Current Report Filing (8-k)

October 09 2020 - 5:24PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): October 5, 2020

SPYR, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Nevada

(State

or other jurisdiction of

incorporation or organization)

|

Commission

File Number

33-20111

|

75-2636283

(I.R.S.

Employer

Identification

Number)

|

(Address of Principal Executive Offices and

Zip Code)

4643 South Ulster Street, Suite 1510

Regency Plaza

Denver Colorado 80237

(303) 991-8000

(Issuer's telephone number)

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbols

|

Name of Exchange on Which Registered

|

|

NONE

|

SPYR

|

NONE

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act

of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 - Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On October 5, 2020, the Registrant closed a

Stock Purchase Agreement with Mr. Mehdi Safavi. Aside from the Stock Purchase Agreement, no material relationship exists between

Mr. Safavi and the Registrant or its affiliates. By virtue of the Stock Purchase Agreement, in two separate closings, the Registrant

agreed to sell Mr. Safavi, in each closing, an 8% $500,000 Convertible Promissory Note and Warrant to purchase one million common

shares. Each Convertible Promissory Note bears 8% interest and is due September 30, 2025. Amounts due under the Convertible Promissory

Note are convertible into the Registrant’s common stock at the lower price of $0.25 per share or 70% of the average of the

three lowest Variable Weighted Average Price (“VWAP”) for the Registrant’s common stock for the twenty trading

days prior to an election to convert. The Warrant for 1,000,000 common shares is exercisable until September 30, 2025, either at

an exercise price of $0.25 per share or in a cashless exercise, subject to the Registrant filing a registration statement including

the shares of common stock that may be issued upon exercise of the Warrant. The second closing is contingent upon the Registrant

filing a registration statement including the shares underlying the Convertible Promissory Notes and Warrant shares.

The Registrant also entered into an Equity

Line of Credit pursuant to an Equity Purchase Agreement with Brown Stone Capital, LP, dated September 30, 2020. Aside from the

Equity Purchase Agreement with Brown Stone, no material relationship exists between Brown Stone and its affiliates, and the Registrant

or its affiliates. Pursuant to an Equity Purchase Agreement, Brown Stone agreed to invest up to $14,000,000 to purchase the Registrant’s

Common Stock, par value $0.0001 per share. The purchase price of the common shares is the lesser of the Fixed price or Market price.

The Fixed price is $0.50 per share in years 1 and 2, after the effectiveness of a registration statement, and $1.00 per share

in years 3, 4 and 5 after the effectiveness of this registration statement. The Market price is 70% of the three lowest Variable

Weighted Average Price (“VWAP”) for the Company’s common stock during the 10 trading day period immediately prior

to the conversion date. Coincidentally, the Registrant and Brown Stone entered into a Registration Rights Agreement, whereby the

Registrant agreed to provide certain registration rights under the Securities Act of 1933, as amended, and the rules and regulations

thereunder, and applicable state securities laws, with respect to the shares of Common Stock issuable for Brown Stone’s investment

pursuant to the Equity Purchase Agreement. The Equity Purchase Agreement terminates five years after the Effective Date, or conditioned

upon the following events: (i) when Brown Stone has purchased the maximum purchase amount; or (ii) in the event a voluntary or

involuntary bankruptcy petition is filed concerning the Registrant; or, (iii) if a Custodian is appointed for the Registrant or

if the Registrant makes a general assignment for all or substantially all of its property for the benefit of its creditors.

The foregoing description of the Stock Purchase

Agreement, Convertible Promissory Notes, Warrants, Equity Purchase Agreement and Registration Rights Agreement is qualified in

its entirety by reference to the transactional documents to be filed as exhibits in the Registrant’s Form 10-Q for the quarter

ended September 30, 2020.

Item 2.01 Completion of Acquisition or

Disposition of Assets.

On September 30, 2020, the Stock Purchase

Agreement, Convertible Promissory Note and Warrant were executed. The first closing occurred on October 5, 2020. The disclosure

included under Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein.

Section 9 - Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

The Company will file exhibits regarding this

Form 8-K in its next Form 10-Q for the quarter ending September 30, 2020.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SPYR, INC. (Registrant)

Date October 9, 2020

By:/s/ James R. Thompson

Chief Executive Officer & President

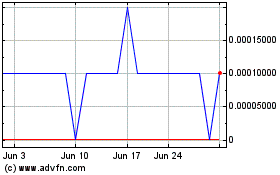

SPYR (PK) (USOTC:SPYR)

Historical Stock Chart

From Apr 2024 to May 2024

SPYR (PK) (USOTC:SPYR)

Historical Stock Chart

From May 2023 to May 2024