0001066923

false

0001066923

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 27, 2023

Future FinTech Group Inc.

(Exact name of registrant as specified in its

charter)

| Florida |

|

001-34502 |

|

98-0222013 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

(Address of principal executive offices, including

zip code)

888-622-1218

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

FTFT |

|

Nasdaq Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 27, 2023, Future FinTech Group Inc. (the

“Company”) received a resignation letter from Mr. Yang (Sean) Liu to resign from his position as the Chief Operating Officer

(“COO”) of the Company, effective on July 28, 2023.

On July 28, 2023, the Board of Directors of the

Company (the “Board”) appointed Mr. Peng Lei as the COO of the Company.

Mr.

Peng Lei, age 46, has served as general manager of Future Commercial Management Co., Ltd., a wholly owned subsidiary of the Company since

July 2022. From July 2019 to July 2022, Mr. Lei served as the general manager of Xi'an Dingtaiheng Supply Chain Management Co., Ltd. and

Ningbo Tielin Supply Chain Management Co., Ltd. From March 2014 to July 2019, Mr. Lei served as a director and general manager of Changan

Parking Investment Management (Shanghai) Co., Ltd. From April 2010 to March 2014, Mr. Lei was the manager of Xi'an Zhonglou Sub-branch

of Shanghai Pudong Development Bank. Mr. Lei received his Ph.D. degree and master’s degree in finance from the School of Economics

and Finance of Xi'an Jiaotong University in September 2011 and July 2009, respectively. Mr. Lei received his bachelor’s degree in

international finance from the School of Management of Xi'an Jiaotong University in July 1999.

In connection with his appointment as COO, the

Company entered into an employment agreement (the “Agreement”) with Mr. Peng Lei on August 1, 2023. The Agreement provides

that Mr. Lei will receive compensation in the amount of $50,000 per year before tax and the term of the Agreement is for one (1) year.

Mr. Lei was not selected pursuant to any arrangement

or understanding between him and any other person. There are no family relationships between Mr. Lei and the directors, nor between Mr.

Lei and any executive officer of the Company. Mr. Lei is not a party to any transaction that would require disclosure under Item 404(a)

of Regulation S-K promulgated under the Securities Act of 1933, as amended.

The foregoing description of the Agreement is

only a summary of the terms of the Agreement and does not purport to be a complete description of such document, and is qualified in its

entirety by reference to the Agreement, a copy of which is attached as an exhibit hereto and is incorporated by reference into this Item

5.02.

Item 8.01 Other Events

On August 2, 2023, the

Company issued a press release announcing the appointment of new COO. The full text of the press release is attached as Exhibit 99.1 to

this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Future FinTech Group Inc. |

| |

|

| Date: August 2, 2023 |

By: |

/s/ Shanchun Huang |

| |

Name: |

Shanchun Huang |

| |

Title: |

Chief Executive Officer |

2

Exhibit

10.1

EMPLOYMENT

AGREEMENT

This

EMPLOYMENT AGREEMENT (the “Agreement”) is made and entered into as of August 1, 2023 (the “Effective Date”),

by and between Future FinTech Group Inc., a Florida corporation (the “Company”), and Peng Lei (the “Executive”).

WITNESSETH:

WHEREAS,

the parties desire to enter into this Agreement setting forth the terms and conditions of the employment relationship between the Executive

and the Company.

NOW,

THEREFORE, in consideration of the foregoing premises and the mutual covenants and agreements contained herein, the parties hereto

agree as follows:

1.

EMPLOYMENT.

1.1

Agreement to Employ. The Company hereby agrees to employ Executive, and Executive hereby agrees to serve, subject to the provisions

of this Agreement, as an officer and employee of the Company.

1.2

Duties and Schedule. Executive shall serve as the Company’s Chief Operation Officer of the Company and shall be subject

to the bylaws of the Company and determined by the Board of Directors of the Company (the “Board”). The Executive

hereby agrees to devote his best efforts to the faithful performance of his duties and to the promotion and advancement of the business

and affairs of the Company. The Executive shall report directly to the CEO and shall have such responsibilities as designated by the

CEO to the extent that such responsibilities are not inconsistent with all applicable laws, regulations and rules. Executive shall devote

his best efforts and all of his business time to his position with the Company and shall have no other employment with a third party

during the Term.

