Current Report Filing (8-k)

January 13 2022 - 8:41AM

Edgar (US Regulatory)

0001729997NONEfalse00017299972022-01-112022-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Date of Report (Date of earliest event reported): January 11, 2022

|

Grayscale Digital Large Cap Fund LLC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Cayman Islands

|

000-56284

|

98-1406784

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

c/o Grayscale Investments, LLC

290 Harbor Drive, 4th Floor

|

|

|

Stamford, Connecticut

|

|

06902

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

Registrant’s Telephone Number, Including Area Code: 212 668-1427

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

GDLC

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Grayscale Digital Large Cap Fund LLC (the “Fund”) values each of the digital assets held by the Fund (each such digital asset, a “Fund Component”) for operational purposes by reference to Digital Asset Reference Rates. The “Digital Asset Reference Rate” for each Fund Component is the volume-weighted average price in U.S. dollars of such Fund Component, as determined by reference to an Indicative Price or an Index Price as reported by TradeBlock, Inc. (the “Reference Rate Provider”), as of 4:00 p.m., New York time, on any business day. An “Indicative Price” is a volume-weighted average price in U.S. dollars for a Fund Component as of 4:00 p.m., New York time, for the immediately preceding 24-hour period derived from data collected from digital asset exchanges trading such Fund Component selected by the Reference Rate Provider. An “Index Price” is a price for a Fund Component determined by the Reference Rate Provider by further cleansing and compiling the trade data used to determine the Indicative Price in such a manner as to algorithmically reduce the impact of anomalistic or manipulative trading. The Digital Asset Reference Rate for each Fund Component is calculated using non-GAAP methodology and is not used in the Fund’s financial statements.

If the Digital Asset Reference Rate for a Fund Component becomes unavailable or if Grayscale Investments, LLC, the manager (the “Manager”) of the Fund, determines in good faith that such Digital Asset Reference Rate does not reflect an accurate price for such Fund Component, then the Manager will employ an alternative method to determine such Digital Asset Reference Rate under the cascading set of rules as described in the Fund's Annual Report on Form 10-K for the period ended June 30, 2021, as filed with the Securities and Exchange Commission on September 27, 2021. Effective January 11, 2022, the Manager has amended the cascading set of rules used to determine the Digital Asset Reference Rates as described below.

Updates to the Fund's Fund Component Value disclosure:

Determination of Digital Asset Reference Rates When Indicative Prices or Index Prices are Unavailable

In case of the unavailability of either Indicative Prices or Index Prices for a particular Fund Component, the Manager will use the following cascading set of rules to calculate the Digital Asset Reference Rates for that Fund Component. For the avoidance of doubt, the Manager will employ the below rules sequentially and in the order as presented below, should one or more specific rule(s) fail:

1.

Digital Asset Reference Rate = The price set by the relevant Indicative Price or Index Price as of 4:00 p.m., New York time, on the valuation date. If the relevant Indicative Price or Index Price becomes unavailable, or if the Manager determines in good faith that the Indicative Price or Index Price does not reflect an accurate digital asset price, then the Manager will, on a best efforts basis, contact the Reference Rate Provider to obtain the Digital Asset Reference Rate directly from the Reference Rate Provider. If after such contact the Indicative Price or Index Price remains unavailable or the Manager continues to believe in good faith that the Indicative Price or Index Price does not reflect an accurate price for the relevant digital asset, then the Manager will employ the next rule to determine the Digital Asset Reference Rate. There are no predefined criteria to make a good faith assessment and it will be made by the Manager in its sole discretion.

2.

Digital Asset Reference Rate = The price set by Coin Metrics Real-Time Rate as of 4:00 p.m., New York time, on the valuation date (the “Secondary Digital Asset Reference Rate”). The Secondary Digital Asset Reference Rate is a real-time reference rate price, calculated using trade data from constituent markets selected by Coin Metrics (the “Secondary Reference Rate Provider”). The Secondary Digital Asset Reference Rate is calculated by applying weighted-median techniques to such trade data where half the weight is derived from the trading volume on each constituent market and half is derived from inverse price variance, where a constituent market with high price variance as a result of outliers or market anomalies compared to other constituent markets is assigned a smaller weight. If the Secondary Digital Asset Reference Rate for the relevant Fund Component becomes unavailable, or if the Manager determines in good faith that the Secondary Digital Asset Reference Rate does not reflect an accurate price for such Fund Component, then the Manager will, on a best efforts basis, contact the Secondary Reference Rate Provider to obtain the Secondary Digital Asset Reference Rate directly from the Secondary Reference Rate Provider. If after such contact the Secondary Digital Asset Reference Rate remains unavailable or the Manager continues to believe in good faith that the Secondary Digital Asset Reference Rate does not reflect an accurate price for such Fund Component, then the Manager will employ the next rule to determine the Digital Asset Reference Rate. There are no predefined criteria to make a good faith assessment and it will be made by the Manager in its sole discretion.

3.

Digital Asset Reference Rate = The price set by the Fund's principal market for the relevant Fund Component (the “Tertiary Pricing Option”) as of 4:00 p.m., New York time, on the valuation date. The Tertiary Pricing Option is a spot price derived from the relevant principal market's public data feed that is believed to be consistently publishing pricing information as of 4:00 p.m., New York time, and is provided to the Manager via an application programming interface. If the Tertiary Pricing Option becomes unavailable, or if the Manager determines in good faith that the Tertiary Pricing Option does not reflect an accurate price for such Fund Component, then the Manager will, on a best efforts basis, contact the Tertiary Pricing Provider to obtain the Tertiary Pricing Option directly from the Tertiary Pricing Provider. If after such contact the Tertiary Pricing Option remains unavailable after such contact or the Manager continues to believe in good faith that the Tertiary Pricing Option does not reflect an accurate price for such Fund Component, then the Manager will employ the next rule to determine the Digital Asset Reference Rate. There are no predefined criteria to make a good faith assessment and it will be made by the Manager in its sole discretion.

4.

Digital Asset Reference Rate = The Manager will use its best judgment to determine a good faith estimate of the Digital Asset Reference Rate. There are no predefined criteria to make a good faith assessment and it will be made by the Manager in its sole discretion.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Grayscale Investments, LLC as Manager of the Grayscale Digital Large Cap Fund LLC

|

|

|

|

|

|

|

Date:

|

January 13, 2022

|

By:

|

/s/ Michael Sonnenshein

|

|

|

|

|

Michael Sonnenshein

Chief Executive Officer

|

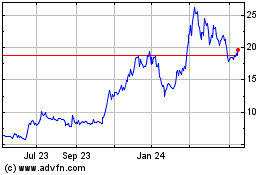

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Jul 2023 to Jul 2024