TIDMFSFL

Highlights

-- The first interim dividend of 3.0 pence per share was paid on 30

September 2014. The second interim dividend of 3.0 pence per share was

approved on 2 March 2015 and will be paid on 27 March 2015, bringing the

full period dividend to 6.0 pence.

-- The Directors have approved an increase in the frequency of dividend

payments from semi-annually to quarterly.

-- The Company's 231MW, ten asset UK solar portfolio is fully operational

following the recent grid connection and financial completion of the UK's

largest operating solar project, the 46MW Landmead asset in Oxfordshire.

-- The Company now owns and manages the largest operating UK solar portfolio

in its listed peer group, including four of the seven largest operational

UK solar plants.

-- The Company's portfolio of ten assets were all connected prior to the 31

March 2015 cut-off when the 1.4 Renewable Obligation Certificate ("ROC")

regime ends for projects greater than 5MWs. As the entire portfolio is

already operational, the assets are each generating income for the

benefit of the Company.

-- The Company maintains a low risk approach to the sector by seeking to

avoid blind pool, development and construction risk in its acquisition of

solar assets. This deliberate strategy minimises the exposure of its

investments to changes in regulation such as the accelerated introduction

of a cliff-edge deadline in March 2015 for ROC projects greater than 5MW.

-- Performance of the assets since their acquisition is in-line with the

expectations of the Investment Manager.

-- Financial completion of the tenth portfolio asset, Kencot, (which has a

binding agreement in place for its acquisition) is expected in the first

quarter of 2015.

-- The financial completion of the Kencot asset will utilise the remainder

of the Company's existing GBP100m acquisition facility.

-- The Company has announced the second placing of new Ordinary Shares under

the Placing Programme announced on 25 September 2014 in accordance with

the Prospectus.

Dividend Timetable

Ex-dividend Date: 12 March 2015

Record Date: 13 March 2015

Payment Date: 27 March 2015

Key Metrics

As at 31 December 2014

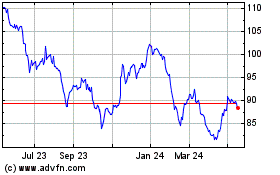

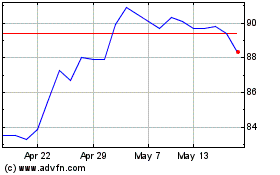

Share Price 104.25 pence

Number of Shares 208 million

Market Capitalisation GBP216.84 million

Dividends for the Period GBP4.50 million

Dividends for the Period per Share 3.0 pence

NAV GBP209.80 million

NAV per Share 100.90 pence

Total Return* 7.25%

*Based on Share price in period since IPO

Commenting on today's results, Alexander Ohlsson, Chairman of Foresight

Solar Fund Limited said:

""The Board and Foresight Group CI Limited, the Investment Manager,

believe that strong progress has been made in establishing the Company's

position on the UK listed market as a leading dedicated solar renewable

infrastructure company. This position is expected to strengthen further

once the exchanged contract to acquire the Kencot plant completes. This

continued growth in scale gives us confidence in achieving the original

objectives of the Company."

A conference call for analysts will be held at 9:00am on Tuesday 3 March

2015. A presentation will be provided separately prior to the call.

To register for the call please contact Malcolm Robertson at Citigate

Dewe Rogerson Malcolm.Robertson@citigatedr.co.uk or by phone: +44 (0)20

7282 2867.

For further information, please contact:

Foresight Group

Elena Palasmith

epalasmith@foresightgroup.eu +44 (0)203 667 8100

Stifel Nicolaus Europe Limited +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Tunga Chigovanyika

J.P. Morgan Cazenove +44 (0)20 7742 4000

William Simmonds

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing Shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013, and a further GBP60.1m through an Initial

Placing and Offer for Subscription in October 2014.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

over GBP1.3 billion of assets under management. As one of the UK's

leading solar infrastructure investment teams Foresight funds currently

manage c. GBP1 billion in over 40 separate operating Photovoltaic ("PV")

plants in the UK, the USA and southern Europe.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in London, Nottingham, Guernsey, Rome and

the USA.

www.foresightgroup.eu

Foresight Solar Fund Limited: Annual Results to 31 December 2014

Financial Highlights

For the period 13 August 2013 to 31 December 2014

-- Foresight Solar Fund Limited ("the Company") is a listed renewable

infrastructure company investing in ground based, operational solar power

plants, predominantly in the UK.

-- The Company raised proceeds of GBP150 million through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013, and a further GBP60.1 million through an

Initial Placing and Offer for Subscription in October 2014.

-- Net Asset Value ("NAV") per ordinary share of 100.9 pence at 31 December

2014, compared to 98.0 pence at IPO, a 3% increase.

-- The first interim dividend of 3.0 pence per share was paid on 30

September 2014. The second interim dividend of 3.0 pence per share was

approved on 2 March 2015 and will be paid on 27 March 2015, bringing the

full period dividend to 6.0 pence.

-- The Directors have approved an increase in the frequency of dividend

payments from semi-annually to quarterly.

-- The Company's 231MW, ten asset UK solar portfolio is fully operational

following the recent grid connection and financial completion of the UK's

largest operating solar project, the 46MW Landmead asset in Oxfordshire.

-- The Company now owns and manages the largest operating UK solar portfolio

in its listed peer group, including four of the seven largest operational

UK solar plants.

-- The Company's portfolio of ten assets were all connected prior to the 31

March 2015 cut-off when the 1.4 Renewable Obligation Certificate ("ROC")

regime ends for projects greater than 5MWs. As the entire portfolio is

already operational, the assets are each generating income for the

benefit of the Company.

-- The Company maintains a low risk approach to the sector by seeking to

avoid blind pool, development and construction risk in its acquisition of

solar assets. This deliberate strategy minimises the exposure of its

investments to changes in regulation such as the accelerated introduction

of a cliff-edge deadline in March 2015 for ROC projects greater than 5MW.

-- Performance of the assets since their acquisition is in-line with the

expectations of the Investment Manager.

-- Financial completion of the tenth portfolio asset, Kencot, (which has a

binding agreement in place for its acquisition) is expected in the first

quarter of 2015.

-- The financial completion of the Kencot asset will utilise the remainder

of the Company's existing GBP100m acquisition facility.

-- The Company has announced the second placing of new Ordinary Shares under

the Placing Programme announced on 25 September 2014 in accordance with

the Prospectus.

Key Metrics

As at 31 December 2014

Share Price 104.25 pence

Number of Shares 208 million

Market Capitalisation GBP216.84 million

Dividends for the Period GBP4.50 million

Dividends for the Period per Share 3.0 pence

NAV GBP209.80 million

NAV per Share 100.90 pence

Total Return* 7.25%

* Based on Share price in period since IPO.

Corporate Summary, Investment Objective and Dividends

Corporate Summary

Foresight Solar Fund Limited is a closed-ended company with an

indefinite life and was incorporated in Jersey under the Companies Law

(Jersey) 1991, as amended, on 13 August 2013, with registered number

113721.

The Company has a single class of 208,000,000 Ordinary Shares in issue

of nil par value which are listed on the premium segment of the Official

List and traded on the London Stock Exchange's Main Market.

The Company's shareholders include a substantial number of institutional

investors.

Investment Objective

The Company seeks to provide investors with a sustainable and Retail

Price Index ("RPI") linked dividend together with the potential for

capital growth over the long-term through investment in a diversified

portfolio of predominantly UK ground based solar assets.