2.

TERM OF EMPLOYMENT. Unless Executive’s employment shall sooner terminate pursuant to Section 4, the Company shall employ

Executive for a one-year term commencing on the Effective Date (the “Term”), which Term shall be renewable upon mutual

agreement of the Company and the Executive.

3.

COMPENSATION.

3.1

Salary and Bonus. Executive’s salary during the Term shall be US$50,000 per year before tax (the “Salary”).

At the sole discretion of the Board, or any committee duly designated by the Board and authorized to act thereto, the Executive shall

be eligible for an annual cash or equity bonus.

3.2

Vacation. Executive shall be entitled to 8 days of paid vacation per year. In the event that Executive remains employed by the

Company for one year or more, Executive shall be entitled to 12 days of paid vacation.

3.3

Business Expenses. Executive shall be reimbursed by the Company for all ordinary and necessary expenses incurred by Executive;

provided that they are incurred and approved in writing in accordance with the Company’s expense policy.

3.4

Benefits. During the Term, Executive shall be allowed to participate, on the same basis generally as other employees of the Company,

in all general employee benefit plans and programs, including improvements or modifications of the same, which may exist as of the Effective

Date or thereafter and which are made available by the Company to all or substantially all of its employees. Except as specifically provided

herein, nothing in this Agreement is to be construed or interpreted to increase or alter in any way the rights, participation, coverage,

or benefits under such benefit plans or programs to other than those provided to other employees pursuant to the terms and conditions

of such benefit plans and programs.

4.

TERMINATION.

4.1

Death. This Agreement shall terminate immediately upon the death of Executive, and Executive’s estate or Executive’s

legal representative, as the case may be, shall be entitled to Executive’s accrued and unpaid Salary as of the date of Executive’s

death, plus all other compensation and benefits that were vested through the date of Executive’s death.

4.2

Disability. In the event of Executive’s Disability, this Agreement shall terminate and Executive shall be entitled to (a)

accrued and unpaid Salary and vacation through the first date that a Disability is determined; and (b) all other compensation and benefits

that were vested through the first date that a Disability has been determined. “Disability” means the good faith determination

of the Board that Executive has become so physically or mentally incapacitated or disabled as to be unable to satisfactorily perform

his duties hereunder for a period of ninety (90) consecutive calendar days or for one- hundred twenty (120) days in any three-hundred

sixty (360) day period, such determination based upon a certificate as to such physical or mental disability issued by a licensed physician

and/or psychiatrist (as the case may be) mutually agreed upon by Executive and the Company.

4.3 Termination

by Company for Cause. The Company may terminate the Executive for Cause and such termination shall take effect upon the receipt

by Executive of the Notice of Termination. Upon the effective date of the termination for Cause, Executive shall be solely entitled

to accrued and unpaid Salary through such effective date. “Cause” means: (i) engaging in any act, omission

or misconduct that is injurious to the Company or an affiliate; (ii) gross negligence or willful misconduct in connection with the

performance of duties; (iii) conviction of a criminal offense (other than minor traffic offenses); (iv) fraud, embezzlement or

misappropriation of funds or property of the Company or an affiliate; (v) material breach of any term of any employment or other

services, confidentiality, intellectual property or non-competition agreements, if any, between the Executive and the Company or an

affiliate; (vi) the entry of an order duly issued by any regulatory agency (including federal, state and local regulatory agencies

and self-regulatory bodies) having jurisdiction over the Company or an affiliate requiring the removal of the Executive from any

office held with the Company or prohibiting the Executive from participating in the business or affairs of the Company or any

affiliate; or (vii) the revocation or threatened revocation of any of the Company’s or an affiliate’s government

licenses, permits or approvals, which is primarily due to the Executive’s action or inaction and such revocation or threatened

revocation would be alleviated or mitigated in any material respect by the termination of the Executive’s employment or

services with the Company or an affiliate.

