participant is has a Disability shall be made by the Board on the basis of such medical evidence as the Board deems warranted under the circumstances. |

| 2.6 |

“Exercise Date” means the date upon which a Participant exercises his or her rights under an Option or Stand-Alone SAR (as defined in section 6.1) or surrenders an unexercised Option in in order o receive a distribution under a Tandem SAR (as defined in section 6.1); |

| 2.7 |

“Exercise Price” means the price to be paid to exercise a Share Appreciation Right, as determined pursuant to Section 6.5 of the Global Equity Incentive Plan. |

| 2.8 |

“Fair Market Value” means, as of any date, the value of a Share determined as follows: (i) if the Company’s shares are listed on any established stock exchange or a national market system, including without limitation the Australian Stock Exchange, Nasdaq Global Select Market, Nasdaq Global Market or the Nasdaq Capital Market of the Nasdaq Stock Market, the Fair Market Value shall be the closing sales price of such shares (or the closing bid, if no sales were reported) as quoted on such exchange or system for the last market trading day prior to the time of determination, as reported in The Wall Street Journal or such other source as the Board deems reliable; or (ii) if the Company’s shares are regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value shall be the mean between the high bid and low asked prices for the Company’s shares on the last market trading day prior to the day of determination; or (iii) in the absence of an established market for the Company’s shares, the Fair Market Value shall be determined in good faith by the Board (including in accordance with an independent third party valuation of the Company which may be obtained by the Board). |

| 2.9 |

“Global Equity Incentive Plan” means this G

Medical Innovations Holdings Ltd., 2016 Global Equity Incentive Plan. |

| 2.10 |

“Merger Transaction” or “Merger” means, any liquidation event, deemed liquidation event, and/or any other similar or parallel definition as determined by the Board, excluding any Re-organization or Spin-off Transaction, and including, for the avoidance of doubt (i) a sale of all or substantially all of the assets of the Company and its subsidiaries taken as a whole, or the sale or disposition (whether by merger or otherwise) of one or more subsidiaries of the Company if substantially all of the assets of the Company and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries; or (ii) a sale of all or substantially all of the shares of the share capital of the Company whether by a single transaction or a series of related transactions which occur either over a period of 12 months or within the scope of the same acquisition agreement; or (iii) a merger, consolidation or like transaction of the Company with or into another corporation including a reverse triangular merger but excluding a merger which falls within the definition of Re-organization. |

| 2.11 |

“Misconduct” means any activity by a Participant that is determined by the Board in its sole and absolute discretion to adversely affect the business or affairs of the Company or any Affiliate in a material manner, including but not limited to the following situations: |

| |

(a) |

Any act of embezzlement, fraud, or dishonesty by a Participant; |

| |

(b) |

Nonpayment of any obligation owed to the Company or any Affiliate; |

| |

(c) |

Breach of a fiduciary duty to the Company or any Affiliate; |

| |

(d) |

Deliberate disregard of Company rules or the rules of any Affiliate resulting in loss, damage, or injury to the Company or any Affiliate; |

| |

(e) |

Unauthorized disclosure or use of any Company or any Affiliate trade secret, proprietary data, or confidential information; |

| |

(f) |

Engagement in any unfair competition with the Company or any Affiliate; |

| |

(g) |

The breach of a non-competition agreement; |

| |

(h) |

Inducement of any customer of the Company or Affiliate to breach a contract with the Company or any Affiliate; |

| |

(i) |

Inducement of any principal for whom the Company or any Affiliate acts as agent to terminate such agency relationship; and |

| |

(j) |

Gross Misconduct or criminal activity harmful to the Company or an Affiliate. |

| 2.12 |

“Option” means an Award of a right to purchase Shares at a set Option Price and subject to a Vesting Period pursuant to Section 5.2 of the Global Equity Incentive Plan. |

| 2.13 |

“Option Price” means the price to be paid to acquire a Share under the terms of an Option, as determined pursuant to Section 5.4 of the Global Equity Incentive Plan. |

| 2.14 |

“Participant” means an employee, director, consultant or sub-contractor of the Company or its Affiliates who is selected by the Board to participate in the Global Equity Incentive Plan. |

| 2.15 |

“Performance Factor(s)” means the factor(s) selected by the Board upon which the performance criteria established by the Board will be based, which may include, but are not limited, to the following: |

| |

(d) |

Income before Income taxes; |

| |

(h) |

Return on capital employed; |

| |

(1) |

Shareholder’s economic added value; |

| |

(m) |

Results on individual confidential business objectives (strategic, tactical or personal); and/or |