Investments outside the UK, and assets which are still under

construction when acquired, will be limited to 25 per cent. of the gross

asset value of the Company, calculated at the time of investment.

The Company is managed by an experienced team from Foresight Group, an

independent infrastructure and private equity investment management firm,

overseen by a strong, experienced and majority independent Board.

Dividends

The Company continues to target a 6.0 pence annual dividend per Ordinary

Share which is expected to increase in line with inflation, together

with a target unlevered Internal Rate of Return ("IRR") of between 7-8%,

net of all fees and expenses.

The first interim dividend of 3.0 pence per Ordinary Share for the

period under review was declared on 19 August 2014 and was paid on 30

September 2014. The second interim dividend of 3.0 pence per Ordinary

share was approved on 2 March 2015 and will be paid on 27 March 2015.

The Directors have approved an increase in the frequency of dividend

payments from semi-annually to quarterly. These are expected to be paid

in respect of the 3 months to 31 March, 30 June, 30 September and 31

December. The payment of dividends will remain subject to market

conditions and the Company's performance, financial position and

financial outlook.

Chairman's Statement

For the period 13 August 2013 to 31 December 2014

"The Board and Foresight Group CI Limited, the Investment Manager,

believe that strong progress has been made in establishing the Company's

position on the UK listed market as a leading dedicated solar renewable

infrastructure company. This position is expected to strengthen further

once the exchanged contract to acquire the Kencot plant completes. This

continued growth in scale gives us confidence in achieving the original

objectives of the Company."

Alexander Ohlsson, Chairman

Results

I am pleased to be able to report strong progress in the formation of

the Company's portfolio of solar investments, both before and following

the period end, which is more fully described in the Investment

Manager's Report. The Placing and Offer for Subscription pursuant to the

Prospectus published by Foresight Solar Fund Limited on 20 September

2013 proved attractive to investors with GBP150,000,000 having been

raised at the time the ordinary shares listed on 29 October 2013. A

further Placing and Offer for Subscription pursuant to the Prospectus

published by Foresight Solar Fund Limited on 25 September 2014 raised a

further GBP60.1 million in October 2014. The Company announced on 19

February 2015 that a further issue of shares under this placing

programme was due to take place during March 2015.

The NAV per Ordinary Share increased to 100.9 pence at 31 December 2014

from 98.0 pence per Ordinary Share at launch on 29 October 2013

(excluding the 3.0 pence per Ordinary Share dividend paid on 30

September 2014). The performance of the underlying portfolio is more

fully described in the Investment Manager's Report.

Dividend Policy

As noted in the Company's Prospectuses published on 20 September 2013

and 25 September 2014 and subject to market conditions, the Company's

performance, financial position and financial outlook, it is the

Directors' intention to pay a sustainable and RPI-linked level of

dividend income to Shareholders. Whilst not forming part of its

Investment Policy, the Company targeted the payment of an initial annual

dividend of 6.0 pence per Share from the year commencing 1 January 2014.

Given the nature of the Company's income streams, the Directors

anticipate being able to increase the dividend in line with Inflation in

the year commencing 1 January 2015.

The first interim dividend of 3.0 pence per Ordinary Share was paid on

30 September 2014. The dividend had a record date of 29 August 2014 and

an ex-dividend date of 27 August 2014.

I am pleased to announce that, as targeted in the Prospectus, the second

interim dividend of 3.0 pence per Ordinary Share will be paid on 27

March 2015. The dividend will have a record date of 13 March 2015 and an

ex-dividend date of 12 March 2015.

As previously announced and following discussions with the Company's

advisers, the Directors will increase the frequency of dividend

payments from semi-annually to quarterly commencing with the

quarterly payment to 31 March 2015 being made in Q2 2015.

The target dividend should not be taken as an indication of the

Company's expected future performance or results.

Share Issues

During the period from incorporation on 13 August 2013 to 31 December

2014, the Board allotted 150,000,000 Ordinary Shares at 100.0 pence per

share in October 2013 and 58,000,000 Ordinary Shares at 103.7 pence per

share in October 2014.

Valuation Policy

Investments held by the Company have been valued in accordance with IAS

39 and IFRS 13, using Discounted Cash Flow ("DCF") Principles. The

portfolio valuations are prepared by Foresight Group, reviewed and

approved by the Board quarterly and subject to audit as a minimum

annually.

Annual General Meeting

The Annual General Meeting ("AGM") was held on 4 February 2015 due to a

requirement to hold the first AGM within 18 months of incorporation at

which all of the resolutions proposed were duly passed. A separate

General Meeting to approve the Annual Report and Accounts and the

Directors' Remuneration Report and Policy will be held in due course.

Outlook

The Board and Foresight Group is encouraged that all of the GBP210

million of equity raised to date as well as the GBP100 million

acquisition facility, secured through Royal Bank of Canada ("RBC"),

Royal Bank of Scotland ("RBS") and Santander, will have been fully

invested following the financial completion of the Kencot asset,

expected in Q1 2015.

Although the UK Government has confirmed changes to the Renewable

Obligations ("RO") incentives from March 2015, the Board and Investment

Manager both believe that a combination of the investments made to date

and the pipeline of potential opportunities currently being considered,

together with the associated benefits of scale, will continue to provide

attractive returns to shareholders over the longer term.

Alexander Ohlsson

Chairman

2 March 2015

Acquisition Solar Construction Power Purchase Agreement ("PPA")

Asset Location Status MW ROCs Date Panels Technology Counterparty Counterparty

Operational

and November

Wymeswold Leicestershire accredited 32 2.0 2013 134,000 Polycrystalline Lark Energy Total

Operational

and

Castle Eaton Wiltshire accredited 18 1.6 June 2014 60,000 Polycrystalline SunEdison SmartestEnergy

Operational

and

Highfields Essex accredited 12 1.6 June 2014 40,000 Polycrystalline SunEdison SmartestEnergy

Operational

and

High Penn Wiltshire accredited 10 1.6 June 2014 34,000 Polycrystalline SunEdison SmartestEnergy

Operational

and

Pitworthy North Devon accredited 16 1.4 June 2014 49,000 Polycrystalline SunEdison SmartestEnergy

Operational

and September

Hunters Race West Sussex accredited 11 1.4 2014 41,000 Polycrystalline Hareon Solar Statkraft

Operational

and November Bester

Spriggs Farm Essex accredited 12 1.6 2014 50,000 Polycrystalline Generation Statkraft

Operational

and December

Bournemouth Dorset accredited 37 1.4 2014 146,000 Polycrystalline Goldbeck Total

Operational

and December

Landmead Oxfordshire accredited 46 1.4 2014 483,000 Thin film Belectric NEAS

Accredited

and

awaiting

Kencot Oxfordshire completion 37 1.4 Q1 2015 144,000 Polycrystalline Conergy Statkraft

Total 231

Investment Manager's Report

For the period 13 August 2013 to 31 December 2014

Foresight Group - The Investment Manager

Foresight Group is a privately owned leading infrastructure and private

equity Investment Manager. Foresight Group manages nine separate

dedicated Solar Funds valued at c.GBP1 billion totalling over 456MW of

existing operational capacity. The Solar team has been active since 2007

and consists of 26 investment professionals.

Foresight Group manages assets of over GBP1.3 billion, raised from

pension funds and other institutional investors, UK and international

private and high net-worth individuals and family offices.

