Exploration budget increasing by $1.1 million

for additional drilling at San Sebastian

Hecla Mining Company (NYSE:HL) today provided an update on its

exploration programs during the second quarter.

Second Quarter Exploration Highlights

- High-grade intersections at the East

Francine Vein confirm a robust resource and, in combination with

the East Middle Vein resource nearby, may represent a new

underground mining area at San Sebastian.

- Drilling of the West Middle Vein has

confirmed potential new reserves that are close to the underground

development at San Sebastian.

- Additional $1.1 million in planned

exploration expenditures at San Sebastian to identify deeper, base

metal rich mineralization in the Middle and West Francine veins

with similar minerology as the Hugh Zone.

- Company expects to have sufficient

material at San Sebastian to fill the mill, and has secured it,

through 2020.

- Surface drilling has defined resources

that may increase the number and size of the open pits along the

Casa Berardi Fault.

- Drilling of East Ore, NWW and Upper

Plate zones should convert resources into reserves in the upper and

central part of the Greens Creek Mine.

“Our continued and focused exploration programs at San

Sebastian, Casa Berardi and Greens Creek are paying off with

potential pit expansions and the discovery of new high-grade zones

underground,” said Phillips S. Baker, Jr., President and CEO. “At

San Sebastian, we have discovered new high-grade underground

mineralization on the Middle and East Francine veins and

mineralization on new veins that have the potential to further

extend mine life. Four years after acquiring Casa Berardi, we

continue to have success identifying high-grade reserves

underground and expanding the open pit potential. Finally, drilling

at Greens Creek is upgrading resources to reserves, confirming our

understanding of the mineralized trends and discovering new

mineralization.”

San Sebastian

Due to significant drilling success over the past four years,

near-surface, high-grade zones are being open pit mined on the

project. Now reserves are being developed for underground mining.

During the quarter three core drills were active along the Middle

and Francine veins, refining recently discovered resources to

prolong high margin metals production and on drilling the newly

defined San Judas veins. A RC (reverse circulation) drill has been

drilling newly identified mineralized veins north and northwest of

the mine area.

In-fill holes were drilled along the western portion of the

Middle Vein to aid stope design for underground mine

development. Recent high-grade intercepts of the Middle Vein

immediately west of the current underground mine development

include 0.03 oz/ton gold, 12.2 oz/ton silver, 1.0% lead, 1.5%

zinc, and 0.9% copper over 11.0 feet. Significantly, these

intercepts are to the west of the current underground mine

development and could expand the near-term underground mine plan in

this area. Although these veins are narrow they show good

continuity and are open to the west and at depth. Deeper drilling

in this area has identified similar base metal-bearing

mineralization to the previously discovered Hugh Zone at depth in

the Francine Vein. Significant drilling will be initiated to

evaluate the potential of “Hugh Zone-like” base metal

mineralization at depth along the Middle and West Francine veins

targeting high temperature Fluid Inclusion and Raman Spectrometry

data.

In late 2016, a new ore shoot at the East Francine Vein

was discovered and drilling has defined an area over 800 feet of

strike length and 600 feet down dip. We are also exploring for new

ore shoots in the vicinity. Recent assay results from the East

Francine Vein include 0.72 oz/ton gold and 288.2 oz/ton silver

over 4.6 feet and 0.68 oz/ton gold and 136 oz/ton silver over

4.7 feet. Drilling of the East Middle Vein, which defines an

area over 700 feet of strike length and 600 feet down-dip, recently

intersected 0.23 oz/ton gold and 18.6 oz/ton silver over 6.7

feet. The East Middle Vein is open along strike to the east and is

parallel to recently discovered mineralization along the East

Francine Vein. The proximity of these two resources may provide the

critical mass to develop a new mining area east of historic mining

of the Francine Vein.

In the fall of 2016, the San Judas Vein was discovered by

RC drilling approximately 1,000 feet north of the North Vein open

pit. Drilling results in the second quarter include

0.01 oz/ton gold and 3.7 oz/ton silver over 5.2 feet, although

a number of assays are pending. The San Judas Vein has very large

size potential and has only been drill tested over a fraction of

its known strike length.

For the remainder of the year, drilling will seek to expand

further the precious metal-rich resources along the Middle, North

and Francine veins and evaluate new vein targets such as the San

Judas and Zapata Norte veins. This program will also evaluate

deeper base metal targets on the Middle and Francine veins. Shallow

RC drilling from 1,000 to 3,000 feet northwest of the North Vein

intersected the western extension of the San Judas Vein carrying

anomalous gold and silver values. A DC (Direct Current) resistivity

geophysical survey at San Sebastian was conducted during the second

quarter to evaluate vein extensions to the Middle, North and

Francine veins.

