By Giulia Petroni

This week, a number of European companies came out of hiding

regarding 2020 guidance, offering new targets or revising previous

ones in the wake of the coronavirus pandemic. Other companies,

however, are still on the sidelines, citing lingering uncertainties

and low visibility as new outbreaks spread across Europe.

Below is a round-up of outlook statements from the past

week.

New guidance:

--BT GROUP PLC: The U.K. telecommunications group issued

full-year guidance, saying it expects adjusted earnings before

interest, depreciation, taxes and amortization for the year ending

March 31, 2021 to be between GBP7.2 billion and GBP7.5 billion.

Adjusted revenue for the year is expected to fall between 5% and

6%.

--NESTLE SA: The Swiss food and beverage giant expects organic

sales growth between 2% and 3%. It also expects its underlying

trading operating profit margin to improve and an increase in

underlying earnings per share in constant currency and capital

efficiency.

Lowered Guidance:

ENGIE SA: The French energy company expects net recurring income

between EUR1.7 billion and EUR1.9 billion and capital expenditure

at between EUR7.5 billion and EUR8 billion, assuming a continued

and gradual return to normality across geographies. The company

withdrew guidance in April.

FRESENIUS SE & CO. KGAA: The German health-care company

expects sales growth of 3% to 6% at constant currencies and net

income growth of between minus 4% to positive 1%. The company had

previously guided for sales growth of 4%-7% and net income growth

of 1%-5%, both at constant currencies.

LEONARDO SPA: The Italian aerospace-and-defense company expects

2020 revenue between EUR13.2 billion and EUR14 billion, and orders

between EUR12.5 billion and EUR13.5 billion. Guidance assumes no

virus resurgence or further lockdowns. Leonardo suspended its 2020

guidance in May.

MTU AERO ENGINES AG: The German engine manufacturer released new

guidance, saying it expects revenue between EUR4 billion and EUR4.4

billion, compared with EUR4.6 billion in 2019. Adjusted EBIT margin

is expected between 9% and 10%, down from 16% the prior year. MTU

Aero scrapped guidance in March, having previously expected revenue

and adjusted earnings before interest and taxes for 2020 to grow at

a high single-digit percentage.

SCHNEIDER ELECTRIC SE: The French energy-management group now

expects revenue to fall between 7% to 10% organically, and adjusted

earnings before interest, taxes and amortization margin to fall by

between 50 basis points and 90bps organically, implying a margin

between 14.5% to 15%.

SIEMENS GAMESA RENEWABLE ENERGY SA: The Madrid-listed turbine

maker guided for revenue between EUR9.5 billion and EUR10 billion

and its EBIT margin before PPA and integration and restructuring

costs to fall between -3% and -1%. This equates to a reduction of

EUR1 billion in revenue and EUR200 million-EUR250 million in

profitability compared to the previous guidance, which was

withdrawn in April.

Lifted Guidance:

DELIVERY HERO AG: The German food-delivery company raised

revenue guidance to a range of between EUR2.6 billion and EUR2.8

billion. It had previously targeted revenue of between EUR2.4

billion and EUR2.6 billion.

NOKIA CORP: The Finnish telecoms giant lifted full-year guidance

as profitability and cash generation strengthened. The company now

expects 2020 adjusted earnings per share of EUR0.25, plus or minus

5 cents, and an adjusted operating margin of 9.5%, plus or minus

1.5 percentage points, from EUR0.23 and 9% respectively.

SANOFI SA: The French pharmaceutical company raised guidance for

business earnings per share for the year. It now expects business

EPS to grow between 6% and 7% at constant exchange rates for 2020,

up from a previous forecast for a 5% rise.

Backed guidance:

ASTRAZENECA PLC: The British pharmaceutical giant said 2020

guidance remains unchanged, and that it continues to expect total

revenue to increase by a high single-digit to a low double-digit

percentage and core EPS to increase by a mid-to-high-teens

percentage.

ATOS SE: The French IT company backed its guidance for 2020,

assuming a progressive recovery over the second half of 2020 and

2021. This includes a revenue fall of between 2% and 4%

organically, an operating margin rate at 9% to 9.5% of revenue and

free cash flow of between EUR500 million and EUR600 million. Atos

cut its targets in April due to the coronavirus pandemic.

GLAXOSMITHKLINE PLC: The British pharmaceutical giant maintained

its 2020 adjusted EPS guidance--a decline in the range of 1% to 4%

at CER--but said there are still some risks to its business

performance over the year, for example the timing of a recovery in

vaccination rates.

SAP SE: The German software company reiterated its 2020 outlook,

saying it expects operating profit to be in a range of EUR8.1

billion to EUR8.7 billion at constant currencies, and total revenue

in a range of EUR27.8 billion to EUR28.5 billion at constant

currencies.

TELEFONICA DEUTSCHLAND HOLDING AG: The German telecommunications

company backed its full-year revenue and operating income guidance

and said it is on track to achieve its expansion targets. It added

it expects revenue for 2020 to be flat or slightly positive on the

year. Oibda is forecast to remain stable or slightly positive on

the year too, it said.

VOLKSWAGEN AG: The German car maker didn't provide detailed

guidance for the year. It confirmed its previous outlook comments,

expecting full-year sales to be "significantly" below prior-year

level and operating profit to be "severely" below last year's

figure but still positive.

Withheld Guidance:

AIRBUS SE: The European plane maker said it still won't issue a

new guidance for the year as visibility remains low, particularly

in regard to deliveries. Full-year guidance was withdrawn in

March.

BASF SE: The German chemical company said it still couldn't

provide a full-year outlook and added it doesn't see third-quarter

EBIT before special items improving significantly on quarter,

partly due to generally lower demand in August. The 2020 outlook

was withdrawn at the end of April.

ESSILORLUXOTTICA SA: The Franco-Italian optical giant said it is

unable to reinstate guidance for the year as the situation is too

volatile, after scrapping it in March.

WACKER CHEMIE AG: The German chemical company refrained from

providing specific guidance for the year. However, it said it

expects sales, Ebitda and Ebitda margin to be below 2019 levels.

Net cash flow is expected be higher.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

July 31, 2020 09:48 ET (13:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

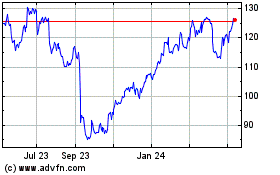

MTU Aero Engines (PK) (USOTC:MTUAY)

Historical Stock Chart

From Feb 2025 to Mar 2025

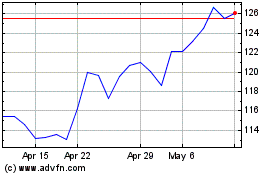

MTU Aero Engines (PK) (USOTC:MTUAY)

Historical Stock Chart

From Mar 2024 to Mar 2025