UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[X] Soliciting Material Under Rule 14a-12

Forgent Networks, Inc.

108 Wild Basin Road, Austin, Texas 78746

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

The Red Oak Fund, LP, a Delaware limited partnership;

Pinnacle Fund, LLLP, a Colorado limited liability limited partnership;

Bear Market Opportunity Fund, L.P., a Delaware limited partnership;

Pinnacle Partners, LLC, a Colorado limited liability company;

Red Oak Partners, LLC, a New York limited liability company;

David Sandberg.

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by

Exchange Act Rule 0 11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or

Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

In connection with the annual meeting of Forgent Networks, Inc. (the "Company")

scheduled to be held on July 30, 2009, Pinnacle Fund, LLLP ("Pinnacle") has

nominated a slate of directors in opposition to the nominees proposed by the

Company. Pinnacle may share copies of certain correspondence between it and

the Company with other holders and is issuing a press release expressing

certain concerns. Therefore, Pinnacle is filing such correspondence and press

release pursuant to Rule 14a-12.

Red Oak Partners, LLC offers the following timeline and history regarding all

of its communication with or regarding ASUR since the Go-Private effort was

rejected by shareholders and the special meeting was canceled by Asure

Software's Board:

On June 3, 2009, Richard Snyder of Asure Software ("ASUR") called David

Sandberg of the Pinnacle Fund LLLP ("Pinnacle") and informed him that ASUR's

directors would be willing to consider a presentation from Red Oak's nominees

regarding their intended business plan, pursuant to which discussions regarding

whether certain of Red Oak's nominees could be added to the Company's

recommended slate for the upcoming election of Directors would be made (by

ASUR's current directors). Mr. Sandberg informed Mr. Snyder that 1)

presentations to a Board were highly uncommon in these instances, 2) that he

believed his slate had far greater shareholder support, and 3) that he sought

replacement of the entire Board but that in the interest of avoiding another

costly proxy fight he would do everything he could to facilitate a productive

meeting. After coordinating with his nominees, on June 3 Mr. Sandberg sent an

email communication to Mr. Snyder with recommended logistics for such a

meeting, which is attached as Exhibit A.

Attached as Exhibit B is Mr. Snyder's June 4 reply via email in which he

suggested alternative meeting dates and locations, and attached as Exhibit C is

Mr. Sandberg's June 4 reply issued later that same day. Also on June 4,

Pinnacle Fund and Red Oak Partners issued a press release thanking ASUR

shareholders for their support in defeating the Go-Private effort attempted by

ASUR's management and Board. In the press release, Pinnacle and Red Oak also

expressed their interest in working with ASUR's Board "as soon as possible

towards cost reductions and Board elections." This press release is attached

as Exhibit D. There was no further response or communication to Mr. Sandberg's

June 4 email from ASUR or Mr. Snyder.

In an effort to attempt to work with ASUR's management and Board and "to not

have to engage ASUR in another costly proxy contest" (as stated explicitly in

Pinnacle' June 4 press release), Mr. Sandberg called Mr. James Gladney and

asked that he attempt to set up further dialogue through ASUR Director Lou

Mazzuchelli, who Mr. Gladney knew through common acquaintances. Mr. Gladney

informed Mr. Sandberg that he had spoken with Mr. Mazzuchelli, who had

expressed that ASUR's Board and Mr. Snyder were upset at Red Oak's June 4 press

release, that the Go-Private vote was not nearly as decided as the press

release had stated, and that they believed Red Oak had a side agenda to take

control of ASUR. After five days had elapsed without formal response from ASUR

since Mr. Sandberg's last email communication, on June 9 Mr. Sandberg issued a

follow-up email to Mr. Snyder directly addressing all three of these issues.

The email also provided detail as to what Mr. Sandberg's recommended course of

action to a new Board would be, additional background as to the complementary

capabilities of Red Oak's nominees, and still requested a meeting, inclusive of

a conference call that coming weekend. This June 9 email communication is

attached as Exhibit E. Attached to this communication was the final Go-Private

vote tally for non-objecting beneficial holders as provided from Broadridge to

Pinnacle. This tally is attached as Exhibit F.

Two days later, on June 11, Mr. Snyder's communication was emailed to Mr.

Sandberg through another ASUR employee (Lisa Flynn). In the communication, Mr.

Snyder referred to Red Oak's "efforts to gain control without paying a

premium," which Mr. Sandberg had thought he had assuaged by the very fact that

Red Oak employees only represented two of the six nominees and that there were

no other affiliations with any of the other nominees, three of whom had come

from other large shareholders. Accordingly, it would be impossible for Red Oak

to control ASUR's Board if its slate was elected. This communication is

attached as Exhibit G.

