Brookfield Corporation (NYSE: BN, TSX: BN) announced strong

financial results for the year ended December 31, 2023.

Nick Goodman, President of Brookfield

Corporation, said, “Our business had another excellent year in 2023

and we delivered strong financial results. Our asset management

business saw very strong fundraising momentum, our insurance

solutions business had a transformational year, and our operating

businesses continued to demonstrate their resilience. These,

combined with our access to multiple sources of capital, enabled us

to execute a number of value acquisitions during the year.”

He added, “We repurchased over $600 million

of shares in 2023 and expect to acquire at least a further

$1 billion this year, adding value to all remaining shares.

With significant growth levers embedded in the business, we are

well positioned to continue to deliver strong financial results

going forward and to achieve our targeted 15%+ per share returns

for our shareholders over the long term.”

Operating Results

Distributable earnings (“DE”) before

realizations increased by 17% and 12% per share compared to the

prior periods, after adjusting for the special distribution of 25%

of our asset management business in December 2022.

|

UnauditedFor the periods ended December 31(US$ millions, except per

share amounts) |

Three Months Ended |

|

Years Ended |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income1 |

$ |

3,134 |

|

$ |

44 |

|

$ |

5,105 |

|

$ |

5,195 |

| Distributable earnings before

realizations2,3 |

|

1,209 |

|

|

1,142 |

|

|

4,223 |

|

|

4,314 |

|

– Adjusted for the special distribution2,3,4 |

|

1,209 |

|

|

1,035 |

|

|

4,223 |

|

|

3,825 |

|

– Per Brookfield share2,3,4 |

|

0.76 |

|

|

0.65 |

|

|

2.66 |

|

|

2.38 |

| Distributable earnings2,3 |

|

1,312 |

|

|

1,498 |

|

|

4,806 |

|

|

5,229 |

|

– Per Brookfield share2,3 |

|

0.83 |

|

|

0.94 |

|

|

3.03 |

|

|

3.25 |

See endnotes on page 8.

Each of our businesses delivered strong

financial results during the year, amidst a challenging market

backdrop. Net income was $5.1 billion for the year, and DE

before realizations were $1.2 billion for the quarter and

$4.2 billion for the year.

Our asset management business benefited from

continued fundraising momentum and strong capital deployment across

our flagship funds and complementary fund offerings, driving an

increase in DE of 7% compared to the prior year.

In our insurance solutions business, we

continued to scale our asset base and leverage our investment

capabilities to drive earnings growth.

Our operating businesses generated stable and

growing cash distributions, underpinned by the resilient earnings

across our renewable power & transition, infrastructure and

private equity businesses, as well as 7% growth in same-store net

operating income (“NOI”) within our core real estate.

During the quarter and for the year, earnings

from realizations were $103 million and $583 million,

respectively, with total DE for the quarter and for the year of

$1.3 billion and $4.8 billion, respectively.

Regular Dividend

Declaration

The Board declared a 14% increase in the

quarterly dividend for Brookfield Corporation to $0.08 per share

(representing $0.32 per annum), payable on March 28, 2024 to

shareholders of record as at the close of business on March 13,

2024. The Board also declared the regular monthly and quarterly

dividends on our preferred shares.

Operating Highlights

DE before realizations were $1.2 billion

($0.76/share) for the quarter and $4.2 billion ($2.66/share) for

the year, representing an increase of 17% and 12% per share over

the prior periods, respectively, after adjusting for the special

distribution of 25% of our asset management business. Total DE was

$1.3 billion ($0.83/share) for the quarter and $4.8 billion

($3.03/share) for the year.

Asset Management:

- Distributable

earnings were $649 million ($0.41/share) in the quarter and

$2.6 billion ($1.61/share) for the year.

- Our private fund

strategies continue to attract strong interest from our clients,

leading to $93 billion of capital raised which, combined with

the approximately $50 billion anticipated upon the closing of

American Equity Life (“AEL”), brings the total to

$143 billion. Fee-bearing capital was $457 billion as of

December 31, 2023, an increase of $39 billion or 9% over the

prior year, and will shortly be over $500 billion with the

closing of AEL.

