false

2023

FY

0000866439

0000866439

2023-01-01

2023-12-31

0000866439

2023-06-30

0000866439

2024-07-15

0000866439

2022-01-01

2022-12-31

0000866439

2023-10-01

2023-12-31

0000866439

2023-12-31

0000866439

2022-12-31

0000866439

us-gaap:SeriesAPreferredStockMember

2023-12-31

0000866439

us-gaap:SeriesAPreferredStockMember

2022-12-31

0000866439

DPLS:SeriesDConvertiblePreferredStockMember

2023-12-31

0000866439

DPLS:SeriesDConvertiblePreferredStockMember

2022-12-31

0000866439

DPLS:PreferredStockSeriesAMember

2021-12-31

0000866439

DPLS:PreferredStockSeriesDMember

2021-12-31

0000866439

us-gaap:CommonStockMember

2021-12-31

0000866439

DPLS:CommonStockToBeIssuedMember

2021-12-31

0000866439

us-gaap:TreasuryStockCommonMember

2021-12-31

0000866439

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000866439

us-gaap:NoncontrollingInterestMember

2021-12-31

0000866439

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0000866439

us-gaap:RetainedEarningsMember

2021-12-31

0000866439

2021-12-31

0000866439

DPLS:PreferredStockSeriesAMember

2022-12-31

0000866439

DPLS:PreferredStockSeriesDMember

2022-12-31

0000866439

us-gaap:CommonStockMember

2022-12-31

0000866439

DPLS:CommonStockToBeIssuedMember

2022-12-31

0000866439

us-gaap:TreasuryStockCommonMember

2022-12-31

0000866439

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000866439

us-gaap:NoncontrollingInterestMember

2022-12-31

0000866439

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000866439

us-gaap:RetainedEarningsMember

2022-12-31

0000866439

DPLS:PreferredStockSeriesAMember

2022-01-01

2022-12-31

0000866439

DPLS:PreferredStockSeriesDMember

2022-01-01

2022-12-31

0000866439

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0000866439

DPLS:CommonStockToBeIssuedMember

2022-01-01

2022-12-31

0000866439

us-gaap:TreasuryStockCommonMember

2022-01-01

2022-12-31

0000866439

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0000866439

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0000866439

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0000866439

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0000866439

DPLS:PreferredStockSeriesAMember

2023-01-01

2023-12-31

0000866439

DPLS:PreferredStockSeriesDMember

2023-01-01

2023-12-31

0000866439

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0000866439

DPLS:CommonStockToBeIssuedMember

2023-01-01

2023-12-31

0000866439

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0000866439

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0000866439

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-12-31

0000866439

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0000866439

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0000866439

DPLS:PreferredStockSeriesAMember

2023-12-31

0000866439

DPLS:PreferredStockSeriesDMember

2023-12-31

0000866439

us-gaap:CommonStockMember

2023-12-31

0000866439

DPLS:CommonStockToBeIssuedMember

2023-12-31

0000866439

us-gaap:TreasuryStockCommonMember

2023-12-31

0000866439

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000866439

us-gaap:NoncontrollingInterestMember

2023-12-31

0000866439

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0000866439

us-gaap:RetainedEarningsMember

2023-12-31

0000866439

DPLS:OptilanMember

2023-12-31

0000866439

DPLS:WildlifeSpecialistsLLCAndRemoteIntelligenceLLCMember

2021-08-27

2021-08-30

0000866439

DPLS:WildlifeSpecialistsLLCAndRemoteIntelligenceLLCMember

2021-08-30

0000866439

DPLS:TJMElectronicsWestMember

2021-09-07

2021-09-08

0000866439

DPLS:TerraDataMember

2021-10-02

0000866439

DPLS:TerraDataUnmannedMember

2021-09-29

2021-10-01

0000866439

currency:GBP

2023-12-31

0000866439

currency:GBP

2023-01-01

2023-12-31

0000866439

currency:CAD

2023-12-31

0000866439

currency:GBP

2022-12-31

0000866439

currency:GBP

2022-01-01

2022-12-31

0000866439

currency:CAD

DPLS:OptilianAcquisitionMember

2022-12-31

0000866439

DPLS:OptilanUKMember

2023-01-01

2023-12-31

0000866439

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

DPLS:OneCustomerMember

2022-01-01

2022-12-31

0000866439

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

DPLS:OneCustomerMember

2023-01-01

2023-12-31

0000866439

us-gaap:FurnitureAndFixturesMember

2023-01-01

2023-12-31

0000866439

DPLS:PlantAndEquipmentMember

2023-01-01

2023-12-31

0000866439

us-gaap:LeaseholdImprovementsMember

2023-01-01

2023-12-31

0000866439

DPLS:MotorVehiclesMember

2023-01-01

2023-12-31

0000866439

DPLS:ConvertibleNotesMember

2023-01-01

2023-12-31

0000866439

DPLS:ConvertibleNotesMember

2022-01-01

2022-12-31

0000866439

us-gaap:SeriesDPreferredStockMember

2023-01-01

2023-12-31

0000866439

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-12-31

0000866439

us-gaap:TransferredAtPointInTimeMember

2023-01-01

2023-12-31

0000866439

us-gaap:TransferredAtPointInTimeMember

2022-01-01

2022-12-31

0000866439

us-gaap:TransferredOverTimeMember

2023-01-01

2023-12-31

0000866439

us-gaap:TransferredOverTimeMember

2022-01-01

2022-12-31

0000866439

us-gaap:ProductMember

2023-01-01

2023-12-31

0000866439

us-gaap:ProductMember

2022-01-01

2022-12-31

0000866439

us-gaap:ServiceMember

2023-01-01

2023-12-31

0000866439

us-gaap:ServiceMember

2022-01-01

2022-12-31

0000866439

srt:NorthAmericaMember

2023-01-01

2023-12-31

0000866439

srt:NorthAmericaMember

2022-01-01

2022-12-31

0000866439

country:GB

2023-01-01

2023-12-31

0000866439

country:GB

2022-01-01

2022-12-31

0000866439

DPLS:RestOfWorldMember

2023-01-01

2023-12-31

0000866439

DPLS:RestOfWorldMember

2022-01-01

2022-12-31

0000866439

us-gaap:PropertyPlantAndEquipmentMember

2023-12-31

0000866439

us-gaap:PropertyPlantAndEquipmentMember

2022-12-31

0000866439

us-gaap:LeaseholdImprovementsMember

2023-12-31

0000866439

us-gaap:LeaseholdImprovementsMember

2022-12-31

0000866439

us-gaap:PatentsMember

2023-01-01

2023-12-31

0000866439

us-gaap:PatentsMember

2022-01-01

2022-12-31

0000866439

DPLS:DPTIMember

2023-12-31

0000866439

DPLS:DPTIMember

2022-12-31

0000866439

DPLS:NeuralSignalsIncMember

2022-09-09

0000866439

DPLS:NeuralSignalsIncMember

2023-01-01

2023-12-31

0000866439

DPLS:NeuralSignalsIncMember

2022-01-01

2022-12-31

0000866439

2023-08-07

0000866439

2023-08-06

2023-08-07

0000866439

2023-09-29

0000866439

2023-09-28

2023-09-29

0000866439

2023-12-04

0000866439

2023-12-03

