November 5, 2021 -- InvestorsHub NewsWire -- via Hawk Point

Media --

MarketWatch

Drilling for oil isn't the only way to get rich. Finding water

can generate similar results. In fact, investors in WaterPure

International Inc. (OTC

Pink: WPUR) found that out firsthand. Over the past

52-weeks, investors saw shares spike by more than 49,600%, with

prices setting all-time highs on October 25th. While it gave back

some of those spectacular gains, the stock is still higher by an

enormous 29,600%, and technicals suggest another leg higher could

be forthcoming.

Here's the better news. While Yahoo! Finance shows the company

to have 247M shares outstanding, the stock trades orderly with only

about 2.5 million shares traded daily. That volume is a small

fraction of most micro-cap companies and, more importantly, allows

for good news to do what it should- drive share prices higher. And

over the past few months, that's been the case. The better news is

that after announcing a water find on Tuesday, subsequent updates

on how that find can translate into revenues can be a substantial

value driver.

Thus, WPUR is deserving of attention for those that like

potentially exponential returns from high risk, high reward

trades.

Mitigating Risk With International Exposure

But, with WPUR announcing striking water in developing a well to

support a dairy operation in Sub Sahara Africa, some of the

near-term risks may be mitigated. And while it may not be a

windfall just yet, it does set up the rest of the year and 2022 as

a potential breakout period of growth.

Keep in mind, WPUR is working on getting water to people that

don't readily have it. Thus, while taken advantage of in most

industrialized countries, WPUR is targeting markets in need, which

simultaneously addresses multiple revenue-generating opportunities

from municipalities and local governments. That could be the point

that investors are attaching to.

Furthermore, the plan is relatively simple. WPUR intends to find

profitable new efficiencies and technologies to manage water

supplies that reverse the growing global water scarcity. It isn't

necessarily rocket science. But the returns can be astronomical and

recent history proves that point. And the process of earning those

returns is orderly as well.

Water Valued Like Gold

And that's excellent news for WPUR investors. In fact, the

simpler the plan, the more revenues can fall faster toward the

bottom line. At WPUR, it's a 1-2-3 process. First, start with

projects in developing economic regions where existing shortages

are a current problem. Second, perform trials, refine strategies,

and prove new efficiencies and technologies. And, third, scale the

results and deploy the technology. The results can then speak for

themselves.

And so far, so good. Since the start of the year, WaterPure has

been busy building the resources to capitalize on global

water-providing opportunities. Earlier this week, they offered a

short video exposing the results- a water strike. Hence, all is

going according to plan. Even better, momentum is at its back after

launching a new website that presents the company's updated

business plan on how it expects to monetize its clean water

operations.

As noted, the website includes details on the company's first

pilot project, which is now fully developed and in operation.

Included is a short video of the company drilling for and striking

water intended to support a dairy operation in Sub Sahara, Africa.

Of course, while potentially an enormous benefit to the community

where the find was made, it's still one small part of a more

ambitious plan.

And WPUR's timing couldn't be better. In 2020, the renewable

water market was valued at an estimated $263 billion. But, by 2028,

the market is expected to explode to a more than $500 billion

revenue-generating opportunity. And while the revenue potential is

enormous, so is the mission. Statistics indicate that water

scarcity today impacts over 3 billion people, and by 2050 is

expected to impact 5 billion. Thus, a massive humanitarian cause is

met as well.

Further, water scarcity is not just a problem for developing

economic regions. Just a few months ago, U.S. authorities declared

a water shortage in the largest U.S. water reserve, Lake Mead,

which serves 10 million residents. In other parts of the country,

low water levels caused residents to boil water and ration use.

Worse, while improvement came, some believe it's only a seasonal

relief. Droughts and low water levels have increased substantially

over the past decades. That's not news to those in California,

Arizona, and surrounding areas.

Seizing Upon An Under The Radar Water Play

Therefore, for companies paying attention, the results can be

tremendous. And while some like WPUR are, others not so much.

Interest in many peer companies to WPUR on focusing on other

sustainable sources like EV technology and mining for battery

metals. While the end result of all the projects is a win for

global climate change, tapping into water reserves may be the more

important of the two markets. Thus, the attention given to WPUR

appears to be well-deserved.

Now, it's up to WPUR to deliver. And that appears to be the

plan. In addition to finding value in Africa, its business plan

includes accelerating its mission to trial and refine new water

management efficiencies and technologies in developing economic

regions. Then, after the right solutions are created for particular

geographies, scale those solutions to use both locally and

potentially for global applications. Notably, WPUR expects to make

a water-related intellectual property acquisition before the end of

the year. That deal could expedite the entire process

So, at the end of the day, the exponential surge in WPUR stock

could be the precursor of better things to come. After all, as of

Tuesday, they are indeed creating value. Thus, while holding its

more than 29,000% gains is certainly impressive, heading back

toward its 52-week highs set last month would be even better. One

thing for sure, those early to WPUR have not been disappointed. And

those considering investment at these levels may be similarly

impressed.

Disclaimers: Hawk Point Media Group, LLC. (Hawk Point Media)

is responsible for the production and distribution of this content.

Hawk Point Media is not operated by a licensed broker, a dealer, or

a registered investment adviser. It should be expressly understood

that under no circumstances does any information published herein

represent a recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The information made

available by Hawk Point Media is not intended to be, nor does it

constitute, investment advice or recommendations. The contributors

may buy and sell securities before and after any particular

article, report and publication. In no event shall Hawk Point Media

be liable to any member, guest or third party for any damages of

any kind arising out of the use of any content or other material

published or made available by Hawk Point Media, including, without

limitation, any investment losses, lost profits, lost opportunity,

special, incidental, indirect, consequential or punitive damages.

Past performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Media strongly urges you conduct a

complete and independent investigation of the respective companies

and consideration of all pertinent risks. Readers are advised to

review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider

reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point

Media, its authors, contributors, or its agents, may be compensated

for preparing research, video graphics, and editorial content. Hawk

Point Media LLC has been compensated up to four-thousand dollars

cash via wire transfer by a third party to prepare and syndicate

content for WaterPure International, Inc.. for a one-month period.

As part of that content, readers, subscribers, and website viewers,

are expected to read the full disclaimers and financial disclosures

statement that is part of this content.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in micro-cap and growth

securities is highly speculative and carries an extremely high

degree of risk. It is possible that an investors investment may be

lost or impaired due to the speculative nature of the companies

profiled.

source - https://www.marketwatch.com/press-release/waterpure-internationals-29000-52-week-gain-proves-water-can-be-as-valuable-as-gold-otc-pink-wpur-2021-11-04

other stocks on the move include

TGGI,

RGBP and

CYBL.

SOURCE: Hawk Point Media

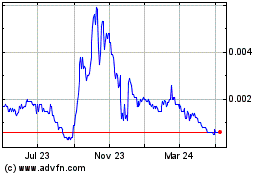

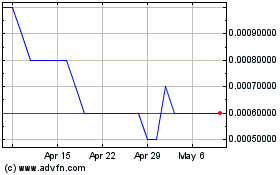

Trans Global (CE) (USOTC:TGGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Trans Global (CE) (USOTC:TGGI)

Historical Stock Chart

From Jan 2024 to Jan 2025