| |

(n) |

Any other performance factors determined by the Board to contribute and/or which have contributed to the Company operation and/or performance and/or shareholder’s value creation. |

| 2.16 |

“Performance Period” means the period of service determined by the Board during which the Participant’s satisfaction of performance criteria is to be measured for Awards. |

| 2.17 |

“Purchase Price” means the price paid to acquire an RSU, as determined under Section 7.2 of the Global Equity Incentive Plan. |

| 2.18 |

“Restricted Share Unit (RSU)” means a right to acquire a Share for a Purchase Price, which is granted pursuant to Section 7 of the Global Equity Incentive Plan. |

| 2.19 |

“Share Appreciation Right (SAR)” means a right to receive the difference between the Fair Market Value of a Share on the Exercise Date and the Exercise Price pursuant to Section 6 of the Global Equity Incentive Plan. |

| 2.20 |

“Spin-off Transaction” means, any transaction in which assets of the Company are transferred or sold to a company or corporate entity in which the Shareholders hold equal stakes, pro-rata to their ownership of the Company. |

| 2.21 |

“Re-organization” means, any re-domestication of the Company, share flip, creation of a holding company for the Company which will hold substantially all of the shares of the Company or any other transaction involving the Company in which the ordinary shares of the Company outstanding immediately prior to such transaction continue to represent, or are converted into or exchanged for shares that represent, immediately following such transaction, at least a majority, by voting power, of the share capital of the surviving, acquiring or resulting corporation and in which there is no material change to the interests held by the Shareholders prior to such transaction and thereafter. |

| 2.22 |

“Share” or “Shares” means an ordinary voting share in the capital of the Company with par value per share of US$0.001 (as may be adjusted pursuant to any consolidation, subdivision, conversion, reduction or other reorganization of the capital of the Company). |

| 2.23 |

“Shareholder” means a holder of Shares. |

| 2.24 |

“Sub-Plan” means rules or procedures adopted by the Board in order for the grant of Awards under the Global Equity Incentive Plan to comply with the laws of the relevant jurisdiction. |

| 2.25 |

“Termination” or “Terminated” means that a Participant has for any reason ceased to provide services as an employee, director, consultant or sub-contractor to the Company or an Affiliate. An employee is not deemed to have ceased to provide services in the case of (a) sick leave, (b) military leave, or (c) any other leave of absence approved by the Board, provided, that such leave is for a period of not more than 90 days, unless reemployment upon the expiration of such leave is guaranteed by contract or statute, or unless provided otherwise pursuant to a formal policy adopted from time to time by the Company or an Affiliate and issued and promulgated to employees in writing. |

In the case of an employee’s approved leave of absence,

subject to the laws of the relevant jurisdiction, the Board may make such provisions to suspend the Vesting of an Award during the period

of leave from the employ of the Company or an Affiliate as it may deem appropriate, provided that in no event may an Award be exercised

after the expiration of the term set forth in the Option Agreement. The Board shall have sole discretion to determine whether a Participant

has ceased to provide services and the effective date on which a Participant ceased to provide services (the “Termination Date”).

| 2.26 |

“Vesting” means the process of satisfying any

condition required such that the Award is not subject to forfeiture. “Vested” means the point in time when a Participant’s

Award is unconditional and absolute. The period of time from the grant of an Award to the date when a Participant’s Award is Vested

is the “Vesting Period.” |

| 3. |

Shares Subject to the Global Equity Incentive Plan |

| 3.1 |

Subject to Section 15 of the Global Equity Incentive Plan, the total

number of Shares reserved and available for grant and issuance under the Global Equity Incentive Plan shall be Four million three hundred

fifty-two thousand three hundred eighty-one (4,352,381) Shares. The Shares subject to the Global Equity Incentive Plan may consist of

authorized and unissued Shares and of previously issued Shares reacquired and held by the Company as treasury shares. Shares subject to

an Award that expires, terminates or is cancelled shall be available for grant or issuance under the Global Equity Incentive Plan to satisfy

any Award. Upon termination of the Global Equity Incentive Plan, any Shares that remain unissued and are not subject to an outstanding

Award shall cease to be available for the purposes of the Global Equity Incentive Plan. |

| 3.2 |

Only whole numbers of Shares may be acquired under an Award. Any

fractional Shares will not be issued to a Participant. |

The Board may grant one or more Awards to any Participant.

