false

0001527702

0001527702

2024-10-18

2024-10-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October

18, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On October 18, 2024, we entered into a Memorandum of Understanding (the

“Agreement”) with M2B Funding Corp. to extend the maturity date on three promissory notes in exchange for stock consideration.

Pursuant to the Agreement, the following promissory notes were extended by 12 months from their original date of maturity:

| |

• |

First Note: Originally

due January 1, 2025, with an outstanding amount of $1,888,888.89, now extended to January 1, 2026. |

| |

• |

Second Note: Originally due

March 12, 2025, with an outstanding amount of $1,111,111.11, now extended to March 12, 2026. |

| |

• |

Third Note: Originally due

March 25, 2025, with an outstanding amount of $555,555.56, now extended to March 25, 2026. |

In consideration for this extension, we agreed to issue 646,467 restricted

common shares to M2B Funding Corp.

The foregoing description is qualified in its entirety by reference to

the Agreement, a copy of which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

Section 2 - Financial Information

Item 2.03 - Creation of a Direct

Financial Obligation or an Obligation Under an Off-balance Sheet Arrangement of a Registrant.

The disclosure contained in Item 1.01 of this

Current Report on Form 8-K is incorporated by reference in this Item 2.03.

SECTION 8 – OTHER EVENTS

Item 8.01

Other Events

On October 21, 2024, we issued a press release announcing the extension.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 8.01 of this Current Report

on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in

such a filing.

SECTION 9 – Financial

Statements and Exhibits

Item 9.01 Financial Statements

and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date October 22, 2024

MEMORANDUM OF UNDERSTANDING

This Memorandum of Understanding (“MOU”)

is entered into on this October 18th, 2024, by and between:

iQSTEL Inc., a Nevada corporation having

its principal place of business at 300 Aragon Ave, Suite 375, Coral Gables, FL 33134 (hereinafter referred to as the “Company”

or “iQSTEL”), and

M2B Funding Corp., a Florida corporation having

its principal place of business at 66 W Flagler Street, Suite 900, Miami, FL 33130 (hereinafter referred to as the “Holder”

or “M2B Funding”).

Collectively referred to as the “Parties” and

individually as a “Party.”

WHEREAS

| | • | iQSTEL

issued a Secured Convertible Promissory Note dated January 1, 2024, with a principal amount

of $2,222,222.22 (the "First Note") with a maturity date of January 1, 2025, to

M2B Funding Corp. M2B Funding has converted |

| | • | iQSTEL

issued a Secured Convertible Promissory Note dated March 13, 2024, with a principal amount

of $1,111,111.11 (the "Second Note") with a maturity date of March 12, 2025, to

M2B Funding Corp.; |

| | • | iQSTEL

issued a Secured Convertible Promissory Note dated March 26, 2024, with a principal amount

of $555,555.56 (the "Third Note") with a maturity date of March 25, 2025, to M2B

Funding Corp.; |

| • | The

Parties wish to extend the maturity dates of the First Note, Second Note, and Third Note

by 12 months; and |

| | • | As

consideration for the extension of the maturity dates, iQSTEL will issue shares of its common

stock to M2B Funding Corp. |

NOW, THEREFORE, the Parties acting in good faith agree

as follows:

| 1. | Extension of Maturity Dates |

The maturity dates of the First Note, Second Note,

and Third Note are hereby extended by twelve (12) months as follows:

| o | First Note: The maturity date is extended from January 1, 2025, to January

1, 2026, with an outstanding balance of $1,888,888.89; |

| o | Second Note: The maturity date is extended from March 12, 2025, to March

12, 2026; |

| o | Third Note: The maturity date is extended from March 25, 2025, to March

25, 2026. |

| 2. | Extension Consideration for First Note |

As consideration for extending the maturity date

of the First Note, iQSTEL agrees to issue M2B Funding a total of 343,435 shares of iQSTEL’s common stock.

| 3. | Extension Consideration for Second Note |

As consideration for extending

the maturity date of the Second Note, iQSTEL agrees to issue M2B Funding a total of 202,021 shares of iQSTEL’s common stock.

| 4. | Extension Consideration for Third Note |

As consideration for extending the maturity date

of the Third Note, iQSTEL agrees to issue M2B Funding a total of 101,011 shares of iQSTEL’s common stock.

iQSTEL agrees to issue a total of 646,467 Restricted

Common Shares to M2B Funding within three (3) business days of the receipt of Consideration. M2B Funding shall pay a cash consideration

of $1,000 to iQSTEL to receive these shares, as well as the consideration of extending the maturity of the three Notes by 12 months respectively.

