Earnings Preview: Equinix Inc. - Analyst Blog

February 10 2012 - 12:25PM

Zacks

Equinix Inc. (EQIX) is scheduled to announce

its fourth quarter 2011 results on February 15, 2011, after the

market closes. We see some movement in analyst estimates at this

point.

Third Quarter Overview

Equinix delivered a mediocre third quarter, with earnings

falling short of the Zacks Consensus Estimate by 54.5%.

Equinix’ revenues in the reported quarter were $417.6 million,

up 26.4% from the year-ago quarter. Quarterly results included a

contribution of $17.9 million from the newly acquired ALOG data

centers.

Revenue growth for the quarter was driven by strong bookings.

Pricing for the company’s cabinet equipment remained stable across

all geographies while bookings and backlog remained healthy. Global

MRR churn, including switch and data, but excluding ALOG was

approximately 2.0% within the company’s targeted range.

Cash gross margin for the quarter was 65.0%, which remained flat

compared with the year-ago quarter. Total operating expenses

increased 19.9% from the year-ago quarter.

Reported net income stood at $20.3 million or 20 cents per

diluted share versus a net income of $11.2 million or 24 cents per

share in the year-ago quarter. One-time items in the quarter were

negligible.

Fourth Quarter Outlook

For fiscal 2011, the company expects total revenue to surpass

$1,600.0 million. The cash gross margin is expected to range

between 65.0% and 66.0%. Cash selling, general and administrative

expenses are expected to be approximately $320.0 million. Adjusted

EBITDA is expected to be more than $730.0 million. Capital

expenditures are expected to be in the range of $645.0 to $665.0

million.

For full-year 2012, total revenue is expected to exceed $1,870.0

million. Adjusted EBITDA for the year is expected to be more than

$850.0 million. Capital expenditures are projected at $700.0 to

$800.0 million.

Agreement of Analysts

Out of the 21 and 16 analysts providing estimates for the fourth

quarter 2011, 1 analyst raised estimates over the last 30 days,

while one analyst lowered. Again, for fiscal year 2011, 2 analysts

raised estimates, while one analyst has lowered over last 30 days.

Moreover for fiscal 2012, two analysts have revised their estimate

downward over the last 30 days, while 1 analyst revised it upward

during the same period.

Some analysts are of the opinion that the latest collaboration

of Equinix with Cable & Wireless will create a win-win

situation, as the latter will use Equinix data centers to service

global enterprise customers, augment their existing cloud

capabilities. This will help improve the customer base for Equinix,

as many would try and leverage the cloud computing expertise of the

company.

Moreover, analysts have high hopes for strong contribution from

ALOG data centers yet again. They are also positive about Equinix’

impressive data center footprint and robust network density, which

have attracted customers for a long time.

Magnitude of Estimate Revisions

We noticed that the Zacks Consensus Estimate for the fourth

quarter has gone up by 2 cents to 44 cents in the past 90 days. On

the other hand, the Zacks Consensus Estimate for fiscal 2011 has

improved by 4 cents. The Zacks Consensus Estimate for fiscal 2012

has improved by 3 cents over the past ninety days to $2.63.

Recommendation

The company has delivered mixed third quarter results with EPS

coming in below our expectations. However, the company’s focus on

collaboration and good execution are working in its favor. We

believe that further growth in the client base and strategic

acquisitions will enhance the company’s revenue potential and

expand its geographic reach.

Moreover, we are encouraged by Equinix’s effort to expand the

current facilities and maintain its fiscal discipline, while making

a considerable effort to improve its cloud computing capabilities.

We are also positive about its recurring revenue model. Despite all

the positives, competitive treats from the likes of

AT&T Inc. (T) and Verizon

Inc. (VZ) makes us cautious. European exposure and

industry consolidation are also causes for concern.

Equinix holds a Zacks #3 Rank, implying a short-term Hold

rating.

EQUINIX INC (EQIX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

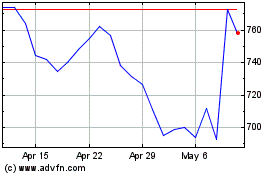

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2024 to May 2024

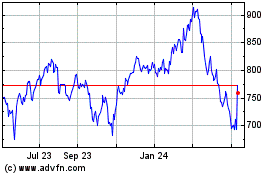

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2023 to May 2024