2023-12-04

0000866439

us-gaap:ConvertibleDebtMember

2023-12-31

0000866439

us-gaap:ConvertibleDebtMember

2022-12-31

0000866439

us-gaap:ConvertibleDebtMember

2023-01-01

2023-12-31

0000866439

us-gaap:ConvertibleDebtMember

2022-01-01

2022-12-31

0000866439

DPLS:GSSpaNoteMember

2021-07-14

0000866439

DPLS:GSSpaNoteMember

2021-07-13

2021-07-14

0000866439

DPLS:GSSpaNoteMember

2023-12-31

0000866439

DPLS:GSSpaNoteMember

2022-12-31

0000866439

DPLS:DiagonalLending1800Member

2023-12-31

0000866439

DPLS:DiagonalLending1800Member

2022-12-31

0000866439

DPLS:Carebourn1Member

2023-12-31

0000866439

DPLS:Carebourn1Member

2022-12-31

0000866439

DPLS:Carebourn2Member

2023-12-31

0000866439

DPLS:Carebourn2Member

2022-12-31

0000866439

DPLS:MoreCapitalMember

2023-12-31

0000866439

DPLS:MoreCapitalMember

2022-12-31

0000866439

DPLS:EMAMember

2023-12-31

0000866439

DPLS:EMAMember

2022-12-31

0000866439

DPLS:RILineOfCreditMember

2023-12-31

0000866439

DPLS:RILineOfCreditMember

2022-12-31

0000866439

DPLS:RIShortTermLoansMember

2023-12-31

0000866439

DPLS:RIShortTermLoansMember

2022-12-31

0000866439

DPLS:WSLineOfCreditMember

2023-12-31

0000866439

DPLS:WSLineOfCreditMember

2022-12-31

0000866439

DPLS:WSShortTermLoansMember

2023-12-31

0000866439

DPLS:WSShortTermLoansMember

2022-12-31

0000866439

DPLS:RISBAEIDLMember

2023-12-31

0000866439

DPLS:RISBAEIDLMember

2022-12-31

0000866439

DPLS:RILongTermLoansMember

2023-12-31

0000866439

DPLS:RILongTermLoansMember

2022-12-31

0000866439

DPLS:WSSBAEIDLMember

2023-12-31

0000866439

DPLS:WSSBAEIDLMember

2022-12-31

0000866439

DPLS:WSLongTermLoansMember

2023-12-31

0000866439

DPLS:WSLongTermLoansMember

2022-12-31

0000866439

us-gaap:SecuredDebtMember

2023-12-31

0000866439

2021-01-11

2021-01-12

0000866439

2021-05-26

2021-05-27

0000866439

2021-08-27

2021-08-31

0000866439

2021-10-19

2021-10-20

0000866439

2022-03-08

2022-03-09

0000866439

us-gaap:PreferredStockMember

2023-12-31

0000866439

us-gaap:PreferredStockMember

2022-12-31

0000866439

DPLS:StockIssuedForSettlementOfDisputeMember

2023-01-01

2023-01-31

0000866439

DPLS:StockIssuedForSettlementOfDisputeMember

2023-01-01

2023-12-31

0000866439

DPLS:StockIssuedForSettlementOfDisputeMember

2023-12-31

0000866439

DPLS:EquityFinancingAgreementMember

2023-01-11

2023-01-12

0000866439

DPLS:EquityFinancingAgreementMember

2023-01-12

0000866439

DPLS:EquityFinancingAgreementMember

2023-01-16

2023-01-17

0000866439

DPLS:EquityFinancingAgreementMember

2023-01-17

0000866439

DPLS:EquityFinancingAgreementMember

2023-01-23

2023-01-24

0000866439

DPLS:EquityFinancingAgreementMember

2023-01-24

0000866439

DPLS:EquityFinancingAgreementMember

2023-02-02

2023-02-03

0000866439

DPLS:EquityFinancingAgreementMember

2023-02-03

0000866439

DPLS:EquityFinancingAgreementMember

2023-02-16

2023-02-17

0000866439

DPLS:EquityFinancingAgreementMember

2023-02-17

0000866439

DPLS:EquityFinancingAgreementMember

2023-02-28

2023-03-01

0000866439

DPLS:EquityFinancingAgreementMember

2023-03-01

0000866439

DPLS:EquityFinancingAgreementMember

2023-03-15

2023-03-16

0000866439

DPLS:EquityFinancingAgreementMember

2023-03-16

0000866439

DPLS:EquityFinancingAgreementMember

2023-03-29

2023-03-30

0000866439

DPLS:EquityFinancingAgreementMember

2023-03-30

0000866439

DPLS:EquityFinancingAgreementMember

2023-04-10

2023-04-11

0000866439

DPLS:EquityFinancingAgreementMember

2023-04-11

0000866439

DPLS:EquityFinancingAgreementMember

2023-04-27

2023-04-28

0000866439

DPLS:EquityFinancingAgreementMember

2023-04-28

0000866439

DPLS:EquityFinancingAgreementMember

2023-06-25

2023-06-26

0000866439

DPLS:EquityFinancingAgreementMember

2023-06-26

0000866439

DPLS:EquityFinancingAgreementMember

2023-07-02

2023-07-03

0000866439

DPLS:EquityFinancingAgreementMember

2023-07-03

0000866439

DPLS:EquityFinancingAgreementMember

2023-07-09

2023-07-10

0000866439

DPLS:EquityFinancingAgreementMember

2023-07-10

0000866439

DPLS:EquityFinancingAgreementMember

2023-09-04

2023-09-05

0000866439

DPLS:EquityFinancingAgreementMember

2023-09-05

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-06

2023-11-07

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-07

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-05

2023-11-08

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-08

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-13

2023-11-14

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-14

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-21

2023-11-22

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-22

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-28

2023-11-29

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-29

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-27

2023-11-30

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-30

0000866439

DPLS:EquityFinancingAgreementMember

2023-11-28

2023-12-01

0000866439

DPLS:EquityFinancingAgreementMember

2023-12-01

0000866439

DPLS:EquityFinancingAgreementOneMember

2023-11-28

2023-12-01

0000866439

DPLS:EquityFinancingAgreementOneMember

2023-12-01

0000866439

DPLS:EquityFinancingAgreementMember

2023-12-10

2023-12-11

0000866439

DPLS:EquityFinancingAgreementMember

2023-12-11

0000866439

DPLS:EquityFinancingAgreementMember

2023-12-26

2023-12-27

0000866439

DPLS:EquityFinancingAgreementMember

2023-12-27

0000866439

DPLS:FederalAndStateMember

2023-12-31

0000866439

us-gaap:HerMajestysRevenueAndCustomsHMRCMember

2023-12-31

0000866439

us-gaap:CanadaRevenueAgencyMember

2023-12-31

0000866439

DPLS:OptilanMember

2023-01-01

2023-12-31

0000866439

DPLS:OptilanMember

2022-01-01

2022-12-31

0000866439

DPLS:RemoteIntelligenceMember

2023-12-31

0000866439

DPLS:RemoteIntelligenceMember

2022-12-31

0000866439

DPLS:WildlifeSpecialistsMember

2023-12-31

0000866439

DPLS:WildlifeSpecialistsMember

2022-12-31

0000866439

DPLS:PurchaseAgreementMember

us-gaap:CommonClassBMember

2022-10-01

2022-10-12

0000866439

DPLS:PurchaseAgreementMember

DPLS:PrivatePlacementWarrantsMember

2022-10-01

2022-10-12

0000866439

DPLS:PurchaseAgreementMember

2022-10-11

2022-10-12

0000866439

2023-03-08

2023-03-09

0000866439

DPLS:SPACMember

2023-12-31

0000866439

DPLS:SPACMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ |

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the fiscal year ended December