More complete drill assay highlights from San Sebastian can be

found in Table A at the end of this release and a presentation

showing drill intersection locations is available at the

following http://ir.hecla-mining.com/interactive/newlookandfeel/4130678/Hecla-Q2-2017-ExplorationUpdate.pdf.

Casa Berardi – Quebec

During the second quarter five underground drills were used to

refine stope designs and expand reserves and resources in the 118,

123, and 124 zones. Up to three drills on surface completed both

in-fill and exploration drilling to define a possible series of

open pit areas along the Casa Berardi Fault.

Drilling of the Lower 118 Zone confirmed the continuity

of multiple mineralized lenses that extend for over 1,600 feet

down-plunge and remain open to depth below the bottom of the

current workings. This drilling also confirmed previous

intersections from surface drilling and expanded the resource to

the west. The new resources to the west show strong mineralization

and included intersections of 0.18 oz/ton gold over 26.0 feet and

0.23 oz/ton gold over 17.1 feet.

Drilling of stacked, high-grade lenses of the 123 Zone

show that mineralized lenses identified higher in the mine extend

to depth and define a semi-continuous mineralized zone of over

3,000 feet down dip and 1,600 feet of strike length. Initial

drilling lower in the mine suggests sulfide-rich mineralization is

open to the east and to depth. Drilling of the lower 123

Zone at the bottom of the mine confirmed the high-grade

resource model with intersections of 0.74 oz/ton gold over 18.3

feet and 0.25 oz/ton gold over 40.4 feet and suggest there is good

potential to find mineralization down-plunge below the current

workings of the mine. The proximity of these new lenses to mine

infrastructure should enable near-term production. Underground

definition and exploration drilling of the 124 Zone

intersected extensions of earlier defined lenses from surface,

returning 0.33 oz/ton gold over 9.8 feet and 0.22 oz/ton over 20.6

feet, and showing the lenses that start on surface remain open

down-plunge to the east.

The surface open pit potential on the mine property is good and

a series of potential pits along the Casa Berardi Fault are being

investigated. Surface drilling along the northeast extension of the

proposed Principal Pit area confirmed its continuity to the

northeast and includes an intersection of 0.18 oz/ton gold over

82.0 feet and shows the potential to increase a future Principal

pit.

Recent surface drilling near the Casa Berardi Fault at the

134 Zone has identified a series of high-grade, sub-parallel

veins including 0.32 oz/ton gold over 42.2 feet within broad zones

of mineralization including 0.10 oz/ton gold over 105.1 feet that

show promise for an open pit. Definition drilling of the 160

Zone, including 0.15 oz/ton gold over 66.0 feet and 0.25 oz/ton

gold over 16.6 feet has upgraded the resource to indicated resource

category, and is the basis for the current investigation into the

viability of an open pit.

Surface drilling of the west extension of the East Mine Crown

Pillar (EMCP) pit and southwest on the adjacent 146 Zone

has intersected strong mineralization including 0.11 oz/ton gold

over 35.8 feet that shows continuity and may extend the open pit.

Surface drilling west of the West Shaft has intersected strong

mineralization up-dip of the Lower Inter and South West zones

including 0.07 oz/ton gold over 180 feet and is an early indication

of the near-surface potential. Assay results from drilling in the

West Block of Casa Berardi confirmed gold mineralization

near the Casa Berardi Fault and include 0.13 oz/ton gold over 17.9

feet and 0.14 oz/ton gold over 3.5 feet. These drill results

are being compiled and targets defined for a follow-up program next

year.

Due to the identification of new resource trends near surface

and underground throughout the West Mine, there was a significant

increase in inferred ounces in 2016. In-fill drilling in 2017 may

convert a large portion of those to indicated category with the

eventual incorporation into the life of mine plan and exploration

drilling continues to expand these mineralized zones.

More complete drill assay highlights from Casa Berardi can be

found in Table A at the end of the release and a presentation

showing drill intersection locations is available at the following

http://ir.hecla-mining.com/interactive/newlookandfeel/4130678/Hecla-Q2-2017-ExplorationUpdate.pdf.

Greens Creek – Alaska

At Greens Creek, drilling in the second quarter refined

resources of the East Ore, NWW, Upper Plate,

and West zones for possible conversion to reserves and may

also have expanded some of these zones. Significant assay results

from previous drilling were also received from the 9A and

Deep Southwest zones. This program has been successful in

defining potential reserves in the core area of the mine close to

surface and the mine portal.