On June 12, Mr. Sandberg replied to Mr. Snyder's email and reiterated that

there was no search for control. He also stated "We do not agree that you have

an "effective strategy" and because of this, we are not confident that the

existing directors have any ability to carry out long-term profitability or to

maximize shareholder value. Further, our prior communications detailed a

comprehensive process for review as well as plans to reduce excessive

management compensation, excessive provider costs, and to enact a reverse split

coupled with a stock repurchase plan in order to maintain a NASDAQ listing and

to provide for potentially accretive share repurchases." Lastly, he informed

Mr. Snyder of his intent to submit a 220 demand letter requesting access to

ASUR information which he believed shareholders had a right to know, regarding

company expenses and the Go-Private vote count. This email is attached as

Exhibit H.

On June 15, Red Oak faxed and couriered the 220 demand letter, attached as

Exhibit I, which requires that information be provided within five business

days. Also attached to this demand letter was a true and correct copy of a DTC

report showing the Pinnacle Fund is the holder of record of 500,000 shares as

of May 15, 2009, attached as Exhibit J.

On June 18, ASUR held its earnings call. No questions were asked on the call,

and on June 19, Mr. Sandberg issued a communication, attached as Exhibit K,

asking: 1) for confirmation that ASUR intended to comply with the 220 demand

request, 2) why shareholders were not allowed to ask questions on the June 18

earnings call and informing ASUR that Red Oak knew of at least six individuals

who were unable to ask questions (only one of which was affiliated with Red Oak

or Pinnacle), and 3) ASUR to correct its public filings to include shares owned

by the Fenil Shah group per its May 28 Schedule 13D Filed with the SEC.

Finally, on June 22 Mr Sandberg issued an email communication directly to ASUR

director Lou Mazzuchelli. This communication, attached as Exhibit L, asked why

shareholders had not been permitted to ask questions on the June 18 call and

stated "As a large shareholder, communication with the management team of a

company I have invested real dollars with is of great importance, especially

given the expectation for this type of communication on at least a quarterly

basis. Given the contested proxy, I am happy to have Red Oak and Pinnacle

employees abstain from asking questions so as to not place Asure's management

in difficult situations facing tough questions from us in a public forum.

Again, our interest is in allowing shareholders as a whole to ask questions

about a company which they collectively own." No one at ASUR including Mr.

Snyder and Mr. Mazzuchelli responded to this or to any communication since June

11.

Attached as Exhibit M is ASUR's general counsel Mark Johnson's (from the firm

Winstead P.C.) June 22 letter issued to Pinnacle's legal counsel, Pete Tennyson

of Paul, Hastings, Janofsky, & Walker LLP stating "the Company will not be

providing Pinnacle access to the Company's books and records and other

documents as demanded." Attached as Exhibit N is Mr. Tennyson's June 24

response to Mr. Johnson, informing him of why the request was applicable and

citing relevant cases, finishing with "If the Company has an appropriate and

compelling reason to keep specific elements of the requested information

confidential, Pinnacle is willing to discuss these concerns. However, a

general denial of access to all information is not acceptable." On June 25,

Mr. Johnson issued Mr. Tennyson a letter (attached as Exhibit O) claiming "The

cases you cited as authority for your position are clearly off point. Given

that, I'm not sure what else need be said."

On June 29, Pinnacle Fund sent a letter to ASUR - attached as Exhibit P -

asking them to initiate another call to allow shareholders to ask questions

about the company, calling for disclosure of information, and rejecting ASUR's

assertion that Pinnacle is "attempting to seize control of your Company without

a tender offer," as alleged in ASUR's June 17 press release. Also, on June 29

Pinnacle Fund and Red Oak Partners issued a press release reporting that it had

sent ASUR the letter attached as Exhibit N and requested that ASUR re-open the

earnings call, provide transparency regarding information which Pinnacle

believes shareholders have a right to know, and re-stated that it was not

seeking control of ASUR and that its slate of six nominees consisted of just

two employees of Red Oak or Pinnacle. This press release is attached as

Exhibit Q.

Pinnacle intends to file a definitive proxy statement soliciting votes for

Pinnacle's nominees to the Company's board of directors. Pinnacle is not

asking you at this time to vote on its slate of directors. Once Pinnacle's

definitive proxy statement for the annual meeting becomes available, Pinnacle

strongly advises stockholders to carefully read that definitive proxy

statement, as it will contain important information. Information concerning

Pinnacle and any other persons deemed participants in Pinnacle's solicitation

of proxies from stockholders in connection with the annual meeting will be

available in Pinnacle's definitive proxy statement for the annual meeting.

Once Pinnacle's definitive proxy statement for the annual meeting becomes

available, stockholders will be able to obtain, free of charge, copies of that

statement and any other documents Pinnacle files with or furnishes to the

Securities and Exchange Commission through the Securities and Exchange

Commission's website at www.sec.gov.

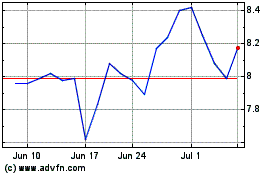

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

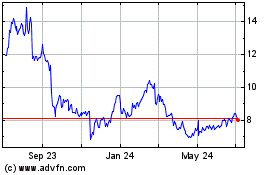

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024