SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1) of the Securities Exchange Act of 1934

IMPERIAL OIL LIMITED

(Name of Subject Company (Issuer))

IMPERIAL OIL LIMITED

(Filing Person(s) (Offeror(s))

Common Stock, without par value

(Title of Class of Securities)

453038408

(CUSIP Number of Class of Securities)

Ian Laing

Vice-President, General Counsel and Corporate Secretary

505 Quarry Park Boulevard S.E.

Calgary,Alberta,

Canada T2C 5N1

(800) 567-3776

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

Copies to:

Patrick S. Brown

Sullivan & Cromwell LLP

1888 Century Park East

21st Floor

Los Angeles, California 90067

(310) 712-6600

☐ Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ third-party tender offer subject to Rule 14d-1.

☒ issuer tender offer subject to Rule 13e-4.

☐ going-private transaction subject to Rule 13e-3.

☐ amendment to Schedule 13D under Rule 13d-2.

☐ Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ Rule 13e-4(i) (Cross-Border Issuer Tender Offer).

☐ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer).

This Amendment No. 1 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission (the “SEC”) on November 3, 2023 (“Schedule TO”), relating to an offer by Imperial Oil Limited, a Canadian corporation (the “Company”), to purchase a number of shares of its common stock, without par value (the “Shares”), for an aggregate purchase price not exceeding C$1,500,000,000, at a purchase price not less than C$78.50 and not more than C$94.00 per Share, in cash, without interest, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated November 3, 2023 (the “Offer to Purchase”), together with the accompanying issuer bid circular (the “Issuer Bid Circular”), and in the related Letter of Transmittal (the “Letter of Transmittal”) and Notice of Guaranteed Delivery (which, together with any amendments or supplements thereto, collectively constitute the “Offer”).

The information in the Schedule TO, including all exhibits to the Schedule TO, which were previously filed with the Schedule TO or any amendment thereto, is incorporated herein by reference in response to Items 1 through 11 of the Schedule TO, except that such information is hereby amended and supplemented to the extent specifically provided in this Amendment. All capitalized terms used but not specifically defined in this Amendment shall have the meanings given to such terms in the Offer to Purchase and the Issuer Bid Circular. The items and exhibits of the Schedule TO set forth below are hereby amended and restated as follows:

AMENDMENTS TO OFFER TO PURCHASE

The Offer to Purchase (Exhibit (a)(1)(i) to the Schedule TO) and the corresponding Items of Schedule TO into which such information is incorporated by reference are hereby amended as follows:

The first paragraph under the heading “Determination of Validity, Rejection and Notice of Defect” beginning on page 16 of the Offer to Purchase is hereby amended and restated to state: “All questions as to the number of tenders to be accepted, the form of documents and the validity, eligibility (including time of receipt) and acceptance for payment of any Shares will be determined by the Company, in its sole discretion, which determination shall be final and binding on all parties, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction. Imperial reserves the absolute right to reject any deposits of Shares determined by it not to be in proper form or completed in accordance with the instructions herein and in the Letter of Transmittal or the acceptance for payment of or payment for which may, in the opinion of the Company’s counsel, be unlawful. Imperial also reserves the absolute right to waive any of the conditions of the Offer or any defect or irregularity in the deposit of any particular Shares, and Imperial’s interpretation of the terms of the Offer (including these instructions) will be final and binding on all parties, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction. No individual deposit of Shares will be deemed to be properly made until all defects and irregularities have been cured or waived. Unless waived, any defects or irregularities in connection with deposits must be cured within such time as Imperial shall determine. None of Imperial, the Depositary, the Dealer Manager nor any other Person is or will be obligated to give notice of defects or irregularities in deposits, nor shall any of them incur any liability for failure to give any such notice. The Company’s interpretation of the terms and conditions of the Offer (including the Letter of Transmittal and the Notice of Guaranteed Delivery) will be final and binding, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

The first sentence in the fourth paragraph in Section 6 of the Offer to Purchase is hereby amended and restated to state: “All questions as to the form and validity (including time of receipt) of notices of withdrawal will be determined by the Company, in its sole discretion, which determination shall be final and binding, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

The second sentence in the second paragraph in Section 7 of the Offer to Purchase is hereby amended and restated to state: “Any determination by the Company concerning the events described in this Section 7 shall be final and binding on all parties, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