- Fee-related

earnings increased by 6% compared to the prior year.

- Our fundraising

outlook remains strong heading into 2024, which should contribute

to meaningful earnings growth.

Insurance Solutions:

- Distributable

operating earnings were $253 million ($0.16/share) in the

quarter and $740 million ($0.47/share) for the year.

- Our insurance

assets increased to approximately $60 billion, with the close

of Argo Group and the origination of new annuity policies. Our

average investment portfolio yield on our insurance assets was

5.5%, approximately 2% higher than the average cost of

capital.

- As at the end of

2023, annualized earnings in this business were $940 million.

With the closing of AEL expected shortly, our insurance solutions

business will grow to over $100 billion of assets and

$1.3 billion of annualized earnings.

- Through our

retail wealth and insurance solutions platforms, we remain on track

to reach $1.5 billion of monthly retail capital inflows in

2024.

Operating Businesses:

- Distributable

earnings were $400 million ($0.25/share) in the quarter and

$1.5 billion ($0.92/share) for the year.

- Operating Funds

from Operations within our renewable power & transition and

infrastructure businesses increased by 7% over the year, supporting

stable cash distributions. Our private equity business continues to

deliver strong earnings growth, with Adjusted EBITDA up by 11%,

benefiting from the essential nature of the services they

provide.

- In our real

estate business, our core portfolio produced same-store NOI growth

of 7% compared to the prior year. We continue to capture tenant

demand with over 15 million square feet of leases executed in

the year across all our office assets, and tenant sales per square

foot were 21% higher than 2019 in our core retail portfolio.

Earnings from the monetization of mature assets

were $103 million ($0.07/share) for the quarter and

$583 million ($0.37/share) for the year.

- During the year,

we monetized over $30 billion of assets—substantially all

transacting at values higher than our IFRS carrying values,

validating the carrying values of our investments.

- We recognized

$570 million of net realized carried interest into income during

the year, and with the pool of carry-eligible capital growing

larger every year, we expect significant cash flows going

forward.

- Total

accumulated unrealized carried interest now stands at $10.2

billion, representing an increase of 11% over the year, net of

carried interest realized into income.

We ended the quarter with $122 billion of

capital available to deploy into new investments.

- Over the year,

we returned $1.1 billion to shareholders through regular dividends

and share repurchases, with total share buybacks of over

$600 million.

- We have

$122 billion of deployable capital, which includes $38 billion

of cash, financial assets and undrawn credit lines at the

Corporation and our affiliates.

- Our balance

sheet remains conservatively capitalized, with a weighted-average

term of 13 years and modest maturities through to the end of

2025.

- We continue to

have strong access to the capital markets. In December, we received

a credit rating upgrade from DBRS on our senior unsecured debt to

A, reflecting the strength of our franchise and continued growth in

our earnings.

