UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-QSB

(Mark

One)

|

x

|

Quarterly

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934.

|

For

the quarter ended

September 30,

2010

|

o

|

Transition Report Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of

1934.

|

For the

transition period from ________ to __________

Commission

File Number:

00-

22413

UNIVEC,

INC.

(Exact

name of small business issuer as specified in its charter)

|

Delaware

|

11-3163455

|

|

(State

or other jurisdiction of incorporation or organization)

|

(IRS

Employee Identification No.)

|

|

9722 Groffs Mill Drive Suite 116, Ownings

Mills

,

MD 21

117

|

|

(Address

of principal executive

offices)

|

|

(4

43

)

253

-

0194

|

|

(Issuer’s

telephone number)

|

(Former

address

: 822

Guilford Avenue, Suite 208, Baltimore, MD 21202

(Former name, former

address, for

mer fiscal year, if changed since last report)

Check

whether the issuer (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Yes

¨

No

x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

o

No

x

The

number of shares outstanding of each of the issuer’s classes of common equity,

as of

September 30,

2010 is 181,210,422 shares of common stock

.

UNIVEC,

INC.

FORM

10-QSB

TABLE

OF CONTENTS

|

PART I - FINANCIAL

INFORMATION

|

|

1

|

|

|

|

|

|

|

|

Item

1. Financial Statements

|

|

1

|

|

|

|

|

|

|

|

Item

2. Management’s Discussion and Analysis or Plan of

Operation

|

|

5

|

|

|

|

|

|

|

|

Item

3. Controls and Procedures

|

|

7

|

|

|

|

|

|

|

|

PART

II - OTHER INFORMATION

|

|

7

|

|

|

|

|

|

|

|

Item

1. Legal Proceedings

|

|

7

|

|

|

|

|

|

|

|

Item

2. Unregistered Sales of Equity Securities and Use of

Proceeds

|

|

7

|

|

|

|

|

|

|

|

Item

3. Defaults Upon Senior Securities

|

|

7

|

|

|

|

|

|

|

|

Item

4. Submission of Matters to a Vote of Security Holders

|

|

7

|

|

|

|

|

|

|

|

Item

5. Other Information

|

|

7

|

|

|

|

|

|

|

|

Item

6. Exhibits

|

|

7

|

|

|

|

|

|

|

|

SIGNATURES

|

|

8

|

|

Except as otherwise required by the

context, all references in this report to "we", "us”, "our", “UNVC”,

“Univec” or "Company"

refer to the consolidated operations of Univec, Inc., a Delaware corporation,

and its wholly owned subsidiaries.

PART

I - FINANCIAL INFORMATION

|

Item 1.

|

Financial

Statements.

|

Univec,

Inc. and Subsidiaries

Consolidated

Balance Sheet (Unaudited)

September

3

0

,

20

10

|

ASSETS

|

|

|

|

|

Cash

|

|

$

|

2,947

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

0

|

|

Common

stock balance and other miscellaneous receivable

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

assets

|

|

|

0

|

|

|

|

|

|

|

|

|

Total

assets

|

|

$

|

3,919

|

|

|

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS' DEFICIT

|

|

|

|

|

Accounts

payable and accrued expenses

|

|

|

|

|

|

Accrued

payroll

|

|

|

1,937,091

|

|

Notes

and loans payable - current

|

|

|

|

|

|

Loans

payable - officers/directors

|

|

|

244,412

|

|

Due

to affiliated companies

|

|

|

|

|

|

Total

current liabilities

|

|

|

3,131,941

|

|

|

|

|

|

|

|

|

Officers/directors

notes and loans payable - long-term

|

|

|

50,000

|

|

Notes

and loans payable - long-term

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred

stock $.001 par value; 3,743,500 shares authorized; none issued and

outstanding

|

|

|

|

|

Series D 5% cumulative

convertible preferred stock,

$.001 par value; authorized:

1,250,000; issued and

outstanding: 208,333 shares

(aggregate liquidation

value:

$563,004)

|

|

|

|

|

Series E cumulative convertible

preferred stock,

$.001 par value; authorized:

2,000 shares; issued and

outstanding: 312 shares

(aggregate liquidation

value:

$358,441)

|

|

|

|

|

Common stock $.001 par value;

authorized:

500

,000,000 shares;

issued:

181,210,422

and outstanding:

181,210,422

shares

|

|

|

181,210

|

|

|

Additional

paid-in capital

|

|

|

11,601,723

|

|

Treasury

stock, 404,154 shares - at cost

|

|

|

|

|

|

Accumulated

deficit

|

|

|

(17,655,678

)

|

|

|

|

|

|

|

|

|

Total

stockholders' deficit

|

|

|

(

5,900,827)

|

|

|

|

|

|

|

|

|

Total

liabilities and stockholders' deficit

|

|

$

|

3,919

|

|

See notes

to the consolidated financial statements.

