false

0001477009

0001477009

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 20, 2024

TREES CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Colorado |

|

000-54457 |

|

90-1072649 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

215 Union Boulevard, Suite 415

Lakewood, Colorado |

|

80228 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 759-1300

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 20, 2024, TREES Corporation through

its wholly-owned subsidiary Trees Oregon, LLC (the “Company”) entered into an Asset Purchase Agreement (“APA”)

with Broadway Project, Inc. (“Buyer”) pursuant to which the Company agreed to sell to Buyer its retail marijuana license in

respect of the Company’s retail dispensary located on NE MLK Boulevard, Portland, Oregon. The purchase price for the sale is an

aggregate of $50,000, of which $12,500 was paid upon the execution of the APA and the remaining $37,500 is to be paid to the Company by

Buyer upon the closing. In addition, Buyer agreed to pay certain renewal and licensing fees. Closing of the transaction is conditioned

upon approval by the Oregon Liquor and Cannabis Commission as well as any applicable local regulatory authority.

The foregoing description of the APA does not

purport to be complete and is qualified in its entirety by reference to the full text thereof, which is annexed hereto as Exhibit 10.1,

and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

Dated: November 25, 2024

| |

By: |

/s/ Adam Hershey |

| |

Name: |

Adam Hershey |

| |

Title: |

Interim Chief Executive Officer |

Exhibit 10.1

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT

(the “Agreement”) is entered into as of November 20, 2024, by and between Broadway

Project, Inc, an Oregon corporation, or its designee (“Buyer”), and TREES Oregon, LLC, a Colorado limited

liability company (“Seller”). Seller and Buyer are sometimes referred to individually as a “Party”

and collectively as the “Parties.”

Recitals

A.

Seller owns the retail marijuana license No. 050-101748151E2 (the “License”) in respect of the premises located

at 7048-7050 NE MLK Boulevard, Portland, Oregon 97239 (the “Premises”); and

B.

Buyer desires to purchase the License from Seller, and Seller desires to sell the License to Buyer, subject to the terms of this

Agreement.

NOW THEREFORE, the Parties

agree as follows:

Terms

ARTICLE I

DEFINITIONS AND CONSTRUCTION

1.1 Definitions.

Capitalized terms have the meanings set forth below unless defined elsewhere in this Agreement.

“Affiliate”

means any Person that directly or indirectly through one or more intermediaries, Controls, is Controlled by or is under common Control

with the Person specified.

“Application Fees”

means all fees paid to Governmental Authorities associated with the Change of Ownership applications.

“Business Day”

means a day other than Saturday, Sunday, or any day on which banks located in the State of Oregon are authorized or obligated to close.

“Change of Ownership”

means the transfer of ownership of the Licenses from Seller to Buyer.

“Charter Documents”

means with respect to any Person, the articles or certificate of incorporation, formation or organization and by-laws or operating agreement,

the limited partnership agreement, the partnership agreement or the limited liability company agreement, or such other organizational

documents of the Person, including those that are required to be registered or kept in the place of incorporation, organization or formation

of the Person and which establish the legal personality of the Person.

“City”

means the City and County of Portland, Oregon.

“Claim”

means any demand, claim, action, investigation, or Proceeding.

“Contract”

means any legally binding written contract, lease, license, evidence of indebtedness, mortgage, indenture, purchase order, binding bid,

letter of credit, security agreement or other written and legally binding arrangement.

“Control”

means the power, direct or indirect, to direct or cause the direction of the management and policies of a Person whether through ownership

of voting securities or ownership interests, by Contract or otherwise, and specifically with respect to a corporation, partnership or

limited liability company, means direct or indirect ownership of at least 50% of the voting securities in the corporation or of the voting

interest in a partnership or limited liability company.

“Final Governmental

Approval” means the final decisions by the OLCC and the City in writing approving the Change of Ownership.

“Governmental Authority”

means any court, tribunal, arbitrator, authority, agency, commission, official or other instrumentality of the United States or any state,

county, city, or other political subdivision or similar governing entity.

“Interim Period”

means the time period from the date of this Agreement through and including the Closing.

“Knowledge”

when used in a particular statement of fact in this Agreement, means the actual knowledge (as opposed to any constructive or imputed knowledge)

of a Party or its owners, without inquiry.

“Laws”

means all laws, statutes, rules, regulations, ordinances, and other pronouncements having the effect of law of a Governmental Authority,

except for any United States federal law, rule, or regulation related to marijuana which this Agreement may violate.

“Lien”

means any mortgage, pledge, assessment, security interest, lien, or other similar encumbrance.

“Loss”

means any and all losses, judgments, liabilities, amounts paid in settlement, damages, fines, penalties, deficiencies, and expenses (including

interest, court costs, reasonable fees of attorneys, accountants and other experts or other reasonable expenses of litigation or other

Proceedings or of any Claim, default or assessment), but only to the extent the loss (a) is not reasonably expected to be covered by a

payment from some third party or by insurance or otherwise recoverable from third parties, and (b) is net of any associated benefits arising

in connection with the loss, including any associated Tax benefits.

