TIDMCRV

RNS Number : 2867H

Craven House Capital PLC

30 November 2015

30 November 2015

Craven House Capital plc

("Craven House" or the "Company")

Annual Results for year ended 31 May 2015

CHAIRMAN'S REPORT

The year ending May 2015 proved to be a frustrating period for

Craven House Capital. As first revealed in our half year

announcement, we are disappointed to report a decrease in Net Asset

Value (NAV) from GBP5.5 million last year to GBP4.7 million at year

end. This reduction is primarily due to the write down of Pressfit

Holdings, which was listed on the AIM Market and then delisted from

the market during the period.

More broadly, the emerging and frontier markets in which we

operate have suffered over the past year and a half. These markets

are highly sensitive to international capital flows. Morgan Stanley

estimates that total net capital outflows from the 19 largest

emerging market economies reached $940 billion in the 13 months to

the end of July 2015, almost double the net $480 billion that

flowed out during three quarters during the 2008/09 financial

crisis. The outflows mark a sharp reversal from the robust infusion

of funds emerging markets received in the six years following the

crisis.

We do not think this trend has run its course. In fact, we

believe capital will continue to flee the emerging markets. This

trend will be reinforced when the US interest rates begin to climb.

Carry trades will be unwound and the landscape where capital was

recently abundant will now be barren. A flood of liquidity will

soon turn to drought. We believed the influx of capital was

excessive and the outflow will be equally if not more so.

The macroeconomic climate in Brazil, South Africa, China,

Argentina, Russia as well as smaller markets will continue to

present challenges for operating companies resulting in a

significantly higher cost of capital. As owners of emerging market

assets this will likely result in significantly longer time

horizons before we can exit current investments. However, as

providers of capital to companies operating in these challenging

environs, we expect to see opportunities to invest on improved

terms. This holds true for existing portfolio companies as well as

future investments. Patient permanent capital is most effective

when markets are in turmoil and funding is scarce.

For the first several years at Craven House we struggled to find

good investments at compelling valuations. We looked at hundreds of

opportunities. Of these only twenty-five or so potential

investments merited serious diligence. Of these, only a handful

resulted in firm offers to invest. Such has been our frustration.

Now we believe the tide has reversed and we expect to see a much

larger number of investable deals with far fewer capital providers

offering terms. This should provide us the opportunity to invest

against the tide. To butcher an old value investor's saw, "We seek

to be courageous when others are fearful and fearful when others

are courageous." For the past several years institutional capital

has led a fearless charge into the most remote and dangerous

corners of the emerging markets and now many of those same brave

warriors are running like scalded dogs. We will seek to take

advantage of this inflection point but it may require a good deal

of patience until the inflection point is reached and the markets

fully capitulate. Equity valuations have begun to soften

significantly and we expect to see irrational valuations in

emerging market corporate credit as investors flee for no reason

other than every other institutional investor is hitting the eject

button.

In the other regions we operate, mainly crisis and post crisis

developed countries in Europe; we continue to see chances to

effectively deploy capital. In particular Ireland, Greece, Cyprus

and Portugal seem to be opening up to investors willing to invest

in small and mid sized companies. These smaller companies still

struggle to find financing. The banks are still very hesitant to

provide growth and acquisition capital and the vast majority of

private equity funds and other capital sources will not look at

companies with Enterprise Values (EV) less than EUR100 million. In

Europe small to mid sized companies with less than EUR25 million in

EBITDA have historically relied on the banking sector to provide

most if not all of their capital. Having focused their efforts on

the beleaguered property sector for the last five years, many

European banks are actively trying to reduce their loan books to

operating companies. We are starting to see acquisition

opportunities at compelling valuations. Banks are no longer

ignoring impaired loans to operating companies thereby providing an

opportunity to recapitalize or acquire on favourable terms. To that

end it remains our stated objective to complete a transformational

acquisition at a valuation that rewards shareholders for their

patience.

Selected Portfolio Company Highlights

Pressfit Plc

The Pressfit investment is emblematic of both the trading

environment in the emerging markets and the receptiveness (or lack

thereof) of the public markets for smaller listed companies with

operations in China. We should have seen this coming and in some

ways we did but we lacked the courage to act. When Pressfit

management first indicated their desire to list on the AIM market

we expressed our belief that the timing was not ideal for admission

to the quoted markets in London. However, management and other

large shareholders were convinced it was the appropriate and

necessary to take the company to the next level. We were outvoted

and frankly did not put forth the impassioned opposition we should

have.

Shortly after the introduction to the AIM market Pressfit's

share price fell precipitously on very thin volume. We did not and

do not believe this was representative of the company's true value

but it was a shock to some investors and management. This

melancholy situation was further exacerbated when the company's

NOMAD, Daniel Stewart Plc, had its authorization to act as a NOMAD

revoked. The company then struggled to find a NOMAD in the

requisite time period and saw its shares delisted through no fault

of its own. The message this sent to suppliers and customers was

not helpful and demoralized both management and the workforce.

Too late, we intervened as both shareholder and creditor to the

company. After prolonged negotiations the CEO resigned and Craven

House in conjunction with another large shareholder, AMCO,

subsequently stepped in to restructure and reorient the company.

AMCO and its management in Europe and Asia are experienced in the

pipefittings and fixtures industry and we remain long term positive

on the sector. The adoption of press fittings in general and the

products Pressfit produces is increasing rapidly in Asia and Europe

and we plan on capitalizing on this trend. New health and building

codes will only increase the demand for the product. However, we

have written down the investment on our books in accordance with a

fair value policy at the balance sheet date and expect the

investment to remain illiquid for the next year or more. While we

had hoped to achieve a profitable exit by now, we are prepared to

roll up our sleeves to create long-term value, accepting that we

should have intervened more aggressively earlier and made a more

adamant protest to the listing.