31, 2023

|

| ☐ |

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-18730

DarkPulse, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

87-0472109 |

| (State of other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 815 Walker Street, Suite 1155, Houston, TX |

|

77002 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(800) 436-1436

(Registrant’s Telephone Number, including

Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Securities registered pursuant to Section 12(g) of the Act: Common

Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant

has submitted electronically, every Interactive Data File pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for

such shorter period that the registrant was required to submit such files). Yes ☐ No

☒

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”,

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark

whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by

any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes ☐

No ☒

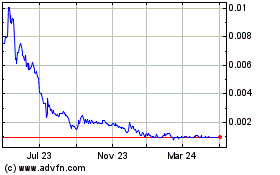

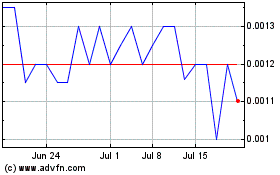

The aggregate market value of the voting and non-voting

stock held by non-affiliates of the registrant as of the last business day of the registrants most recently completed second fiscal quarter,

based on the price at which the common equity was last sold on the OTC Markets on June 30, 2023 was approximately $40,283,509. For purposes

of this computation only, all officers, directors and 10% or greater stockholders of the registrant are deemed to be “affiliates.”

The number of shares of the

registrant’s common stock, $0.0001 par value per share, outstanding as of July 15, 2024, was 8,961,842,234.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Form

10-K”) for DarkPulse, Inc., a Delaware corporation (the “Company”), and the exhibits attached hereto contain

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking

statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned

development of the Company’s technology, plans related to its business and other matters that may occur in the future. These statements

relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and

assumptions of management. Such forward-looking statements include, among others, those statements including the words “expects”,

“anticipates”, “intends”, “believes” and similar language. Our actual results may differ significantly

from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not

limited to, those discussed in the section “Risk Factors.” We undertake no obligation to publicly release any revisions to

the forward-looking statements or reflect events or circumstances after the date of this report.

Although we believe that the expectations reflected

in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause

actual results to differ materially from such forward-looking statements. These factors include among others:

| |

· |

The impact of conflict between the Russian Federation and Ukraine on our operations; |

| |

|

|

| |

· |

Geo-political events, such as the crisis in Ukraine, government responses to such events and the related impact on the economy both nationally and internationally; |

| |

|

|

| |

· |

Our ability to raise sufficient capital and continue to fund operating expenses; |

| |

|

|

| |

· |

Our ability to get our technology to work in accordance with our technical specifications; |

| |

|

|

| |

· |

Our ability to attract customers to our products once they are developed; |

| |

|

|

| |

· |

Our ability to generate sales of our products once they are developed; |

| |

|

|

| |

· |

Our ability to attract and retain the necessary personnel with the expertise needed to ensure that we can operate the Company effectively; |

| |

|

|

| |

· |

Actions or inactions of third-party contractors and vendors; |

| |

|

|

| |

· |

Our ability to successfully patent and protect our intellectual property; and |

| |

|

|

| |

· |

General economic conditions. |

This list is not exhaustive of the factors that

may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements

are described further under the sections titled “Business”, “Risk Factors”, and “Management’s

Discussion and Analysis.” Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place

undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to

revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence

of anticipated or unanticipated events.

We qualify all the forward-looking statements

contained in this Form 10-K by the foregoing cautionary statements.

PART I

As used in this Form 10-K, the terms “we,”

“us,” “our,” and the “Company” refer to DarkPulse, Inc., a Delaware corporation, and its subsidiaries.

Organization

DarkPulse, Inc. (“DPI” or “Company”)

is a technology-security company incorporated in 1989 as Klever Marketing, Inc. (“Klever”). Its’ wholly-owned

subsidiary, DarkPulse Technologies Inc. (“DPTI”), originally started as a technology spinout from the University of

New Brunswick, Fredericton, Canada. The Company’s security and monitoring systems will initially be delivered in applications for

border security, pipelines, the oil and gas industry and mine safety. Current uses of fiber optic distributed sensor technology have been

limited to quasi-static, long-term structural health monitoring due to the time required to obtain the data and its poor precision. The

Company’s patented BOTDA dark-pulse sensor technology allows for the monitoring of highly dynamic environments due to its greater

resolution and accuracy.

University of New Brunswick

In December 2010, DPTI entered into an Assignment

Agreement with the University, pursuant to which the University sold, transferred, and assigned to us Patents in exchange for the issuance

of a debenture to the University in the amount of C$1,500,000 (Canadian dollars). In April 2017, DPTI issued the Debenture. The

Patents and the Debenture were initially recorded in our accounts at $1,491,923, based upon the exchange rate between the U.S. dollar

and the Canadian dollar on December 16, 2010, the date of the original debenture. In addition to the repayment of principal and interest,

the Debenture requires DPTI to pay the University a 2% royalty on sales of any and all products or services which incorporate the Patents

for a period of five years commencing on April 24, 2018, as well as to reimburse the University for its patent-related costs.

On February 1, 2024,

our board of directors approved entering into the Amendment No. 01 to Convertible Debenture (Secured) Term Debenture with the University

pursuant to which, effective January 17, 2024, section (c) of the recitals of the Convertible Debenture (Secured) Term Debenture effective

April 24, 2017 was amended to the following:

“(c) the date that

is seven (7) years from the Issue Date; or”

Section 3.1 of the Debenture

is amended to the following:

3.1 Payback on the Principal

Sum will commence over a four (4) year period upon the earlier of the following (each a “Payback Period”): (a) three (3) years

following the Payor achieving a positive earnings before interest, taxes, depreciation and amortization for two (2) consecutive quarters;

or (b) the date that is seven (7) years from the Issue Date.

Section 3.2 of the Debenture

is amended to the following:

“3.2 The Payor

shall be required to pay the Payee, in quarterly installments over a four (4) year period commencing from the start of the Payback Period,

the following:

(a) Ninety-Three Thousand

Seven Hundred and Fifty Canadian Dollars ($93,750.00 CDN); and

(b) interest accrued

on the Principal Sum on a declining balance; and

(c) all costs associated

with protecting the Technology.”

