Santa Fe Gold and Canarc Resource Announce Strategic Share Exchange; Commitment for $22 Million Gold Bond Financing; Restruct...

July 15 2014 - 5:25PM

Marketwired Canada

Santa Fe Gold Corporation ("Santa Fe") (OTCBB:SFEG) and Canarc Resource Corp.

("Canarc") (TSX:CCM) (OTCBB:CRCUF) are pleased to announce the execution of a

strategic share exchange agreement (the "Agreement") pursuant to which Santa Fe

will issue 66,000,000 shares of its common stock to Canarc and Canarc will issue

33,000,000 of its common shares to Santa Fe (the "Share Exchange"). Upon

consummation of the Share Exchange, Santa Fe will own approximately 17 percent

of Canarc's outstanding shares and Canarc will own approximately 34 percent of

Santa Fe's outstanding common shares.

The purpose of the Share Exchange is to facilitate a significant turnaround for

Santa Fe and a material new opportunity for Canarc driven by the appointment of

Canarc nominees to the Santa Fe management team and Board of Directors, the

re-capitalization of Santa Fe, the re-structuring of Santa Fe secured debt and

re-development of its Summit gold-silver mine in New Mexico to production while

preserving Santa Fe's net operating loss carry-forwards totaling in excess of

$78 million. The Agreement contains representations, warranties, conditions and

covenants of the parties customary for transactions of this type.

In connection with the strategic Share Exchange:

-- Santa Fe's senior secured creditors, Waterton Global Value, L.P.

("Waterton"), Sandstorm Gold Ltd. and Sandstorm Gold (Barbados) Ltd.

("Sandstorm") have entered into respective agreements that demonstrate

that they are supportive of the share exchange transaction and that they

are amenable to restructuring collectively approximately $20 million of

Santa Fe indebtedness.

-- Santa Fe has entered into a "best-efforts" Placement Agreement with an

investment bank with which Canarc and Endeavour Silver have enjoyed a

long standing relationship, pursuant to which will place an estimated

$22 million of 8% Gold Bonds Due in 2018 that are redeemable in cash or

gold ETF.

-- Effective today, Mr. Bradford Cooke, Chairman and Founder of Canarc and

Founder and CEO of Endeavour Silver Corp. (NYSE:EXK and TSX:EDR) has

been appointed as Chairman of Santa Fe and Santa Fe's board will consist

of three current Santa Fe directors: Jakes Jordan, Michael Heeley and

Erich Hofer, and two Canarc nominees: Bradford Cooke and Catalin

Chiloflischi. To facilitate the appointment of Mr. Bradford Cooke and

Catalin Chiloflischi to the Santa Fe Board, Pierce Carson and Glenn

Henricksen, have resigned as Directors of Santa Fe effective today.

-- Also today, Canarc CEO, Catalin Chiloflischi has been appointed

President and Chief Executive Officer and Director of Santa Fe and

Canarc Chief Operating Officer, Garry Biles has been appointed Chief

Operating Officer of Santa Fe.

Jakes Jordaan, Santa Fe's departing Chairman and Interim CEO, noted five key

reasons underlying Santa Fe's Independent Special Committee and the Board

opinion that the strategic Share Exchange is expected to significantly increase

Santa Fe's long-term stockholder value:

-- "We strengthen our management team and Board of Directors with world-

class talent: Canarc's Chairman and Founder, Mr. Bradford Cooke, is also

the founder and CEO of Endeavour Silver, a successful silver mining

company with three operating mines in Mexico. Mr. Cooke has grown

Endeavour Silver from start-up into a significant mid-tier silver and

gold producer in 10 years and listed Endeavour on the TSX and NYSE with

a market cap of over $600 million today. We believe that under his

leadership, Canarc's seasoned management team of mine finders, builders

and operators have the experience and capabilities to turn our Summit

mine into a near-term profitable producing asset and execute a well-

defined and focused growth strategy in Steeplerock mining district;

-- We benefit from the restructuring of our Senior Debt. The Canarc team

successfully sought the cooperation of Waterton and Sandstorm and their

proven operating record and ability to attract capital was a fundamental

driver in these discussions;

-- We Benefit from the non-dilutive gold bond financing. Canarc introduced

us to an investment bank to which Canarc and Endeavour Silver have

enjoyed a long standing relationship and successfully negotiated the

gold bond financing. Their operating experience and expertise were

necessary elements for the investment bank agreeing to act as the lead

placement agent for the gold bond financing - a major financing

structure with almost no equity dilution to our stockholders;

-- We Benefit from Canarc's High-Grade New Polaris Gold mine property.