South African Agricultural Land Portfolio

We remain very bullish on Agriculture globally and in South

Africa. South Africa is struggling to cope with the pronounced

downturn in commodities. Their economy is highly leveraged to the

price of precious and base metals and the rapid decline in these

markets has hurt the economy and the currency. The South African

Rand has lost significant purchasing power since we first invested

in 2013. The currency has fallen from just under 9 ZAR to the US

Dollar to over 14 ZAR to the dollar since we entered the market.

This has spooked many international investors. As an example, it

impacted on our negotiation for the sale of our vegetable

dehydration facility and farmland with a European investor. This

investor was a company with current vegetable dehydration

operations in Austria and Hungary. They provide ingredients to

major international food companies globally. They made a firm offer

for our operation at a price that would have locked in a

significant gain on our investment. However, as the South African

economy began to struggle and the currency cratered their financing

from Europe fell away and they were unable to complete the

transaction. We have had subsequent offers above our cost basis and

negotiations continue. We must be prepared to wait until the cycle

turns before we seek an exit. We are presently evaluating what to

do with these investments. Our belief is that the underlying ZAR

value is not relevant. The business sells an agricultural product

sold globally in US dollars and will only benefit from the fall in

local operating costs. Given this underlying situation we believe

our patience will be rewarded.

Brazilian Ocean Front Land

Brazil, like South Africa, has suffered from declining commodity

prices and a falling currency. It has also captivated the

international press with stories of corruption in the government

and state owned industry. There is talk of impeaching the president

and the infrastructure for the upcoming Olympic Games is said to be

well behind schedule. This environment has reversed investor

sentiment towards Brazil.

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

Despite the headline risk and general economic malaise, our

interest in a large block of ocean front agricultural land remains

a solid investment priced in Brazilian reals (BRL) but valued in US

dollars. In most of South America agricultural land is priced in

dollars regardless of the underlying local currency. This, as

mentioned above, is due to the fact that the agricultural sector is

export based and produces a commodity sold around the world in US

dollars. Our view is that the falling local currency and production

costs will result in stable or increasing agricultural land prices.

At present we are in discussions with several agricultural

producers who have expressed interest in the agricultural land. Our

preferred outcome is a transaction that will see Craven House sell

the inland portion of the land while retaining control of the ocean

front parcel. This may or may not happen and will require

significant dialogue with the local authorities but we believe this

is the best way to maximize the long-term value for shareholders.

If it does not materialize we are comfortable holding on to the

parcel for an indefinite period. We are comfortable with the

operating hypothesis that ocean front land will increase in value

over time.

Irish Hotel Mortgage

As previously announced, Craven House has begun to exit its

position in a first mortgage against the Green Isle Hotel in

Dublin. This represents a successful restructuring of an attractive

asset where Craven House invested in a distressed situation in

different portions of the capital structure. We invested in both

the debt and equity of an insolvent hotel operator and worked to

recapitalize the insolvent enterprise. We believe there will be

further distressed opportunities in Ireland as well as in Greece,

Portugal and Cyprus.

Conclusion

As shareholders and managers we align our interests with all

other stakeholders. It is unpleasant to report our first decrease

in NAV since we took control of the company. We don't like to be

the bearer of bad news but we gladly shoulder the bad news burden

rather than overpay for assets. During the period ending May 31(st)

2015 we abandoned three transactions after spending months

evaluating and negotiating a prospective acquisition. This is a

painful process and we had to work hard to repress the natural

desire to finish what we started. In each of the three cases we

could not reach the level of comfort necessary to commit our

capital. In two of the three cases it was a matter of valuation. We

could not bring ourselves to overpay. In the third we could not get

comfortable with the management. All three aborted deals consumed

our time and capital. It was difficult to walk away but with the

benefit of time and perspective we are confident we made the

correct decision. In a fourth transaction we were outbid or as

investment industry professionals say "re-traded" after we thought

we had a deal agreed. We had a choice to make. We either increased

our bid beyond what we thought the business was worth or walk away

after all the effort and expense that went into analyzing the

business and transaction. We had no choice but to walk away.

As managers we receive no performance fees for the year and will

not receive any performance fees until such time as the NAV rises

above its previous high. As shareholders our portfolio suffers

alongside other shareholders when the market fails to reward our

methodology. While we understand the frustration of some

shareholders, especially those with a near term investment horizon,

we believe that our contrarian DNA and willingness to wait for deep

value opportunities will pay off. We will not pull the proverbial

trigger unless we are highly confident an investment will increase

the NAV on a per share basis.

As always, we want to warn shareholders that our patience has no

bounds and we are willing to do nothing if doing nothing is the

best course of action. We will wait until the right opportunity

comes along at the right price with the right long term prospects.

Famed international investor Jim Rogers was quoted in the Book

Market Wizards, "I just wait until there is money lying in the

corner, and all I have to do is go over there and pick it up. I do

nothing in the meantime." Given the current state of markets we

think this is an apt metaphor.

Mark Pajak

Acting Chairman

INCOME STATEMENT

FOR THE YEAR ENDED 31 MAY 2015

2015 2014

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue - 249

Gross Portfolio return (705) (845)

Administrative expenses (229) (307)

OPERATING LOSS (932) (903)

Finance costs 4 (27) (16)

Finance income 4 48 39

-------- --------

LOSS BEFORE INCOME TAX 5 (911) (880)

Income tax 6 - -

-------- --------

LOSS FOR THE PERIOD (911) (880)

======== ========

Loss per share expressed

In pence per share:

Basic and Diluted 7 (0.11) (0.13)

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 MAY 2015

2015 2014

GBP'000 GBP'000

LOSS FOR THE PERIOD (911) (880)

OTHER COMPREHENSIVE - -

INCOME

TOTAL COMPREHENSIVE

LOSS FOR THE PERIOD (911) (880)