Foresight's head office is located in The Shard at London Bridge with

further offices in Guernsey, Nottingham, Rome and San Francisco.

The Company

The Company's IPO on 24 October 2013 raised GBP150 million, creating the

largest dedicated solar investment company listed in the UK at the time.

In October 2014 a further 58 million shares were issued raising gross

proceeds of GBP60.1 million increasing the shares issued by the Company

to 208 million.

On 19 May 2014, the Company entered into a GBP100 million debt

acquisition facility. This facility has been partially drawn to fund the

acquisition of the Bournemouth asset. A further draw down will be made

to fund the acquisition of the Kencot asset on financial completion

which will utilise the remainder of the facility.

The acquisition of Kencot asset will not be recognised in the financial

statements until financial completion has been reached. The Company has

the contractual right to all revenue generated from the asset since the

start of its operations in September 2014 but the vendor has entered

into sale agreements contingent on certain conditions being met. It is

the prudent policy of the Company not to recognise acquisition or

revenue generation of assets until financial completion has been

achieved.

Investment Portfolio

The Investment Manager believes the portfolio of assets has been wholly

acquired at attractive pricing and offer manufacturer and geographical

diversification across the UK for the portfolio.

Crucially, the portfolio has been designed to deliver the target return

profile without taking unnecessary risk. This is defined as the

avoidance of construction risk which, in itself, can be managed

depending on the balance sheet strength of the construction contractor.

More difficult to manage is the risk of failing to meet the 31 March ROC

subsidy deadline which in 2015 is a cliff-edge deadline given the

acceleration of the Contracts for Difference ("CfD") mechanism for

projects greater than 5MWs after this date.

Foresight Group have deliberately set out to execute a low risk strategy

of avoiding construction and subsidy risk and have negotiated these

terms accordingly with large and experienced contractors. This avoids

unnecessary risk exposure for shareholders.

Portfolio Performance

Operational performance of the assets to date is in line with

expectations, with total portfolio electricity production of 86.1

Gigawatt Hours ("GWh") for the period. As the Wymeswold asset is the

only asset that has been under our operational management for a

significant proportion of the period, providing details of operational

performance across the whole portfolio would be less directly relevant

for the Company at this time.

Foresight Group's in-house technical team continue to focus on

increasing operational efficiencies across the portfolio. We do not

expect any short-term fluctuations in power generation to affect the

medium to long-term forecasts.

Investment Performance

The NAV at launch was 98.0 pence per share. The NAV per share as at 31

December 2014 had grown to 100.9 pence, with an interim dividend of 3.0

pence per share paid in September 2014.

A breakdown in the movement of the NAV is shown in the table below.

(GBPm)

IPO Proceeds 150.0

Equity Raise 60.2

Share Issue Costs (3.9)

Valuation: Power Price Movements (11.6)

Valuation: Discount Rate Adjustment 10.8

Valuation: Other Movements 7.1

Dividends (4.5)

Management Fee (1.9)

Finance Fee (2.5)

Other Costs (1.1)

Income 7.2

The changes in portfolio valuation have been mainly driven by the

following factors:

-- Power Price - Power prices during the period were lower than expected and

our long-term power price forecasts have also been reduced. This has led

to an absolute reduction in NAV, excluding all other factors. The Company

uses a blended average of the most recent forward power curve forecasts

from a number of providers in our NAV calculations and believe the recent

changes have now been appropriately reflected. It should also be noted

that our forecasts continue to assume an increase in power prices in real

terms over the medium to long-term.

-- Discount Rate - During the period, the Company reduced its average

discount rate applied to future cashflows by 0.2% to 7.8%, which has had

a positive impact on NAV. We believe this reduction has brought the

Company in line with the UK listed solar peer group, and more accurately

reflects the risk profile of the assets that have been acquired.

-- Other - During the period, the Company saw a reduction in operational

costs through the renewal of long-term contractual arrangements. This had

a positive impact on NAV.

Valuation of the Portfolio

The Investment Manager is responsible for providing fair market

valuations of the Group's assets to the Directors. The Directors review

and approve these valuations following appropriate challenge and

examination. Valuations are undertaken quarterly.

The current portfolio consists of non-market traded investments and

valuations are based on a DCF methodology. This methodology adheres to

both IAS 39 and IFRS 13 accounting standards.

It is the policy of the Investment Manager to value with reference to

DCF immediately following acquisition. This is partly due to the long

periods between agreeing an acquisition price and financial completion

of the acquisition. Quite often this delay incorporates construction as

well as time spent applying for, and achieving, ROC accreditation upon

which the Company's acquisition of assets is usually contingent upon.

Revenues generally accrue for the benefit of the purchaser, revenues

accrued do not form part of the DCF calculation when making a fair and

proper valuation until financial completion has been achieved.

A broad range of assumptions are used in our valuation models. These

assumptions are based on long-term forecasts and are not affected by

short-term fluctuations in inputs, be it economic or technical.

Valuation Sensitivities

Where possible, assumptions are based on observable market and technical

data. In many cases, such as the forward power price, we make use of

professional advisors to provide reliable and evidenced information

while often applying a more prudent approach to that of than our

information providers. We have set out the inputs we have ascertained

would have a material effect upon the NAV below. All sensitivities are

calculated independently of each other.

Discount Rate

The weighted average discount rate used is 7.8%. The Directors do not

expect to see a significant change in the discount rates applied within

the Solar Infrastructure sector. Therefore a variance of +/- 0.5% is

considered reasonable.

-0.5% -0.25% Base +0.25% +0.5%

Directors' valuation 239.17 244.11 249.19 254.48 259.94

NAV per share (pence) 96.1 98.4 100.9 103.4 106.0

Energy Yield

Base case assumptions are based on P50 forecasts (50 per cent

probability of exceedance) produced by market experts. P10 (10 per cent

probability of exceedance) and P90 (90 per cent probability of

exceedance) variances are given to offer comparison across the industry.

Energy yield is a function of solar irradiance and technical

performance.

P90 P10

(10 year) Base (10 year)

Directors' valuation 225.79 249.19 269.94

NAV per share (pence) 89.60 100.9 110.9

Power Price

DCF models assume power prices that are consistent with the Power

Purchase Agreements ("PPA") currently in place. At the PPA end date, the

model reverts to the power price forecast.

The power price forecasts are updated quarterly and based on power price

forecasts from leading independent sources. The Investment Manager

adjusts where more conservative assumptions are considered appropriate

and applies expected PPA sales discounts. The forecast assumes an

average annual increase in power prices in real terms of approximately

1.9%.

The Company's NAV sensitivity to power price movements is lessened due

to the fact that assets representing c.40% of the portfolio's

operational capacity benefit from fixed price arrangements under the

terms of their Power Purchase Agreements ("PPAs").

-20.0% -10.0% Base +10% +20%

Directors' valuation 222.46 236.01 249.19 261.39 272.82

NAV per share (pence) 88.0 94.5 100.9 106.8 112.2

Inflation

A variable of 1.0% is considered reasonable given historic fluctuations.

We assume inflation will remain constant at 2.5%.

-1.0% -0.5% Base +0.5% +1.0%

Directors' valuation 230.17 239.46 249.19 258.80 268.44

NAV per share (pence) 91.7 96.2 100.9 105.5 110.1

Operating Costs (investment level)

Operating costs include operating and maintenance ("O&M"), insurance and

lease costs. Base case costs are based on current commercial agreements.