All shares will be issued as restricted securities per R144.

Except as modified by this MOU, all other terms

and conditions of the First Note, Second Note, and Third Note shall remain in full force and effect.

This MOU shall be governed by and construed in

accordance with the laws of the State of Nevada.

The Parties acknowledge that they have reached

this agreement in good faith and with the mutual intent to honor the commitments stated herein.

Signatures

iQSTEL Inc.

By: /s/

Leandro Jose Iglesias

Name: Leandro Jose Iglesias

Title: President & CEO

Date: Oct. 18th, 2024

M2B Funding Corp.

By: /s/ Daniel Kordash

Name: Daniel Kordash

Title: President

Date: Oct. 18th, 2024

IQST - iQSTEL Secures Major 12-Month Extension

on Convertible Notes, Paving the Way for Explosive Growth and Nasdaq Uplisting

New York, NY –

October 21, 2024 – iQSTEL Inc. (OTC: IQST), a trailblazer in high-tech telecommunications and technology solutions, is thrilled

to announce a significant development that accelerates its path to a Nasdaq uplisting. With unwavering investor confidence, iQSTEL has

secured a 12-month extension on its convertible notes with M2B Funding Corp. – a strategic milestone that solidifies iQSTEL’s

momentum and reinforces its vision of achieving $1 billion in revenue by 2027.

For the past six years,

iQSTEL’s visionary leadership and relentless pursuit of innovation have built a robust business platform, earning the trust and

support of investors who believe in the company’s unstoppable growth. This extension demonstrates their continued confidence in

iQSTEL’s ability to lead the next wave of high-tech, high-margin products.

“Our investors see

the incredible potential in iQSTEL. They trust our long-term strategy and vision,” said Leandro Jose Iglesias, CEO and President

of iQSTEL. “We’ve done the hard work, building invaluable, trusted relationships with the largest telecom companies around

the world. Now, we are fully prepared to leverage those relationships and drive exponential growth through cutting-edge, high-margin solutions.”

Following extensive discussions

with M2B Funding Corp. and a shared commitment to iQSTEL’s future, the maturity dates of three key convertible notes have been extended

by 12 months, securing a critical financial foundation to fuel iQSTEL’s growth strategy and innovation.

Details of the extended notes:

| |

• |

First

Note: Originally due January 1, 2025, with an outstanding amount of $1,888,888.89, now extended to January 1, 2026. |

| |

|

|

| |

• |

Second

Note: Originally due March 12, 2025, with an outstanding amount of $1,111,111.11, now extended to March 12, 2026. |

| |

|

|

| |

• |

Third

Note: Originally due March 25, 2025, with an outstanding amount of $555,555.56, now extended to March 25, 2026. |

In consideration for this

extension, iQSTEL will issue 646,467 restricted IQST common stock to M2B Funding Corp., further strengthening the financial partnership

and demonstrating their absolute faith in the company’s future.

“This is a monumental

step in our journey to greatness,” Iglesias continued. “With this extension, we are not only reinforcing our financial position

but also safeguarding shareholder value as we continue to execute our bold business plan. iQSTEL is set for extraordinary growth.”

But the excitement doesn’t stop there.

iQSTEL is poised to revolutionize

the high-tech sector. The recent partnership with Cycurion is a clear example of iQSTEL’s relentless drive to expand its high-margin

product offerings. “By teaming up with Cycurion, we’re bringing advanced cybersecurity solutions to our telecom clients. This

opens the door to new, lucrative opportunities and keeps us ahead of the curve,” Iglesias said enthusiastically.