Our Operating Units

The Company’s subsidiaries consist of Remote

Intelligence, LLC, a company headquartered in Pennsylvania who provides unmanned aerial drone and unmanned ground crawler (UGC) services

to a variety of clients from industrial mapping and ecosystem services, to search and rescue, to pipeline security; Wildlife Specialists,

LLC, a company headquartered in Pennsylvania who provides clients with comprehensive wildlife and environmental assessment, planning,

and monitoring services; TerraData Unmanned, PLLC, a company headquartered in Florida who custom manufactures NDAA compliant drones and

unmanned ground crawlers to meet the needs of its customers; and TJM Electronics West, Inc., a company headquartered in Arizona who is

a U.S. manufacturer and tester of advanced electronics, cables and sub-assemblies specializing in advanced package and complex CCA and

hardware.

TerraData Unmanned

Comprised of a team with more than 30 years cumulative

experience in the unmanned industry, TerraData Unmanned (“TerraData”) custom manufactures National Defense Authorization

Act (“NDAA”) compliant drones and unmanned ground crawlers to meet the needs of its customers. TerraData has successfully

delivered a custom drone platform per a customer’s specifications which exceeds current industry offering by more than 30 minutes.

The team has manufactured, and successfully flight tested a Quad Copter drone with 1.5KG payload capabilities that delivers more than

60 minutes of continuous flight. This cutting-edge design is a combination of proprietary software and hardware. The custom platform

offers NDAA compliant autopilot, communications links, Technical Standard Orders (“TSO”) certified GPS unit and ground

control station. Future designs include integrating Real-Time Kinematic (“RTK”) for mapping, methane detectors, and

true terrain following capabilities. There are also improvements scheduled that are intended to further extend the endurance and provide

over 4KG of payload capacity, not including batteries. TerraData has also announced the research, development and successful testing

of an autonomous crawler soon to be released to the market with methane and multi gas detection capabilities. Working seamlessly with

its partners at DarkPulse and its subsidiary companies, TerraData can custom design, build and operate a system to meet our customers'

needs 24 hours a day 365 days a year around the globe.

Acquisitions

On August 9, 2021, we entered into a Share Purchase

Agreement with Optilan Guernsey Limited and Optilan Holdco 2 Limited, pursuant to which we purchased from the sellers all of the

issued and outstanding equity interests of Optilan HoldCo 3 Limited, a private company incorporated in England and Wales (“Optilan”),

for £1.00. In connection with the acquisition, the Company acquired $14,828,459 in assets and assumed liabilities totaling $25,179,320.

As a result of the transaction, Optilan became a wholly-owned subsidiary of the Company.

On August 30, 2021, we closed two separate Membership

Interest Purchase Agreements with RI and WS pursuant to which we agreed to pay to the majority stockholder of each of RI and WS

an aggregate of 15,000,000 shares of our Common Stock, $500,000 to be paid on the closing date, and an additional $500,000 to be paid

12 weeks from closing date in exchange for 60% ownership of each of RI and WS. As a result of the transactions, RI and WS each became

subsidiaries of the Company with the respective non-controlling interests recoded on the consolidated balance sheets.

On September 8, 2021, we entered into and closed

the Stock Purchase Agreement with TJM and TJM’s stockholders, pursuant to which we agreed to purchase all of the equity interests

in TJM in exchange for $450,000, subject to adjustments as defined in the Stock Purchase Agreement. As a result of the transaction, TJM

became a wholly-owned subsidiary of the Company.

Effective October 1, 2021, we entered into and

closed the Membership Purchase Agreement with TerraData and Justin Dee, the sole stockholder of TerraData, pursuant to which we agreed

to purchase 60% of the equity interests in TerraData in exchange for 3,725,386 shares of our Common Stock and $400,000, subject to adjustments

as defined in the Membership Purchase Agreement, to be paid within 12 weeks of closing. As a result of the transaction, TerraData became

a subsidiary of the Company.

On December 1, 2023, we entered into the Sale

Agreement with Optilan (UK) Limited (in liquidation) incorporated and registered in England and Wales with company number 02715788, and

Colin Hardman, Christopher Allen and Gregory Andrew Palfrey, as joint liquidators of the Optilan all of Evelyn Partners LLP. Under thea,

we intended to purchase from Optilan for $65,000 all right, title, and interest in the following: (1) shares in Optilan India PVT (India),

(2) shares in Optilan Communications & Security Systems Ltd (Turkey), and (3) the “Applicable Intellectual Property Rights,”

as defined in the agreement. The closing of this agreement never occurred and Optilan India PVT (India) and Optilan Communications &

Security Systems Ltd (Turkey) were never acquired by us.

Liquidation/winding up of Optilan (UK) Limited

On May 3, 2023, Eversheds Sutherland (International)

LLP, a creditor of Optilan (UK) Limited, filed a petition to wind up (“Winding up Petition”) Optilan (UK) Limited, a wholly

owned subsidiary of the Company’s Subsidiary, Optilan HoldCo 3 Limited, and the matter was due to be heard in the Portsmouth Combined

Court Centre on June 28, 2023.

On June 28, 2023, the High Court of Justice in

the United Kingdom issued a winding-up order for the liquidation and winding up of the affairs of Optilan (UK) Limited (“Optilan

Liquidation”). In conjunction with the order, the court appointed the Official Receiver’s Office (“OR”) to take

the appointment as liquidator of Optilan (UK) Limited and take control of Optilan (UK) Limited’s assets.

At the same time the court appointed the OR to

take the appointment as liquidator of Optilan (UK) Limited. The OR has taken control of Optilan (UK) Limited’s assets. To date the

ORs Office has initiated contact with Optilan but we still wait to receive details of the individual who will be taking the role of OR.

On July 3, 2023, Optilan (UK) Limited received

a letter from The Insolvency Service, an executive agency sponsored by the Department for Business and Trade located in the U.K. Pursuant

to the letter of The Insolvency Services, the Company was required to provide information relating to Optilan (UK) Limited to the Official

Receiver’s Office (a government body of Plymouth, the United Kingdom) and attend an interview with staff of the Official Receiver’s

Office to review the prospect of recovering the assets of Optilan (UK) Limited for the benefit of creditors. The interview was scheduled

for July 18, 2023.

On July 18, 2023, the interview was held between

the Official Receiver’s Office (“OR”) and the CEO at time of dissolution. The OR office requested a list of assets,

bank account information and amounts along with any contracts held by Optilan (UK) Limited to begin the liquidation process.

On August 9, 2023, Evelyn Partners was appointed Joint Liquidator.

There are no new claims against Optilan (UK) Limited

as of July 15, 2024 and Evelyn Partners continue to liquidate the company’s assets.

The Company is an Unsecured creditor of Optilan

(UK) Limited and is at risk of losing any repayment of obligations due from Optilan (UK) Limited because there are several intercompany

relationships between the Company and Optilan (UK) Limited, the financial impact of any future claims and liabilities may not be known

for several months. The Company has approximately $19.4 million intercompany payables due from Optilan (UK), which will increase the Company

liabilities for any obligations not repaid. The Company expects the remaining assets held by Optilan (UK) Limited to be fully impaired

and reported as Loss on Deconsolidation during the second quarter of 2023 as a result of the winding-up order for liquidation. At the

time of this filing the Company is still evaluating the full effects of the winding-up order for liquidation and the material adverse

effects it will have on the Company’s continued operations and ability to meet future obligations.

Global System Dynamics, Inc.

