Gildan Activewear Inc. (GIL; TSX and NYSE) today announced a

refreshed Board of Directors that has been thoughtfully constructed

based on extensive shareholder engagement. The new Board will guide

the Company’s next phase of growth under the leadership of

President and Chief Executive Officer Vince Tyra and ensure the

previously announced sale process is conducted in a manner that

will benefit all shareholders of Gildan.

The Company is pleased to announce that its

Board of Directors has appointed Timothy (Tim) Hodgson, former

Special Advisor to Governor Carney at the Bank of Canada and former

CEO of Goldman Sachs Canada, Lewis L. (Lee) Bird III, former

Chairman and Chief Executive Officer of At Home Group Inc., Jane

Craighead, former Senior Vice President Global Human Resources at

Scotiabank, Lynn Loewen, former President of Minogue Medical Inc.,

and Les Viner, former Managing Partner of Torys LLP, as independent

directors of the Board, effective May 1, 2024. The five new

directors take the seats of Directors Donald C. Berg, Maryse

Bertrand, Shirley Cunningham, Charles Herington, and Craig Leavitt.

The Board decided that near-term board refreshment was in the best

interests of Gildan. To facilitate a smooth transition process at

this important junction, the new directors have been recent

observers to the Board.

In addition, Luc Jobin and Chris Shackelton,

members of the Special Committee supervising the ongoing sale

process, will continue in their roles to help transition the

Special Committee to the refreshed Board. They have informed the

Board that they will not stand for re-election at the Company’s

2024 Annual Meeting and will retire after the Annual Meeting. The

Board recommends that shareholders vote for the elections of Karen

Stuckey and J.P. Towner, who have been nominated by a shareholder,

Browning West. The Board requested to interview all of Browning

West’s candidates, but that request was declined. It was clear to

the Board during deliberations, through prior consideration of

potential candidates for board refreshment, and feedback received

from shareholders and other stakeholders of the Company, that Karen

Stuckey and J.P. Towner would be additive to the Board as Gildan

pursues its growth agenda. The Board does not believe that the rest

of Browning West’s slate offers an increase in expertise or

experience to Gildan’s business, and accordingly, they do not

represent the best mix of Director candidates.

The Board unanimously recommends and it is

expected that the new Board as it will be constituted on May 1,

2024 will appoint Tim Hodgson as Independent / Non-Executive Chair,

effective that day. With these changes, the Company’s recommended

slate of Director candidates for the 2024 Annual Meeting will

include the following individuals:

- Tim Hodgson, Independent /

Non-Executive Chair

- Lee Bird

- Dhaval Buch

- Marc Caira

- Jane Craighead

- Sharon Driscoll

- Lynn Loewen

- Anne Martin-Vachon

- Vincent (Vince) J. Tyra, President

& CEO

- Les Viner

- Karen Stuckey – recommended

Browning West nominee

- J.P. Towner – recommended Browning

West nominee

These individuals are highly qualified. The

Company’s nominees have been thoughtfully selected to serve on the

Board of Directors following a robust recruitment process,

including the hiring of an independent search firm, and extensive

shareholder engagement. The Board possesses strong business and

core industry experience and deep expertise in key functional

areas, such as corporate governance, legal, ESG, and HR, which are

needed to oversee Gildan in its next phase of growth.

“I look forward to working with this highly

qualified Board and management team to realize the full benefits of

Vince’s ambitious yet realistic plan to drive growth by enhancing

the Gildan Sustainable Growth strategy,” said Tim Hodgson, incoming

Chair of Gildan. “The refreshed Board and I fully believe in Vince

and his talented team as well as Gildan’s leading market position

and growth prospects. Rest assured, I and every member of the Board

and management team will continue to work tirelessly on behalf of

all Gildan shareholders to ensure value is being maximized.”

“I am excited to lead Gildan forward with Tim

and this world-class, reconstituted Board, and look forward to

leveraging their deep, varied expertise and strengths as we aim to

build value together through thoughtful execution and sustainable

growth,” said Vince Tyra, President and Chief Executive Officer of

Gildan.

In addition, the previously disclosed Support

Agreement entered between Gildan and Coliseum Capital Management,

LLC (“Coliseum”) on December 17, 2023, remains in effect. Mr.