The first sentence in the fifth paragraph in Section 13 of the Offer to Purchase is hereby amended and restated to state: “The Company, in its sole discretion, shall be entitled to make a final and binding determination of all questions relating to the interpretation of the Offer, the validity of any acceptance of the Offer and the validity of any withdrawals of Shares, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

AMENDMENTS TO LETTER OF TRANSMITTAL

The Letter of Transmittal (Exhibit (a)(1)(ii) to the Schedule TO) and the corresponding Items of Schedule TO into which such information is incorporated by reference are hereby amended as follows:

The third sentence in the tenth paragraph of the Letter of Transmittal is hereby amended and restated to state: “The Company’s determination as to pro-ration shall be final and binding on all parties, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

Section 10 of the Letter of Transmittal is hereby amended and restated to state: “All questions as to the number of Shares to be taken up, the price to be paid therefor, the form of documents and the validity, eligibility (including time of receipt) and acceptance for payment of any deposit of Shares will be determined by Imperial, in its sole discretion, which determination shall be final and binding on all parties, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction. Imperial reserves the absolute right to reject any deposits of Shares determined by it not to be in proper form or completed in accordance with the instructions in the Offer and in this Letter of Transmittal or the acceptance for payment of or payment for which may, in the opinion of Imperial’s counsel, be unlawful. Imperial also reserves the absolute right to waive any of the conditions of the Offer or any defect or irregularity in the deposit of any particular Shares and Imperial’s interpretation of the terms of the Offer (including the instructions in the Offer and this Letter of Transmittal) will be final and binding on all parties, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction. No individual deposit of Shares will be deemed to be properly made until all defects and irregularities have been cured or waived. Unless waived, any defects or irregularities in connection with deposits must be cured within such time as Imperial shall determine. None of Imperial, the Depositary, the Dealer Manager nor any other person is or will be obligated to give notice of defects or irregularities in notices of withdrawal, nor shall any of them incur any liability for failure to give any such notice. Imperial’s interpretation of the terms and conditions of the Offer (including this Letter of Transmittal and the Notice of Guaranteed Delivery) will be final and binding, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

AMENDMENTS TO THE SUMMARY ADVERTISEMENT

The Summary Advertisement (Exhibit (a)(1)(v) to the Schedule TO) (the “Summary Advertisement”) is hereby amended as follows:

The Summary Advertisement is hereby amended to add the following sentence to the end of the first paragraph: “The Company is offering to purchase the Shares for cancellation in order to continue the Company’s long-standing commitment to returning surplus cash to shareholders.”

ITEM 7

Item 7(b) of the Schedule TO is hereby amended and restated in its entirety to read as follows:

“None.”

ITEM 12. EXHIBITS.

The following are attached as exhibits to this Schedule TO:

| | | | | |

| (a)(1)(i) | |

| (a)(1)(ii) | |

| (a)(1)(iii) | |

| (a)(1)(iv) | |

| (a)(1)(v) | |

| (a)(5)(i) | |

| (a)(5)(ii) | |

| (a)(5)(iii) | |

| (a)(5)(iv) | |

| (d)(i) | Form of Letter relating to Supplemental Retirement Income (Incorporated herein by reference to Exhibit (10)(c)(3) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1980 (File No. 2-9259)).* |

| (d)(ii) | Deferred Share Unit Plan for Nonemployee Directors (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1998 (File No. 0-12014)).* |

| (d)(iii) | |

| (d)(iv) | |

| | | | | |

| (d)(v) | |

| (d)(vi) | |

| (d)(vii) | |

| 99.1 | |

| 107 | |

† Included in mailing to shareholders.

* Previously Filed.

** Filed herewith.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3.

Not Applicable.