4.4

Voluntary Termination by Executive. The Executive may voluntarily terminate his employment for any reason and such termination

shall take effect 30 days after the receipt by Company of the Notice of Termination. Upon the effective date of such termination, Executive

shall be entitled to (a) accrued and unpaid Salary and vacation through such termination date; and (b) all other compensation and benefits

that were vested through such termination date. In the event Executive is terminated without notice, it shall be deemed a termination

by the Company for Cause.

4.5

Notice of Termination. Any termination of the employment by the Company or the Executive shall be communicated by a notice in

accordance with Section 8.4 of this Agreement (the “Notice of Termination”). Such notice shall (a) indicate the specific

termination provision in this Agreement relied upon and (b) if the termination is for Cause, the date on which the Executive’s

employment is to be terminated.

4.6

Severance. The Executive shall not be entitled to severance payments upon any termination provided in Section 4 herein.

5.

EMPLOYEE’S REPRESENTATION. The Executive represents and warrants to the Company that: (a) he is subject to no contractual,

fiduciary or other obligation which may affect the performance of his duties under this Agreement; (b) he has terminated, in accordance

with their terms, any contractual obligation which may affect his performance under this Agreement; and (c) his employment with the Company

will not require him to use or disclose proprietary or confidential information of any other person or entity.

6. CONFIDENTIAL

INFORMATION Except as permitted or directed by the Board of Directors of the Company in writing, during the time the Executive

is employed by the Company or at any time thereafter, the Executive shall not use for his personal purposes nor divulge, furnish, or

make accessible to anyone or use in any way (other than in the ordinary course of the business of the Company) any confidential or

secret information or knowledge of the Company, whether developed by himself or by others. Such confidential and/or secret

information encompassed by this Section 6 includes, but is not limited to, the Company’s customer and supplier lists, trade

secrets, ideas, concepts, designs, software, coding, configurations, specifications, drawings, blueprints, diagrams, models,

prototypes, samples, flow charts processes, techniques, formulas, improvements, inventions, domain names, data, know-how,

discoveries, copyrightable materials, marketing plans and strategies, sales and financial reports and forecasts, studies, reports,

records, books, contracts, instruments, surveys, computer disks, diskettes, tapes, computer programs and business plans, prospects

and opportunities (such as possible acquisitions or dispositions of businesses or facilities). The Executive agrees to refrain from

any acts or omissions that would reduce the value of any confidential or secret knowledge or information to the Company, both during

his employment hereunder and at any time after the termination of his employment. The Executive’s obligations of

confidentiality under this Section 6 shall not apply to any knowledge or information that is now published publicly or that

subsequently becomes generally publicly known, other than as a direct or indirect result of a breach of this Agreement by the

Executive.

7.

NON-COMPETITION: NON-SOLICITATION; INVENTIONS.

7.1

Non-Competition. During the employment of the Executive under this Agreement and for a period of six (6) months after termination

of such employment, the Executive shall not at any time compete on his own behalf, or on behalf of any other person or entity, with the

Company or any of its affiliates within all territories in which the Company does business with respect to the business of the Company

or any of its affiliates as such business shall be conducted on the date hereof or during the employment of the Executive under this

Agreement. The ownership by the Executive of not more than 5% of a corporation, partnership or other enterprise shall not constitute

a violation hereof.

7.2

Non-Solicitation. During the employment of the Executive under this Agreement and thereafter Executive shall not at any time (i)

solicit or induce, on his own behalf or on behalf of any other person or entity, any employee of the Company or any of its affiliates

to leave the employ of the Company or any of its affiliates; or (ii) solicit or induce, on his own behalf or on behalf of any other person

or entity, any customer or Prospective Customer of the Company or any of their respective affiliates to reduce its business with the

Company or any of its affiliates. For the purposes of this Agreement, “Prospective Customer” shall mean any individual,

corporation, trust or other business entity which has either (a) entered into a nondisclosure agreement with the Company or any Company

subsidiary or affiliate or (b) has within the preceding 12 months received a currently pending and not rejected written proposal in reasonable

detail from the Company or any of the Company’s subsidiary or affiliate.

