Sartorius (FWB:SRT), a leading international laboratory and

pharmaceutical equipment provider, successfully closed the first

six months of 2012, with substantial gains in order intake, sales

revenue and earnings. The Bioprocess Solutions Division that

primarily specializes in single-use products for pharmaceutical

drug manufacture performed especially well. Furthermore, initial

consolidation of the Biohit Liquid Handling business considerably

boosted growth for the Laboratory Products & Services Division.

Based on the company’s strong first-half results, management lifted

its guidance for the full year of 2012. Accordingly, Sartorius now

expects its sales to grow by about 11% in constant currencies

(former guidance: +10%). In addition, provided that currency

exchange rates remain favorable as in the first half, adjusted

earnings (operating EBITA) are projected to increase by around 15%

(former guidance: +10%).

Dynamic Growth of Sales Revenue and Order IntakeIn the

first half of 2012, Sartorius increased its sales revenue year over

year by 19.3%, or 15.6% in constant currencies, to 422.1 million

euros. The Biohit Liquid Handling business acquired at the end of

2011 added approximately six percentage points to this gain. In the

same period, order intake rose 15.3%, or 11.7% in constant

currencies, to 434.2 million euros.

All three Group divisions fueled this dynamic business

performance. Accounting for more than half of consolidated revenue,

the Bioprocess Solutions Division continued on the growth track of

the past quarters: it posted solid organic sales growth of 237.4

million euros, up 21.2%, or 17.3% in constant currencies. Order

intake for this division also rose significantly by 12.2%, or 8.5%

in constant currencies, to 243.4 million euros. Demand was strong,

especially for single-use products for the manufacture of

biopharmaceuticals, such as specialty filters and aseptic bags and

tanks.

The Lab Products & Services Division, which provides premium

laboratory instruments and consumables, boosted its first-half

sales revenue by 20.2%, or 16.1% in constant currencies, to 133.0

million euros, seeing an uptick in order intake of 29.0%, or 24.7%

in constant currencies, to 139.7 million euros. Initial

consolidation of the Biohit Liquid Handling business acquired at

the end of 2011 contributed around 18 percentage points, based on

constant currencies, to growth for this division. Sales revenue for

the company’s smallest division, Industrial Weighing, improved,

also when seen against the backdrop of a moderate year-earlier

revenue base, by 9.5%, or 7.3% in constant currencies, to 51.8

million euros, while its order intake at 51.1 million euros was

nearly at the previous year’s level of 51.4 million

(currency-adjusted: -2.6%).

Regional analysis shows that North America posted the highest

growth, up 30.2%. In Asia, business expanded by 14.9%; Europe saw

gains of 10.8% (all regional figures in constant currencies).

Significant Increase in EarningsBased on its dynamic

sales performance, Sartorius further increased its first-half

earnings year over year. The Group's operating earnings1) surged by

around one-fourth (+24.6%) from 51.1 million euros to 63.6 million

euros; the respective margin for the Group climbed from 14.4% to

15.1%. In the same period, the Bioprocess Solutions Division

boosted its earnings 28.7% to 42.9 million euros; its margin rose

from 17.0% to 18.1%. The Lab Division lifted its operating earnings

by nearly 9% to 16.5 million euros from 15.2 million euros, with a

margin of 12.4%, relative to 13.7% a year earlier. Following a

comparatively moderate first half in 2011 (2.5 million euros), the

Industrial Weighing Division achieved operating earnings of 4.2

million euros. Accordingly, its operating margin improved

significantly from 5.4% to 8.1%.

Group EBITA rose year on year by 27.3% to 56.5 million euros, up

from 44.4 million euros. This figure includes extraordinary items

of -7.1 million euros (1st half 2011: -6.7 million euros), which

were essentially related to integration of the Biohit Liquid

Handling business, preparations for the transfer of single-use bag

manufacture from the USA to Puerto Rico and to various

cross-divisional projects. The corresponding EBITA margin was at

13.4%, compared with 12.5% a year ago. The Group’s relevant net

profit2) soared 24.5% from 23.7 million euros a year earlier to

29.5 million euros. The Group’s respective earnings per share are

at 1.73 euros, up from 1.39 euros in the previous year.

Full-year Guidance RaisedBased on the company’s strong

business performance in the first half, management raised its sales

and earnings guidance for the full year of 2012. Sartorius now

anticipates that full-year sales revenue will grow by about 11%

(former guidance: about 10%) in constant currencies. Around five

percentage points of this gain are forecast to be generated by the

initial consolidation of the Biohit Liquid Handling business. In

addition, provided that currency exchange rates remain favorable as

in the first half of 2012, management projects that operating EBITA

will increase by around 15% (former guidance: around 10%).