| 5.1 |

Form of Option Grant. Each Option granted under the Global Equity Incentive Plan shall be evidenced by an agreement (“Option Agreement”) in such form and containing such provisions as the Board shall determine which shall comply with and be subject to the terms and conditions of the Global Equity Incentive Plan and any applicable Sub-Plan. |

| 5.2 |

Vesting Period. Subject to a Participant’s continued employment or service with the Company or an Affiliate, Options shall vest upon completion of: (a) a certain number of months or years of services with the Company or an Affiliate; and/or (b) performance criteria based on one or more Performance Factors as determined by the Board and as set forth in the Option Agreement. |

| 5.3 |

Exercise of Options. A Participant may exercise an Option, or a part thereof, only to the extent that such Option has Vested and any conditions set forth in an Option Agreement or Sub-Plan have been satisfied. An Option may be exercised only by delivery to the Company of an exercise notice in a form approved by the Board together with payment in full of the aggregate Option Price for the number of Shares as to which an Option is exercised. |

| 5.4 |

Option Price. The Option Price shall be determined by the Board when such Option is granted. After the grant of an Option, the Board shall not amend the Option Price or grant an Option in substitution of an outstanding Option with a different Option Price than the Option Price of such Outstanding Option, except as provided under Section 15 of the Global Equity Incentive Plan. |

| 5.5 |

Shareholder Rights. a Participant shall not be entitled to receive dividends, exercise voting rights, or exercise any other rights of a shareholder with respect to Options until the Participant has exercised the Option pursuant to Section 5.3 of the Global Equity Incentive Plan and the Shares have been issued or transferred to such Participant.

|

| 5.6 |

Option Term. The term of an

Option shall be determined by the Board provided, however, that no Option shall be exercisable after

the fifth (5th) anniversary of the date an Option is granted. |

| 5.7 |

Restriction on Transfer and Sale.

The Board may determine that the Shares issued or transferred to a Participant pursuant to the exercise

of an Option shall be restricted as to transferability and sale. If so restricted, such Shares shall

not be sold, transferred, or disposed of in any manner contrary to the terms of such restriction, and

such Shares shall not be pledged or otherwise hypothecated until the restriction expires by its terms.

The terms of any such restriction, the circumstances under which any such restriction shall expire and

any applicable sanction for non compliance with such restriction, shall be determined by the Board. |

| 6.1 |

Form of SAR Grant. Each SAR

granted under the Global Equity Incentive Plan shall be evidenced by an agreement (“SAR Agreement”)

in such form and containing such provisions as the Board shall determine which shall comply with and

be subject to the terms and conditions of the Global Equity Incentive Plan and any applicable Sub-Plan. |

| 6.2 |

Grants. The Board may grant: (i) a SAR independent of an Option (a “Stand-Alone SAR”); or (ii) a SAR in connection with an Option, or a portion thereof (a “Tandem SAR”). |

| |

a) |

A Stand-Alone SAR shall. cover a specified number of underlying Shares as determined by the Board. Upon exercise of a Stand-Alone SAR, a Participant shall be entitled to receive a distribution from the Company of (i) cash in an amount equal to the number of Shares covered by the. SAR multiplied by the difference between the Fair Market Value of a Share on the Exercise Date and the Exercise Price; (ii) Shares with a value equal to the number of Shares covered by the SAR multiplied by the difference between the Fair Market Value of a Share on the Exercise Date and the Exercise Price; or (iii) a combination of Shares and cash, as the Board shall deem appropriate. |

| |

b) |

A Tandem SAR gives the Participant the right to elect between

(i) the exercise of the underlying Option pursuant to Section 5 of the Global Equity Incentive Plan for Shares; or (ii) the surrender

of such unexercised Option, to the extent that such Option is exercisable pursuant to Section 5 of the Global Equity Incentive Plan,

in exchange for a distribution of Shares and/or cash from the Company in an amount equal to the number of Options surrendered multiplied

by the difference between the Fair Market Value of the Shares on the date the Options are surrendered and the aggregate Option Price

of the Options surrendered. No such surrender of an Option shall be effective unless approved by the Board, either at the time an Option

is surrendered or at any earlier time. If the surrender is so approved, then the distribution to which the Participant shall become entitled

under this Section 6 may be made: (i) in Shares; (ii) in cash; or (iii) in a combination of Shares and cash, as the Board shall deem

appropriate (and for these purposes, the value to be attributed to each Share that is so distributed shall be the Fair Market Value of

the Shares on the date the relevant Options were surrendered). The number of Options surrendered shall be equal to the number of Tandem

