2nd UPDATE: Traders, Electronic Systems Tested By Tuesday's Quake

August 23 2011 - 5:24PM

Dow Jones News

Exchanges' trading operations and electronic market systems

stood firm through a 5.8 earthquake that struck Virginia early

Tuesday afternoon, according to officials.

Some traders evacuated from exchange floors and offices, but

infrastructure supporting a network of automated trading continued

without a hitch following the strongest quake to hit the state in

more than 100 years, according to the U.S. Geological Survey.

U.S. stocks briefly retreated after the quake shook the

Washington, D.C., area and sent out tremors felt in New York and

Detroit, but prices quickly rebounded. Oil and other industrial

commodities briefly dipped while gold, already settled for the day,

headed lower.

"It started rumbling and everyone looked around at each other,"

said Joseph Mazzella, managing director for equities trading at

Knight Capital Group (KCG) in Jersey City, N.J. "We ran a

diagnostic [on trading systems] behind the scenes but you didn't

see even a blink on your screen."

Representatives for NYSE Euronext (NYX), Nasdaq OMX Group Inc.

(NDAQ), BATS Global Markets, Direct Edge and the International

Securities Exchange said that dealing in securities and stock

options continued unabated following the earthquake.

The New York Stock Exchange's downtown New York trading floor

wasn't evacuated, nor was Nasdaq's Philadelphia options-trading

floor.

"It felt like there was a subway train going underneath the

building," said Jonathan Corpina, senior managing partner of

Meridian Equity Partners, a broker on the NYSE floor. Within 20

seconds it was "business as usual" again, he said.

Some traders departed the New York Mercantile Exchange floor,

though no official evacuation was ordered. IntercontinentalExchange

Inc. (ICE) did evacuate its New York floors where options on cotton

and the U.S. dollar index are traded, and Direct Edge evacuated

non-essential staff from its Jersey City headquarters.

The quake tested the high-tech infrastructure supporting stock

and derivatives markets that are now heavily electronic. New

York-area data centers run by NYSE Euronext and specialist firms

such as Equinix Inc. (EQIX) and Telx Group Inc. saw no hitches

affecting the trades and messages among exchanges, brokers and

proprietary trading firms.

Spread Networks, which runs a high-speed fiber corridor between

the New York and Chicago financial hubs, said its connections were

unaffected by the temblor.

Facilities housing exchanges' matching engines and the servers

used by traders to send orders into the market are built to

withstand catastrophes such as earthquakes, fires, floods and

lengthy power outages. NYSE Euronext over the past two years has

spent about $500 million constructing facilities in New Jersey and

the United Kingdom, with backup generators ensuring power continues

to flow in the event of a blackout.

"The bones of the building need to be extremely durable for our

purposes," said Michael Terlizzi, executive vice president of

engineering and construction for Telx, who said he couldn't feel

the quake from inside the company's facility on 8th Avenue in

Manhattan.

Telx, which houses exchanges and telecom companies in its data

centers, looks to repurpose buildings originally constructed to

house heavy industry like printing presses, according to Terlizzi.

"Right after power and fiber concentration, what we look for in a

particular property are its structural attributes," he said.

Representatives for Citigroup Inc. (C) and J.P. Morgan Chase

& Co. (JPM) said their trading operations were operating as

normal and there were no major disruptions. J.P. Morgan said it

allowed employees to leave its New York buildings voluntarily, but

there were no forced evacuations and operations continued as

normal.

The U.S. Geological Survey rated the earthquake at 5.8 late

Tuesday afternoon, after revising it downward from earlier

estimates.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

--Steve Russolillo, David Benoit and Daniel Strumpf contributed

to this article.

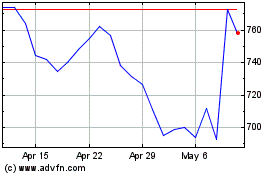

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2024 to May 2024

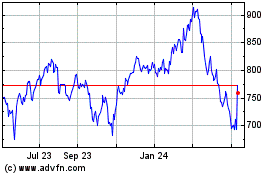

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2023 to May 2024