7.3

Inventions and Patents. The Company shall be entitled to the sole benefit and exclusive ownership of any intellectual property

including but not limited to copy rights, designs and patents, inventions or improvements in products, processes, or other things that

may be made or discovered by Executive while he is in the service of the Company, and all patents for the same. During the Term, Executive

shall do all acts necessary or required by the Company to give effect to this section and, following the Term, Executive shall do all

acts reasonably necessary or required by the Company to give effect to this section. In all cases, the Company shall pay all reasonable

costs and fees associated with such acts by Executive.

7.4

Return of Property. The Executive agrees that all property in the Executive’s possession that he obtains or is assigned

in the course of his employment with the Company, including, without limitation, all documents, reports, manuals, memoranda, customer

lists, credit cards, keys, access cards, and all other property relating in any way to the business of the Company, is the exclusive

property of the Company, even if the Executive authored, created, or assisted in authoring or creating such property. The Executive shall

return to the Company all such property immediately upon termination of employment or at such earlier time as the Company may request.

7.5

Court Ordered Revisions. If any portion of this Section 7 is found by a court of competent jurisdiction to be invalid or unenforceable,

but would be valid and enforceable if modified, this Section 7 shall apply with such modifications necessary to make this Section 7 valid

and enforceable. Any portion of this Section 7 not required to be so modified shall remain in full force and effect and not be affected

thereby.

7.6

Specific Performance. The Executive acknowledges that the remedy at law for any breach of any of the provisions of Section 7 will

be inadequate, and that the Company shall be entitled, in addition to any remedy at law or in equity, to preliminary and permanent injunctive

relief and specific performance.

8.

MISCELLANEOUS.

8.1

Indemnification. The Company and each of its subsidiaries shall, to the maximum extent provided under applicable law, indemnify and

hold Executive harmless from and against any expenses, including reasonable attorney’s fees, judgments, fines, settlements and

other legally permissible amounts (“Losses”), incurred in connection with any proceeding arising out of, or

related to, Executive’s employment by the Company, other than any such Losses incurred as a result of Executive’s

negligence or willful misconduct. The Company shall, assume the defense of the action or proceeding against the Executive mentioned

above and will employ counsel reasonably satisfactory to the Executive and will pay the reasonable fees and expenses of such

counsel, or advance to Executive any expenses, including attorney’s fees and costs of settlement, incurred in defending any

such proceeding to the maximum extent permitted by applicable law. Such costs and expenses incurred by Executive in defense of any

such proceeding shall be paid by the Company or applicable subsidiary in advance of the final disposition of such proceeding

promptly upon receipt by the Company of (a) written request for payment; (b) appropriate documentation evidencing the incurrence,

amount and nature of the costs and expenses for which payment is being sought; and (c) an undertaking adequate under applicable law

made by or on behalf of Executive to repay the amounts so advanced if it shall ultimately be determined pursuant to any

non-appealable judgment or settlement that Executive is not entitled to be indemnified by the Company or any subsidiary thereof. If

the Company obtains director and officer insurance coverage for any period in which Executive was an officer of the Company,

Executive shall be a named insured and shall be entitled to the coverage thereunder.

8.3

Applicable Law. Except as may be otherwise provided herein, this Agreement shall be governed by and construed in accordance with

the laws of the State of Florida, applied without reference to principles of conflict of laws. Any legal action or proceeding arising

out of or relating to this Agreement shall be brought in the courts in the State of Florida.

8.4

Amendments. This Agreement may not be amended or modified otherwise than by a written agreement executed by the parties hereto

or their respective successors or legal representatives.

8.5

Notices. All notices and other communications hereunder shall be in writing and shall be given by hand-delivery to the other party,

by an international mail courier, or by registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If

to the Executive:

Attn:

Peng Lei

If

to the Company:

Future

FinTech Group Inc.

