Combination Will Create “Best Steelmaker with

World-Leading Capabilities”

Stockholders’ Approval Represents Key Milestone

Toward Completion of Transaction

Following the special meeting of stockholders (the “Special

Meeting”) held earlier today, United States Steel Corporation

(NYSE: X) (“U. S. Steel”) announced that, based on the preliminary

vote count, U. S. Steel stockholders overwhelmingly voted to

approve the proposed merger with Nippon Steel Corporation (NSC)

(TSE: 5401). More than 98% of the shares voted at the Special

Meeting, representing approximately 71% of the shares of U. S.

Steel common stock issued and outstanding as of the record date for

the Special Meeting, were voted in favor of the proposal to adopt

the merger agreement.

David B. Burritt, President & Chief Executive Officer of U.

S. Steel commented on the vote,

“The overwhelming support from our stockholders is a clear

endorsement that they recognize the compelling rationale for our

transaction with NSC. This is an important milestone as we progress

toward completing the transaction. We are one step closer to

bringing together the best of our companies and moving forward

together as the ‘Best Steelmaker with World-Leading

Capabilities.’

This transaction truly represents the best path forward for all

of U. S. Steel’s stakeholders – union and non-union employees,

customers, communities and stockholders – and for the United States

and our home in Pennsylvania. By creating the best steelmaker in

the world, we will have a stronger company to sustain our talented

employees and fulfill all commitments to them, including all of the

obligations under the agreements in place with our unions. We will

deliver enhanced capabilities and innovations for our customers in

the United States and globally, and be able to invest in greener

steel to meet our climate commitments. And we will maintain the U.

S. Steel name and Pittsburgh headquarters, with even more capital

to invest in Pennsylvania.

This transaction will make U. S. Steel and the domestic steel

industry stronger and more competitive, enhancing the legacy of

steel that is mined, melted and made in America, in the face of

unfair competition from China.”

U. S. Steel will disclose the final, certified voting results on

a Form 8-K with the U.S. Securities and Exchange Commission when

they are available.

Barclays Capital Inc., Goldman Sachs & Co. LLC and Evercore

Inc. are serving as financial advisors to U. S. Steel. Milbank LLP

and Wachtell, Lipton, Rosen & Katz are acting as legal

advisors.

About U. S. Steel

Founded in 1901, United States Steel Corporation is a leading

steel producer. With an unwavering focus on safety, the Company’s

customer-centric Best for All® strategy is advancing a more secure,

sustainable future for U. S. Steel and its stakeholders. With a

renewed emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products such as U. S.

Steel’s proprietary XG3® advanced high-strength steel. The Company

also maintains competitively advantaged iron ore production and has

an annual raw steelmaking capability of 22.4 million net tons. U.

S. Steel is headquartered in Pittsburgh, Pennsylvania, with

world-class operations across the United States and in Central

Europe. For more information, please visit www.ussteel.com.

Forward-Looking Statements

This release contains information regarding the Company and NSC

that may constitute “forward-looking statements,” as that term is

defined under the Private Securities Litigation Reform Act of 1995

and other securities laws, that are subject to risks and

uncertainties. We intend the forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements in those sections. Generally, we have identified such

forward-looking statements by using the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “target,”

“forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,”

“may” and similar expressions or by using future dates in

connection with any discussion of, among other things, statements

expressing general views about future operating or financial

results, operating or financial performance, trends, events or

developments that we expect or anticipate will occur in the future,

anticipated cost savings, potential capital and operational cash

improvements and changes in the global economic environment, the

construction or operation of new or existing facilities or

capabilities, statements regarding our greenhouse gas emissions

reduction goals, as well as statements regarding the proposed

transaction, including the timing of the completion of the

transaction. However, the absence of these words or similar

expressions does not mean that a statement is not forward-looking.

Forward-looking statements include all statements that are not

historical facts, but instead represent only the Company’s beliefs

regarding future goals, plans and expectations about our prospects

for the future and other events, many of which, by their nature,

are inherently uncertain and outside of the Company’s or NSC’s

control. It is possible that the Company’s or NSC’s actual results

and financial condition may differ, possibly materially, from the

anticipated results and financial condition indicated in these

forward-looking statements. Management of the Company believes that

these forward-looking statements are reasonable as of the time

made. However, caution should be taken not to place undue reliance

on any such forward-looking statements because such statements

speak only as of the date when made. In addition, forward looking

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from the Company’s

historical experience and our present expectations or projections.

Risks and uncertainties include without limitation: the ability of

the parties to consummate the proposed transaction on a timely

basis or at all; the timing, receipt and terms and conditions of

any required governmental and regulatory approvals of the proposed

transaction; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

definitive agreement and plan of merger relating to the proposed

transaction (the “Merger Agreement”);

the risk that the parties to the Merger Agreement may not be able

to satisfy the conditions to the proposed transaction in a timely

manner or at all; risks related to disruption of management time

from ongoing business operations due to the proposed transaction;

certain restrictions during the pendency of the proposed

transaction that may impact the Company’s ability to pursue certain

business opportunities or strategic transactions; the risk that any

announcements relating to the proposed transaction could have

adverse effects on the market price of the Company’s common stock;

the risk of any unexpected costs or expenses resulting from the

proposed transaction; the risk of any litigation relating to the

proposed transaction; the risk that the proposed transaction and

its announcement could have an adverse effect on the ability of the

Company or NSC to retain customers and retain and hire key

personnel and maintain relationships with customers, suppliers,

employees, stockholders and other business relationships and on its

operating results and business generally; and the risk the pending

proposed transaction could distract management of the Company. The

Company directs readers to its Quarterly Report on Form 10-Q for

the quarter ended September 30, 2023 and Form 10-K for the year

ended December 31, 2023, and the other documents it files with the

SEC for other risks associated with the Company’s future

performance. These documents contain and identify important factors

that could cause actual results to differ materially from those

contained in the forward-looking statements. All information in

this communication is as of the date above. The Company does not

undertake any duty to update any forward-looking statement to

conform the statement to actual results or changes in the Company’s

expectations whether as a result of new information, future events

or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240412512822/en/

Media Contacts:

Tara Carraro Senior Vice President, Chief Communications

Officer, U. S. Steel T- 412-433-1300 E- media@uss.com

Kelly Sullivan / Ed Trissel Joele Frank, Wilkinson

Brimmer Katcher T- 212-895-8600

Emily Chieng Investor Relations Officer, U. S. Steel T –

(412) 618-9554 E – ecchieng@uss.com

Scott Winter / Gabrielle Wolf Innisfree M&A

Incorporated T - 212.750.5833

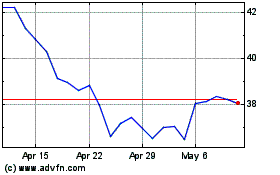

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2024 to Dec 2024

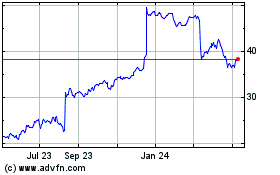

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2023 to Dec 2024