Univec,

Inc. and Subsidiaries

Consolidated

Statement of Operations (Unaudited)

|

|

|

Three

months

ended

September

3

0

,

|

|

|

|

|

20

10

|

|

|

200

9

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

972

|

|

|

$

|

800

|

|

|

|

|

|

(0

|

)

|

|

|

(600

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

972

|

|

|

|

200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing

and selling

|

|

|

(9,000

|

)

|

|

|

0

|

|

|

|

|

|

0

|

|

|

|

0

|

|

|

General

and administrative

|

|

|

(14,258

|

)

|

|

|

(43,918

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

operating expenses

|

|

|

(23,258

|

)

|

|

|

(43,918

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss

from Operations

|

|

|

(22,286

|

)

|

|

|

(43,718

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other

Income (Expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

(0

|

)

|

|

|

(29,426

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0

|

)

|

|

|

(29,423

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(22,286

|

)

|

|

|

(73,141

|

)

|

|

|

|

|

|

|

|

|

|

|

Dividends

attributable to preferred stock

|

|

|

(8,213

|

)

|

|

|

(8,213

|

)

|

|

|

|

|

|

|

|

|

|

|

Loss

attributable to common stockholders

|

|

|

(30,499

|

)

|

|

|

(81,354

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

and diluted net loss per common share

|

|

$

|

(0.0001

|

)

|

|

$

|

(0.001

|

)

|

|

|

|

|

|

|

|

|

|

|

Basic

weighted average number

of common shares

outstanding

|

|

|

181

,

210

,

422

|

|

|

|

63,444,360

|

|

See notes

to the consolidated financial statements.

Univec,

Inc. and Subsidiaries

Consolidated

Statement of Cash Flows (Unaudited)

Nine

months ended

September

31,

20

10

and

200

9

|

|

|

2007

|

|

|

2006

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from operating activities

|

|

|

|

|

|

|

|

|

|

$

|

(22,286

|

)

|

|

$

|

(73,141

|

)

|

|

Adjustments

to reconcile net loss to net cash

used

in operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation

and amortization

|

|

|

0

|

|

|

|

26,418

|

|

Changes

in assets and liabilities

|

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

|

(975

|

)

|

|

|

(799

|

)

|

|

|

|

|

0

|

|

|

|

600

|

|

|

Accounts

payable and accrued expenses

|

|

|

0

|

|

|

|

46,871

|

|

|

|

|

|

|

|

|

|

62,175

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash (used in) operating activities

|

|

|

(22,997

|

)

|

|

|

(51

|

)

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from investing activities

|

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash used in investing activities

|

|

|

|

|

|

|

|

|

|

Cash

flows from financing activities

|

|

|

|

|

|

|

|

|

Increase

in due from affiliated companies

|

|

|

|

|

|

|

0

|

|

|

Increase

in loans payable - officers/directors

|

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash provided by financing activities

|

|

|

25,944

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

increase (decrease) in cash

|

|

|

2,632

|

|

|

|

(51

|

)

|

Cash,

beginning of period

|

|

|

264

|

|

|

|

315

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2,947

|

|

|

$

|

264

|

|

See notes

to the consolidated financial statements.

UNIVEC,

Inc. and Subsidiaries

Notes to

Consolidated Financial Statements (Un-audited)

1. Nature

of Operations

Univec,

Inc. (Company)

distributes,

produces, licenses and markets

specialty

pharmaceutical drugs. Physician and Pharmaceutical Services, Inc. (PPSI), a

subsidiary, provides pharmaceutical samples and group purchasing services

for

pharmaceutical

companies and health

care providers.

2.

Summary of Significant Accounting Policies

Financial

Statements

The

accompanying un-audited consolidated financial statements have been prepared in

accordance with accounting principles generally accepted in the United States

for interim financial statements and with the rules and regulations of the

Securities and Exchange Commission for Form 10-QSB. Accordingly, they do not

include all of the information and footnotes required by accounting principles

generally accepted in the United States for complete financial statements. In

the opinion of management, all adjustments (consisting only of normal recurring

accruals) considered necessary for a fair presentation of the consolidated

financial position, results of operations and cash flows for the interim periods

presented have been included. These consolidated financial statements should be

read in conjunction with the consolidated financial statements of Univec, Inc.,

together with the Company’s Management’s Discussion and Analysis, included in

the Company’s Form 10-KSB for the year ended

September 30, 2010.