Drilling of the East Ore Zone compares favorably to

previously modeled resource estimates at higher elevations that may

expand the current resource model. Recent intersections include

26.7 oz/ton silver, 0.10 oz/ton gold, 10.0% zinc, and 5.4% lead

over 5.6 feet and 29.7 oz/ton silver, 0.07 oz/ton gold, 1.8% zinc,

and 1.0% lead over 5.4 feet. Exploration drilling immediately west

of the East Ore Zone in the Klaus Shear structure also identified

new mineralization. Recent drilling of the West Zone

suggests resource additions along the nose and eastern limb as well

as along the Maki Fault. Intersections include 643.5 oz/ton silver,

1.8 oz/ton gold, 14.9% zinc, and 7.8% lead over 4.8 feet and

31.7 oz/ton silver, 0.21 oz/ton gold, 13.6% zinc, and 6.5% lead

over 4.6 feet.

Recent assay results from the 9A Zone suggest the current

resource may increase and include 27.5 oz/ton silver, 0.03 oz/ton

gold, 15.8% zinc, and 7.9% lead over 8.2 feet and 10.4 oz/ton

silver, 0.04 oz/ton gold, 11.3% zinc, and 2.2% lead over 45.0 feet.

These resources are immediately available to existing ramps.

Drilling of the Deep Southwest Zone identified

mineralization that extends north of previous mining in the zone

and down to the upper limb of the NWW. Recent assay results include

47.2 oz/ton silver, 0.22 oz/ton gold, 4.3% zinc, and 2.0% lead

over 7.9 feet.

Surface drilling at Greens Creek commenced in late June at the

Gallagher target. Initial drilling has intersected a mineralized

zone up to 100-feet thick with sheared veins and breccia locally

containing strong base metal mineralization along the flat-lying

Klaus Shear. These intersections are over 1,500 feet west of ore

zones on the Klaus Shear at the mine and may represent extensions

of known mineralization at the mine. The surface program at Greens

Creek is planned for over 21,000 feet to evaluate the Gallagher,

East Ore and 5250 zone targets.

More complete drill assay highlights from Greens Creek can be

found in Table A at the end of this release and a presentation

showing drill intersection locations is available at the

following http://ir.hecla-mining.com/interactive/newlookandfeel/4130678/Hecla-Q2-2017-ExplorationUpdate.pdf.

Other Properties

Summer fieldwork on the Opinaca-Wildcat project near the

Eleonore Mine in northern Quebec, and summer drilling at the Little

Baldy property in Idaho and the Kinskuch property in northern

British Columbia are underway. Resource modeling of the Montanore

mineralization is complete and coordination with hydrologic and

geotechnical consultants is underway to augment mine design and

future drilling. The mine plan for Montanore is expected to be

updated with the new 2016 block model.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska, Idaho

and Mexico, and is a growing gold producer with an operating mine

in Quebec, Canada. The Company also has exploration and

pre-development properties in seven world-class silver and gold

mining districts in the U.S., Canada, and Mexico, and an

exploration office and investments in early-stage silver

exploration projects in Canada.

Cautionary Statements Regarding Forward Looking

Statements

Statements made or information provided in this news release

that are not historical facts are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 and "forward-looking information" within the meaning of

Canadian securities laws. Words such as “may”, “will”, “should”,

“expects”, “intends”, “projects”, “believes”, “estimates”,

“targets”, “anticipates” and similar expressions are used to

identify these forward-looking statements. The material factors or

assumptions used to develop such forward-looking statements or

forward-looking information include that the Company’s plans for

development and production will proceed as expected and will not

require revision as a result of risks or uncertainties, whether

known, unknown or unanticipated, to which the Company’s operations

are subject.

Forward-looking statements involve a number of risks and

uncertainties that could cause actual results to differ materially

from those projected, anticipated, expected or implied. These risks

and uncertainties include, but are not limited to, metals price

volatility, volatility of metals production and costs, litigation,

regulatory and environmental risks, operating risks, project

development risks, political risks, labor issues, ability to raise

financing and exploration risks and results. Refer to the Company's

Form 10K and 10-Q reports for a more detailed discussion of

factors that may impact expected future results. The Company

undertakes no obligation and has no intention of updating

forward-looking statements other than as may be required by

law.

Cautionary Statements to Investors on Reserves and

Resources

Reporting requirements in the United States for disclosure of

mineral properties are governed by the SEC and included in the

SEC's Securities Act Industry Guide 7, entitled “Description of

Property by Issuers Engaged or to be Engaged in Significant Mining

Operations” (Guide 7). However, the Company is also a “reporting

issuer” under Canadian securities laws, which require estimates of

mineral resources and reserves to be prepared in accordance with

Canadian National Instrument 43-101 (NI 43-101). NI 43-101 requires

all disclosure of estimates of potential mineral resources and

reserves to be disclosed in accordance with its requirements. Such

Canadian information is being included here to satisfy the

Company's “public disclosure” obligations under Regulation FD of

the SEC and to provide U.S. holders with ready access to

information publicly available in Canada.