We would not expect these costs to fluctuate widely over the life of the

assets and are comfortable that the base case is prudent. A variance of

+/- 5.0% is considered reasonable, a variable of 10.0% is shown for

information purposes.

-10% -5% Base +5% +10%

Directors' valuation 243.39 246.31 249.19 252.03 254.75

NAV per share (pence) 98.1 99.5 100.9 102.2 103.6

Financial Results

The Company has prepared financial statements for the period from

incorporation to 31 December 2014. No meaningful activities took place

between incorporation and IPO. The period represents the first full

accounting period of the Company.

As at 31 December 2014, the NAV of the Company was GBP209.8 million or

100.9 pence per Ordinary share issued. Profit before tax for the period

was GBP8.1 million and earnings per share were 5.90 pence.

The Directors have satisfied themselves with the valuation methodology

including the underlying assumptions used and have approved the

portfolio valuation. Since inception, the Company has confirmed its

intent to deliver its target dividend of 6.0 pence per Ordinary Share in

respect of its first financial period. Strong underlying asset

performance and attractive pricing gives the Directors comfort that

target distribution levels will be met whilst maintaining capital in

real terms.

Ongoing Charges

The ongoing charges ratio for the period under review is 1.57 per cent.

This has been calculated using methodology as typically recommended by

the AIC.

Financing

The proposed acquisition facility outlined in the IPO Prospectus reached

financial close within the period for a total of GBP100 million provided

equally by RBC, RBS and Santander. This facility has been partly drawn

to fund the acquisition of the Bournemouth asset. A further draw will be

made to fund the acquisition of the Kencot asset on financial completion

which will utilise the remainder of the facility. It is expected that

the facility will be repaid through a combination of excess dividend

cover, further equity issuance and/or refinancing with a long-term debt

facility.

We expect the facility to be extended up to GBP140 million in Q1 2015,

with the full facility to be provided equally by RBS and Santander.

The Articles provide that gearing, calculated as borrowings as a

percentage of the Company's Gross Asset Value will not exceed 50% at the

time of drawdown. It is the Board's current intention that gearing,

calculated as borrowings as a percentage of the Company's Gross Asset

Value, will not exceed 40 per cent. at the time of drawdown. We would

expect long term debt may be introduced at an investment level over the

medium to long-term.

Alternative Investment Fund Management Directive ("AIFMD")

The AIFMD, which was implemented across the EU on 22 July 2013 with the

transition period ending 22 July 2014, aims to harmonise the regulation

of Alternative Investment Fund Managers ("AIFMs") and imposes

obligations on managers who manage or distribute Alternative Investment

Funds ("AIFs") in the EU or who market shares in such funds to EU

investors.

Both the Company and the Investment Manager are located outside the EEA

but the Company's marketing activities in the UK are subject to

regulation under the AIFMD.

Risk Management

Reliance is placed on the internal systems and controls of external

service providers such as the Administrator and the Investment Manager

in order to effectively manage risk across the portfolio. The

identification, quantification and management of risk are central to the

role of the Investment Manager who, for this purpose, categorises risk

per the below. Operational risks at investment level are deemed key

risks due to the impact of operational performance on the fair value of

the investments.

Day-to-Day Risk Management Monitoring performance of contractors

Promoting safe, compliant and reliable operating

environments

Monitoring levels of solar irradiation

Review of insurances

Review of land and property, including lease negotiation

Environmental reviews, including health and safety

concerns

Review of technology (including suppliers, warranties

and quality)

Business and Strategic Risk Integration of risk management into key business processes

Management such as acquisition identification, performance management,

resource allocation

Monitoring economic factors including power prices,

interest rates and inflation

Monitoring political factors including tax and energy

subsidy legislation

Monitoring financial and technical reporting accuracy

and timeliness

The Board provide oversight to identify and mitigate

Corporate Oversight and Governance significant risks. The Board are responsible for monitoring

the Company's reliance on professional advisors

Monitoring potential conflicts of interest

Monitoring performance against financial objectives

Outlook

Financial completion of the Kencot asset is expected to take place

before the end of March 2015 and will be funded using the remainder of

the acquisition facility. The asset was connected to the grid in

September 2014 and received accreditation at the 1.4 ROC rate in

December 2014. Under the terms of the share purchase agreement agreed

with RWE, the cash flows generated by the asset since the time of

connection are being accrued at a project level for the benefit of the

Company.

The March 2015 1.4 ROC branding deadline for assets over 5MW has so far

driven large amounts of activity this year in terms of new capacity

being installed, with total UK solar capacity expected to reach

approximately 7GW by the end of the Quarter. This scale of UK installed

solar capacity has created an active market in large-scale secondary

assets, and as such we are reviewing a number of secondary

opportunities.

Following the March 2015 deadline, the ROC regime for assets over 5MW

will be replaced by the Contracts for Difference ("CfD") mechanism. The

results of the first CfD auction were released on 26 February 2015 with

five Solar PV projects being awarded contracts. We had expected a

limited number of solar projects to compete in this first auction as

developers focussed on the completion of ROC projects before the 31st

March 2015 deadline. Moving forward we expect to see more large scale

projects entering the auction process following the end of the ROC

subsidy for assets over 5MW and as installation costs in the UK solar

sector continue to decrease. This should lead to solar becoming cost

competitive with onshore wind in the short term, allowing for an

increase in CfD allocation in the next auction rounds. We continue to

work closely with developers to ensure that we are well placed to take

advantage of potential CfD projects in the future.

We also expect large portfolios of up to 5MW 1.3 ROC assets to deliver

significant pipeline volume going forward and have identified a strong,

near-term pipeline of such assets for connection from 1 April 2015.

The Company expects to benefit from the pipeline of projects outlined

above through the refinancing of the existing acquisition facility

alongside further equity issuances.

From 1 January 2015 the Directors will increase the frequency of

dividend payments from semi-annually to quarterly. The payment of

dividends will remain subject to market conditions and the Company's

performance, financial position and financial outlook.

Foresight Group CI Limited

Investment Manager

2 March 2015

Corporate Governance Report

The Board has considered the principles and recommendations of the AIC

Code of Corporate Governance (AIC Code) by reference to the AIC

Corporate Governance Guide for investment Companies (AIC Guide). The AIC

Code, as explained by the AIC Guide, addresses all the principles set

out in the UK Corporate Governance Code, as well as setting out

additional principles and recommendations on issues that are of specific

relevance to the Company.

The Board considers that reporting against the principles and

recommendations of the AIC Code, and by reference to the AIC Guide

(which incorporates the UK Corporate Governance Code), will provide

better information to shareholders. The Company has complied with the

recommendations of the AIC Code and the relevant provisions of the UK

Corporate Governance Code, except as set out below.

The UK Corporate Governance Code includes provisions relating to:

-- The role of the Chief Executive

-- Executive Directors' remuneration

-- The need for an internal audit function

For the reasons set out in the AIC Guide, and as explained in the UK

Corporate Governance Code, the Board does not consider these provisions

to be relevant to the position of the Company, being an externally

managed investment company. In particular, all of the Company's

day-to-day management and administrative functions are outsourced to

third parties. As a result, the Company has no Executive Directors,

employees or internal operations. The Company has therefore not reported

further in respect of these provisions.