“Marijuana Code”

means, collectively, Chapters 475C and 845 of the Oregon Revised Statutes – Cannabis Regulation and Oregon Administrative Rules

for Recreational Marijuana, respectively, together with any and all additional applicable regulations of the OLCC as the same may be supplemented

or amended from time to time, together with the regulations promulgated thereunder, and all applicable local Laws and regulations thereto

promulgated by a Governmental Authority.

“Material Adverse

Effect” means any occurrence, condition, change, development, event or effect that has or could reasonably be expected to have

a material adverse effect on the assets, properties, financial condition, or results of operations on a Party, as the context dictates,

taken as a whole. Material Adverse Effect does not include events, occurrences, facts, conditions, or changes arising out of, relating

to, or resulting from: (a) changes generally affecting the economy, financial, or securities markets; (b) conditions generally affecting

the industry in which the Business operates; (c) any outbreak or escalation of war or any act of terrorism; (d) any epidemic, pandemic

or quarantine related to such and affecting business operations; or (e) the announcement of the transactions contemplated by this Agreement.

“OLCC”

means the Oregon Liquor and Cannabis Commission.

“Permits”

means all licenses (including the License), permits, certificates of authority, authorizations, approvals, registrations, franchises,

and similar consents granted by a Governmental Authority related to the transactions contemplated by this Agreement.

“Person”

means any natural person, corporation, general partnership, limited partnership, limited liability company, proprietorship, other business

organization, trust, union, association, or Governmental Authority.

“Proceeding”

means any complaint, lawsuit, action, suit, Claim (including claim of a violation of Law), or other proceeding at law or in equity or

order or ruling, in each case by or before any Governmental Authority or arbitral tribunal.

“Tax” or

“Taxes” means any federal, state, local, or foreign income, gross receipts, ad valorem, sales, use, employment, social

security, disability, occupation, property, severance, value added, goods and services, documentary, stamp duty, transfer, conveyance,

capital stock, excise, or withholding tax or other taxes imposed by or on behalf of any Governmental Authority, including any interest,

penalty or addition thereto.

1.2 Rules

of Construction.

(a) All

article, section, subsection, schedules and exhibit references used in this Agreement are to articles, sections, subsections, schedules

and exhibits to this Agreement unless otherwise specified. The exhibits and schedules attached to this Agreement constitute a part of

this Agreement and are incorporated herein for all purposes.

(b) If

a term is defined as one part of speech (such as a noun), it has a corresponding meaning when used as another part of speech (such as

a verb). Unless the context of this Agreement clearly requires otherwise, words importing the masculine gender include the feminine and

neutral genders and vice versa. Words in the plural form include the singular form, and words in the singular form include the plural

form. The words “includes” or “including” means “including without limitation,” the words “hereof,”

“hereby,” “herein,” “hereunder” and similar terms in this Agreement refer to this Agreement as a whole

and not any particular section or article in which the words appear and any reference to a Law includes any rules and regulations promulgated

thereunder. Currency amounts referenced herein are in U.S. dollars.

(c) Whenever

this Agreement refers to a number of days, the number refers to calendar days unless Business Days are specified. Whenever any action

must be taken hereunder on or by a day that is not a Business Day, then the action may be validly taken on or by the next day that is

a Business Day.

(d) Each

Party and its respective attorneys have been given an equal opportunity to negotiate the terms and conditions of this Agreement, and any

rule of construction to the effect that ambiguities are to be resolved against the drafting Party or any similar rule operating against

the drafter of an agreement will not be applicable to the construction or interpretation of this Agreement.

ARTICLE II

PURCHASE OF BUSINESS, PAYMENT, AND CLOSING

2.1 Purchase

of License. At the Closing, and subject to the terms of this Agreement, Seller shall sell to Buyer and Buyer shall purchase from Seller

the License.

2.2 Purchase

Price. The purchase price for the License is $50,000 (the “Purchase Price”), payable as follows:

(a)

Buyer shall pay to Seller $12,500 upon the execution and delivery of this Agreement, which is non-refundable to Buyer, except in

the event that this Agreement is terminated in a manner other than by the Buyer’s material breach.

(b)

Buyer shall pay an additional $37,500 to Seller upon the Closing.

In addition to the Purchase Price, Buyer

shall pay or reimburse Seller, as the case may be, no later than the Closing Date, for any and all license fees and/or other costs related

to the License, including licensing, renewal and application fees due in calendar year 2024, which are estimated to equal $5,000, and

if applicable, City of Portland renewal fees.

2.3 Closing.

The closing for the purchase and sale of the License (the “Closing”) will be held within five (5) Business Days of

Final Governmental Approval (the “Closing Date”). The Closing will be at a time and place agreed to by the Parties,

unless the Parties agree that the Closing need not occur at a specific location.

2.4 Documents

Deliverable at Closing. At the Closing:

(a)

Seller shall provide to Buyer (collectively, “Seller’s Closing Documents”):

(i)

Such documents or instruments reasonably requested by Buyer.

(b)

Buyer shall provide to Seller (collectively, “Buyer’s Closing Documents”):

(i)

Such documents or instruments reasonably requested by Buyer.

ARTICLE III

SELLER’S STATEMENTS OF FACT

Seller states that the following

are true as of the date of this Agreement:

3.1 Seller’s

Organization. Seller is a limited liability company duly formed, validly existing and in good standing under the Laws of the State

of Colorado and has all requisite limited liability company power and authority to conduct its Business as it is now being conducted in

accordance with the Laws.

