Kintavar Exploration Inc. (the “

Corporation” or

“

Kintavar”) (TSX-V: KTR) (FRANKFURT: 58V), is

pleased to announce that it has closed a non-brokered private

placement (the “

Offering”) and issued 7,112,500

units of the Corporation (each a “

Unit”) at a

price of $0.08 per Unit and 7,617,310 common shares of the

Corporation (each a “

Share”), issued on a flow

through basis, at a price of $0.11 per Share, for total cumulative

gross proceeds of $1,406,904. Each Unit being comprised of one (1)

Share and one half of one (1/2) Share purchase warrant, each whole

warrant entitling the holder hereof to acquire one (1) Share at a

price of $0.15 per Share until December 11, 2022.

“The majority of this financing was subscribed

by existing shareholders of the Corporation, a strong sign of

support and confidence. Furthermore, the strength of the copper

market and the future demand projections are pointing to a

significant supply deficit. Global economies are injecting

unprecedented amounts of funds in transport electrification and

renewable energies, both sectors of significant copper demand. And

lastly, the global pandemic highlighted the need to diversify

supply sources and that includes base metals and copper. The

district scale mineralization at Mitchi and Wabash discovered by

Kintavar’s team highlights the potential for development in a

world-class jurisdiction like Quebec. Our technical team is

currently working on processing the soil geochemical data, Induced

Polarization (IP) data from the ongoing geophysical survey and is

still awaiting pending results from the trenches and channels that

were completed late fall. Based on those results, the Corporation

is targeting a maiden drilling campaign on Wabash in the first

quarter of 2021. This will be followed up by further field work

starting late spring and continuing throughout the summer.”

commented Kiril Mugerman, President & CEO of Kintavar

Exploration.

Certain officers and directors of the Company

have participated in this Private Placement for a total of 490,910

Shares and 125,000 Units distributed pursuant to the Offering (the

“Insiders’ Participation”). The Insiders’

Participation is exempt from the formal valuation and shareholder

approval requirements provided under Regulation 61-101 respecting

Protection of Minority Holders in Special Transactions

(“Regulation 61-101”) in accordance with sections

5.5(a) and 5.7(a) of said Regulation 61-101. The exemption is based

on the fact that the market value of the Insiders’ Participation or

the consideration paid by such insiders does not exceed 25% of the

market value of the Company. The Company did not file a material

change report at least 21 days prior to the completion of the

private placement since the Insiders’ Participation was not

determined at that moment.

The Company will use the proceeds of the

Offering for surface exploration and drilling on the Wabash

property and for working capital purposes.

The shares acquired by the subscribers are

subject to a hold period of four months plus one day from the

closing date, ending on April 12, 2021, except as permitted by

applicable securities legislation and the rules of TSX Venture

Exchange.

In connection with this Offering, the

Corporation has paid a cash finder’s fee in an amount of $47,631

and issued 455,448 non-transferable broker warrants to acquire such

number of common shares at a price of $0.15, exercisable for a

period of twenty-four (24) months and subject to a hold period of

four months plus one day from the closing date.

About Kintavar Exploration & the

Mitchi – Wabash Properties

Kintavar Exploration is a Canadian mineral

exploration Corporation engaged in the acquisition, assessment,

exploration and development of gold and base metal mineral

properties. Its flagship project is the Mitchi – Wabash

copper-silver district (approx. 37,000 hectares, 100% owned)

located 100 km north of the town of Mont-Laurier and 15 km East of

the town of Parent in Quebec. Both properties cover an area of more

than 300 km2 accessible by a network of logging and gravel

roads with access to hydro-electric power already on site, major

regional roads including rail road and a spur. The properties are

located in the north-western portion of the central metasedimentary

belt of the Grenville geological province. The projects primarily

focus on sediment-hosted stratiform copper type mineralization

(SSC) but include Iron Oxide Copper Gold (IOCG) and skarn type

targets. Osisko holds a 2% NSR on 27 claims of the southern portion

of the Mitchi property, outside of the sedimentary basin. Kintavar

also has exposure in the gold greenstones of Quebec by advancing

the Anik Gold Project in a partnership with IAMGOLD and several

early-stage projects that were optioned by Gitennes

Exploration.

Kintavar supports local development in the

Mitchi-Wabash region where it owns and operates the Fer à Cheval

outfitter, a profitable cashflow generating operation where it

employs local workforce. It as well works with local First Nations

to provide training and employment.

For further information contact:

Kiril Mugerman, President and CEOPhone : +1 450 641 5119

#5653Email : kmugerman@kintavar.comWeb: www.kintavar.com

Forward looking Statements:

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This news release contains statements that may

constitute “forward-looking information” or “forward looking

statements” within the meaning of applicable Canadian securities

legislation. Forward-looking information and statements may

include, among others, statements regarding future plans, costs,

objectives or performance of the Corporation, or the assumptions

underlying any of the foregoing. In this news release, words such

as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”,

“anticipate”, “intend”, “plan”, “estimate” “target” and similar

words and the negative form thereof are used to identify

forward-looking statements. Forward-looking statements should not

be read as guarantees of future performance or results, and will

not necessarily be accurate indications of whether, or the times at

or by which, such future performance will be achieved. No assurance

can be given that any events anticipated by the forward-looking

information will transpire or occur, including additional closings

of the private placement referred to above, or if any of them do

so, what benefits the Corporation will derive. Forward-looking

statements and information are based on information available at

the time and/or management's good-faith belief with respect to

future events and are subject to known or unknown risks,

uncertainties, assumptions and other unpredictable factors, many of

which are beyond the Corporation’s control. These risks,

uncertainties and assumptions include, but are not limited to,

those described under “Risk Factors” in the Corporation’s

management’s discussion and analysis for the fiscal year ended

December 31, 2019, which is available on SEDAR at www.sedar.com;

they could cause actual events or results to differ materially from

those projected in any forward-looking statements. The Corporation

does not intend, nor does the Corporation undertake any obligation,

to update or revise any forward-looking information or statements

contained in this news release to reflect subsequent information,

events or circumstances or otherwise, except if required by

applicable laws.

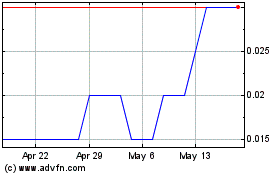

Kintavar Exploration (TSXV:KTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

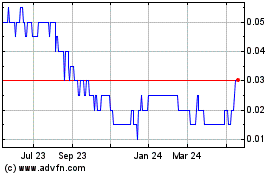

Kintavar Exploration (TSXV:KTR)

Historical Stock Chart

From Dec 2023 to Dec 2024