Reporting requirements in the United States for disclosure of

mineral properties under Guide 7 and the requirements in Canada

under NI 43-101 standards are substantially different. This

document contains a summary of certain estimates of the Company,

not only of proven and probable reserves within the meaning of

Guide 7, which requires the preparation of a “final” or “bankable”

feasibility study demonstrating the economic feasibility of mining

and processing the mineralization using the three-year historical

average price for any reserve or cash flow analysis to designate

reserves and that the primary environmental analysis or report be

filed with the appropriate governmental authority, but also of

mineral resource and mineral reserve estimates estimated in

accordance with the definitional standards of the Canadian

Institute of Mining, Metallurgy and Petroleum referred to in NI

43-101. The terms “measured resources”, “indicated resources,” and

“inferred resources” are Canadian mining terms as defined in

accordance with NI 43-101. These terms are not defined under Guide

7 and are not normally permitted to be used in reports and

registration statements filed with the SEC in the United States,

except where required to be disclosed by foreign law. The term

“resource” does not equate to the term “reserve”. Under Guide 7,

the material described herein as “indicated resources” and

“measured resources” would be characterized as “mineralized

material” and is permitted to be disclosed in tonnage and grade

only, not ounces. The category of “inferred resources” is not

recognized by Guide 7. Investors are cautioned not to assume that

any part or all of the mineral deposits in such categories will

ever be converted into proven or probable reserves. “Resources”

have a great amount of uncertainty as to their existence, and great

uncertainty as to their economic and legal feasibility. It cannot

be assumed that all or any part of such a “resource” will ever be

upgraded to a higher category or will ever be economically

extracted. Investors are cautioned not to assume that all or any

part of a “resource” exists or is economically or legally mineable.

Investors are also especially cautioned that the mere fact that

such resources may be referred to in ounces of silver and/or gold,

rather than in tons of mineralization and grades of silver and/or

gold estimated per ton, is not an indication that such material

will ever result in mined ore which is processed into commercial

silver or gold.

Qualified Person (QP) Pursuant to Canadian National

Instrument 43-101

Dean McDonald, PhD. P.Geo., Senior Vice President - Exploration

of Hecla Mining Company, who serves as a Qualified Person under

National Instrument 43-101, supervised the preparation of the

scientific and technical information concerning Hecla’s mineral

projects in this news release. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of sample, analytical or

testing procedures for the Greens Creek Mine are contained in a

technical report prepared for Hecla titled “Technical Report for

the Greens Creek Mine, Juneau, Alaska, USA” effective date March

28, 2013, and for the Lucky Friday Mine are contained in a

technical report prepared for Hecla titled “Technical Report on the

Lucky Friday Mine Shoshone County, Idaho, USA” effective date April

2, 2014, for the Casa Berardi Mine are contained in a technical

report prepared for Hecla titled "Technical Report on the Mineral

Resource and Mineral Reserve Estimate for the Casa Berardi Mine,

Northwestern Quebec, Canada" effective date March 31, 2014 (the

"Casa Berardi Technical Report"), and for the San Sebastian Mine

are contained in a technical report prepared for Hecla titled

"Technical Report for the San Sebastian Ag-Au Property, Durango,

Mexico" effective date September 8, 2015. Also included in these

three technical reports is a description of the key assumptions,

parameters and methods used to estimate mineral reserves and

resources and a general discussion of the extent to which the

estimates may be affected by any known environmental, permitting,

legal, title, taxation, socio-political, marketing or other

relevant factors. Copies of these technical reports are available

under Hecla's profile on SEDAR at www.sedar.com.

