Stella-Jones Inc. (TSX: SJ) (“Stella-Jones” or the “Company”) today

announced financial results for its second quarter ended June 30,

2019.

“We are pleased with our second quarter results

given the short-term challenges experienced in certain markets.

Sales were stable as higher sales prices and healthy demand for

utility poles, combined with the positive currency conversion

effect, were offset by lower volume and pricing in logs and lumber,

temporary shipment delays in railway ties and wet weather

conditions in residential lumber. Notwithstanding this operating

environment, we delivered increased profitability driven by

improved pricing and better operational efficiencies in the U.S.

Southeast,” said Brian McManus, President and Chief Executive

Officer.

“We continued to follow our strategy of

continental expansion by completing a tuck-in acquisition in

Ontario in April and finalizing our plant expansion in Cameron,

Wisconsin. For 2019, we expect higher year-over-year sales and

margin improvement over last year. Our strategy remains intact as

we will continue to focus on optimizing our operations across the

organization while seeking acquisitions to further expand our

presence in our core markets,” stated Eric Vachon, Senior

Vice-President and CFO.

|

Financial Highlights (in millions of Canadian

dollars, except per share data and margin) |

Q2-19 |

|

Q2-18(2) |

|

YTD Q2-19 |

|

YTD Q2-18(2) |

|

|

Sales |

661.8 |

|

662.3 |

|

1,102.6 |

|

1,061.1 |

|

|

EBITDA(1) |

94.2 |

|

80.1 |

|

158.0 |

|

124.1 |

|

|

EBITDA margin (%)(1) |

14.2 |

% |

12.1 |

% |

14.3 |

% |

11.7 |

% |

|

Operating income(1) |

76.7 |

|

71.0 |

|

122.4 |

|

106.5 |

|

|

Net income for the period |

52.3 |

|

48.1 |

|

81.7 |

|

71.2 |

|

|

Per share – basic and diluted ($) |

0.76 |

|

0.69 |

|

1.18 |

|

1.03 |

|

|

Weighted average shares outstanding (basic, in ‘000s) |

69,131 |

|

69,347 |

|

69,134 |

|

69,352 |

|

- This is a non-IFRS financial measure which does not have a

standardized meaning prescribed by IFRS and may therefore not be

comparable to similar measures presented by other issuers.

- Results for fiscal 2018 were not restated as per IFRS 16.

SECOND QUARTER RESULTSOn

January 1, 2019, the Company retrospectively adopted IFRS 16,

Leases, but has not restated comparatives for the 2018 reporting

period, as permitted under the specific transitional provisions in

the standard. For the three-month period ended June 30, 2019,

instead of lease expenses, $8.1 million in right-of-use asset

depreciation and $1.0 million in financing expenses were recorded

in the consolidated statement of income. For the six-month period

ended June 30, 2019, the adoption of IFRS 16 added $15.9 million in

right-of-use asset depreciation and $2.0 million in financing

expenses. Please refer to the impact of new accounting

pronouncements and interpretation section of the quarterly

Management’s Discussion and Analysis for further details.

Sales reached $661.8 million, stable, versus

sales of $662.3 million for the corresponding period last year. The

currency conversion effect had a positive impact of $17.7 million.

Excluding the currency conversion effect, sales decreased

approximately $18.2 million, or 2.7%, primarily due to lower volume

and pricing in logs and lumber, temporary delayed shipments in

railway ties and wet weather conditions in residential lumber. This

was offset by higher selling prices and healthy demand for utility

poles as detailed below.

- Utility poles (31.2% of Q2-19 sales): Sales

reached $206.3 million, up 15.0% from sales of $179.4 million last

year. The currency conversion effect had a positive impact of $6.6

million. Excluding the currency conversion effect, utility pole

sales increased approximately $20.3 million, or 11.3%, primarily

driven by increased sales prices coupled with continued volume

increases in the U.S. Southeast and overall healthy demand in the

United States.

- Railway ties (29.4% of Q2-19 sales): Sales

totalled $194.7 million, down 3.2% from sales of $201.2 million

last year. The currency conversion effect had a positive impact of

$6.7 million. Excluding the currency conversion effect, railway tie

sales decreased approximately $13.2 million, or 6.6%. This variance

is mainly explained by delayed shipments due to low railcar

availability and longer treating cycle times which has pushed the

delivery of certain orders to the second half of 2019. The longer

treating cycles are a result of the tight supply market for

untreated railway ties which requires the Company to treat railway

ties that are not air-seasoned.

