Banco Bilbao Vizcaya Argentaria SA Implementation of IAS 29 to BBVA Turkey (5460Q)

June 29 2022 - 2:00AM

UK Regulatory

TIDMBVA

RNS Number : 5460Q

Banco Bilbao Vizcaya Argentaria SA

28 June 2022

Banco Bilbao Vizcaya Argentaria, S.A. (BBVA), in accordance with

the provisions of the Securities Market legislation, hereby

communicates the following:

INSIDE INFORMATION

BBVA will implement the IAS29 accounting standards "Financial

Reporting in Hyperinflationary Economies" to its Group entities in

Turkey ([1]) , with effects from 1st January 2022. The impacts of

such implementation will be reflected in the second quarter of 2022

BBVA Group financial statements.

In order to facilitate monitoring the quarterly information of

the BBVA Group, attached is a presentation which includes the BBVA

Group pro-forma simplified balance sheet and income statement for

the first quarter of 2022 applying IAS29 accounting standards. Such

presentation also describes the details of the adjustments to the

BBVA Group's financial statements as a result of the implementation

of the referred IAS29 standards.

The main impacts calculated on the BBVA Group's financial

statements as of 31 March 2022 are as follows:

-- A positive impact on the Common Equity Tier 1 (fully loaded)

ratio of approximately 19 basis points.

-- A negative impact ([2]) on the BBVA Group's net attributable

profit of approximately -324 million euros.

In 2022, considering the expected annual inflation ([3]) in

Turkey, it is envisaged that (i) the earnings contribution of the

Group's entities in Turkey to the BBVA Group's results will be

non-material and (ii) capital and tangible book value will be

positively impacted in the coming quarters.

Madrid, June 28, 2022

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/5460Q_1-2022-6-28.pdf

([1]) IAS 29 does not apply to the operations outside Turkey of

the Türkiye Garanti Bankası A. . group of companies, and in

particular to the financial statements of Garanti Bank S.A. in

Romania and GarantiBank International N.V. in the Netherlands.

([2]) For the calculation of this impact, the exchange rate of

16.28 Turkish Lira per Euro (applicable on 31 March 2022) and the

cumulative inflation rate in Turkey in the first quarter of 2022 of

22.8% (published by the Turkish Statistical Institute) have been

used.

([3]) According to BBVA Research estimates, Turkey's annual

inflation rate will be around 60% in 2022, which implies a

moderation in the quarterly inflation rate in the coming

quarters.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFPMRTMTATBJT

(END) Dow Jones Newswires

June 29, 2022 02:00 ET (06:00 GMT)

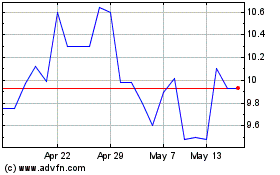

Banco Bilbao Vizcaya Arg... (LSE:BVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Banco Bilbao Vizcaya Arg... (LSE:BVA)

Historical Stock Chart

From Nov 2023 to Nov 2024