SARs exercised. |

| 6.3 |

Vesting Period. A SAR shall vest upon completion of: (i) a certain number of months or years of service with the Company or an Affiliate; and/or (ii) performance criteria based on one or more Performance Factors as determined by the Board and as set forth in the SAR Agreement. The Board also may provide for a SAR to vest at one time, or a portion of a SAR to vest from time to time, periodically or otherwise, in such number of Shares or percentage of Shares as shall be determined by the Board. At any time after the granting of a SAR, the Board may accelerate the Vesting of such SAR. |

| 6.4 |

Exercise of a SAR. Except as otherwise provided in the Global Equity Incentive Plan, a Participant may exercise a SAR, or a part thereof, only to the extent that such SAR has Vested and any conditions set forth in a SAR Agreement have been satisfied. A SAR may be exercised only by delivery to the Company of an exercise notice in a form approved by the Board. |

| 6.5 |

Exercise Price. The Exercise Price of a SAR shall be determined by the Board when a SAR is granted at such price as the Board shall determine. |

| 7. |

Restricted Share Units (“RSU”) |

| 7.1 |

Form of RSU Grant. Each Award of RSUs under the Global Equity Incentive Plan shall be evidenced by an agreement (“RSU Agreement”) in such form and containing such provisions as the Board shall determine which shall comply with and be subject to the terms and conditions of the Global Equity Incentive Plan and any applicable Sub-Plan. |

| 7.2 |

Purchase Price. The Purchase Price shall be determined by the Board on the date such Award is made. After the Award of an RSU, the Board shall not amend the Purchase Price or grant an RSU in substitution of an outstanding RSU with a different Purchase Price than the Purchase Price of such outstanding RSU, except as provided under Section 15 of the Global Equity Incentive Plan. |

| 7.3 |

Vesting Period. A RSU shall vest upon completion of: (a) a certain number of months or years of service with the Company or an Affiliate; and / or (b) performance criteria based on one or more Performance Factors as determined by the Board and as set forth in the RSU Agreement governing such RSU. At any time after the granting of a RSU, the Board may accelerate the Vesting of such RSU. |

| 7.4 |

Issuance of Shares. Upon the Vesting and exercise of a RSU, the Company shall issue or cause there to be transferred to the Participant one Share in exchange for each RSU that has Vested and been exercised. |

| 7.5 |

Restriction on Transfer and Sale. The Board may determine that the Shares issued or transferred to a Participant pursuant to an RSU shall be restricted as to transferability and sale. If so restricted, such Shares shall not be sold, transferred, or disposed of in any manner, and such Shares shall not be pledged or otherwise hypothecated until the restriction expires by its terms. The circumstances under which any such restriction shall expire and any applicable sanction shall be determined by the Board. |

| 7.6 |

Shareholder Rights. A Participant shall not be entitled to receive dividends, exercise voting rights, or exercise any other rights of a shareholder with respect to RSUs until the RSUs have Vested and been exercised, and the Shares in question have been issued or transferred by the Company. |

| 8. |

Termination of Employment |

| |

a. |

Termination. If a Participant’s employment or service with the Company or an Affiliate is Terminated for any reason except death, retirement, Disability, or Misconduct, then such Participant may exercise his or her Option or SAR for a period of ninety (90) days after the Termination Date, or such shorter or longer time period as may be determined by the Board, but only to the extent that such Option or SAR is Vested on the Termination Date.

|

| |

b. |

Termination Due to Death. If a Participant’s employment or service with the Company or an Affiliate is Terminated due to a Participant’s death, or if a Participant dies during the period provided for exercise of his or her Option or SAR following the relevant Termination Date in Sections 8.1(a) and 8.1(c), then such Participant’s Option or SAR may be exercised by his or her legal representative or authorized assignee for a period of six (6) months after the date of death, or such shorter or longer time period as may be determined by the Board, but only to the extent that such Option or SAR is Vested on the Termination Date. |

| |

c. |

Termination Due to Retirement. If a Participant’s employment with the Company or an Affiliate is Terminated due to such Participant’s retirement, within the meaning of any prevailing pension plan in which such Participant is a participant, then such Participant may exercise his or her Option or SAR after the Termination Date for the full term of the Option or SAR as set by the Board in the Option Agreement or SAR Agreement, but only to the extent that such Option or SAR is Vested on the Termination Date and subject to the provisions of an applicable Sub-Plan. |

