In this public offering we, “LifeQuest World Corp.”

are offering 15,000,000 shares of our common stock and we are registering 3,700,000 shares of our common stock and 1,300,000 shares

of our common stock underlying warrants on behalf of the selling shareholder. This offering will terminate upon the earliest

of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified

date of this offering circular, unless extended by our directors for an additional 90 days. We may however, at any time and for

any reason terminate the offering.

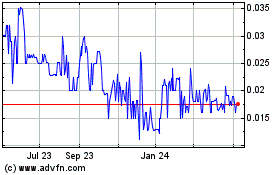

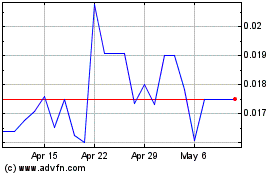

Our Common Stock trades in the OTCMarket Pink Open Market under

the symbol LQWC. There is currently no active trading market for our securities. There is no assurance that a regular trading market

will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our

company.

All of the shares being registered for sale by us and the selling

shareholder will be sold at a fixed price of $0.20 per share. This offering is being conducted on a “best efforts”

basis without any minimum offering amount pursuant to Regulation A of Section 3(6) of the Securities Act for Tier 1 offerings.

We reserve the right to undertake one or more closings on a rolling basis. Until we complete a closing, the proceeds for the offering

will not be kept in an escrow account. All funds derived by us from this offering will be immediately available for use by us,

in accordance with the uses set forth in the section of this Offering Circular entitled “Use of Proceeds.” If there

are no sales of our common stock pursuant to this Offering Circular, or upon termination of this offering without any corresponding

sales, the investments for this offering will be promptly returned to investors, without deduction and generally without interest.

There is no minimum purchase requirement for investors. See “Plan of Distribution.”

We will not receive any of the proceeds from the sale of shares

by the selling shareholders unless the warrants are exercised. Resale shares may be sold to or through underwriters or dealers,

directly to purchasers or through agents designated from time to time by the selling shareholders. For additional information regarding

the methods of sale, you should refer to the section entitled “Plan of Distribution” in this offering.

We expect to commence the offer and sale of the shares of common

stock being offered pursuant to this Offering Circular as of the date on which the offering statement of which this Offering Circular

is a part (the “Offering Statement”) is qualified by the SEC.

The following table of contents has been designed

to help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

You should rely only on the information contained in this

offering circular or contained in any free writing offering circular filed with the Securities and Exchange Commission. We have

not authorized anyone to provide you with additional information or information different from that contained in this offering

circular filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the

reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common

stock only in jurisdictions where offers and sales are permitted. The information contained in this offering circular is accurate

only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of shares

of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This offering circular, and any supplement to this offering circular

include “forward-looking statements”. To the extent that the information presented in this offering circular discusses

financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise

makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by

the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”,

“forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations

reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties

that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary

statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position

and Results of Operations” section in this offering circular.

This summary only highlights selected information contained in greater

detail elsewhere in this offering circular. This summary may not contain all of the information that you should consider before

investing in our common stock. You should carefully read the entire offering circular, including “Risk Factors” beginning

on Page 13, and the financial statements, before making an investment decision.

Generally, no sale may be made to you in this offering if the aggregate

purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited

investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds,

we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer

to www.investor.gov.

Sale of these shares will commence within two calendar days of the

qualification date and it will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

LifeQuest World Corp (“we” or the “Company”

or “LifeQuest”) through its our wholly owned subsidiary, BioPipe Global Corp., is a wastewater treatment company with

world’s only sludge free onsite waste water system.

On April 17, 2019, we entered into an Agreement and Plan of Merger

(the “Merger Agreement”) with BioPipe Acquisition, Inc., a New Jersey corporation (“Merger Sub”) and BioPipe

Global Corp., a privately held New Jersey corporation (“BioPipe Global”). In connection with the closing of this merger

transaction, Merger Sub merged with and into BioPipe Global (the “Merger”) on April 30, 2019, with the filing of Articles

of Merger with the New Jersey Secretary of State.

As a result of the Merger Agreement, we are engaged in eco-friendly

decentralized wastewater treatment.

On May 7, 2019, BioPipe Global acquired all the assets of BioPipe

Global AG, a Swiss company, and its wholly-owned Turkish subsidiary, BioPipe Cevre Teknolojileri A.S. We acquired all patents,

trade receivables, income, royalties, damages, rights to sue, rights to enforce and any and all payments unpaid and due now or

hereafter due or payable with respect to the BioPipe System.

The Company issued Seventy One Million Eight Hundred Forty Six Thousand

Six hundred and Sixty Seven shares (71,846,667) duly authorized, validly issued, fully paid and nonassessable shares of common

stock to the Shareholders of Biopipe Cevre Teknolojileri A.S and a Three million One Hundred and Fifty-three Thousand and Three

Hundred and Thirty Three (3,153,333) duly authorized, validly issued, fully paid and nonassessable shares of common stock to Biopipe

Global AG.

In the last seven years, the BioPipe system has been installed in

Turkey, UAE, Qatar, Saudi Arabia, Oman Maldives and Bangladesh. These BioPipe systems are running successfully at resorts, hotels,

commercial and government buildings, labor camps, ports and individual homes. In the future we can expect to see an increase in

these types of installations as well as a cost-effective replacement for today’s Septic systems for single family homes and

housing communities in the USA and around the world.

Biopipe Global acquired the assets from Biopipe Global AG and Biopipe

Cevre and then merged with Lifequest World Corp.

Biopipe Global did not have an operating history. Biopipe Global

AG had installed systems in multiple countries, including the system in Bangladesh that has been running continuously for 3 years

and the other countries listed above. Biopipe Global AG had licensed the technology to Metito (Overseas) Ltd. which failed to make

any payments to Biopipe Global AG even though they installed 17 systems and hence the reason for non-renewal of the licensing agreement.

We have acquired the right to collect from Metito, but given the uncertainties of prosecuting a claim in the UAE, we have chosen

to forgo the lawsuit for the time being.

Traditional centralized wastewater treatment systems are expensive,

energy-intensive and chemical-dependent. The world is seeking sustainable solutions through decentralized wastewater treatment

which “get back to nature” while using 21st century technologies and management. Reuse may include irrigation of gardens

and agricultural fields or replenishing surface water and groundwater. Reused water may also be directed toward fulfilling certain

needs in residences (e.g. toilet flushing), businesses and industry, and where necessary, treated to reach potable standards.