CONSOLIDATED BALANCE SHEETS

|

Unaudited(US$ millions) |

|

December 31 |

|

December 31 |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

11,222 |

|

$ |

14,396 |

| Other financial assets |

|

|

28,324 |

|

|

26,899 |

| Accounts receivable and

other |

|

|

31,001 |

|

|

30,208 |

| Inventory |

|

|

11,412 |

|

|

12,843 |

| Equity accounted

investments |

|

|

59,124 |

|

|

47,094 |

| Investment properties |

|

|

124,152 |

|

|

115,100 |

| Property, plant and

equipment |

|

|

147,617 |

|

|

124,268 |

| Intangible assets |

|

|

38,994 |

|

|

38,411 |

| Goodwill |

|

|

34,911 |

|

|

28,662 |

|

Deferred income tax assets |

|

|

3,338 |

|

|

3,403 |

|

Total Assets |

|

$ |

490,095 |

|

$ |

441,284 |

|

|

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

| Corporate borrowings |

|

$ |

12,160 |

|

$ |

11,390 |

| Accounts payable and

other |

|

|

59,011 |

|

|

57,941 |

| Non-recourse borrowings |

|

|

221,550 |

|

|

202,684 |

| Subsidiary equity

obligations |

|

|

4,145 |

|

|

4,188 |

| Deferred income tax

liabilities |

|

|

24,987 |

|

|

23,190 |

| |

|

|

|

|

| Equity |

|

|

|

|

|

Non-controlling interests in net assets |

$ |

122,465 |

|

$ |

98,138 |

|

|

Preferred equity |

|

4,103 |

|

|

4,145 |

|

|

Common equity |

|

41,674 |

|

168,242 |

|

39,608 |

|

141,891 |

|

Total Equity |

|

|

168,242 |

|

|

141,891 |

|

Total Liabilities and Equity |

|

$ |

490,095 |

|

$ |

441,284 |

CONSOLIDATED STATEMENTS OF

OPERATIONS

|

UnauditedFor the periods ended December 31(US$ millions, except per

share amounts) |

Three Months Ended |

|

Years Ended |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenues |

$ |

24,518 |

|

|

$ |

24,213 |

|

|

$ |

95,924 |

|

|

$ |

92,769 |

|

| Direct costs1 |

|

(18,168 |

) |

|

|

(18,218 |

) |

|

|

(72,334 |

) |

|

|

(70,828 |

) |

| Other income and gains |

|

4,256 |

|

|

|

989 |

|

|

|

6,501 |

|

|

|

1,594 |

|

| Equity accounted income |

|

429 |

|

|

|

273 |

|

|

|

2,068 |

|

|

|

2,613 |

|

| Interest expense |

|

|

|

|

|

|

|

|

– Corporate borrowings |

|

(142 |

) |

|

|

(158 |

) |

|

|

(596 |

) |

|

|

(527 |

) |

|

– Non-recourse borrowings |

|

|

|

|

|

|

|

|

Same-store |

|

(3,637 |

) |

|

|

(3,127 |

) |

|

|

(13,195 |

) |

|

|

(10,175 |

) |

|

Acquisitions, net of dispositions2 |

|

(260 |

) |

|

|

— |

|

|

|

(1,392 |

) |

|

|

— |

|

|

Upfinancings2 |

|

(6 |

) |

|

|

— |

|

|

|

(320 |

) |

|

|

— |

|

| Corporate costs |

|

(16 |

) |

|

|

(33 |

) |

|

|

(69 |

) |

|

|

(122 |

) |

| Fair value changes |

|

(1,326 |

) |

|

|

(1,811 |

) |

|

|

(1,396 |

) |

|

|

(977 |

) |

| Depreciation and

amortization |

|

(2,427 |

) |

|

|

(1,989 |

) |

|

|

(9,075 |

) |

|

|

(7,683 |

) |

| Income

tax |

|

(87 |

) |

|

|

(95 |

) |

|

|

(1,011 |

) |

|

|

(1,469 |

) |

|

Net income |

$ |

3,134 |

|

|

$ |

44 |

|

|

$ |

5,105 |

|

|

$ |

5,195 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to: |

|

|

|

|

|

|

|

|

Brookfield shareholders |

$ |

699 |

|

|

$ |

(316 |

) |

|

$ |

1,130 |

|

|

$ |

2,056 |

|

|

Non-controlling interests |

|

2,435 |

|

|

|

360 |

|

|

|

3,975 |

|

|

|

3,139 |

|

|

|

$ |

3,134 |

|

|

$ |

44 |

|

|

$ |

5,105 |

|

|

$ |

5,195 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

share |

|

|

|

|

|

|

|

|

Diluted |

$ |

0.42 |

|

|

$ |

(0.23 |

) |

|

$ |

0.61 |

|

|

$ |

1.19 |

|

|

Basic |

|

0.43 |

|

|

|

(0.23 |

) |

|

|

0.62 |

|

|

|

1.22 |

|

1. Direct costs disclosed above exclude depreciation and

amortization expense.2. Interest expense from acquisitions, net of

dispositions, and upfinancings completed over the year ended

December 31, 2023.

