Big 5 Sporting Goods Corporation (NASDAQ:BGFV) (the “Company”), a

leading sporting goods retailer, today reported financial results

for the fiscal 2017 second quarter ended July 2, 2017.

For the fiscal 2017 second quarter, net sales

were $243.7 million compared to net sales of $241.4 million for the

second quarter of fiscal 2016. Same store sales increased

0.8% for the second quarter of fiscal 2017, reflecting continued

market share gains resulting from the closure of certain major

competitors last year, but also lower demand for certain hardgoods

product categories, primarily related to firearms, camping and

water sports. As anticipated, sales comparisons to the prior

year were negatively affected by calendar shifts related to the

Easter and Fourth of July holidays.

Gross profit for the fiscal 2017 second quarter

was $79.3 million, compared to $76.3 million in the second quarter

of the prior year. The Company’s gross profit margin was

32.5% in the fiscal 2017 second quarter versus 31.6% in the second

quarter of the prior year, reflecting an increase in merchandise

margins of 37 basis points and a decrease in distribution expense

resulting from higher costs capitalized into inventory.

Selling and administrative expense as a

percentage of net sales was 30.4% in the fiscal 2017 second quarter

versus 29.9% in the second quarter of the prior year. Overall

selling and administrative expense for the quarter increased by

$1.9 million from the prior year primarily due to higher employee

labor expense and expenses related to information technology

systems and services.

Net income for the second quarter of fiscal 2017

was $2.8 million, or $0.13 per diluted share, compared to net

income for the second quarter of fiscal 2016 of $2.1 million, or

$0.10 per diluted share. Results for the second quarter of

fiscal 2016 included a charge of $0.01 per diluted share for the

write-off of deferred tax assets related to share-based

compensation.

For the 26-week period ended July 2, 2017, net

sales were $496.3 million compared to net sales of $475.9 million

in the first 26 weeks of last year. Same store sales

increased 4.3% in the first 26 weeks of fiscal 2017 versus the

comparable period last year. Net income for the first 26

weeks of fiscal 2017 was $8.1 million, or $0.37 per diluted share,

compared to net income for the first 26 weeks of fiscal 2016 of

$1.0 million, or $0.05 per diluted share, including $0.04 per

diluted share of charges for the write-off of deferred tax assets

related to share-based compensation.

“After a solid start to the period, sales for

our second quarter came in below expectations,” said Steven G.

Miller, the Company’s Chairman, President and Chief Executive

Officer. “Same store sales increased in the low

mid-single-digit range for each of our April and May periods, but

decreased in the low single-digit range for June as we experienced

weakness in certain outdoor product categories related to firearms,

camping and water sports, and also began to cycle some of the

benefit from the competitor store closures that occurred last

year. As a result of the weakness in June, same store sales

in our hardgoods category decreased in the low single-digit range

for the quarter. Our apparel category continued to perform

exceptionally well throughout the quarter, with same store sales

increasing in the high single-digit range, and same store sales in

our footwear category increased in the low single-digit range for

the period.”

“During the third quarter, we expect sales

comparisons to be pressured as we continue to cycle the lift in

sales that we experienced last year as a result of the competitor

store closures, while also operating in a challenging retail

environment. Our efforts are focused on retaining the market

share gains that we have produced over the past year, and we

believe that our inventories are well positioned for the remainder

of the summer and the back to school season.”

Quarterly Cash Dividend The

Company's Board of Directors has declared a quarterly cash dividend

of $0.15 per share of outstanding common stock, which will be paid

on September 15, 2017 to stockholders of record as of September 1,

2017.

Share Repurchases During the

fiscal 2017 second quarter, pursuant to its share repurchase

program, the Company repurchased 6,400 shares of its common stock

for a total expenditure of $0.1 million. During the fiscal

2017 third quarter through July 31, 2017, the Company has

repurchased 373,847 shares of its common stock for a total

expenditure of $4.3 million. As of July 31, 2017, the Company

had $19.0 million available for future repurchases under its $25.0

million share repurchase program.

GuidanceFor the fiscal 2017 third quarter, the

Company expects same store sales to be in the negative low

single-digit range and earnings per diluted share to be in the

range of $0.22 to $0.32, compared to a same store sales increase of

6.8% and earnings per diluted share of $0.38, including $0.03 per

diluted share for store closing costs, in the third quarter of

fiscal 2016. Fiscal 2017 third quarter guidance reflects a

small benefit as a result of the calendar shift related to the

Fourth of July holiday.