The reuse of wastewater has long been established as critically

important for irrigation, especially in arid countries. According to the World Bank, there will be a 40 percent global shortfall

between supply and demand of water by 2030. And by 2025, approximately 1.8 billion people will be living in regions with “absolute

water scarcity.” The World Bank also estimates that 70 percent of water use today is for agriculture. A projected global

population of 9 billion by 2050 is expected to require a 60 percent increase in agricultural production and a 15 percent increase

in water withdrawals. Recycled water can meet some of this need, benefited by the nutrient content inherent in wastewater. Only

mid-range treatment levels would be required, as irrigation can be accomplished while minimizing the potential for human contact

with the recycled water. Reusing wastewater as part of sustainable water management allows water to remain as an alternative water

source for human activities. This can reduce scarcity and alleviate pressures on groundwater and other natural water bodies. At

the nexus between unusable wastewater and usable clean water, lies BioPipe:

We are a company seeking, and finding, opportunities to improve

the supply of clean water for emerging and first-world nations. Clean water availability is a globally essential issue and critical

to stopping the cycle of disease and sickness across the globe. Lifequest's main business focus is on reclamation and resuse of

treated wastewater. Reuse may include irrigation of gardens and agricultural fields or replenishing surface water and groundwater.

Reused water may also be directed toward fulfilling certain needs in residences (e.g. toilet flushing), businesses and industry,

and where necessary, treated to reach drinking water standards. Reclaiming water from waste for reuse applications (instead of

using freshwater supplies) can be a water-saving measure. When treated waste water is eventually discharged back into natural water

sources, it still has significant benefits to the ecosystem; improving streamflow, nourishing plant life and recharging aquifers,

as part of the natural water cycle. With number of water-stressed countries rising, treatment and reuse of wastewater is becoming

increasingly necessary.

BioPipe is a revolutionary sewage wastewater treatment system. Patented

in over 40 plus countries, Biopipe is a highly scalable, eco-friendly and extremely cost-effective wastewater treatment with a

broad installed base. It is the planet’s first biological wastewater treatment system where the process takes place entirely

inside the pipe and:

Biopipe has around 37 plants installed around the globe and we expect

significant number of projects in Bangladesh, India and South Africa. We have set up joint venture in Bangladesh and finalized

joint venture terms with in-country partners in India and South Africa and have ongoing discussion in various other countries.

Our initial focus is on countries that have high water stress and

a large gap between production of sewage and industrial wastewater versus installed capacity or simply lag adequate wastewater

treatment infrastructure.

Our core strategy is to introduce Biopipe through joint ventures

with strategic and well-established partners in top 10 countries with sewage problem. The JV partners, handles sales marketing,

installation, operations and maintenance. This includes India, Bangladesh, Indonesia, Ethiopia, Nigeria, and Pakistan.

Bangladesh is an important market for our solutions. According to

Bangladesh Institute of Planners, capital Dhaka along dumps 1.16 million m3 of sewage per day into the local rivers. https://bdnews24.com/environment/2019/05/25/dhaka-pumps-1.1-million-cubic-metres-of-sewage-into-rivers-daily-study-says

India is unique because it not only one of the most water stressed

countries in the world and also has a huge sewage and industrial wastewater problem.

We have signed and MoU and finalized a 50-50 joint venture agreement

with Environest Global Pvt Limited to introduce Biopipe in India, Mauritius, Maldives and Sri Lanka. The agreement calls for minimum

sale of 10,000 m3 in total capacity in Year 2020 and must maintain it in order to maintain exclusivity.

We are targeting the textile and tannery wastewater sector outside

the joint venture. Currently textile manufacturers are willing to pay up to $18/m3 for treating textile waste and if we put a reverse

osmosis (RO) unit in, the water can be resold to the government for $2/m3.

South Africa is another water stressed country with massive sewage

problem. More than half of the sewage treatment installed capacity is not working and close to 50,000 liters of sewage is being

dumped every second -

https://mg.co.za/article/2017-07-21-south-africas-shit-has-hit-the-fan

. The local governments are asking developers to have their own decentralized sewage wastewater systems before any development

is approved. This creates a highly scalable Build Own & Operate (BOO) or leasing opportunity whereby we will provide the system

and charge the customers for the amount of water reused. BOO or Leasing is expected to produce a long term stable cashflow.

Sanitation makes a key contribution to public health,

particularly in densely populated areas. Adequate sanitation is defined as any private or shared, but not public, facility that

guarantees that waste is hygienically separated from human contact (JMP, 2000). Adequate sanitation reduces the risk of a broad

range of diseases – including respiratory ailments, malaria, and diarrhea – and reduces the prevalence of malnutrition.

Access to this standard of sanitation produces direct health gains by preventing disease and delivering economic and social benefits.

It is estimated that a reduction in diarrhea illness would produce a gain of 99 million days of school and 456 million days of

work for the working population (age 15–59) in Africa.

The 2016 General Household Survey performed by Stats

SA reported on, inter alia, the number of households with access to sanitation and the type of sanitation accessed. The table

below uses information from the survey and links it to the suitability of the Biopipe closed loop, flush toilet system:

From the above table, one can deduce the available market

for the Biopipe closed loop flush toilet system to be around 6.25 million households. Assuming a flush volume of 4 liters and 10

flushes per household per day, that equates to a market size, by treatment volume, of 250,000 m3/day.

With the average system servicing 25 households – i.e. 1,000

liters per day (25*40 liters), the market equates to 250,000 systems.

We have finalized a 50-50 Joint Venture with Abrimix (Pty) Ltd.

to introduce Biopipe system in Africa, excluding Morocco and Egypt and vice versa we will introduce Abrimix system in Bangladesh,

India and Turkey.

Additionally, we are having dialogue with potential partners in

the Philippines, Egypt and Ethiopia.

Our principal place of business is located at 100 Challenger Road,

8th Floor Ridgefield Park, NJ 07660. General information about us can be found at http://biopipe.co/. The information contained

on or connected to our website is not incorporated by reference into this Offering Circular on Form 1-A and should not be considered

part of this or any other report filed with the SEC.

