Conn's (CONN) and Susser Holdings (SUSS) - Zacks #1 Rank Top Performers

October 18 2011 - 8:00PM

Zacks

Conn’s Inc. (CONN) has a big blocker in the state of Texas,

which has been holding up better than most of the other 49 during

this economic malaise.

This specialty retailer, based in Beaumont, Texas that also has

locations in Louisiana and Oklahoma, saw a sharp rise in earnings

estimates after its fiscal second-quarter report, and today had a

prominent position in the Zacks #1 Rank Top Performers List.

Shares gained almost 3.1% Wednesday, which made CONN one of the

better-performing Zacks #1 Ranks with a share price over $5.

Its second-quarter report wasn’t all good news, as total sales

slipped 13.5% and same-store sales dropped 12.8%. However, earnings

per share of 17 cents surpassed the Zacks Consensus Estimate by

practically 55%. Operating income almost doubled as well.

CONN said that the changes it has made so far will drive

improved profitability moving forward, and forecasted EPS between

65 cents and 75 cents for fiscal 2012. That was better than the

Zacks Consensus Estimate at the time.

Led by that full-year outlook, the results were enough to launch

the Zacks Consensus Estimate for this fiscal year by 40% over the

past 2 months to 70 cents from 50 cents. Meanwhile, the outlook for

next fiscal year, ending January 2013, gained 13.5% in that time to

84 cents from 74 cents.

In addition, analysts currently expect EPS for next fiscal year

to advance 20% from this fiscal year.

Texas is surely big enough to handle

another Zacks #1 Rank Top Performer today. Such was the case for

Corpus Christi-based Susser Holdings Corporation (SUSS),

which gained 3% on Wednesday; a day when it offered an operating

results update for the third quarter.

Texas is surely big enough to handle

another Zacks #1 Rank Top Performer today. Such was the case for

Corpus Christi-based Susser Holdings Corporation (SUSS),

which gained 3% on Wednesday; a day when it offered an operating

results update for the third quarter.

This convenience store and gas station operator expects

same-store merchandise sales growth of about 7.4% against last

year. Furthermore, retail average per-store fuel volumes should

increase 5.6%.

As has been reported in this article before, SUSS had a solid

second quarter performance in August. Earnings per share of $1.36

beat the Zacks Consensus Estimate of 53 cents by as much as 156%,

while revenue increased to $1.38 billion from $1.02 billion last

year. Driving this positive performance were contributions from new

stores, a continued strong same-store performance and higher

margins at its fuel business.

The company’s earnings estimates retain the bump from that

second-quarter report. The Zacks Consensus Estimate for 2011 is at

$1.93 per share, or 7.8% better than 2 months ago. The outlook for

2012 is at $1.31 per share, up 7.4% in that time.

The company will report its third quarter results on Nov 9.

CONNS INC (CONN): Free Stock Analysis Report

SUSSER HLDGS CP (SUSS): Free Stock Analysis Report

Zacks Investment Research

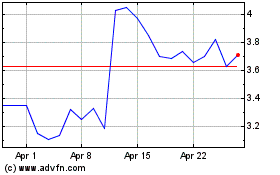

Conns (NASDAQ:CONN)

Historical Stock Chart

From May 2024 to Jun 2024

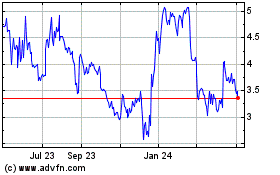

Conns (NASDAQ:CONN)

Historical Stock Chart

From Jun 2023 to Jun 2024