============ ============

STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2015

2015 2014

Notes GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Property, plant 8 - -

and equipment

Investments at

fair value through

profit or loss 9 4,673 6,095

--------- ---------

4,673 6,095

--------- ---------

CURRENT ASSETS

Trade and other

receivables 10 312 114

Cash and cash equivalents 11 217 -

--------- ---------

529 114

--------- ---------

TOTAL ASSETS 5,202 6,209

========= =========

EQUITY

SHAREHOLDERS' EQUITY

Called up share

capital 12 8,526 8,519

Share premium 7,391 7,310

Retained earnings (11,210) (10,299)

--------- ---------

TOTAL EQUITY 4,707 5,530

--------- ---------

LIABILITIES

CURRENT LIABILITIES

Trade and other

payables 13 104 339

Financial liabilities-borrowings

Interest bearing

loans and borrowings 14 391 340

--------- ---------

495 679

--------- ---------

TOTAL LIABILITIES 495 679

--------- ---------

TOTAL EQUITY AND

LIABILITIES 5,202 6,209

========= =========

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 MAY 2015

Called Profit

up share and loss Share Total

capital account premium equity

GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 June 2013 8,313 (9,419) 4,948 3,842

Changes in equity

Issue of share capital 206 - 2,362 2,568

Total comprehensive

income - (880) - (880)

---------- ---------- ---------- ----------

Balance at 31 May 2014 8,519 (10,299) 7,310 5,530

Changes in equity

Issue of share capital 7 - 81 88

Total comprehensive

income - (911) - (911)

---------- ---------- ---------- ----------

Balance at 31(st) May

2015 8,526 (11,210) 7,391 4,707

---------- ---------- ---------- ----------

STATEMENT OF CASH FLOWS

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

FOR THE YEAR ENDED 31 MAY 2015

2015 2014

Notes GBP'000 GBP'000

Cash flows from operating

activities

Cash used in operations 1 (564) (103)

Interest paid (13) (16)

Net cash used in operating

activities (577) (119)

Cash flows used in investing

activities

Purchase of fixed asset

investments - (2,382)

Sale of fixed asset investments 717 -

Advance of loans 321 -

Repayment of loans (270) (123)

Interest received 42 39

-------- --------

Net cash (used in)/from

investing activities 810 (2,466)

Cash flows from financing

activities

Share issue - 2,568

-------- --------

Net cash from financing

activities - 2,568

-------- --------

Increase/(decrease) in cash

and cash equivalents 233 (17)

Cash and cash equivalents

at the beginning 2 (16) 1

of the year

Cash and cash equivalents

at the end of the 2 217 (16)

======== ========

Year

Cash and cash equivalents

consist of: 217 (16)

Cash and cash equivalents

included in current

assets/(Trade and other

payables)

NOTES TO THE STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 MAY 2015

1. RECONCILIATION OF LOSS BEFORE INCOME TAX TO CASH USED IN OPERATIONS

2015 2014

GBP'000 GBP'000

Loss before income tax (911) (880)

Finance costs 27 16

Finance income (48) (39)

Decrease/(increase) in

value in investments 705 884

-------- --------

(227) (19)

Increase in trade and other

receivables (198) (35)

(Decrease)/increase in

trade and other payables (139) (49)

-------- --------

Cash used in operations (564) (103)

======== ========

2. CASH AND CASH EQUIVALENTS

The amounts disclosed on the statement of cash flow in respect

of cash and cash equivalents are in respect of these statement of

financial position amounts:

Year ended 31 May 2015

31.5.15 1.6.14

GBP'000 GBP'000

Cash and cash equivalents 217 (16)

Year ended 31 May 2014

31.5.14 1.6.13

GBP'000 GBP'000

Cash and cash equivalents (16) 1

======== ========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 MAY 2015

1. ACCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared in accordance with

International Financial Reporting Standards and IFRIC

interpretations and with those parts of the Companies Act 2006

applicable to companies reporting under IFRS.

Craven House Capital plc is a company incorporated in the United

Kingdom under the Companies Act. The address of the registered

office is given on the company information page. The Company is

listed on the AIM Market of the London Stock Exchange (code:

CRV).

The financial statements have been prepared under the historical

cost convention, except to the extent varied below for fair value

adjustments required by accounting standards, and in accordance

with applicable International Financial Reporting Standards (IFRS)

as adopted for use by the European Union. The principal accounting

policies are set out below.

These financial statements are presented in pounds sterling,

rounded to the nearest GBP'000. Pounds sterling is the currency of

the primary economic environment in which the company operates.

The accounting policies adopted by the Company are consistent

with those of the previous financial year except for the treatment

of the subsidiary. For the year commencing 1 June 2014 the company

has adopted provisions in IFRS 10 to treat its subsidiary as an

investment at fair value through profit or loss. Accordingly

comparatives have been represented to reflect this change in

accounting policy.

Going concern

The company's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chairman's Report, the financial statements

include the Company's objectives, policies and processes for

managing its capital; its financial risk management objectives;

details of its financial instruments; and its exposures to credit

risk and liquidity risk. The company has considerable financial

resources. As a consequence, the directors believe that the company

is well placed to manage its business risks successfully despite

the current uncertain economic outlook. The directors have a

reasonable expectation that the company has adequate resources to

continue in operational existence for the foreseeable future. Thus

they continue to adopt the going concern basis of accounting in

preparing the annual financial statements.

Changes in accounting standards

IFRS 10, 11 and 12 are effective for the first time in the year

ended 31 May 2015. The principal changes as a result of these

standards arise from IFRS 10, as well as "Investment Entities"

(Amendments to IFRS 10, IFRS 12 and IAS 27).

Under IFRS 10, companies are able to consider whether they are

classed as an investment entity.