Our business will be subject to numerous risks and uncertainties,

including those described in “Risk Factors” immediately following this offering circular summary and elsewhere in this

offering circular. These risks represent challenges to the successful implementation of our strategy and to the growth and future

profitability of our business. These risks include, but are not limited to, the following:

The Offering

|

|

|

|

Securities being offered by the Company

|

15,000,000 shares of common stock, at a fixed price of $0.20 offered

by us on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold, through

our officers and directors. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been

sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular unless extended by our

Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. There is no

minimum number of shares required to be purchased by each investor.

|

|

Securities being offered by the Selling Stockholders

|

3,700,000 shares of common stock and 1,300,000 shares of common stock underlying warrants, at a fixed price of $0.20 offered by selling stockholder in a resale offering. This fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

|

|

|

|

|

Offering price per share

|

We and the selling shareholder will sell the shares at a fixed price per share of $0.20 for the duration of this Offering.

|

|

|

|

|

Number of shares of common stock outstanding before the offering of common stock

|

92,113,150 common shares are currently issued and outstanding.

|

|

Number of shares of common stock outstanding after the offering of common stock

|

107,113,150 common shares will be issued and outstanding if we sell all of the shares we are offering herein.

|

|

|

|

|

The minimum number of shares to be sold in this offering

|

None.

|

|

|

|

|

Use of Proceeds

|

We intend to use the gross proceeds to us for working capital and to invest in Build Own & Operate (BOO) and Build Own Operate & Transfer (BOOT) plants in South Africa, Bangladesh and India, and for other corporate purposes. Please see “Use of Proceeds.”

|

|

|

|

|

Termination of the Offering

|

The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

|

|

|

|

|

Subscriptions:

|

All subscriptions once accepted by us are irrevocable.

|

|

Registration Costs

|

We estimate our total offering registration costs to be approximately

$15,000.

|

|

Risk Factors:

|

See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock.

|

You should rely only upon the information contained in this offering

circular. We have not authorized anyone to provide you with information different from that which is contained in this offering

circular. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales

are permitted.

MANAGEMENT’S DISCUSSION AND ANALYSIS

You should read the following discussion

and analysis of our financial condition and results of our operations together with our financial statements and related notes

appearing at the end of this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations

that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these

forward-looking statements due to a number of factors, including those discussed in the section entitled "Risk Factors"

and elsewhere in this Offering Circular.

Impact of Covid 19

In March 2020, the World Health Organization

declared the outbreak of coronavirus/COVID-19 (collectively referred to herein as “COVID-19”) a pandemic, which has

continued to spread throughout the U.S. and the world, resulting in governmental authorities implementing numerous containment

measures, including travel bans and restrictions, quarantines, shelter-in-place orders, and business limitations and shutdowns.

The safety and well-being of our employees

and customers and those of our joint venture partners in Bangladesh, India, South Africa has been and will continue to be our top

priority during this global crisis,

Due to the pandemic our orders and sales pipeline

are essentially on hold. With India under lockdown, we have been able to continue with fabrication of our systems by our backup

manufacturer in Turkey (http://www.pimtasplastik.com.tr/en/main-page), which is operating on a limited schedule and expects to

deliver at least three systems in the next sixty days.

We are unable to predict the full impact that

COVID-19 will have on our results from operations, financial condition, liquidity and cash flows due to numerous uncertainties,

including the duration and severity of the pandemic and containment measures and the related macro-economic impacts. Overall, the

pandemic is expected to have a material negative impact on our consolidated financial results for the fourth quarter of our fiscal

year 2020 and first quarter of fiscal year 2021.

Although we have a diversified offering which

reduces our dependence sewage treatment system and we have other product offerings, including Abrimix to treat industrial waste

water, Glanris media for pre and post treatment and Goslyn for fat oil and grease removal, we do not expect to be operating at

full capacity while the pandemic and the associated shutdowns continue.

We expect that our sales pipeline focused on

the hospitality industry in India and textile industry in Bangladesh to continue to remain frozen until lockdowns are lifted. However,

we continue to proceed with government orders in Bangladesh, where activity has increased since the fourth quarter of 2019, and

to focus on the contracts in the government sector of India, where we have started pursing these agreements. We are actively managing

this dynamic environment and have updated our plans to reflect the unique aspects of the pandemic.

We continue to execute various long-term productivity

and temporary cost saving actions to manage the downturn and improve our ability to scale, once the world is back in business.

We have ample liquidity at hand which will support our working capital and capex needs, excluding build own operate (BOO) projects

for the foreseeable future. We continue to actively monitor this situation and may take further actions that alter our business

operations as may be required by respective governments in countries we operate in and federal, state or local authorities here

in the USA.

Results of Operations for the Years Ended

May 31, 2020 and 2019

Revenues

Our total revenue reported for the year ended

May 31, 2020 was $371,567, compared with $3,302 for the year ended May 31, 2019.

Our revenues have increased as a result of

our joint ventures and other marketing initiatives. We expect our revenues to increase in future quarters from these efforts.

Cost of Revenues

Our total cost of revenues for the year ended

May 31, 2020 was to $112,498, compared with $2,254 for the year ended May 31, 2019.

We expect to sell our Biopipe systems with

at least 50% gross margin.

Operating Expenses

Operating expenses increased to $273,642 for

the year ended May 31, 2020 from $162,562 for the year ended May 31, 2019. The increase in operating expenses is a result of professional

fees and deferred compensation expense.

We expect to incur more in operating expenses

for the year ended May 31, 2021 as a result of the increased costs of reporting with the Securities and Exchange Commission and

the growth of our business with access to the capital in this offering.

Other Expenses/Other Income

We had other expenses of $4,281 for the year ended May 31, 2020,

as compared with other expenses of $8,411,921 for the same period ended 2019. Our other expenses in 2019 were largely the result

of $8,319,099 in loss on settlement of debt, and our other expenses in 2020 were largely the result of interest expense of $4,635.

Net Loss

We finished the year ended May 31, 2020 with a loss of $18,854,

as compared to a net loss of $8,248,311 during the year ended May 31, 2019.

Liquidity and Capital Resources

As of May 31, 2020, we had total current assets of $966,023 and

current liabilities of $149,901, resulting in working capital of $816,122.

Our operating activities used $227,932 in cash for the year ended

May 31, 2020 as compared with cash provided of $23,964 from operating activities in the year ended May 31, 2019. Our negative operating

cash flow for 2020 was mainly the result of changes in accounts receivable and our net loss for the period and our negative operating

cash flow for 2019 was mainly the result of our net loss.

Our investing activities used $33,558 for the year ended May 31,

2020, as compared with no cash used for year ended May 31, 2019. Our investing activities in 2020 are largely the result of the

purchase of fixed assets.

Financing activities provided $943,883 in cash for the year ended

May 31, 2020 compared with $49,200 used in the year ended May 31, 2019. Our positive financing cash flow in 2020 was largely the

result of proceeds from contributed capital and convertible debt. Our positive financing cash flow in 2019 was largely the result

of proceeds from convertible debt.

Based upon our current financial condition, we do not have sufficient

cash to operate our business at the current level for the next twelve months. We intend to fund operations through increased sales

and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. We plan

to seek additional financing in a private equity offering to secure funding for operations. There can be no assurance that we will

be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business

plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or

at all.