Canarc has spent over $28 million on the discovery and delineation of a

high grade gold deposit on its New Polaris Gold Mine Property in British

Columbia, Canada. An NI 43-101 compliant resource for Canarc's New

Polaris Project consists of approximately 1.4 million tons grading 0.36

oz per ton (opt) Au of measured and indicated resources, and about 2.0

million tons of inferred resources grading also about 0.36 opt Au.

Through our 17 percent interest in Canarc, we anticipate future benefits

as this project advances toward feasibility and production.

-- We Maximize the Future Availability of our Net Operating Loss Carry-

forwards. At March 30, 2014, Santa Fe had net operating loss carry-

forwards of approximately $78 million. A primary driver underlying the

share exchange structure was the desire to preserve this substantial

off-balance sheet asset. Should the Summit mine reach its anticipated

potential, these NOL carry-forwards should add significant future

stockholder value."

Bradford Cooke, Chairman and Founder of Canarc and incoming Chairman of Santa Fe

commented: "Today's announcement marks an important step forward that will

provide Canarc with significant exposure to and management of a growing

gold-silver producer in the near term. The proposed transaction represents a

great opportunity for both Canarc and Santa Fe shareholders to benefit from the

combination of Santa Fe's Summit mine and Lordsburg mill and Canarc's seasoned

management team of mine finders, builders and operators."

Mr. Catalin Chiloflischi, CEO of Canarc and incoming CEO of Santa Fe,

highlighted the main reasons why the strategic Share Exchange with Santa Fe

could significantly enhance Canarc's long-term shareholder value:

-- "We see an opportunity to replicate the success of the Endeavour

business model. Endeavour grew into a strong mid-tier silver-gold mining

company through strategic acquisitions of distressed mines in historic

districts that held the potential for operational turn-arounds to return

the mines to profitability, and new discoveries that could be fast-

tracked to production to drive annual organic growth and unfold the full

mineral potential of each district. Canarc sees a similar opportunity to

create value out of Santa Fe's Summit mine and other properties by

following Endeavour's successful business model;

-- We Gain exposure to and management of a near-term producing gold-silver

mine with significant turnaround potential. Santa Fe plans to redevelop

its high grade Summit gold-silver mine and Lordsburg mill into a near-

term profitable producing asset which if successful would positively

impact Santa Fe's share value and therefore Canarc's share value;

-- We See an opportunity to acquire other old mines in the steeplerock

district with good potential for new discoveries to drive organic

growth. One of the keys to the Endeavour business model is acquiring

additional properties and making new discoveries in order to drive

organic growth. Canarc's management team is also intimately familiar

with the low sulfidation epithermal, high grade vein mines that

Endeavour operates. The Summit mine and Steeplerock district are prime

examples of such mines, and Canarc sees a similar opportunity to acquire

and explore other properties within the Steeplerock district;

-- We Gain exposure to and management of Santa Fe's other assets without

exposure to their debts. Santa Fe holds an option to purchase the

Mogollon gold-silver district and a lease on the Ortiz gold mine

properties in New Mexico. Canarc intends to more fully evaluate these

assets for potential value creation, but does not have any liability for

Santa Fe's debts.

-- We can reduce our G&A costs by sharing management and staff with Santa

Fe. By sharing certain management members and office staff between

Canarc and Santa Fe, we should be able to reduce G&A costs for both

companies;

-- Canarc will continue to evaluate other strategic opportunities and

advance its assets in an effort to create shareholder value. This is

just the next step forward for Canarc in our drive to build a successful

company. We view the junior gold mining sector as ripe for

consolidation"

The foregoing description of the Share Exchange does not purport to be complete,

and is qualified in its entirety by reference to the Agreement, which is

included as Exhibit 2.1 to Santa Fe's Current Report on Form 8-K, dated July 15,

2014, which has been filed with the SEC and is be available at www.sec.gov.

Completion of the Share Exchange is subject to certain standard conditions,

including the approval of Toronto Stock Exchange (TSX) and British Columbia

Securities Commission (BCSC).

Mr. Garry Biles, President & COO of Canarc, is the Qualified Person pursuant to

NI 43-101 who reviewed and approved the scientific and technical information

included in this news release.