Store OpeningsDuring the second

quarter of fiscal 2017, the Company opened two stores, ending the

quarter with 433 stores in operation. The Company anticipates

closing one store in the third quarter. For the fiscal 2017

full year, the Company currently anticipates opening approximately

six new stores and closing approximately three stores.

Conference Call InformationThe

Company will host a conference call and audio webcast today, August

1, 2017, at 2:00 p.m. Pacific (5:00 p.m. EDT), to discuss financial

results for the second quarter of fiscal 2017. To access the

conference call, participants in North America should dial (888)

487-0355, and international participants should dial (719)

325-2157. Participants are encouraged to dial in to the

conference call ten minutes prior to the scheduled start

time. The call will also be broadcast live over the Internet

and accessible through the Investor Relations section of the

Company’s website at www.big5sportinggoods.com. Visitors to

the website should select the “Investor Relations” link to access

the webcast. The webcast will be archived and accessible on

the same website for 30 days following the call. A telephone

replay will be available through August 8, 2017 by calling (844)

512-2921 to access the playback; passcode is 8127399.

About Big 5 Sporting Goods CorporationBig 5 is

a leading sporting goods retailer in the western United States,

operating 433 stores under the “Big 5 Sporting Goods” name as of

the fiscal quarter ended July 2, 2017. Big 5 provides a

full-line product offering in a traditional sporting goods store

format that averages 11,000 square feet. Big 5’s product mix

includes athletic shoes, apparel and accessories, as well as a

broad selection of outdoor and athletic equipment for team sports,

fitness, camping, hunting, fishing, tennis, golf, winter and summer

recreation and roller sports.

Except for historical information contained

herein, the statements in this release are forward-looking and made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

known and unknown risks and uncertainties and other factors that

may cause Big 5’s actual results in current or future periods to

differ materially from forecasted results. Those risks and

uncertainties include, among other things, continued or worsening

weakness in the consumer spending environment and the U.S.

financial and credit markets, fluctuations in consumer holiday

spending patterns, breach of data security or other unauthorized

disclosure of sensitive personal or confidential information, the

competitive environment in the sporting goods industry in general

and in Big 5’s specific market areas, inflation, product

availability and growth opportunities, changes in the current

market for (or regulation of) firearm-related products, seasonal

fluctuations, weather conditions, changes in cost of goods,

operating expense fluctuations, changes in laws or regulations,

including those related to tariffs and duties, lower than expected

profitability of Big 5’s e-commerce platform or cannibalization of

sales from Big 5’s existing store base which could occur as a

result of operating the e-commerce platform, litigation risks,

stockholder campaigns and proxy contests, disruption in product

flow, changes in interest rates, credit availability, higher

expense associated with sources of credit resulting from

uncertainty in financial markets and economic conditions in

general. Those and other risks and uncertainties are more fully

described in Big 5’s filings with the Securities and Exchange

Commission, including its Annual Reports on Form 10-K and Quarterly

Reports on Form 10-Q. Big 5 conducts its business in a highly

competitive and rapidly changing environment. Accordingly, new risk

factors may arise. It is not possible for management to predict all

such risk factors, nor to assess the impact of all such risk

factors on Big 5’s business or the extent to which any individual

risk factor, or combination of factors, may cause results to differ

materially from those contained in any forward-looking statement.

Big 5 undertakes no obligation to revise or update any

forward-looking statement that may be made from time to time by it

or on its behalf.

FINANCIAL TABLES FOLLOW

| |

|

|

|

|

|

|

| BIG 5 SPORTING GOODS CORPORATION |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Unaudited) |

| (In thousands, except share amounts) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