Inflation

Although our operations are influenced by general economic conditions,

we do not believe that inflation had a material effect on our results of operations during the years ended May 31, 2020 and 2019.

Critical Accounting Polices

In December 2001, the SEC requested that all registrants list their

most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical

accounting policy” is one which is both important to the portrayal of a company’s financial condition and results,

and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates

about the effect of matters that are inherently uncertain. Our critical accounting policies are disclosed in Note 2 of our unaudited

consolidated financial statements included in this Offering Circular with the Securities and Exchange Commission.

Off Balance Sheet Arrangements

As of May 31, 2020, there were no off-balance sheet arrangements.

Recent Accounting Pronouncements

The recent accounting pronouncements that are material to our financial

statements are disclosed in Note 2 of our consolidated unaudited financial statements included in this Offering Circular filed

with the Securities and Exchange Commission and in Note 2 of our unaudited consolidated financial statements included herein.

RISK FACTORS

Please consider the following risk factors and other information

in this offering circular relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a

high degree of risk. You should carefully consider the risks described below and all of the information contained in this offering

circular before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial

condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks,

and you may lose all or part of your investment.

We consider the following to be the material risks for an investor

regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our

common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should

only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk

factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks

actually occur, our business and financial results could be negatively affected to a significant extent.

Risk Factors Related to the Business of the Company

Our business, results of operations, and our financial condition

may be further impacted by the outbreak of COVID-19 and such impact could be materially adverse.

In March 2020, the World Health Organization declared the outbreak

of coronavirus/COVID-19 (collectively referred to herein as “COVID-19”) a pandemic, which has continued to spread throughout

the U.S. and the world, resulting in governmental authorities implementing numerous containment measures, including travel bans

and restrictions, quarantines, shelter-in-place orders, and business limitations and shutdowns.

The safety and well-being of our employees and customers and those

of our joint venture partners in Bangladesh, India, South Africa has been and will continue to be our top priority during this

global crisis,

Due to the pandemic our orders and sales pipeline are essentially

on hold. With India under lockdown, we have been able to continue with fabrication of our systems by our backup manufacturer in

Turkey (http://www.pimtasplastik.com.tr/en/main-page), which is operating on a limited schedule and expects to deliver at least

three systems in the next sixty days.

The global spread of COVID-19 has created significant volatility,

uncertainty and economic disruption. The extent to which the coronavirus pandemic impacts our business, operations, and financial

results is uncertain and will depend on numerous evolving factors that we may not be able to accurately predict, including:

|

|

§

|

the duration and scope of the pandemic;

|

|

|

§

|

governmental, business and individual actions taken in response to the pandemic and the impact of those actions on global economic activity;

|

|

|

§

|

the actions taken in response to economic disruption;

|

|

|

§

|

the impact of business disruptions;

|

|

|

§

|

the increase in business failures that we may utilize as industry partners and the customers we serve;

|

|

|

§

|

uncertainty as to the impact or staff availability during and post the pandemic; and

|

|

|

§

|

our ability to provide our services, including as a result of our employees or our customers and suppliers working remotely and/or closures of offices and facilities.

|

Overall, the pandemic could have a material negative impact on our

consolidated financial results for the rest of 2020 and into 2021.

Although we have a diversified offering which reduces our dependence

sewage treatment system and we have other product offerings, including Abrimix to treat industrial waste water, Glanris media for

pre and post treatment and Goslyn for fat oil and grease removal, we do not expect to be operating at full capacity while the pandemic

and the associated shutdowns continue.

We expect that our sales pipeline focused on

the hospitality industry in India and textile industry in Bangladesh to continue to remain frozen until lockdowns are lifted. However,

we continue to proceed with government orders in Bangladesh, where activity has increased since the fourth quarter of 2019, and

to focus on the contracts in the government sector of India, where we have started pursing these agreements. We are actively managing

this dynamic environment and have updated our plans to reflect the unique aspects of the pandemic.

We continue to execute various long-term productivity and temporary

cost saving actions to manage the downturn and improve our ability to scale, once the world is back in business. We have ample

liquidity at hand which will support our working capital and capex needs, excluding build own operate (BOO) projects for the foreseeable

future. We continue to actively monitor this situation and may take further actions that alter our business operations as may be

required by respective governments in countries we operate in and federal, state or local authorities here in the USA.

We have limited cash on hand and there is substantial doubt

as to our ability to continue as a going concern.

As at May 31, 2020, we had cash on hand of $682,393, working capital

of $816,122 and $371,567 in revenues. However, this amount will limit our ability to make capital investments in Build Own &

Operate or Leased projects. We also expect to continue to incur significant operating and capital expenditures for the next twelve

months as we ramp our marketing and funding of Build Own & Operate and Leased plants. We also expect to experience negative

cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate

significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability

in the future. Our failure to achieve or maintain profitability could negatively impact the value of our Common Stock.

We have a limited operating history upon which investors can

evaluate our future prospects.

Our operating subsidiary, BioPipe Global Corp., was incorporated

in the State of New Jersey on April 23, 2019. Therefore, we have limited operating history upon which an evaluation of our business

plan or performance and prospects can be made. The business and prospects of the Company must be considered in the light of the

potential problems, delays, uncertainties and complications encountered in connection with a newly established business. To successfully

introduce and market our products and services at a profit, we must establish brand name recognition and competitive advantages

for our products. There are no assurances that the Company can successfully address these challenges. If it is unsuccessful, the

Company and its business, financial condition and operating results could be materially and adversely affected.

Given the limited operating history, management has little basis

on which to forecast future demand for our products and services from our existing customer base, much less new customers. We are

depended on our in-country joint venture partners. It is difficult to accurately forecast future revenues because the business

of the Company is new and its market has not been developed. If the forecasts for the Company prove incorrect, the business, operating

results and financial condition of the Company will be materially and adversely affected. Moreover, the Company may be unable to

adjust its spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction

in revenues would immediately and adversely affect the business, financial condition and operating results of the Company.

We are dependent on our in-country Joint Venture partners

We intend not to enter markets without joint venture or distributorship.

Our success depends on the ability of our joint venture partners and distributors to effectively market, install and support our

wastewater treatment systems.

We may not be able to compete successfully with current and

future competitors.

We have many potential competitors in the wastewater equipment and

services industry. We will compete, in our current and proposed businesses, with other companies, most of which have far greater

marketing and financial resources and experience than we do. We cannot guarantee that we will be able to penetrate our intended

market and be able to compete profitably, if at all.

If we do not continually upgrade our technology, it may become

obsolete and we may not be able to compete with other companies.