A joint conference call to discuss this transaction with shareholders and

investors has been scheduled for Wednesday July 16, 2014 at 9.00am PST (12.00pm

EST). Please see dialing instructions below.

Conference Call Numbers

Canada & USA Toll Free Dial In: 1 800 319 4610

Outside of Canada & USA call: +1 604 638 5340

About Santa Fe Gold

Santa Fe Gold is a U.S.-based mining and exploration enterprise focused on

acquiring and developing gold, silver, copper and industrial mineral properties.

Santa Fe controls: (i) the Summit mine and Lordsburg mill in southwestern New

Mexico; (ii) a substantial land position near the Lordsburg mill, comprising the

core of the Lordsburg Mining District; (iii) the Mogollon gold-silver project,

within trucking distance of the Lordsburg mill; (iv) the Ortiz gold property in

north-central New Mexico; (v) the Black Canyon mica deposit near Phoenix,

Arizona; and (vi) a deposit of micaceous iron oxide (MIO) in Western Arizona.

Santa Fe Gold intends to build a portfolio of high-quality, diversified mineral

assets with an emphasis on precious metals.

To learn more about Santa Fe Gold, visit www.santafegoldcorp.com.

About Canarc Resource Corp.

Canarc is a growth-oriented, gold exploration and mining company listed on the

TSX (CCM) and the OTC-BB (CRCUF). Canarc is currently seeking a partner to

advance its 1.1 million oz, high grade, underground, New Polaris gold mine

project in British Columbia to feasibility and is preparing to drill its

Windfall Hills gold properties in central B.C. Canarc is also seeking to acquire

interests in operating or pre-production gold mines in the Americas.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS - SAFE HARBOR

This press release contains forward-looking statements. Those statements

constitute forward-looking statements within the meaning of the Safe Harbor

Provisions of the Private Securities Litigation Reform Act of 1995 and

forward-looking information under Canadian securities law. Forward-looking

statements can be identified by the use of words such as "expects," "projects,"

"plans," "will," "may," "anticipates," believes," "should," "intend,"

"estimates," and other words of similar meaning. These statements include, among

others, the anticipated purpose of the Share Exchange to facilitate a

turn-around of Santa Fee, recapitalization of Santa Fe, restructuring of Santa

Fe debt, redevelopment of the Summit Gold-Silver Mine, preserving net operations

less carry forwards, anticipated best efforts placement of gold bonds,

expectations of replicating the Endeavor business model, expectations related to

creating shareholder value and other statements that are not historical fact.

These statements are subject to risks and uncertainties that cannot be predicted

or quantified, and our actual results may differ materially from those expressed

or implied by such forward-looking statements, including the following risks and

uncertainties: financing risks, exploration and development risks, gold-silver

commodity price risks, risks related to obtaining consents, permits and

licenses, regulatory and governmental risks, currency fluctuation risks, TSX and

BCSC approval, uncertainty of the outcomes of litigation and risks associated

with the inherent uncertainty of future litigation results, adverse outcomes in

litigation may result in significant monetary damages or injunctive relief that

could adversely affect our ability to conduct our business. All forward-looking

statements included in this release are made as of the date of this press

release, and the parties assume no obligation to update any such forward-looking

statements.

This press release does not constitute an offer to sell or a solicitation of an

offer to buy the gold bonds, and shall not constitute an offer, solicitation or

sale of any gold bonds in any jurisdiction in which such offer, solicitation or

sale would be unlawful. This press release is being issued pursuant to and in

accordance with Rule 135c under the Act.

FOR FURTHER INFORMATION PLEASE CONTACT:

Santa Fe Gold Corp

Catalin Chiloflischi

President and Chief Executive Officer

Toll Free: 1-877-684-9700 or (604) 685-9700

www.santafegoldcorp.com

Canarc Resource Corp.

Catalin Chiloflischi

CEO

Toll Free: 1-877-684-9700 or (604) 685-9700

(604) 685-9744 (FAX)

info@canarc.net

www.canarc.net

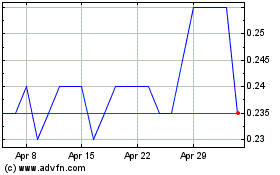

Canagold Resources (TSX:CCM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Canagold Resources (TSX:CCM)

Historical Stock Chart

From Dec 2023 to Dec 2024