| |

d. |

Termination Due to Misconduct. If a Participant’s employment or service with the Company or an Affiliate is Terminated for Misconduct or if a Participant engages in Misconduct after the Termination Date, any Option or SAR held by such Participant shall immediately expire and the Company shall dispatch notice or advice to the Participant either that the Participant has been Terminated due to Misconduct or the Participant has engaged in Misconduct after the Termination Date. Any exercise of rights under an Option or SAR following the date of Termination for Misconduct or engagement in Misconduct after the Termination Date but prior to the foregoing dispatch of notice or advice by the Company to the Participant shall not be effective and no issue or transfer of Shares or distribution of cash shall be made pursuant thereto. Subject to the laws of the relevant jurisdiction, the Board shall be the sole judge of whether the Participant’s employment or service is Terminated for Misconduct or the Participant engages in Misconduct. If an allegation of Misconduct by a Participant is made to the Board, the Board, in its sole discretion, may suspend the Vesting or the Participant’s ability to exercise his or her Option or SAR for up to two (2) months to permit the investigation of such allegation. |

| |

e. |

Termination Due to Disability. If a Participant’s employment or service? with the Company or an Affiliate is Terminated due to Disability, then the Participant may exercise his or her Option or SAR for a period of twelve (12) months after the Termination Date, or such shorter or longer time period as may be determined by the Board, but only to the extent that such Option or SAR is Vested on the Termination Date. |

| |

f. |

Notwithstanding the other provisions of this Section 8.1, in no event may an Option or SAR be exercised after the expiration of five (5) vears from the date the Award is granted. |

| |

a. |

If a Participant’s employment or service with the Company or an Affiliate is Terminated, then such Participant shall be entitled to payment (whether in Shares, cash, or otherwise, as determined by the Board) with respect to an RSU Award only to the extent that the RSU has Vested as of the Termination Date in accordance with the RSU Agreement, unless the Board determines otherwise. |

| |

b. |

Accelerated delivery upon death. Upon Termination of employment

with or service to the Company or an Affiliate by reason of Participant’s death, the Company shall, upon payment of the aggregate

Purchase Price therefor, issue or transfer the Shares related to Restricted Share Units which have Vested at the time of the Participant’s

death to the Participant’s legal representative or authorized assignee, at their request, within six months following the Participant’s

death. Any Restricted Share Units that have not Vested at the date of a Participant’s death shall lapse and no Shares related to

Restricted Share Units that have not Vested at the time of the Participant’s death shall be issued or transferred to the Participant’s

heirs. Shares shall only be issued or transferred to a Participant’s legal representative or authorized assignee in accordance

with this section 8.2(b) to the extent that the Participant’s legal representative or authorized assignee agrees to comply with

the restrictions on the sale of Shares set forth in the Participant’s RSU Agreement, this Global Equity Incentive Plan and/or the

applicable Sub-Plan. |

Payment for Shares shall be made in cash or its equivalent (e.g.,

check) in the currency set out in the relevant RSU Agreement, SAR Agreement or Option Agreement or, if approved for a Participant

by the Board, permitted by the laws of the relevant jurisdiction, and subject to the obtainment of a tax ruling issued by the tax authorities

in the country of residence of the Participant, if required, by:

| |

a. |

Set-off by the Company of the price to be paid for the Shares against any indebtedness of the Company to the Participant; |

| |

b. |

With respect to purchases of Shares upon exercise of an Option only, delivery of irrevocable instructions to a broker to sell sufficient Shares to be acquired upon the exercise of an Option to fund (net of all broking and other fees, taxes and charges) the payment of the aggregate Option Price and to deliver the aggregate Option Price to the Company from the proceeds of such sale; or |

| |

c. |

Any combination of the foregoing. |

Prior to the grant of an Award subject to performance criteria, the

Board shall: (a) determine the nature, length and starting date of any Performance Period for such Award; and (b) select from among the

Performance Factors to be used to measure performance criteria. Prior to the payment of any Award, the Board shall determine the extent

to which the performance criteria have been met. Performance Periods may overlap and a Participant may receive multiple Awards that are

subject to different Performance Periods or have different performance criteria. Notwithstanding the foregoing, grant of an Award subject

to Performance criteria to Israeli Employees (as such term is defined in the Sub-Plan applicable to Israeli resident Participants) will

be subject to the obtainment of a tax ruling issued by the Israeli Tax Authority.

An Award granted under the Global Equity Incentive Plan and any interest

therein shall not be transferable or assignable by any Participant, and may not be made subject to execution, attachment or similar process,

otherwise than by will or by the laws of descent and distribution or as otherwise determined by the Board subject to any applicable law.

