false

0001163302

UNITED STATES STEEL CORP

0001163302

2024-05-30

2024-05-30

0001163302

exch:XNYS

2024-05-30

2024-05-30

0001163302

exch:XCHI

2024-05-30

2024-05-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported):

May 30, 2024

United States Steel Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-16811 |

|

25-1897152 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

600 Grant Street,

Pittsburgh, PA 15219-2800

(Address of Principal Executive Offices,

and Zip Code)

(412) 433-1121

Registrant’s Telephone Number,

Including Area Code

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which registered |

| Common Stock |

X |

New York Stock Exchange

|

| Common Stock |

X |

Chicago Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On May 30, 2024, United States Steel Corporation and Nippon Steel

Corporation issued a joint press release titled “U. S. Steel and Nippon Steel Corporation Announce Receipt of All Non-U.S. Regulatory

Approvals.” A copy of that press release is attached hereto as Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

| By |

/s/

Manpreet S. Grewal |

|

| |

Manpreet S. Grewal |

|

| |

Vice President, Controller & Chief Accounting

Officer |

|

Dated: May 30, 2024

Exhibit 99.1

|

News release |

For

Immediate release

U. S. Steel and

Nippon Steel Corporation Announce Receipt of All Non-U.S. Regulatory Approvals

Approvals are Significant Milestones for Completion

of the Transaction

PITTSBURGH

May 30, 2024 – United States Steel Corporation (NYSE: X) (“U. S. Steel”) and Nippon Steel Corporation (“Nippon

Steel”) (TSE: 5401) announced that they have received all regulatory approvals outside of the United States related to the proposed

transaction between U. S. Steel and Nippon Steel. These approvals have been received from the Directorate-General for Competition of

the European Commission (pursuant to the EU Merger Regulation and, separately, the Foreign Subsidies Regulation), the Mexican Federal

Economic Competition Commission, the Serbian Competition Commission, the Ministry of Economy of Slovakia, the Turkish Competition Authority.

In addition, the United Kingdom Competition and Markets Authority confirmed that it had no further questions regarding the proposed transaction

in response to the submission of a voluntary briefing paper.

David B.

Burritt, President & Chief Executive Officer of U. S. Steel, commented, “We are pleased with the regulatory approvals

received, as they are a clear indication that the transaction with Nippon Steel is pro-competitive and supports the strategic merits

of foreign investment. Together with Nippon Steel, U. S. Steel will become a world-leading steelmaker with enhanced technologies and

resources to support a stronger steel industry with enhanced competition. This deal is the best deal for American steel, the best

deal for American jobs and the best deal for America’s ability to create an even stronger alliance with Japan against

China.”

| ©2024 U. S. Steel. All Rights Reserved | www.ussteel.com |  |

News release

Takahiro Mori, Representative

Director and Vice Chairman of Nippon Steel, said, “We appreciate this significant milestone of receiving regulatory approvals necessary

to consummate the transaction from all non-U.S. authorities. Our goal for this transaction has been clear and consistent – to protect

and grow U. S. Steel. We are confident that this transaction will be for the benefit of all of U. S. Steel’s stakeholders, including

customers, employees, suppliers, and communities. U. S. Steel and Nippon Steel are committed to, as in the months past, continuing to

fully cooperate with the examination of the relevant authorities and are determined to complete the transaction.”

U. S. Steel held

a Special Meeting of Stockholders on April 12, 2024, with 71% of the outstanding shares of U. S. Steel common stock voting in favor

of the proposed transaction, resulting in an overwhelming vote of approval of 99% of the shares represented at that meeting.

U. S. Steel and

Nippon Steel currently expect that the transaction will be completed in the second half of 2024, subject to the fulfillment of the remaining,

customary closing conditions, including the receipt of required U.S. regulatory approvals.

| ©2024 U. S. Steel. All Rights Reserved | www.ussteel.com |  |

News release

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release

contains information regarding U. S. Steel and Nippon Steel that may constitute “forward-looking statements,” as that term

is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties.

We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections.

Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,”

“should,” “plan,” “goal,” “future,” “will,” “may” and similar

expressions or by using future dates in connection with any discussion of, among other things, statements regarding the proposed transaction,

including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that

a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent

only U. S. Steel’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events,

many of which, by their nature, are inherently uncertain and outside of U. S. Steel’s or Nippon Steel’s control and may differ,

possibly materially, from the anticipated events indicated in these forward-looking statements. Management of U. S. Steel or Nippon Steel,

as applicable, believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not

to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition,

forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from U.