23/F,

South Tower, Kaisa Plaza,86th Jianguo Rd.

Chaoyang

District, Beijing, China

Beijing,

China 100025

Attn: the CEO Shanchun Huang

Or

to such other address as either party shall have furnished to the other in writing in accordance herewith. Notices and communications

shall be effective when delivered to the addressee.

8.4

Withholding. The Company may withhold from any amounts payable under the Agreement, such federal, state and local income, unemployment,

social security and similar employment related taxes and similar employment related withholdings as shall be required to be withheld

pursuant to any applicable law or regulation.

8.5

Severability. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability

of any other provision of this Agreement and any such provision which is not valid or enforceable in whole shall be enforced to the maximum

extent permitted by law.

8.6

Captions. The captions of this Agreement are not part of the provisions and shall have no force or effect.

8.7

Entire Agreement. This Agreement contains the entire agreement among the parties concerning the subject matter hereof and supersedes

all prior agreements, understandings, discussions, negotiations and undertakings, whether written or oral, between the parties with respect

thereto.

8.8

Survival. The respective rights and obligations of the parties hereunder shall survive any termination of this Agreement or the

Executive’s employment hereunder to the extent necessary to the intended preservation of such rights and obligations.

8.9

Waiver. Either Party’s failure to enforce any provision or provisions of this Agreement shall not in any way be construed as a

waiver of any such provision or provisions, or prevent that party thereafter from enforcing each and every other provision of this Agreement.

8.10

Successors. This Agreement is personal to Executive and, without the prior express written consent of the Company, shall not be

assignable by Executive. This Agreement shall inure to the benefit of and be enforceable by Executive’s estate, heirs, beneficiaries,

and/or legal representatives. This Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns.

8.11

Joint Efforts/Counterparts. Preparation of this Agreement shall be deemed to be the joint effort of the parties hereto and shall

not be construed more severely against any party. This Agreement may be signed in two or more counterparts, each of which shall be deemed

an original and all of which together shall constitute one and the same instrument.

8.12

Representation by Counsel. Each Party hereby represents that it has had the opportunity to be represented by legal counsel of

its choice in connection with the negotiation and execution of this Agreement.

IN

WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

| EXECUTIVE: |

|

FUTURE FINTECH GROUP INC. |

| |

|

|

|

|

| By: |

/s/ Peng

Lei |

|

By: |

/s/ Shanchun

Huang |

| Name: |

Peng Lei |

|

Name: |

Shanchun Huang |

|

|

|

Title: |

CEO |

6

Exhibit 99.1

Future

FinTech Appoints Peng Lei as Chief Operating Officer

NEW YORK, August 2, 2023 /PRNewswire/ -- Future

Fintech Group Inc. (NASDAQ: FTFT), (hereinafter referred to as “Future FinTech”, “FTFT” or the “Company”,

a comprehensive financial and digital technology service provider, announced today that on July 28, 2023, it appointed Mr. Peng Lei as

the Chief Operating Officer (“COO”) of the Company. Mr. Lei will be fully responsible for managing the Company’s operations,

helping it to grow its supply chain financing and service business and promoting FTFT’s continued strategic transformation. Mr.

Lei replaces Mr. Yang Liu as COO, while Mr. Liu still holds various positions with the subsidiaries of the Company.

Mr. Peng Lei is an experienced senior manager

with more than 20 years of experience in several fields including supply chain finance, banking, investment management and corporate restructuring.

Since July 2022, Mr. Lei served as the general manager of Future Commercial Management Co., Ltd., a wholly owned subsidiary of the Company.

From July 2019 to July 2022, he founded two supply chain companies, Xi’an Dingtaiheng Supply Chain Management Co., Ltd. and Ningbo Tielin

Supply Chain Management Co., Ltd., and served as their general manager to develop the coal supply chain finance business. From March 2014

to July 2019, Mr. Lei founded Changan Parking Investment Management (Shanghai) Co., Ltd. and served as its director and general manager.