No purported assignment or transfer of an Award, whether voluntary or involuntary, by operation of law or otherwise shall vest in the

purported assignee or transferee any interest or right therein whatsoever. Immediately upon any such purported assignment or transfer,

or any attempt to make the same, such Award shall terminate and become of no further effect, except to the extent that such assignment

or transfer is completed pursuant to the Global Equity Incentive Plan, an applicable Sub-Plan or an Award agreement.

| 12. |

Restrictions on Participant’s Gain Under the Awards |

| 12.1 |

The Company may impose a limit on the maximum gain that a Participant may realize from an Award. If imposed, the maximum gain that a Participant may realize from an Award shall be established by the Board. |

| 12.2 |

The procedure for imposing the limit on the maximum gain shall

be determined at the discretion of the Board and shall be set forth in the applicable Option Agreement, SAR Agreement, or RSU Agreement.

In effecting any such limit on the maximum gain that a Participant may realize from an Award, the Board may reduce the number of Shares

exercisable under an Award such that the benefit at the time of exercise does not exceed the limit on maximum gain set by the Board. |

| 13. |

Evidence of Instruments |

All evidence of the instruments delivered under the Global Equity Incentive

Plan shall be subject to such share transfer orders, legends, and other restrictions as the Board may deem necessary or advisable, including

restrictions under any applicable law, or any rules, regulations, and other requirements of the securities authorities or any stock exchange

or automated quotation system upon which the Shares may be listed or quoted.

| 14. |

Exchange and Buyout of Awards |

The Board may, at any time or from time to time, authorize the Company,

with the consent of the respective Participants, to issue new Awards in exchange for the surrender and cancellation of any or all outstanding

Awards. The Board may at any time buy from a Participant an Award previously granted with payment in cash, Shares, or other consideration,

based on such terms and conditions as the Board and the Participant may agree. Notwithstanding the foregoing, an exchange and buyout of

Awards granted to Israeli Employees (as such term is defined in the Sub-Plan applicable to Israeli resident Participants) will be subject

to an obtainment of a tax ruling issued by the Israeli Tax Authority which permits such an exchange and/or buyout.

| 15. |

Reorganizations, Spin-Off Transactions, Mergers and Recapitalizations of the Company |

| 15.1 |

Change in Capitalization |

Subject to any required action by the Shareholders, the number of Shares

subject to each outstanding Award that has not yet Vested or been exercised, and the number of Shares which have been authorized for issuance

under the Global Equity Incentive Plan but as to which no Awards have yet been granted or which have been returned to the Global Equity

Plan, and the per Share Exercise Price, Option Price or Purchase Price (as applicable) of each such Award, shall be proportionately and

equitably adjusted for any increase or decrease in the number of issued Shares resulting from a stock split, reverse stock split, combination,

reclassification, the payment of a stock dividend on the Shares or any other increase or decrease in the number of such Shares effected

without receipt of consideration by the Company without changing the aggregate exercise price, provided, however, that conversion

of any convertible securities of the Company shall not be deemed to have been effected without receipt of consideration. Such adjustment

shall be made by the Board, whose determination in that respect shall be final, binding and conclusive. Except as expressly provided herein,

no issue by the Company of shares in the capital of the Company of any class, or securities convertible into shares of any class, shall

affect, and no adjustment by reason thereof shall be made with respect to, the number or price of Shares subject to an Award. The Board

may, if it so determines in the exercise of its sole discretion, also make provision for proportionately adjusting the number or class

of securities covered by any Award, as well as the price to be paid therefor, in the event that the Company effects one or more reorganizations,

recapitalizations, rights offerings, or

| 15.4 |

Spin-Off Transaction. |

In the event of a Spin-Off Transaction, the Board may determine that

the holders of Awards shall be entitled to receive equity or replacement awards in respect of equity in the new company formed as a result

of the Spin-Off Transaction, in accordance with equity granted to the ordinary Shareholders within the Spin-Off Transaction, taking into

account the terms of the Awards, including the vesting schedule and exercise price. The determination regarding the Participant’s

entitlement within the scope of a Spin-Off Transaction shall be in the sole and absolute discretion of the Board.

| 16. |

Administration of the Global Equity Incentive Plan |

| 16.1 |

The Global Equity Incentive Plan shall be administered by the Board, which may delegate its duties and powers in whole or in part as it determines. |

| 16.2 |

Subject to the laws of the relevant jurisdiction, the Board is authorized to construe and interpret the Global Equity Incentive Plan, any Award agreement and any other agreement or document executed pursuant to the Global Equity Incentive Plan; prescribe, amend, and rescind rules and regulations relating to the Global Equity Incentive Plan or any Award; designate Participants to receive Awards; determine the form, timing and terms of Awards; determine the number of Shares or other consideration subject to Awards; determine whether Awards will be granted singly, in combination with, in tandem with, in replacement of, or as alternatives to, other Awards under the Global Equity Incentive Plan or any other incentive or compensation plan of the Company or any Affiliate; grant waivers of conditions under the Global Equity Incentive Plan or an Award; determine the Vesting, ability to exercise and payment of Awards; correct any defect, supply any omission or reconcile any inconsistency in the Global Equity Incentive Plan, any Award or any Award Agreement; and make all other determinations necessary, advisable or desirable for the administration of the Global Equity Incentive Plan. |