The Board

The Company has a Board of three Non-Executive Directors, two of whom

are considered to be independent. Peter Dicks is considered

non-independent under the listing rules by virtue of being a Director of

other Foresight Venture Capital Trusts ("VCTs") which are also managed

by Foresight Group.

Peter Dicks is a Director of Foresight VCT plc, Foresight 2 VCT plc,

Foresight 3 VCT plc and Foresight 4 VCT plc. Due to the different

investment focus of the Company the Board believes there to be no

conflict between the roles Mr Dicks performs. Where conflicts of

interest do arise between the different funds, the common Director would

seek to act fairly and equitably between different groups of

shareholders. If a conflict were to occur then decisions would be taken

by the independent Directors.

Division of Responsibilities

The Board is responsible to shareholders for the proper management of

the Company and Board meetings are held on at least a quarterly basis

with further ad hoc meetings scheduled as required. In the period under

review 16 Board meetings were held. The Board has formally adopted a

schedule of matters for which its approval is required, thus maintaining

full and effective control over appropriate strategic, financial,

operational and compliance issues. A Management Agreement between the

Company and the Manager sets out the matters over which the Manager has

authority, including monitoring and managing the existing investment

portfolio and the limits above which Board approval must be sought. All

other matters are reserved for the approval by the Board of Directors.

Individual Directors may, at the expense of the Company, seek

independent professional advice on any matter that concerns them in the

furtherance of their duties. In view of its Non-Executive nature and the

requirements of the Articles of Association that Directors retire by

rotation at the third Annual General Meeting after the AGM at which they

were elected, the Board considers that it is not appropriate for the

Directors to be appointed for a specific term as recommended by the AIC

Code.

Full details of duties and obligations are provided at the time of

appointment and are supplemented by further details as requirements

change. There is no formal induction programme for the Directors as

recommended by the AIC Code.

The Board has access to the officers of the Company Secretary who also

attend Board Meetings. Representatives of the Manager attend all formal

Board Meetings although the Directors may meet without the Manager being

present. Informal meetings with the Manager are also held between Board

Meetings as required. The Company Secretary

provides full information on the Company's assets, liabilities and other

relevant information to the Board in advance of each Board Meeting.

Attendance by Directors at Board and Committee meetings is detailed in

the table below.

Board Management Engagement & Remuneration Audit

Alex Ohlsson 15/16 1/1 2/2

Peter Dicks 15/16 1/1 2/2

Christopher Ambler 16/16 1/1 2/2

In the light of the responsibilities retained by the Board and its

Committees and of the responsibilities delegated to Foresight Group CI

Limited, JTC (Jersey) Limited and its legal advisors, the Company has

not appointed a Chief Executive Officer, Deputy Chairman or a Senior

Independent Non-Executive Director as recommended by the AIC Code. As

such, the provisions of the UK Corporate Governance Code which relate to

the division of responsibilities between a Chairman and a Chief

Executive Officer are not considered applicable to the Company.

Investment Manager

As an experienced multi-fund asset manager, Foresight Group has in place

established policies and procedures designed to address conflicts of

interest in allocating investments among its respective investment

funds.

Foresight Group is fully familiar with, and has extensive experience in

allocating investments, ensuring fair treatment for all investors and

managing conflicts of interest should these arise. Foresight Group is

keen to ensure such fair treatment for all investors. Under the rules

and regulations of the Guernsey Financial Services Commission ("GFSC"),

Foresight Group is also legally obliged to treat its investors fairly

and handle such conflicts in an open and transparent manner and such

processes are audited on an annual basis.

In terms of allocation, Foresight Group adheres to a formal written

policy for allocating new investments which are overseen by the Group's

Investment Committee and signed off by the CIO. Each available funding

opportunity is allocated pro-rata to the net amounts raised by each

Foresight Group managed fund with a sector and asset class investment

strategy matching the proposed investment. Where the allocation would

result in any Foresight Group managed fund having insufficient liquidity

or excessive portfolio concentration, or would fail to reach a

deployment deadline set by regulation or contract, the allocation is

revised accordingly.

Foresight Group's allocation policy is reviewed from time-to-time by the

independent Board of Directors of each of the Foresight Group funds and

has been operated successfully for many years. All investments are

allocated on pari passu terms. Foresight Group seek to ensure that the

interests of all clients are appropriately protected and that

investments are allocated and executed fairly.

After a full evaluation of the performance of the Investment Manager,

including review of assets purchased by the Company and the results of

ongoing portfolio management, it is the opinion of the Directors that

the continuing appointment of the Investment Manager on the terms

currently agreed is in the interests of the shareholders.

Board Committees

The Board has adopted formal terms of reference, which are available to

view by writing to the Company Secretary at the registered office, for

two standing committees which make recommendations to the Board in

specific areas.

The Audit Committee comprises Christopher Ambler (Chairman), Alexander

Ohlsson and Peter Dicks, all of whom are considered to have sufficient

financial experience to discharge the role. The Committee meets at least

twice a year to, amongst other things, consider the following:

-- Monitor the integrity of the financial statements of the Company and

approve the accounts;

-- Review the Company's internal control and risk management systems;

-- Make recommendations to the Board in relation to the appointment of the

external auditors;

-- Review and monitor the external Auditors' independence; and

-- Implement and review the Company's policy on the engagement of the

external Auditors to supply non-audit services.

KPMG LLP has completed the Company's external audit for the period and

has not performed any non-audit services during the year. Ernst & Young

LLP prepares all necessary tax returns following sign off of the annual

accounts.

The Management Engagement & Remuneration Committee, which has

responsibility for reviewing the remuneration of the Directors,

comprises Alexander Ohlsson (Chairman), Peter Dicks and Christopher

Ambler and meets at least annually to consider the levels of

remuneration of the Directors, specifically reflecting the time

commitment and responsibilities of the role. The Management Engagement &

Remuneration Committee also undertakes external comparisons and reviews

to ensure that the levels of remuneration paid are in line with industry

standards. The Management Engagement & Remuneration Committee also

reviews the appointment and terms of engagement of the Manager.

The Board believes that, as a whole, it has an appropriate balance of

skills, experience and knowledge. The Board also believes that diversity

of experience and approach, including gender diversity, amongst Board

members is important and it is the Company's policy to give careful

consideration to issues of Board balance and diversity when making new

appointments.

Copies of the terms of reference of each of the Company's committees can

be obtained from the Company Secretary upon request.

Board Evaluation

The Board undertakes an annual evaluation of its own performance and

that of its Committees through an initial evaluation questionnaire. The

Chairman then discusses the results with the Board and its Committees

and will take appropriate action to address any issues arising from the

process. The first evaluation will take place in 2015.

Relations with Shareholders

The Company communicates with shareholders and solicits their views when

it is considered appropriate to do so. Individual shareholders are

welcomed to the Annual General Meeting where they have the opportunity

to ask questions of the Directors, including the Chairman, as well as

the Chairman of the Audit, Remuneration and the Management Engagement &

Remuneration Committee. From time to time, the Board may also seek

feedback through shareholder questionnaires and through open invitations

for shareholders to meet the Investment Manager.

Internal Control

The Directors of the Company have overall responsibility for the

Company's system of internal controls and the review of their

effectiveness. The internal controls system is designed to manage,

rather than eliminate, the risks of failure to achieve the Company's

business objectives. The system is designed to meet the particular needs

of the Company and the risks to which it is exposed and by its nature

can provide reasonable but not absolute assurance against misstatement

or loss.