On December 14, 2022, we entered into a Business

Combination Agreement (the “BCA”) by, between, and among our company, Global System Dynamics, Inc., a Delaware corporation

(“GSD”), and Zilla Acquisition Corp, a Delaware corporation and wholly owned subsidiary of GSD (the “Merger

Sub”). Pursuant to the terms of the BCA, a business combination between us and GSD will be effected through the merger of Merger

Sub with and into DarkPulse, with DarkPulse surviving the merger as a wholly owned subsidiary of GSD).

On August 8, 2023, we entered into Amendment No.

1 to the BCA pursuant to which the “Termination Date,” as defined in the BCA was amended from “August 9, 2023”

to “February 9, 2024.” No other changes were made to the BCA.

On January 23, 2024,

the BCA was terminated by mutual consent of the parties thereto. Although, as the Sponsor of GSD, the Company still owns all of the issued

and outstanding shares of Class B Common Stock of GSD, all legal rights the Company had under the BCA have been terminated.

Our Business

We offer a full suite of engineering, installation

and security management solutions to industries and governments. Coupled with our patented BOTDA technology, we provide our customers

a comprehensive data stream of critical metrics for assessing the health and security of their infrastructure. Our comprehensive system

provides for rapid, precise analysis and responsive activities predetermined by the end-user customer. These responses include the

use of “smart” AI platformed cameras, facial recognition technologies and multiple drone platforms. Our User Interface (UI)

is cloud based which offers end-users access to their systems on any device located anywhere in the world. Additional programming of the

UI is being completed within a game engine that will also offer access via Virtual Reality headsets, allowing end-users to virtually inspection

their assets.

Historically, distributed sensor systems have

been too costly, slow and limited in their capabilities to attain widespread use. In addition, Brillouin-based sensors have been plagued

with temperature and strain cross-sensitivity, i.e. the inability to distinguish between temperature and strain change along the same

fiber. The loss of spatial resolution with an increase in fiber length has also limited the use of distributed sensor systems. Due to

these shortcomings, existing technologies are unable to succeed within today’s dynamic environments, and needs for more advanced

sensor technologies have remained unsatisfied.

By contrast to existing technologies, our BOTDA

technology is a distributed-fiber sensing system, based on dark-pulse Brillouin scattering, which reports in real-time on conditions

such as temperature, stress, strain corrosion and structural health monitoring of Critical Infrastructure/Key Resources including Bridges,

Buildings, Roadways pipelines and mining installations.

Our BOTDA technology’s differentiators from

and advantages over existing technologies:

| |

· |

Real-time Reporting: Higher data acquisition speeds allowing for structural monitoring of dynamic systems; |

| |

|

|

| |

· |

Cost to Customer: Significantly lower acquisition and operating costs; |

| |

|

|

| |

· |

Precision: A greater magnitude of precision and spatial resolution than other systems currently available; |

| |

|

|

| |

· |

Applications: Wider range of capabilities than other systems currently available; |

| |

|

|

| |

· |

Power Consumption: Lower power consumption than existing systems allowing for off-grid installations; |

| |

|

|

| |

· |

Integration: Capable of integrating with existing systems; and |

| |

|

|

| |

· |

Central station monitoring/cloud based GUI. |

We believe that these key advantages should allow

us not only to enter existing markets, but more importantly, to open new market opportunities with new applications. We intend to leverage

new applications to target clients that have been unable to make use of distributed fiber optic technology to date.

Revenue

The Company’s revenues are generated primarily

from the sales of our services, which consist primarily of advanced technology solutions for integrated communications and security systems,

as well as habitat management. The Company’s sales of products are primarily generated from our TJM subsidiaries.

Our Market

Current uses of fiber optic distributed sensor

technology have been limited to quasi-static, long-term structural health monitoring due to the time required to obtain the data and its

poor precision. Our BOTDA technology allows for the monitoring of highly dynamic environments due to its magnitude of increased resolution

and greater accuracy. The resulting high speed, real-time monitoring capabilities of our BOTDA technology should satisfy a broad range

of existing and emerging requirements. Use of our BOTDA technology by our customers should result in lower production costs with increased

sensing capabilities that can integrate with existing technology and be upgraded cost effectively.

Due to the characteristics of the fiber used in

fiber optic sensing, the uses of our BOTDA technology are wide ranging. Optical fiber is hard-wearing, which allows it to be used in environments

where other technologies fail (for example, at temperatures ranging from -40°C to 300°C and 1000psi). Additionally, our BOTDA

sensors allow for live sensing due to the speed at which the analysis takes place.

Our management team is continually identifying

markets in which our BOTDA technology may be readily applied. Once these markets (as described below) have been addressed, our technology

may be adapted and applied to new markets.

Structural Monitoring

| |

· |

Buildings and Skyscrapers; |

| |

|

|

| |

· |

Bridges, Tunnels and Dams; and |

| |

|

|

| |

· |

Roads and Railway tracks. |

Temperature Sensing

| |

· |

Fire Alarm and Environment control; |

| |

|

|

| |

· |

Low cost and maintenance; |

| |

|

|

| |

· |

Long life span; and |

| |

|

|

| |

· |

Ability to withstand harsh working environment. |

Security & Defense

| |

· |

National Border Protection; and |

| |

|

|

| |

· |

Protection of Military and other sensitive installations. |

Consulting Services:

| |

· |

Consulting (as stand-alone or presales); |

| |

|

|

| |

· |

Post sales deployment and Support; and |

| |

|

|

| |

· |

Managed services (monitoring, etc.). |

Additional Potential Markets:

| |

· |

Monitoring of composite structures in aircraft; |

| |

|

|

| |

· |

Dynamic stress monitoring of runways; |

| |

|

|

| |

· |

Dynamic ship hull stress monitoring, especially with a view to double-hull oil tankers; |

| |

|

|

| |

· |

Smart grid and power conservation applications based on cooling and/or heat proximity – for instance, computer rooms, cell towers for heat soak; |

| |

|

|

| |

· |

Monitor low temperatures as part of control systems; |

| |

|

|

| |

· |

Monitoring of temperatures in extreme refrigeration environments; |

| |

|

|

| |

· |

Avalanche early warning systems; and |

| |

|

|

| |

· |

Sea defense monitoring. |

Marketing

We utilize our BOTDA technology as the foundation

of our ongoing marketing initiatives. Most notably, the greater magnitude of increased capabilities of our BOTDA technology versus existing

bright-pulsing technologies. Existing bright-pulse Brillouin-based sensors have historically been plagued with temperature and strain

cross-sensitivity, i.e. the inability to distinguish between temperature and strain change along the same fiber. The loss of spatial resolution

with an increase in fiber length is also a limiting factor for the use of distributed sensor systems. Because of these shortcomings, existing

bright-pulse Brillouin-based technologies are unable to succeed within today’s dynamic environments, which coincides with our BOTDA

technology’s increased capabilities over bright-pulse systems. Our marketing initiatives include daily, broad-based social media

engagement, management of our website, email campaigns, national television commercials, magazine ads, and other ongoing initiatives designed

to increase awareness of our products and services and drive conversion and adoption rates.