| 16.3 |

The Board may adopt rules or procedures relating to the operation and administration of the Global Equity Incentive Plan to accommodate the specific requirements of the law and procedures of a relevant jurisdiction. Without limiting the generality of the foregoing, the Board is specifically authorized to adopt rules and procedures regarding handling of direct payments, payroll deductions or other approved contributions, payment of interest, conversion of local currency, payroll tax, income tax withholding and reporting procedures, and handling of documents evidencing ownership of securities that vary with the laws of the relevant jurisdiction. |

| 16.4 |

The Board may also adopt rules, procedures, or Sub-Plans applicable to particular Affiliates of the Company. The rules of the Sub-Plans may take precedence over other provisions of this Global Equity Incentive Plan, with the exception of Section 3. Unless otherwise superseded by the terms of a Sub-Plan, the provisions of the Global Equity Incentive Plan shall govern the operation of the Sub-Plan. |

| 16.5 |

Any decision of the Board in the interpretation and administration of the Global Equity Incentive Plan and any applicable Sub-Plan shall be final, conclusive and binding on the Company, the Participants and any other parties that may have an interest in any Award under the Global Equity Incentive Plan and an applicable Sub-Plan. |

| 17. |

Termination or Amendment of the Global Equity Incentive Plan |

The Board may amend, alter, or discontinue the Global Equity Incentive

Plan, provided that no amendment, alteration, or discontinuation shall be made that, without the consent of a Participant, would diminish

any of the rights of that Participant under any Award previously granted to such Participant under the Global Equity Incentive Plan. Notwithstanding

the provisions of this Section 17, the Board may amend the Global Equity Incentive Plan in such manner as it deems necessary to permit

Awards to meet the requirements of the laws of the relevant jurisdiction.

| 18. |

No Right to Employment |

The granting of an Award under the Global Equity Incentive Plan shall

impose no obligation on the Company or any Affiliate to continue the employment of a Participant and shall not lessen or affect the Company’s

or Affiliate’s right to terminate the employment of such Participant.

| 19. |

Successors and Assigns |

The Global Equity Incentive Plan shall be binding on all successors

and assigns of the Company and a Participant, including without limitation, the estate of such Participant and the executor, administrator,

or trustee of such estate, or any receiver or trustee in bankruptcy or representative of the Participant’s creditors.

| 20. |

Regulatory Compliance |

An Award shall not be effective unless such Award is in compliance

with all applicable laws, rules, and regulations of any governmental body of any country that may have jurisdiction over matters related

to the Global Equity Incentive Plan, and the requirements of any stock exchange or automated quotation system upon which the Shares may

then be listed or quoted, as they are in effect on the date of grant of the Award and also on the date of exercise or other issuance or

transfer. Notwithstanding any other provision in the Global Equity Incentive Plan, the Company shall have no obligation to issue or transfer

Shares or make any payments under the Global Equity Incentive Plan prior to obtaining any approvals and completing any registration, filing,

or notification requirements under any law or ruling of any governmental body of any country, including the registration, qualification,

or listing requirements of any securities law, stock exchange or automated quotation system, that the Company determines are necessary

or advisable. The Company shall be under no obligation to obtain any approvals or complete any registration, filing, or notification requirement

of any governmental body of any country, including the registration, qualification or listing requirements of any securities law, stock

exchange or automated quotation system, and the Company shall have no liability for any inability or failure to do so.

The Company shall determine its responsibilities with respect to the

withholding and reporting requirements of income tax, social insurance, Value Added Tax, payroll tax and any other tax matter (“Tax-Related

Items”) in connection with a Participant’s participation in the Global Equity Incentive Plan and an applicable Sub-Plan,

including the grant of Awards, the exercise of such Awards, the acquisition of Shares pursuant to those Awards or the subsequent sale

of Shares acquired under the Global Equity Incentive Plan. Prior to each of the aforementioned events, each Participant shall make adequate

arrangements, acceptable to the Company and/or the Affiliate employing the Participant, to satisfy all withholding obligations of the