Interim results are not necessarily indicative of the results for a full

year.

Net Loss

Per Share

Basic net

loss per share was computed based on the weighted-average number of common

shares outstanding during the three month periods ended

September

30,2010.

Estimates

The

preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the amounts reported in the consolidated financial statements and

accompanying notes. Actual results could differ from those

estimates.

New

Accounting Pronouncements

Management

does not believe that any recently issued, but not yet effective accounting

pronouncements, if adopted, would have a material effect on the accompanying

financial statements.

3. Debt

Repayment

During

the three month period ended

September 30,2010

the Company did not repay any additional outstanding debt.

4.

Financing Agreement

On July

31, 2006 the Company completed the private placement of a $2,000,000 6% Note

Warrants Securities Purchase Agreement. The Agreement allows the investor to

purchase 10,000,000 common stock warrants for seven years at an exercise price

of $0.02 each. The Note and Warrants were issued in reliance upon exemptions

from regulation pursuant to section 4(2) of the Securities Act of 1933 and Rule

506 of Regulation D promulgated thereto. Each of the Investors is an accredited

investor as defined in Rule 501 of Regulation D under the Securities Act of

1933.

|

Item 2.

|

Management’s Discussion and

Analysis or Plan of

Operation.

|

The

following discussion should be read in conjunction with the Financial Statements

and Notes thereto appearing elsewhere in this Form 10-QSB.

Safe Harbor Regarding

Forward-Looking Statements

The

following discussion contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 relating to future events or our future performance. Actual

results may materially differ from those projected in the forward-looking

statements as a result of certain risks and uncertainties set forth in this

prospectus. Although management believes that the assumptions made and

expectations reflected in the forward-looking statements are reasonable, there

is no assurance that the underlying assumptions will, in fact, prove to be

correct or that actual results will not be different from expectations expressed

in this report.

Results of

Operations

For

the Three Months Ended

September 30, 2010

compared to the Three Months Ended

September 30,

2009

Condensed

Consolidated Results of Operations

|

|

|

Three

months

ended

September

30

|

|

|

|

|

|

|

|

|

|

20

10

|

|

|

200

9

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

972

|

|

|

$

|

800

|

|

|

Cost

of Revenues

|

|

|

(0

|

)

|

|

|

(600

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Gross

Margin

|

|

|

972

|

|

|

|

200

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Marketing

and Selling

|

|

|

9,000

|

|

|

|

0

|

|

|

Product

Development

|

|

|

0

|

|

|

|

0

|

|

|

General

and Administrative

|

|

|

(14,258

|

)

|

|

|

(43,918

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss

from operations

|

|

|

(23,258

|

)

|

|

|

(43,718

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other

Income (Expense)

|

|

|

|

|

|

|

|

|

|

Interest

Expense, Net

|

|

|

(0

|

)

|

|

|

(29,426

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net

Loss

|

|

$

|

(22,286

|

)

|

|

$

|

(73,141

|

)

|

As illustrated in the

table above, overall revenues for the three month period ended

September

30 increased by $172

as compared to the comparable period ended

September 30, 2009.

. Product sales alone

accounted for all of th

is increase. The company has gone through a

transition period for its business model to focus on pharmaceuticals and the

marketing and distribution of its own private line as well as a private

distributor of other lines. The Company management believes that the

concentrated resources will produce greater results, with greater profit

margins.

The

Company will endeavor to

increase revenue with

greater profit margin

by placing increased product sales in the direct

marketplace and by

directing resources

on

its higher gross profit product sales.

The

Company will focus on the

distribution,

marketing,

development and distribution of its pharmaceutical and

proprietary products

.

Physician

and Pharmaceutical Services, Inc. (PPSI) is a Group Purchasing Organization

(GPO), formulary management

and sampling of

pharmaceutical products

company. Group purchasing allows companies to get

better prices by combining purchasing power. It is also important that the

products being purchased are appropriate for the drug formulary that is

approved.

We

anticipate gross margin levels to remain at these decreased levels due to

the GPO’s principal customers’ commercial activity decline.

Marketing and selling

costs for the three periods ended

September 30, 2010

increased $9000 due to the start up of our new product development

model

as compared to

the comparable period ended

September 30, 2009.

There

were

no

product development expenses incurred for three month period ended

September 30, 2010 and

also for the comparable period ended

September

30,2009.

General and administrative

expenses

$14,258

for the three month period

ended

September 30, 2010 was due to legal and professional fees and

securities maintenance expenses.