3.2 Authority.

Seller has all requisite power and authority to execute and deliver this Agreement and the other instruments to be delivered by Seller

at the Closing, to perform its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby,

subject to approvals required by the Marijuana Code. Subject to approvals required by the Marijuana Code, the execution and delivery of

this Agreement and the other instruments to be delivered by Seller at the Closing, and the performance by Seller of its obligations hereunder

and thereunder, have been duly and validly authorized by necessary action. This Agreement has been, and the instruments to be delivered

by Seller at the Closing will at the Closing be, duly and validly executed and delivered by Seller and constitute (or, in the case of

instruments to be delivered by Seller at the Closing, will at the Closing constitute) the legal, valid and binding obligation of Seller

enforceable against it in accordance with its terms, subject to approvals required by the Marijuana Code, except as the same may be limited

by bankruptcy, insolvency, reorganization, fraudulent conveyance, arrangement, moratorium or other similar Laws relating to or affecting

the rights of creditors generally, or by general equitable principles.

3.3 No

Conflicts; Consents and Approvals. The execution and delivery by Seller of this Agreement do not, and the performance by Seller of

its obligations under this Agreement does not:

(a) violate

or result in a breach of its Charter Documents;

(b) (i)

violate or result in a breach of any Law applicable to Seller, except for the violations or breaches that would not materially interfere

with Seller’s ability to perform its obligations hereunder or (ii) require any consent or approval of any Governmental Authority

other than the OLCC and the City and under any Law applicable to Seller, other than in each case any consent or approval which, if not

made or obtained, would not reasonably be expected to result in a Material Adverse Effect on Seller.

3.4 Proceedings.

There are no Proceeding pending, or to Seller’s Knowledge threatened, against Seller before or by any Governmental Authority, which

seeks a writ, judgment, order or decree restraining, enjoining, or otherwise prohibiting or making illegal any of the transactions contemplated

by this Agreement.

3.5 Compliance

with Laws and Orders. To Seller’s Knowledge, Seller is in compliance with all Laws and orders applicable to it except where

any non-compliance would not reasonably be expected to result in a Material Adverse Effect on Seller; provided, however,

that this Section 3.6 does not address matters relating Permits, which are exclusively addressed by Section 3.7.

3.6 Liens. At

or immediately following the Closing, the License will be free and clear of all Liens.

3.7 Condition

of License. Seller has maintained the License in the ordinary course of business. Seller makes no representations or warranties as

to the condition of the License, and Seller disclaims any implied warranty as to the condition of the License, including the implied warranties

of merchantability, fitness for a particular purpose, and non-infringement. Other than the express warranties set forth in this Agreement,

the License is sold as-is, where-is.

3.8 Broker. Seller

does not have any liability or obligation to pay fees or commissions to any broker, finder, or agent with respect to the transactions

contemplated by this Agreement for which Buyer or any of its Affiliates could become liable or obligated.

3.9 No

Other Representations and Warranties. Except for the representations and warranties contained in this Article III, neither Seller

nor any other Person has made or makes any other express or implied representation or warranty, either written or oral, on behalf of Seller,

including any representation or warranty as to the accuracy or completeness of any information, documents or material regarding the Business

and the License furnished or made available to Buyer in any form (including any information,

documents, or material delivered to Buyer on behalf of Seller for purposes of this Agreement),

or as to the future revenue, profitability, or success of the Business, or any representation or warranty arising from statute or otherwise

in Law.

(collectively, “Seller’s Statements

of Fact”).

ARTICLE IV

BUYER’S STATEMENTS OF FACT

Buyer states that the following

is true as of the date of this Agreement:

4.1 Organization.

Buyer is a corporation duly formed, validly existing and in good standing under the Laws of the State of Oregon and has all requisite

corporate power and authority to conduct its business as it is now being conducted.

4.2 Authority.

Buyer has all requisite power and authority to execute and deliver this Agreement and the other instruments to be delivered by Buyer at

the Closing, to perform its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby,

subject to approvals required by the Marijuana Code. The execution and delivery by Buyer of this Agreement and the other instruments to

be delivered by Buyer at the Closing, and the performance by Buyer of its obligations hereunder and thereunder, have been duly and validly

authorized by necessary action. This Agreement has been, and the instruments to be delivered by Buyer at the Closing will at the Closing

be, duly and validly executed and delivered by Buyer and constitutes (or, in the case of instruments to be delivered by Buyer at the Closing,

will at the Closing constitute) the legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with their terms,

except as the same may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, arrangement, moratorium or other similar

Laws relating to or affecting the rights of creditors generally, or by general equitable principles.

4.3 No

Conflicts; Consents and Approvals. The execution and delivery by Buyer of this Agreement do not, and the performance by Buyer of its

obligations hereunder and the consummation of the transactions contemplated hereby do not:

(a) violate or

result in a breach of its Charter Documents;

(b) (i)

violate or result in a breach of any Law applicable to Buyer, except as would not reasonably be expected materially interfere with Buyer’s

ability to perform its obligations hereunder or (ii) require any consent or approval of any Governmental Authority (other than the OLCC

and the City) under any Law applicable to Buyer, other than in each case any such consent or approval which, if not made or obtained,

would not reasonably be expected to result in a Material Adverse Effect on Buyer’s ability to perform its obligations hereunder.