S. Steel’s or Nippon Steel’s historical experience and our present expectations or projections. Risks and uncertainties include

without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt

and terms and conditions of any required governmental and regulatory approvals of the proposed transaction; the occurrence of any event,

change or other circumstances that could give rise to the termination of the definitive agreement and plan of merger relating to the

proposed transaction (the “Merger Agreement”); the risk that the parties to the Merger Agreement may not be able to satisfy

the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing

business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact

U. S. Steel’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating

to the proposed transaction could have adverse effects on the market price of U. S. Steel’s common stock or Nippon Steel’s

common stock or American Depositary Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the

risk of any litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have an

adverse effect on the ability of U. S. Steel or Nippon Steel to retain customers and retain and hire key personnel and maintain relationships

with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally;

and the risk the pending proposed transaction could distract management of U. S. Steel. U. S. Steel directs readers to its Quarterly

Report on Form 10-Q for the quarter ended September 30, 2023 and Form 10-K for the year ended December 31, 2023,

and the other documents it files with the SEC for other risks associated with U. S. Steel’s future performance. These documents

contain and identify important factors that could cause actual results to differ materially from those contained in the forward-looking

statements.

###

2024-022

About U. S.

Steel

Founded in 1901, United

States Steel Corporation is a leading steel producer. With an unwavering focus on safety, U. S. Steel’s customer-centric Best for

All® strategy is advancing a more secure, sustainable future for U. S. Steel and its stakeholders. With a renewed emphasis

on innovation, U. S. Steel serves the automotive, construction, appliance, energy, containers, and packaging industries with high value-added

steel products such as U. S. Steel’s proprietary XG3® advanced high-strength steel. U. S. Steel also maintains competitively

advantaged iron ore production and has an annual raw steelmaking capability of 22.4 million net tons. U. S. Steel is headquartered in

Pittsburgh, Pennsylvania, with world-class operations across the United States and in Central Europe. For more information, please visit

www.ussteel.com.

| ©2024 U. S. Steel. All Rights Reserved | www.ussteel.com |  |

News release

About Nippon

Steel

Nippon Steel is

Japan’s largest steelmaker and one of the world’s leading steel manufacturers. Nippon Steel has a global crude steel production

capacity of approximately 66 million tonnes and employs approximately 100,000 people in the world. Nippon Steel’s manufacturing

base is in Japan and the company has presence in 15 additional countries including: United States, India, Thailand, Indonesia,

Vietnam, Brazil, Mexico, Sweden, China and others. Nippon Steel established a joint venture in the United States around 40 years ago

and has focused on building cooperative and good relationships with employees, labor unions, suppliers, customers, and communities. As

the ‘Best Steelmaker with World-Leading Capabilities,’ Nippon Steel pursues world-leading technologies and manufacturing

capabilities and contributes to society by providing excellent products and services. For more information, please visit: https://www.nipponsteel.com.

Media Contacts:

U. S. Steel

Contacts

Tara Carraro

Senior Vice President,

Chief Communications Officer, U. S. Steel

T- 412-433-1300

E- media@uss.com

Kelly Sullivan

/ Ed Trissel

Joele Frank, Wilkinson

Brimmer Katcher

T- 212-895-8600

| ©2024 U. S. Steel. All Rights Reserved | www.ussteel.com |  |

News release

Emily Chieng

Investor Relations

Officer, U. S. Steel

T – (412)

618-9554

E – ecchieng@uss.com

Nippon Steel

Contacts

Media

pr_contact@jp.nipponsteel.com

Kayo Kikuchi /

+81-3-6867-2977 / kikuchi.26s.kayo@jp.nipponsteel.com

Masato Suzuki /

+81-3-6867-2135 / suzuki.s4f.masato@jp.nipponsteel.com

Investors

ir@jp.nipponsteel.com

Yuichiro Kaneko

/ +81-80-9022-6867 / kaneko.yc3.yuichiro@jp.nipponsteel.com

Yohei Kato / +81-80-2131-0188

/ kato.rk5.yohei@jp.nipponsteel.com

General Inquiries

(U.S.)

Nippon Steel North

America, Inc. / +1 (713) 654 7111

U.S. Media

Contacts

NSCMedia@teneo.com

Robert Mead / +1

(917) 327 9828 / Robert.Mead@teneo.com

Monika Driscoll

/ +1 (929) 388 9442 / Monika.Driscoll@teneo.com

Tucker Elcock /

+1 (917) 208 4652 / Tucker.Elcock@teneo.com

| ©2024 U. S. Steel. All Rights Reserved | www.ussteel.com |  |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

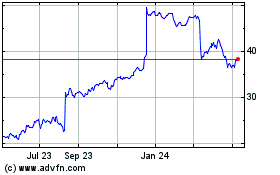

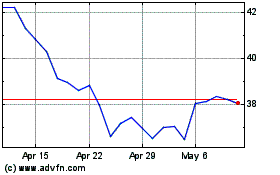

US Steel (NYSE:X)

Historical Stock Chart

From Nov 2024 to Dec 2024

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2023 to Dec 2024