An investment entity is an entity that:

(a) obtains funds from one or more investors for the purpose of

providing those investor(s) with investment management

services;

(b) commits to its investor(s) that its business purpose is to

invest funds solely for returns from capital appreciation,

investment income, or both; and

(c) measures and evaluates the performance of substantially all

of its investments on a fair value basis.

In assessing whether a company meets the definition of an

investment entity, the following

characteristics must be considered:

(a) it has more than one investment;

(b) it has more than one investor;

(c) it has investors that are not related parties of the entity;

and

(d) it has ownership interests in the form of equity or similar

interests.

The directors have considered the definition of an investment

entity in IFRS 10 as well as the associated application guidance.

The directors considered that Craven House Capital met the

definition of an investment entity.

Previously, the financial information presented included that of

Craven House Capital plc and its subsidiary undertaking, Craven

House Industries Limited ('CHI'). With effect from this accounting

period, the investment in CHI will be accounted for at fair value

through profit and loss and CRV is therefore presenting information

for them as an individual entity and not as a group. This has had

no impact on the net assets reported in prior periods.

GBP596,000 that was classified as investment in subsidiary in

the 2014 financial statements has been represented as investments

at fair value through profit and loss in the comparative statement

of financial position. The transitional provisions inserted into

IAS 27 by the Investment Entities amendments have been applied, and

that those transitional provisions required retrospective

application.

Standards, amendments and interpretations to be published

standards not yet effective

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and in

some cases have not yet been adopted by the EU.

The directors do not expect that the adoption of these standards

will have a material impact on the financial statements of the

Group in future periods, except that IFRS 9 will impact both the

measurement and disclosures of financial instruments and IFRS 15

may have an impact on revenue recognition and related disclosures.

At this point it is not practicable for the directors to provide a

reasonable estimate of the effect of IFRS 9 and IFRS 15 as their

detailed review of these standards is still ongoing.

Financial assets

Purchases or sales of financial assets are recognised at the

date of the transaction. Where appropriate criteria are met, the

Company makes use of the option of designating fixed asset

investments upon initial recognition as financial assets at fair

value through profit or loss. These criteria include that the fixed

asset investment should meet the Company's published Investing

Policy and form part of the Company's managed portfolio or similar

investments. Such financial assets are carried at fair value and

movements in fair value are taken through the profit and loss

account. For quoted securities, fair value is either the bid price

or the last traded price, depending on the convention of the

exchange on which the investment is quoted.

Measurement

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

Financial assets at fair value through profit or loss are

initially recognised at fair value. Transaction costs are expensed

through the profit or loss. Subsequent to initial recognition, all

financial assets at fair value through profit or loss are measured

at fair value in accordance with International Private Equity and

Venture Capital Valuation ("IPEVCV") guidelines, as the Group's

business is to invest in financial assets with a view to profiting

from their total return in the form of capital growth and income.

Gains and losses arising from changes in the fair value of the

financial assets at fair value through profit or loss are presented

in the period in which they arise.

Valuation of investments

Some of the Company's assets and liabilities are measured at

fair value for financial reporting purposes. The Investment Manager

determines the appropriate valuation techniques and inputs for fair

value measurements.

In estimating the fair value of an asset or a liability, the

Investment Manager uses market-observable data to the extent it is

available. The Investment Manager reports its findings to the board

of directors of the Company every quarter to explain the cause of

fluctuations in the fair value of the assets and liabilities.

Information about the valuation techniques and inputs used in

determining the fair value of various assets and liabilities are

disclosed in notes 9 and 15.

Financial instruments that are measured subsequent to initial

recognition at fair value are grouped into Levels 1 to 3 based on

the degree to which the fair value is observable:

Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities; and

Level 2 fair value measurements for those derived from inputs

other than quoted prices included within Level 1 that are

observable for the assets or liability, either directly or

indirectly.

Level 3 fair value measurements are those derived from inputs

that are not based on observable market data.

At the balance sheet date all of the Company's financial assets

fell into Level 3.

a) Quoted investments

Where investments are quoted on recognised stock markets and an

active market in the shares exists, the company values those

investments at closing mid-market price on the reporting date.

Where an active market does not exist those quoted investments are

valued by the application of an appropriate valuation methodology

as if the relevant investment was unquoted.

b) Unquoted investments

In estimating the fair value for an unquoted investment, the

Company applies a methodology that is appropriate in light of the

nature, facts and circumstances of the investment and its

materiality in the context of the total investment portfolio using

reasonable data, market inputs, assumptions and estimates. Any

changes in the above data, market inputs, assumptions and estimates

will affect the fair value of an investment which may lead to a

recognition of an impairment loss in the statements of

comprehensive income if an indication of impairment exists.

The carrying value of unquoted investments at the balance sheet

date was GBP4,673,984.

Financial liabilities and equity

Financial liabilities are classified according to the substance

of the contractual arrangements entered into. An equity instrument

is any contract that evidences a residual interest in the assets of

the group after deducting all its liabilities.

Revenue recognition

Revenue recognition depends on the type of revenue

concerned:

-- Management fees are recognised as they are earned.

-- Interest income and expense is recognised on an accruals basis as finance income.

-- Investments are revalued periodically and any change in value

recognised on the revaluation date as gross portfolio return.

The above policies on revenue recognition result in both

deferred and accrued income.

Property, plant and equipment

Depreciation is provided at the following annual rates in order

to write off each asset over its estimated useful life.

Computer equipment - 33% on cost

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax at rates substantively enacted at the balance

sheet date.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The Company's

liability for current tax is calculated using tax rates that have

enacted by the balance sheet date.

Deferred tax

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the balance sheet date

where transactions or events that result in an obligation to pay

more tax in the future or a right to pay less tax in the future

have occurred at the balance sheet date. Timing differences between

the Company's taxable profits and its results as stated in the

financial information that arises from the inclusion of gains and

losses in tax assessments in periods different from those in which

they are recognised in the financial information.