4.4 Proceedings.

There is no Proceeding pending or, to Buyer’s Knowledge threatened, against Buyer before or by any Governmental Authority, which

seeks a writ, judgment, order or decree restraining, enjoining, or otherwise prohibiting or making illegal any of the transactions contemplated

by this Agreement.

4.5 Compliance

with Laws and Orders. Buyer is not in violation of, or in default under, any Law or order applicable to Buyer the effect of which,

in the aggregate, would reasonably be expected to hinder, prevent or delay Buyer from performing its obligations hereunder.

4.6 Broker.

Buyer does not have any liability or obligation to pay fees or commissions to any broker, finder, or agent with respect to the transactions

contemplated by this Agreement for which Seller or any of its Affiliates could become liable or obligated.

4.7 Sufficient

Funds. Buyer has sufficient funds, liquid assets or access to capital to pay the Purchase Price.

(collectively, “Buyer’s Statements of Fact”).

ARTICLE V

COVENANTS

5.1 Regulatory

and Other Approvals. During the Interim Period:

(a) Each

Party shall attempt to obtain as promptly as practicable all consents and approvals that either Party or its respective Affiliates are

required to obtain in order to consummate the transactions contemplated hereby; provided that, for purposes of clarification, and notwithstanding

anything to the contrary in this Agreement, the obtaining of the consents and approvals will not be a condition to the Closing except

to the extent set forth in Articles VI or VII, as applicable.

(b) Each

Party shall (i) make or cause to be made the filings required of the Person or any of its applicable Affiliates under any Laws applicable

to it with respect to the transactions contemplated by this Agreement and to pay any fees due of it in connection with the filings, as

promptly as is reasonably practicable, provided that, for purposes of clarification, and notwithstanding anything to the contrary in this

Agreement, the filings and payments will not be conditions to the Closing except to the extent set forth in Articles VI and VII; (ii)

cooperate with the other Party and furnish the information that is necessary in connection with the other Party’s filings; (iii)

use reasonable efforts to cause the expiration of the notice or waiting periods under any Laws applicable to it with respect to the consummation

of the transactions contemplated by this Agreement as promptly as is reasonably practicable; (iv) promptly inform the other Party of any

communication from or to, and any proposed understanding or agreement with, any Governmental Authority in respect of the filings; (v)

reasonably consult and cooperate with the other Party in connection with any analyses, appearances, presentations, memoranda, briefs,

arguments, and opinions made or submitted by or on behalf of any Party in connection with all meetings, actions or other Proceedings with

Governmental Authorities relating to the filings; (vi) comply, as promptly as is reasonably practicable, with any requests received by

the Party under any Laws for additional information, documents or other materials with respect to the filings; and (vii) attempt to resolve

any objections as may be asserted by any Governmental Authority with respect to the transactions contemplated by this Agreement.

(c) If

a Party (or any of its applicable Affiliates) intends to participate in any meeting with any Governmental Authority with respect to the

filings and if permitted by, or acceptable to, the applicable Governmental Authority, it shall give the other Party reasonable prior notice

of, and an opportunity to participate in, the meeting.

(d) In

connection with any such filings, the Parties shall cooperate in good faith with Governmental Authorities and undertake promptly any and

all action required to lawfully complete the transactions contemplated by this Agreement.

(e) Each

Party shall provide prompt notification to the other when it becomes aware that any such consent or approval referred to in this Section

5.1 is obtained, taken, made, given or denied, as applicable.

(f) In

furtherance of the foregoing covenants:

(i) Each

Party shall prepare, or cause its Affiliates to prepare, as soon as is practicable following the execution of this Agreement, all necessary

filings applicable to it and in connection with the transactions contemplated by this Agreement that may be required under any Laws; provided

that, for purposes of clarification, and notwithstanding anything to the contrary in this Agreement, the filings will not be conditions

to the Closing except to the extent set forth in Articles VI and VII. Specifically, Buyer agrees to submit a new application within two

(2) business days of the execution of this Agreement, and Seller agrees to file Ownership Change and Location Change applications within

four (4) business days following Buyer’s submission of Application. Buyer will provide Seller the Application ID number at

that time, as part of the requirements for their Ownership Change and Location Change applications.

(ii) Each

Party shall promptly furnish the other Party with copies of any notices, correspondence or other written communication received by it

from the relevant Governmental Authority, shall promptly make any appropriate or necessary subsequent or supplemental filings required

of it, and shall cooperate in the preparation of the filings as is reasonably necessary and appropriate.

(iii) Each

Party shall not, and shall cause its respective Affiliates not to, take any action that could reasonably be expected to adversely affect

the approval of any Governmental Authority.

5.2 Updating.

From time to time prior to the Closing, Seller may, at its option, supplement or amend and deliver updates to Buyer as necessary to complete

or correct any information in this Agreement or Seller’s Statements of Fact; provided that any such supplement, amendment or update

may only be made as to circumstances occurring after the date hereof.

