Alcoa and Century Aluminum Benefit From Aluminum's Greater Exposure

November 04 2011 - 8:16AM

Marketwired

Aluminum prices are at a low right now as investors worry about a

weak U.S. economy and a possible European recession negatively

affecting the global industry. With aluminum being used in many

different industries across the market, weak aluminum prices could

reflect broader economic troubles ahead. The Paragon Report

examines investing opportunities in the Aluminum industry and

provides equity research on Alcoa, Inc. (NYSE: AA) and Century

Aluminum Co. (NASDAQ: CENX). Access to the full company reports can

be found at:

www.paragonreport.com/AA

www.paragonreport.com/CENX

Aluminum prices have fallen approximately 10 percent this year

amid concerns that the global economic slowdown may cut demand for

raw materials. While that number may be alarming, ten percent is

the smallest drop among the six industrial metals traded on the

London Metal Exchange.

Aluminum has been taking on a bigger role in electronics

products as designers have started to use more environmentally

friendly materials. Industry experts explain that the metal is

easily recycled with no loss in quality. Moreover, the push by

automotive and aerospace companies to create lighter and

consequently more fuel efficient vehicles has also helped to

bolster demand for lightweight aluminum. Alcoa spokesman Kevin

Lowery said Aluminum's density is one-third that of steel.

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the aluminum industry register with us free

at www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Alcoa announced that third quarter net income rose to $172

million, or 15 cents a share, from $61 million, or 6 cents, a year

earlier. Sales increased 21 percent to $6.4 billion, beating the

$6.23 average of nine analyst estimates. Chairman and Chief

Executive Klaus Kleinfeld said he sees stable prices in the near

future for the raw materials used in making aluminum. Kleinfeld is

blaming falling aluminum prices on negative bets from the financial

industry.

Century Aluminum reported a net loss of $6.6 million ($0.07 per

basic and diluted share) for the third quarter of 2011. Financial

results were positively impacted by a mark-to-market gain on

forward contracts of $4.2 million related primarily to aluminum put

options. Cost of sales for the quarter included a $13.5 million

charge for lower of cost or market inventory adjustments.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

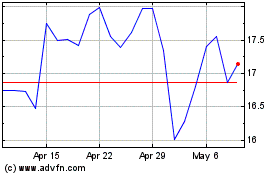

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Apr 2024 to May 2024

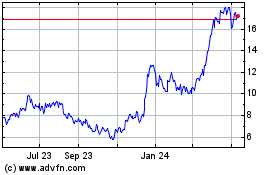

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From May 2023 to May 2024