From April 2010 to March 2014, Mr. Lei served as the manager of Xi’an Zhonglou Sub-branch of Shanghai Pudong Development Bank, and participated

in the development of equity investment funds in Shaanxi Province. Mr. Lei received a Ph.D. and a Master’s degree in Finance from the

School of Economics and Finance, Xi’an Jiaotong University, in September 2011 and July 2009, respectively. Mr. Lei received a Bachelor’s

degree in International Finance from the School of Management, Xi’an Jiaotong University in July 1999.

Future FinTech CEO Mr. Shanchun Huang said, “Mr.

Lei is an excellent manager as he has been immersed in the financial service and technology industry for many years and has accumulated

rich management experience. Mr. Lei has not only been a leader and originator of many of the Company’s day-to-day business procedures,

but he has also had vast experience in conceiving and implementing strategic transformations. I am pleased that Mr. Lei has been appointed

as the Company’s Chief Operating Officer and am confident that Mr. Lei will undertake his new responsibilities with his full commitment,

and help the Company to further execute upon its mission.”

“FTFT is currently implementing a strategic

transformation to build a financial technology industry ecosystem. Our strategy is to use technology to promote a new blueprint of banking

and payment systems to create a closed-loop challenger banking business ecosystem, with our goal to become a top financial technology

innovation enterprise. I look forward to Mr. Lei’s help in implementing this strategy.”

Mr. Peng Lei said, “I attach great importance

to this new appointment and opportunity. I look forward to working closely with the FTFT team to help the Company achieve sustainable

development and accelerate the transformation of its global plan. I am excited about this new role and am fully committed to excellence

in every aspect of this function. As FTFT’s Chief Operating Officer, my mission is to implement innovative technology and provide

our customers with new solutions via a wide range of financial applications. Our mission is to create value for our worldwide customers,

employees and shareholders.”

About Future Fintech Group Inc.

Future FinTech Group Inc. (NASDAQ: FTFT) is a

comprehensive financial and digital technology service provider. The Company, through its subsidiaries, conducts asset management in Hong

Kong, operates a cross-border payment business in the United Kingdom, provides cryptocurrency trading data information services in the

United Arab Emirates, and engages in supply chain trading and finance businesses in China. In addition, the Company provides digital asset

computing power custody services in Paraguay and has initiated digital asset mining farm operations in the United States. FTFT adheres

to the concept of improving financial services with digital and internet technology, and provides its business and individual customers

with stable, safe and efficient digital financial services. For more information, please visit www.ftft.com.

Safe Harbor Statement

Certain of the statements

made in this press release are “forward-looking statements” within the meaning and protections of Section 27A of the Securities

Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements

include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions,

and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which

may cause the actual results, performance, capital, ownership or achievements of the Company to be materially different from future results,

performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical

fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words

such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,”

“believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point

to,” “project,” “could,” “intend,” “target” and other similar words and expressions of the

future.

All

written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including,

without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2022 and

our other reports and filings with SEC. Such reports are available upon request from the Company, or from the Securities and Exchange

Commission, including through the SEC’s Internet website at http://www.sec.gov.

We have no obligation and do not undertake to update, revise or correct any of the forward-looking statements after the date hereof, or

after the respective dates on which any such statements otherwise are made.

IR Contact:

Future FinTech Group Inc.

Tel: +1-888-622-1218

Email: ir@ftft.com

SOURCE: Future FinTech Group Inc.

###

v3.23.2

Cover

|

Jul. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity File Number |

001-34502

|

| Entity Registrant Name |

Future FinTech Group Inc.

|

| Entity Central Index Key |

0001066923

|

| Entity Tax Identification Number |

98-0222013

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

Americas Tower

|

| Entity Address, Address Line Two |

1177 Avenue of The Americas

|

| Entity Address, Address Line Three |

Suite 5100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

888

|

| Local Phone Number |

622-1218

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

FTFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

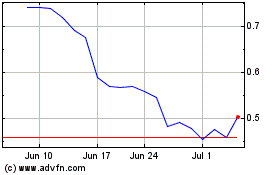

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024