The Board's appointment of JTC (Jersey) Limited as accountant and

administrator has delegated the financial administration of the Company.

There is an established system of financial controls in place, to ensure

that proper accounting records are maintained and that financial

information for use within the business and for reporting to

shareholders is accurate and reliable and that the Company's assets are

safeguarded.

Directors have access to the advice and services of the Company

Secretary, who is responsible to the Board for ensuring that Board

procedures and applicable rules and regulations are complied with.

Pursuant to the terms of its appointment, Foresight Group invests the

Company's assets in infrastructure investments and have physical custody

of documents of title relating to the equity investments involved.

The Investment Manager confirms that there is a continuous process for

identifying, evaluating and managing the significant risks faced by the

Company. This has been in place for the period under review and up to

the date of approval of the Annual Report and financial statements, and

is regularly reviewed by the Board and accords with the guidance. The

process is overseen by the Investment Manager and uses a risk-based

approach to internal control whereby a test matrix is created that

identifies the key functions carried out by the Investment Manager and

other service providers, the individual activities undertaken within

those functions, the risks associated with each activity and the

controls employed to minimise those risks. A residual risk rating is

then applied. The Board is provided with reports highlighting all

material changes to the risk ratings and confirms the action that has or

is being taken. This process covers consideration of the key business,

operational, compliance and financial risks facing the Company and

includes consideration of the risks associated with the Company's

arrangements with professional advisors.

The Audit Committee has carried out a review of the effectiveness of the

system of internal control, together with a review of the operational

and compliance controls and risk management. The Audit Committee has

reported its conclusions to the Board which was satisfied with the

outcome of the review.

The Board monitors the investment performance of the Company in

comparison to its objective at each Board meeting. The Board also

reviews the Company's activities since the last Board meeting to ensure

that the Investment Manager adheres to the agreed investment policy and

approved investment guidelines and, if necessary, approves changes to

such policy and guidelines.

The Board has reviewed the need for an internal audit function. It has

decided that the systems and procedures employed by the Investment

Manager, the Audit Committee and other third party advisers

provide sufficient assurance that a sound system of internal control to

safeguard shareholders' investment and the Company's assets, is

maintained. In addition, the Company's financial statements are audited

by external Auditors and thus an internal audit function specific to the

Company is considered unnecessary.

Directors' Professional Development

Full details of duties and obligations are provided at the time of

appointment and are supplemented by further details as requirements

charge, although there is no formal induction programme for the

Directors as recommended by the AIC Code. Directors are also provided

with key information on the Company's policies, regulatory and statutory

requirements and internal controls on a regular basis. Changes affecting

Directors' responsibilities are advised to the Board as they arise.

Directors also participate in industry seminars.

Bribery Act 2010

The Company is committed to carrying out business fairly, honestly and

openly. The Investment Manager has established policies and procedures

to prevent bribery within its organisation.

Directors Remuneration Report

Introduction

The Board has prepared this report in line with the AIC code. An

ordinary resolution to approve this report will be put to the members at

the forthcoming Annual General Meeting.

The law requires the Company's Auditor, KPMG LLP, to audit certain of

the disclosures provided. Where disclosures have been audited, they are

indicated as such. The Auditor's opinion is included in the 'Independent

Auditor's Report.'

Annual Statement from the Chairman of the Management Engagement &

Remuneration Committee.

The Board, which is profiled below, consists solely of Non-Executive

Directors and considers at least annually the level of the Board's fees.

Consideration by the Directors of matters relating to Directors'

Remuneration

The Management Engagement & Remuneration Committee comprises three

Directors: Alexander Ohlsson (Chairman), Christopher Ambler and Peter

Dicks. The Committee has responsibility for reviewing the remuneration

of the Directors, specifically reflecting the time commitment and

responsibilities of the role, and meets at least annually. The Committee

also undertakes external comparisons and reviews to ensure that the

levels of remuneration paid are broadly in line with industry standards

and members have access to independent advice where they consider it

appropriate.

During the year neither the Board nor the Committee has been provided

with external advice or services by any person, but has received

industry comparison information from management in respect of the

Directors' remuneration. The remuneration policy set by the Board is

described below. Individual remuneration packages are determined by the

Remuneration Committee within the framework of this policy. The

Directors are not involved in deciding their own individual

remuneration.

Remuneration Policy

The Board's policy is that the remuneration of Non-Executive Directors

should reflect time spent and the responsibilities borne by the

Directors for the Company's affairs and should be sufficient to enable

candidates of high calibre to be recruited. The levels of Directors'

fees paid by the Company for the period ended 31 December 2014 were

agreed during the year. It is considered appropriate that no aspect of

Directors' remuneration should be performance related in light of the

Directors' Non-Executive status.

The Company's policy is to pay the Directors quarterly in arrears, to

the Directors personally (or to a third party if requested by any

Director). Mr Ohlsson's remuneration is paid to Carey Olsen Corporate

Services Jersey Limited. None of the Directors has a service contract

but, under letters of appointment dated 16th August 2013 may resign at

any time by mutual consent. No Compensation is payable to Directors

leaving office. As the Directors are not appointed for a fixed length of

time there is no unexpired term to their appointment but, as noted above,

the Directors will retire by rotation every year. It is the intention of

the Board that the above remuneration policy will, subject to

shareholder approval, come into effect immediately following the next

Annual General Meeting of the Company and will continue for the

financial year ended 31 December 2015 and subsequent years.

Shareholders' views in respect of Directors' remuneration are

communicated at the Company's Annual General Meeting and are taken into

account in formulating the Directors' remuneration policy.

Details of Individual Emoluments and Compensation

The emoluments in respect of qualifying services of each person who

served as a Director during the period and those forecast for the year

ahead are shown below. No Director has waived or agreed to waive any

emoluments from the Company in the period under review. No other

remuneration was paid or payable by the Company during the current

period nor were any expenses claimed by or paid to them other than for

expenses incurred wholly, necessarily and exclusively in furtherance of

their duties as Directors of the Company. The Company's Articles of

Association do not set an annual limit on the level of Directors' fees

but fees must be considered within the wider Remuneration Policy noted

above. Directors' liability insurance is held by the Company in respect

of the Directors.

Anticipated Directors' fees for the year ended Anticipated one off fees paid for additional services Audited Directors' fees for the period from 16th August

31 December 2015 in relation to the issuance of new 2013 to 31 December

equity during the year ended 2014

31 December 2015

Alexander GBP60,000 GBP10,000 GBP75,796

Ohlsson

(Chairman)

Christopher GBP45,000 GBP10,000 GBP55,122

Ambler

Peter Dicks GBP35,000 GBP10,000 GBP41,342

The Directors are not eligible for pension benefits, share options or

long-term incentive schemes.

Directors' Interests

Directors who had interests in the shares of the Company as at 31

December 2014 are shown below. There were no changes in the interests

shown as at 2 March 2015. The Directors do not have any options over

shares.

Ordinary shares of nil par value held at 31 December

2014

Alexander Ohlsson 25,000(1)

Christopher Ambler Nil

Peter Dicks 51,433

1 Includes 25,000 shares legally and beneficially owned by a

personal pension company.

Approval of Report

The Board will propose a resolution in the forthcoming AGM that the

remuneration of the Directors will remain at the levels shown above for

the year to 31 December 2015.

The Audit Committee Report

The Audit Committee is chaired by Christopher Ambler and comprises the

full Board. The Committee operates within clearly defined terms of

reference. The terms of reference were reviewed during the period under

review and were deemed appropriate.

