Form 10-Q - Quarterly report [Sections 13 or 15(d)]

August 09 2023 - 4:36PM

Edgar (US Regulatory)

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Nov 2024 to Dec 2024

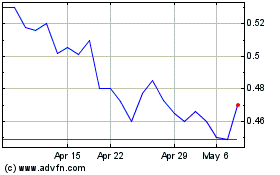

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Dec 2023 to Dec 2024