- Residential lumber (29.4% of Q2-19 sales):

Sales totalled $194.8 million, down 4.3% from sales of $203.5

million last year. The currency conversion effect had a positive

impact of $2.5 million. Excluding the currency conversion effect,

residential lumber sales decreased approximately $11.2 million, or

5.5%. This variance is primarily explained by lower demand due to

wet weather conditions in Eastern Canada and to a lesser extent, by

lower pricing.

- Industrial products (5.9% of Q2-19 sales):

Sales reached $38.8 million, compared with $32.9 million last year.

The currency conversion effect had a positive impact of $1.4

million. Excluding the currency conversion effect, sales increased

$4.5 million, or 13.8%, primarily as a result of stronger

rail-related product sales.

- Logs and lumber (4.1% of Q2-19 sales): Sales

totalled $27.1 million, compared with $45.3 million last year.

Excluding the currency conversion effect, sales for this product

category decreased by $18.6 million. This variance is a result of

reduced selling prices driven by lower lumber market costs, a

decrease in lumber transaction volumes as well as lower log sales

due to the timing of harvesting activities.

Operating income was $76.7 million, or 11.6% of sales, compared

with $71.0 million, or 10.7% of sales, in the second quarter of the

previous year. The increase versus last year is explained by

improved pricing and better operational efficiencies in the U.S.

Southeast. In addition, lower lumber costs, which are passed

through in a timely manner to customers via lower selling prices,

have contributed to decreased cost of sales but have also driven

margins up as a percentage of sales. These factors were partially

offset by the effect of currency translation.

Net income for the second quarter of 2019

reached $52.3 million, or $0.76 per diluted share, versus net

income of $48.1 million, or $0.69 per diluted share, in the

corresponding period last year.

SIX-MONTH RESULTSFor the first

six months of 2019, sales amounted to $1.10 billion, versus $1.06

billion for the corresponding period last year. Acquisitions

contributed sales of $11.5 million, while the currency conversion

effect had a positive impact of $36.4 million. Excluding these

factors, sales decreased approximately $6.4 million, or 0.6%.

Operating income reached $122.4 million, or

11.1% of sales, compared with $106.5 million, or 10.0% of sales

last year. Net income totalled $81.7 million, or $1.18 per diluted

share, versus $71.2 million, or $1.03 per diluted share last

year.

ACQUISITIONOn April 1, 2019,

the Company completed the acquisition of substantially all of the

assets of Shelburne Wood Protection Ltd. (“SWP”), located in

Shelburne, Ontario. The SWP plant is specialized in the treatment

of residential lumber. The total consideration for the acquisition

was approximately $9.2 million of which $8.5 million was financed

through the Company’s syndicated credit facilities and $0.7 million

was recorded as a balance of purchase price. The balance of

purchase price bears no interest, will be paid to the seller in two

equal amounts on the first and second anniversary of the

transaction and was recorded at fair value using an effective

interest rate of 3.31%. The SWP acquisition has been accounted for

as an acquisition of a group of assets.

CEO TO STEP DOWNOn July 15,

2019, the Company announced that Brian McManus has made the

decision to step down as President and CEO, effective October 11,

2019. Until such date, Mr. McManus will work closely with

management and the Board to ensure a smooth transition. Upon Mr.

McManus’ departure, Eric Vachon, Senior Vice-President and CFO,

will be serving as interim CEO. Mr. Vachon is a twelve-year veteran

of the Company, whose prior roles have included Director, Treasury

and Financial Reporting, Vice President Finance, U.S. Operations

and Vice President and Treasurer since joining Stella-Jones in

2007. Mr. Vachon will retain his CFO responsibilities during the

interim period. A special committee of the Board of Directors has

been formed to conduct a search for the Company's next CEO and will

be considering both internal and external candidates.

AMENDED CREDIT AGREEMENT On May

3, 2019, the Company amended and restated the fifth amended and

restated credit agreement dated as of February 26, 2016,

as amended on May 18, 2016, on March 15, 2018

and on January 14, 2019, pursuant to a sixth amended and

restated credit agreement (the “Sixth ARCA”). Under the terms of

the Sixth ARCA, the following syndicated credit facilities are made

available to the Company as well as Stella-Jones Corporation and

Stella-Jones U.S. Holding Corporation (collectively, with the

Company, the “Borrowers”), both wholly-owned subsidiaries of

the Company, by a syndicate of lenders: (i) an unsecured revolving

facility in the amount of US$325.0 million made available to the

Borrowers until February 27, 2024, (ii) an unsecured non-revolving

term facility in the amount of US$50.0 million made available to

Stella-Jones Corporation until February 26, 2021 and (iii) an

unsecured non-revolving term facility in the amount of US$50.0

million made available to Stella-Jones Corporation until February

28, 2022. Under the Sixth ARCA, financing is provided up to $556.2

million (US$425.0 million). For additional details please refer to

the Management’s Discussion and Analysis for the quarter.

