Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 23 2023 - 6:02AM

Edgar (US Regulatory)

PRICING TERM SHEET

Dated June 22, 2023 |

Issuer Free Writing Prospectus

Filed Pursuant to Rule

433

Registration Statement

No. 333-264946

Supplementing the Preliminary

Prospectus Supplement

dated June 22, 2023 and

the

Prospectus dated May 13, 2022 |

Starwood Property Trust, Inc.

$350,000,000 6.750% Convertible Senior Notes

due 2027

This pricing term sheet

supplements Starwood Property Trust, Inc.’s preliminary prospectus supplement, dated June 22, 2023 (the “Preliminary Prospectus

Supplement”), including the documents incorporated by reference therein, relating to the offering of the Notes, and supersedes the

information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement.

In all other respects, this pricing term sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. Terms

used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus Supplement. All references

to dollar amounts are references to U.S. dollars. Unless the context otherwise requires, references to “Starwood” or the “Issuer,”

“we,” “us” and “our” in this pricing term sheet mean Starwood Property Trust, Inc. and not its subsidiaries.

| Issuer: |

Starwood Property Trust, Inc., a Maryland corporation

|

| Title of Securities: |

6.750% Convertible Senior Notes due 2027 (the

“Notes”)

|

| Ticker / Exchange: |

STWD / New York Stock Exchange (the “NYSE”)

|

| Securities Offered: |

$350,000,000 (or, if the underwriters fully exercise

their over-allotment option, $402,500,000) principal amount of Notes

|

| Maturity: |

July 15, 2027 unless earlier converted, repurchased

or redeemed

|

| Issue Price: |

100.00%, plus accrued interest, if any, from July

3, 2023

|

|

Price to Underwriters: |

97.47% |

| Use of Proceeds: |

We estimate that the net proceeds from this offering

will be approximately $340.5 million (or approximately $391.7 million if the underwriters fully exercise their over-allotment option),

after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to allocate an amount

equal to the net proceeds from this offering to finance or refinance, in whole or in part, recently completed or future eligible projects

that meet the eligibility criteria described in our Sustainable Finance Framework (such projects, “Eligible Green and/or Social

Projects”) in alignment with the four core components of the Green Bond Principles 2021 (with June 2022 Appendix 1), Social Bond

Principles 2021 (with June 2022 Appendix 1) and Sustainability Bond Guidelines 2021 as administered by the International Capital Market

Association (eligibility criteria from our Sustainable Finance Framework is described below). Net proceeds allocated to previously incurred

costs associated with Eligible Green and/or Social Projects will be available for the repayment of indebtedness previously incurred. Pending

full allocation of an amount equal to the net proceeds to Eligible Green and/or Social Projects, we intend to use the net proceeds for

general corporate purposes, including the repayment of outstanding indebtedness under our repurchase facilities.

|

| Interest: |

6.750% per year. Interest will accrue from July

3, 2023 (the scheduled date of original issuance)

|

| Conversion Premium: |

Approximately 12.5% above the NYSE last reported

sale price on June 22, 2023

|

| Interest Payment Dates: |

Each January 15 and July 15, beginning on January

15, 2024

|

|

Interest Payment Record Dates:

|

Each January 1 and July 1 |

|

NYSE Last Reported Sale Price on June 22, 2023:

|

$18.45 per share of the Issuer’s common

stock

|

| Initial Conversion Rate: |

48.1783 shares of the Issuer’s common stock

for each $1,000 principal amount of Notes

|

| Initial Conversion Price: |

Approximately $20.76 per share of the Issuer’s

common stock

|

| Redemption: |

The Issuer may not redeem the Notes prior to April

15, 2027. On or after April 15, 2027, the Issuer may redeem the Notes for cash, in whole or from time to time in part, at the Issuer’s

option, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest thereon

to, but excluding, the redemption date.

|

| Trade Date: |

June 23, 2023

|

| Expected Settlement Date: |

July 3, 2023 (T + 6)

|

| Joint Book-Running Managers: |

Goldman, Sachs & Co. LLC, J.P. Morgan Securities LLC, Wells Fargo Securities, LLC, Barclays Capital Inc., BofA Securities, Citigroup Global Markets Inc. and Morgan Stanley & Co. LLC |

| CUSIP / ISIN: |

85571B BA2/ US85571BBA26 |

| Adjustment to Shares Delivered Upon Conversion Upon a Make-Whole Fundamental Change: |