Table A - Assay Results – Q2

2017

San Sebastian (Mexico)

Zone

Drill HoleNumber

SampleFrom (ft)

SampleTo (ft)

Width(feet)

TrueWidth(feet)

Gold(oz/ton)

Silver(oz/ton)

Zinc(%)

Lead(%)

Copper(%)

Middle Vein SS-1286 314.5 317.6 3.1

2.9 0.01 3.6 0.01 0.00

0.00 Middle Vein SS-1287 580.5 587.2

6.9 6.7 0.23 18.6 0.01 0.01

0.01 Middle Vein SS-1288 970.9 972.3

1.5 1.2 0.01 1.7 0.03

0.02 0.00 Middle Vein SS-1289 634.6

636.2 2.0 1.5 0.01 5.4 0.01

0.00 0.00 Middle Vein SS-1291 632.4

635.0 2.6 2.5 0.01 2.9

0.02 0.01 0.00 Middle Vein SS-1293

979.2 985.4 6.9 6.2 0.01 2.3

0.02 0.02 0.01 Middle Vein SS-1297

890.9 894.2 3.4 3.3 0.01

5.2 0.04 0.03 0.01 Middle Vein SS-1300

680.8 693.7 12.8 11.0 0.03

12.2 1.49 1.02 0.89 Middle Vein

SS-1316 726.2 729.3 3.1 2.4 0.02

4.1 0.22 0.16 0.01 Middle Vein

SS-1319 256.2 259.4 3.2 3.2 0.20

2.1 0.00 0.00 0.00 East Francine

SS-1290 277.4 281.3 4.0 3.8 0.07

6.3 0.04 0.00 0.00 East Francine

SS-1295 977.7 983.9 6.2 6.2 0.04

11.6 0.04 0.02 0.01 East Francine

SS-1337 187.9 189.3 4.6 4.6

0.72 288.2 0.40 0.30 0.10

including 188.4 188.7 1.1

1.1 2.95 1186.9 1.80 1.40 0.50

East Francine SS-1340 677.0 687.0 10.0

9.7 0.02 11.6 0.10 0.10

0.00 East Francine SS-1345 691.4 699.1

7.8 7.6 0.01 3.7 0.00 0.00

0.00 East Francine SS-1346 706.1 710.7

4.7 4.7 0.68 135.9 0.30

0.20 0.10 San Judas SS-1334 523.2 528.7

5.5 5.2 0.01 3.7 0.01

0.00 0.00

Casa Berardi (Quebec)

Zone

Drill HoleNumber

DrillHoleSection

DrillHoleAzm/Dip

SampleFrom

SampleTo

TrueWidth(feet)

Gold(oz/ton)

DepthFromMineSurface(feet)