We cannot assure you that we will be able to keep pace with advances

in technology for wastewater treatment or that our services will not become obsolete. We cannot assure you that competitors will

not develop related or similar wastewater treatment systems.

Defects in our products or failures in quality control could

impair our ability to sell our products or could result in product liability claims, litigation and other significant events involving

substantial costs.

Detection of any significant defects in our products or failure

in our quality control procedures may result in, among other things, delay in time-to-market, loss of sales and market acceptance

of our products, diversion of development resources, and injury to our reputation. The costs we may incur in correcting any product

defects may be substantial. Additionally, errors, defects or other performance problems could result in financial or other damages

to our customers, which could result in litigation. Product liability litigation, even if we prevail, would be time consuming and

costly to defend, and if we do not prevail, could result in the imposition of a damages award. We presently maintain product liability

insurance; however, it may not be adequate to cover any claims.

There can be no assurances of protection for proprietary rights

or reliance on trade secrets.

The ownership and protection of the Company’s trademarks,

patents, trade secrets and intellectual property rights are significant aspects of its future success. Unauthorized parties may

attempt to replicate or otherwise obtain and use the Company’s products and technology. Policing the unauthorized use of

current or future trademarks, patents, trade secrets or intellectual property rights could be difficult, expensive, time-consuming

and unpredictable, as may be enforcing these rights against unauthorized use by others. Identifying unauthorized use of intellectual

property rights is difficult as the Company may be unable to effectively monitor and evaluate the intellectual property used by

its competitors, including parties such as unlicensed dispensaries, and the processes used to produce such products. In addition,

in any infringement proceeding, some or all of the trademarks, patents or other intellectual property rights or other proprietary

know-how, or arrangements or agreements seeking to protect the same may be found invalid, unenforceable, anti-competitive or not

infringed. An adverse result in any litigation or defense proceedings could put one or more of the trademarks, patents or other

intellectual property rights at risk of being invalidated or interpreted narrowly and could put existing intellectual property

applications at risk of not being issued. Any or all of these events could materially and adversely affect the Company’s

business, financial condition and results of operations.

In addition, other parties may claim that the Company’s products

infringe on their proprietary and perhaps patent protected rights. Such claims, whether or not meritorious, may result in the expenditure

of significant financial and managerial resources, legal fees, result in injunctions, temporary restraining orders and/or require

the payment of damages.

We may not be able to manage our growth effectively.

We must continually implement and improve our products and/or services,

operations, operating procedures and quality controls on a timely basis, as well as expand, train, motivate and manage our work

force in order to accommodate anticipated growth and compete effectively in our market segment. Successful implementation of our

strategy also requires that we establish and manage a competent, dedicated work force and employ additional key employees in corporate

management, product development, client service and sales. We can give no assurance that our personnel, systems, procedures and

controls will be adequate to support our existing and future operations. If we fail to implement and improve these operations,

there could be a material, adverse effect on our business, operating results and financial condition.

Risks associated with operating abroad may negatively affect

our ability to implement our business plan.

The Company’s expansion into jurisdictions outside of the

United States is subject to risks. In addition, in jurisdictions outside of the United States, there can be no assurance that any

market for the Company’s products or services will develop or be maintained. The Company may face new or unexpected risks

or significantly increase its exposure to one or more existing risks, including economic instability, changes in laws and regulations,

and the effects of competition. These factors may limit the Company’s ability to successfully expand its operations into

such jurisdictions and may have a material adverse effect on the Company’s business, financial condition and results of operations.

If we make any acquisitions or enter into a merger or similar

transaction, our business may be negatively impacted.

We have no present plans for any specific acquisition. However,

in the event that we make acquisitions in the future, we could have difficulty integrating the acquired companies’ personnel

and operations with our own. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot

predict the effect expansion may have on our core business. In addition to the risks described above, acquisitions, mergers and

other similar transactions are accompanied by a number of inherent risks, including, without limitation, the following:

|

|

●

|

the difficulty of integrating acquired products, services or operations;

|

|

|

|

|

|

|

●

|

the potential disruption of the ongoing businesses and distraction of our Management and the management of acquired companies;

|

|

|

|

|

|

|

●

|

the difficulty of incorporating acquired rights or products into our existing business;

|

|

|

|

|

|

|

●

|

difficulties in maintaining uniform standards, controls, procedures and policies;

|

|

|

|

|

|

|

●

|

the potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers;

|

|

|

|

|

|

|

●

|

potential unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool, reposition or modify the marketing and sales of acquired products or the defense of any litigation, whether or not successful, resulting from actions of the acquired company prior to our acquisition.

|

There might be unanticipated obstacles to the execution of

our business plan.

The Company’s business plans may change significantly. The

Company’s Build Own & Operate (BOO) and Leasing endeavors are capital intensive. Management believes that the Company’s

chosen activities and strategies are achievable in light of current water stress and wastewater problem around the world.

Insiders will continue to have substantial control over us

and our policies after this offering and will be able to influence corporate matters.

Enes Kutluca, our COO and director, owns 25,152,009 shares of our

common stock representing 27.59% of our outstanding shares. Mr. Kutluca also has an option to purchase 10% of our outstanding common

stock. The option is exercisable at market price and subject to vesting. Max Khan, our CEO and director, has the same option as

Mr. Kutluca. These options commence, as stated in their respective employment agreements, upon the company adopting a stock option

plan, which has not yet occurred and the board of directors has stated that it does not expect to adopt a plan until the third

quarter of 2020. Fifty percent (50%) of the options shall vest on the date a stock option plan is adopted and the remaining fifty

percent (50%) of the options shall vest and become exercisable on the first anniversary of the date a stock option plan is adopted

by the company.

Once the stock option plan is adopted, these shareholders will have

the right to acquire approximately 40% of our outstanding common stock. Even after the offering, these officers and shareholders,

whose interests may differ from other stockholders, have the ability to exercise significant control over us. They are able to

exercise significant influence over all matters requiring approval by our stockholders, including the election of directors, the

approval of significant corporate transactions, and any change of control of our company. They could prevent transactions, which

would be in the best interests of the other shareholders. Their interests may not necessarily be in the best interests of the shareholders

in general.

We may engage in transactions that present conflicts of interest.

The Company’s officers and directors may enter into agreements

with the Company from time to time which may not be equivalent to similar transactions entered into with an independent third party.

A conflict of interest arises whenever a person has an interest on both sides of a transaction. While we believe that it will take

prudent steps to ensure that all transactions between the Company and any officer or director are fair, reasonable, and no more

than the amount it would otherwise pay to a third party in an “arms’-length” transaction, there can be no assurance

that any transaction will meet these requirements in every instance.

