Current Report Filing (8-k)

September 26 2022 - 4:34PM

Edgar (US Regulatory)

0001729997NONEfalse00017299972022-09-262022-09-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 26, 2022 |

Grayscale® Digital Large Cap Fund LLC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Cayman Islands |

000-56284 |

98-1406784 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Grayscale Investments, LLC 290 Harbor Drive, 4th Floor |

|

Stamford, Connecticut |

|

06902 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 668-1427 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Grayscale Digital Large Cap Fund LLC Shares |

|

GDLC |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 26, 2022 (the “Record Date”), Grayscale Investments, LLC, the manager (the “Manager”) of Grayscale Digital Large Cap Fund, LLC (the “Fund”), distributed the rights to the ETH Proof of Work tokens (“ETHPoW”) received by the Fund, as a result of a fork in the Ethereum blockchain on September 15, 2022 to holders of record (“Record Date Shareholders”) of the Fund’s equal, fractional, undivided interests in the profits, losses, distributions, capital and assets of, and ownership of the Fund (the “Shares”) as of the close of business on the Record Date. The right to acquire, or otherwise establish dominion and control over, any ETHPoW as a result of the aforementioned fork in the Ethereum blockchain is referred to as a “right to the Forked Asset” and any such ETHPoW acquired through such a right to the Forked Asset is referred to as the “Forked Asset”.

Pursuant to the terms of the LLC Agreement governing the Fund, the Fund has appointed Grayscale Investments, LLC as agent (in this capacity, the “Agent”) on behalf of the Record Date Shareholders and transferred the rights to the Forked Assets held by the Fund to the Agent on behalf of the Record Date Shareholders. The Fund transferred the rights to approximately 40,653.24325763 tokens of the Forked Asset, or approximately 0.00256206 ETHPoW tokens per Share based on 15,867,400 Shares of the Fund outstanding. Upon transfer, the Fund determined that the fair market value of the Forked Assets was $0 per token (or unit) of the Forked Asset due to the lack of a trading venue accessible to the Agent and uncertainty regarding the ability to safely access and custody the Forked Assets.

The Agent will look to acquire the Forked Assets as soon as practicable after the transfer and sell the Forked Assets over a period of time, which is not currently expected to exceed 180 days, on behalf of the Record Date Shareholders. In case the Agent determines a market for the Forked Asset does not develop or the cost incurred by the Agent in connection with the sale of the Forked Assets is likely to be greater than the aggregate sale value, the Agent will abandon the Forked Assets.

In the event that the Agent is able to sell the Forked Assets, the Agent will remit the cash proceeds from the sales, net of any administrative and other reasonable expenses incurred by the Agent in its capacity as agent of the Record Date Shareholders and not in its capacity as Manager of the Fund, ratably to Record Date Shareholders. The Agent will announce one or more dates for remittance of such net cash proceeds as well as the right to remit any net cash proceeds from sales of the Record Date Shareholders’ Forked Assets prior to the sale of all tokens of the Forked Asset, in more than one remittance. The Agent may use an affiliated dealer, including Genesis Global Trading, Inc., to facilitate the sale of the Forked Assets. Any such affiliated dealer would expect to receive a customary markup or other customary compensation for its services.

The trading venues for the Forked Asset are not broadly established and there is uncertainty as to whether digital asset custodians will support the Forked Asset or if trading markets with meaningful liquidity will develop. In the event digital asset custodians do support the Forked Asset and trading markets do develop it is expected that there will be widely fluctuating values for the Forked Asset for some time. As a result of this uncertainty and the potential for significant volatility in prices for the Forked Asset, it is not possible to predict the value, if any, that the Agent will be able to realize from sales of the Forked Assets after the Record Date. Therefore, if the Agent is able to sell the Forked Assets at all, there can be no assurance as to the price or prices for the Forked Asset that may be realized, and the value of the Forked Asset may increase or decrease after any sale of the Forked Assets by the Agent.

Record Date Shareholders are advised to consult with their advisors as to the tax consequences of the foregoing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Grayscale Investments, LLC as Manager of Grayscale

Digital Large Cap Fund LLC |

|

|

|

|

Date: |

September 26, 2022 |

By: |

/s/ Michael Sonnenshein |

|

|

|

Michael Sonnenshein

Chief Executive Officer |

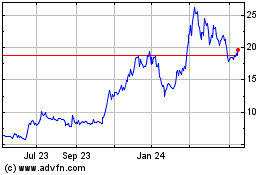

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Jul 2023 to Jul 2024