Competition

The overall optical sensing market is projected

to reach USD $3.47 billion by 2023 from USD $1.13 billion in 2016, at a CAGR of 15.47% between 2017 and 2023.[1] We are active

in the optical sensing market, including Oil & Gas pipeline health monitoring, Infrastructure, National Border Security applications,

and the mining industry. We believe that fiber sensing applications which incorporate our BOTDA technology may provide significant competitive

advantages over structural health monitoring applications offered by the long-term leaders in the field, such as Schlumberger, Hewlett-Packard,

and Yokogawa, which collectively account for a significant portion of industry sales. These companies, as well as others, have numerous

differences in feature sets and functionality, but all share certain basic attributes: a bright-pulse technology as the core of their

systems architecture. An architecture designed using bright-pulsing technology has limited sensing capabilities and resolutions of one

meter allowing for mostly long-term quasi-static deployments.

However, we utilize our BOTDA technology allowing

for multiple applications into those markets unavailable to companies using bright-pulse technology. While many of the companies using

bright-pulse technology have attempted to incorporate various sensing techniques into a legacy technology, none have been able to offer

the order of magnitude resolutions offered by our patented dark-pulse based BOTDA technology. This magnitude in resolution coupled with

our BOTDA technology’s increased data collection speeds allows our technology to be installed into areas of the market that our

competitors cannot. Our future financial condition and operating results depend on our ability to provide a high-quality solution as well

as increased distribution of the solutions in each of the markets in which we compete or intend to compete within.

The markets for our products and services are

highly competitive and we are confronted by aggressive competition. These markets are characterized by frequent product introductions

and rapid technological advances. Our financial condition and operating results can be adversely affected by these and other industry-wide

downward pressures on gross margins. Principal competitive factors important to us include price, product features, relative price and

performance, product quality and reliability, marketing and distribution capability, service and support and corporate reputation.

Intellectual Property

Our policy is to protect our technology by, among

other things, patents, trade secret protection and copyrights. We have taken security measures to protect our trade secrets and proprietary

know-how, to the greatest extent possible. Our means of protecting our proprietary rights may not prove to be adequate and our competitors

may independently develop technology or products that are similar to ours or that compete with ours. Trade secret, patent and copyright

laws afford only certain protections for our technology and products. The laws of many countries do not protect our proprietary rights

to as great an extent as do the laws of the United States. Despite our efforts to protect our proprietary rights, unauthorized parties

may attempt to obtain and use information that we regard as proprietary. Third parties may also design around our proprietary rights,

which may render our protected technology and products less valuable, if the design around is favorably received in the marketplace.

In addition, any of our products or technology

covered by patents or other intellectual property rights, could cause us to be subject to various legal actions. Litigation may be necessary

to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights

of others, or to defend against claims of infringement, invalidity, misappropriation, or other claims.

Through DPTI’s April 2017 Intellectual Property

agreement with the University, DPTI was sold, transferred, and assigned U.S. Patent Nos. 7,245,790, 8,643,829, and 9,534,965, each of

which are related to our BOTDA dark-pulse technology. In addition, Canadian Patent No. 2,502,275 was also assigned.

__________

[1]

https://www.marketsandmarkets.com/Market-Reports/optical-sensing-market-197592599.html

Suppliers

We currently rely on a full-time, dedicated, external

team of experienced professionals for the coding and maintenance of our products. We believe we have mitigated the associated risks of

managing an external team of software and engineering development professionals by incorporating internal management and oversight, as

well as appropriate systems, protocols, controls, and procedures and ensuring that we have access to additional qualified professionals

to provide like or complementary services.

Government Regulation

Government regulation is not of significant concern

for our business nor is government regulation expected to become an impediment to the business in the near- or mid-term as management

is currently unaware of any planned or anticipated government regulation that would have a material impact on our business. Our management

believes it currently possesses all requisite authority to conduct our business as described in this report.

Employees

As of July 15, 2024, we had three full-time

employees and no part-time employees.

Readers should carefully consider the risks and

uncertainties described below.

Our failure to successfully address the risks

and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations,

and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that

we will successfully address these risks or other unknown risks that may affect our business.

As an enterprise engaged in the commercialization

of new technology, our business is inherently risky. Our common shares are considered speculative during the development of our

business operations. Prospective investors should consider carefully the risk factors set out below.

Summary Risk Factors

The following summarizes certain principal factors

that make an investment in our Company speculative or risky, all of which are more fully described in the “Risk Factors”

section herein. This summary should be read in conjunction with the “Risk Factors” section and should not be relied

upon as an exhaustive summary of the material risks facing the Company.

| |

· |

If we default on the Secured Debenture, the secured holder could take possession of our assets, including our patents and other intellectual property. |

| |

|

|

| |

· |

Our stockholders have limited voting power compared to the holder of our Series A Preferred Stock. |

| |

|

|

| |

· |

We have a limited operating history in an evolving and highly volatile industry, which makes it difficult to evaluate future prospects and may increase the risk that we will not be successful. |

| |

|

|

| |

· |

We face intense and increasing competition and, if we do not compete effectively, our competitive positioning and our operating results will be harmed. |

| |

|

|

| |

· |

Our operating results may fluctuate due to market forces out of our control that impact demand for our products and services. |

| |

|

|

| |

· |

Cyberattacks and security breaches of our systems, or those impacting customers or third parties, could adversely impact our brand and reputation and our business, operating results and financial condition. |

| |

|

|

| |

· |

Any significant disruption in our technology could adversely impact our brand and reputation and our business, operating results, and financial condition. |

| |

|

|

| |

· |

Certain large customers provide a significant share of our revenue and the termination of such agreements or reduction in business with such customers could harm our business. If we were to lose or were unable to renew these and other client contracts at favorable terms, our results of operations and financial condition may be adversely affected. |

| |

|

|

| |

· |

There is no assurance that we will achieve profitability or that our revenue and business models will be successful. |

| |

|

|

| |

· |

We will require additional capital to support business growth,

and this capital might not be available or may require stockholder approval to obtain. |

| |

|

|

| |

· |

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. |

| |

|

|

| |

· |

The future development and growth of our technology and product offerings are subject to a variety of factors that are difficult to predict and evaluate and may be in the hands of third parties to a substantial extent. If our product offerings do not grow as expected, our business, operating results, and financial condition could be adversely affected. |

| |

|

|

| |

· |

Our intellectual property rights are valuable, and any inability to protect them could adversely impact our business, operating results, and financial condition. |

RISKS RELATED TO OUR BUSINESS

Our former wholly-owned subsidiary, Optilan

(UK) Limited, is in liquidation. As an unsecured creditor, we are at risk of losing significant repayment obligations due from Optilan

(UK) Limited.

On May 3, 2023, Eversheds Sutherland (International)

LLP, a creditor of Optilan (UK) Limited, filed a petition to wind up (“Winding up Petition”) Optilan (UK) Limited,

a wholly owned subsidiary of the Company’s Subsidiary, Optilan HoldCo 3 Limited, and the matter was due to be heard in the Portsmouth

Combined Court Centre on June 28, 2023.