We have agreed to indemnify our officers and directors against

lawsuits to the fullest extent of the law.

The Company is a Minnesota corporation. Minnesota law permits the

indemnification of officers and directors against expenses incurred in successfully defending against a claim. Minnesota law also

authorizes corporations to indemnify their officers and directors against expenses and liabilities incurred because of their being

or having been an officer or director. Our organizational documents provide for this indemnification to the fullest extent permitted

by law.

We currently do not maintain any insurance coverage. In the event

that we are found liable for damage or other losses, we would incur substantial and protracted losses in paying any such claims

or judgments. Although we intend to acquire such coverage immediately upon resources becoming available, there is no guarantee

that we can secure such coverage or that any insurance coverage would protect us from any damages or loss claims filed against

us.

Failure to comply to local laws and regulations.

We may incur substantial costs on an ongoing basis to comply with

all laws and regulations. New or stricter laws and/or regulations could increase our costs and make us less competitive.

Wastewater operations entail significant risks and may impose

significant costs.

Wastewater treatment systems fail or do not operate properly, or

if there is a spill, untreated or partially treated wastewater could discharge onto property or into nearby streams and rivers,

causing various damages and injuries, including environmental damage. Liabilities resulting from such damages and injuries

could harm our business, financial condition, and results of operations.

Significant or prolonged disruptions in the supply of important

goods or services from third parties could harm our business, financial condition, and results of operations.

We are dependent on procuring all our components from third parties

and any deterioration in quality or disruption or prolonged delays in obtaining important supplies such as water pipe, valves,

pumps, control panels, or other materials, could harm our ability to deliver and commission plants on time.

We depend significantly on the services of the members of

our management team, and the departure of any of those persons could cause our operating results to suffer.

Our success depends significantly on the continued individual and

collective contributions of our management team. The loss of the services of any member of our management team or the

inability to hire and retain experienced management personnel could harm our business, financial condition, and results of operations.

Members of our Board and our executive officers may have other

business interests and obligations to other entities.

Neither our directors nor our executive officers will be required

to manage our company as their sole and exclusive function and they may have other business interests and may engage in other activities

in addition to those relating to our company, provided that such activities do not compete with the business of our company. We

are dependent on our directors and executive officers to successfully operate our company, and in particular Max Khan and Mehmet

Enes Kutluca. Their other business interests and activities could divert time and attention from operating our business.

Risks Related to the Offering and the Market for our Stock

Because there is no minimum offering amount, funds raised

may not be sufficient to complete the plans of the Company as set forth in “Use of Proceeds” in this Offering Circular.

There is no minimum offering amount. If we do not raise the maximum

proceeds, funds raised may not be sufficient to complete all plans of the Company as set forth in “Use of Proceeds”

in this Offering Circular, which could inhibit our ability to commence to generate revenue.

We have the right to issue shares of preferred stock. If we

were to issue preferred stock, it is likely to have rights, preferences and privileges that may adversely affect the common stock.

We are authorized to issue 50,000,000 shares of “blank check”

preferred stock, with such rights, preferences and privileges as may be determined from time-to-time by our board of directors.

Our board of directors is empowered, without stockholder approval, to issue preferred stock in one or more series, and to fix for

any series the dividend rights, dissolution or liquidation preferences, redemption prices, conversion rights, voting rights, and

other rights, preferences and privileges for the preferred stock.

The issuance of shares of preferred stock, depending on the rights,

preferences and privileges attributable to the preferred stock, could reduce the voting rights and powers of the common stock and

the portion of our assets allocated for distribution to common stockholders in a liquidation event, and could also result in dilution

in the book value per share of the common stock we are offering. The preferred stock could also be utilized, under certain circumstances,

as a method for raising additional capital or discouraging, delaying or preventing a change in control of the Company, to the detriment

of the investors in the common stock offered hereby.

New investors in our common stock will experience immediate

and substantial dilution after this Offering.

If you purchase shares of common stock in this Offering, you will

experience immediate dilution, because the price that you pay will be substantially greater than the adjusted pro forma net tangible

book value per share that you acquire. This dilution is due in large part to our negative book value.

If a market for our common stock does not develop, shareholders

may be unable to sell their shares.

Our common stock is quoted under the symbol “LQWC” on

the OTCPink operated by OTC Markets Group, Inc., an electronic inter-dealer quotation medium for equity securities. We do not currently

have an active trading market. There can be no assurance that an active and liquid trading market will develop or, if developed,

that it will be sustained.

Our securities are very thinly traded. Accordingly, it may be difficult

to sell shares of our common stock without significantly depressing the value of the stock. Unless we are successful in developing

continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the

stock.

The market price of our common stock is likely to be highly

volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control.

Our stock price is subject to a number of factors, including:

|

|

§

|

Technological innovations or new products and services by us or our competitors;

|

|

|

§

|

Government regulation of our products and services;

|

|

|

§

|

The establishment of partnerships with other environmental companies;

|

|

|

§

|

Intellectual property disputes;

|

|

|

§

|

Additions or departures of key personnel;

|

|

|

§

|

Issuances of our common stock;

|

|

|

§

|

Our ability to execute our business plan;

|

|

|

§

|

Operating results below or exceeding expectations;

|

|

|

§

|

Financial condition of our joint venture partners;

|

|

|

§

|

Whether we achieve profits or not;

|

|

|

§

|

Loss or addition of any strategic relationship;

|

|

|

§

|

Economic and other external factors; and

|

|

|

§

|

Period-to-period fluctuations in our financial results.

|

Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated

to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market

price of our common stock.

Because we are subject to the “Penny Stock” rules,

the level of trading activity in our stock may be reduced.

The Securities and Exchange Commission has adopted regulations which

generally define "penny stock" to be any listed, trading equity security that has a market price less than $5.00 per

share or an exercise price of less than $5.00 per share, subject to certain exemptions. The penny stock rules require a broker-dealer,

prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document

that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer

with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction,

and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition,

the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement

to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary

market for a stock that becomes subject to the penny stock rules which may increase the difficulty Purchasers may experience in

attempting to liquidate such securities.

We do not expect to pay dividends in the foreseeable future.

Any return on investment may be limited to the value of our common stock.

We do not anticipate paying cash dividends on our common stock in

the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business

and economic factors affecting it at such time as the board of directors may consider relevant. If we do not pay dividends, our

common stock may be less valuable because a return on your investment will occur only if our stock price appreciates.

We will have broad discretion in applying the net proceeds

of this Offering and we may not use those proceeds in ways that will enhance our business operations.