Meetings are scheduled to coincide with the reporting cycle of the

Company and the committee has met twice in the period under review. The

function of the Committee is to ensure that the Company maintains the

highest standards of integrity, financial reporting, internal and risk

management systems and corporate governance and maintains an effective

relationship with the Company's Auditors. None of the members of the

Audit Committee has any involvement in the preparation of the financial

statements of the Company.

The Audit Committee is charged with maintaining an open relationship

with the Company's Auditors. The Chairman of the Audit Committee keeps

in regular contact with the Auditors throughout the audit process and

the Auditors attend the Audit Committee meeting at which the annual and

interim accounts are considered. The Committee reports directly to the

Board which retains the ultimate responsibility for the financial

statements of the Company.

Significant issues Considered

The Audit Committee has identified and considered the following key

areas of risk in relation to the business activities and financial

statements of the company:

-- Valuation and existence of unquoted investments. This issue was discussed

with the Investment Manager and the Auditor at the conclusion of the

audit of the financial statements, as explained below:

Valuation and Existence of Unquoted Investments

The most significant risk in the annual accounts is that of the

valuation of unquoted investments. There is an inherent risk of the

Investment Manager unfairly valuing investments due to the Investment

Managers fee being linked directly to the Net Asset Value of the

Company.

During the valuation process the Board and Audit Committee and the

Investment Manager follow the valuation methodologies for unlisted

investments as set out in the International Private Equity and Venture

Capital Valuation guidelines and appropriate industry valuation

benchmarks. These valuation policies are set out in Note 3 of the

accounts. These were then further reviewed by the Audit Committee. The

Investment Manager confirmed to the Audit Committee that the investment

valuations had been calculated consistently throughout the period and in

accordance with published industry guidelines, taking account of the

latest available information about investee companies and current market

data. Furthermore, the Investment Manager held discussions regarding the

investment valuations with the Auditors.

The Investment Manager has agreed the valuation assumptions with the

Audit Committee.

Key assumptions used in the valuation forecasts are detail in note 17 of

the financial statements. The Investment Manager has provided

sensitivities around those assumptions which are detailed in note 17.

The Investment Manager and Auditors confirmed to the Audit Committee

that they were not aware of any material misstatements. Having reviewed

the reports received from the Investment Manager and Auditors, the Audit

Committee is satisfied that the key areas of risk and judgement have

been addressed appropriately in the financial statements and that the

significant assumptions used in determining the value of assets and

liabilities have been properly appraised and are sufficiently robust.

The Audit Committee considers that KPMG LLP has carried out its duties

as Auditor in a diligent and professional manner.

During the year, the Audit Committee assessed the effectiveness of the

current external audit process by assessing and discussing specific

audit documentation presented to it in accordance with guidance issued

by the Auditing Practices Board. The audit partner is rotated every five

years ensuring that objectivity and independence is not impaired. This

is the first period end that both KPMG LLP and the audit partner has

been in place for. No tender for the audit of the Company has been

undertaken since this date. As part of its review of the continuing

appointment of the Auditors, the Audit Committee considers the need to

put the audit out to tender, its fees and independence from the

Investment Manager along with any matters raised during each audit.

The Audit Committee considered the performance of the Auditor during the

year and agreed that KPMG LLP continued to provide a high level of

service and maintained a good knowledge of the market, making sure audit

quality continued to be maintained.

Statement of Directors Responsibilities

The Directors of the Company have accepted responsibility for the

preparation of these non-statutory accounts for the period ended 31

December 2014 which are intended by them to give a true and fair view of

the state of affairs of the Company and of the profit or loss for that

period. They have decided to prepare the non-statutory accounts in

accordance with International Financial Reporting Standards as adopted

by the European Union ("EU").

In preparing these non-statutory accounts, the Directors have:

-- Selected suitable accounting policies and applied them consistently;

-- Made judgements and estimates that are reasonable and prudent;

-- Stated whether they have been prepared in accordance with IFRS as adopted

by the EU; and

-- Prepared the non-statutory accounts on the going concern basis as they

believe that the Company will continue in business.

The Directors have general responsibility for taking such steps as are

reasonably open to them to safeguard the assets of the Company and to

prevent and detect fraud and other irregularities.

For and on behalf of the Board

Alexander Ohlsson

Chairman

2 March 2015

Directors

The Directors, who are Non-Executive and, other than Mr Dicks,

independent of the Investment Manager, are responsible for the

determination of the investment policy of the Company, have overall

responsibility for the Company's activities including its investment

activities and for reviewing the performance of the Company's portfolio.

The Directors are as follows:

Alexander Ohlsson (Chairman)

Mr Ohlsson is Managing Partner for the law firm Carey Olsen in Jersey.

He is recognised as a leading expert in corporate and finance law in

Jersey and is regularly instructed by leading global law firms and

financial institutions. He is the independent chairman of the States of

Jersey's Audit Committee and an Advisory Board member of Jersey Finance,

Jersey's promotional body. He is also a member of the Financial and

Commercial Law Sub-Committee of the Jersey Law Society which reviews as

well as initiates proposals for legislative changes. He was educated at

Victoria College Jersey and at Queens' College, Cambridge, where he

obtained an MA (Hons) in Law. He has also been an Advocate of the Royal

Court of Jersey since 1995.

Mr Ohlsson was appointed as a non-executive Director and Chairman on 16

August 2013.

Christopher Ambler

Mr Ambler has been the Chief Executive of Jersey Electricity plc since 1

October 2008. He previously held various senior positions in the global

industrial, energy and materials sectors working for major corporations,

such as ICI/ Zeneca, the BOC Group and Centrica/British Gas as well as

in strategic consulting roles. Mr Ambler is a Chartered Engineer and a

Member of the Institution of Mechanical Engineers. He holds a first

class Honours Degree from Queens' College Cambridge and an MBA from

INSEAD.

Mr Ambler was appointed as a non-executive Director on 16 August 2013.

Peter Dicks

Mr Dicks is currently a Director of a number of quoted and unquoted

companies. In addition, he was the Chairman of Foresight VCT plc and

Foresight 2 VCT plc from their launch in 1997 and 2004 respectively

until 2009 and since then he has continued to serve on both of these

boards. He is also on the Board of Foresight 3 VCT plc, Foresight 4 VCT

plc, Graphite Enterprise Trust plc and Mears Group plc. He is also

Chairman of Unicorn AIM VCT plc and Private Equity Investor plc.

Mr Dicks was appointed as a non-executive Director on 16 August 2013.

Environmental and Social Governance

Environmental

The Company invests in solar farms. The environmental benefits received

through the production of renewable energy are widely publicised.

Further to the obvious environmental advantages of large scale renewable

energy, each investment is closely scrutinised for localised

environmental impact. Where improvements can be made the Company will

work with planning and local authorities to minimise visual and auditory

impact of sites.

Biodiversity Assessments

During the period, the Investment Manager appointed Kent Wildlife to

explore the feasibility of maximising the biodiversity and wildlife

potential for all of its UK solar assets. The initial phase of the

initiative has involved undertaking site visits involving a walkover

survey and preliminary desktop ecological study. The results have been

used to prepare scoping reports which identify existing features of

wildlife importance and assess the opportunities for biodiversity

enhancements that each site offers.

These initial reports will be used for the preparation of a series of

site specific biodiversity enhancement and management plan to secure

long-term gains for wildlife. These assessments are still in progress

across the portfolio.