SUMMARIZED FINANCIAL

RESULTS

DISTRIBUTABLE EARNINGS

|

UnauditedFor the periods ended December 31(US$ millions) |

Three Months Ended |

|

Years Ended |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Asset management |

$ |

649 |

|

|

$ |

702 |

|

|

$ |

2,554 |

|

|

$ |

2,944 |

|

| |

|

|

|

|

|

|

|

| Insurance solutions |

|

253 |

|

|

|

170 |

|

|

|

740 |

|

|

|

388 |

|

| |

|

|

|

|

|

|

|

| BEP |

|

102 |

|

|

|

100 |

|

|

|

417 |

|

|

|

400 |

|

| BIP |

|

79 |

|

|

|

75 |

|

|

|

319 |

|

|

|

300 |

|

| BBU |

|

9 |

|

|

|

9 |

|

|

|

36 |

|

|

|

33 |

|

| BPG |

|

218 |

|

|

|

251 |

|

|

|

733 |

|

|

|

854 |

|

|

Other |

|

(8 |

) |

|

|

11 |

|

|

|

(43 |

) |

|

|

(53 |

) |

|

Operating businesses |

|

400 |

|

|

|

446 |

|

|

|

1,462 |

|

|

|

1,534 |

|

| |

|

|

|

|

|

|

|

|

Corporate costs and other |

|

(93 |

) |

|

|

(176 |

) |

|

|

(533 |

) |

|

|

(552 |

) |

|

Distributable earnings before realizations1 |

|

1,209 |

|

|

|

1,142 |

|

|

|

4,223 |

|

|

|

4,314 |

|

| Realized carried interest,

net |

|

100 |

|

|

|

280 |

|

|

|

570 |

|

|

|

555 |

|

|

Disposition gains from principal investments |

|

3 |

|

|

|

76 |

|

|

|

13 |

|

|

|

360 |

|

|

Distributable earnings1 |

$ |

1,312 |

|

|

$ |

1,498 |

|

|

$ |

4,806 |

|

|

$ |

5,229 |

|

1. Non-IFRS measure – see Non-IFRS and Performance Measures

section on page 8.

