Bergio International Announces Profitable 2nd Quarter Results

August 15 2012 - 11:22AM

Marketwired

Bergio International, Inc. (OTCQB: BRGO) (PINKSHEETS: BRGO)

("Bergio" or the "Company") announced a profitable second quarter

result ended June 30, 2012.

The Company reported a net income of $9,581 for its 2nd quarter

ended June 30, 2012 compared to a loss of ($74,391) for the same

period last year.

Bergio had a net profit from operations of $49,067 for the 2nd

quarter compared to a loss of ($7,750) for the same period in 2011.

Net profit from operations for the 6 months ending 6/30/2012 was

$16,616 compared to a loss of ($166,675) for the same period in

2011.

The Company also reports an increase in revenue of 20% for total

net sales of $450,553 for the 2nd quarter ended June 30, 2012, as

compared to $364,661 for same period last year. The 6 month sales

were $780,500 for 2012 compared to $635,212 for 2011, this is a 23%

increase from last year. The gross profit for 2nd quarter ended

June 30, 2012 was up by 6% compared to same period last year. The 6

month gross profit was up by 16% compared to the same period last

year.

Berge Abajian, CEO of Bergio, stated, "I am happy to report that

this is our first quarter, since Bergio went public, that we are

showing a positive net income for the 2nd quarter along with a

positive net income from operations. This is our 9th straight

quarter that we have shown an increase in revenue. This is very

positive for the direction of our company and all the decisions

that were made in the past are being realized today. I am in the

final stages on a mega partnership which will be disclosed in a

future PR once it has been signed."

Berge Abajian continues, "I would like to thank all our

shareholders for staying with us during these tough economic

conditions. My main goal is to maintain a healthy stockholder

equity and a minimum of a 2:1 asset to liability ratio. This

quarter results prove that we are moving on the right track and the

future is very bright."

About Bergio International, Inc.

Bergio International, Inc. a leading jeweler creating a

diversified jewelry designer and manufacturer through acquisitions

and consolidation in the estimated $160 billion a year highly

fragmented independently owned jewelry industry Bergio currently

sells its jewelry to approximately 50 jewelry retailers across the

United States. Bergio has manufacturing control over its line

through its manufacturing facility in New Jersey, as well as

subcontracts with facilities in the United States and Italy.

Forward-Looking Statements:

The information contained herein includes forward-looking

statements. These statements relate to future events or to our

future financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking

statements. You should not place undue reliance on forward-looking

statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

our control and which could, and likely will, materially affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects our current views with

respect to future events and is subject to these and other risks,

uncertainties and assumptions relating to our operations, results

of operations, growth strategy and liquidity. We assume no

obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results

could differ materially from those anticipated in these

forward-looking statements, even if new information becomes

available in the future.

Contact: Bergio International, Inc. Investor Relations

973-227-3230 Ext13 www.bergio.com

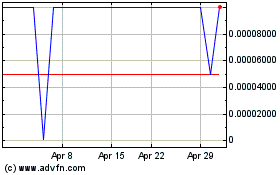

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Apr 2024 to May 2024

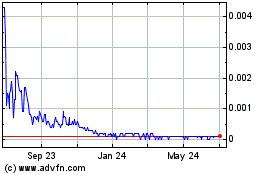

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From May 2023 to May 2024