Upper 118 - 530 Level CBP-0530-379 12299

180/-34 217.8 246.1 15.1 0.16

-1843.4 118 CBP-0530-379 12299 180/-34

325.5 335.3 5.1 0.27 -1890.9 Lower 118

- 950-990 Levels CBP-0950-012 11968 191/-33

129.9 171.6 38.3 0.15 -3196.2

118 CBP-0950-017 11938 180/-49 157.5

200.1 26.0 0.18 -3250.9 118

CBP-0950-018 11938 180/-39 147.6 167.3

13.6 0.19 -3217.1 118 CBP-0950-020

11940 179/17 111.9 137.8 23.7

0.17 -3073.4 118 CBP-0950-022 11999

190/-45 202.1 232.6 17.6 0.30

-3270.0 118 CBP-0950-024 12001 190/-27

90.2 134.5 39.1 0.18 -3168.8 118

CBP-0970-016 11970 202/-39 101.7

128.0 17.1 0.23 -3246.9 118

CBP-0970-016 11965 202/-39 154.2 167.7

9.1 0.21 -3274.2 118 CBP-0970-018

11969 202/20 78.7 103.7 20.5

0.19 -3139.9 Lower 123 - 950-1070 Levels

CBP-0611 12357 176/-26 655.8 669.3

12.1 0.21 -3299.6 123 CBP-0613

12371 176/-10 542.3 585.3 40.4

0.25 -3212.0 123 CBP-0614 12389 167/-37

737.2 755.9 11.8 0.54 -3531.0

123 CBP-0615 12387 167/-30 713.6

744.8 20.4 0.22 -3435.1 Lower 123 - 830-1010

Levels CBP-0870-099 12405 180/-3 60.7

65.6 4.7 1.72 -2845.4 123

CBP-0870-104 12464 149/-8 183.7 194.6

9.1 0.32 -2863.6 123 CBP-0870-105

12460 149/-26 150.3 203.4 30.8

0.28 -2919.8 123 CBP-0870-105 12469

149/-26 236.2 255.9 13.7 0.20

-2949.0 123 CBP-0870-110 12435 179/27

51.5 62.3 10.7 0.29 -2811.8 123

CBP-0870-111 12434 179/-21 65.9

108.3 18.3 0.74 -2874.3 123

CBP-0910-084 12277 159/-30 507.2 537.7

20.3 0.31 -3211.7 123 CBP-0910-085

12280 159/-39 628.0 658.1 17.0

0.30 -3354.0 123 CBP-0910-087 12271

146/-46 442.9 452.8 4.3 0.45

-3278.6 123 CBP-0910-088 12231 172/6

353.3 376.6 22.9 0.20 -2912.4

Upper Principal 124 CBP-0330-038 12513 148/-16

276.2 280.8 9.8 0.33 -1104.8 124

CBP-0330-039 12438 197/-35 426.5

448.5 20.6 0.22 -1284.3 Surface - Principal

Pit Area CBS-17-758 12360 360/-45 246.1

354.3 82.0 0.18 -164.0 124

CBS-17-760 12330 360/-45 262.8 271.7

6.6 0.13 -210.0 Surface - 134 Pit Area

CBF-134-004 13192 355/-45 141.1 193.6

41.1 0.15 -116.6 134 CBF-134-005

13189 355/-57 183.7 256.9 39.4

0.14 -199.3 134 CBF-134-007 13209

360/-55 190.3 246.1 42.2 0.32

-187.7 134 CBF-134-007 13208 360/-55

260.8 303.1 24.4 0.08 -237.4 134

CBF-134-007 13208 360/-55 441.3 536.4

87.4 0.05 -397.9 134 CBF-134-015

13287 356/-60 301.5 324.1 16.6

0.25 -269.8 134 CBF-134-026 13324

358/-62 659.4 674.2 12.5 0.16

-563.8 134 CBF-134-028 13274 343/-47

295.3 416.0 105.0 0.10 -253.8 134

CBF-134-037 13343 352/-61 475.7

498.7 21.9 0.10 -433.8 134 CBF-134-037

13342 352/-61 521.7 528.2 5.2

0.11 -465.2 Surface - EMCP Pit CBF-148-004

14685 360/-45 241.1 265.7 19.0

0.07 -189.7 148 CBF-148-013 14639

360/-54 187.0 226.4 35.8 0.11

-163.1 148 CBF-148-017 14672 360/-45

364.2 418.3 47.3 0.06 -287.0 148

CBF-148-017 14672 360/-45 482.3

526.6 38.0 0.05 -366.1 148 CBF-148-020

14623 360/-50 324.8 354.3 25.3

0.05 -288.4 148 CBF-148-045 14468

360/-60 483.9 515.7 25.7 0.07

-407.5 Surface - 160 Pit CBF-160-011 16005

360/-45 106.0 172.2 66.0 0.15

-113.2 160 CBF-160-020 15939 360/-45

457.7 502.0 22.1 0.20 -330.3 160

CBF-160-020 15938 360/-45 541.3

615.2 48.5 0.07 -390.7 160 CBF-160-021

15955 9/-48 649.6 733.3 83.5

0.07 -465.0 160 CBF-160-022 15941

4/-55 157.5 260.8 80.2 0.09

-171.0 160 CBF-160-043 15868 360/-52

364.2 482.3 93.6 0.09 -344.5 160

CBF-160-044 16021 360/-45 251.0

300.2 45.6 0.16 -206.5 160 CBF-160-056

15920 357/-45 124.7 526.6 329.8

0.07 -235.4 Surface - SW-NW Area CBS-17-766

10681 180/-50 265.7 508.5 180.4

0.07 -147.6 SW CBS-17-766 10681

180/-50 722.4 736.5 10.6 0.09

-36.1

Casa Berardi - West Block

Zone

Drill Hole Number

DrillHoleAzm/Dip

SampleFrom

SampleTo

TrueWidth(feet)

Gold(oz/ton)

DepthFromSurface(feet)

West Block CBS-17-783 340/-49 1186.0

1197.5 7.5 0.05 -895

1266.4 1268.1 1.1 0.03

-956 CBS-17-784 340/-50 879.3

882.2 1.9 0.04 -674

CBS-17-785 360/-46 426.5 446.2 13.7

0.03 -307 including

436.4 439.7 2.3 0.06 -314

CBS-17-786 360/-50 439.7 467.5

17.9 0.13 -337 including

462.6 467.5 3.1 0.50 -354

CBS-17-787 360/-53 1022.0 1025.3

2.0 0.06 -816 CBS-17-788 355/-53

441.3 444.6 2.0 0.13 -352

768.6 774.3 3.5

0.14 -614

956.1 964.6 5.1 0.04 -764

including 958.8 960.6 1.1

0.09 -766 CBS-17-795 360/-46

284.8 286.4 1.1 0.05 -205

448.8 452.8 2.7

0.10 -323

Greens Creek (Alaska)

Zone

DrillHoleNumber

DrillholeAzm/Dip

SampleFrom

SampleTo

TrueWidth(feet)

Silver(oz/ton)

Gold(oz/ton)

Zinc(%)

Lead(%)

DepthFromMinePortal(feet)