RECONCILIATION OF NET INCOME TO

DISTRIBUTABLE EARNINGS

|

UnauditedFor the periods ended December 31(US$ millions) |

Three Months Ended |

|

Years Ended |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income |

$ |

3,134 |

|

|

$ |

44 |

|

|

$ |

5,105 |

|

|

$ |

5,195 |

|

| Financial statement components

not included in DE: |

|

|

|

|

|

|

|

|

Equity accounted fair value changes and other items |

|

1,097 |

|

|

|

938 |

|

|

|

2,902 |

|

|

|

1,840 |

|

|

Fair value changes and other |

|

1,549 |

|

|

|

1,811 |

|

|

|

1,952 |

|

|

|

977 |

|

|

Depreciation and amortization |

|

2,427 |

|

|

|

1,989 |

|

|

|

9,075 |

|

|

|

7,683 |

|

|

Disposition gains in net income |

|

(4,424 |

) |

|

|

(1,280 |

) |

|

|

(6,080 |

) |

|

|

(2,604 |

) |

|

Deferred income taxes |

|

(416 |

) |

|

|

(285 |

) |

|

|

(897 |

) |

|

|

191 |

|

| Non-controlling interests in

the above items1 |

|

(2,064 |

) |

|

|

(1,802 |

) |

|

|

(7,941 |

) |

|

|

(8,109 |

) |

| Less: realized carried

interest, net |

|

(100 |

) |

|

|

(280 |

) |

|

|

(570 |

) |

|

|

(555 |

) |

| Working

capital, net |

|

6 |

|

|

|

7 |

|

|

|

677 |

|

|

|

(304 |

) |

|

Distributable earnings before

realizations2 |

|

1,209 |

|

|

|

1,142 |

|

|

|

4,223 |

|

|

|

4,314 |

|

| Realized carried interest,

net3 |

|

100 |

|

|

|

280 |

|

|

|

570 |

|

|

|

555 |

|

|

Disposition gains from principal investments |

|

3 |

|

|

|

76 |

|

|

|

13 |

|

|

|

360 |

|

|

Distributable earnings2 |

$ |

1,312 |

|

|

$ |

1,498 |

|

|

$ |

4,806 |

|

|

$ |

5,229 |

|

1. Amounts attributable to non-controlling interests are

calculated based on the economic ownership interests held by

non-controlling interests in consolidated subsidiaries. By

adjusting DE attributable to non-controlling interests, we are able

to remove the portion of DE earned at non-wholly owned subsidiaries

that is not attributable to Brookfield.2. Non-IFRS measure – see

Non-IFRS and Performance Measures section on page 8.3. Includes our

share of Oaktree’s distributable earnings attributable to realized

carried interest.

EARNINGS PER SHARE

|

UnauditedFor the periods ended December 31(US$ millions) |

Three Months Ended |

|

Years Ended |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income |

$ |

3,134 |

|

|

$ |

44 |

|

|

$ |

5,105 |

|

|

$ |

5,195 |

|

|

Non-controlling interests |

|

(2,435 |

) |

|

|

(360 |

) |

|

|

(3,975 |

) |

|

|

(3,139 |

) |

|

Net income (loss) attributable to shareholders |

|

699 |

|

|

|

(316 |

) |

|

|

1,130 |

|

|

|

2,056 |

|

| Preferred share

dividends1 |

|

(43 |

) |

|

|

(39 |

) |

|

|

(166 |

) |

|

|

(150 |

) |

|

Net income (loss) available to common shareholders |

|

656 |

|

|

|

(355 |

) |

|

|

964 |

|

|

|

1,906 |

|

|

Dilutive impact of exchangeable shares of affiliate |

|

3 |

|

|

|

— |

|

|

|

5 |

|

|

|

5 |

|

|

Net income (loss) available to common shareholders including

dilutive impact of exchangeable shares |

$ |

659 |

|

|

$ |

(355 |

) |

|

$ |

969 |

|

|

$ |

1,911 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares |

|

1,540.1 |

|

|

|

1,574.8 |

|

|

|

1,558.5 |

|

|

|

1,567.5 |

|

|

Dilutive effect of conversion of options and escrowed shares using

treasury stock method2and exchangeable shares of affiliate |

|

40.8 |

|

|

|

— |

|

|

|

29.7 |

|

|

|

40.7 |

|

|

Shares and share equivalents |

|

1,580.9 |

|

|

|

1,574.8 |

|

|

|

1,588.2 |

|

|

|

1,608.2 |

|

|

|

|

|

|

|

|

|

|

| Diluted

earnings per share3 |

$ |

0.42 |

|

|

$ |

(0.23 |

) |

|

$ |

0.61 |

|

|

$ |

1.19 |

|

1. Excludes dividends paid on perpetual subordinated notes of

$2 million (2022 – $2 million) and $10 million (2022 –

$10 million) for the three months and year ended December 31, 2023,

which are recognized within net income.2. Includes management share

option plan and escrowed stock plan.3. Per share amounts are

inclusive of dilutive effect of mandatorily redeemable preferred

shares held in a consolidated subsidiary.

Additional Information

The Letter to Shareholders and the company’s

Supplemental Information for the three months and year ended

December 31, 2023, contain further information on the company’s

strategy, operations and financial results. Shareholders are

encouraged to read these documents, which are available on the

company’s website.

The statements contained herein are based

primarily on information that has been extracted from our financial

statements for the quarter and year ended December 31, 2023, which

have been prepared using IFRS, as issued by the IASB. The amounts

have not been audited by Brookfield Corporation’s external

auditor.

Brookfield Corporation’s Board of Directors has

reviewed and approved this document, including the summarized

unaudited consolidated financial statements prior to its

release.

Information on our dividends can be found on our

website under Stock & Distributions/Distribution History.

Quarterly Earnings Call

Details

Investors, analysts and other interested parties

can access Brookfield Corporation’s 2023 Fourth Quarter Results as

well as the Shareholders’ Letter and Supplemental Information on

Brookfield Corporation’s website under the Reports & Filings

section at www.bn.brookfield.com.