In view of the three divisions, Sartorius anticipates that

currency-adjusted sales revenue for Bioprocess Solutions will grow

approximately 10% (former guidance: 6% to 8%). Operating EBITA is

expected to increase by around 15% (former guidance: 6% to 8%)

compared to the previous year.

For the Lab Products & Services Division, management's

forecast has remained unchanged: sales revenue is projected to

expand by approximately 16% to 20% in constant currencies,

primarily due to initial consolidation of the Biohit Liquid

Handling business. The division's operating EBITA is forecasted to

increase in fiscal 2012 by around 20% to 24% (former guidance: 16%

to 20%).

The growth and earnings forecast for the Industrial Weighing

Division is confirmed: currency-adjusted sales revenue and

operating EBITA are expected to show stable development relative to

the previous year.

1) Sartorius uses earnings before interest, taxes and

amortization, EBITA, as the key profitability measure. To enable a

more informative comparison of the figures given for the previous

years, the company additionally reports operating earnings adjusted

for extraordinary items (= operating EBITA) besides EBITA.

2) Underlying net profit after non-controlling interest,

excluding non-cash amortization and effects from valuation

adjustments of derivative financial instruments.

Key Figures for the First Half of

2012http://www.sartorius.de/fileadmin/media/global/company/pr_20120725_hy_figures_sag.pdf

Current Image FilesDr. Joachim Kreuzburg, CEO and

Executive Board Chairman of Sartorius

AG:www.sartorius.com/fileadmin/media/global/company/pr_20120419_kreuzburg.jpg

Sartorius products used in the manufacture of

medications:www.sartorius.com/fileadmin/media/global/company/pr_20120419_bioprocess_solutions.jpg

Sartorius products used in laboratory

research:www.sartorius.com/fileadmin/media/global/company/pr_20120419_lab_products_services.jpg

Conference Call and Webcast

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius, will discuss the 2012 first-half results with analysts

and investors on July 25, 2012, at 3:30 p.m. Central European Time

in a webcast teleconference. You may dial into the teleconference

starting at 3:15 p.m. CET at the following numbers:

Germany: +49 (0)69 3807 89637France: +33 (0)1 70 48 01 63UK:

+44(0)20 3106 7162USA: +1646 254 3370

The dial-in code is as follows: 4528852; the webcast and

presentation can be viewed at: www.sartorius.com

Upcoming Financial Dates:October 29, 2012 Publication of

nine-month figures (January to September 2012)January 2013

Publication of the preliminary figures for fiscal 2012

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties.

This is a translation of the original German-language press

release. Sartorius shall not assume any liability for the

correctness of this translation. The original German press release

is the legally binding version. Furthermore, Sartorius reserves the

right not to be responsible for the topicality, correctness,

completeness or quality of the information provided. Liability

claims regarding damage caused by the use of any information

provided, including any kind of information which is incomplete or

incorrect, will therefore be rejected.

A Profile of SartoriusThe Sartorius Group is a leading

international laboratory and process technology provider covering

the segments of Bioprocess Solutions, Lab Products & Services

and Industrial Weighing. In 2011, the technology group earned sales

revenue of 733.1 million euros. Founded in 1870, the

Goettingen-based company currently employs more than 5,000 persons.

The major areas of activity of its Bioprocess Solutions segment

cover filtration, fluid management, fermentation, cell cultivation

and purification, and focus on production processes in the

biopharmaceutical industry. The Lab Products & Services segment

primarily manufactures laboratory instruments and consumables.

Industrial Weighing concentrates on weighing, monitoring and

control applications in the manufacturing processes of the food,

chemical and pharma sectors. Sartorius has its own production

facilities in Europe, Asia and America as well as sales

subsidiaries and local commercial agencies in more than 110

countries.

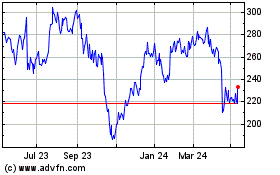

Sartorius (TG:SRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

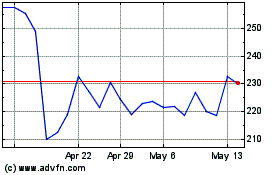

Sartorius (TG:SRT)

Historical Stock Chart

From Jan 2024 to Jan 2025