Shackelton has been valuable in helping to stabilize the Company,

evaluate opportunities for future growth, and ensure Gildan has the

right long-term strategy and best possible Board in place. Coliseum

intends to vote in favor of Gildan’s recommended slate of Director

candidates at the 2024 Annual Meeting.

“Gildan is a great business with several

compelling strategic paths available for continued value creation,

and I am encouraged by the Company’s focus and performance at this

pivotal point in its evolution. I am confident that the refreshed

board has the right skills, commitment, and character to forge a

bright future for the benefit of all shareholders,” said Chris

Shackelton, Co-Founder and Managing Partner of Coliseum Capital

Management.

Background on Refreshment Process

In connection with today’s news, the Board

provided additional background on the refreshment process:

“Over the past five months, Gildan’s Board has

engaged with, welcomed and sought out the views of the Company’s

shareholders including Browning West and their supporters. Our

first choice has always been to resolve this unnecessary proxy

contest in a mutually agreeable manner that benefits all

shareholders of Gildan. Throughout this process, the Board has

sought to maintain open lines of communication with Browning West,

including discussing numerous settlement possibilities that balance

Browning West’s interests with those of Gildan’s broader

shareholder base. The Board and management team have held 87

meetings with shareholders, including multiple meetings with

Gildan’s top 25 shareholders and those who Browning West has deemed

as supportive.

Through that engagement, it was evident that

there was not unanimous support for the Browning West nominees –

even amongst those who Browning West counts publicly as supportive.

Specifically, there was concern about Mr. Chamandy returning to the

Company, that the nominees were selected by Browning West without

input from other shareholders, and about providing Browning West

with unchecked control of the Company. It became clear that the

type of board that shareholders wanted to see moving forward was a

board that balanced fresh perspectives with historic knowledge;

previous board experience with a focus on governance, industry, and

manufacturing experience; and one that was responsive to the views

of shareholders.

With this significant input from shareholders,

the Corporate Governance and Social Responsibility Committee, which

included members who were not targeted by Browning West, conducted

an extensive recruitment process with the assistance of an external

independent recruitment firm. Our slate strikes a balance between

ensuring the Board retains historical continuity during a period of

transition and provides fresh perspectives to ensure it continues

to serve its important oversight function on behalf of all

shareholders.

In Browning West’s rush to get the board they

wanted – and in their unwillingness to engage constructively – they

overlooked one obvious fact that underscores how needless their

actions of the last four months have been: The Board has always

been open to and pursued proactive refreshment to ensure the right

balance of fresh perspectives and historical continuity. This

includes a regular pattern of planned refreshment. If this is about

governance and expertise required for the future success of the

company, as Browning West asserts, then they should have no problem

supporting this board. But if this is about putting their interests

first and getting the board they picked with no checks and balances

as shareholders have expressed concern about, then they will

continue to drive forward with the slate they, not other

shareholders, have picked.

The new Board greatly appreciates the support

and leadership that Donald, Maryse, Shirley, Luc, Charles, Craig,

and Chris provided Gildan and wish them the best.”

Update on Sale Process

The Board also provided an update today on its

previously communicated sale process in response to the receipt of

a confidential non-binding expression of interest to acquire

Gildan:

“There continues to be external interest in

acquiring the Company and the process is ongoing. Due to the timing

of the upcoming Annual Meeting, which the Board is fully committed

to hold on May 28, as originally planned, we do not expect to make

any further announcements on the potential sale process before

then. We are confident that with the stability resulting from the

resolution of the contested directors’ election issue at the Annual

Meeting, the newly reconstituted Board that we are recommending to

our shareholders will, if elected, pursue their fiduciary duties by

reviewing such external interest and assessing it against the

Company’s future plans.”

Gildan intends to file by April 29, 2024 its

management proxy circular with the Canadian securities regulatory

authorities on SEDAR+ in connection with its upcoming 2024 Annual

Meeting to be held on May 28, 2024.

About Tim Hodgson

Tim Hodgson has a long and distinguished

leadership career in asset management, finance, and public service.

