TDG Beats Estimate, Ups Guidance - Analyst Blog

May 09 2012 - 4:45AM

Zacks

TransDigm Group

Incorporated (TDG) reported second-quarter fiscal 2012

earnings per share from continuing operations of $1.51, outpacing

the Zacks Consensus Estimate of $1.30 and prior-year earnings per

share of 69 cents.

Revenue

Net sales were $423.5 million, up

39.2% year over year. Organically, sales during the quarter surged

approximately 14.9%, driven by increased sales in commercial OEM

markets and aided by acquisitions of Schneller, Harco and

Amsafe.

Income &

Expenses

Income from operations for the

quarter was $177.2 million compared with $113.2 million in the

prior-year period. Selling and administrative expenses were $49.5

million compared with $33.2 million in the comparable quarter last

year. EBITDA for the quarter jumped $192.5 million from $128.3

million.

Balance Sheet & Cash

Flow

Cash and cash equivalents were

$201.5 million at the end of the quarter compared with $376.2

million at the end of fiscal 2011. Long-term debt was $3.6 billion

while shareholders equity was $994.9 million at the end of the

quarter.

Net cash from operating activities

was $164.8 million in the quarter compared with $129.2 million in

the prior-year period.

Outlook

Driven by the robust performance in

the second quarter, the company raised its full year 2012 guidance.

TransDigm expects its total revenue for fiscal 2012 to be in the

range of $1,670 million to $1,698 million, up from its prior

guidance range of $1,470 million to $1,510 million. Further,

earnings per share are expected to be in the range of $5.47 to

$5.82, up from its prior guidance of $5.15 to $5.49. Adjusted

earnings per share are expected to be in the range of $6.23 to

$6.57, up from its prior guidance range of $5.66 to $6.00.

The company revised its guidance to

account for the recent acquisition of AmSafe and good performance

in the first half of the year. However, uncertain aerospace market

and worldwide economic environment remain a matter of concern.

Based in Cleveland, Ohio,

TransDigm Group Inc.designs, produces, and supplies engineered

aircraft components for use on commercial and military aircraft.

The company operates principally in the US. Major competitors of

the company are Goodrich Corp. (GR),

Honeywell International Inc. (HON) and

United Technologies Corp. (UTX).

We continue to maintain an

Outperform rating on TranDigm for the long term. The company has a

Zacks #1 Rank (Strong-Buy recommendation) over the next

one-to-three months.

GOODRICH CORP (GR): Free Stock Analysis Report

HONEYWELL INTL (HON): Free Stock Analysis Report

TRANSDIGM GROUP (TDG): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

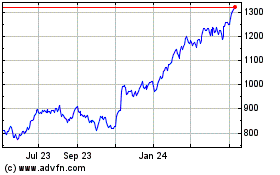

Transdigm (NYSE:TDG)

Historical Stock Chart

From Sep 2024 to Oct 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From Oct 2023 to Oct 2024