Additionally, iQSTEL has

partnered with ONAR, a top-tier marketing agency, to amplify its branding and marketing presence. “We are taking iQSTEL’s

brand to new heights, ensuring that our story of innovation and growth resonates across the globe. ONAR will help us seize the attention

of investors and clients alike,” Iglesias added.

This evolution of a great

corporation and its strategic moves are part of iQSTEL’s successful progression. With a solid business plan and the trust of our

investors, we are stepping up to the next level with an imminent NASDAQ uplisting. This is a crucial step toward achieving our goal of

becoming a $1 billion company. Now is the ideal time to join us as we embark on this exciting phase of our unstoppable growth.

We invite you to watch the latest video on our

YouTube channel: https://www.youtube.com/watch?v=RK3SIH7EEUo

About iQSTEL Inc. – The Future of Global Innovation

- Updated Oct. 2024

iQSTEL Inc. (OTC-QX: IQST) is on the

brink of explosive growth, poised to become a major player in the global market. With 2023 revenues of $144 million and forecasted

2024 revenues of $290 million, iQSTEL is not only growing but thriving, with positive operating income expected in the seven digits

for our operating subsidiaries. The company is in the final stages of its Nasdaq listing journey, setting the stage for unprecedented

opportunities and expansion.

At its core, iQSTEL is driven by a mission

to meet modern human needs across the globe, offering essential tools that empower people, regardless of race, ethnicity, or socioeconomic

status. iQSTEL is transforming industries by making advanced technologies accessible and affordable, from telecommunications and financial

freedom to clean mobility and cutting-edge AI solutions.

iQSTEL is strategically positioned to hit

$1 billion in revenue by 2027, powered by organic growth, high-margin products, and strategic acquisitions. Here’s a glimpse

into iQSTEL’s diverse portfolio:

| |

• |

Telecommunications Services: A full suite of telecom solutions including VoIP, SMS, international fiber-optic

networks, IoT services, and a revolutionary blockchain-based mobile portability platform. |

| |

|

|

| |

• |

Fintech Division: iQSTEL is delivering financial freedom through services like remittances, mobile top-ups, a MasterCard

debit card, US bank accounts without the need for an SSN, and a cutting-edge mobile app that puts financial power in the hands of users

worldwide. |

| |

|

|

| |

• |

Electric Vehicles (EV) Division: iQSTEL is electrifying the future of transportation, offering electric motorcycles and

gearing up to launch a mid-speed electric car. With clean, affordable mobility, iQSTEL is set to become a game-changer in the EV space. |

| |

|

|

| |

• |

Artificial Intelligence (AI) Services: iQSTEL’s AI division is bringing the future to today’s world with unified

AI customer engagement tools and a 3D virtual platform that delivers entertainment, services, and support—all at users’

fingertips. |

| |

|

|

| |

• |

Cybersecurity: Partnering with Cycurion, iQSTEL now offers 24/7 cybersecurity solutions that protect telecom clients with

cutting-edge threat detection, incident response, and compliance management—essential tools for a digital world. |

Since 2018, iQSTEL has successfully completed

11 acquisitions, and the company is far from done. With an active pipeline of potential acquisitions and a clear focus on high-margin

products, iQSTEL is rapidly expanding its reach.

Being part of iQSTEL is not just growing

but revolutionizing entire industries. iQSTEL is your opportunity to be part of the future of telecommunications, fintech,

electric vehicles, AI, and cybersecurity. With a clear path to Nasdaq and $1 billion in sight, iQSTEL is a company

built for sustained success and transformative innovation.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but

are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating

to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections

about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ

materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements

speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for

sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

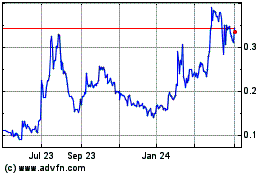

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Jan 2025 to Feb 2025

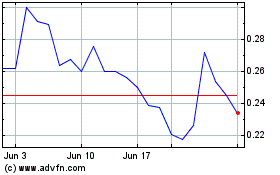

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Feb 2024 to Feb 2025