SOLID FINANCIAL POSITION As at

June 30, 2019, the Company’s long-term debt, including the current

portion, stood at $619.7 million compared with $513.5 million as at

December 31, 2018. The increase mainly reflects higher working

capital requirements, higher capital expenditures and financing

required for the acquisition of SWP, partially offset by the effect

of local currency translation on U.S. dollar denominated long-term

debt.

QUARTERLY DIVIDEND On August 6,

2019, the Board of Directors declared a quarterly dividend of $0.14

per common share, payable on September 20, 2019 to shareholders of

record at the close of business on September 2, 2019. This dividend

is designated to be an eligible dividend.

NORMAL COURSE ISSUER BIDIn the

three-month period ended June 30, 2019, as part of its Normal

Course Issuer Bid, the Company did not repurchase any common shares

for cancellation. Since the launch of the Normal Course Issuer Bid

on December 20, 2018, the Company repurchased 251,000 common shares

for cancellation in consideration of $9.8 million.

OUTLOOKThe general outlook remains unchanged

from last quarter. Management expects higher year-over-year sales,

based on current market conditions, the current level of lumber

prices and assuming stable currencies. This increase is driven by

stronger pricing for railway ties and utility poles as well as

increased market reach for the utility pole product category.

Management also expects improved year-over-year margins on a

consolidated basis. Higher margins will be primarily driven by

increased pricing and volume for railway ties coupled with improved

product mix and demand for utility poles. Furthermore, it is

important to note that the 2019 EBITDA will be positively impacted

by the adoption of IFRS 16, Leases. For additional details per

product category, please refer to the Management’s Discussion and

Analysis for the quarter.

CONFERENCE CALLStella-Jones

will hold a conference call to discuss these results on August 7,

2019, at 10:00 AM Eastern Time. Interested parties can join the

call by dialing 1-647-788-4922 (Toronto or overseas) or

1-877-223-4471 (elsewhere in North America). Parties unable to call

in at this time may access a recording by calling 1‑800-585-8367

and entering the passcode 5153779. This recording will be available

on Wednesday, August 7, 2019 as of 1:00 PM Eastern Time until 11:59

PM Eastern Time on Wednesday, August 14, 2019.

NON-IFRS FINANCIAL MEASURESEBITDA (operating

income before depreciation of property, plant and equipment and

amortization of intangible assets), operating income and operating

margins are financial measures not prescribed by IFRS and are not

likely to be comparable to similar measures presented by other

issuers. Management considers these non-IFRS measures to be useful

information to assist knowledgeable investors regarding the

Company’s financial condition and results of operations as it

provides an additional measure of its performance. Please refer to

the non-IFRS financial measures section in the Management’s

Discussion and Analysis.

ABOUT STELLA-JONESStella-Jones Inc. (TSX: SJ)

is a leading producer and marketer of pressure treated wood

products. The Company supplies North America’s railroad operators

with railway ties and timbers, and the continent’s electrical

utilities and telecommunication companies with utility poles.

Stella-Jones also manufactures and distributes residential lumber

and accessories to retailers for outdoor applications, as well as

industrial products for construction and marine applications. The

Company’s common shares are listed on the Toronto Stock

Exchange.

Except for historical information provided

herein, this press release may contain information and statements

of a forward-looking nature concerning the future performance of

the Company. These statements are based on suppositions and

uncertainties as well as on management's best possible evaluation

of future events. Such factors may include, without excluding other

considerations, fluctuations in quarterly results, evolution in

customer demand for the Company's products and services, the impact

of price pressures exerted by competitors, the ability of the

Company to raise the capital required for acquisitions, and general

market trends or economic changes. As a result, readers are advised

that actual results may differ from expected results.

Note to readers:

Condensed interim unaudited consolidated financial statements for

the second quarter ended June 30, 2019 are available on

Stella-Jones' website at

www.stella-jones.com

|

Source: |

Stella-Jones Inc. |

|

| |

|

|

| Contacts: |

Éric Vachon, CPA,

CA |

Pierre Boucher, CPA,

CMA |

| |

Senior Vice-President and Chief

Financial Officer |

Jennifer McCaughey, CFA

MaisonBrison Communications |

| |

Tel.: (514) 940-3903 |

Tel.: (514) 731-0000 |

| |

evachon@stella-jones.com |

pierre@maisonbrison.com

jennifer@maisonbrison.com |

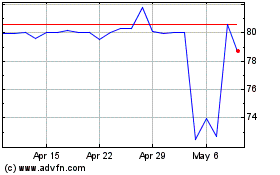

Stella Jones (TSX:SJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Nov 2023 to Nov 2024