Vital Energy Announces Offering of $100.0 Million of Senior Notes

April 01 2024 - 7:33AM

Vital Energy, Inc., a Delaware corporation (NYSE: VTLE) (“Vital

Energy” or the “Company”), today announced that it intends to offer

(the “Offering”), subject to market and other conditions, $100.0

million in aggregate principal amount of 7.875% senior notes due

2032 (the “senior notes”) in a private placement to eligible

purchasers. The Company intends to use the net proceeds from this

offering, if completed, to repay or repurchase indebtedness,

including in connection with the funding of the purchase for cash

our 10.125% senior notes due 2028 and certain of our 9.750% senior

notes due 2030 in the cash tender offers (the “Tender Offers”) the

Company commenced pursuant to an offer to purchase dated March 14,

2024, as amended, or for general corporate purposes. The senior

notes will be senior unsecured obligations of the Company and will

be guaranteed on a senior unsecured basis by Vital Midstream

Services, LLC, a subsidiary of the Company, and certain of its

future subsidiaries.

The senior notes are being offered as additional notes under the

indenture dated as of March 28, 2024 (the “Indenture”), pursuant to

which the Company has previously issued $800.0 million aggregate

principal amount of 7.875% senior notes due 2032 (the “existing

notes”). The senior notes have substantially identical terms, other

than the issue date and issue price, as the existing notes, and the

senior notes and the existing notes will be treated as a single

class of securities under the Indenture and will vote together as a

single class.

The senior notes have not been registered under the Securities

Act of 1933, as amended (the “Securities Act”), or any state

securities laws, and may not be offered or sold within the United

States or to, or for the account or benefit of, U.S. persons except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws. The senior notes will be offered and sold

only to persons reasonably believed to be qualified institutional

buyers pursuant to Rule 144A under the Securities Act and to

non-U.S. persons outside the United States pursuant to Regulation S

under the Securities Act.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the senior notes, nor shall it

constitute an offer, solicitation or sale in any jurisdiction in

which, or to any person to whom, such an offer, solicitation or

sale is unlawful. Additionally, this press release shall not

constitute an offer to purchase or a solicitation of an offer to

purchase or sell the notes subject to the Tender Offers, and such

Tender Offers are being made solely pursuant to the offer to

purchase.

About Vital EnergyVital Energy, Inc. is an

independent energy company with headquarters in Tulsa, Oklahoma.

Vital Energy’s business strategy is focused on the acquisition,

exploration and development of oil and natural gas properties in

the Permian Basin of West Texas.

Forward-Looking StatementsThis press release

contains forward-looking statements as defined under Section 27A of

the Securities Act and Section 21E of the Exchange Act. All

statements, other than statements of historical facts, that address

activities that Vital Energy assumes, plans, expects, believes,

intends, projects, indicates, enables, transforms, estimates or

anticipates (and other similar expressions) will, should or may

occur in the future are forward-looking statements. The

forward-looking statements are based on management’s current

belief, based on currently available information, as to the outcome

and timing of future events. Such statements are not guarantees of

future performance and involve risks, assumptions and

uncertainties. General risks relating to Vital Energy include, but

are not limited to, continuing and worsening inflationary pressures

and associated changes in monetary policy that may cause costs to

rise; changes in domestic and global production, supply and demand

for commodities, including as a result of actions by the

Organization of Petroleum Exporting Countries and other producing

countries (“OPEC+”) and the Russian-Ukrainian or Israeli-Hamas

military conflicts, the decline in prices of oil, natural gas

liquids and natural gas and the related impact to financial

statements as a result of asset impairments and revisions to

reserve estimates, reduced demand due to shifting market perception

towards the oil and gas industry; competition in the oil and gas

industry; the ability of the Company to execute its strategies,

including its ability to successfully identify and consummate

strategic acquisitions at purchase prices that are accretive to its

financial results and to successfully integrate acquired

businesses, assets and properties, pipeline transportation and

storage constraints in the Permian Basin, the effects and duration

of the outbreak of disease, and any related government policies and

actions, long-term performance of wells, drilling and operating

risks, the possibility of production curtailment, the impact of new

laws and regulations, including those regarding the use of

hydraulic fracturing, and under the Inflation Reduction Act (the

“IRA”), including those related to climate change, the impact of

legislation or regulatory initiatives intended to address induced

seismicity on our ability to conduct our operations; uncertainties

in estimating reserves and production results; hedging activities,

tariffs on steel, the impacts of severe weather, including the

freezing of wells and pipelines in the Permian Basin due to cold

weather, possible impacts of litigation and regulations, the impact

of the Company’s transactions, if any, with its securities from

time to time, the impact of new environmental, health and safety

requirements applicable to the Company’s business activities, the

possibility of the elimination of federal income tax deductions for

oil and gas exploration and development and imposition of any

additional taxes under the IRA or otherwise, and other factors,

including those and other risks described in its Annual Report on

Form 10-K for the year ended December 31, 2023 and those set forth

from time to time in other filings with the Securities and Exchange

Commission (“SEC”). These documents are available through Vital

Energy’s website at www.vitalenergy.com under the tab “Investor

Relations” or through the SEC’s Electronic Data Gathering and

Analysis Retrieval System at www.sec.gov. Any of these factors

could cause Vital Energy’s actual results and plans to differ

materially from those in the forward-looking statements. Therefore,

Vital Energy can give no assurance that its future results will be

as estimated. Any forward-looking statement speaks only as of the

date on which such statement is made. Vital Energy does not intend

to, and disclaims any obligation to, correct, update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Investor Contact:Ron

Hagood918.858.5504ir@vitalenergy.com

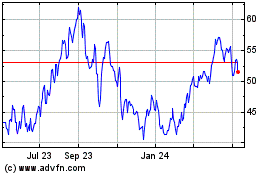

Vital Energy (NYSE:VTLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

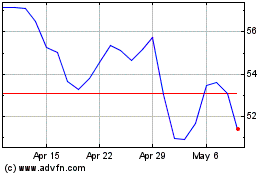

Vital Energy (NYSE:VTLE)

Historical Stock Chart

From Nov 2023 to Nov 2024