9A GC4490 243/61 0.00 9.00 8.2

27.50 0.03 15.85 7.90 -164

15.00 17.50

2.3 13.54 0.08 9.90 4.40 -164

113.50 116.20

2.4 20.56 0.04 16.54 11.27

-69 131.40

136.40 4.5 20.05 0.01 11.30 6.00

-69 GC4493 243/20 0.00

4.00 3.5 13.03 0.01 12.30 5.80

-99 58.60

66.50 6.8 21.16 0.03 7.39 3.53

-99 186.00

238.00 45.0 10.44 0.04 11.30

2.18 -99 308.00

314.50 5.6 7.75 0.05 17.39

3.16 -99 GC4497 243/31

103.00 111.60 7.4 19.54 0.02

16.21 13.35 -79

160.40 165.00 4.0 12.11 0.02

15.99 4.41 -79

206.80 210.00 2.8 7.71

0.04 23.50 7.30 -79

292.00 295.60 3.1 10.10

0.01 14.10 5.10 -79

GC4500 210/50 108.90 113.50 4.2

15.76 0.02 17.33 12.15 -119

GC4503 243/33 128.70 131.00 2.2

23.52 0.03 24.20 17.30 -109

133.00 136.00

2.8 36.80 0.01 2.10 1.13

-109 140.80 155.80

14.1 8.13 0.01 7.56 3.69

-109 256.60 264.20

7.1 11.82 0.01 8.80 2.29

-9 GC4505 243/17 148.00 150.50

2.5 25.93 0.02 16.33 6.51

-134 GC4509 243/52 150.00 155.00

4.5 10.74 0.03 3.80 2.40

-84 South West Bench GC4498 353/-13 267.70

275.20 5.5 37.66 0.11 8.37

4.18 -389 West GC4516 243/12

2.50 4.70 2.2 24.41 0.03 13.69

6.30 -199 GC4517 63/13

146.00 151.00 3.2 73.57 0.46

9.42 4.80 -159 GC4525 243/4

0.00 51.00 17.4 19.88 0.17

26.37 14.84 -194 GC4526

243/-14 0.00 13.50 4.6 16.47

0.03 14.97 7.26 -199 GC4530

63/-60 32.30 43.00 10.5 23.25

0.23 17.97 7.93 -234

GC4533 243/-55 158.00 178.50 19.3

13.94 0.14 9.41 3.18 -344

GC4535 243/-37 149.00 157.00 7.9

21.36 0.06 4.94 1.92 -334

161.00 170.00 8.9

24.99 0.20 5.42 2.40 -334

GC4537 243/8 54.70 97.00 14.5

26.31 0.20 22.08 12.63 -184

GC4538 243/8 25.00 27.20

2.2 93.00 0.35 3.05 1.36 -241

GC4544 243/9 96.70 108.00

4.8 642.73 1.80 14.92 7.83 -179

113.00 140.00

11.4 18.58 0.16 29.27 17.65

-179 142.50

204.00 26.0 9.47 0.24 24.28 9.92

-174 GC4549 243/-53 87.70

100.00 10.1 8.81 0.03 13.13 6.52

-279 GC4552 243/-31 158.00

163.00 3.2 58.44 0.39 5.98

2.75 -289 GC4559 243/-60

77.50 80.00 2.0 42.83 0.14 7.98

3.56 -259

117.50 121.50 3.3 14.54 0.12

7.85 3.07 -229 GC4563 243/-19

87.70 126.70 13.3 14.65 0.18

23.96 11.56 -209

131.00 147.00 5.5 23.15

0.42 18.23 7.09 -234 GC4567

63/-1 42.50 46.00 2.5 6.34

0.06 16.08 8.91 -199

72.50 79.00 4.6

31.72 0.21 13.56 6.48 -199

GC4572 230/-52 7.00 10.00 2.3

7.88 0.04 9.28 6.10 -209

39.50 43.00 2.7

19.14 0.03 7.74 4.55 -229

GC4577 227/-37 16.00 21.80 4.4

12.11 0.08 13.68 8.81 -214

GC4578 256/-58 132.00 208.00

26.0 8.50 0.14 12.96 3.37

-319 230.80 241.20

3.6 18.12 0.28 14.05 4.03

-409 GC4584 256/-44 79.00 89.40

3.6 14.35 0.10 6.68 2.76

-289 GC4586 256/-66 27.80 32.40

3.5 16.43 0.06 5.01 2.33

-236 74.00 91.00

16.7 8.39 0.13 13.02 3.03

-279 GC4590 227/-60 40.50 52.00

10.8 27.49 0.04 9.09 5.09

-249 58.00 64.00

5.6 15.17 0.02 3.09 1.54

-269 East Ore GC4528 63/34 711.50