Social

Wymeswold Solar Farm was invited by the Solar Trade Association to open

its operations to visitors from local homes, schools, businesses and

community groups on 4 July 2014 as part of the nationwide Solar

Independence day event. The event formed part of an educational push to

communicate the benefits of solar and the need for more stable policy

support.

An educational visit to Hunters Race Solar Farm by a local college in

Chichester has been planned for March 2015 and we continue to actively

seek similar opportunities for the other assets within the portfolio.

The Investment Manager appointed a health and safety consultant to

review all portfolio assets to ensure they not only meet, but outclass,

industry and legal standards. Desktop assessments and site visits of the

solar assets are underway.

Foresight Group is a signatory to the United Nations-supported

Principles for Responsible Investment ("UNPRI"). The UNPRI is a global,

collaborative network of investors established in 2006.

Independent Auditor's Report to the Members of Foresight Solar Fund

Limited only

Independent Auditor's Report

Opinions and conclusions arising from our audit

1 Our opinion on the Group Financial Statements is unmodified

We have audited the Group Financial Statements of Foresight Solar Fund

Limited for the period from 13 August 2013 (date of incorporation) to 31

December 2014 which comprise the Consolidated Statement of Comprehensive

Income, the Consolidated Statement of Financial Position, the

Consolidated Statement of Changes in Equity, the Consolidated Statement

of Cash Flows and the related notes on below. In our opinion, the Group

Financial Statements:

-- give a true and fair view of the Group's affairs as at 31 December 2014,

and of its profit for the period then ended;

-- have been properly prepared in accordance with International Financial

Reporting Standards as adopted by the European Union; and

-- have been properly prepared in accordance with the Companies (Jersey) Law

1991.

2 Our assessment of risks of material misstatement

In arriving at our audit opinion above on the financial statements the

risk of material misstatement that had the greatest effect on our audit

was as follows:

Valuation of Unquoted Investments: GBP249.19m

Refer to (Audit Committee Report), note 2 (accounting policy) and

(Financial Statements).

The risks: 94% of the Group's total assets (by value) is held in

investments where no quoted market price is available. Unquoted

investments are measured at fair value which is established in

accordance with the International Private Equity and Venture Capital

Valuation Guidelines by using discounted cash flow measurements. There

is a significant risk over the valuation of these investments and this

is the key judgemental area that our audit focused on.

Our response: Our procedures included:

-- Documenting and assessing the design and implementation of the investment

valuation processes and controls in place.

-- Challenging the Investment Manager on key judgements affecting the

investee company valuations in the context of observed industry best

practice and the provisions of the International private Equity and

Venture Capital Valuation Guidelines. In particular, we challenged the

appropriateness of the valuation basis selected as well as underlying

assumptions, such as energy yield, power price, costs and inflation rates

which produce the cash flow projections and the appropriate discount

factors. We compared key underlying financial data inputs to external

sources and management information as applicable. We challenged the

assumptions around the sustainability of earnings based on the plans of

the investee companies and whether these are achievable, and we obtained

an understanding of existing and prospective investee company cash flows

to understand whether borrowings can be serviced or refinancing may be

required. Our work included consideration of events which incurred

subsequent to the year end up until the date of this audit report.

-- Attending the year end Audit Committee meeting where we assessed the

effectiveness of the Audit Committee's challenge and approval of unlisted

investment valuations; and

-- Consideration of the appropriateness, in accordance with relevant

accounting standards, of the disclosures in Note 17 in respect of

unquoted investments and the effect of changing one or more inputs to

reasonably possible alternative valuation assumptions.

3 Our application of materiality and an overview of the scope of our

audit

The materiality for the Financial Statements as a whole was set at

GBP5.29 million. This was determined using a benchmark of Total Assets

(of which it represents 2%). Total Assets which is primarily composed of

the Company's capital and revenue performance and, as such, we consider

it to be one of the principal considerations for members of the Company

in assessing the financial performance of the Company.

In addition, we applied a materiality of GBP0.57 million to income from

investments for which we believe misstatements of lesser amounts than

materiality as a whole could be reasonably expected to influence the

economic decisions of the members of the Company taken on the basis of

the Financial Statements.

We report to the Audit Committee any corrected and uncorrected

identified misstatements exceeding GBP265,000, in addition to other

audit misstatements that warrant reporting on qualitative grounds.

The Group audit team performed the audit of the Group as if it was a

single aggregated set of financial information. The audit was performed

using the materiality level set out above and covered 100% of total

Group revenue,

Group profit before tax and total Group assets, and was performed at

Foresight Group, the Shard, 32 London Bridge Street, London, SE1 9SG.

4 We have nothing to report in respect of the matters on which we are

required to report by exception

Under ISAs (UK and Ireland) we are required to report to you if, based

on the knowledge we acquired during our audit, we have identified other

information in the annual report that contains a material inconsistency

with either that knowledge or the financial statements, a material

misstatement of fact, or that is otherwise misleading.

In particular, we are required to report to you if:

-- we have identified material inconsistencies between the knowledge we

acquired during our audit and the Directors' statement that they consider

that the annual report and financial statements taken as a whole is fair,

balanced and understandable and provides the information necessary for

shareholders to assess the Group's performance, business model and

strategy; or

-- the Audit Committee Report does not appropriately address matters

communicated by us to the audit committee.

-- Under the Companies (Jersey) Law 1991 we are required to report to you if,

in our opinion:

-- proper accounting records have not been kept by the Company; or

-- the Company's accounts are not in agreement with the accounting records;

or

-- we have not received all the information and explanations we require for

our audit.

Under the Listing Rules we are required to review the part of the

Corporate Governance Statement on below relating to the Company's

compliance with the ten provisions of the 2012 UK Corporate Governance

Code specified for our review.

We have nothing to report in respect of the above responsibilities.

Respective responsibilities of Directors and auditor

As explained more fully in the Directors' Responsibilities Statement set

out above, the Directors are responsible for the preparation of Group

financial statements which give a true and fair view. Our responsibility

is to audit, and express an opinion on, the Group financial statements

in accordance with applicable law and international Standards of

Auditing (UK and Ireland). Those standards require us to comply with the

UK Ethical Standards for Auditors.

Scope of an audit of financial statements performed in accordance with

ISAs (UK and Ireland)

A description of the scope of an audit of financial statements is

provided on our website at www.kpmg.com/ uk/auditscopeukco2014. This

report is made subject to important explanations regarding our

responsibilities, as published on that website, which are incorporated

into this report as if set out in full and should be read to provide an

understanding of the purpose of this report, the work we have undertaken

and the basis of our opinions.

The purpose of our audit work and to whom we owe our responsibilities

This report is made solely to the Company's members, as a body, in

accordance with Article 113A of the Companies (Jersey) Law 1991. Our

audit work has been undertaken so that we might state to the Company's

members those matters we are required to state to them in an auditor's

report and for no other purpose. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

Company and the Company's members, as a body, for our audit work, for

this report, or for the opinions we have formed.

Jatin Patel (Senior Statutory Auditor)

for and on behalf of KPMG LLP

Chartered Accountants and Recognised Auditor

15 Canada Square London

E14 5GL

2 March 2015

Consolidated Statement of Comprehensive Income

For the period 13 August 2013 to 31 December 2014

Period

13 August 2013

to

31 December

2014

Notes GBP

Continuing operations