We have significant flexibility in applying the net proceeds we

will receive in this Offering. We will use the proceeds that we receive from the sale of shares in this Offering for legal fees,

accounting expenses, research and development, capital investments and working capital. As part of your investment decision, you

will not be able to assess or direct how we apply these net proceeds. If we do not apply these funds effectively, we may lose significant

business opportunities.

The securities laws may restrict transferability of the securities

sold in the Offering.

The shares in this Offering have not been registered under the Securities

Act or registered or qualified under any state or foreign securities laws. Such securities are being issued based upon the Company’s

reliance upon an exemption from registration under the Securities Act for an offer and sale of securities that does not involve

a public offering. Unless such securities are so registered, they may not be offered or sold except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements of the Securities Act and applicable state or foreign securities

laws.

You must make an independent investment analysis in connection

with this Offering.

No independent legal, accounting or business advisors have been

appointed to represent the interests of prospective Investors in connection with this Offering. Neither the Company nor any of

its officers, directors, employees or agents makes any representation or expresses any opinion with respect to the merits of an

investment in the shares offered hereby. Each prospective Investor is therefore encouraged to engage independent accountants, appraisers,

attorneys and other advisors to (i) conduct due diligence review as the prospective investor may deem necessary and advisable,

and (ii) provide advice with respect to the merits of an investment in the shares offered hereby and applicable risk factors as

a prospective investor may deem necessary and advisable to rely upon. We will fully cooperate with any prospective Investor who

desires to conduct an independent analysis, so long as it determines, in our sole discretion, that cooperation is not unduly burdensome.

Each prospective Investor acknowledges that he, she or it has been informed and understands.

Because we lack certain internal controls over financial reporting

in that we do not have an audit committee and our Board of Directors has no technical knowledge of U.S. GAAP and internal control

of financial reporting and relies upon the Company's financial personnel to advise the Board on such matters, we are subject to

increased risk related to financial statement disclosures.

We lack certain internal controls over financial

reporting in that we do not yet have an audit committee and our Board of Directors has little technical knowledge of U.S. GAAP

and internal control of financial reporting and relies upon the Company's financial personnel and Accounting firm to advise the

Board on such matters. Accordingly, we are subject to increased risk related to financial statement disclosures.

FORWARD LOOKING STATEMENTS

This offering circular contains forward-looking statements

that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”,

“expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements.

Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management

as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements

for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this

offering circular.

DESCRIPTION OF BUSINESS

Overview

LifeQuest World Corp (“we” or the “Company”

or “LifeQuest”) through its our wholly owned subsidiary, BioPipe Global Corp., is a wastewater treatment company with

world’s only sludge free onsite waste water system.

On April 17, 2019, we entered into an Agreement and Plan of Merger

(the “Merger Agreement”) with BioPipe Acquisition, Inc., a New Jersey corporation (“Merger Sub”) and BioPipe

Global Corp., a privately held New Jersey corporation (“BioPipe Global”). In connection with the closing of this merger

transaction, Merger Sub merged with and into BioPipe Global (the “Merger”) on April 30, 2019, with the filing of Articles

of Merger with the New Jersey Secretary of State.

In addition, pursuant to the terms and conditions of the Merger

Agreement:

|

|

§

|

All of the outstanding shares of BioPipe Global was exchanged for the right to receive an aggregate of 75,000,000 share of the Company’s common stock, par value $0.001 per share (the “Common Stock”), which was issued to certain shareholders in connection with an Intellectual Property Purchase Agreement set forth below;

|

|

|

§

|

BioPipe Global provided customary representations and warranties and closing conditions, including approval of the Merger by a majority of its voting shareholders; and

|

|

|

§

|

Bradford Brock, our prior officer and director, was required to cancel 55,000,000 shares of his Common Stock in the Company but permitted to retain 1,000,000 shares in the Company.

|

As a result of the Merger Agreement, we are engaged in eco-friendly

decentralized wastewater treatment.

On May 7, 2019, BioPipe Global acquired all the assets of BioPipe

Global AG, a Swiss company, and BioPipe Cevre Teknolojileri A.S. a Turkish company. We acquired all patents, trade receivables,

income, royalties, damages, rights to sue, rights to enforce and any and all payments unpaid and due now or hereafter due or payable

with respect to the BioPipe System.

The Company issued Seventy One Million Eight Hundred Forty Six Thousand

Six hundred and Sixty Seven shares (71,846,667) duly authorized, validly issued, fully paid and nonassessable shares of common

stock to the Shareholders of Biopipe Cevre Teknolojileri A.S and a Three million One Hundred and Fifty-three Thousand and Three

Hundred and Thirty Three (3,153,333) duly authorized, validly issued, fully paid and nonassessable shares of common stock to Biopipe

Global AG.

In the last seven years, the BioPipe system has been installed in

Turkey, UAE, Qatar, Saudi Arabia, Oman Maldives and Bangladesh. These BioPipe systems are running successfully in resorts and hotels,

high-rise office and residential buildings, labor camps and single family homes. In the future we can expect to see an increase

in these types of installations as well as a cost-effective replacement for today’s Septic systems for single family homes

and housing communities in the USA and around the world.

Biopipe Global acquired the assets from Biopipe Global AG and Biopipe

Cevre and then merged with Lifequest World Corp.

Biopipe Global did not have an operating history. Biopipe Global

AG had installed systems in multiple countries, including the system in Bangladesh that has been running continuously for 3 years

and the other countries listed above. Biopipe Global AG had licensed the technology to Metito (Overseas) Ltd. which failed to make

any payments to Biopipe Global AG even though they installed 17 systems and hence the reason for non-renewal of the licensing agreement.

We have acquired the right to collect from Metito, but given the uncertainties of prosecuting a claim in the UAE, we have chosen

to forgo the lawsuit for the time being.

Traditional centralized wastewater treatment systems are expensive,

energy-intensive and chemical-dependent. The world is seeking sustainable solutions through decentralized wastewater treatment

which “get back to nature” while using 21st century technologies and management. Reuse may include irrigation of gardens

and agricultural fields or replenishing surface water and groundwater. Reused water may also be directed toward fulfilling certain

needs in residences (e.g. toilet flushing), businesses and industry, and where necessary, treated to reach drinking water standards.