To participate in the Conference Call today at

10:00 a.m. EST, please pre-register at

https://register.vevent.com/register/BId6d208f8e3d945d3895a5237b545f122.

Upon registering, you will be emailed a dial-in number, and unique

PIN. The Conference Call will also be webcast live at

https://edge.media-server.com/mmc/p/k46r888g. For those unable to

participate in the Conference Call, the telephone replay will be

archived and available until February 8, 2025. To access this

rebroadcast, please visit:

https://edge.media-server.com/mmc/p/k46r888g.

About Brookfield

Corporation

Brookfield Corporation is a premier global

wealth manager for institutions and individuals around the world.

With one of the largest pools of discretionary capital globally, we

invest in real assets that form the backbone of the global economy

to deliver attractive risk-adjusted returns to our stakeholders. We

do this three ways: directly with our $150 billion of capital,

through Brookfield Asset Management, one of the leading global

alternative asset managers with over $900 billion of assets under

management, and through our Insurance Solutions business which

today has $60 billion of assets. Over the long term, we are focused

on delivering 15%+ annualized returns to our shareholders.

Brookfield Corporation is publicly traded in New York and Toronto

(NYSE: BN, TSX: BN).

Please note that Brookfield Corporation’s

previous audited annual and unaudited quarterly reports have been

filed on EDGAR and SEDAR+ and can also be found in the investor

section of its website at www.brookfield.com. Hard copies of the

annual and quarterly reports can be obtained free of charge upon

request.

For more information, please visit our website at

www.bn.brookfield.com or contact:

|

Communications & Media:Kerrie McHughTel: (212)

618-3469Email: kerrie.mchugh@brookfield.com |

|

Investor Relations: Linda Northwood Tel: (416)

359-8647Email: linda.northwood@brookfield.com |

Non-IFRS and Performance

Measures

This news release and accompanying financial

information are based on International Financial Reporting

Standards (“IFRS”), as issued by the International Accounting

Standards Board (“IASB”), unless otherwise noted.

We make reference to Distributable Earnings

(“DE”). We define DE as the sum of distributable earnings from our

asset management business, distributable operating earnings from

our insurance solutions business, distributions received from our

ownership of investments, realized carried interest and disposition

gains from principal investments, net of earnings from our

Corporate Activities, preferred share dividends and equity-based

compensation costs. We also make reference to DE before

realizations, which refers to DE before realized carried interest

and realized disposition gains from principal investments. We

believe these measures provide insight into earnings received by

the company that are available for distribution to common

shareholders or to be reinvested into the business.

Realized carried interest and realized

disposition gains are further described below:

- Realized Carried

Interest represents our contractual share of investment gains

generated within a private fund after considering our clients’

minimum return requirements. Realized carried interest is

determined on third-party capital that is no longer subject to

future investment performance.

- Realized

Disposition Gains from principal investments are included in DE

because we consider the purchase and sale of assets from our

directly held investments to be a normal part of the company’s

business. Realized disposition gains include gains and losses

recorded in net income and equity in the current period, and are

adjusted to include fair value changes and revaluation surplus

balances recorded in prior periods which were not included in prior

period DE.

We make reference to Funds from Operations

(“FFO”). We define FFO as net income attributable to shareholders

prior to fair value changes, depreciation and amortization, and

deferred income taxes, and it includes realized disposition gains

that are not recorded in net income as determined under IFRS. FFO

also includes the company’s share of equity accounted investments’

FFO on a fully diluted basis.

FFO consists of the following components:

- Operating FFO

represents the company’s share of revenues less direct costs and

interest expenses; excludes realized carried interest and

disposition gains, fair value changes, depreciation and

amortization and deferred income taxes; and includes our

proportionate share of FFO from operating activities recorded by

equity accounted investments on a fully diluted basis. We present

this measure as we believe it assists in describing our results and

variances within FFO.

- Realized Carried

Interest as defined above.

- Realized

Disposition Gains are included in FFO because we consider the

purchase and sale of assets to be a normal part of the company’s

business. Realized disposition gains include gains and losses

recorded in net income and equity in the current period, and are

adjusted to include fair value changes and revaluation surplus

balances recorded in prior periods which were not included in prior

period FFO.