745.00 16.8 4.36 0.16 7.98 2.08

1071 GC4531 63/-1 374.70

379.70 4.9 28.26 0.00 3.40 1.76

651 GC4542 91/-6 179.00

181.50 2.5 49.31 0.11 13.20 5.50

691 GC4548 100/-7 195.00

201.00 5.6 26.69 0.10 10.02 5.40

686 GC4551 63/-55 416.00

420.70 4.1 6.27 0.12 10.70 2.77

321 GC4564 63/-28 335.00

338.00 2.9 6.48 0.21 1.08 0.25

506 GC4570 63/19 533.10

538.00 3.8 10.83 0.02 8.31 2.93

856 542.00

546.70 3.6 6.21 0.03 13.87 6.30

856 GC4574 63/25 578.20

582.60 3.4 1.12 0.02 23.99 6.36

916 590.20

600.50 7.9 6.53 0.12 21.31 8.95

916 GC4579 63/32 709.00

716.00 5.4 7.06 0.14 7.78 2.14

1041 GC4593 63/30 639.00

647.60 4.6 4.83 0.11 8.97 1.91

981 GC4598 63/25 582.00

587.00 3.2 12.47 0.52 3.78 1.31

931 597.00

602.00 3.2 10.48 0.14 2.82 1.00

931 622.00

629.00 4.5 10.84 0.31 15.07 4.83

931 GC4602 63/21 517.00

521.00 2.9 24.21 0.00 1.73 0.72

856 GC4605 63/26 570.00

573.50 2.3 3.28 0.11 12.77 2.35

926 594.80

602.60 5.2 5.46 0.12 13.33 3.59

926 GC4608 63/-59 414.50

417.50 2.6 21.75 0.08 11.29 2.12

336 GC4609 63/-35 353.00

358.50 5.4 29.67 0.07 1.76 0.66

466 GC4610 63/30 644.00

681.60 18.8 9.20 0.09 17.65 5.86

1031 GC4613 63/15 482.50

497.00 12.2 6.04 0.11 23.48 9.08

801 GC4618 63/27 559.00

586.00 18.1 6.71 0.10 14.56 4.44

941 595.00

599.00 2.7 6.07 0.28 1.05 0.44

941 GC4623 63/-88 518.50

524.50 6.0 3.31 0.30 21.60 3.90

151 GC4626 63/10 457.00

473.50 14.1 5.91 0.14 9.69 2.93

766 477.50

480.00 2.1 9.05 0.03 5.51 3.51

766 GC4636 63/-77 542.90

548.30 5.4 12.58 0.11 21.72 5.79

146 Deep South West GC4594 145/-62

634.40 637.40 3.0 23.22 0.34

22.30 9.10 -1259

641.90 648.00 6.1 15.02 0.12

23.78 7.49 -1259 GC4604

170/-60 774.40 777.00 2.5 37.53

0.42 22.50 9.40 -1359

792.40 801.00 8.3 22.56

0.15 6.56 2.48 -1384

851.00 859.20 7.9

47.18 0.22 4.30 1.98 -1429

Lucky Friday (Idaho)

Vein

Drill HoleNumber

Drill HoleAzm/Dip

SampleFrom

SampleTo

TrueWidth(feet)

Ag(oz/ton)

Zinc(%)

Lead(%)

MineLevel

Elevation(feet)

30 GH65-28 189.9/0.0 300.00 308.40

8.4 52.1 5.0 26.4 6455

-3075 60 GH65-28 187.6/-0.1 218.20

219.50 1.3 27.5 2.1 25.3 6455

-3075 70 GH65-28 187.6/-0.1 178.90

185.70 6.8 10.1 1.1 9.6

6455 -3075 80 GH65-28 187.6/-0.1 153.80

159.40 5.6 29.0 0.3 21.7

6455 -3075 100 GH65-28 187.4/+0.1 80.30

83.10 2.8 8.3 0.1 9.9

6455 -3075 110 GH65-28 186.7/-0.1 63.00

67.70 4.7 44.4 0.2 0.5

6455 -3075

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170802006478/en/

Hecla Mining CompanyMike Westerlund, 800-HECLA91

(800-432-5291)Vice President, Investor

Relationshmc-info@hecla-mining.comwww.hecla-mining.com

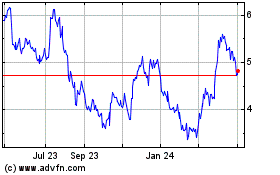

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2024 to May 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From May 2023 to May 2024