Foreign currencies

In preparing the financial statements of the Company,

transactions in currencies other than the entity's functional

currency are recorded at the rates of exchange prevailing at the

dates of the transactions. At each balance sheet date, monetary

items denominated in foreign currencies are retranslated at the

rates prevailing at the date when the fair value was determined.

Non-monetary items that are measured in terms of historical cost in

a foreign currency are not retranslated.

Exchange differences are recognised in profit or loss in the

period in which they arise except for exchange differences on

monetary items receivable from or payable to a foreign operation

for which settlement is neither planned nor likely to occur; which

form part of the net investment in a foreign operation and which

are recognised in the foreign currency translation reserve.

For the purposes of presenting sterling financial statements,

the assets and liabilities of the Company's foreign operations are

expressed using exchange rates prevailing at the balance sheet

date. Income and expense items are translated at the average

exchange rate for the period, unless exchange rates fluctuated

significantly during that period, in which case the exchange rates

at the dates of the transactions are used. Exchange differences

arising, if any, are classified as equity and recognised in a

foreign currency translation reserve.

Hire purchase and leasing commitments

Rentals paid under operating leases are charged to the profit

and loss account on a straight line basis over the period of the

lease.

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the directors. The directors, who

are responsible for allocating resources and assessing performance

of the operating segments, have been identified as the senior

management that make strategic decisions. The Company is

principally engaged in investment business; the directors consider

there is only one business segment significant enough for

disclosure.

Critical accounting estimates and judgements

Preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expenses. The estimates

and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources.

In particular, significant areas of estimation, uncertainty and

critical judgements in applying accounting policies that have the

most significant effect on the amount recognised in the financial

statements are in the following areas:

Valuation of investments

The Company has made a number of investments in the form of

loans or equity instruments in private companies operating in

emerging markets. The investee companies are generally at a key

stage in their development and operating in an environment of

uncertainty in capital markets. Should planned development prove

successful, the value of the Company's investment is likely to

increase, although there can be no guarantee that this will be the

case. Should planned development prove unsuccessful, there is a

material risk that the Company's investments may be impaired. The

carrying amounts of investments are therefore highly sensitive to

the assumption that the strategies of these investee companies will

be successfully executed.

2. SEGMENTAL REPORTING

The operating segment has been determined and reviewed by the

directors to be used to make strategic decisions. The directors

consider there to be a single business segment being that of

investing activities, therefore there is only one reportable

segment.

3. EMPLOYEES AND DIRECTORS

2015 2014

GBP'000 GBP'000

Wages and salaries - Directors'

remuneration 30 48

======== ========

The average monthly number if employees during the year was as

follows:

2015 2014

Directors 3 3

===== =====

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

Directors' remuneration was split as follows;

2015 2014

GBP'000 GBP'000

Fees 30 30

Share based payments - 18

-------- --------

Total 30 48

======== ========

Further details of directors' remuneration is included in the

Director's Report.

The highest paid director received emoluments and benefits as

follows:

2015 2014

GBP'000 GBP'000

Fees 30 30

======== ========

Desmond Holdings Ltd is the Company's Investment Manager. The

directors are the key management of the Company. There were no

directors (2014: none) to whom retirement benefits were accruing

under money purchase schemes.

4. NET FINANCE INCOME

2015 2014

GBP'000 GBP'000

Finance income:

Interest receivable 48 39

-------- --------

48 39

======== ========

Finance costs:

Loan interest 27 16

-------- --------

27 16

======== ========

Net finance income 21 23

======== ========

5. LOSS BEFORE INCOME TAX

The loss before income tax is stated after

charging/(crediting):

2015 2014

GBP'000 GBP'000

Rental charges 2 2

Depreciation -owned assets - 1

Fees payable to the Company's

auditor for the audit of

the Company's annual accounts 13 13

Fees payable to the Company's

auditor for other services

- tax services 3 3

* other services 2 2

Foreign exchange (gains)/losses (16) (12)

======== ========

6. INCOME TAX

Analysis of charge in the year

2015 2014

GBP'000 GBP'000

Current tax: - -

Deferred tax - -

Tax on profit on ordinary - -

activities

======== ========

2015 2014

GBP'000 GBP'000

Loss on ordinary activities

before tax (911) (880)

======== ========

Analysis of charge in the year

2015 2014

GBP'000 GBP'000

Profit on ordinary activities

multiplied by small companies

rate of corporation tax

in the UK of 20% (2014:

20%) (182) (176)

Effects of:

Loss carried forward 182 176

-------- --------

Current tax charge for - -

the year as above

======== ========

At 31 May 2015 the Company had UK tax losses of approximately

GBP2,891,000 (2014: GBP1,980,000) available to be carried forward

and utilised against future taxable profits. A deferred tax asset

has not been recognised due to uncertainties over when profits will

arise.

7. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted loss per share earnings per share has not been disclosed

as the inclusion of unexercised warrants would be

anti-dilutive.

Reconciliations are set out below.

2015

Earnings Weighted average Per-share

GBP'000 number of amount

shares Pence

Basic EPS

Earning attributable

to ordinary

shareholders (911) 799,920,183 -0.11

2014

Earnings Weighted average Per-share

GBP'000 number of amount

shares pence

Basic EPS

Earning attributable

to ordinary

shareholders (880) 673,998,159 -0.13

8. PROPERTY, PLANT AND EQUIPMENT

Computer

Equipment

GBP'000

COST

At 1 June 2014 2

Additions -

-----------

At 31 May 2015 2

-----------

DEPRECIATION

At 1 June 2014 2

Charge for the year -

-----------

At 31 May 2015 2

-----------

NET BOOK VALUE

At 31 May 2015 -

===========

At 31 May 2014 -

===========

9. INVESTMENTS Investments at fair value through profit or loss

The Company adopted the recent investment methodology prescribed

in the IPEVCV guidelines to value its investments at fair value

through profit and loss.