The following table sets forth the number

of additional shares (as defined under “Description of the Notes—Adjustment to Conversion Rate Upon Conversion in Connection

with a Make-Whole Fundamental Change” in the Preliminary Prospectus Supplement) to be received per $1,000 principal amount of Notes

for each stock price and effective date set forth below: |

| | |

Stock Price | |

| Effective Date | |

$18.45 | | |

$19.00 | | |

$19.50 | | |

$20.00 | | |

$20.76 | | |

$21.00 | | |

$22.00 | | |

$23.00 | | |

$25.00 | | |

$30.00 | |

| July 3, 2023 | |

| 6.0222 | | |

| 5.0163 | | |

| 4.2041 | | |

| 3.482 | | |

| 2.5424 | | |

| 2.2824 | | |

| 1.3695 | | |

| 0.6970 | | |

| 0.0168 | | |

| 0.0000 | |

| July 15, 2024 | |

| 6.0222 | | |

| 5.0163 | | |

| 4.2041 | | |

| 3.482 | | |

| 2.5424 | | |

| 2.2824 | | |

| 1.3695 | | |

| 0.6970 | | |

| 0.0168 | | |

| 0.0000 | |

| July 15, 2025 | |

| 6.0222 | | |

| 5.0163 | | |

| 4.2041 | | |

| 3.482 | | |

| 2.5424 | | |

| 2.2824 | | |

| 1.3695 | | |

| 0.6970 | | |

| 0.0168 | | |

| 0.0000 | |

| July 15, 2026 | |

| 6.0222 | | |

| 5.0163 | | |

| 4.0569 | | |

| 3.1700 | | |

| 2.0689 | | |

| 1.7805 | | |

| 0.8577 | | |

| 0.3143 | | |

| 0.0016 | | |

| 0.0000 | |

| July 15, 2027 | |

| 6.0222 | | |

| 4.4533 | | |

| 3.1036 | | |

| 1.8215 | | |

| 0.0000 | | |

| 0.0000 | | |

| 0.0000 | | |

| 0.0000 | | |

| 0.0000 | | |

| 0.0000 | |

The exact stock prices and

effective dates may not be set forth in the table above, in which case:

| · | if the stock price is between two stock prices in the table or the effective date is between two effective

dates in the table, the number of additional shares will be determined by a straight-line interpolation between the number of additional

shares set forth for the higher and lower stock prices and the earlier and later effective dates, as applicable, based on a 365-day year; |

| · | if the stock price is greater than $30.00 per share (subject to adjustment in the same manner as the stock

prices set forth in the column headings of the table above), no additional shares will be added to the conversion rate; or |

| · | if the stock price is less than $18.45 per share (subject to adjustment in the same manner as the stock

prices set forth in the column headings of the table above), no additional shares will be added to the conversion rate. |

Notwithstanding the foregoing,

in no event will the conversion rate be increased on account of a make-whole fundamental change to exceed 54.2005 shares of the Issuer’s

common stock per $1,000 principal amount of Notes, subject to adjustments in the same manner as the conversion rate is required to be

adjusted as set forth under “Description of the Notes—Conversion Rights—Conversion Rate Adjustments” in the Preliminary

Prospectus Supplement.

General

This communication is intended for the sole use

of the person to whom it is provided by the sender.

This communication shall not constitute an

offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of these securities in any state in which

such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state.

The Issuer has filed a registration statement

(including a prospectus, dated May 13, 2022, and a preliminary prospectus supplement, dated June 22, 2023) with the Securities and Exchange

Commission, or SEC, for the offering of the Notes. Before you invest, you should read the preliminary prospectus supplement, the accompanying

prospectus and the other documents the Issuer has filed with the SEC for more complete information about the Issuer and the offering of

the Notes. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the Issuer,

the underwriter or any dealer participating in the offering of the Notes will arrange to send you the preliminary prospectus supplement

and the accompanying prospectus if you request it by contacting Goldman, Sachs & Co. LLC toll-free at (866) 471-2526 or emailing prospectus-ny@ny.email.gs.com;

J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 Telephone 866-803-9204; Wells

Fargo Securities, Attention: Equity Syndicate Department, 500 West 33rd St. 14th Floor, New York, NY 10001 or (800) 326-5897 or email

a request to cmclientsupport@wellsfargo.com; Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, telephone: 888-603-5847, email: Barclaysprospectus@broadridge.com; BofA Securities, Attention: Prospectus Department, NC1-022-02-25,

201 North Tryon Street, Charlotte, NC 28255-0001, or by emailing dg.prospectus_requests@bofa.com; Citigroup Global Markets Inc., c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone: (800) 831-9146; or Morgan Stanley & Co. LLC, Attention:

Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014 or by phone: 1-866-718-1649.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR

BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED

AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

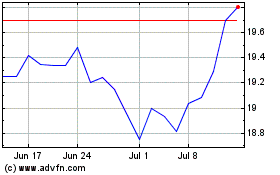

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Jun 2024 to Jul 2024

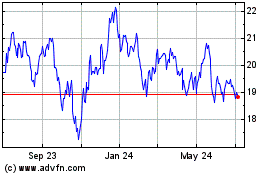

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Jul 2023 to Jul 2024