Athabasca Minerals Inc. Announces Q2 2019 Financial Results

August 13 2019 - 7:01AM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) announces its financial results for the second quarter ended

June 30, 2019. The Corporation’s financial statements and

management’s discussion and analysis (“MD&A”) for the quarter

ended June 30, 2019 are available on SEDAR at www.sedar.com and on

the Athabasca Minerals Inc. website at www.athabascaminerals.com.

Robert Beekhuizen, Chief Executive Officer,

states: “During Q2 2019 the Corporation has continued to

re-position across multiple business fronts – growth of its base

Aggregates division, growth of its AMI Silica sand division, and

growth of its Aggregates Marketing division. AMI’s vision is to

become the leading publicly trading aggregates company in Canada;

and its mission is to do so with discipline by capturing

progressive and innovative opportunities that will differentiate

the Corporation’s performance in the market.”

Business Highlights:

- The Corporation was awarded a

15-year contract with a 10-year renewal option to manage the Coffey

Lake Public Pit located approximately 50 km north of Susan

Lake. Coffey Lake is situated on approximately 1345 acres of

crown land. The Corporation is required to obtain regulatory

approvals and permits to manage the pit on behalf of Alberta

Environment and Parks (“AEP”). The Corporation submitted its

regulatory application in Q3-2019;

- The Duvernay frac sand project

progressed with the delineation drilling program consisting of 55

auger holes drilled to date. Samples have been collected and

testing has been conducted to verify the quality and scale of the

resource. The NI 43-101 report is currently with management

in draft form and is being updated with additional laboratory

information. The Corporation has secured a sufficient land

position for the life of the project. Engineering design and

permitting work has commenced;

- Exercised option to purchase

additional 33.4% interest in the Duvernay frac sand project,

increasing the Corporation’s total ownership interest to

49.6%;

- Signed a 10-year aggregates

management agreement with Montana First Nation for the processing

and sale of aggregates from a 185-acre property located near

Ponoka, Alberta. The Corporation is conducting field tests to

determine the extent of the resource;

- Susan Lake Closure Plan is under

review with AEP. Milestones for progressively closing the Susan

Lake gravel pit have continued into 2019;

- The Corporation was granted

Metallic and Industrial Mineral (“MIM”) leases for the Richardson

Dolomite / Granite Aggregate Project ("Richardson Quarry

Project"). The Richardson Quarry Project comprises three

contiguous subsurface leases totaling 3,904 hectares located 70

kilometers from the heart of major oilsands operations north of

Fort McMurray; and

- Built out the team and technology

platform for Aggregates Marketing Inc. and completed multiple

purchase orders through the midstream platform.

Financial Highlights

|

($ thousands of CDN) |

Three Months Q2 2019 |

Three Months Q2 2018 |

Six Months Q2 2019 |

Six Months Q2 2018 |

|

Aggregate management services |

$- |

$1,125 |

$434 |

$1,232 |

|

Aggregate sales revenue |

$980 |

$248 |

$980 |

$254 |

|

Total revenue |

$980 |

$1,373 |

$1,414 |

$1,486 |

|

Gross profit |

$(295) |

$(494) |

$(406) |

$50 |

|

Total loss and comprehensive loss |

$(1,311) |

$(55) |

$(2,368) |

$(795) |

|

Cash position |

$3,722 |

$4,594 |

$3,722 |

$4,594 |

|

Net cash generated (used) |

$(1,554) |

$1,968 |

$(1,356) |

$1,965 |

|

Loss per share, basic and fully diluted

($/share) |

$(0.030) |

$(0.002) |

$(0.057) |

$(0.024) |

2019 Operational OutlookOver the coming year

the Corporation is actively addressing and working on various

strategic and operational initiatives relating to restructuring the

Corporation's business model and expanding its operating lines

across the base Aggregates division, growth of its AMI Silica sand

division, and growth of its Aggregates Marketing division.

Base Aggregates

Business

- Obtain regulatory approvals for Coffey Lake Public Pit with a

planned opening in second half of 2019;

- Acquire approval for the Susan Lake Public Pit Closure Plan

(still pending approval by AEP);

- Continue to work on the resolution of the Syncrude

Lawsuit;

- Monetize the corporate-owned and third-party aggregate pits

through the royalty agreements with strategic partners;

- Through the partnership with Montana First Nation, complete

aggregate exploration activities on multiple properties owned by

the Nation;

- Working to secure key industrial partners to set-up a JV

relationship for the permitting and development of the Richardson

Quarry Project; and

- Selectively pursue conventional aggregate companies for

acquisition.

AMI Silica

- Secure offtake agreements for the supply of frac sand and

augment with 'Last-Mile' delivery solutions for customers;

- Finalize the updated NI 43-101 for the Duvernay frac sand

project;

- Complete facility design and permitting for the Duvernay frac

sand project;

- Secure financing and/or a JV partner for the Duvernay frac sand

project; and

- Continue the delineation drilling program for the Montney frac

sand project.

Aggregates Marketing

- Continue to generate sales through Aggregates Marketing

Inc.;

- Establish key client accounts with owner companies, general

contractors, and civil contractors;

- Strengthen business systems, processes and back office

support;

- Strategically hire Key Account Executives to strengthen sales

capabilities; and

- Launch a Social / Digital Media Campaign to improve AMI’s

branding and online recognition.

About Athabasca MineralsThe

Corporation is an integrated group of aggregates companies involved

in resource development, aggregates marketing and midstream

supply-logistics solutions. Business activities include aggregate

production, pit management services, sales from corporate-owned and

third-party pits, acquisitions of sand and gravel operations, and

new venture development. Athabasca Minerals is the parent company

of Aggregates Marketing Inc. – a midstream business providing

integrated supply and transportation solutions for industrial and

construction markets. It is also the parent company of AMI Silica

Inc. – a subsidiary positioning to become a leading supplier of

premium domestic in-basin frac sand with regional deposits in

Alberta and NE British Columbia. It is the joint venture owner of

the Montney In-Basin and Duvernay Basin Frac Sand Projects.

Additionally, the Corporation has industrial mineral leases, such

as those supporting the Richardson Quarry Project, that are

strategically positioned for future development in industrial

regions of high potential aggregates demand.

For further information on Athabasca,

please contact:Dean StuartT: 403-617-7609E:

dean@boardmarker.net

Robert Beekhuizen T: 587-525-9610

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

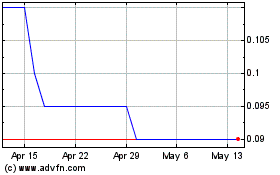

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Nov 2024 to Dec 2024

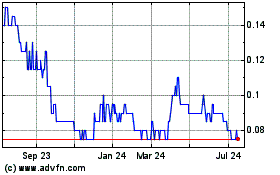

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Dec 2023 to Dec 2024