The Company had the following holdings at 31 May 2015:

Pressfit Holdings PLC 22.60%

Ceniako Limited 49.00%

Craven House Industries

Ltd 95.00%

EmVest Barvale (Pty) Ltd 49.00%

EmVest Evergreen (Pty)

Ltd 49.00%

EmVest Evergreen Properties

(Pty) Ltd 49.00%

EmVest Foods (Pty) Ltd 49.00%

Royalty Sports Brands Ltd 49.00%

Farm Lands of Africa Ltd 50.00%

Investments that are held as part of the Company's investment

portfolio are carried in the balance sheet at fair value even

though the Company may have significant influence over those

companies. This treatment is permitted by IAS 28 - Investment in

Associates, which requires investment held by venture organisations

to be excluded from its scope where those investments are

designated, upon initial recognition, as at fair value through

profit or loss and accounted for in accordance with IAS 39, with

changes in fair value recognised in profit or loss in the period of

change. The Company has no interests in associates through which it

carries on its business.

Investments at fair value through profit or loss

Quoted Unquoted

Investments Investments Total

GBP'000 GBP'000 GBP'000

At 1 June 2013 887 3,710 4,597

Additions - 2,382 2,382

Revaluations (190) (672) (862)

Effect of foreign

exchange - (22) (22)

Reclassification (686) 686 -

-------------- -------------- ----------

At 31 May 2014 11 6,084 6,095

============== ============== ==========

Disposals - (717) (717)

Revaluations (586) (119) (705)

Effect of foreign - - -

exchange

Reclassification 575 (575) -

At 31 May 2015 - 4,673 4,673

====== ====== ======

Unquoted investments

Convertible

Equity loans Loan Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 June 2013 2,987 124 599 3,710

Additions 2,382 - - 2,382

Revaluations (1260) (33) 621 (672)

Effect of foreign

exchange (22) - - (22)

Reclassification 686 - - 686

---------- -------------- ---------- ------------

At 31 May 2014 4,773 91 1,220 6,084

========== ============== ========== ============

Disposals - - (717) (717)

Effect of foreign exchange 25 - (144) (119)

Reclassification (575) - - (575)

At 31 May 2015 4,223 91 359 4,673

====== === ====== ======

Quoted investments at 31 May 2015 relate to shares held in Farm

Lands of Africa Inc, a company listed on the OTC market in New

York. These shares have been measured on a Level 3 basis due to

these not being traded in an active market.

Unquoted investments at 31 May 2015 have been measured on a

Level 3 basis as no observable market data was available. These

investments are as follows:

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

Shares in Pressfit Holdings Plc are valued at GBP516,648,

representing a 22.6% holding. These have been valued using an

earnings multiple as the Directors believe this is the best

indication of the fair value of the investment at the reporting

date. They are not aware of any circumstances to indicate an

impairment of this investment.

Shares in Ceniako Limited valued at GBP718,301, representing a

49% holding. These have been valued at the price paid by Craven

House Capital as the Directors believe that the price of recent

investment continues to represent the best indication of the fair

value at the year end.

Shares in Craven House Industries Limited are valued at

GBP653,442, representing a 95% holding. These have been valued at

the price paid by the Company for its 50.1% stake in Finishtec

Acabamento Tecnicos em Matais Ltd, as the Directors believe that

the price of recent investment continues to represent the best

indication of the fair value at the year end in light of supporting

forecasts.

Shares in EmVest Barvale (Pty) Ltd valued at GBP411,338,

representing a 49% holding. These have been valued at the price

paid by Craven House Capital, as the Directors believe that this is

the best indication of the value at the year end.

Shares in EmVest Evergreen (Pty) Ltd valued at GBP0,

representing a 49% holding. These have not been attributed a value

as the Directors believe that this is the best indication of the

value at the year end.

Shares in EmVest Evergreen Properties (Pty) Ltd valued at

GBP462,697, representing a 49% holding. These have been valued at

the price paid by Craven House Capital, during the year, as the

Directors believe that this is the best indication of the value at

the year end.

Shares in EmVest Foods (Pty) Ltd valued at GBP154,232,

representing a 49% holding. These have been valued at the price

paid by Craven House Capital, as the Directors believe that this is

the best indication of the value at the year end based in

supporting forecasts.

Shares in Royalty Sports Brands Ltd valued at GBP1,306,799,

representing a 49% holding. These have been valued at the price

paid by Craven House Capital, as the Directors believe that this is

the best indication of the value at the year end.

Shares in Farm Lands of Africa Ltd valued at zero, representing

a 50% holding. The value of the shares have been written down to

zero as the Directors believe that this is the best indication of

the value at the year end considering the Ebola outbreak in

Guinea.

A convertible loan to Pressfit Holdings Plc valued at GBP91,376.

This has been valued based on the number of shares that Craven

House Capital would receive on conversion using the same earning

multiple as the shares held above as these can be converted at any

time at Craven House's option.

A loan with Greentel Limited valued at GBP359,150 The year end

valuation is based on the agreed conversion of the loan into a

facility of EUR500,000 to be repaid on or before 14 November 2016,

which the Directors believe is the most appropriate indicator of

the year end valuation based on the information available to them

regarding net assets.

Further details on the investments are contained in the

Chairman's report on pages 2 to 5.