5.3 Further

Assurances. Subject to the terms and conditions of this Agreement, at any time or from time to time after the Closing, at a Party’s

request and without further consideration, the other Party shall execute and deliver to the requesting Party such other instruments of

sale, transfer, conveyance, assignment and confirmation, provide such materials and information and take such other actions as the Party

may reasonably request in order to consummate the transactions contemplated by this Agreement.

5.4 Delay

by the OLCC or the City of Notification of Final Governmental Approval. Notwithstanding anything to the contrary set forth in Section

5.1(e), if Final Governmental Approval occurs, but the OLCC or the City does not promptly notify a Party of Final Governmental Approval,

and such delay causes or might cause one or more of the Parties to violate the Marijuana Code, the Parties shall work in good faith to

take all necessary action to ensure that the Parties minimize or eliminate any violations of the Marijuana Code and that the Business

continue in the ordinary course. Each Party will be responsible for its respective out-of-pocket expenses incurred by such Party with

respect to this Section 5.4.

5.5 Buyer’s

Obligations if No Closing. If the Closing does not occur by reason of Buyer’s default for any reason or if Buyer terminates

this Agreement after Final Governmental Approval, Buyer shall, in a timely manner, cooperate with Seller in executing all documents reasonably

necessary to void the Change of Ownership.

5.6 Application

Fees. Buyer shall pay the Application Fees.

5.7 Ordinary

Course. Seller shall operate the Business in the ordinary course consistent with past practices during the Interim Period, will use

commercially reasonable efforts to maintain or renew the lease on the property until the Closing Date.

5.8 Sales

and Use Tax. Following the Closing, Buyer shall timely pay all sales and use tax assessed by any Governmental Authority by reason

of the transactions contemplated by this Agreement.

ARTICLE VI

BUYER’S CONDITIONS TO CLOSING

The obligation of Buyer to

consummate the Closing is subject to the fulfillment of each of the following conditions (except to the extent waived in writing by Buyer

in its sole discretion):

6.1 Statements

of Fact. (a) Seller’s Statements of Fact will be true and correct on and as of the Closing as though made on and as of the Closing

(other than those Statements of Fact that speak to an earlier date); and (b) in the case of Seller’s Statements of Fact that speak

to an earlier date, such Statements of Fact will be true and correct as of the earlier date.

6.2 Performance.

Seller has performed and complied in all material respects with the agreements, covenants, and obligations required by this Agreement

to be performed or complied with by Seller at or before the Closing.

6.3 Seller’s

Deliverables. Seller has delivered to Buyer at the Closing Seller’s Closing Documents.

6.4 Orders

and Laws. There is no Law or order (except for any such order issued in connection with a Proceeding instituted by Buyer or its Affiliates)

restraining, enjoining or otherwise prohibiting or making illegal the consummation of the transactions contemplated by this Agreement

or the operation of the Business.

6.5 Consents

and Approvals. All terminations or expirations of waiting periods imposed by any Governmental Authority with respect to this Agreement

have occurred; provided, however, that the absence of any appeals and the expiration of any appeal period with respect to

any of the foregoing will not constitute a condition to the Closing hereunder.

6.6 Final

Governmental Approval. Final Governmental Approval has occurred.

ARTICLE VII

SELLER’S CONDITIONS TO CLOSING

The obligation of Seller to

consummate the Closing is subject to the fulfillment of each of the following conditions (except to the extent waived in writing by Seller

in its sole discretion):

7.1 Statements

of Fact. (a) Buyer’s Statements of Fact will be true and correct on and as of the Closing as though made on and as of the Closing

(other than those Statements of Fact that speak to an earlier date); and (b) in the case of those Statements of Fact that speak as to

an earlier date, such Statements of Fact will be true and correct as of the earlier date.

7.2 Performance.

Buyer will have performed and complied in all material respects with the agreements, covenants and obligations required by this Agreement

to be so performed or complied with by Buyer at or before the Closing.

7.3 Buyer’s

Deliverables. Buyer will have delivered to Seller the Purchase Price and Buyer’s Closing Documents.

7.4 Orders

and Laws. There is no Law or order (except for any such order issued in connection with a Proceeding instituted by Seller or its Affiliates)

restraining, enjoining or otherwise prohibiting or making illegal the consummation of the transactions contemplated by this Agreement.

7.5 Consents

and Approvals. All terminations or expirations of waiting periods imposed by any Governmental Authority with respect to this

Agreement will have occurred; provided, however, that the absence of any appeals and the expiration of any appeal period

with respect to any of the foregoing will not constitute a condition to the Closing hereunder.

7.6 Final

Governmental Approval. Final Governmental Approval will have occurred.

ARTICLE VIII

TERMINATION

8.1 Termination.

This Agreement may be terminated in one or more of the following ways:

(a) At

any time before the Closing, by Seller or Buyer, by written notice to the other, if any Law or final order of a Governmental Authority

restrains, enjoins or otherwise prohibits or makes illegal the sale of the License pursuant to this Agreement;

(b) At

any time before the Closing, by Seller or Buyer, by written notice to the other, if the other Party has materially breached its Statements

of Fact or obligations under this Agreement and the breach would or does result in the failure of any condition set forth in Articles

VI or VII;

(c) If the Closing

has not occurred by the one-year anniversary of the date of this Agreement.