July 2,

2017 |

|

|

January 1, 2017 |

|

ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash |

|

$ |

6,628 |

|

|

$ |

7,895 |

|

| Accounts

receivable, net of allowances of $40 and $42, respectively |

|

|

12,125 |

|

|

|

12,200 |

|

| Merchandise

inventories, net |

|

|

328,716 |

|

|

|

294,319 |

|

| Prepaid

expenses |

|

|

11,531 |

|

|

|

10,085 |

|

|

Total current assets |

|

|

359,000 |

|

|

|

324,499 |

|

| |

|

|

|

|

|

|

| Property

and equipment, net |

|

|

77,438 |

|

|

|

78,420 |

|

| Deferred income

taxes |

|

|

21,640 |

|

|

|

23,699 |

|

| Other assets, net of

accumulated amortization of $1,508 and $1,420, respectively |

|

|

2,656 |

|

|

|

2,528 |

|

| Goodwill |

|

|

4,433 |

|

|

|

4,433 |

|

|

Total assets |

|

$ |

465,167 |

|

|

$ |

433,579 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| Accounts

payable |

|

$ |

116,433 |

|

|

$ |

109,314 |

|

| Accrued

expenses |

|

|

61,847 |

|

|

|

76,887 |

|

| Current portion

of capital lease obligations |

|

|

1,698 |

|

|

|

1,326 |

|

|

Total current liabilities |

|

|

179,978 |

|

|

|

187,527 |

|

| |

|

|

|

|

|

|

| Deferred rent, less

current portion |

|

|

16,096 |

|

|

|

17,028 |

|

| Capital lease

obligations, less current portion |

|

|

2,890 |

|

|

|

1,999 |

|

| Long-term debt |

|

|

47,920 |

|

|

|

10,000 |

|

| Other long-term

liabilities |

|

|

11,501 |

|

|

|

11,988 |

|

|

Total liabilities |

|

|

258,385 |

|

|

|

228,542 |

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

|

| Common stock,

$0.01 par value, authorized 50,000,000 shares; issued 24,921,672

and |

|

|

|

|

|

|

| 24,784,367 shares, respectively; outstanding 22,139,456

and 22,012,651 shares, respectively |

249 |

|

|

|

248 |

|

| Additional

paid-in capital |

|

|

115,189 |

|

|

|

114,797 |

|

| Retained

earnings |

|

|

125,851 |

|

|

|

124,363 |

|

| Less:

Treasury stock, at cost; 2,782,216 and 2,771,716 shares,

respectively |

|

|

(34,507 |

) |

|

|

(34,371 |

) |

|

Total stockholders' equity |

|

|

206,782 |

|

|

|

205,037 |

|

|

Total liabilities and stockholders' equity |

|

$ |

465,167 |

|

|

$ |

433,579 |

|

|

|

|

|

|

|

|

|

| BIG 5 SPORTING GOODS CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited) |

| (In thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

|

26 Weeks Ended |

| |

|

|

July 2, 2017 |

|

|

July 3, 2016 |

|

|

July 2, 2017 |

|

|

July 3, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

243,671 |

|

$ |

241,409 |

|

$ |

496,275 |

|

$ |

475,937 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

164,363 |

|

|

165,152 |

|

|

333,345 |

|

|

328,715 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

79,308 |

|

|

76,257 |

|

|

162,930 |

|

|

147,222 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling

and administrative expense |

|

|

74,188 |

|

|

72,259 |

|

|

148,832 |

|

|

143,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

5,120 |

|

|

3,998 |

|

|

14,098 |

|

|

3,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

380 |

|

|

429 |

|

|

648 |

|

|

881 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

4,740 |

|

|

3,569 |

|

|

13,450 |

|

|

2,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income taxes (1) |

|

|

1,962 |

|

|

1,445 |

|

|

5,346 |

|

|

1,858 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (1) |

|

$ |

2,778 |

|

$ |

2,124 |

|

$ |

8,104 |

|

$ |

1,005 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.13 |

|

$ |

0.10 |

|

$ |

0.37 |

|

$ |

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (1) |

|

$ |

0.13 |

|

$ |

0.10 |

|

$ |

0.37 |

|

$ |

0.05 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends per

share |

|

$ |

0.15 |

|

$ |

0.125 |

|

$ |

0.30 |

|

$ |

0.25 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares

of common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

21,746 |

|

|

21,646 |

|

|

21,715 |

|

|

21,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

21,871 |

|

|

21,740 |

|

|

21,923 |

|

|

21,784 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) In the second quarter and first half of fiscal 2016, the

Company recorded charges of $0.2 million and $0.8 million,

respectively, to write off deferred tax assets related to

share-based compensation. These charges reduced net income per

diluted share by $0.01 and $0.04, respectively. |

| |

Contact:

Big 5 Sporting Goods Corporation

Barry Emerson

Sr. Vice President and Chief Financial Officer

(310) 536-0611

ICR, Inc.

John Mills

Partner

(646) 277-1254

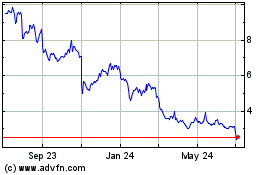

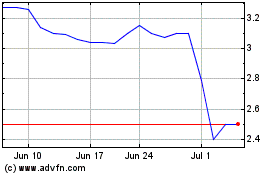

Big 5 Sporting Goods (NASDAQ:BGFV)

Historical Stock Chart

From Apr 2024 to May 2024

Big 5 Sporting Goods (NASDAQ:BGFV)

Historical Stock Chart

From May 2023 to May 2024