10. TRADE AND OTHER RECEIVABLES

2015 2014

GBP'000 GBP'000

Current:

Other receivables 247 56

Prepayments and accrued

income 65 58

-------- --------

312 114

======== ========

11. CASH AND CASH EQUIVALENTS 2015 2014

GBP'000 GBP'000

Bank accounts 217 -

======== ========

12. CALLED UP SHARE CAPITAL

Authorised

Equity shares Nominal 2015 2014

Number: Class: Value: GBP'000 GBP'000

2,280,038,212 Ordinary 0.001 2,280 2,280

77,979,412 Deferred 0.09 7,018 7,018

77,979,412 Deferred 0.009 702 702

-------- --------

10,000 10,000

======== ========

Allotted, called up

and fully paid

Equity shares Nominal 2015 2014

Number: Class: Value: GBP'000 GBP'000

805,540,872 Ordinary 0.001 806 799

(2014: 798,466,557)

77,979,412 Deferred 0.09 7018 7018

77,979,412 Deferred 0.009 702 702

-------- --------

8,526 8,519

======== ========

The deferred shares carry no entitlement to receive notice of

any general meeting, to attend, speak or vote at such general

meeting. Holders are not entitled to receive dividends, and on a

winding up of the Company holders of deferred shares are entitled

to a return of capital only after the holder of each Ordinary share

has received a return of capital together with a payment of GBP1

million per share. The deferred shares may be cancelled at any time

for no consideration by way of a reduction in capital.

On 18 March 2015, the Company allotted 7,074,315 new ordinary

shares to Desmond Holdings Ltd in lieu of the performance fee due

for the year ended 31(st) May 2014. The value of the performance

being GBP88,400.This was included as a liability at 31(st) May

2014.

During the year the Company extended the time scale of

82,226,266 fully transferable exercisable warrants issued in the

year ended 31(st) May 2012. At the date of issue the warrants could

be exercised on or before 30(th) June 2014, this period has now

been extended to 30(th) June 2016.

13. TRADE AND OTHER PAYABLES

2015 2014

GBP'000 GBP'000

Current:

Bank overdraft - 16

Trade payables 76 212

Accruals and deferred

income 28 111

104 339

======== ========

14. FINANCIAL LIABILITIES - BORROWINGS

2015 2014

GBP'000 GBP'000

Current:

Other loans 391 340

======== ========

Term and debt repayment schedule 1 year

or less

GBP'000

Other loans 391

==========

Other loans of GBP391,000 comprise a convertible loan made by Mr

E Kalimtgis, a shareholder, totalling GBP311,000 and loans made by

Wise Star Capital Investment Limited, a Hong Kong investment

company. The loans were provided to enable the Company to make

qualifying investments under its Investing Policy and to provide

working capital for the Company.

The loan provided by Mr E Kalimtgis is a convertible loan which

includes interest payable at a rate of 6% per annum. The loan was

provided for 12 months dated 22(nd) October 2014 with the holder

having the option of converting the principal portion of GBP300,000

into 24,000,000 fully paid Ordinary Shares of 0.1p pence per share

at the conversion price of 1.25 pence per share. The loan has been

extended to 22(nd) October 2016 post year end. The directors do not

consider the value of the conversion rights attaching to the loans

to be a material component of equity.

The loan provided by Wise Star Capital Investment Limited

includes interest payable at a rate of 6% per annum. The loan was

provided for 12 months dated 1st September 2011; however this loan

has since been extended to at least 31(st) May 2016. The amount

owed to Wise Star Capital Investment Limited at the balance sheet

date was GBP80,000.

15. FINANCIAL INSTRUMENTS

Financial risk management objectives and policies

Management has adopted certain policies on financial risk

management with the objective of:

i. ensuring that appropriate funding strategies are adopted to

meet the Company's short-term and long-term funding requirements

taking into consideration the cost of funding, gearing levels and

cash flow projections;

ii. ensuring that appropriate strategies are also adopted to

manage related interest and currency risk funding; and

iii. ensuring that credit risks on receivables are properly

managed.

Financial instrument by category

The accounting policies for financial instruments have been

applied to the line items below:

Financial assets at fair value through profit or loss

Financial instruments that are measured subsequent to initial

recognition at fair value are grouped into Levels 1 to 3 based on

the degree to which the fair value is observable:

Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities; and

Level 2 fair value measurements for those derived from inputs

other than quoted prices included within Level 1 that are

observable for the assets or liability, either directly or

indirectly.

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

Level 3 fair value measurements are those derived from inputs

that are not based on observable market data.

At the balance sheet date all of the Company's financial

investments fell into Level 3.

Unquoted equity investments held at fair value through profit or

loss are valued in accordance with the IPEVCV guidelines as

follows;

2015 2014

GBP'000 GBP'000

Investment valuation

methodology

Earnings multiple 517 -

Recent investment

price 3,706 4,864

4,223 6,084

========== ==========

Level 3 valuations include inputs based on non-observable market

data. IFRS 13 requires an entity to disclose quantitative

information about the significant unobservable inputs used. 88% of

Level 3 equity investments are held at recent investment price,

where no significant judgement has been applied to the valuation

inputs. 12% of Level 3 investments are valued on an earnings

multiple basis where significant judgement has been applied to the

valuation inputs. An earnings multiple of 9 has been used to

calculate the value, which the Directors consider to be appropriate

given the operating sector of the investment and after allowing for

a suitable marketability discount range. Any increase/decrease in

the earnings multiple would result in an increase/decrease in the

valuation.

IFRS 13 and IFRS 7 requires the Directors to consider the impact

of changing one or more of the inputs used as part of the valuation

process to reasonable possible alternative assumptions. After due

consideration and noting that the valuation methodology applied to

over 88% of the Level 3 investments (by valuation) is based on

recent investment price, the Directors believe that changes to

reasonable possible alternative input assumptions (a reasonable

discount to the earnings multiple) for the valuation of the

remainder of the portfolio could lead to a change in the fair value

of the portfolio. The impact of these changes could result in an

increase in the valuation of the equity investments by GBP155,088

or a decrease in the valuation of equity investments by

GBP68,608.

The valuation method applied to each equity investment is that

which is considered most appropriate with regard to the stage of

development of the investee business and the IPEVCV guidelines. In

applying the price of recent investment valuation methodology the

basis used is either the initial cost of the investment, or, where

there has been subsequent follow-on investment, the price at which

a significant new investment was made.