On June 28, 2023, the High Court of Justice in

the United Kingdom issued a winding-up order for the liquidation and winding up of the affairs of Optilan (UK) Limited (“Optilan

Liquidation”). In conjunction with the order, the court appointed the Official Receiver’s Office (“OR”)

to take the appointment as liquidator of Optilan (UK) Limited and take control of Optilan (UK) Limited’s assets.

At the same time the court appointed the OR to

take the appointment as liquidator of Optilan (UK) Limited. The OR has taken control of Optilan (UK) Limited’s assets. To date the

ORs Office has initiated contact with Optilan but we still wait to receive details of the individual who will be taking the role of OR.

On July 3, 2023, Optilan (UK) Limited received

a letter from The Insolvency Service, an executive agency sponsored by the Department for Business and Trade located in the U.K. Pursuant

to the letter of The Insolvency Services, the Company was required to provide information relating to Optilan (UK) Limited to the Official

Receiver’s Office (a government body of Plymouth, the United Kingdom) and attend an interview with staff of the Official Receiver’s

Office to review the prospect of recovering the assets of Optilan (UK) Limited for the benefit of creditors. The interview was scheduled

for July 18, 2023.

On July 18, 2023, the interview was held between

the OR and the CEO at time of dissolution. The OR office requested a list of assets, bank account information and amounts along with any

contracts held by Optilan (UK) Limited to begin the liquidation process.

On August 9, 2023, Evelyn Partners was appointed Joint Liquidator.

There are no new claims as of April 16, 2024 against

Optilan (UK) Limited and Evelyn Partners continue to liquidate the company’s assets.

We are an unsecured creditor of Optilan (UK) Limited

and are at risk of losing any repayment of obligations due from Optilan (UK) Limited because there are several intercompany relationships

between the Company and Optilan (UK) Limited, the financial impact of any future claims and liabilities may not be known for several months.

We have approximately $19.4 million intercompany payables due from Optilan (UK), which will increase our liabilities for any obligations

not repaid. We expect the remaining assets held by Optilan (UK) Limited to be fully impaired and reported as Loss on Deconsolidation during

the second quarter of 2023 as a result of the winding-up order for liquidation. We are still evaluating the full effects of the winding-up

order for liquidation and the material adverse effects it will have on our continued operations and ability to meet future obligations.

In the event we lose the repayment obligations of Optilan (UK) Limited, our financial condition could be materially adversely effected.

We may be adversely affected by natural

disasters, pandemics, and other catastrophic events, and by man-made problems such as war or terrorism, that could disrupt our business

operations, and our business continuity and disaster recovery plans may not adequately protect us from a serious disaster.

Natural disasters or other catastrophic events

may also cause damage or disruption to our operations, international commerce, and the global economy, and could have an adverse effect

on our business, operating results, and financial condition. Our business operations are subject to interruption by natural disasters,

fire, power shortages, and other events beyond our control.

In addition, our global operations expose us to

risks associated with public health crises, such as pandemics and epidemics, which could harm our business and cause its operating results

to suffer.

Further, war, acts of terrorism, labor activism

and other geopolitical unrest could cause disruptions in our business or the businesses of its partners or the economy as a whole. In

the event of a natural disaster, including a major earthquake, blizzard, or hurricane, or a catastrophic event such as a fire, power loss,

or telecommunications failure, we may be unable to continue our operations and may endure system interruptions, reputational harm, delays

in development of our products and services, lengthy interruptions in service, breaches of data security, and loss of critical data, all

of which could have an adverse effect on our future operating results.

Escalating global tensions, including the

conflict between Russia and Ukraine, could negatively impact us.

The ongoing conflict between Russia and Ukraine

could led to disruption, instability and volatility in global markets and industries that could negatively impact our operations. The

U.S. government and other governments in jurisdictions in which we operate have imposed severe sanctions and export controls against Russia

and Russian interests and threatened additional sanctions and controls. The impact of these measures, as well as potential responses to

them by Russia, is currently unknown and they could adversely affect our business, partners or customers.

If we default on the Secured Debenture, the secured holder could

take possession of our assets, including our patents and other intellectual property.

The Secured Debenture issued April 24, 2017, is

secured by our assets, which includes our patents and other intellectual property. In the event that we default on the obligations in

the Debenture, the secured holder could take possession of our assets, including our patents and other intellectual property. If this

were to occur, investors would likely lose all of their investment.

Several of the convertible notes issued

by us are in litigation with uncertain outcomes.

We have issued several convertible notes which

are currently the subject of litigation (See “Legal Proceedings”). The outcomes of each of these matters is uncertain

and we may be required to both expend large sums of resources on both defending against and pursuing our causes of action in each of these

proceedings. In addition, there is no certainty that any outcome will be in favor of us and we may be required to pay settlements or judgments

the amounts of which may be material to us. In the event that we do not achieve favorable outcomes to each of the outstanding legal proceedings

with convertible note holders, it could have a material adverse effect on us and our operations may fail.

Our future growth depends significantly

on our marketing efforts, and if our marketing efforts are not successful, our business and results of operations will be harmed.

We have dedicated some, and intend to significantly

increase, resources to marketing efforts. Our ability to attract and retain customers depends in large part on the success of these marketing

efforts and the success of the marketing channels we use to promote our products and services. Our marketing channels include, but are

not limited to, social media, traditional media such as the press, online affiliations, search engine optimization, search engine marketing,

and offline partnerships.

While our goal remains to increase the strength,

recognition and trust in our brand by increasing our customer base and expanding our products and services, if any of our current marketing

channels becomes less effective, if we are unable to continue to use any of these channels, if the cost of using these channels was to

significantly increase or if we are not successful in generating new channels, we may not be able to attract new customers in a cost-effective

manner or increase the use of our products and services. If we are unable to recover our marketing costs through increases in the size,

value or other product selection and utilization, it could have a material adverse effect on our business, financial condition, results

of operations, cash flows and future prospects.

Our stockholders have limited voting power

compared to the holder of our Series A Preferred Stock.

Our CEO, Dennis O’Leary, is the sole holder

of our Series A Preferred Stock, will control a majority of the voting power of our Company. For so long as Mr. O’Leary holds all

of the shares of Series A Preferred Stock, he is expected to hold a majority of our outstanding voting power and he will control the outcome

of matters submitted to a stockholder vote, including the appointment of all directors of the Company.

Our management controls all corporate activities

and can approve all transactions, including mergers, without the approval of other stockholders.

Our CEO, Dennis O’Leary, owns 100 shares

of our Series A Preferred Stock that gives him the right to a majority of the voting power of the Company. Therefore, our management effectively

controls all corporate activities and can approve transactions, including possible mergers, issuance of shares and compensation levels,

without the approval of other stockholders. The decisions of our management may not be consistent with or in the best interests of other

stockholders.

This capital structure may have anti-takeover

effects preventing a change in control transaction that the minority owners of our Common Stock might consider in their best interest.

The ability of our management to control

our business may limit or eliminate minority stockholders’ ability to influence corporate affairs.