Company and/or the Affiliate employing the Participant. At such time, the Company and/or the Affiliate and/or a trustee designated by

the Company and/or an Affiliate may withhold all applicable Tax-Related Items and the Company and/or the Affiliate may sell or arrange

for the sale of Shares purchased by the Participant to meet the minimum withholding obligations for Tax-Related Items. The Company and/or

the Affiliate employing the Participant and/or a trustee designated by the Company and/or an Affiliate will return to the Participant

any estimated withholding that is collected but not required in satisfaction of the Tax-Related Items. To the extent that a Participant

is unable to satisfy the payment of Tax-Related Items by the foregoing methods, the Participant shall pay to the Company or the Affiliate

employing the Participant and/or the trustee designated by the Company and/or an Affiliate any amount of the Tax-Related Items that such

entity may be required to withhold as a result of his or her participation in the Global Equity Incentive Plan, in the manner and at

the time as determined by the Company.

All notices and other communications hereunder shall be in writing

and hand delivered or mailed by registered or certified mail (return receipt requested), or sent by any means of electronic message transmission

with delivery confirmed (by voice or otherwise), to the Company at 5 Oppenheimer St., Rehovot, Israel and to the Participant at the address

appearing in the personnel records of the Company or an Affiliate for the Participant or to either party at such other address as either

party hereto may hereafter designate in writing to the other. Any such notice shall be deemed effective upon receipt thereof by the addressee.

The Global Equity Incentive Plan, all agreements there under and any

related matter shall be governed by the laws of the Cayman Islands.

| 24. |

Term of the Global Equity Incentive Plan |

The Global Equity Incentive Plan shall be effective as of December

26, 2016.

The Global Equity Incentive Plan shall terminate on December 26, 2026.

No new Awards shall be made after such date, but existing Awards may continue to Vest and be exercised after such date in accordance with

the terms applicable to them under the relevant Award agreement, the Global Equity Incentive Plan and any applicable Sub-Plan.

page 10 of 10

Exhibit 107

Calculation of Filing

Fee Tables

Form S-8

(Form Type)

G Medical Innovations

Holdings Ltd.

(Exact Name of Registrant

as Specified in its Charter)

Newly Registered Securities

| |

Security

Type | |

Security Class

Title | |

Fee Calculation | |

Amount

Registered(1) | | |

Proposed

Maximum

Offering

Price Per

Share | | |

Proposed

Maximum

Aggregate

Offering

Price | | |

Fee Rate | | |

Amount of

Registration Fee | |

| Newly Registered Securities |

| Fees to Be Paid | |

Equity | |

Ordinary shares, par value $0.0001 per share, reserved for future issuance

under the Plan | |

Rule 457(c) | |

| 4,018,281 | (2) | |

$ | 0.3787 | (3) | |

$ | 1,521,723.01 | | |

$ | 0.00011020 | | |

$ | 167.69 | |

| | |

Total Offering Amounts | | |

$ | 1,521,723.01 | | |

| | | |

$ | 167.69 | |

| | |

Total Fees Previously Paid | | |

| | | |

| | | |

| --- | |

| | |

Total Fee Offsets | | |

| | | |

| | | |

| --- | |

| | |

Net Fee Due | | |

| | | |

| | | |

$ | 167.69 | |

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended,

or the Securities Act, this Registration Statement also covers an indeterminate number of additional securities which may be offered and

issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or similar transactions. |

| |

|

| (2) |

Represents the additional ordinary shares reserved for future issuance

under the G Medical Innovations Holdings Ltd. 2016 Global Amended And Restated Equity Incentive Plan, G Medical Innovations Holdings Ltd.

– Israel Sub-Plan and G Medical Innovations Holdings Ltd. – U.S. Sub-Plan, as amended from time to time, or, collectively,

the Plans. |

| |

|

| (3) |

Estimated in accordance with Rule 457(c) under the Securities Act,

based upon the average of the high ($0.3864) and low ($0.3711) sales prices of the registrant’s ordinary shares as reported on the

Nasdaq Capital Market on June 30, 2023. |

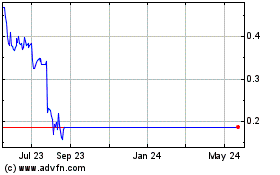

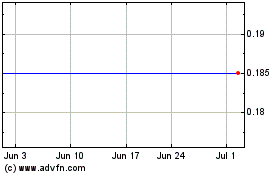

G Medical Innovations (NASDAQ:GMVD)

Historical Stock Chart

From Mar 2024 to Apr 2024

G Medical Innovations (NASDAQ:GMVD)

Historical Stock Chart

From Apr 2023 to Apr 2024