Investments in debt instruments are valued at their recoverable

amounts.

All other financial instruments, including cash and cash

equivalents, trade and other receivables, trade and other payables

and loans and borrowings, are measured at amortised cost.

Due to their short-term nature, the carrying values of cash and

cash equivalents, trade and other receivables, trade and other

payables and loans and borrowings approximates their fair

value.

Credit risk

The Company's credit risk is primarily attributable to other

receivables. Management has a credit policy in place and the

exposure to credit risks is monitored on an ongoing basis. In

respect of other receivables, individual credit evaluations are

performed whenever necessary. The Company's maximum exposure to

credit risk is represented by loans, both those held as unquoted

investments and included in other receivables, and cash balances.

The Company monitors the financial position of borrowing entities

on an ongoing basis and is satisfied with the quality of the debt.

Investment of surplus cash balances are reviewed on an annual basis

by the Company and it is satisfied with the choice of

institution.

Interest rate risk

The Company currently operates with positive cash and cash

equivalents as a result of issuing share capital in anticipation of

future funding requirements. As the Company has no borrowings from

the bank and the amount of deposits in the bank are not

significant, the exposure to interest rate risk is not significant

to the Company. The effect of a 10% increase or fall in interest

rates obtainable on cash and on short-term deposits would be to

increase or decrease the Company's profit by less than GBP1,000

(2014: Less than GBP1,000).

Liquidity risk

The Company manages its liquidity requirements by the use of

both short-term and long-term cash flow forecasts. The Company's

policy to ensure facilities are available as required is to issue

equity share capital in accordance with agreed settlement terms

with vendors or professional firms, and all are due within one

year.

The table below summarises the maturity profile of the Company's

financial liabilities based on contractual discounted payments.

Less 3 to

On than 12

demand 3 months months Total

Year ended

31 May 2015 GBP000 GBP000 GBP000 GBP000

Trade payables 76 - - 76

Accruals and

deferred income 28 - - 28

Interest bearing

loans and borrowings - - 80 391

104 0 80 495

------- --------- ------- -------

Year ended

31 May 2014

Bank overdraft 16 - - 16

Trade payables 212 - - 212

Accruals and

deferred income 111 - - 111

Interest bearing

loans and borrowings - - 70 340

339 0 70 679

------- --------- ------- -------

Post year end, GBP311,000 of loans shown as due in 3-12 months

have been extended. Had the extension been agreed pre-year end,

GBP311,000 would be shown as due in 1-5 years.

Price risks

The Company's securities are susceptible to price risk arising

from uncertainties about future value of its investments. This

price risk is the risk that the fair value of future cash flows

will fluctuate because of changes in market prices, whether those

changes are caused by factors specific to the individual investment

or financial instrument or its holder or factors affecting all

similar financial instruments or investments traded in the

market.

During the year under review, the Company did not hedge against

movements in the value of its investments. A 10% increase/decrease

in the fair value of investments would result in a GBP467,300

(2014: GBP609,500) increase/decrease in the net asset value.

While investments in companies whose business operations are

based in emerging markets may offer the opportunity for significant

capital gains, such investments also involve a degree of business

and financial risk, in particular for unquoted investments.

Generally, the Company is prepared to hold unquoted investments

for a middle to long time frame, in particular if an admission to

trading on a stock exchange has not yet been planned. Sale of

securities in unquoted investments may result in a discount to the

book value.

Currency risks

The Company is exposed to foreign currency risk on its

investments held at fair value and adverse movements in foreign

exchange rates will reduce the values of these investments. There

is no systematic hedging in foreign currencies against such

possible losses on translation/realisation. Otherwise the Company

operates primarily within its local currency.

The sensitivity to a reasonable possible change in US$ exchange

rates, with all other variables held constant, would be GBP94,000

(2014: GBP73,000) which would directly affect both profits before

tax and the effect on pre tax equity. This is assuming a 5%

variance. The impact on the profit before tax and pre tax equity is

due to the fair value adjustment of assets and liabilities. The

Company's exposure to other foreign currency changes is not deemed

to be material.

Capital management

The Company's financial strategy is to utilise its resources to

further grow its portfolio. The Company keeps investors and the

market informed of its progress with its portfolio through periodic

announcements and raises additional equity finance at appropriate

times.

The Company regularly reviews and manages its capital structure

for the portfolio companies to maintain a balance between the

higher shareholder returns that might be possible with certain

levels of borrowing for the portfolio and the advantages and

security afforded by a sound capital position, and makes

adjustments to the capital structure of the portfolio in the light

of changes in economic conditions. Although the Company has

utilised loans from shareholders to acquire investments, it is the

Company's policy as far as possible to finance its investing

activities with equity and not to have gearing in its

portfolio.

At the balance sheet date the capital structure of the Company

consisted of borrowings disclosed in note 14, cash and cash

equivalents and equity comprising issued capital and reserves.

16. RELATED PARTY DISCLOSURES

During the year, the Company entered into the following

transactions with related parties and connected parties:

Loans from Wise Star Capital Investment Limited

At the year end the Company owed GBP80,000 to Wise Star Capital

Investment Limited, Mark Pajak was Director of Wise Star Capital

Investment Limited during the year. Details of the loan are set out

in note 14.

Loans from Mr E Kalimtgis

During the year the Company received a loan of GBP300,000 from

Evangellos Kalimtgis, a shareholder. GBP11,000 interest was charged

in the year. At the year end the balance owed to Evangellos

Kalimtgis was GBP311,000. Details of the loan are set out in note

14.

Management fees payable to Desmond Holdings Limited

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

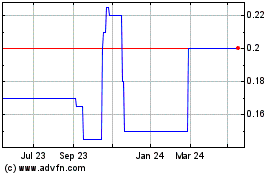

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jul 2023 to Jul 2024