8.2 Effect

of Valid Termination.

(a) If

this Agreement is validly terminated pursuant to Section 8.1, there will be no liability or obligation hereunder on the part of either

Party or any of their respective Affiliates, except as provided herein other than that described in Section 2.2(a) above, provided,

however, that Article I, Sections 8.2 and 9.4, and Article X (other than Section 10.11) will survive any such termination.

ARTICLE IX

LIMITATIONS ON LIABILITY, THIRD-PARTY CLAIMS,

AND ARBITRATION

9.1 Indemnity.

From and after the Closing:

(a) Seller

shall indemnify, defend, and hold harmless Buyer from and against all Losses incurred or suffered by Buyer resulting from:

(i) any

material breach as of the Closing (as though made on and as of the Closing except to the extent a statement of fact is expressly made

as of an earlier date, in which case only as of the earlier date) of Seller’s Statements of Fact; and

(ii) any

material breach of any covenant or agreement of Seller contained in this Agreement.

(b) Buyer

shall indemnify, defend, and hold Seller harmless from and against all Losses incurred or suffered by Seller resulting from:

(i) any

material breach as of the Closing (as though made on and as of the Closing Date except to the extent a statement of fact is expressly

made as of an earlier date, in which case only as of the earlier date) of Buyer’s Statements of Fact; and

(ii) any

material breach of any covenant or agreement of Buyer contained in this Agreement.

9.2 Limitations

of Liability. Notwithstanding anything in this Agreement to the contrary:

(a) Seller’s

Statements of Fact and Buyer’s Statements of Fact will survive the Closing; provided, however, that no claim may be

made with respect to any statement of fact, covenant, agreement, or obligation of Sections 9.1(a)(i) or (b)(i) that a Party breaches later

than six months following the Closing.

(b) Buyer

shall give written notice to Seller within a reasonable period of time after becoming aware of any breach by Seller of any of Seller’s

Statements of Fact, covenant, agreement, or obligation in this Agreement, but in any event no later than 30 days after becoming aware

of such breach.

(c) Seller

shall give written notice to Buyer within a reasonable period of time after becoming aware of any breach by Buyer of any of Buyer’s

Statements of Fact, covenant, agreement or obligation in this Agreement, but in any event no later than 30 days after becoming aware of

such breach.

(d) the

Parties have a duty to mitigate any Loss in connection with this Agreement.

(e) Either

Party’s liability with respect to Section 9.1 is limited to Losses incurred or suffered by such Party in an amount not to exceed

$5,000.

9.3 Procedure

with Respect to Third-Party Claims.

(a) If

a Party is threatened with or becomes subject to a third party Claim, and such Party (the “Claiming Party”) believes

it has a claim entitled to indemnification from the other Party (the “Responding Party”) as provided in Section 9.1

as a result, then the Claiming Party shall notify the Responding Party in writing of the basis for the Claim setting forth the nature

of the Claim in reasonable detail. The failure of the Claiming Party to so notify the Responding Party will not relieve the Responding

Party of liability hereunder except to the extent that the defense of the Claim is prejudiced by the failure to give the notice.

(b) If

any Proceeding is brought by a third party against a Claiming Party and the Claiming Party gives notice to the Responding Party pursuant

to Section 9.3(a), the Responding Party may participate in the Proceeding and, to the extent that it wishes, to assume the defense of

the Proceeding, if (i) the Responding Party provides written notice to the Claiming Party that the Responding Party intends to undertake

the defense, (ii) the Responding Party conducts the defense of the third-party Claim actively and diligently with counsel reasonably satisfactory

to the Claiming Party, and (iii) if the Responding Party is a party to the Proceeding, the Responding Party or the Claiming Party has

not determined in good faith that joint representation would be inappropriate because of a conflict of interest. The Claiming Party may,

in its sole discretion, employ separate counsel (who may be selected by the Claiming Party in its sole discretion) in any such action

and to participate in the defense thereof, and the Claiming Party shall pay the fees and expenses of its counsel. The Claiming Party shall

cooperate with the Responding Party and its counsel in the defense or compromise of the Claim. If the Responding Party assumes the defense

of a Proceeding, no compromise or settlement of the Claims may be effected by the Responding Party without the Claiming Party’s

consent unless (x) there is no finding or admission of any violation of Law or any violation of the rights of any Person and no effect

on any other Claims that may be made against the Claiming Party, and (y) the sole relief provided is monetary damages that the Responding

Party pays in full.

(c) If

notice is given to the Responding Party of the commencement of any third-party Proceeding and the Responding Party does not, within 14

days after the Claiming Party’s notice is given pursuant to Section 9.3(a), give notice to the Claiming Party of its election to

assume the defense of the Proceeding, any of the conditions set forth in clauses (i) through (iii) of Section 9.3(b) above become unsatisfied

or a Claiming Party determines in good faith that there is a reasonable probability that a Proceeding may adversely affect it other than

as a result of monetary damages for which it would be entitled to indemnification from the Responding Party under this Agreement, then

the Claiming Party may (upon notice to the Responding Party) undertake the defense, compromise or settlement of the Claim; provided,

however, that the Responding Party shall reimburse the Claiming Party for the Losses associated with defending against the third-party

Claim (including reasonable attorneys’ fees and expenses) and will remain otherwise responsible for any liability with respect to

amounts arising from or related to the third-party Claim, in both cases to the extent it is ultimately determined that the Responding

Party is liable with respect to the third-party Claim for a breach under this Agreement. The Responding Party may elect to participate

in the Proceedings, negotiations or defense at any time at its own expense.