We use DE and FFO to assess our operating

results and the value of Brookfield Corporation’s business and

believe that many shareholders and analysts also find these

measures of value to them.

We make reference to Net Operating Income

(“NOI”), which refers to the revenues from our operations less

direct expenses before the impact of depreciation and amortization

within our real estate business. We present this measure as we

believe it is a key indicator of our ability to impact the

operating performance of our properties. As NOI excludes

non-recurring items and depreciation and amortization of real

estate assets, it provides a performance measure that, when

compared to prior periods, reflects the impact of operations from

trends in occupancy rates and rental rates.

We report adjusted earnings before interest,

taxes, depreciation, and amortization (“Adjusted EBITDA”), which

refers to our private equity business’ net income and equity

accounted income at its share, excluding the impact of interest

income (expense), net, income taxes, depreciation and amortization,

gains (losses) on acquisitions/dispositions, net, transaction

costs, restructuring charges, revaluation gains or losses,

impairment expenses or reversals, other income (expense), net and

distributions to preferred equity holders. We believe that Adjusted

EBITDA is a measure of our private equity business’ ability to

generate recurring earnings.

We disclose a number of financial measures in

this news release that are calculated and presented using

methodologies other than in accordance with IFRS. These financial

measures, which include DE and FFO, should not be considered as the

sole measure of our performance and should not be considered in

isolation from, or as a substitute for, similar financial measures

calculated in accordance with IFRS. We caution readers that these

non-IFRS financial measures or other financial metrics are not

standardized under IFRS and may differ from the financial measures

or other financial metrics disclosed by other businesses and, as a

result, may not be comparable to similar measures presented by

other issuers and entities.

We provide additional information on key terms

and non-IFRS measures in our filings available at

www.bn.brookfield.com.

1. Consolidated basis – includes amounts

attributable to non-controlling interests. 2.

Excludes amounts attributable to non-controlling interests.3. See

Reconciliation of Net Income to Distributable Earnings on page 5

and Non-IFRS and Performance Measures section on page 8.4.

Distributable earnings before realizations, including per share

amounts, for the three months and year ended December 31, 2022 were

adjusted for the special distribution of 25% of our asset

management business on December 9, 2022.

Notice to Readers

Brookfield Corporation is not making any offer

or invitation of any kind by communication of this news release and

under no circumstance is it to be construed as a prospectus or an

advertisement.

This news release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of the

U.S. Securities Act of 1933, the U.S. Securities Exchange Act of

1934, “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and in any applicable

Canadian securities regulations (collectively, “forward-looking

statements”). Forward-looking statements include statements that

are predictive in nature, depend upon or refer to future results,

events or conditions, and include, but are not limited to,

statements which reflect management’s current estimates, beliefs

and assumptions regarding the operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies, capital management and outlook of Brookfield

Corporation and its subsidiaries, as well as the outlook for North

American and international economies for the current fiscal year

and subsequent periods, and which are in turn based on our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors

management believes are appropriate in the circumstances. The

estimates, beliefs and assumptions of Brookfield Corporation are

inherently subject to significant business, economic, competitive

and other uncertainties and contingencies regarding future events

and as such, are subject to change. Forward-looking statements are

typically identified by words such as “expect,” “anticipate,”

“believe,” “foresee,” “could,” “estimate,” “goal,” “intend,”

“plan,” “seek,” “strive,” “will,” “may” and “should” and similar

expressions. In particular, the forward-looking statements

contained in this news release include statements referring to the

impact of current market or economic conditions on our business,

the future state of the economy or the securities market, the AEL

acquisition, including its anticipated closing timeline and

expected impact on our business, the anticipated allocation and

deployment of our capital, our fundraising targets, and our target

growth objectives.