Our CEO, Dennis O’Leary, owns 100 shares

of Series A Preferred Stock that gives him the right to a majority of the voting power of our Company. Because of this beneficial stock

ownership, Mr. O’Leary is in a position to continue to elect our entire board of directors, decide all matters requiring stockholder

approval, including potential mergers or business changes, and determine our policies. The interests of our management may differ from

the interests of our minority stockholders with respect to the issuance of shares, business transactions with or sales to other companies,

selection of officers and directors and other business decisions. Our minority stockholders have no way of overriding decisions made by

our management. This level of control may also have an adverse impact on the market value of our shares because our management may institute

or undertake transactions, policies or programs that may result in losses, may not take any steps to increase our visibility in the financial

community and/or may sell sufficient numbers of shares to significantly decrease our price per share.

We have made and expect to continue to make

acquisitions that could disrupt our operations and harm our operating results.

Our growth depends upon market growth, our ability

to enhance our existing products, and our ability to introduce new products on a timely basis. We intend to continue to address the need

to develop new products and enhance existing products through acquisitions of other companies, product lines, technologies, and personnel.

Acquisitions involve numerous risks, including the following:

| |

· |

Difficulties in integrating the operations, systems, technologies, products, and personnel of the acquired companies, particularly companies with large and widespread operations and/or complex products; |

| |

|

|

| |

· |

Diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from acquisitions; |

| |

|

|

| |

· |

Potential difficulties in completing projects associated with in-process research and development intangibles; |

| |

|

|

| |

· |

Difficulties in entering markets in which we have no or limited direct prior experience and where competitors in such markets have stronger market positions; |

| |

|

|

| |

· |

Initial dependence on unfamiliar supply chains; |

| |

|

|

| |

· |

Insufficient revenue to offset increased expenses associated with acquisitions; and |

| |

|

|

| |

· |

The potential loss of key employees, customers, distributors, vendors and other business partners of the companies we acquire following and continuing after announcement of acquisition plans. |

Acquisitions may also cause us to:

| |

· |

Issue common stock that would dilute our current shareholders’ percentage ownership; |

| |

|

|

| |

· |

Use a substantial portion of our cash resources or incur debt; |

| |

|

|

| |

· |

Significantly increase our interest expense, leverage and debt service requirements if we incur additional debt to pay for an acquisition; |

| |

|

|

| |

· |

Assume liabilities; |

| |

|

|

| |

· |

Record goodwill and non-amortizable intangible assets that are subject to impairment testing on a regular basis and potential periodic impairment charges; |

| |

|

|

| |

· |

Incur amortization expenses related to certain intangible assets; |

| |

|

|

| |

· |

Incur tax expenses related to the effect of acquisitions on our intercompany research and development cost sharing arrangement and legal structure; |

| |

|

|

| |

· |

Incur large and immediate write-offs and restructuring and other related expenses; and |

| |

|

|

| |

· |

Become subject to intellectual property or other litigation. |

Mergers and acquisitions are inherently risky

and subject to many factors outside of our control, and no assurance can be given that our previous or future acquisitions will be successful

and will not materially adversely affect our business, operating results, or financial condition. Failure to manage and successfully integrate

acquisitions could materially harm our business and operating results. Prior acquisitions could result in a wide range of outcomes, from

successful introduction of new products and technologies to a failure to do so. Even when an acquired company has already developed and

marketed products, there can be no assurance that product enhancements will be made in a timely fashion or that pre-acquisition due diligence

will have identified all possible issues that might arise with respect to such products.

From time to time, we have made acquisitions that

resulted in charges in an individual quarter. These charges may occur in any particular quarter, resulting in variability in our quarterly

earnings. In addition, our effective tax rate for future periods is uncertain and could be impacted by mergers and acquisitions. Risks

related to new product development also apply to acquisitions.

Acquisitions, joint ventures or other strategic

transactions create certain risks and may adversely affect our business, financial condition or results of operations.

Acquisitions, partnerships and joint ventures

are part of our growth strategy. We evaluate and expect in the future to evaluate potential strategic acquisitions of, and partnerships

or joint ventures with, complementary businesses, services or technologies. We may not be successful in identifying acquisition, partnership

and joint venture targets. In addition, we may not be able to successfully finance or integrate any businesses, services or technologies

that we acquire or with which we form a partnership or joint venture.

We may not be able to identify suitable acquisition

candidates or complete acquisitions in the future, which could adversely affect our future growth; or businesses that we acquire may not

perform as well as expected or may be more difficult or expensive to integrate and manage than expected, which could adversely affect

our business and results of operations. In addition, the process of integrating these acquisitions may disrupt our business and divert

our resources.

In addition, acquisitions outside our current operating jurisdictions

often involve additional or increased risks including, for example:

| |

· |

managing geographically separated organizations, systems and facilities; |

| |

|

|

| |

· |

integrating personnel with diverse business backgrounds and organizational cultures; |

| |

|

|

| |

· |

complying with foreign regulatory requirements; |

| |

|

|

| |

· |

fluctuations in exchange rates; |

| |

|

|

| |

· |

enforcement and protection of intellectual property in some foreign countries; |

| |

|

|

| |

· |

difficulty entering new foreign markets due to, among other things, customer acceptance and business knowledge of these new markets; and |

| |

|

|

| |

· |

general economic and political conditions. |

These risks may arise for a number of reasons:

we may not be able to find suitable businesses to acquire at affordable valuations or on other acceptable terms; we may face competition

for acquisitions from other potential acquirers; we may need to borrow money or sell equity or debt securities to the public to finance

acquisitions and the terms of these financings may be adverse to us; changes in accounting, tax, securities or other regulations could

increase the difficulty or cost for us to complete acquisitions; we may incur unforeseen obligations or liabilities in connection with

acquisitions; we may need to devote unanticipated financial and management resources to an acquired business; we may not realize expected

operating efficiencies or product integration benefits from an acquisition; we could enter markets where we have minimal prior experience;

and we may experience decreases in earnings as a result of non-cash impairment charges.

We cannot ensure that any acquisition, partnership

or joint venture we make will not have a material adverse effect on our business, financial condition and results of operations.

Because of the unique difficulties and uncertainties

inherent in technology development, we face a risk of business failure.

Potential investors should be aware of the difficulties

normally encountered by companies developing new technology and the high rate of failure of such enterprises. The likelihood of success

must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the development

of new technology with limited personnel and financial means. These potential problems include, but are not limited to, unanticipated

technical problems that extend the time and cost of product development, or unanticipated problems with the operation of our technology

or that with which we are licensing that also extend the time and cost of product development.

Successful technical development of our

products does not guarantee successful commercialization.

We may successfully complete the technical development

for one or all of our product development programs, but still fail to develop a commercially successful product for a number of reasons,

including among others the following:

| |

· |

Competing products; |

| |

|

|

| |

· |

Ineffective distribution and marketing; |

| |

|

|

| |

· |

Lack of sufficient cooperation from our partners; and |

| |

|

|

| |

· |

Demonstrations of the products not aligning with or meeting customer needs. |

Our success in the market for the products we

develop will depend largely on our ability to prove our products’ capabilities. Upon demonstration, our products and/or technology

may not have the capabilities they were designed to have or that we believed they would have. Furthermore, even if we do successfully

demonstrate our products’ capabilities, potential customers may be more comfortable doing business with a larger, more established,

more proven company than us. Moreover, competing products may prevent us from gaining wide market acceptance of our products. Significant