Northwest Biotherapeutics Inc - Current report filing (8-K)

May 15 2008 - 6:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) May 12, 2008

NORTHWEST BIOTHERAPEUTICS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

|

|

|

|

|

|

DELAWARE

|

|

|

|

|

|

(STATE OR OTHER

|

|

0-33393

|

|

94-3306718

|

|

JURISDICTION

|

|

(COMMISSION FILE

|

|

(I.R.S. EMPLOYER

|

|

OF INCORPORATION)

|

|

NUMBER)

|

|

IDENTIFICATION NO.)

|

7600 Wisconsin Avenue, Suite 750, Bethesda, MD 20814

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE)

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE (240) 497-9024

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

|

|

|

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

Item 1.01.

|

|

Entry into a Material Definitive Agreement.

|

On

May 12, 2008, Northwest

Biotherapeutics, Inc. (the “Company”) executed a Loan Agreement and

Promissory Note (the “Note”) with Al Rajhi Holdings W.L.L. (“Al Rajhi”), a beneficial owner of

greater than 10% of the Company’s common stock. Under the Note, Al Rajhi will loan the Company

$4,000,000 and the Company will repay Al Rajhi $4,240,000 at

maturity, representing the principal

and an original issue discount of six percent. The Note is an unsecured obligation of the Company.

The initial term of the Note expires on October 30, 2008, and the term may be extended in Al

Rajhi’s sole discretion upon the Company’s request. The Note may be paid at any time without a

prepayment penalty. All amounts owed under the Note are to be repaid at maturity in cash; however,

Al Rajhi may elect to have the original issue discount amount paid at maturity in unregistered

shares of the Company’s common stock, at a price per share equal to the average closing price of

the common stock on the NASD Over-The-Counter Bulletin Board (the “OTCBB”) over the ten trading

days prior to the date on which the Note was executed. The Company granted Al Rajhi piggyback registration rights covering any

shares of the Company’s common stock issued under the Note.

The Note contains customary representations and warranties and affirmative and negative covenants

regarding the operation of the Company’s business during the term of the Note. The Company agreed

in the Note to indemnify Al Rajhi for a period of two years following the parties’ entry into the

Note for any losses suffered by Al Rajhi as a result of the inaccuracy of any representation and

warranty or a breach of any covenant of the Company under the Note. In addition, following any

default by the Company under the Note, (a) Al Rajhi may accelerate all amounts due and owing under

the Note and (b) the Company is obligated to pay Al Rajhi monthly default payments equal to 0.25%

of the then-outstanding principal amount of the Note until the earlier to occur of the default

being cured or all the repayment by the Company of amounts then due and owing to Al Rajhi under the

Note. Any default payment is to be paid in unregistered shares of the Company’s common stock, at a

price per share equal to the lower of the average closing price of the common stock on the OTCBB

over the ten trading days prior to the date on which (i) the default payment is due or (ii) the

default payment is actually made.

A copy of the Note is attached as Exhibit 4.5 hereto and is incorporated into this Item 1.01 by

this reference.

|

|

|

|

|

Item 2.03.

|

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The disclosure under Item 1.01 of this Form 8-K is incorporated into this Item 2.03 by this

reference.

|

|

|

|

|

Item 3.02.

|

|

Unregistered Sales of Equity Securities.

|

The disclosure under Item 1.01 of this Form 8-K is incorporated into this Item 2.03 by this

reference. The Company claims exemption from the registration requirements under the Securities

Act of 1933, as amended (the “Securities Act”), with respect to the shares of the Company’s common

stock issuable pursuant to the Note under Section 4(2) of the Securities Act and/or Regulation D

thereunder, as transactions not involving any public offering. Al Rajhi represented and warranted

in the Note that it is an “accredited investor,” as defined under the Securities Act. The Company

claims this exemption on the basis that (i) Al Rajhi represented that it intends to acquire any

shares of common stock issued pursuant to the Note for investment only and not with a view to the

distribution thereof and that it has received adequate information about the Company or had access

to such information and (ii) appropriate legends will be affixed to any stock certificates issued

to Al Rajhi pursuant to the Note.

On May 9, 2008, the Company issued a press release announcing that it secured $4,000,000 of

financing from Al Rajhi and its entry into the Note. A copy of this press release is attached as

Exhibit 99.1 hereto and is incorporated into this Item 8.01 by this reference.

|

|

|

|

|

Item 9.01.

|

|

Financial Statements and Exhibits.

|

|

|

(a)

|

|

Financial Statements of Businesses Acquired: Not Applicable

|

|

|

|

|

(b)

|

|

Pro Forma Financial Information: Not Applicable

|

|

|

|

|

(c)

|

|

Shell Company Transactions: Not Applicable

|

|

|

|

|

(d)

|

|

Exhibits.

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

4.5

|

|

Loan Agreement and Promissory Note, dated May

6, 2008, between the Company and Al Rajhi Holdings WLL

|

|

|

|

|

|

99.1

|

|

Press Release dated May 9, 2008: Northwest

Secures US$4.0 Million in Debt Financing

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Northwest Biotherapeutics, Inc.

|

|

|

|

By: /s/

|

Anthony P. Deasey

|

|

|

|

|

Anthony P. Deasey

|

|

|

|

|

Senior Vice President and

Chief Financial Officer

|

|

|

|

Date:

May 14, 2008

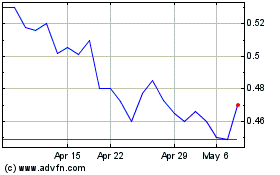

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jul 2023 to Jul 2024