9.4 Mandatory

Binding Arbitration.

(a)

Except for Claims arising under Section 10.11, any dispute, Claim, interpretation, controversy, or issues of public policy arising

out of or relating to this Agreement, including the determination of the scope or applicability of this Section 9.4, will be determined

exclusively by arbitration held in Portland, Oregon, and will be governed exclusively by the applicable Oregon statutes and regulations

relating to arbitration (the “OAL”).

(b)

The arbitrator will be selected from the roster of arbitrators at JAMS. in Portland, Oregon (“JAMS”), unless

the Parties agree otherwise. If the Parties do not agree on the selection of a single arbitrator within ten days after a demand for arbitration

is made, then the arbitrator will be selected by JAMS from among its available professionals. Arbitration of all disputes and the outcome

of the arbitration will remain confidential between the Parties except as necessary to obtain a court judgment on the award or other relief

or to engage in collection of the judgment. The Parties will share equally in all costs of arbitration and shall each pay one-half of

all invoices for arbitration when due in connection with any arbitration under this Section 9.4, provided that nothing in this sentence

will impact the applicability of Section 10.10.

(c)

The Parties irrevocably submit to the exclusive jurisdiction of the state courts located in Portland, Oregon, with respect to this

Section 9.4 to compel arbitration, to confirm an arbitration award or order, or to handle court functions permitted under the OAL.

The Parties irrevocably waive defense of an inconvenient forum to the maintenance of any such action or other proceeding. The Parties

may seek recognition and enforcement of any O state court judgment confirming an arbitration award or order in any United States state

court or any court outside the United States or its territories having jurisdiction with respect to recognition or enforcement of such

judgment.

(d)

The Parties waive (i) any right of removal to the United States federal courts and (ii) any right in the United States federal

courts to compel arbitration, to confirm any arbitration award or order, or to seek any aid or assistance of any kind.

ARTICLE X

MISCELLANEOUS

10.1 No

Third-Party Beneficiaries. The terms and provisions of this Agreement are intended solely for the benefit of the Parties and their

respective successors or permitted assigns, and it is not the intention of the Parties to confer third-party beneficiary rights upon any

other Person.

10.2 Entire

Agreement. This Agreement supersedes all prior discussions and agreements between the Parties and/or their Affiliates with respect

to the subject matter hereof and contains the sole and entire agreement between the Parties and their Affiliates with respect to the subject

matter hereof.

10.3 Waiver.

Any term or condition of this Agreement may be waived at any time by the Party that is entitled to the benefit thereof, but no such waiver

will be effective unless set forth in a written instrument duly executed by or on behalf of the Party waiving the term or condition. No

waiver by a Party of any term or condition of this Agreement, in any one or more instances, will be deemed to be or construed as a waiver

of the same or any other term or condition of this Agreement on any future occasion. All remedies, either under this Agreement or by Law,

are cumulative and not alternative.

10.4 Succession

and Assignment. This Agreement is binding upon and will inure to the benefit of the Parties and their successors and assigns. Buyer

may assign its rights, interests and obligations hereunder. Seller may not assign this Agreement or any of its rights, interests, or obligations

hereunder.

10.5 Counterparts;

Electronic or Fax Signatures. This Agreement may be executed in counterparts, each of which will be an original and all of which,

when taken together, will constitute one instrument notwithstanding that all parties have not executed the same counterpart. Signatures

that are transmitted electronically or by fax will be effective as originals.

10.6 Headings.

The headings used in this Agreement have been inserted for convenience of reference only and do not modify, define, or limit any of its

terms or provisions.

10.7 Notices.

(a) Any

notice, request, demand, Claim, or other communication hereunder will be in writing and will be deemed delivered: (a) three Business Days

after it is sent by U.S. mail, certified mail, return receipt requested, postage prepaid; or (b) one Business Day after it is sent via

a reputable nationwide overnight courier or sent via email, in each of the foregoing cases to the intended recipient as set forth below:

| | If to Buyer: | Broadway Project, Inc. |

219 SW Broadway

Portland Oregon 97205

E-mail: tony@broadway-cannabis.com

| If to Seller: | TREES Oregon, LLC |

215 Union Boulevard, Suite 415

Lakewood, Colorado 80228

Attention: David R. Fishkin, General Counsel

E-mail: dfishkin@treescann.com

(b) A

Party may change the address to which notices, requests, demands, Claims, and other communications hereunder are to be delivered by giving

notice to the other Party in the manner herein set forth.