Although Brookfield Corporation believes that

such forward-looking statements are based upon reasonable

estimates, beliefs and assumptions, actual results may differ

materially from the forward-looking statements. Factors that could

cause actual results to differ materially from those contemplated

or implied by forward-looking statements include, but are not

limited to: (i) returns that are lower than target; (ii) the impact

or unanticipated impact of general economic, political and market

factors in the countries in which we do business; (iii) the

behavior of financial markets, including fluctuations in interest

and foreign exchange rates; (iv) global equity and capital markets

and the availability of equity and debt financing and refinancing

within these markets; (v) strategic actions including acquisitions

and dispositions; the ability to complete and effectively integrate

acquisitions into existing operations and the ability to attain

expected benefits; (vi) changes in accounting policies and methods

used to report financial condition (including uncertainties

associated with critical accounting assumptions and estimates);

(vii) the ability to appropriately manage human capital; (viii) the

effect of applying future accounting changes; (ix) business

competition; (x) operational and reputational risks; (xi)

technological change; (xii) changes in government regulation and

legislation within the countries in which we operate; (xiii)

governmental investigations; (xiv) litigation; (xv) changes in tax

laws; (xvi) ability to collect amounts owed; (xvii) catastrophic

events, such as earthquakes, hurricanes and epidemics/pandemics;

(xviii) the possible impact of international conflicts and other

developments including terrorist acts and cyberterrorism; (xix) the

introduction, withdrawal, success and timing of business

initiatives and strategies; (xx) the failure of effective

disclosure controls and procedures and internal controls over

financial reporting and other risks; (xxi) health, safety and

environmental risks; (xxii) the maintenance of adequate insurance

coverage; (xxiii) the existence of information barriers between

certain businesses within our asset management operations; (xxiv)

risks specific to our business segments including real estate,

renewable power and transition, infrastructure, private equity, and

reinsurance; and (xxv) factors detailed from time to time in our

documents filed with the securities regulators in Canada and the

United States.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive and other

factors could also adversely affect future results. Readers are

urged to consider these risks, as well as other uncertainties,

factors and assumptions carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such

forward-looking statements, which are based only on information

available to us as of the date of this news release. Except as

required by law, Brookfield Corporation undertakes no obligation to

publicly update or revise any forward-looking statements, whether

written or oral, that may be as a result of new information, future

events or otherwise.

Past performance is not indicative nor a

guarantee of future results. There can be no assurance that

comparable results will be achieved in the future, that future

investments will be similar to historic investments discussed

herein, that targeted returns, growth objectives, diversification

or asset allocations will be met or that an investment strategy

or investment objectives will be achieved (because of economic

conditions, the availability of appropriate opportunities or

otherwise).

Target returns and growth objectives set forth

in this news release are for illustrative and informational

purposes only and have been presented based on various assumptions

made by Brookfield Corporation in relation to the investment

strategies being pursued, any of which may prove to be incorrect.

There can be no assurance that targeted returns or growth

objectives will be achieved. Due to various risks, uncertainties

and changes (including changes in economic, operational, political

or other circumstances) beyond Brookfield Corporation’s control,

the actual performance of the business could differ materially from

the target returns and growth objectives set forth herein. In

addition, industry experts may disagree with the assumptions used

in presenting the target returns and growth objectives. No

assurance, representation or warranty is made by any person that

the target returns or growth objectives will be achieved, and undue

reliance should not be put on them. Prior performance is not

indicative of future results and there can be no guarantee that

Brookfield Corporation will achieve the target returns or growth

objectives or be able to avoid losses.

Certain of the information contained herein is

based on or derived from information provided by independent

third-party sources. While Brookfield Corporation believes that

such information is accurate as of the date it was produced and

that the sources from which such information has been obtained are

reliable, Brookfield Corporation makes no representation or

warranty, express or implied, with respect to the accuracy,

reasonableness or completeness of any of the information or the

assumptions on which such information is based, contained herein,

including but not limited to, information obtained from third

parties.

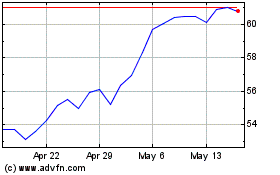

Brookfield (TSX:BN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brookfield (TSX:BN)

Historical Stock Chart

From Nov 2023 to Nov 2024