The reuse of wastewater has long been established as critically

important for irrigation, especially in arid countries. According to the World Bank, there will be a 40 percent global shortfall

between supply and demand of water by 2030. And by 2025, approximately 1.8 billion people will be living in regions with “absolute

water scarcity.” The World Bank also estimates that 70 percent of water use today is for agriculture. A projected global

population of 9 billion by 2050 is expected to require a 60 percent increase in agricultural production and a 15 percent increase

in water withdrawals. Recycled water can meet some of this need, benefited by the nutrient content inherent in wastewater. And

only mid-range treatment levels would be required, as irrigation can be accomplished while minimizing the potential for human contact

with the recycled water. Reusing wastewater as part of sustainable water management allows water to remain as an alternative water

source for human activities. This can reduce scarcity and alleviate pressures on groundwater and other natural water bodies. At

the nexus between unusable wastewater and clean water, lies BioPipe:

We are a company seeking, and finding, opportunities to improve

the supply of clean water for emerging and first-world nations. BioPipe's main business focus is water reclamation. This is the

process of converting wastewater into water that can be repurposed for other uses. Reclaiming water from waste for reuse applications

(instead of using freshwater supplies) can be a water-saving measure. When treated waste water is eventually discharged back into

natural water sources, it still has significant benefits to ecosystems; improving streamflow, nourishing plant life and replenishing

aquifers, as part of the natural water cycle. Wastewater reuse is a long-established practice used for irrigation, especially in

arid countries. Reusing wastewater as part of sustainable water management allows water to remain as an alternative water source

for human activities. This can reduce scarcity and alleviate pressures on groundwater and other natural water bodies.

BioPipe is a revolutionary wastewater treatment system. Patented

in 40 plus countries, Biopipe is a highly scalable, eco-friendly and extremely cost-effective wastewater treatment with a broad

installed base. It is the planet’s first biological wastewater treatment system where the process takes place entirely inside

the pipe and:

|

|

§

|

has an extremely small foot print which allows it to be installed in places of high population density and commercial buildings;

|

|

|

§

|

very low energy consumption; and

|

|

|

§

|

discharge meets strict European Union standards.

|

Biopipe has a robust pipeline of projects in various parts of the

world and is in the process of setting up joint ventures in Bangladesh, India, South Africa and Netherlands.

Industry Drivers

According to Water Resource Institute water shortages affect 2.7

billion people now and 2.4 billion people lack proper wastewater treatment. An additional 2.1 billion people need upgraded treatment.

Population is expected to grow from 7.4 billion in 2016 to 9.1 billion in 2050 which will require 60% increase in global food production

by 2050. Manufacturing water demand will grow 400% by 2050 and global water consumption is expected to double by 2050. This will

result in 40% water deficit by 2030 and by 2025, two-thirds of the world will face water shortages. Governments and private sectors

are rapidly moving towards treatment and re-use.

Our Solutions

SEWAGE WASTEWATER

Biopipe, established in 2014, is the

1st patented and world’s only sludge free onsite

wastewater treatment system. Biopipe is 100% sludge free, odor free, silent, easy to assemble and install, scalable, low cost,

ecological and virtually maintenance free (if 1000 gallons of sewage wastewater (grey water and black water) goes in, 1000 gallons

of clean water is discharged). The treated water is clean enough to exceed EU Standards for discharge and reuse. The entire treatment

takes place within a series of pipes and the only output is non-potable clean water that can be used for irrigation, flushing or

cleaning.

37 systems are currently running around the world at

government and commercial buildings, hotels, resorts, labor camps and residences.

Example 1: 73m3/day system

running at a government building in Sharjah- UAE

Example 2: 100m3/day system

running a government residential building in Dhaka, Bangladesh

The system has a very small footprint and can treat a single residential

home (replaces expensive septic tank), large commercial properties like hotels, offices, labor camps, and community housing. It

does not use any chemicals, low cost, easy to design and install and the only output is clean water that meets European Union standards

and can be discharged into the ground. Throughout Middle East the treated water is used for irrigation and can certainly be used

for re-flushing and cleaning.

Decentralized (Onsite) Wastewater Treatment Market

Wastewater treatments that have small foot print, mobile, plug and

play solutions like Biopipe and Abrimix are highly desirable. They require very little onsite infrastructure and require low capex.

These systems can be remotely monitored and operated substantially lower cost than centralized systems. Additionally, localized

treatment and reuse reduces water and energy demand. Biopipe uses very low power to operate because it does not use blowers in

its system.

Septic Tank Market

Biopipe residential system has the potential to replace septic tanks.

Our small footprint system can be easily installed in the basement or backyard and the water can be either discharged or re-used

for irrigation. According to the U.S. Bureau of the Census, the distribution and density of septic systems vary widely by region

and state, from a high of about 55 percent in Vermont to a low of about 10 percent in California. New England states have the highest

proportion of homes served by septic

systems. New Hampshire and Maine both report that about one-half of all homes are served by

individual systems. More than one-third of the homes in the southeastern states depend on these systems, including approximately

48 percent in North Carolina and about 40 percent in both Kentucky and South Carolina. More than 60 million people in the nation

are served by septic systems. About one-third of all new development is served by septic or other decentralized treatment systems.

More than one in five households in the United States depend on individual onsite or small community cluster systems (septic systems)

to treat their wastewater. These systems are used to treat and dispose of relatively small volumes of wastewater, usually from

houses and businesses located in suburban and rural locations not served by a centralized public sewer system.

INDUSTRIAL WASTEWATER

We are in the process of adding Abrimix’s unique patented

technology for treating a variety of industrial wastewater such as textile, tanneries, fisheries, food processing, abattoir, dairy

processing waste oil. It is vastly superior to competing DAF (Dissolved Air Floatation) technology and has low capital and operational

costs, small footprint and easy to maintain.

Textile and tannery wastewater are a huge problem in India and Bangladesh

which are the two important countries for Biopipe. We are looking to combine Abrimix and Biopipe in certain industries like Dairy

where Abrimix cannot make the water dischargeable but when combined with Biopipe, the post treated water will become dischargeable.

Biopipe currently has 11 plants running in South Africa and Nigeria.

Example: 5m3/day Tannery

Wastewater Treatment Plant

Untreated

Treated

Competition

The wastewater treatment industry is highly competitive and dominated

by large companies. However, the decentralized wastewater treatment industry, which is growing rapidly, remains fragmented. To

best of our knowledge there is no other competitive system like Biopipe that is low cost, low maintenance, modular, silent, odorless,

zero sludge and yields clear dischargeable water.

Abrimix competes with DAF and other ETPs but no technology can match

the price performance of Abrimix.

Environmental, Health and Safety Regulation

Different countries have different discharge

standards for treated wastewater. We meet or exceed the discharge standards in countries we are now operating or intend to operate

in. We are not subject to EPA regulations.

USE

OF PROCEEDS

We estimate that, at a per share price of $0.20, the net proceeds

from the sale of the 15,000,000 shares in this offering will be approximately $2,985,000, after deducting the estimated offering