Get the DD on the Most Talked About Micro-Cap Stocks in the Market

March 22 2013 - 1:01PM

Marketwired

First Penny Picks is offering a free DD report

this week on: M Line Holding, Inc. (OTCQB: MLHC)

, Trulan Resources Inc. (PINKSHEETS: TRLR)

and Southern Products, Inc. (OTCQB: SNPD)

M Line Holding, Inc. (OTCQB: MLHC)

experienced a record trading day and offered investors very little

opportunity for profits. On paper MLHC looked

like a sure winner, all the stats were there. M

Line Holding, Inc. had an extremely undervalued market cap of

$1.23 million with revenues exceeding $10 million and over $4

million in assets for the fiscal year ending June 29th, 2012. The

estimated float is very tiny with only 7 million shares and a

record $2.8 million in gross profit were recorded the previous

fiscal year. These are great indicators that a stock should

perform. To find out how MLHC can trade

nearly 88 times its 3 month daily average, 4.4 million shares, and

provide almost zero opportunity for investors to profit yesterday

read the full report at: http://bit.ly/NewResearchReports

Trulan Resources Inc. (PINKSHEETS: TRLR)

reached a loan agreement with private investment group for $1

million to be funded in stages and repaid at a 6% rate which can be

converted into common shares at a share price of $0.25 the first

year and $0.50 per share the second year according to a news

release issued by TRLR. Historically mining

companies have the best ROI for shareholders and after viewing the

terms of this loan it looks like the private investment community

feels the same way. Read the full report to get more insight on the

day's trading and the potential of TRLR here:

http://bit.ly/NewResearchReports

Southern Products, Inc. (OTCQB: SNPD)

ended the trading session for March 21st, 2013 just way it began

with a share price of $0.1999 while the majority of the securities

traded in the $0.20-$0.21 range. The total cash volume that traded

hands on March 21st, 2013 was nearly $106k. The revenues for

SNPD have mirrored the industry revenues over

the past 2 years. Revenues and demand have decreased in the U.S.

market due to a maturing customer base that already has at least

one flat panel TV. Experts agree this trend is going to continue at

a 5% declining rate and that if companies in this industry are

going to survive their sales will be based on features and size of

that flat panel TV.

To view the full report that describes SNPD plans to succeed in a declining market with a

unique feature follow the link provided:

http://bit.ly/NewResearchReports

For mobile alerts text "FPPALERTS" to

25827

VIP Group

Increase Your Day Trading Odds by joining our VIP

Pre-promotion/Early Alert Membership For only $49.95/month or

$495/year: http://www.firstpennypicks.com/vip-membership/

Disclaimer: Firstpennypicks.com is owned by Elite Traders Group

LLC. Information, opinions and analysis contained herein are based

on sources believed to be reliable, but no representation,

expressed or implied, is made as to its accuracy, completeness or

correctness. The opinions contained herein reflect our current

judgment and are subject to change without notice. We accept no

liability for any losses arising from an investor's reliance on or

use of this report. This report is for information purposes only,

and is neither a solicitation to buy nor an offer to sell

securities. Certain information included herein is forward-looking

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, statements concerning

manufacturing, marketing, growth, and expansion. Such

forward-looking information involves important risks and

uncertainties that could affect actual results and cause them to

differ materially from expectations expressed herein. First Penny

Picks has not been compensated for this report.

Contact: Elite Traders Group LLC Email Contact

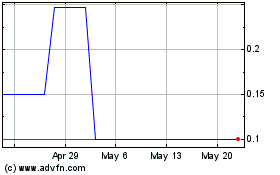

Trinity Resources (PK) (USOTC:TRRI)

Historical Stock Chart

From Nov 2024 to Dec 2024

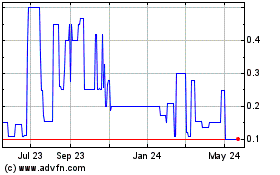

Trinity Resources (PK) (USOTC:TRRI)

Historical Stock Chart

From Dec 2023 to Dec 2024