XPO Completes Spin-Off of RXO

November 01 2022 - 7:00AM

XPO (NYSE: XPO) today announced that it has completed the

previously announced spin-off of RXO, Inc., creating two

independent, publicly traded companies. XPO is a leading provider

of less-than-truckload transportation in North America, and RXO is

the fourth largest US truckload broker. XPO shares will continue to

trade on the New York Stock Exchange under the symbol “XPO” and,

effective today, RXO will begin “regular way” trading on the NYSE

under the symbol “RXO.”

Brad Jacobs, executive chairman of XPO, said,

“With the spin-off complete, XPO and RXO have both launched from

positions of strength as independent public companies. I want to

thank the many people who have worked to make our strategic plan a

success and created powerful new avenues for value creation.”

The separation was completed through a

distribution to XPO stockholders of one share of RXO common stock

for every one share of XPO common stock held as of the close of

business on the record date for the distribution, October 20, 2022.

RXO shares were distributed at 12:01 a.m. Eastern Time on November

1, 2022 in a distribution that is intended to be tax-free to XPO

stockholders for U.S. federal income tax purposes.

BofA Securities, Inc., Goldman Sachs & Co. LLC

and Morgan Stanley & Co. LLC acted as financial advisors and

Paul, Weiss, Rifkind, Wharton & Garrison LLP and Wachtell,

Lipton, Rosen & Katz acted as legal advisors in connection with

the separation.

About XPO

XPO (NYSE: XPO) is one of the largest providers of

asset-based less-than-truckload (LTL) transportation in North

America, with proprietary technology that moves goods efficiently

through its network. Together with its business in Europe, XPO

serves approximately 43,000 shippers with 564 locations and

38,000 employees. The company is headquartered in Greenwich,

Conn., USA. Visit xpo.com for more information, and

connect with XPO

on Facebook, Twitter, LinkedIn, Instagram and YouTube.

Forward-Looking Statements

This press release includes forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements other than statements of

historical fact are, or may be deemed to be, forward-looking

statements, including the statements above regarding benefits of

the spin-off transaction, as well as the expected performance of

the company after the spin-off. Any forward-looking statements

contained herein are based on our management’s current beliefs and

expectations, but are subject to a number of risks, uncertainties

and changes in circumstances, which may cause the company’s actual

results or actions to differ materially from what is expressed or

implied by these statements. Such risks include, but are not

limited to: uncertainties as to the impact of the spin-off on the

company’s business, as well as the disclosure contained under the

heading “Risk Factors” in the company’s filings with the U.S.

Securities and Exchange Commission. We disclaim any obligation to

update these forward-looking statements other than as required by

law.

Investor ContactTavio

HeadleyXPO+1-203-413-4006tavio.headley@xpo.com

Media ContactKarina

FrayterXPO+1-203-484-8303karina.frayter@xpo.com

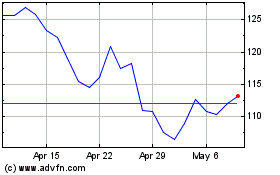

XPO (NYSE:XPO)

Historical Stock Chart

From Jun 2024 to Jul 2024

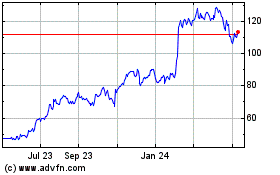

XPO (NYSE:XPO)

Historical Stock Chart

From Jul 2023 to Jul 2024