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | | | | | | | | |

| Imperial Oil Limited |

| | | |

| By: | /s/ Ian Laing |

| | | |

| | | |

| | Name: | Ian Laing |

| | Title: | Vice President, General Counsel and Corporate Secretary |

| | | |

| | | |

| By: | /s/ Cathryn Walker |

| | | |

| | | |

| | Name: | Cathryn Walker |

| | Title: | Assistant Corporate Secretary |

| | | |

Date: November 15, 2023

EXHIBIT INDEX

| | | | | |

| Exhibit | |

| (a)(1)(i) | Offer to Purchase, dated November 3, 2023, together with the Issuer Bid Circular.* |

| (a)(1)(ii) | Form of Letter of Transmittal.* |

| (a)(1)(iii) | Form of Notice of Guaranteed Delivery.* |

| (a)(1)(iv) | Form of Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9.† |

| (a)(1)(v) | Summary Advertisement as published on November 3, 2023 in the Wall Street Journal.* |

| (a)(5)(i) | Pre-Commencement Press Release Announcing Earnings issued by the Company on October 27, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 27, 2023).* |

| (a)(5)(ii) | Pre-Commencement Press Release Announcing Intention to Launch Substantial Issuer Bid issued by the Company on October 27, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 27, 2023).* |

| (a)(5)(iii) | Transcript of earnings release conference call of the Company on October 27, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 30, 2023).* |

| (a)(5)(iv) | Pre-Commencement Press Release Announcing Terms of Substantial Issuer Bid issued by the Company on October 30, 2023 (Incorporated herein by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on October 31, 2023).* |

| (d)(i) | Form of Letter relating to Supplemental Retirement Income (Incorporated herein by reference to Exhibit (10)(c)(3) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1980 (File No. 2-9259)).* |

| (d)(ii) | Deferred Share Unit Plan for Nonemployee Directors (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the Company’s Annual Report on Form 10-K for the year ended December 31, 1998 (File No. 0-12014)).* |

| (d)(iii) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2011 and subsequent years, as amended effective November 14, 2011 (Incorporated herein by reference to Exhibit 9.01(c)10(iii)(A)(1) of the Company’s Form 8-K filed on February 23, 2012 (File No. 0-12014)).* |

| (d)(iv) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2016 and subsequent years, as amended effective October 26, 2016 (Incorporated herein by reference to Exhibit 9.01(c)10(iii)(A)(1) of the Company’s Form 8-K filed on October 31, 2016 (File No. 0-12014)).* |

| (d)(v) | Amended Short Term Incentive Program with respect to awards granted in 2016 and subsequent years, as amended effective October 26, 2016 (Incorporated herein by reference to Exhibit 9.01(c)10(iii)(A)(1) of the Company’s Form 8-K filed on October 31, 2016 (File No. 0-12014)).* |

| (d)(vi) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2020 and subsequent years, as amended effective November 24, 2020 (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 (File No. 0-12014)).* |

| (d)(vii) | Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2022 and subsequent years, as amended effective November 29, 2022 (Incorporated herein by reference to Exhibit (10)(iii)(A)(7) of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (File No. 0-12014)). |

| 99.1 | Material Change Report, dated November 3, 2023.* |

| 107 | Filing Fee Table.** |

† Included in mailing to shareholders.

* Previously Filed.

** Filed herewith.

Exhibit 107

Calculation of Filing Fee Tables

SC TO

(Form Type)

IMPERIAL OIL LIMITED

(Exact Name of Registrant as Specified in its Charter)

Table 1 – Transaction Valuation

| | | | | | | | | | | |

| Transaction Valuation |

Fee rate | Amount of Filing Fee |

Fees to Be Paid | $1,084,350,000.00(1) | 0.00014760 | $160,050.06 |

Fees Previously Paid | | | |

Total Transaction Valuation | | | $1,084,350,000.00 |

Total Fees Due for Filing | | | $160,050.06(2) |

Total Fees Previously Paid | | | |

Total Fee Offsets | | | |

Net Fee Due | | | $160,050.06 |

| | | | | | | | | | | | | | |

| (1) | The transaction value is estimated for purposes of calculating the amount of the filing fee only. The repurchase price of the Common Shares, as described in the Schedule TO, is C$1,500,000,000. The repurchase price has been converted into U.S. dollars based on an exchange rate on October 30, 2023, as reported by the Bank of Canada, for the conversion of Canadian dollars into U.S. dollars of C$1 equals US$0.7229. |

| (2) | The fee of $160,050.06 was paid in connection with the filing of the Schedule TO-I by the Company (File No. 005-35902) on November 3, 2023. |

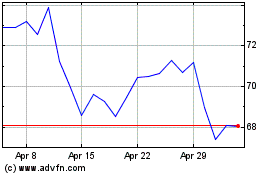

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024