Tim was Special Advisor to Governor Carney at the Bank of Canada

and served as Chief Executive Officer of Goldman Sachs Canada from

2005 to 2010, after having risen through various positions within

the international investment bank’s New York, London, Silicon

Valley, and Toronto offices. Tim has more than 15 years of board

experience spanning several sectors. He currently serves as Chair

of Hydro One, a TSX 60 company and Canada’s largest publicly traded

electricity transmission and distribution service provider. He also

serves as Chair of the Canadian Investment Regulatory Organization,

Vice Chair of the Investments Committee of the Ontario Teacher’s

Pension Plan and on the board of the Property and Casualty

Insurance Compensation Corporation. Tim most recently served as

Managing Partner and Director of Alignvest Management Corporation,

a Canadian-based private equity investment firm. His prior board

directorships include Dialogue Health Technologies, PSP

Investments, Sagicor Financial Company, MEG Energy, the Ivey School

of Business at Western University, and Bridgepoint Health. He is a

Fellow of the Institute of Chartered Professional Accountants

(FCPA) and holds the Institute of Corporate Directors designation

(ICD.D).

About Lee Bird

Lee Bird brings to the Gildan board deep

leadership experience and relevant industry expertise. He most

recently served as Chairman and CEO of At Home Group Inc., a

US-based retailer. Prior to that, Bird served as Managing

Director/Consumer Practice Leader of The Gores Group, a global

private equity firm. Prior to this, Lee served as Group President

of Nike Affiliates for Nike Inc., Chief Operating Officer of The

Gap and Chief Financial Officer of Old Navy. Before his

consumer/retail career, he held various strategic and financial

leaderships roles at Gateway, Inc., Honeywell/AlliedSignal, Inc.,

and Ford Motor Company. He started his career as an Assistant Vice

President & Commercial Loan Officer for BayBanks, Inc. Lee is

currently on the Board of the Larry H. Miller Companies, the

National Advisory Committee for the Marriott School of Business at

Brigham Young University and is a member of the Ownership Advisory

Group of the NHL Dallas Stars.

About Jane Craighead

Jane Craighead has over 20 years of experience

with public companies, first as executive management and then as an

independent corporate director. Jane is skilled in finance and

accounting, human resource management including executive

compensation, corporate governance, business strategy and change

management. She most recently served as Senior Vice President

Global Human Resources at Scotiabank. Prior to that, she served as

Global Practice Leader, Total Rewards of Rio Tinto, as well as a

similar role at Alcan. She is currently a member of the Board of

Directors of Crombie Real Estate Investment Trust where she is a

member of the Human Resources Committee and Chair of the Governance

and Nominating Committee, of Wajax Corporation where she is a

member of the Audit Committee and Chair of the Human Resources

Committee, and of Telesat Corporation where she is a member of the

Audit and Nominating and Governance committees and Chair of the

Human Resources and Compensation Committee. Her prior board

directorships include Jarislowsky Fraser Limited, Intertape Polymer

Group Inc., Clearwater Seafoods Incorporated, and Park Lawn

Corporation. Jane has a PhD in Management and is a Chartered

Professional Accountant (CPA).

About Lynn Loewen

Lynn Loewen brings a wealth of valuable

experience to the Board, particularly in executive leadership,

governance, risk management, finance, technology, accounting and

sustainability/ESG. She most recently served as President of

Minogue Medical Inc., a Canada-based healthcare organization

specializing in the delivery of innovative medical technologies to

hospitals and medical clinics. Before Minogue, Lynn served as

President of Expertech Network Installation Inc. Lynn has also held

key positions with Bell Canada Enterprises including Vice President

of Finance Operations and Vice President of Financial Controls.

Prior to this, she was Vice President of Corporate Services and

Chief Financial Officer of Air Canada Jazz. In addition, Lynn

possesses extensive Board experience; she currently serves as a

member of the Board of Directors and Chair of the Audit Committee

of National Bank of Canada, a Canadian Chartered Bank, and a

Director of Emera Incorporated, a TSX-listed multinational energy

company. Lynn is the current Chancellor of Mount Allison

University. She is a Fellow of the Institute of Chartered

Professional Accountants (FCPA) and holds the Institute of

Corporate Directors designation (ICD.D).