10.8 Governing

Law. This Agreement is governed by and construed and enforced in accordance with the Laws of the State of Oregon, without giving effect

to any conflict or choice of law provision that would result in imposition of another state’s Law. THE PARTIES ACKNOWLEDGE THAT

(A) OREGON HAS ENACTED CERTAIN LEGISLATION TO GOVERN THE MARIJUANA INDUSTRY AND (B) THE POSSESSION, SALE, MANUFACTURE, AND CULTIVATION

OF MARIJUANA IS ILLEGAL UNDER FEDERAL LAW. THE PARTIES WAIVE ANY DEFENSES BASED UPON INVALIDITY OF CONTRACTS FOR PUBLIC POLICY REASONS

AND/OR THE SUBSTANCE OF THE CONTRACT VIOLATING FEDERAL LAW.

10.9 Waiver

of Right to Trial by Jury. EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES TO THE FULLEST EXTENT PERMITTED BY LAW TRIAL BY JURY

IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS AGREEMENT AND WITH RESPECT TO ANY COUNTERCLAIM THEREIN.

10.10 Attorneys’

Fees. If either Party brings a Proceeding to enforce the provisions of this Agreement, the substantially prevailing Party will be

entitled to recover its reasonable attorneys’ fees and expenses incurred in such action from the non-prevailing Party as determined

by the arbitrator or a court of law.

10.11 Specific

Performance. The rights of the Parties to consummate the transactions contemplated hereby (including the satisfaction of any condition

to the Closing) are special, unique, and of extraordinary character, and if either Party violates or fails or refuses to perform any covenant

or agreement made by it herein, the non-breaching Party may be without an adequate remedy at law. If either Party violates or fails or

refuses to perform any covenant or agreement made by it herein, the non-breaching Party may (at any time prior to the earlier of a) valid

termination of this Agreement pursuant to Article VIII and b) the Closing), subject to the terms hereof, institute and prosecute an action

to enforce specific performance of the covenant or agreement. The Parties irrevocably submit to the exclusive jurisdiction of the state

courts located in Portland, Oregon, with respect to this Section 10.11. The Parties irrevocably waive defense of an inconvenient forum

to the maintenance of any such action or other proceeding with respect to this Section 10.11.

10.12 Invalid

Provisions. If a dispute between the Parties arises out of this Agreement or the subject matter of this Agreement, the Parties would

want a court or arbitrator to interpret this Agreement as follows:

(a)

With respect to any provision held to be unenforceable, by modifying that provision to the minimum extent necessary to make it

enforceable or, if that modification is not permitted by law or public policy, by disregarding the provision;

(b)

if an unenforceable provision is modified or disregarded in accordance with this Section 10.12, by holding the rest of the Agreement

will remain in effect as written;

(c)

by holding that any unenforceable provision will remain as written in any circumstances other than those in which the provision

is held to be unenforceable; and

(d)

if modifying or disregarding the unenforceable provision would result in a failure of an essential purpose of this Agreement, by

holding the entire Agreement unenforceable.

Upon the determination that any term or other

provision of this Agreement is invalid, illegal or incapable of being enforced, the Parties shall negotiate in good faith to modify this

Agreement so as to affect the original intent of the Parties as closely as possible in an acceptable manner to the end that the transactions

contemplated hereby are fulfilled to the extent possible.

10.13 Expenses. Except

as otherwise provided in this Agreement, whether or not the transactions contemplated hereby are consummated, each Party shall pay its

own costs and expenses incurred in anticipation of, relating to and in connection with the negotiation and execution of this Agreement

and the transactions contemplated hereby.

10.14 Amendments.

The Parties may amend any provision of this Agreement only by a written instrument signed by the Parties.

10.15 Confidentiality

and Publicity. This Agreement is confidential and will not be disclosed to any third party (other than the Parties’ Affiliates,

attorneys, accountants, auditors, or other advisors, or Governmental Authorities) except as required for Tax purposes or as required by

Law. A Party receiving a request for this Agreement shall promptly notify the other Party to afford it the opportunity to object or seek

a protective order regarding this Agreement or information contained herein.

10.16 Advice

of Counsel. Each Party has had the opportunity to seek the advice of independent legal counsel and has read and understood each

of the terms and provisions of this Agreement.

10.17 OLCC

Reformation. This Agreement and the transactions contemplated hereby are subject to review by the OLCC and the City. If the OLCC or

the City determines that this Agreement must be reformed, the Parties shall negotiate in good faith to so reform this Agreement according

to such Governmental Authority’s requirements while effectuating the original intent of this Agreement as near as possible.

[Remainder of page intentionally left blank;

signatures on following page]

IN WITNESS WHEREOF, this Agreement

has been duly executed and delivered by the Parties as of the date first above written.

| |

Buyer: |

| |

Broadway Project, Inc. |

| |

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

| |

Seller: |

| |

TREES Oregon, LLC |

| |

|

|

| |

By: |

|

| |

|

Name: |

Adam Hershey |

| |

|

Title: |

Interim CEO |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

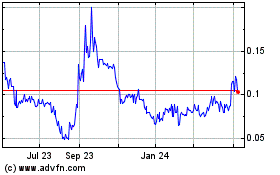

TREES (QB) (USOTC:CANN)

Historical Stock Chart

From Nov 2024 to Dec 2024

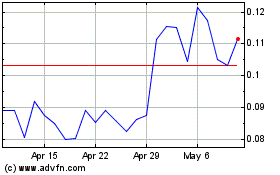

TREES (QB) (USOTC:CANN)

Historical Stock Chart

From Dec 2023 to Dec 2024