Net loss for the three

month period ended

September 30, 2010 decreased by $50,855 as compared to

the three month period ended September 30,2009 due to the above details and

activity within the company.

The

relatively low trading price and volume of our common shares hampers our ability

to raise equity capital. There is no assurance that any such equity financing

will be available to the Company or on terms we deem favorable. Management will

continue its efforts to obtain debt and/or equity financing.

Significant

Estimates

Univec’s

business plan upon acquiring PPSI was to fully utilize its distribution

capabilities to increase sales and profitability. A shortage of cash flow has

slowed the effectiveness of the plan. Management has reviewed the carrying

amount of goodwill and fixed assets and recognized appropriate write-offs during

the periods prior to the quarter ended considering their fair value based on

anticipated future undiscounted cash flows and appraisals of the

equipment

We have

also reviewed the carrying value of both our accounts receivable and inventory.

Based on both our anticipated future undiscounted cash flows and recent

financings, no additional impairment is required to be

recognized.

New Accounting

Pronouncements

Management

does not believe that any recently issued, but not yet effective accounting

pronouncements, if adopted, would have a material effect on the accompanying

financial statements.

Off-Balance Sheet

Arrangements

We do not

have off-balance sheet arrangements, financings, or other relationships with

unconsolidated entities or other persons, also known as “special purpose

entities” (SPEs).

|

Item 3.

|

Controls

and Procedures

|

Evaluation of Disclosure

Controls and Procedures

Under the

supervision and with the participation of our management, including our

principal executive officer and principal financial officer, we conducted an

evaluation of our disclosure controls and procedures, as such term is defined

under Rule 13a-15(e) and Rule 15d-15(e) promulgated under the Securities

Exchange Act of 1934, as amended (Exchange Act), as of March 31, 2007. Based on

this evaluation, our principal executive officer and principal financial officer

have concluded that our disclosure controls and procedures are effective to

ensure that information required to be disclosed by us in the reports we file or

submit under the Exchange Act is recorded, processed, summarized, and reported

within the time periods specified in the Securities and Exchange Commission's

rules and forms and that our disclosure and controls are designed to ensure that

information required to be disclosed by us in the reports that we file or submit

under the Exchange Act is accumulated and communicated to our management,

including our principal executive officer and principal financial officer, or

persons performing similar functions, as appropriate to allow timely decisions

regarding required disclosure.

Changes in Internal

Controls

There

were no changes (including corrective actions with regard to significant

deficiencies or material weaknesses) in our internal controls over financial

reporting that occurred during the fiscal quarter ended March 31, 2007 that has

materially affected, or is reasonably likely to materially affect, our internal

control over financial reporting.

PART

II - OTHER INFORMATION

|

Item 1.

|

Legal

Proceedings.

|

To the

best of our knowledge, neither the Company nor any of its subsidiaries is a

party to any pending or threatened legal proceedings.

|

Item 2.

|

Unregistered Sales of Equity

Securities and Use of

Proceeds.

|

None.

|

Item 3.

|

Defaults Upon Senior

Securities.

|

None.

|

Item 4.

|

Submission of Matters to a Vote

of Security Holders.

|

None.

|

Item 5.

|

Other

Information.

|

None.

|

Exhibit No.

|

|

Title

of Document

|

|

|

|

|

|

31.1

|

|

Certification

pursuant to Section 302 of Sarbanes Oxley Act of 2002

|

|

|

|

|

|

31.2

|

|

Certification

pursuant to Section 302 of Sarbanes Oxley Act of

2002

|

SIGNATURES

In

accordance with the requirements of the Exchange Act, the registrant caused this

report to be signed on its behalf by the undersigned, there unto duly

authorized.

|

UNIVEC,

INC.

|

|

|

|

|

By:

|

/s/ Dr. David Dalton

|

|

|

DR.

DAVID DALTON

|

|

|

President,

Chief Executive Officer,

Chief

Financial Officer

|

|

|

|

|

Date:

|

November

4, 2010

|

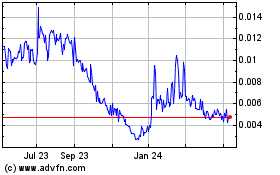

Univec (PK) (USOTC:UNVC)

Historical Stock Chart

From Dec 2024 to Jan 2025

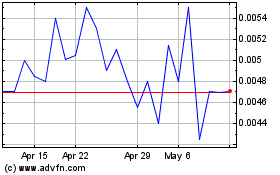

Univec (PK) (USOTC:UNVC)

Historical Stock Chart

From Jan 2024 to Jan 2025