About Les Viner

Les Viner is a lawyer, Chartered Professional Accountant (CPA),

and seasoned business leader, bringing to the Board extensive

experience in financial and strategic planning, change management,

talent development, risk management, conflict resolution, business

development and transaction execution. Les most recently served as

a Senior Partner of Torys LLP, a leading international business law

firm headquartered in Toronto. Before that, Les Viner served as

Managing Partner of Torys, where he was responsible for the firm’s

overall strategic direction and client focus, as well as for all

professional and administrative matters. In this role, Les Viner

led the transition from a single office, founder-led firm to a

multi-office, professionally led firm, while developing and

implementing a differentiated strategy which led to marketplace

recognition and profitable growth. During his time at Torys, Les

stepped in to serve as Interim General Counsel and Corporate

Secretary of Canada Post Corporation, advising the Company’s Board

and leading legal, compliance, and ESG functions. Prior to that,

Les practiced corporate, securities and natural resources law with

Macleod Dixon in Calgary, and international corporate and finance

law with Allen & Overy in London, England. Les obtained his

B.Comm. from University of Calgary, J.D. from University of

Toronto, and LL.M. from Harvard University. Les Viner holds the

Institute of Corporate Directors designation (ICD.D).

Caution Concerning Forward-Looking

Statements

Certain statements included in this press release

constitute “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995 and Canadian

securities legislation and regulations and are subject to important

risks, uncertainties, and assumptions. This forward-looking

information includes, amongst others, information with respect to

our objectives and strategies to achieve these objectives.

Forward-looking statements generally can be identified by the use

of conditional or forward-looking terminology such as “may”,

“will”, “expect”, “intend”, “estimate”, “project”, “assume”,

“anticipate”, “plan”, “foresee”, “believe”, or “continue”, or the

negatives of these terms or variations of them or similar

terminology. We refer you to the Company’s filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the risks described under the

“Financial risk management”, “Critical accounting estimates and

judgments”, and “Risks and uncertainties” sections of the Company’s

Management’s Discussion and Analysis for the year ended December

31, 2023 (“FY2023 MD&A”) for a discussion of the various

factors that may affect these forward-looking statements. Material

factors and assumptions that were applied in drawing a conclusion

or making a forecast or projection are also set out throughout such

document.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion or projection in such forward-looking

information, include, but are not limited to changes in general

economic, financial or geopolitical conditions globally or in one

or more of the markets we serve, including the pricing and

inflationary environment, and our ability to implement our growth

strategies and plans, as well as those factors listed in the FY2023

MD&A under the “Risks and uncertainties” section and “Caution

regarding forward-looking statements” sections. These factors may

cause the Company’s actual performance in future periods to differ

materially from any estimates or projections of future performance

expressed or implied by the forward-looking statements included in

this press release.

There can be no assurance that the expectations represented by

our forward-looking statements will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management’s expectations regarding the

Company’s future financial performance and may not be appropriate

for other purposes. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date of this press release, and we do not undertake any

obligation to update publicly or to revise any of the included

forward-looking statements, whether as a result of new information,

future events, or otherwise unless required by applicable

legislation or regulation. The forward-looking statements contained

in this press release are expressly qualified by this cautionary

statement.

About Gildan

Gildan is a leading manufacturer of everyday basic apparel. The

Company’s product offering includes activewear, underwear and

socks, sold to a broad range of customers, including wholesale

distributors, screenprinters or embellishers, as well as to

retailers that sell to consumers through their physical stores

and/or e-commerce platforms and to global lifestyle brand

companies. The Company markets its products in North America,

Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American

Apparel®, Comfort Colors®, GOLDTOE® and Peds®.

Gildan owns and operates vertically integrated, large-scale

manufacturing facilities which are primarily located in Central

America, the Caribbean, North America, and Bangladesh. Gildan

operates with a strong commitment to industry-leading labour,

environmental and governance practices throughout its supply chain

in accordance with its comprehensive ESG program embedded in the

Company's long-term business strategy. More information about the

Company and its ESG practices and initiatives can be found at

www.gildancorp.com.

Media inquiries:

Genevieve Gosselin

Director, Global Communications and Corporate Marketing

(514) 343-8814

ggosselin@gildan.com

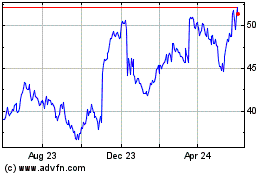

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Dec 2023 to Dec 2024